Global Automotive Adhesives Market Overview

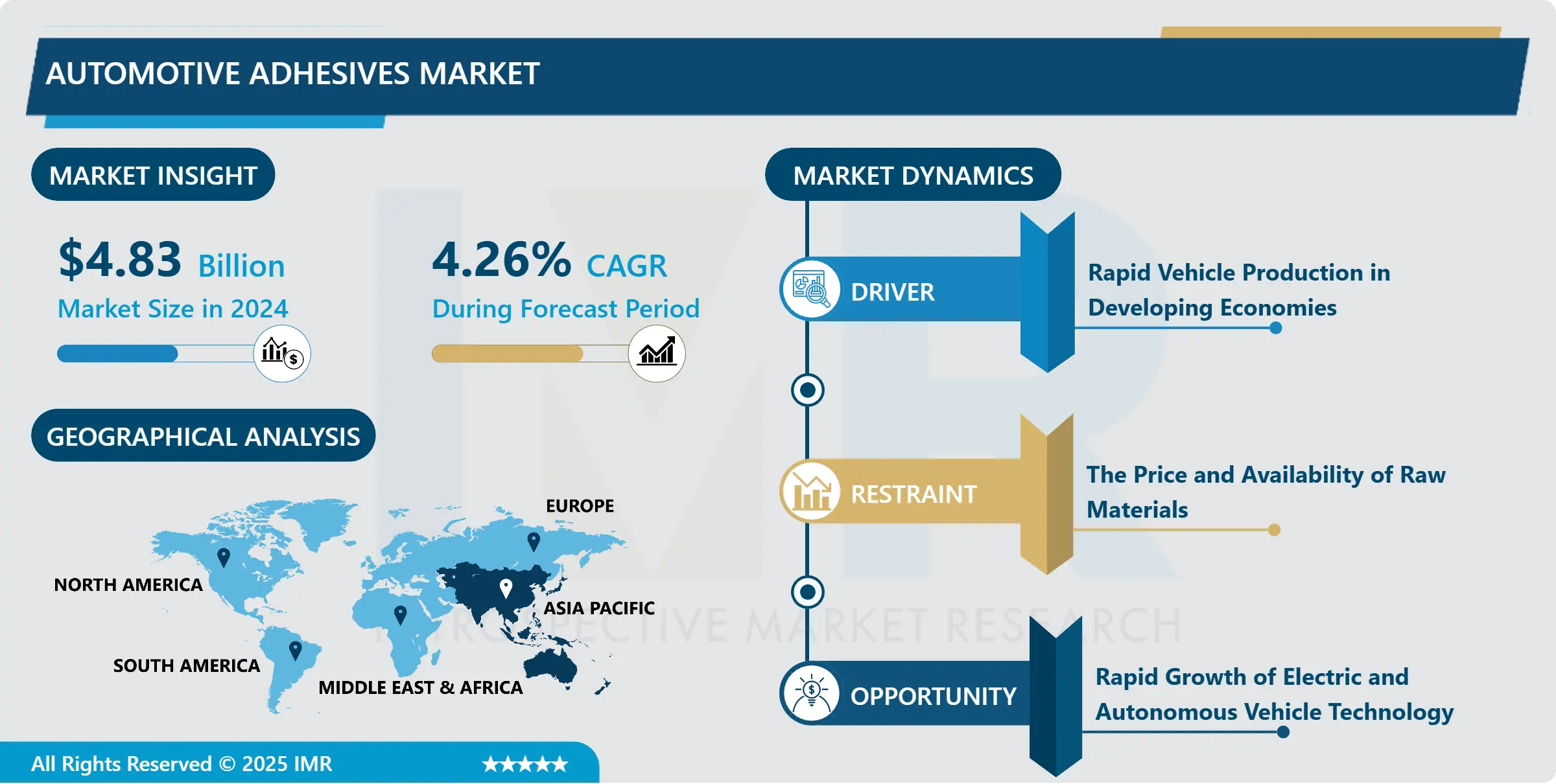

Global Automotive Adhesives Market was valued at USD 4.83 billion in 2024 and is expected to reach USD 7.64 billion by the year 2035, at a CAGR of 4.26%.

Automotive adhesives are specialized adhesive materials designed for the structural bonding of various automotive components. These adhesives are critical in addressing the complex requirements of modern automakers, facilitating a wide range of applications such as potting or casting, conformal coating, thermal management, and electromagnetic interference (EMI) or radio frequency interference (RFI) shielding. Their versatility allows them to create strong mechanical bonds and ensure reliable electrical connections, making them indispensable in many automotive systems.

