Automotive Wrap Films Market Synopsis

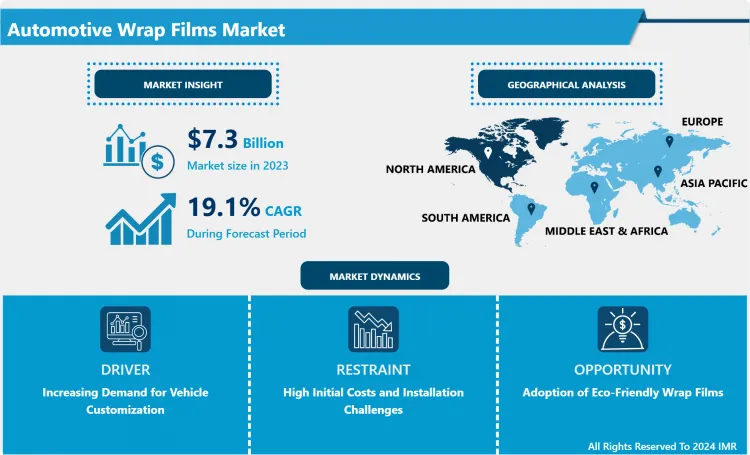

Automotive Wrap Films Market Size Was Valued at USD 7.3 Billion in 2023, and is Projected to Reach USD 35.2 Billion by 2032, Growing at a CAGR of 19.1% From 2024-2032.

Automotive wrap film is the industry specialization field in auto industry that concerns with the manufacturing of Vinyl, cast or calendered films used for the covering of exterior surface of a vehicle. These films replace conventional paint jobs and are applied for beauty and elegance, commercialism, and shielding. Car wrap vinyls are exceptionally some of the most durable, flexible materials capable of being ordered in a multitude of sheens ranging from high gloss, matte, satin and even textured finishes. This is because they also afford the owner or fleet manager’s protection against the uv rays, small impacts, and the wearing effects of the weather, making the vehicles attractive proposition. The films can therefore be used on personal, commercial, racing as well as public use vehicles and transport means. Recent years have seen an influx of these films and increased uptake due to the trending market of vehicle customization, commercial branding via vehicle wraps, and considering that these films are cheaper and more versatile than repainting. Also, miscellaneous factors such as the ease to install or replace covers without harming the paint have also contributed to their increasing use especially among environmentally concern citizens and companies.

- The automotive wrap films market has been growing constantly on the global platform due to factors such as growing automobile customizations and widespread application of wrap films in commercial advertisements. Car owners, whether private drivers, or those managing large fleets of vehicles, are applying wraps as a cheaper method of altering the appearance of their vehicle or as a protective layer from the original paint. Unlike early films, available in a very limited variety, the options today are much broader – different colors, finishes, and textures of the film mean that the car can be personalized to fit the owner’s desire without the need for expensive operations that would require a new custom paint job, for instance. Apart from the above, these films offer various protective functions; they protect cars from environmental factors, ultra violet radiation, and minor surface abrasions among others. This has made them a favourite of car owners who would want to retain the market value of their automobiles. On the commercial side of things, automotive wraps are now being adopted by many companies as a way to convert vehicles into moving advertisements thus improving the marketing of the brand and the car.

- On a regional basis, there has been dominance of the developed country markets, particularly North America and Europe; this due to the high disposable income levels, development of the advanced car technologies and strong culture of customization.. Developed regions such as Asia-Pacific are also displaying potential as the automotive industry in such regions develops. The increasing popularity of EVs has also helped drive the market for automotive wrap films since owners of these cars seek personalization. Firms in this market are also attempting to develop eco-materials for the wraps as more consumers are becoming more conscious of their carbon footprint. Competition is stiff as the market for projection screens continues to grow mature and as a result organizations are developing not only the actual film in terms of design and capability but also in terms of how easy it is to apply and remove.

Automotive Wrap Films Market Trend Analysis

Growing Popularity of Matte and Satin Finishes

- Perhaps one of the most significant trends that have been identified in the automotive wrap films industry is that of matte and satin automotive wrap films.. Originally, the gloss finishes were most popular but due to constant evolving demands of the buyers, they are now inclining towards a matte and a more low sheen type of finish giving cars a more elegant look. The matte and satin looks are less glossy and are currently gaining much popularity among the owners of and fans of luxury car brands. These finishes have the added bonus of a layer of protection against contaminants such as dirt or dust; and there is arguably nothing more appealing than the richness of a matte finish to offset the shininess of the steel components on these vehicles. With these new textures being introduced to the market as consumers look to stand out from the rest in terms of their vehicles, it is widening the realm of what can be considered customization. Also, owners of commercial fleets and advertisers who seek to brand out their vehicles in traffic appeals to these finishes further boosting the market for these wrap films.

