Augmented Reality and Virtual Reality Market Synopsis

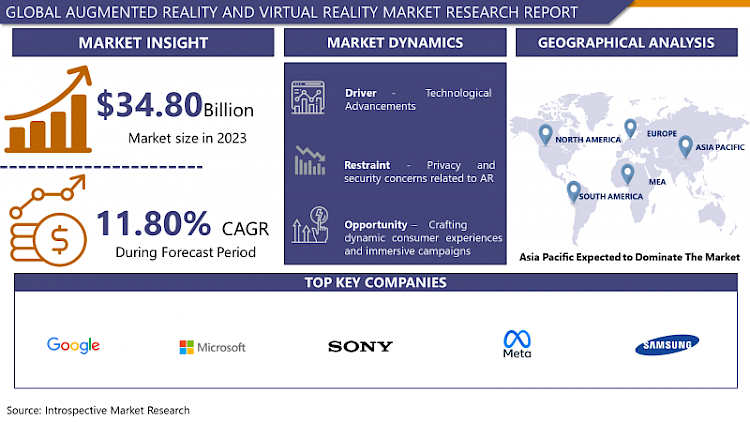

Augmented Reality and Virtual Reality Market Size Was Valued at USD 34.80 Billion in 2023, and is Projected to Reach USD 94.96 Billion by 2032, Growing at a CAGR of 11.80% From 2024-2032.

The augmented reality (AR) and virtual reality (VR) market comprises the rapidly growing field that involves the development of technologies allowing for the realistic interaction with objects in digitally-generated environments. Augmented reality is the technology under which digital information is superimposed over real-world environment, thus bringing some sense of reality in it by embedding it with virtual reality, generally, using smart phones or AR glasses. While augmented reality overlays digital images and data on top of the real world, embracing features of a physical environment, virtual reality generates completely computer generated environments that are commonly accessed via a headset and allow the user to indirectly interface with artificial environments. The AR/VR hardware market includes headsets, sensors, and input devices like controllers, gloves, and others, while the software market covers games, entertainment, learning applications in healthcare, business training as well as across numerous other industries. Leveraging technology and as usage of AR and VR applications becomes more widespread across sectors, the market for both technologies also continues to grow, providing new and exciting experiences and applications for consumers globally.

- The Augmented Reality (AR) and Virtual Reality (VR) market continues to surge with unprecedented growth, driven by technological advancements and expanding applications across various industries. AR, which overlays digital information onto the physical world, and VR, which immerses users into entirely virtual environments, are revolutionizing how businesses interact with customers and employees alike. With the proliferation of smartphones and affordable VR headsets, the consumer market for AR and VR experiences is booming, encompassing gaming, entertainment, and social media.

- Moreover, businesses are increasingly adopting AR and VR technologies to enhance customer engagement, streamline operations, and improve training processes. From virtual product demonstrations to immersive training simulations, companies are leveraging AR and VR to deliver compelling experiences that drive sales and efficiency. Industries such as healthcare, education, automotive, and retail are particularly ripe for disruption, as AR and VR solutions offer innovative ways to visualize data, collaborate remotely, and personalize customer interactions.

- The COVID-19 pandemic has further accelerated the adoption of AR and VR, as remote work and virtual collaboration became the new norm. Organizations turned to immersive technologies to bridge the gap created by physical distancing measures, enabling teams to collaborate in virtual environments and providing remote training and support. As businesses prioritize digital transformation initiatives, investments in AR and VR are expected to soar, with the market projected to reach unprecedented heights in the coming years.

- However, challenges such as high development costs, hardware limitations, and concerns over data privacy and security remain significant hurdles to widespread adoption. Addressing these challenges will be crucial for unlocking the full potential of AR and VR technologies and ensuring their seamless integration into everyday life. Despite these obstacles, the future of AR and VR appears promising, with continued innovation driving new use cases and unlocking opportunities across industries. As businesses and consumers alike embrace the possibilities of augmented and virtual realities, the market for AR and VR is poised for sustained growth and evolution in the years to come.