The application of automotive adhesives spans a diverse array of components, including engine control units, anti-lock brake systems (ABS), displays, climate control systems, vehicle stability controls, navigation systems, transmission control units, vision systems, instrument panels, sensors, connectors, detectors, security devices, and battery monitoring systems. As the automotive industry embraces electrification and advanced electronic technologies, the role of adhesives is becoming increasingly significant.

One of the key advantages of using automotive adhesives is their potential to reduce vehicle weight, which directly impacts fuel efficiency and carbon emissions. By substituting traditional welding and metal joints with adhesives, manufacturers can create lightweight vehicles that are not only more efficient but also environmentally friendly. According to Henkel, the implementation of modern adhesives can decrease a vehicle's weight by as much as 15%, which is a substantial reduction.

The growing trend toward lightweight vehicles is anticipated to drive demand for automotive adhesives in the coming years. As automakers strive to meet stringent regulatory standards for emissions and fuel efficiency, the adoption of these advanced adhesive technologies will likely accelerate. This shift represents a significant transformation in vehicle production and design, showcasing how automotive adhesives are essential in shaping the future of the automotive industry.

Market Dynamics and Factors for the Automotive Adhesives Market:

Automotive Adhesives Market Drivers- Strong Application Utilization

Adhesives are gradually restoring spot welding for connecting the raw vehicle structure. Their deployment results in weight loss improved collision resilience and decreased metal exhaustion. Adhesives are utilized in a range of interior uses, such as speakers, dashboards, chairs, door panels, and trunk trim. They play a major role in ensuring sound reduction to give travelers a relaxing journey. Adhesives have outstanding heat tolerance and a fast-curing operation. These properties make it easy to use them extensively in headlamps, tailgates, fascia, roof modules, assembled parts, and spoilers. They are preferably owing to their good structural properties and are best suited for cross bonding of metals to composites.

Automotive Adhesives Market Restraints- The price and availability of raw materials

The price and availability of raw materials are the major factors considered by adhesive manufacturers for determining the cost structure of their products. Raw materials utilized by the adhesive industry include plastic resins, inorganic chemicals, industrial inorganic chemicals, and refined petroleum products. Most of these raw materials are petroleum-based derivatives and are exposed to fluctuations in commodity prices. Crude oil prices have been highly volatile in recent times. Growing global demand and unrest in the Middle East have been majorly responsible for this price fluctuation.

Automotive Adhesives Market Opportunities- Rapid Growth of Electric and Autonomous Vehicle Technology

Over the last year, significant technology advances have occurred in four areas vehicle electrification, widespread charging networks and fast charging technology, renewable electric power generation, and autonomous vehicle technology. The scarcity of infrastructure to charge these electric vehicles has been another barrier, but EV infrastructure is developing in many economies. Tesla's Supercharger network consists of more than 9,000 fast-charging points at over 1,200 locations, mainly in the U.S. 4 BMW, Daimler, Ford, and Volkswagen are emerging the IONITY network of 400 charging sites along major highways in Europe by 2020. At the same time, autonomous vehicle technology is advancing. Today, the field for autonomous vehicles is diverse, from incumbent car producers to electronic mapping companies to entrepreneurs in total, 44 different corporations and over 250 startups are currently working on the technology.

Market Segmentation

Segmentation for the Automotive Adhesives Market:

Based on the technology, the hotmelt segment is expected to register the maximum automotive adhesives market during the forecast period. Demand for hot melt adhesives is rising considerably owing to their superior durability. Hot melts based on reactive polyurethane are reaching popularity in the automotive industry owing to their ability to offer a superior bond and strong resistance against heat, moisture, and chemicals. Also, the application of hot melts in the automotive industry speeds up the production process in comparison to water-based and solvent-based products.

Based on the application, the body in the white segment is anticipated to dominate the automotive adhesives market during the forecast period. Adhesives are increasingly restoring spot welding for the bonding of raw vehicle framework. Their application leads to weight reduction, increased crash durability, and decreased metal exhaustion. Epoxy and polyurethane are the highly utilized products in the body in a white application. Moreover, each stage of the development of an automobile, whether for non-loading body components or structural parts, uses adhesives one way or another. Adhesives are utilized in the manufacturing of engines, body parts, gearboxes, and installed parts such as wing mirrors, seats, and steering wheels.

