Global Baby Food Market Synopsis

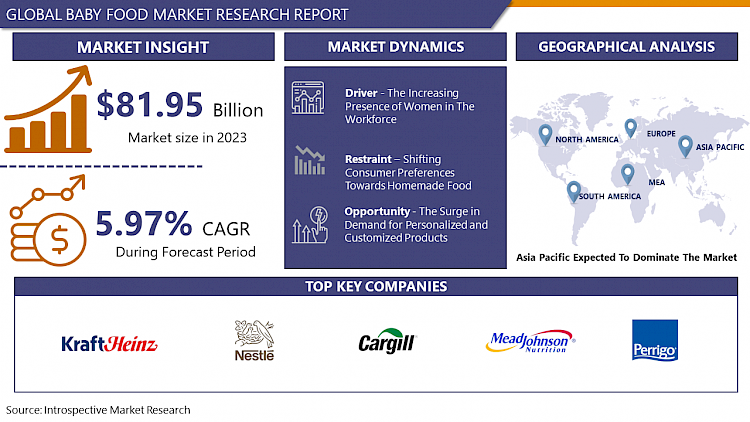

Global Baby Food Market size is expected to grow from USD 81.95 Billion in 2023 to USD 138.1 Billion by 2032, at a CAGR of 5.97% during the forecast period 2024-2032.

Baby food refers to specially created nourishment tailored to meet the dietary requirements of infants and young children. It's primarily intended for little ones aged between 4 months and 36 months, and it comes in various forms such as purees, cereals, snacks, and formulas. These products are specifically designed to supply vital nutrients essential for healthy growth and development during early childhood.

- The uses of baby food are diverse. Initially, it acts as a supplement to breast milk or formula as babies’ transition to solid foods, usually starting around 4 to 6 months. Introducing different tastes and textures through baby food helps in developing chewing and swallowing abilities. Moreover, these foods are carefully crafted with suitable textures and a balanced nutritional profile to support the rapid growth and milestones of infants.

- The benefits of baby food include its convenience, nutritional richness, and safety. These products are meticulously prepared to provide the necessary vitamins, minerals, and nutrients crucial for a baby's growth. Additionally, they are often packaged in user-friendly formats, making feeding easier for parents. Rigorous quality checks ensure that baby food is safe and suitable for sensitive digestive systems. Overall, baby food plays a crucial role in delivering essential nutrients required for healthy development during a child's early years.

Global Baby Food Market Trend Analysis

The Increasing Presence of Women in The Workforce

- The increasing presence of women in the workforce is significantly influencing the growth of the baby food market. As more women globally pursue professional careers, it's reshaping family dynamics and approaches to child-rearing. Balancing work and childcare, working mothers often grapple with time limitations, leading them to seek convenient solutions, particularly when it comes to feeding their infants and toddlers.

- This shift in demographics has resulted in a higher reliance on easily prepared and ready-to-use baby food products. The demands of busy work schedules leave little time for meal preparation, making packaged baby food a practical option for many working mothers. These products offer convenience by eliminating the need for extensive planning and cooking, catering well to the fast-paced lifestyles of working professionals.

- Furthermore, the financial independence of working women gives them greater purchasing power, enabling them to afford premium and specialized baby food choices. Consequently, the market experiences a surge in demand for a wider variety of high-quality baby food products that cater to different nutritional requirements and preferences. This trend isn't just about convenience; it's also about ensuring that infants and toddlers receive adequate and nutritious meals despite their parents' hectic schedules. This drive both the expansion and diversification of the baby food market.

The Surge in Demand for Personalized and Customized Products

- Parents today are increasingly particular about their child's nutrition, seeking tailored solutions that fit specific dietary needs, preferences, and developmental stages. This shift toward personalized options goes beyond standard baby food products, encompassing choices that precisely match individual requirements, like organic, allergen-free, or culturally relevant offerings.

- Companies have an opportunity to capitalize on this trend by providing customizable baby food solutions. This allows parents to handpick ingredients, flavors, and nutritional compositions that best suit their child's needs. This not only addresses concerns related to allergies or intolerances but also empowers parents to actively shape their children's diet, giving them a sense of control and satisfaction.