Integration of Smart Wrap Films

- Another future scope in the automotive wrap films market is the provision of smart wrap films that contain technologies.. The simple features of films for the automobile are slowly changing, and companies are starting to look for films that provide more than looks and durability. Oh yes, there is; smart wrap films can adapt to the ambient temperature, light, or any other factor, making a vehicle uniquely customized for the owner. These advanced films also steady possible to include functionalities, such as the photoelectricity converting function in which films participate in energy-saving, especially for EVs. Moreover, functional graphic films that can accept images, animations, messages, or promotional content, or dynamic data, as speed or consumption, are being considered. These innovations are expected to significantly disrupt the market by satisfying tech-savvy clientèle who require versatile products in sync with the trend of connected vehicles and smart automotive solutions.

Automotive Wrap Films Market Segment Analysis:

Automotive Wrap Films Market Segmented on the basis of Film Type, Vehicle Type and Application.

By Film Type, Windows Films segment is expected to dominate the market during the forecast period

- Segmenting the automotive wrap films market by film type, Window films segment is projected to hold the largest share during the forecast period.. It has been established that there is an increased demand for improved looks of vehicles; privacy and protection. Benefits of window films include cutting on glare, eliminating the risky UV rays and applying a security feature where it can keep the shattered glass in place. These films are most effectively used in areas with hot climates due to their ability to lower the temperature inside cars and thereby save energy from air conditioning.

- In the same way, innovations like smart tinting and enhanced durability are flooded the market to attract the maximum number of consumers and thus enhancing the dominance of the segment.. Originally used by car owners, the survey also shows that many fleet managers are now installing window films for these protective and functional purposes, hence suggesting that this segment could experience enormous new sales in the future years.

By Vehicle Type, Commercial Cars segment expected to held the largest share

- Based on vehicles, the commercial cars segment accounts for the largest share of the automotive wrap films market for the duration of the forecast period.. This growth is attributed by the rising trend of using vehicle wrapping for advertisement and identification of commercial vehicles. Companies are more and more frequently using commercial vehicles as advertizing space, incorporating in films for this purpose to advertise their goods and services at comparatively low cost and with great effect. Since wraps can be easily changed, they are perfect for businesses who want to have their advertisement changed frequently or switched altogether.

- Further, small business supplies vehicles like delivery vans, taxi, and service trucks need wraps for both identification and also as protective layer against various weather conditions, road debris or any other vandals which extend vehicle’s life and retain its looks.. A broad application of wraps across and into the transportation and logistics, as well as, public transportation, increases the size of the commercial cars segment, which have remained the largest segment in the automotive wrap films market.

Automotive Wrap Films Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2023, North America dominated in the global automotive wrap films market and held about 35% of the market share.. These factors are; high demand for automotive accessories customized for their cars, throve automotive industry and geopolitical concentration of important market players. Also, consumers across the North American region are relatively wealthy with high per capita disposable income and the trend towards customization especially for automobiles is well entrenched. The market has also been driven by increased in commercial advertising where vehicle wraps are used by businesses as an advertising medium.

- Another reason is new usage type which is the electric vehicles, where the owners are using wraps to stand out.. The automotive wrap films markets have been relatively constant in countries such as the U.S. and Canada and while the demand for aesthetic wrap films also continues to reign, protective features of wraps also bring about market growth. However, due to its ongoing innovations especially in wrap technologies which include the sustainable and smart wraps, the region is expected to dominate the world market in coming years.

Active Key Players in the Automotive Wrap Films Market

- 3M (USA)

- Alltak (Brazil)

- Arlon Graphics LLC (USA)

- Avery Dennison Corporation (USA)

- Eastman Performance Films, LLC (USA)

- Fellers (USA)

- FlexiShield (South Africa)

- Guangzhou Carbins Film Co., Ltd. (China)

- Hexis S.A. (France)

- Inozetek (USA)

- JMR Graphics (USA)

- Kay Premium Marking Films (KPMF) (UK)

- Orafol Europe GmbH (Germany)

- Ritrama S.p.A. (Italy)

- Vvivid Vinyl (Canada) and Other Active Players.

Key Industry Developments in the Automotive Wrap Films Market:

- In February 2023, Fedrigoni S.P.A acquired a new R&D center in Grenoble, France to enhance its production innovation path and meet the growing consumer demand for innovative automotive films and wraps.

|

Global Automotive Wrap Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

19.1% |

Market Size in 2032: |

USD 35.2 Bn. |

|

Segments Covered: |

By Film Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Wrap Films Market by Film Type (2018-2032)

4.1 Automotive Wrap Films Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Windows Films

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wrap Films

4.5 Paint Protection Films

Chapter 5: Automotive Wrap Films Market by Vehicle Type (2018-2032)

5.1 Automotive Wrap Films Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Cars

5.5 Heavy Commercial Vehicles

Chapter 6: Automotive Wrap Films Market by Application (2018-2032)

6.1 Automotive Wrap Films Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Advertisement Purpose

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Safety Purpose

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Wrap Films Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALLTAK (BRAZIL)