Based on the vehicle type, the passenger vehicles segment is projected to dominate the automotive adhesives market over the forecast period. The rising manufacturing of electric vehicles is anticipated to enhance the growth of the global automotive adhesives market. Additionally, along with structural bonding, adhesives act as a buffer and crash-resistant material in the event of an accident.

Based on the sales channel, the OEM segment held a prominent share of the automotive adhesives market with the major utilizations of adhesives being in production lines from automakers. The aftermarket segment is projected to grow at a significant pace as aftermarket repairs and overhauling are probably to improve the demand for automotive adhesives in the aftermarket.

Regional Analysis for the Automotive Adhesives Market:

The Asia Pacific is anticipated to dominate the automotive adhesive market over the forecast period, and led by China, due to large-scale vehicle production for international markets in the region. The demand for automotive adhesives in the APAC region is mainly turned by China and India. As per the China Adhesive Association, currently, China is the globally leading market for adhesives, in terms of production and demand, owing to the large number of vehicles manufactured in the country. Other economies, including those under ASEAN and India, are also anticipated to observe the highest growth on account of reduced labor and materials costs, and the consequent cost benefits to potential vehicle owners. In addition, nations in the Asia Pacific region are benefiting from efforts by market players towards regional and capacity expansion.

Players Covered in Automotive Adhesives Market are :

- 3M Company

- DuPont de Nemours Inc.

- Transtar Autobody Technologies Inc.

- Bondo Corporation

- Arkema S.A.

- Bostik S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Bemis Associates Inc.

- Covestro AG

- EMS-Chemie Holding AG

- Permatex Inc.

- H.B. Fuller Company

- Nitto Denko Corporation

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- Lord Corporation

- Nippon Paint Co. Ltd.

- RPM International Inc.

- Royal Adhesives and Sealants LLC

- The Dow Chemical Company

- ThreeBond Co. Ltd.

- Wacker-Chemie AG and other active players.

Key Industry Developments in the Automotive Adhesives Market:

-

In August 2023, Dow introduced VORANOL CP1100 polyol, a novel material engineered for crafting high-performance automotive adhesives. This innovative polyol is distinguished by its exceptional adhesion, flexibility, and durability, making it ideal for diverse automotive applications such as bonding lightweight materials, sealing components, and affixing trim.

In September 2023, Sika is launch of its new SikaForce-7760 structural adhesive, which is designed for bonding lightweight materials in electric vehicles and other automotive applications. Th4.26%.e adhesive is said to offer high strength and durability, as well as excellent resistance to chemicals and temperature extremes.

COVID-19 Impact on the Automotive Adhesives Market:

COVID-19 crisis has made a rapid economic impact on various financial as well as industrial sectors, such as travel and tourism, production, and aviation. As per the World Bank, the thrash economic recession is anticipated during 2020-2021. With the growing number of economies imposing and extending lockdowns, economic activities are decreasing, influencing the global economy. Producers in the automotive adhesive market are expected to be adversely impacted by the coronavirus pandemic. Lockdowns and restrictions on the manufacturing and automotive sectors of multiple nations have been key issues holding back revenue and market developments in the short term. Automotive OEMs have been largely impacted due to operational costs and capital problems, owing to delays in delivery of raw materials, which, in turn, is also impacting the automotive adhesive market. With continuing limitations on supply chains and the current health threat for workers, manufacturers are estimated to push for work-from-home operations for employees not running production lines. Also, manufacturing facilities are subject to stringent social distancing and other regulatory guidelines, which will produce short-term operational challenges for the duration of the crisis.

|

Automotive Adhesives Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.83 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.26%. |

Market Size in 2035: |

USD 7.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Sales Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Adhesives Market by Type (2018-2035)

4.1 Automotive Adhesives Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polyurethanes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Epoxy

4.5 Acrylics

4.6 Silicone

4.7 Others

Chapter 5: Automotive Adhesives Market by Technology (2018-2035)

5.1 Automotive Adhesives Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hotmelt

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Solvent Based

5.5 Water-Based

5.6 Pressure Sensitive

5.7 Others

Chapter 6: Automotive Adhesives Market by Application (2018-2035)

6.1 Automotive Adhesives Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Body in White

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Power Train

6.5 Paint Shop

6.6 Assembly

Chapter 7: Automotive Adhesives Market by Sales Channels (2018-2035)

7.1 Automotive Adhesives Market Snapshot and Growth Engine

7.2 Market Overview

7.3 OEM

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Aftermarket

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Adhesives Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BASF SE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ACCEPTA LTD.

