Global Automatic Power Factor Controller Market Overview

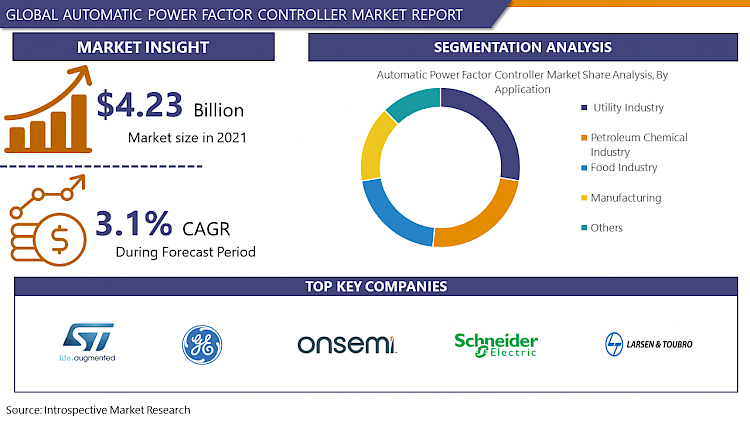

Global Automatic Power Factor Controller Market Size Was Valued at USD 4.36 Billion In 2022 And Is Projected to Reach USD 5.57 Billion By 2030, Growing at A CAGR of 3.1% From 2023 To 2030.

An automatic power factor controller project is developed to enhance the power factor automatically whenever the power factor falls below a certain level. As we know demand for electrical energy is rising day by day. More and more inductive loads are being utilized in industry and domestic applications. Inductive loads are the key factor for low power factors in the power system. Hence, we require to design a method to enhance the power factor automatically. Furthermore, an automatic power controller project offers a solution to this problem. Low power factor incorporates a redundant burden on the power system and transmission lines. By improving the power factor of the power system automatically, power system efficiency can be boosted. Furthermore, the power factor correction prototype is designed using a pic microcontroller, transformer, relays, current transformer, and zero-crossing circuit. The factors that accelerate the growth of the global automatic power factor controller market incorporates execution of automatic power factor controller in almost all the industries such as petroleum chemical industry, food industry, manufacturing, utility, commercial, enterprise, pharmaceutical industry, military, and others. In addition, rising demand for power management devices in the industries; thus, eventually a requirement for automatic power factor controllers. Several beneficial characteristics also turn the growth of the automatic power factor controller market such as management of power factor, need for inhibiting electronic apparatus from destruction, declines in electricity expenses, and power saving.

COVID-19 Impact on the Automatic Power Factor Controller Market

Most industries over the globe have been poorly influenced over the last 18 months owing to the COVI-19 outbreak. This can be attributed to significant interruptions faced by their respective production and supply-chain operations as a result of various precautionary lockdowns, as well as other restrictions that were imposed by governing authorities over the world. The same applies to the global automatic power factor controller market. Furthermore, consumer demand has also subsequently declined as individuals are now more keep on removing non-essential expenses from their respective budgets as the general economic status of most individuals has been adversely influenced by this pandemic. These above-mentioned elements are anticipated to burden the revenue track of the global automatic power factor controller market during the forecast period. Nevertheless, as respective governing authorities started to lift these enforced lockdowns, the global automatic power factor controller market is anticipated to recover accordingly.

Market Dynamics For Automatic Power Factor Controller Market

Drivers:

An automatic power factor controller is a device that is programmed to automatically improve the output power when the power factor decreases under a certain level. Demand for electric power is growing constantly. In addition, the requirement to build a system for automatic improvement in the power factor is rising, as low power factor puts lavish pressure on power grids and transmission lines. This requirement can be accomplished by using automatic power factor controllers. Demand for automatic power factor controllers is anticipated to grow at a significantly high rate shortly and the existing players are anticipated to reach a higher market share over the forecast period.