- Technology stands as a crucial tool in personalizing baby food. Advancements in data analytics and AI enable companies to analyze consumer preferences, nutritional needs, and buying habits to offer personalized recommendations. This could involve subscription-based services or apps suggesting customized meal plans based on a child's age, dietary restrictions, and developmental milestones.

- Embracing personalization and customization allows baby food manufacturers to build stronger connections with consumers, foster brand loyalty, and cater to the diverse and evolving needs of modern parents. These parents seek tailored, individualized solutions for their children's nutrition and overall well-being.

Global Baby Food Market Segment Analysis

Baby Food Market is Segmented on the basis of product type, nature, age group, and distribution channel.

By Product Type, Infant Formula segment is expected to dominate the market during the forecast period

- First and foremost, infant formula plays a vital role in providing essential nutrition for babies who are not breastfed or need additional supplementation while breastfeeding. Its widespread necessity creates a consistent and enduring global demand.

- Continual advancements in infant formula formulations, including tailored variations designed for specific dietary requirements like lactose intolerance or allergies, have propelled its prominence in the market. These innovations address diverse nutritional needs, ensuring optimal growth and development for infants. Moreover, the convenience it offers remains a significant factor for busy parents and caregivers, further cementing its sustained dominance in the market.

- The persistent dedication to creating high-quality, nutrient-packed formulas and the growing preference for specialized and premium options are anticipated to strengthen the dominance of infant formula within the baby food market for the foreseeable future.

By Nature, the Organic segment held the largest market share of 55.6% in 2022

- Organic baby food is poised to be the predominant segment in the baby food market due to the increasing demand for natural and wholesome nutrition for infants. Parents are increasingly drawn to organic options, as they prioritize the well-being of their children and seek products free from synthetic pesticides, hormones, and genetically modified ingredients. The rising awareness of the potential health benefits associated with organic foods, such as reduced exposure to harmful chemicals and enhanced nutritional content, further fuels this trend.

- Additionally, the growing emphasis on sustainable and environmentally friendly practices resonates with consumers, contributing to the popularity of organic baby food. As more parents seek transparency in food sources and production methods, the organic segment is expected to continue its ascent, reflecting a broader societal shift towards healthier and eco-conscious choices for the youngest consumers.

Global Baby Food Market Regional Insights

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region experiences significant market growth due to rapid urbanization, expanding populations, and increased incomes in countries like China, India, Japan, and Southeast Asian nations. These factors drive shifts in lifestyles, eating habits, and a preference for convenient baby food products.

- Furthermore, changing consumer tastes and a growing understanding of the significance of proper infant nutrition contribute to a rising demand for baby food in this region. Concerns regarding child health and development among parents lead to a higher adoption of commercially produced baby foods, such as infant formula, baby cereals, snacks, and prepared meals.

- Moreover, government efforts aimed at enhancing child health and nutrition, coupled with the expansion of distribution channels and major market players investing in innovative products and marketing strategies, reinforce the Asia-Pacific region's leadership in the global baby food market throughout the projected period.

Global Baby Food Market Top Key Players:

- Abbott (U.S.)

- The Kraft Heinz Company (U.S.)

- Cargill Inc. (U.S.)

- Mead Johnson & Company, LLC. (U.S.)

- Sun-Maid Growers of California (U.S.)

- Hipp Gmbh & Co. Vertrieb Kg (Germany)

- Pz Cussons (U.K.)

- Reckitt Benckiser Group Plc (U.K)

- Bledina Sa (France)

- Danone Sa (France)

- Nestle S.A. (Switzerland)

- Hero Group (Switzerland)

- Alter S.L. (Italy)

- Frieslandcampina (Netherlands)

- Perrigo Company Plc (Ireland)

- Semper AB (Sweden)

- Feihe International Inc. (China)

- Asahi Group Holdings, Ltd. (Japan)

- Kewpie Corporation (Japan)

- Morinaga Milk Industry Co. Ltd. (Japan)

- Bellamy’s Organic (Australia)

Key Industry Development: -

- In November 2023, Nestlé announced that it has developed N3 milk with new nutritional values, the first to be launched in China. Made from cow's milk, it contains all the essential nutrients found in milk, such as proteins, vitamins, and minerals. In addition, it contains prebiotic fiber, is low in lactose, and has more than 15% fewer calories.

