Baby Care Products Market Synopsis

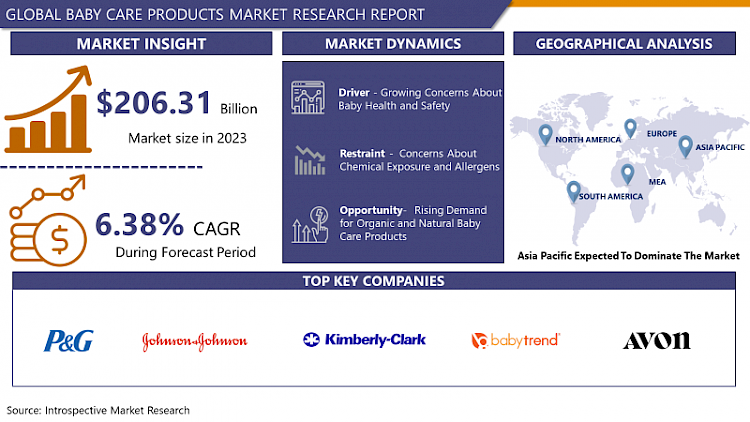

Baby Care Products Market Size Was Valued at USD 206.31 Billion in 2023, and is Projected to Reach USD 359.96 Billion by 2032, Growing at a CAGR of 6.38% From 2024-2032.

Baby care products typically refer to a range of items designed to meet the needs of infants and young children. These products can include diapers, baby wipes, baby shampoo, baby lotion, baby oil, baby powder, diaper rash cream, baby bottles, pacifiers, baby formula, baby food, baby clothes, baby blankets, baby toys, and other items essential for the care, hygiene, and comfort of babies and toddlers.

- Baby care products are essential for infants and toddlers, ensuring their health, hygiene, and comfort. Common items include diapers, wipes, bath products, lotion/oil, baby powder, clothing, bedding, feeding products, pacifiers, thermometers, nail care, car seats and strollers, toys and entertainment, safety products, and healthcare products. Diapers absorb urine and feces, while wipes clean during diaper changes and wipe messy hands. Bath products include shampoo, soap, and body wash, while lotion and oil moisturize and soothe delicate skin. Baby powder absorbs moisture and reduces friction, especially in areas prone to diaper rash. Bedding items include crib sheets, blankets, mattress protectors, and crib bumpers, providing a comfortable sleeping environment.

- Feeding products include bottles, bottle brushes, breast pumps, formula, and baby food. Pacifiers soothe babies and satisfy their natural sucking reflex, while thermometers help monitor fever and illness. Nail care includes clippers and files to trim and maintain nails. Car seats and strollers provide protection and comfort while traveling. Toys and entertainment stimulate babies' senses and encourage development. Safety products include baby gates, outlet covers, cabinet locks, and corner guards. Healthcare products include nasal aspirators, saline drops, teething gels, and pain relievers to manage common health issues. The global population growth, increasing in babies each year, drives the demand for baby care products.

- Parents are becoming more aware of the importance of products designed for babies' delicate skin and well-being, leading to a demand for safer, more natural options. As more parents work outside the home, there is a greater demand for convenient solutions like disposable diapers and pre-made formulas. Health and hygiene are top priorities, with products like wipes, lotions, shampoos, and soaps playing a crucial role. Fashion trends and changing preferences also influence the popularity of baby care items. Gift giving is another significant factor, with products often given as gifts for occasions like baby showers and birthdays. Despite economic fluctuations, spending on baby care products remains stable, with essential purchases like diapers and formula being essential.

Baby Care Products Market Trend Analysis

Growing Concerns About Baby Health and Safety

- The baby care products industry is experiencing a surge in concerns about baby health and safety due to various factors. Health-conscious parents are increasingly seeking safe, non-toxic products, with a preference for natural and organic ingredients over synthetic ones. Stringent product safety regulations are in place to ensure product safety and quality, building trust with consumers.