Furthermore, the automatic power factor controller market is the growing demand for power management in certain industries such as utility, manufacturing, defense, commercial, and enterprise among others. Power management is applied in computers, graphics power units (GPU), computer peripherals were turning off switches declines power supplies consequently leading to an efficient power supply to this device. Automatic power factor controller once installed in these industries decreases power requirement and low level of power utilization finally decrease electricity expenses also. Accessibility of extra KVA from the same existing supply. The decline in I²R losses in transformers and distribution equipment. Most of the utility industries such as power plants and transformers need reactive power factors and reduction in power losses is one of the foremost requirements. This would save electrical equipment from damaging and automatic power factor controller is anticipated to attain rising demand throughout the forecast period.

Restraints:

Some factors hamper the automatic power factor controller market during the forecast period. Automatic power factor controller has a short service life ranging from 8 to 10 years, also they are easily damaged if the voltage surpassed the rated value and once the capacitors are damaged, their repair is uneconomical which affect the automatic power factor controller market growth during the forecast period.

Opportunities:

A prototype-designed GSM system can be utilized for the large rating of automatic power factor controller system. Decreases harmonic content in the network which further reduces disturbances in the telecommunication network, misbehavior in control equipment and relay protections, measuring errors in the metering system. Furthermore, declines in network losses and equipment overloading & stress on insulation Reduces cost, unplanned outages, and rise power accessibility thus, which is expected to create a lucrative opportunity for the automatic power factor controller market in the upcoming years.

Market Segmentation

Global Automatic Power Factor Controller Market Research report comprises of Porter's five forces analysis to do the detail study about its each segmentation like Product segmentation, End user/application segment analysis and Major key players analysis mentioned as below;

Segmentation Analysis of Automatic Power Factor Controller Market:

Based on Type, the active power factor controller is expected to dominate the automatic power factor controller market and gain US$3 Billion during the forecast period. The factors that attribute to the increase of this sector are the adoption of Active Automatic Power Factor Controller by many sectors such as manufacturing, commercial, military, utility, and others. In addition, the active automatic power factor controller incorporates active components such as diodes and transistors that allow the engineers to attain a high-power factor of 0.99. Thus, most industries select active automatic power factor controllers owing to the high precision of power superiority.

Based on Component, microcontrollers are anticipated to dominates the automatic power factor controller market over the forecast period. In the age of industrialization, there is a rising requirement for inductive charging, and losses in the electrical system are common. Hence, the demand for APFC microcontrollers would increase, and demand for APFC microcontrollers is probably to grow over the forecast period.

Based on Application, the utility industry is expected to register the maximum automatic power factor controller market share over the forecast period. The factors that attribute to the growth of this sector are decreases in power loss in the distribution system, safeguarding the electronic devices from destruction, and superiority of reactive power. Furthermore, the utility industry is also determined to improve the power factor.

Regional Analysis of Automatic Power Factor Controller Market:

The North American market is anticipated to record the maximum revenue share in the global automatic power factor controller market during the forecast period. The major share of North America can be owed to the existence of major key players such as Fairchild Semiconductor International Inc. (US), Texas Instruments Inc. (US), ON Semiconductor Corporation (U.S.), General Electric (U.S.), and others will hasten the automatic power factor controller market in the region.

Furthermore, revenues from the Asia Pacific market are anticipated to grow at a significantly high speed during the forecast period, due to increasing urbanization, rising industrialization, and rising investments in infrastructure development in the region.

Players Covered in Automatic Power Factor Controller market are :

- STMicroelectronics NV (Switzerland)

- Eaton Corporation Plc. (Ireland)

- General Electric Company (US)

- EPCOS AG (Germany)

- Fairchild Semiconductor International Inc. (US)

- Larsen & Turbo (India)

- APFC panels manufacturers include ABB Ltd. (Switzerland)

- Crompton Greaves Ltd. (India)

- General Electric (U.S.)

- Schneider Electric (France)

- Texas Instruments Inc. (US)

- ON Semiconductor Corporation (U.S.)