- In June 2023, Nature's Path Organic Foods, a privately held family business, acquired certified organic food manufacturer Love Child Organics, a Canadian organic baby food and children's snack brand. The deal would allow Nature's Path Organic Foods to expand Love Child Organics baby foods into the US market.

|

Global Baby Food Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 81.95 Bn. |

|

|

CAGR (2024-2032): |

5.97% |

Market Size in 2032: |

USD 138.1 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Nature |

|

|

||

|

By Age-Group |

|

|

||

|

By Distribution Channel |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BABY FOOD MARKET BY PRODUCT TYPE (2017-2032)

- BABY FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INFANT FORMULA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BABY CEREALS

- BABY SNACKS

- PREPARED BABY FOOD

- BABY FOOD MARKET BY NATURE (2017-2032)

- BABY FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORGANIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INORGANIC

- BABY FOOD MARKET BY AGE GROUP (2017-2032)

- BABY FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INFANT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TODDLER

- PRE-SCHOOL

- BABY FOOD MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- BABY FOOD MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKET/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GROCERY STORES & PHARMACY STORES

- ONLINE STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BABY FOOD Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABBOTT (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- THE KRAFT HEINZ COMPANY (U.S.)

- CARGILL INC. (U.S.)

- MEAD JOHNSON & COMPANY, LLC. (U.S.)

- SUN-MAID GROWERS OF CALIFORNIA (U.S.)

- HIPP GMBH & CO. VERTRIEB KG (GERMANY)

- PZ CUSSONS (U.K.)

- RECKITT BENCKISER GROUP PLC (U.K)

- BLEDINA SA (FRANCE)

- DANONE SA (FRANCE)

- NESTLE S.A. (SWITZERLAND)

- HERO GROUP (SWITZERLAND)

- ALTER S.L. (ITALY)

- FRIESLANDCAMPINA (NETHERLANDS)

- PERRIGO COMPANY PLC (IRELAND)

- SEMPER AB (SWEDEN)

- FEIHE INTERNATIONAL INC. (CHINA)

- ASAHI GROUP HOLDINGS, LTD. (JAPAN)

- KEWPIE CORPORATION (JAPAN)

- MORINAGA MILK INDUSTRY CO. LTD. (JAPAN)

- BELLAMY’S ORGANIC (AUSTRALIA)

- COMPETITIVE LANDSCAPE

- GLOBAL BABY FOOD MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Nature

- Historic And Forecasted Market Size By Age Group

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Baby Food Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 81.95 Bn. |

|

|

CAGR (2024-2032): |

5.97% |

Market Size in 2032: |

USD 138.1 Bn. |

|

|

Segments Covered: |

By Product Type |

|

|

|

|

By Nature |

|

|

||

|

By Age-Group |

|

|

||

|

By Distribution Channel |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BABY FOOD MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BABY FOOD MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BABY FOOD MARKET COMPETITIVE RIVALRY

TABLE 005. BABY FOOD MARKET THREAT OF NEW ENTRANTS

TABLE 006. BABY FOOD MARKET THREAT OF SUBSTITUTES

TABLE 007. BABY FOOD MARKET BY PRODUCT TYPE

TABLE 008. BABY FOOD BY MILK FORMULA MARKET OVERVIEW (2016-2028)

TABLE 009. BABY FOOD CEREALS MARKET OVERVIEW (2016-2028)

TABLE 010. BABY FOOD FROZEN MARKET OVERVIEW (2016-2028)

TABLE 011. BABY FOOD READY TO EAT MARKET OVERVIEW (2016-2028)