- Increased information accessibility has also influenced this trend, with parents having access to vast amounts of information online, enabling them to research and educate themselves about potential risks associated with certain ingredients. Media coverage of product recalls and safety scandals has heightened parental concerns, leading to increased scrutiny and demand for safer alternatives.

- Consumers are also demanding transparency from manufacturers regarding the ingredients used in baby care products and their potential health implications. Companies that provide clear information about product safety and sourcing are likely to gain a competitive edge. Health-conscious lifestyle trends are also driving this trend, with parents seeking products that align with their values and lifestyle choices, including those that prioritize environmental sustainability and ethical sourcing practices.

Restraint

Concerns About Chemical Exposure and Allergens

- Concerns about chemical exposure and allergens in baby care products are increasing due to research suggesting exposure to chemicals like parabens, phthalates, and fragrances may cause adverse health effects, including skin irritation and allergic reactions. Parents and caregivers are becoming more vigilant about ingredient lists and seeking safer alternatives. This trend has led to companies reformulating their products to eliminate or reduce the use of harmful substances.

- Manufacturers are developing products labeled as "hypoallergenic," "fragrance-free," "paraben-free," and "phthalate-free," while organic and natural brands are gaining popularity. Regulatory bodies and advocacy groups are implementing stricter regulations on labeling and formulation, as well as conducting research into the potential health impacts of common chemicals in these products.

Opportunity

Rising Demand for Organic and Natural Baby Care Products

- The growing demand for organic and natural baby care products presents a significant opportunity in the market. Parents are becoming more aware of the harmful effects of chemicals and synthetic ingredients in traditional products, leading to a shift towards organic alternatives. Health and safety concerns are also driving parents to seek safer alternatives, such as plant-based ingredients, which are perceived as gentler on sensitive baby skin.

- However, there is a growing preference for environmentally sustainable and eco-friendly options, with organic and natural baby care products often using ingredients sourced from sustainable and renewable resources and produced using eco-friendly manufacturing practices. The market for organic and natural baby care products is experiencing rapid growth, providing opportunities for both established companies and new entrants to expand their product offerings and capture a larger share of the market.

- Organic and natural baby care products often command higher price points, allowing companies to achieve higher profit margins by catering to consumers willing to pay a premium for safer and higher quality products. Innovation and product differentiation are also opportunities for companies in the baby care products industry to stand out in a crowded market and attract discerning consumers.

Challenge

Consumers are Increasingly Demanding Transparency Regarding the Ingredients

- Consumers are demanding transparency regarding the ingredients of baby care products due to safety concerns, health awareness, allergies, sensitivities, ethical and environmental concerns, and regulatory scrutiny. Safety concerns arise from parents and caregivers wanting assurance that the ingredients are safe and won't harm their child's health. Health awareness is growing, leading to a preference for natural or organic ingredients.

- Allergies and sensitivities can cause skin irritation or adverse reactions, so parents want to know exactly what is in their products. Ethical and environmental concerns arise from the environmental impact of the ingredients and the ethical practices of the companies producing them. Regulatory scrutiny is also increasing, with manufacturers facing pressure to provide detailed ingredient lists and demonstrate product safety. Overall, consumers are demanding transparency and understanding of the ingredients of baby care products.

Baby Care Products Market Segment Analysis:

Baby Care Products Market Segmented based on product type, age, and distribution channel.

By Product Type, the Baby Skincare Products segment is expected to dominate the market during the forecast period

- The demand for specialized skincare products for babies is on the rise due to parents' growing awareness of the importance of their skin's health. Babies are prone to skin conditions like diaper rash, eczema, and dry skin, leading to a higher demand for specialized products. Parents are also becoming more discerning about the ingredients used in baby products, preferring natural and gentle ones.

- Hypoallergenic and organic options are particularly popular among parents. The Baby Skincare Products segment offers a diverse range of products, allowing parents to customize their routines. With rising disposable income levels, parents are willing to invest in premium skincare products. Social media and marketing influence consumer preferences and drive demand for certain brands and formulations.

