Automotive damper Market Synopsis

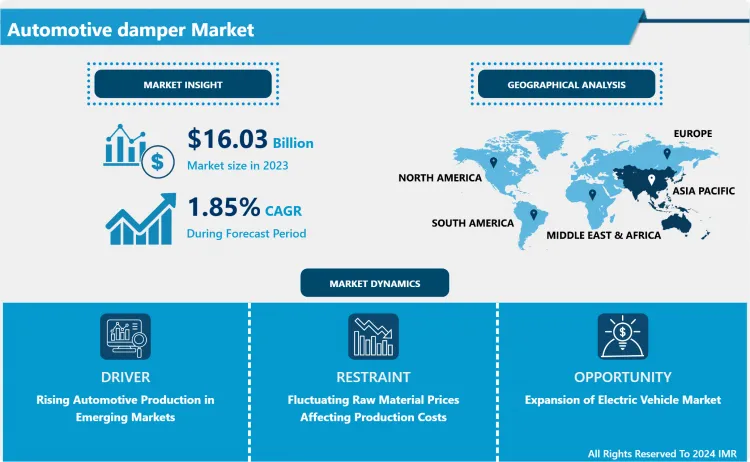

Automotive damper Market Size is Valued at USD 16.03 Billion in 2024, and is Projected to Reach USD 18.57 Billion by 2032, Growing at a CAGR of 1.85% From 2024-2032.

The automotive damper market is directly related with an assembly of components having the ability to reduce and regulate the motion energy created by path irregularities. These dampers are indispensable for improving ride comfort, stability and safety, by correcting the oscillation of suspension. They arebecoming popular in different classes of automobiles such as personal use vehicles, commercial and electric vehicles enhancing overall driving habits and vehicle stability.

- The major factor analised for the automotive damper market is the rising consumer expectation towards better ride quality and ride control. Whenever consumers insist on comfort and performance of car, manufacturers are forced to develop and improve the suspension systems. The adoption of sophisticated technologies like electronically controlled dampers and adaptive suspension systems is also adopted by car manufactures across the new model developments to meet consumers demands and provide smoother ride.

- Also, increasing production of automobile and especially in the growing markets is driving the automotive damper market. Higher per capita income, increased population in cities, and growing rates of car ownership increase the number of customers demand vehicles with improved suspension. Subsequently, due to the trend of manufacturing car and establishing/acquiring car plant to manufacture car meeting necessary safety and comfort standards, the demand for automotive damper is expected to escalate.

Automotive damper Market Trend Analysis

Shift towards lightweight materials and designs.

- One of the most popular trends in the automotive damper market is the introduction of less weight materials and constructions. Major players in the manufacturing industry are now turning to metals like aluminum along with composites as a way of lowering the total weight of dampers. This shift not only increases fuel efficiency and decreases emissions but also generally increases the performance of the vehicle due to its better control. In addition, improvement of manufacturing technologies like additive manufacturing or 3D printing effectuates the development of more sophisticated and effective damper systems.

- Another new development is the increasing incorporation of smart technologies in dampers. Electronically controlled dampers that can change the degree of their stiffness according to the current situation on the road is being developed. This innovation leads to increased comfort, and even more significantly, improvement of the car driving performance. In a near and connected/autonomous car environment, more sophisticated damper systems, which can interconnect with other systems and major components of the vehicle, may be expected by consumers.

The shift towards electric vehicles (EVs)

- Climb in demand of EVs can be seen as the key prospective of the automotive damper market. With changes in the nature and design of vehicles ongoing particularly in the shift to electrification of automobiles, there is need to develop and adopt complex suspension systems which will enable to handle the required load or the distribution of load weight of these special forms of vehicles. Existing manufacturers who are able to introduce new dampers with electric vehicle requirements in mind will be further positioned well in this fast-growing market.

- Also, the growing trend of self-driven vehicles may be another opportunity for the consumptions of automotive damper. So, as the technology of autonomous driving develops, people will pay more attention to both stability of the car and comfort of the passengers. Designing dampers that may improve comfort and safety of ride in autonomous cars is going to be important for producers who wish to tap into this growing niche market.