TABLE 012. BABY FOOD MARKET BY DISTRIBUTION CHANNELS

TABLE 013. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 014. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

TABLE 015. LOCAL RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. BABY FOOD MARKET BY AGE-GROUP

TABLE 018. INFANTS MARKET OVERVIEW (2016-2028)

TABLE 019. TODDLERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA BABY FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 021. NORTH AMERICA BABY FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 022. NORTH AMERICA BABY FOOD MARKET, BY AGE-GROUP (2016-2028)

TABLE 023. N BABY FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE BABY FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 025. EUROPE BABY FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 026. EUROPE BABY FOOD MARKET, BY AGE-GROUP (2016-2028)

TABLE 027. BABY FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC BABY FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 029. ASIA PACIFIC BABY FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 030. ASIA PACIFIC BABY FOOD MARKET, BY AGE-GROUP (2016-2028)

TABLE 031. BABY FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA BABY FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA BABY FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BABY FOOD MARKET, BY AGE-GROUP (2016-2028)

TABLE 035. BABY FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA BABY FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 037. SOUTH AMERICA BABY FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 038. SOUTH AMERICA BABY FOOD MARKET, BY AGE-GROUP (2016-2028)

TABLE 039. BABY FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 040. NESTLE S.A.: SNAPSHOT

TABLE 041. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 042. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 043. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. H.J. HEINZ: SNAPSHOT

TABLE 044. H.J. HEINZ: BUSINESS PERFORMANCE

TABLE 045. H.J. HEINZ: PRODUCT PORTFOLIO

TABLE 046. H.J. HEINZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BRISTOL MYERS SQUIBB: SNAPSHOT

TABLE 047. BRISTOL MYERS SQUIBB: BUSINESS PERFORMANCE

TABLE 048. BRISTOL MYERS SQUIBB: PRODUCT PORTFOLIO

TABLE 049. BRISTOL MYERS SQUIBB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DANONE S.A.: SNAPSHOT

TABLE 050. DANONE S.A.: BUSINESS PERFORMANCE

TABLE 051. DANONE S.A.: PRODUCT PORTFOLIO

TABLE 052. DANONE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. HERO GROUP: SNAPSHOT

TABLE 053. HERO GROUP: BUSINESS PERFORMANCE

TABLE 054. HERO GROUP: PRODUCT PORTFOLIO

TABLE 055. HERO GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ABBOTT NUTRITION: SNAPSHOT

TABLE 056. ABBOTT NUTRITION: BUSINESS PERFORMANCE

TABLE 057. ABBOTT NUTRITION: PRODUCT PORTFOLIO

TABLE 058. ABBOTT NUTRITION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. MEAD JOHNSON AND COMPANY LLC: SNAPSHOT

TABLE 059. MEAD JOHNSON AND COMPANY LLC: BUSINESS PERFORMANCE

TABLE 060. MEAD JOHNSON AND COMPANY LLC: PRODUCT PORTFOLIO

TABLE 061. MEAD JOHNSON AND COMPANY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. COW AND GATE: SNAPSHOT

TABLE 062. COW AND GATE: BUSINESS PERFORMANCE

TABLE 063. COW AND GATE: PRODUCT PORTFOLIO

TABLE 064. COW AND GATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. HIPP: SNAPSHOT

TABLE 065. HIPP: BUSINESS PERFORMANCE

TABLE 066. HIPP: PRODUCT PORTFOLIO

TABLE 067. HIPP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. FRISO: SNAPSHOT

TABLE 068. FRISO: BUSINESS PERFORMANCE

TABLE 069. FRISO: PRODUCT PORTFOLIO

TABLE 070. FRISO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ORGANIX: SNAPSHOT

TABLE 071. ORGANIX: BUSINESS PERFORMANCE

TABLE 072. ORGANIX: PRODUCT PORTFOLIO

TABLE 073. ORGANIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. PLUM BABY: SNAPSHOT

TABLE 074. PLUM BABY: BUSINESS PERFORMANCE

TABLE 075. PLUM BABY: PRODUCT PORTFOLIO

TABLE 076. PLUM BABY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. ELLA’S KITCHEN: SNAPSHOT