8.4 MULTISORB TECHNOLOGIES INC.

8.5 MITSUBISHI GAS CHEMICAL COMPANY INC.

8.6 ANGUS CHEMICAL COMPANY

8.7 ARKEMA S.A.

8.8 CHEMFAX PRODUCTS LTD.

8.9 SOLENIS LLC

8.10 CLARIANT INTERNATIONAL LTD.

8.11 ROEMEX LIMITED

8.12 EASTMAN CHEMICAL COMPANY

8.13 ECOLAB INC.

8.14 GUARDIAN CHEMICALS INC.

8.15 THERMAX LTD

8.16 HENKEL AG & CO. KGAA

8.17 HYDRITE CHEMICAL CO.

8.18 TETRA TECHNOLOGIES INC.

8.19 SUEZ WATER TECHNOLOGIES & SOLUTIONS AND OTHER MAJOR PLAYERS.

Chapter 9: Global Automotive Adhesives Market By Region

9.1 Overview

9.2. North America Automotive Adhesives Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Polyurethanes

9.2.4.2 Epoxy

9.2.4.3 Acrylics

9.2.4.4 Silicone

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Hotmelt

9.2.5.2 Solvent Based

9.2.5.3 Water-Based

9.2.5.4 Pressure Sensitive

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Body in White

9.2.6.2 Power Train

9.2.6.3 Paint Shop

9.2.6.4 Assembly

9.2.7 Historic and Forecasted Market Size by Sales Channels

9.2.7.1 OEM

9.2.7.2 Aftermarket

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Adhesives Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Polyurethanes

9.3.4.2 Epoxy

9.3.4.3 Acrylics

9.3.4.4 Silicone

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Hotmelt

9.3.5.2 Solvent Based

9.3.5.3 Water-Based

9.3.5.4 Pressure Sensitive

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Body in White

9.3.6.2 Power Train

9.3.6.3 Paint Shop

9.3.6.4 Assembly

9.3.7 Historic and Forecasted Market Size by Sales Channels

9.3.7.1 OEM

9.3.7.2 Aftermarket

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Adhesives Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Polyurethanes

9.4.4.2 Epoxy

9.4.4.3 Acrylics

9.4.4.4 Silicone

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Hotmelt

9.4.5.2 Solvent Based

9.4.5.3 Water-Based

9.4.5.4 Pressure Sensitive

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Body in White

9.4.6.2 Power Train

9.4.6.3 Paint Shop

9.4.6.4 Assembly

9.4.7 Historic and Forecasted Market Size by Sales Channels

9.4.7.1 OEM

9.4.7.2 Aftermarket

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Adhesives Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Polyurethanes

9.5.4.2 Epoxy

9.5.4.3 Acrylics

9.5.4.4 Silicone

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Hotmelt

9.5.5.2 Solvent Based

9.5.5.3 Water-Based

9.5.5.4 Pressure Sensitive

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Body in White

9.5.6.2 Power Train

9.5.6.3 Paint Shop

9.5.6.4 Assembly

9.5.7 Historic and Forecasted Market Size by Sales Channels

9.5.7.1 OEM

9.5.7.2 Aftermarket

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Adhesives Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Polyurethanes

9.6.4.2 Epoxy

9.6.4.3 Acrylics

9.6.4.4 Silicone

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Hotmelt

9.6.5.2 Solvent Based

9.6.5.3 Water-Based

9.6.5.4 Pressure Sensitive

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Body in White

9.6.6.2 Power Train

9.6.6.3 Paint Shop

9.6.6.4 Assembly

9.6.7 Historic and Forecasted Market Size by Sales Channels

9.6.7.1 OEM

9.6.7.2 Aftermarket

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Adhesives Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Polyurethanes

9.7.4.2 Epoxy

9.7.4.3 Acrylics

9.7.4.4 Silicone

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Hotmelt

9.7.5.2 Solvent Based

9.7.5.3 Water-Based

9.7.5.4 Pressure Sensitive

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Body in White

9.7.6.2 Power Train

9.7.6.3 Paint Shop

9.7.6.4 Assembly

9.7.7 Historic and Forecasted Market Size by Sales Channels

9.7.7.1 OEM

9.7.7.2 Aftermarket

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Automotive Adhesives Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.83 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.26%. |

Market Size in 2035: |

USD 7.64 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Sales Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||