Automotive damper Market Segment Analysis:

Automotive damper Market Segmented on the basis of type, Material,

By Type, Shock Absorbers segment is expected to dominate the market during the forecast period

- Based on the type, the automotive damper market is classified as shock absorbers, struts, viscous dampers, hydraulic dampers, others. Cho” and “ko” are the Japanese words for ‘Shock absorbers’ as they are used to regulate the bumping and bouncing movement of a vehicles suspensions to give it a smoother ride without jerking. More than merely supporting weight of the car, struts also protect against oscillations – acting as both suspension and a shock absorber. Viscous dampers employ a chamber filled with fluid to isolate energy and absorb motion to eliminate vibration on diverse structures. Twin tube dampers work in a similar manner but instead of a solid iron piston using hydraulic fluid to offer its resistance against movement while driving. The “others” segment might therefore include other damper types not incorporated in the current vehicle, for instance, other advanced types addressed to particular automotive application or types developed as a consequence of the advancements in automobile engineering. Every kind of damper is extremely important and contributes greatly in improving vehicle performance, driving comfort and safety.

By Material, Steel segment held the largest share in 2024

- The automotive damper market is also classified on the basis of the material used in the product, which include steel, aluminum and composite material. Steel is preferred to be used since its properties of strength, durability for elongation, it is economical and reliable when used for the automotive industry applications. Meanwhile, aluminum is a comparably lighter material that improves fuel consumption and dynamism of automobile besides giving acceptable sturdiness and protection against corrosion. Composites or polymer matrix composites are an emergent form of material where two or more materials are placed together in a manner that their strength to weight ratio and performance can be maximised. These materials are gradually finding their way into applications in high-performance and electric vehicles where reduction of weight plays a crucial role. Each of the materials used has its advantages in that it enables manufacturers to design the dampers to suit certain automotive vehicles or market demand.

Automotive damper Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The automotive dampers market is presently most developed in the Asia-Pacific region as result of increasing automobile manufacturing and sales across countries including China, Japan, and India. Vehicle ownership is on the rise in the region due to rising middle class and levels of disposable income. Besides, key auto makers are setting up production facilities in this area to meet the increasing need for automotive suspension systems fitted in automobiles. Availability of a broad customer base and government measures to increase demand for automotive vehicles and components strengthen Asia-Pacific as the leading market for automotive dampers.

- Apart from that, further developments of automotive infrastructures and urbanization in the Asia-Pacific region are the factors that continue to boost the automotive industry. As vehicles continue to be produced today, there is the need for enhancing comfort and safety of riders through good suspension systems. Therefore, it could be anticipated that the growth rate of the automotive damper market in this region will increase in the future years, as the manufacturers seek to improve their by developing new equipment to suit the changing needs of the customer.

Active Key Players in the Automotive damper Market

- Monroe (United States)

- Bilstein (Germany)

- KYB Corporation (Japan)

- Gabriel (United States)

- Sachs (Germany)

- Tenneco Inc. (United States)

- ZF Friedrichshafen AG (Germany)

- Showa Corporation (Japan)

- Mando Corporation (South Korea)

- Boge Rubber & Plastics (Germany) and Other Active Players

|

Global Automotive damper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.85 % |

Market Size in 2032: |

USD 18.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive damper Market by Type (2018-2032)

4.1 Automotive damper Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Shock Absorbers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Struts

4.5 Viscous Dampers

4.6 Hydraulic Dampers

4.7 Others

4.8 Material

4.9 Steel

4.10 Aluminum

4.11 Composites

Chapter 5: Automotive damper Market by Application (2018-2032)

5.1 Automotive damper Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Front Dampers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rear Dampers

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Automotive damper Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MONROE (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BILSTEIN (GERMANY)