TABLE 077. ELLA’S KITCHEN: BUSINESS PERFORMANCE

TABLE 078. ELLA’S KITCHEN: PRODUCT PORTFOLIO

TABLE 079. ELLA’S KITCHEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. PERRIGO NUTRITIONALS: SNAPSHOT

TABLE 080. PERRIGO NUTRITIONALS: BUSINESS PERFORMANCE

TABLE 081. PERRIGO NUTRITIONALS: PRODUCT PORTFOLIO

TABLE 082. PERRIGO NUTRITIONALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. BUBS: SNAPSHOT

TABLE 083. BUBS: BUSINESS PERFORMANCE

TABLE 084. BUBS: PRODUCT PORTFOLIO

TABLE 085. BUBS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. HAIN CELESTIAL GROUP: SNAPSHOT

TABLE 086. HAIN CELESTIAL GROUP: BUSINESS PERFORMANCE

TABLE 087. HAIN CELESTIAL GROUP: PRODUCT PORTFOLIO

TABLE 088. HAIN CELESTIAL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. ALTER FARMACIA: SNAPSHOT

TABLE 089. ALTER FARMACIA: BUSINESS PERFORMANCE

TABLE 090. ALTER FARMACIA: PRODUCT PORTFOLIO

TABLE 091. ALTER FARMACIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BABY FOOD MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BABY FOOD MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. BABY FOOD BY MILK FORMULA MARKET OVERVIEW (2016-2028)

FIGURE 013. BABY FOOD CEREALS MARKET OVERVIEW (2016-2028)

FIGURE 014. BABY FOOD FROZEN MARKET OVERVIEW (2016-2028)

FIGURE 015. BABY FOOD READY TO EAT MARKET OVERVIEW (2016-2028)

FIGURE 016. BABY FOOD MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 017. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 018. SPECIALTY STORE MARKET OVERVIEW (2016-2028)

FIGURE 019. LOCAL RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. BABY FOOD MARKET OVERVIEW BY AGE-GROUP

FIGURE 022. INFANTS MARKET OVERVIEW (2016-2028)

FIGURE 023. TODDLERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA BABY FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE BABY FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC BABY FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA BABY FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA BABY FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Baby Food Market research report is 2024-2032.

Abbott (U.S.), The Kraft Heinz Company (U.S.), Cargill Inc. (U.S.), Mead Johnson & Company, LLC. (U.S.), Sun-Maid Growers of California (U.S.), Hipp Gmbh & Co. Vertrieb Kg (Germany), Pz Cussons (U.K.), Reckitt Benckiser Group Plc (U.K), Bledina Sa (France), Danone Sa (France), Nestle S.A. (Switzerland), Hero Group (Switzerland), Alter S.L. (Italy), Frieslandcampina (Netherlands), Perrigo Company Plc (Ireland), Semper Ab (Sweden), Feihe International Inc. (China), Asahi Group Holdings, Ltd. (Japan), Kewpie Corporation (Japan), Morinaga Milk Industry Co. Ltd. (Japan), Bellamy’s Organic (Australia)and Other Major Players.

Baby Food Market is segmented into Product Type, Nature, Age Group, Distribution Channel and Region. By Product Type, the market is categorized into Infant Formula, Baby Cereals, Baby Snacks, and Prepared Baby Food. By Nature, the market is categorized into Organic and Inorganic. By Age Group, the market is categorized into Infant, Toddler, and Pre-school. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Grocery Stores and pharmacy Stores, and Online Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Baby food refers to specially created nourishment tailored to meet the dietary requirements of infants and young children. It's primarily intended for little ones aged between 4 months and 36 months, and it comes in various forms such as purees, cereals, snacks, and formulas. These products are specifically designed to supply vital nutrients essential for healthy growth and development during early childhood.

Global Baby Food Market size is expected to grow from USD 81.95 Billion in 2023 to USD 138.1 Billion by 2032, at a CAGR of 5.97% during the forecast period 2024-2032.