- STMicroelectronics (Switzerland)

- and others Major Players.

|

Global Automatic Power Factor Controller Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 4.36 Bn. |

|

Forecast Period 2022-28 CAGR: |

3.1% |

Market Size in 2030: |

USD 5.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Installation Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Component

3.3 By Installation Type

3.4 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Automatic Power Factor Controller Market by Type

5.1 Automatic Power Factor Controller Market Overview Snapshot and Growth Engine

5.2 Automatic Power Factor Controller Market Overview

5.3 Active Power Factor Controller

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Active Power Factor Controller: Grographic Segmentation

5.4 Passive Power Factor Controller

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Passive Power Factor Controller: Grographic Segmentation

Chapter 6: Automatic Power Factor Controller Market by Component

6.1 Automatic Power Factor Controller Market Overview Snapshot and Growth Engine

6.2 Automatic Power Factor Controller Market Overview

6.3 Relays

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Relays: Grographic Segmentation

6.4 Capacitors

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Capacitors: Grographic Segmentation

6.5 Resistors

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Resistors: Grographic Segmentation

6.6 Displays

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Displays: Grographic Segmentation

6.7 Microcontrollers

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Microcontrollers: Grographic Segmentation

6.8 Switches

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Switches: Grographic Segmentation

Chapter 7: Automatic Power Factor Controller Market by Installation Type

7.1 Automatic Power Factor Controller Market Overview Snapshot and Growth Engine

7.2 Automatic Power Factor Controller Market Overview

7.3 Self-Standing APFC Panels

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Self-Standing APFC Panels: Grographic Segmentation

7.4 Wall-Mounted APFC Panels

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Wall-Mounted APFC Panels: Grographic Segmentation

Chapter 8: Automatic Power Factor Controller Market by Application

8.1 Automatic Power Factor Controller Market Overview Snapshot and Growth Engine

8.2 Automatic Power Factor Controller Market Overview

8.3 Petroleum Chemical Industry

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Petroleum Chemical Industry: Grographic Segmentation

8.4 Food Industry

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Food Industry: Grographic Segmentation

8.5 Manufacturing

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Manufacturing: Grographic Segmentation

8.6 Utility Industry

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Utility Industry: Grographic Segmentation

8.7 Others

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Others: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Automatic Power Factor Controller Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Automatic Power Factor Controller Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Automatic Power Factor Controller Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 STMICROELECTRONICS NV

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 EATON CORPORATION PLC.

9.4 GENERAL ELECTRIC COMPANY

9.5 EPCOS AG

9.6 FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC.

9.7 LARSEN & TURBO

9.8 ABB LTD.

9.9 CROMPTON GREAVES LTD.

9.10 GENERAL ELECTRIC

9.11 SCHNEIDER ELECTRIC

9.12 TEXAS INSTRUMENTS INC.

9.13 ON SEMICONDUCTOR CORPORATION

9.14 STMICROELECTRONICS

9.15 OTHER MAJOR PLAYERS

Chapter 10: Global Automatic Power Factor Controller Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Active Power Factor Controller

10.2.2 Passive Power Factor Controller

10.3 Historic and Forecasted Market Size By Component

10.3.1 Relays

10.3.2 Capacitors

10.3.3 Resistors

10.3.4 Displays

10.3.5 Microcontrollers

10.3.6 Switches

10.4 Historic and Forecasted Market Size By Installation Type

10.4.1 Self-Standing APFC Panels

10.4.2 Wall-Mounted APFC Panels

10.5 Historic and Forecasted Market Size By Application

10.5.1 Petroleum Chemical Industry

10.5.2 Food Industry

10.5.3 Manufacturing

10.5.4 Utility Industry

10.5.5 Others

Chapter 11: North America Automatic Power Factor Controller Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Active Power Factor Controller

11.4.2 Passive Power Factor Controller

11.5 Historic and Forecasted Market Size By Component

11.5.1 Relays

11.5.2 Capacitors

11.5.3 Resistors

11.5.4 Displays

11.5.5 Microcontrollers

11.5.6 Switches

11.6 Historic and Forecasted Market Size By Installation Type

11.6.1 Self-Standing APFC Panels

11.6.2 Wall-Mounted APFC Panels

11.7 Historic and Forecasted Market Size By Application

11.7.1 Petroleum Chemical Industry

11.7.2 Food Industry

11.7.3 Manufacturing

11.7.4 Utility Industry

11.7.5 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Automatic Power Factor Controller Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Active Power Factor Controller