By Age, the Infants segment held the largest share of 29.6% in 2023

- Infants have essential needs that require a wide range of products, including diapers, baby wipes, skincare products, and baby food. These products are necessary for their daily care and hygiene, leading to consistent demand within this age group. Infants typically require more frequent diaper changes, feeding, and skincare compared to older children. As a result, parents of infants tend to purchase baby care products more frequently, contributing to a larger share of the market.

- New parents, particularly first-time parents, often invest heavily in baby care products for their newborns. They are more likely to purchase a variety of products to ensure the health and well-being of their infants, leading to increased sales within the Infants segment. Infancy is a critical growth phase, and parents are particularly sensitive to the quality and safety of products used during this period. They are more likely to invest in premium and trusted brands, driving higher revenue within the Infants segment.

Baby Care Products Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region, with a growing population, is experiencing a surge in demand for baby care products like diapers, wipes, lotions, and food. Economic development in the region has led to higher disposable income, allowing parents to invest more in high-quality products. Urbanization is also driving market growth, with urban consumers having higher purchasing power. The rise of dual-income households and changing lifestyles has led to a demand for convenient, time-saving solutions like disposable diapers and pre-moistened wipes.

- As education levels and access to information increase, parents are becoming more aware of the importance of safe, high-quality products. The expansion of retail distribution channels, including online platforms and specialty baby stores, has made products more accessible to consumers in both urban and rural areas, contributing to the market growth.

Baby Care Products Market Top Key Players:

- Procter & Gamble (US)

- Johnson & Johnson (US)

- Kimberly-Clark Corporation (US)

- Baby Trend, Inc. (US)

- Avon Products, Inc. (US)

- Abbott Laboratories (US)

- The Clorox Company (US)

- Mead Johnson Nutrition Company (US)

- Naterra International, Inc. (US)

- Henkel AG & Co. KGaA (Germany)

- Beiersdorf AG (Germany)

- Reckitt Benckiser Group plc (United Kingdom)

- Unilever (United Kingdom/Netherlands)

- Danone S.A. (France)

- Weleda AG (Switzerland)

- Nestlé S.A. (Switzerland)

- Dabur India Limited (India)

- The Himalaya Drug Company (India)

- Kao Corporation (Japan)

- Pigeon Corporation (Japan)

- Kimberly-Clark Australia Pty Limited (Australia), and other major players

Key Industry Developments in the Baby Care Products Market:

- In June 2024, Lifelong Online, a prominent Indian e-commerce brand for consumer goods, entered the thriving baby care market by introducing a new category of baby products. The company aimed to revolutionize modern parenting by offering innovative and safe products. This new line included wearable breast pumps, strollers, bottle warmers, collapsible baby bathtubs, anti-slip baby bathers, and baby car seats. These advanced products were designed to enhance convenience and provide peace of mind for busy parents, ensuring the safety and well-being of their children.

- In January 2024, Pampers launched an all-new and enhanced range of Premium Care Diapers for babies. Featuring a unique 360-degree cottony softness, the improved Pampers Premium Care Diaper made babies feel like they were wearing nothing at all while receiving all the benefits of an all-in-one diaper. It boasted an inbuilt anti-rash blanket and lotion with aloe vera, safeguarding the delicate skin of the baby from rashes. The launch marked a significant advancement in baby care, ensuring comfort and protection for little ones.

|

Global Baby Care Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

206.31 Bn |

|

Forecast Period 2024-32 CAGR: |

6.38 % |

Market Size in 2032: |

359.96 Bn |

|

Segments Covered: |

By Product Type |

|

|

|

By Age |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BABY CARE PRODUCTS MARKET BY PRODUCT TYPE (2017-2032)

- BABY CARE PRODUCTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIAPERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BABY WIPES

- BABY FOOD

- BABY SKINCARE PRODUCTS

- BABY CLOTHING

- TOYS

- BABY CARE PRODUCTS MARKET BY AGE (2017-2032)