Augmented Reality and Virtual Reality Market Trend Analysis

Transforming Healthcare and Retail Experiences

- In the realm of healthcare, augmented reality (AR) has emerged as a transformative tool, revolutionizing the way medical professionals approach surgical procedures, training, and patient care. One of the most impactful applications of AR in healthcare is surgical navigation, where surgeons can overlay real-time imaging data onto a patient's anatomy during operations. This technology provides surgeons with enhanced visualization, precise guidance, and better decision-making capabilities, ultimately leading to more successful surgeries and improved patient outcomes. Moreover, AR is playing a pivotal role in medical education by offering immersive experiences for students to practice procedures in virtual environments, increasing proficiency and confidence before entering the operating room. Additionally, AR is being utilized in patient care, allowing physicians to visualize and explain complex medical conditions to patients more effectively, leading to better understanding, adherence to treatment plans, and overall satisfaction with healthcare services.

- In the retail sector, augmented reality (AR) applications have redefined the customer experience by bridging the gap between online and offline shopping environments. Through AR technology, customers can now visualize products in their real-world surroundings before making a purchase, enabling them to make more informed buying decisions. For instance, furniture retailers are leveraging AR to allow customers to virtually place and visualize furniture pieces in their homes, ensuring proper fit and aesthetics. Similarly, cosmetic brands are using AR to offer virtual try-on experiences, allowing customers to see how makeup products look on their own faces before purchasing. This not only enhances the shopping experience but also reduces returns and increases customer satisfaction. Furthermore, AR-powered interactive displays and advertisements are becoming increasingly prevalent in retail spaces, captivating shoppers' attention and driving engagement by offering immersive and personalized experiences tailored to individual preferences and interests. As AR technology continues to advance, its integration into retail environments is expected to further revolutionize the way consumers interact with products and brands.

Expanding Horizons

- Virtual reality (VR) has established itself as a powerhouse in the realms of gaming and entertainment, offering immersive experiences that transport users to fantastical worlds and engage their senses in unprecedented ways. However, the true potential of VR goes beyond entertainment, as its applications span across various industries, revolutionizing the way training and simulation are conducted. In sectors such as aviation, automotive, and military, VR is becoming an invaluable tool for training personnel in realistic scenarios without the need for costly physical prototypes or exposing individuals to real-world risks. By simulating complex environments and scenarios, VR enables trainees to gain hands-on experience and develop critical skills in a safe and controlled setting, ultimately enhancing proficiency and preparedness for real-world situations.

- Furthermore, VR is emerging as a game-changer in the field of mental health therapy, offering innovative solutions for treating various psychological disorders and promoting well-being. Through immersive environments and interactive experiences, VR therapy provides individuals with a safe and controlled space to confront and overcome their fears through exposure therapy. Additionally, VR-based mindfulness exercises and relaxation techniques offer effective strategies for stress reduction and emotional regulation, empowering individuals to manage their mental health more effectively. The immersive nature of VR therapy allows for personalized and adaptive interventions tailored to individual needs, leading to improved outcomes and a more accessible approach to mental healthcare. As research and development in VR therapy continue to advance, the potential for leveraging virtual reality as a therapeutic tool for mental health is vast, promising transformative benefits for individuals seeking support and treatment.

Augmented Reality and Virtual Reality Market Segment Analysis:

Augmented Reality and Virtual Reality Market is Segmented based on Technology Type, End-user Type, application, Device and Component.

By Technology Type, Virtual Reality (VR) segment is expected to dominate the market during the forecast period

- Virtual Reality (VR) has become a cornerstone technology in various commercial sectors due to its unparalleled capacity to deliver fully immersive experiences. In the gaming industry, VR has redefined the boundaries of interactive entertainment, offering gamers an unprecedented level of immersion. Players can now step into virtual worlds, where they are not just spectators but active participants in the gaming narrative. From heart-pounding adventures to mind-bending puzzles, VR gaming experiences transport users to realms where their actions and decisions shape the outcome, creating a level of engagement that traditional gaming platforms struggle to match. This revolution in gaming has not only captivated audiences but also spurred innovation, with developers continuously pushing the boundaries of what is possible in virtual environments.

- Moreover, the impact of VR extends far beyond entertainment, penetrating critical sectors like healthcare and engineering. In healthcare, VR technologies have emerged as powerful tools for training medical professionals and simulating complex procedures. Surgeons can practice delicate operations in virtual environments, refining their skills and techniques without risk to patients. Similarly, VR facilitates immersive medical education, allowing students to explore anatomical structures or witness medical scenarios in realistic settings. In engineering, VR's ability to visualize and simulate complex designs has transformed the product development process. Engineers can prototype and test designs in virtual environments, identifying potential issues and refining solutions before physical production, thereby reducing costs and time-to-market. Ultimately, VR's impact in commercial applications underscores its transformative potential across diverse industries, revolutionizing how we interact with technology and engage with our surroundings.