12.4.2 Passive Power Factor Controller

12.5 Historic and Forecasted Market Size By Component

12.5.1 Relays

12.5.2 Capacitors

12.5.3 Resistors

12.5.4 Displays

12.5.5 Microcontrollers

12.5.6 Switches

12.6 Historic and Forecasted Market Size By Installation Type

12.6.1 Self-Standing APFC Panels

12.6.2 Wall-Mounted APFC Panels

12.7 Historic and Forecasted Market Size By Application

12.7.1 Petroleum Chemical Industry

12.7.2 Food Industry

12.7.3 Manufacturing

12.7.4 Utility Industry

12.7.5 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Automatic Power Factor Controller Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Active Power Factor Controller

13.4.2 Passive Power Factor Controller

13.5 Historic and Forecasted Market Size By Component

13.5.1 Relays

13.5.2 Capacitors

13.5.3 Resistors

13.5.4 Displays

13.5.5 Microcontrollers

13.5.6 Switches

13.6 Historic and Forecasted Market Size By Installation Type

13.6.1 Self-Standing APFC Panels

13.6.2 Wall-Mounted APFC Panels

13.7 Historic and Forecasted Market Size By Application

13.7.1 Petroleum Chemical Industry

13.7.2 Food Industry

13.7.3 Manufacturing

13.7.4 Utility Industry

13.7.5 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Automatic Power Factor Controller Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Active Power Factor Controller

14.4.2 Passive Power Factor Controller

14.5 Historic and Forecasted Market Size By Component

14.5.1 Relays

14.5.2 Capacitors

14.5.3 Resistors

14.5.4 Displays

14.5.5 Microcontrollers

14.5.6 Switches

14.6 Historic and Forecasted Market Size By Installation Type

14.6.1 Self-Standing APFC Panels

14.6.2 Wall-Mounted APFC Panels

14.7 Historic and Forecasted Market Size By Application

14.7.1 Petroleum Chemical Industry

14.7.2 Food Industry

14.7.3 Manufacturing

14.7.4 Utility Industry

14.7.5 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Automatic Power Factor Controller Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Active Power Factor Controller

15.4.2 Passive Power Factor Controller

15.5 Historic and Forecasted Market Size By Component

15.5.1 Relays

15.5.2 Capacitors

15.5.3 Resistors

15.5.4 Displays

15.5.5 Microcontrollers

15.5.6 Switches

15.6 Historic and Forecasted Market Size By Installation Type

15.6.1 Self-Standing APFC Panels

15.6.2 Wall-Mounted APFC Panels

15.7 Historic and Forecasted Market Size By Application

15.7.1 Petroleum Chemical Industry

15.7.2 Food Industry

15.7.3 Manufacturing

15.7.4 Utility Industry

15.7.5 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Automatic Power Factor Controller Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 4.36 Bn. |

|

Forecast Period 2022-28 CAGR: |

3.1% |

Market Size in 2030: |

USD 5.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Installation Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUTOMATIC POWER FACTOR CONTROLLER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUTOMATIC POWER FACTOR CONTROLLER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUTOMATIC POWER FACTOR CONTROLLER MARKET COMPETITIVE RIVALRY

TABLE 005. AUTOMATIC POWER FACTOR CONTROLLER MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUTOMATIC POWER FACTOR CONTROLLER MARKET THREAT OF SUBSTITUTES

TABLE 007. AUTOMATIC POWER FACTOR CONTROLLER MARKET BY TYPE

TABLE 008. ACTIVE POWER FACTOR CONTROLLER MARKET OVERVIEW (2016-2028)

TABLE 009. PASSIVE POWER FACTOR CONTROLLER MARKET OVERVIEW (2016-2028)

TABLE 010. AUTOMATIC POWER FACTOR CONTROLLER MARKET BY COMPONENT

TABLE 011. RELAYS MARKET OVERVIEW (2016-2028)

TABLE 012. CAPACITORS MARKET OVERVIEW (2016-2028)

TABLE 013. RESISTORS MARKET OVERVIEW (2016-2028)