6.4 KYB CORPORATION (JAPAN)

6.5 GABRIEL (UNITED STATES)

6.6 SACHS (GERMANY)

6.7 TENNECO INC. (UNITED STATES)

6.8 ZF FRIEDRICHSHAFEN AG (GERMANY)

6.9 SHOWA CORPORATION (JAPAN)

6.10 MANDO CORPORATION (SOUTH KOREA)

6.11 BOGE RUBBER & PLASTICS (GERMANY)

Chapter 7: Global Automotive damper Market By Region

7.1 Overview

7.2. North America Automotive damper Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Shock Absorbers

7.2.4.2 Struts

7.2.4.3 Viscous Dampers

7.2.4.4 Hydraulic Dampers

7.2.4.5 Others

7.2.4.6 Material

7.2.4.7 Steel

7.2.4.8 Aluminum

7.2.4.9 Composites

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Front Dampers

7.2.5.2 Rear Dampers

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Automotive damper Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Shock Absorbers

7.3.4.2 Struts

7.3.4.3 Viscous Dampers

7.3.4.4 Hydraulic Dampers

7.3.4.5 Others

7.3.4.6 Material

7.3.4.7 Steel

7.3.4.8 Aluminum

7.3.4.9 Composites

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Front Dampers

7.3.5.2 Rear Dampers

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Automotive damper Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Shock Absorbers

7.4.4.2 Struts

7.4.4.3 Viscous Dampers

7.4.4.4 Hydraulic Dampers

7.4.4.5 Others

7.4.4.6 Material

7.4.4.7 Steel

7.4.4.8 Aluminum

7.4.4.9 Composites

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Front Dampers

7.4.5.2 Rear Dampers

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Automotive damper Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Shock Absorbers

7.5.4.2 Struts

7.5.4.3 Viscous Dampers

7.5.4.4 Hydraulic Dampers

7.5.4.5 Others

7.5.4.6 Material

7.5.4.7 Steel

7.5.4.8 Aluminum

7.5.4.9 Composites

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Front Dampers

7.5.5.2 Rear Dampers

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Automotive damper Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Shock Absorbers

7.6.4.2 Struts

7.6.4.3 Viscous Dampers

7.6.4.4 Hydraulic Dampers

7.6.4.5 Others

7.6.4.6 Material

7.6.4.7 Steel

7.6.4.8 Aluminum

7.6.4.9 Composites

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Front Dampers

7.6.5.2 Rear Dampers

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Automotive damper Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Shock Absorbers

7.7.4.2 Struts

7.7.4.3 Viscous Dampers

7.7.4.4 Hydraulic Dampers

7.7.4.5 Others

7.7.4.6 Material

7.7.4.7 Steel

7.7.4.8 Aluminum

7.7.4.9 Composites

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Front Dampers

7.7.5.2 Rear Dampers

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Automotive damper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.03 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.85 % |

Market Size in 2032: |

USD 18.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive damper Market research report is 2024-2032.

Monroe (United States), Bilstein (Germany), KYB Corporation (Japan), Gabriel (United States), Sachs (Germany), Tenneco Inc. (United States), ZF Friedrichshafen AG (Germany), Showa Corporation (Japan), Mando Corporation (South Korea), Boge Rubber & Plastics (Germany) and Other Major Players.

The Automotive damper Market is segmented into by Type (Shock Absorbers, Struts, Viscous Dampers, Hydraulic Dampers, Others), By Material (Steel, Aluminum, Composites), Application (Front Dampers, Rear Dampers). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The automotive damper market encompasses a range of components designed to absorb and dissipate energy generated during vehicle motion, particularly from road irregularities. These dampers play a crucial role in enhancing ride comfort, stability, and safety by controlling the oscillation of suspension systems. They are widely used in various vehicle types, including passenger cars, commercial vehicles, and electric vehicles, contributing to overall driving performance and vehicle dynamics.

Automotive damper Market Size is Valued at USD 16.03 Billion in 2024, and is Projected to Reach USD 18.57 Billion by 2032, Growing at a CAGR of 1.85% From 2024-2032.