- BABY CARE PRODUCTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NEWBORNS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INFANTS

- TODDLERS

- PRESCHOOLERS

- BABY CARE PRODUCTS MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- BABY CARE PRODUCTS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- ONLINE RETAIL

- PHARMACIES

- CONVENIENCE STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Baby Care Products Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PROCTER & GAMBLE (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- JOHNSON & JOHNSON (US)

- KIMBERLY-CLARK CORPORATION (US)

- BABY TREND, INC. (US)

- AVON PRODUCTS, INC. (US)

- ABBOTT LABORATORIES (US)

- THE CLOROX COMPANY (US)

- MEAD JOHNSON NUTRITION COMPANY (US)

- NATERRA INTERNATIONAL, INC. (US)

- HENKEL AG & CO. KGAA (GERMANY)

- BEIERSDORF AG (GERMANY)

- RECKITT BENCKISER GROUP PLC (UNITED KINGDOM)

- UNILEVER (UNITED KINGDOM/NETHERLANDS)

- DANONE S.A. (FRANCE)

- WELEDA AG (SWITZERLAND)

- NESTLÉ S.A. (SWITZERLAND)

- DABUR INDIA LIMITED (INDIA)

- THE HIMALAYA DRUG COMPANY (INDIA)

- KAO CORPORATION (JAPAN)

- PIGEON CORPORATION (JAPAN)

- KIMBERLY-CLARK AUSTRALIA PTY LIMITED (AUSTRALIA)

- COMPETITIVE LANDSCAPE

- GLOBAL BABY CARE PRODUCTS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Age

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Baby Care Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

206.31 Bn |

|

Forecast Period 2024-32 CAGR: |

6.38 % |

Market Size in 2032: |

359.96 Bn |

|

Segments Covered: |

By Product Type |

|

|

|

By Age |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BABY CARE PRODUCTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BABY CARE PRODUCTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BABY CARE PRODUCTS MARKET COMPETITIVE RIVALRY

TABLE 005. BABY CARE PRODUCTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BABY CARE PRODUCTS MARKET THREAT OF SUBSTITUTES

TABLE 007. BABY CARE PRODUCTS MARKET BY TYPE

TABLE 008. BABY SKIN CARE MARKET OVERVIEW (2016-2028)

TABLE 009. BABY HAIR CARE MARKET OVERVIEW (2016-2028)

TABLE 010. BABY TOILETRIES MARKET OVERVIEW (2016-2028)

TABLE 011. BABY ORAL CARE MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. BABY CARE PRODUCTS MARKET BY CATEGORY

TABLE 014. MASS MARKET OVERVIEW (2016-2028)

TABLE 015. PREMIUM MARKET OVERVIEW (2016-2028)

TABLE 016. BABY CARE PRODUCTS MARKET BY DISTRIBUTION CHANNELS

TABLE 017. SUPERMARKETS/ HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 018. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 019. PHARMACIES/DRUG STORES MARKET OVERVIEW (2016-2028)

TABLE 020. ONLINE RETAILS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA BABY CARE PRODUCTS MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA BABY CARE PRODUCTS MARKET, BY CATEGORY (2016-2028)

TABLE 024. NORTH AMERICA BABY CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 025. N BABY CARE PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE BABY CARE PRODUCTS MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE BABY CARE PRODUCTS MARKET, BY CATEGORY (2016-2028)

TABLE 028. EUROPE BABY CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 029. BABY CARE PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC BABY CARE PRODUCTS MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC BABY CARE PRODUCTS MARKET, BY CATEGORY (2016-2028)

TABLE 032. ASIA PACIFIC BABY CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 033. BABY CARE PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BABY CARE PRODUCTS MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BABY CARE PRODUCTS MARKET, BY CATEGORY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA BABY CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 037. BABY CARE PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA BABY CARE PRODUCTS MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA BABY CARE PRODUCTS MARKET, BY CATEGORY (2016-2028)