TABLE 014. DISPLAYS MARKET OVERVIEW (2016-2028)

TABLE 015. MICROCONTROLLERS MARKET OVERVIEW (2016-2028)

TABLE 016. SWITCHES MARKET OVERVIEW (2016-2028)

TABLE 017. AUTOMATIC POWER FACTOR CONTROLLER MARKET BY INSTALLATION TYPE

TABLE 018. SELF-STANDING APFC PANELS MARKET OVERVIEW (2016-2028)

TABLE 019. WALL-MOUNTED APFC PANELS MARKET OVERVIEW (2016-2028)

TABLE 020. AUTOMATIC POWER FACTOR CONTROLLER MARKET BY APPLICATION

TABLE 021. PETROLEUM CHEMICAL INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 022. FOOD INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 023. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 024. UTILITY INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY TYPE (2016-2028)

TABLE 027. NORTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COMPONENT (2016-2028)

TABLE 028. NORTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY INSTALLATION TYPE (2016-2028)

TABLE 029. NORTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY APPLICATION (2016-2028)

TABLE 030. N AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY TYPE (2016-2028)

TABLE 032. EUROPE AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COMPONENT (2016-2028)

TABLE 033. EUROPE AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY INSTALLATION TYPE (2016-2028)

TABLE 034. EUROPE AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY APPLICATION (2016-2028)

TABLE 035. AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY TYPE (2016-2028)

TABLE 037. ASIA PACIFIC AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COMPONENT (2016-2028)

TABLE 038. ASIA PACIFIC AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY INSTALLATION TYPE (2016-2028)

TABLE 039. ASIA PACIFIC AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY APPLICATION (2016-2028)

TABLE 040. AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COUNTRY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY TYPE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COMPONENT (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY INSTALLATION TYPE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY APPLICATION (2016-2028)

TABLE 045. AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COUNTRY (2016-2028)

TABLE 046. SOUTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY TYPE (2016-2028)

TABLE 047. SOUTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COMPONENT (2016-2028)

TABLE 048. SOUTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY INSTALLATION TYPE (2016-2028)

TABLE 049. SOUTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY APPLICATION (2016-2028)

TABLE 050. AUTOMATIC POWER FACTOR CONTROLLER MARKET, BY COUNTRY (2016-2028)

TABLE 051. STMICROELECTRONICS NV: SNAPSHOT

TABLE 052. STMICROELECTRONICS NV: BUSINESS PERFORMANCE

TABLE 053. STMICROELECTRONICS NV: PRODUCT PORTFOLIO

TABLE 054. STMICROELECTRONICS NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. EATON CORPORATION PLC.: SNAPSHOT

TABLE 055. EATON CORPORATION PLC.: BUSINESS PERFORMANCE

TABLE 056. EATON CORPORATION PLC.: PRODUCT PORTFOLIO

TABLE 057. EATON CORPORATION PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 058. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 059. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 060. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. EPCOS AG: SNAPSHOT

TABLE 061. EPCOS AG: BUSINESS PERFORMANCE

TABLE 062. EPCOS AG: PRODUCT PORTFOLIO

TABLE 063. EPCOS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC.: SNAPSHOT

TABLE 064. FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 065. FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 066. FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. LARSEN & TURBO: SNAPSHOT

TABLE 067. LARSEN & TURBO: BUSINESS PERFORMANCE

TABLE 068. LARSEN & TURBO: PRODUCT PORTFOLIO

TABLE 069. LARSEN & TURBO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ABB LTD.: SNAPSHOT

TABLE 070. ABB LTD.: BUSINESS PERFORMANCE

TABLE 071. ABB LTD.: PRODUCT PORTFOLIO

TABLE 072. ABB LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. CROMPTON GREAVES LTD.: SNAPSHOT

TABLE 073. CROMPTON GREAVES LTD.: BUSINESS PERFORMANCE

TABLE 074. CROMPTON GREAVES LTD.: PRODUCT PORTFOLIO

TABLE 075. CROMPTON GREAVES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GENERAL ELECTRIC: SNAPSHOT

TABLE 076. GENERAL ELECTRIC: BUSINESS PERFORMANCE

TABLE 077. GENERAL ELECTRIC: PRODUCT PORTFOLIO

TABLE 078. GENERAL ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 079. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 080. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 081. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TEXAS INSTRUMENTS INC.: SNAPSHOT