7.4 ARLON GRAPHICS LLC (USA)

7.5 AVERY DENNISON CORPORATION (USA)

7.6 EASTMAN PERFORMANCE FILMS

7.7 LLC (USA)

7.8 FELLERS (USA)

7.9 FLEXISHIELD (SOUTH AFRICA)

7.10 GUANGZHOU CARBINS FILM COLTD. (CHINA)

7.11 HEXIS S.A. (FRANCE)

7.12 INOZETEK (USA)

7.13 JMR GRAPHICS (USA)

7.14 KAY PREMIUM MARKING FILMS (KPMF) (UK)

7.15 ORAFOL EUROPE GMBH (GERMANY)

7.16 RITRAMA S.P.A. (ITALY)

7.17 VVIVID VINYL (CANADA)

Chapter 8: Global Automotive Wrap Films Market By Region

8.1 Overview

8.2. North America Automotive Wrap Films Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Film Type

8.2.4.1 Windows Films

8.2.4.2 Wrap Films

8.2.4.3 Paint Protection Films

8.2.5 Historic and Forecasted Market Size by Vehicle Type

8.2.5.1 Passenger Cars

8.2.5.2 Commercial Cars

8.2.5.3 Heavy Commercial Vehicles

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Advertisement Purpose

8.2.6.2 Safety Purpose

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Wrap Films Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Film Type

8.3.4.1 Windows Films

8.3.4.2 Wrap Films

8.3.4.3 Paint Protection Films

8.3.5 Historic and Forecasted Market Size by Vehicle Type

8.3.5.1 Passenger Cars

8.3.5.2 Commercial Cars

8.3.5.3 Heavy Commercial Vehicles

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Advertisement Purpose

8.3.6.2 Safety Purpose

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automotive Wrap Films Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Film Type

8.4.4.1 Windows Films

8.4.4.2 Wrap Films

8.4.4.3 Paint Protection Films

8.4.5 Historic and Forecasted Market Size by Vehicle Type

8.4.5.1 Passenger Cars

8.4.5.2 Commercial Cars

8.4.5.3 Heavy Commercial Vehicles

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Advertisement Purpose

8.4.6.2 Safety Purpose

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automotive Wrap Films Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Film Type

8.5.4.1 Windows Films

8.5.4.2 Wrap Films

8.5.4.3 Paint Protection Films

8.5.5 Historic and Forecasted Market Size by Vehicle Type

8.5.5.1 Passenger Cars

8.5.5.2 Commercial Cars

8.5.5.3 Heavy Commercial Vehicles

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Advertisement Purpose

8.5.6.2 Safety Purpose

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Wrap Films Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Film Type

8.6.4.1 Windows Films

8.6.4.2 Wrap Films

8.6.4.3 Paint Protection Films

8.6.5 Historic and Forecasted Market Size by Vehicle Type

8.6.5.1 Passenger Cars

8.6.5.2 Commercial Cars

8.6.5.3 Heavy Commercial Vehicles

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Advertisement Purpose

8.6.6.2 Safety Purpose

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Wrap Films Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Film Type

8.7.4.1 Windows Films

8.7.4.2 Wrap Films

8.7.4.3 Paint Protection Films

8.7.5 Historic and Forecasted Market Size by Vehicle Type

8.7.5.1 Passenger Cars

8.7.5.2 Commercial Cars

8.7.5.3 Heavy Commercial Vehicles

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Advertisement Purpose

8.7.6.2 Safety Purpose

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Automotive Wrap Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

19.1% |

Market Size in 2032: |

USD 35.2 Bn. |

|

Segments Covered: |

By Film Type |

|

|

|

By Vehicle Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Wrap Films Market research report is 2024-2032.

3M (USA), Alltak (Brazil), Arlon Graphics LLC (USA), Avery Dennison Corporation (USA), Eastman Performance Films, LLC (USA) and Other Major Players.

The Automotive Wrap Films Market is segmented into Film Type, Vehicle Type, Application and region. By Film Type, the market is categorized into Windows Films, Wrap Films, Paint Protection Films. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Cars, Heavy Commercial Vehicles. By Application, the market is categorized into Advertisement Purpose, Safety Purpose. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Automotive wrap film is the industry specialization field in auto industry that concerns with the manufacturing of Vinyl, cast or calendered films used for the covering of exterior surface of a vehicle. These films replace conventional paint jobs and are applied for beauty and elegance, commercialism, and shielding. Car wrap vinyls are exceptionally some of the most durable, flexible materials capable of being ordered in a multitude of sheens ranging from high gloss, matte, satin and even textured finishes. This is because they also afford the owner or fleet manager’s protection against the uv rays, small impacts, and the wearing effects of the weather, making the vehicles attractive proposition. The films can therefore be used on personal, commercial, racing as well as public use vehicles and transport means. Recent years have seen an influx of these films and increased uptake due to the trending market of vehicle customization, commercial branding via vehicle wraps, and considering that these films are cheaper and more versatile than repainting. Also, miscellaneous factors such as the ease to install or replace covers without harming the paint have also contributed to their increasing use especially among environmentally concern citizens and companies.

Automotive Wrap Films Market Size Was Valued at USD 7.3 Billion in 2023, and is Projected to Reach USD 35.2 Billion by 2032, Growing at a CAGR of 19.1% From 2024-2032.