TABLE 040. SOUTH AMERICA BABY CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 041. BABY CARE PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 042. JOHNSON & JOHNSON SERVICES INC: SNAPSHOT

TABLE 043. JOHNSON & JOHNSON SERVICES INC: BUSINESS PERFORMANCE

TABLE 044. JOHNSON & JOHNSON SERVICES INC: PRODUCT PORTFOLIO

TABLE 045. JOHNSON & JOHNSON SERVICES INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. NESTLÉ S.A: SNAPSHOT

TABLE 046. NESTLÉ S.A: BUSINESS PERFORMANCE

TABLE 047. NESTLÉ S.A: PRODUCT PORTFOLIO

TABLE 048. NESTLÉ S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. UNILEVER GROUP: SNAPSHOT

TABLE 049. UNILEVER GROUP: BUSINESS PERFORMANCE

TABLE 050. UNILEVER GROUP: PRODUCT PORTFOLIO

TABLE 051. UNILEVER GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. L'ORÉAL S.A.: SNAPSHOT

TABLE 052. L'ORÉAL S.A.: BUSINESS PERFORMANCE

TABLE 053. L'ORÉAL S.A.: PRODUCT PORTFOLIO

TABLE 054. L'ORÉAL S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. THE HIMALAYA DRUG COMPANY LTD.: SNAPSHOT

TABLE 055. THE HIMALAYA DRUG COMPANY LTD.: BUSINESS PERFORMANCE

TABLE 056. THE HIMALAYA DRUG COMPANY LTD.: PRODUCT PORTFOLIO

TABLE 057. THE HIMALAYA DRUG COMPANY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PROCTER & GAMBLE: SNAPSHOT

TABLE 058. PROCTER & GAMBLE: BUSINESS PERFORMANCE

TABLE 059. PROCTER & GAMBLE: PRODUCT PORTFOLIO

TABLE 060. PROCTER & GAMBLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. KIMBERLY-CLARK CORPORATION: SNAPSHOT

TABLE 061. KIMBERLY-CLARK CORPORATION: BUSINESS PERFORMANCE

TABLE 062. KIMBERLY-CLARK CORPORATION: PRODUCT PORTFOLIO

TABLE 063. KIMBERLY-CLARK CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OWLET BABY CARE: SNAPSHOT

TABLE 064. OWLET BABY CARE: BUSINESS PERFORMANCE

TABLE 065. OWLET BABY CARE: PRODUCT PORTFOLIO

TABLE 066. OWLET BABY CARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. PURE BY PRIYANKA: SNAPSHOT

TABLE 067. PURE BY PRIYANKA: BUSINESS PERFORMANCE

TABLE 068. PURE BY PRIYANKA: PRODUCT PORTFOLIO

TABLE 069. PURE BY PRIYANKA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ABBOTT NUTRITION: SNAPSHOT

TABLE 070. ABBOTT NUTRITION: BUSINESS PERFORMANCE

TABLE 071. ABBOTT NUTRITION: PRODUCT PORTFOLIO

TABLE 072. ABBOTT NUTRITION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. DABUR INDIA LTD: SNAPSHOT

TABLE 073. DABUR INDIA LTD: BUSINESS PERFORMANCE

TABLE 074. DABUR INDIA LTD: PRODUCT PORTFOLIO

TABLE 075. DABUR INDIA LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. NEW AVON COMPANY: SNAPSHOT

TABLE 076. NEW AVON COMPANY: BUSINESS PERFORMANCE

TABLE 077. NEW AVON COMPANY: PRODUCT PORTFOLIO

TABLE 078. NEW AVON COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ARTSANA S.P.A.: SNAPSHOT

TABLE 079. ARTSANA S.P.A.: BUSINESS PERFORMANCE

TABLE 080. ARTSANA S.P.A.: PRODUCT PORTFOLIO

TABLE 081. ARTSANA S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. DABUR INTERNATIONAL LIMITED: SNAPSHOT

TABLE 082. DABUR INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 083. DABUR INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 084. DABUR INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. DANONE S A: SNAPSHOT