TABLE 082. TEXAS INSTRUMENTS INC.: BUSINESS PERFORMANCE

TABLE 083. TEXAS INSTRUMENTS INC.: PRODUCT PORTFOLIO

TABLE 084. TEXAS INSTRUMENTS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. ON SEMICONDUCTOR CORPORATION: SNAPSHOT

TABLE 085. ON SEMICONDUCTOR CORPORATION: BUSINESS PERFORMANCE

TABLE 086. ON SEMICONDUCTOR CORPORATION: PRODUCT PORTFOLIO

TABLE 087. ON SEMICONDUCTOR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. STMICROELECTRONICS: SNAPSHOT

TABLE 088. STMICROELECTRONICS: BUSINESS PERFORMANCE

TABLE 089. STMICROELECTRONICS: PRODUCT PORTFOLIO

TABLE 090. STMICROELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY TYPE

FIGURE 012. ACTIVE POWER FACTOR CONTROLLER MARKET OVERVIEW (2016-2028)

FIGURE 013. PASSIVE POWER FACTOR CONTROLLER MARKET OVERVIEW (2016-2028)

FIGURE 014. AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY COMPONENT

FIGURE 015. RELAYS MARKET OVERVIEW (2016-2028)

FIGURE 016. CAPACITORS MARKET OVERVIEW (2016-2028)

FIGURE 017. RESISTORS MARKET OVERVIEW (2016-2028)

FIGURE 018. DISPLAYS MARKET OVERVIEW (2016-2028)

FIGURE 019. MICROCONTROLLERS MARKET OVERVIEW (2016-2028)

FIGURE 020. SWITCHES MARKET OVERVIEW (2016-2028)

FIGURE 021. AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY INSTALLATION TYPE

FIGURE 022. SELF-STANDING APFC PANELS MARKET OVERVIEW (2016-2028)

FIGURE 023. WALL-MOUNTED APFC PANELS MARKET OVERVIEW (2016-2028)

FIGURE 024. AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY APPLICATION

FIGURE 025. PETROLEUM CHEMICAL INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 026. FOOD INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 027. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 028. UTILITY INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA AUTOMATIC POWER FACTOR CONTROLLER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Automatic Power Factor Controller Market research report is 2023-2030.

STMicroelectronics NV (Switzerland), Eaton Corporation Plc. (Ireland), General Electric Company (US), EPCOS AG (Germany), Fairchild Semiconductor International Inc. (US), Larsen & Turbo (India), APFC panels manufacturers include ABB Ltd. (Switzerland), Crompton Greaves Ltd. (India), General Electric (U.S.), Schneider Electric (France), Texas Instruments Inc. (US), ON Semiconductor Corporation (U.S.), STMicroelectronics (Switzerland), and other major players.

The Automatic Power Factor Controller Market is segmented into Type, Component, Installation Type, Application, and region. By Type, the market is categorized into Active Power Factor Controller and Passive Power Factor Controller. By Component, the market is categorized into Relays, Capacitors, Resistors, Displays, Microcontrollers, and Switches. By Installation Type, the market is categorized into Self-Standing APFC Panels and Wall-Mounted APFC Panels. By Application, the market is categorized into Petroleum Chemical Industry, Food Industry, Manufacturing, Utility Industry, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An automatic power factor controller project is developed to enhance the power factor automatically whenever the power factor falls below a certain level. As we know demand for electrical energy is rising day by day. More and more inductive loads are being utilized in industry and domestic applications. Inductive loads are the key factor for low power factors in the power system. Hence, we require to design a method to enhance the power factor automatically.

Global Automatic Power Factor Controller Market Size Was Valued at USD 4.36 Billion In 2022 And Is Projected to Reach USD 5.57 Billion By 2030, Growing at A CAGR of 3.1% From 2023 To 2030.