TABLE 085. DANONE S A: BUSINESS PERFORMANCE

TABLE 086. DANONE S A: PRODUCT PORTFOLIO

TABLE 087. DANONE S A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. WELEDA AG: SNAPSHOT

TABLE 088. WELEDA AG: BUSINESS PERFORMANCE

TABLE 089. WELEDA AG: PRODUCT PORTFOLIO

TABLE 090. WELEDA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. BEIERSDORF GROUP: SNAPSHOT

TABLE 091. BEIERSDORF GROUP: BUSINESS PERFORMANCE

TABLE 092. BEIERSDORF GROUP: PRODUCT PORTFOLIO

TABLE 093. BEIERSDORF GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. BURT'S BEES INC.: SNAPSHOT

TABLE 094. BURT'S BEES INC.: BUSINESS PERFORMANCE

TABLE 095. BURT'S BEES INC.: PRODUCT PORTFOLIO

TABLE 096. BURT'S BEES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 097. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 098. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 099. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BABY CARE PRODUCTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BABY CARE PRODUCTS MARKET OVERVIEW BY TYPE

FIGURE 012. BABY SKIN CARE MARKET OVERVIEW (2016-2028)

FIGURE 013. BABY HAIR CARE MARKET OVERVIEW (2016-2028)

FIGURE 014. BABY TOILETRIES MARKET OVERVIEW (2016-2028)

FIGURE 015. BABY ORAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. BABY CARE PRODUCTS MARKET OVERVIEW BY CATEGORY

FIGURE 018. MASS MARKET OVERVIEW (2016-2028)

FIGURE 019. PREMIUM MARKET OVERVIEW (2016-2028)

FIGURE 020. BABY CARE PRODUCTS MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 021. SUPERMARKETS/ HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 022. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 023. PHARMACIES/DRUG STORES MARKET OVERVIEW (2016-2028)

FIGURE 024. ONLINE RETAILS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA BABY CARE PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE BABY CARE PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC BABY CARE PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA BABY CARE PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA BABY CARE PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Baby Care Products Market research report is 2024-2032.

Procter & Gamble (US), Johnson & Johnson (US), Kimberly-Clark Corporation (US), Baby Trend, Inc. (US), Avon Products, Inc. (US), Abbott Laboratories (US), The Clorox Company (US), Mead Johnson Nutrition Company (US), Naterra International, Inc. (US), Henkel AG & Co. KGaA (Germany), Beiersdorf AG (Germany), Reckitt Benckiser Group plc (United Kingdom), Unilever (United Kingdom/Netherlands), Danone S.A. (France), Weleda AG (Switzerland), Nestlé S.A. (Switzerland), Dabur India Limited (India), The Himalaya Drug Company (India), Kao Corporation (Japan), Pigeon Corporation (Japan), Kimberly-Clark Australia Pty Limited (Australia), and Other Major Players.

The Baby Care Products Market is segmented into Product Type, Age, Distribution Channel, and region. By Product Type, the market is categorized into Diapers, Baby Wipes, Baby Food, Baby Skincare Products, Baby Clothing, and Toys By Age, the market is categorized into Newborns, Infants, Toddlers, Preschoolers. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Pharmacies, Convenience Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Baby care products typically refer to a range of items designed to meet the needs of infants and young children. These products can include diapers, baby wipes, baby shampoo, baby lotion, baby oil, baby powder, diaper rash cream, baby bottles, pacifiers, baby formula, baby food, baby clothes, baby blankets, baby toys, and other items essential for the care, hygiene, and comfort of babies and toddlers.

Baby Care Products Market Size Was Valued at USD 206.31 Billion in 2023, and is Projected to Reach USD 359.96 Billion by 2032, Growing at a CAGR of 6.38% From 2024-2032.