By Device, Handheld devices segment held the largest share in 2023

- Handheld devices, including smartphones and tablets, have emerged as the primary conduit for accessing augmented reality (AR) and virtual reality (VR) experiences, commanding the largest share in the immersive technology market. Their ubiquity among consumers, coupled with continuous advancements in hardware capabilities, has democratized access to AR and VR content, making these technologies more accessible and inclusive. Through the installation of apps or accessing web-based AR experiences, users can seamlessly integrate virtual elements into their real-world environments, whether it's overlaying digital information onto physical spaces or immersing themselves in VR simulations. This accessibility has significantly broadened the audience for AR and VR, transcending traditional barriers and fostering widespread adoption across diverse demographics and geographic regions.

- The prevalence of handheld devices as the dominant platform for AR and VR experiences is further reinforced by their versatility and portability. Unlike dedicated VR headsets or AR glasses, which may require additional investment and specialized hardware, smartphones and tablets are devices that users already own and carry with them daily. This inherent convenience transforms these devices into natural entry points for individuals curious about exploring immersive content and experiences. Whether it's exploring virtual exhibitions, trying on virtual makeup, or playing AR-enhanced games, users can easily dip their toes into the world of AR and VR without the need for dedicated hardware setups. This accessibility not only lowers barriers to entry but also facilitates seamless integration of immersive technology into everyday activities, paving the way for new forms of entertainment, communication, and interaction in the digital age.

Augmented Reality and Virtual Reality Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, China stands out as a dominant force in the AR and VR market, boasting a significant share of global investments and technological advancements. With a population exceeding 1.4 billion and a rapidly expanding middle class, China presents an immense consumer base eager to embrace innovative technologies. This burgeoning demand has propelled the growth of the AR and VR market, with Chinese consumers increasingly seeking immersive experiences in gaming, entertainment, and education. Moreover, government support plays a pivotal role in driving technological innovation, with initiatives such as the "Made in China 2025" strategy emphasizing the development of high-tech industries including AR and VR. China's regulatory environment, though stringent, has also fostered a competitive landscape that encourages domestic companies like Tencent, Alibaba, and Huawei to invest heavily in AR and VR technologies. These tech giants have not only capitalized on the entertainment sector but have also diversified into e-commerce, healthcare, and manufacturing, leveraging AR and VR to enhance customer experiences, improve operational efficiency, and drive business growth.

- Meanwhile, Japan and South Korea contribute significantly to the Asia-Pacific AR and VR market, leveraging their advanced technological infrastructure and innovation-driven economies. Japanese companies like Sony and Panasonic have been at the forefront of developing cutting-edge VR hardware and software solutions, catering to both consumer and enterprise markets. Similarly, South Korea's tech giants such as Samsung and LG have made substantial investments in AR and VR technologies, particularly in the gaming and entertainment sectors. With a strong emphasis on research and development, as well as partnerships with global leaders in the AR and VR space, Japan and South Korea continue to solidify their positions as key players in shaping the future of immersive technologies in the Asia-Pacific region and beyond.

Active Key Players in the Augmented Reality and Virtual Reality Market

- Google (US),

- Microsoft (US),

- Sony Group Corporation (Japan),

- META (US),

- SAMSUNG (South Korea),

- HTC Corporation (Taiwan),

- Apple Inc. (US),

- PTC Inc. (US),

- Seiko Epson Corporation (Japan),

- Lenovo (China),

- Wikitude, a Qualcomm company (Austria),

- EON Reality (US),

- MAXST Co., Ltd. (South Korea),

- Magic Leap, Inc. (US),

- Blippar Group Limited(UK),

- Atheer, Inc (US),

- Vuzix (US),

- CyberGlove Systems Inc. (US),

- Leap Motions (Ultraleap) (US),

- Penumbra, Inc. (US)

- Other Key Players

Key Industry Developments in the Augmented Reality and Virtual Reality Market:

- In July 2023, Google and Taito are collaborating to create Space Invaders, an immersive AR game in which you may protect the Earth from your neighborhood. The game is driven by our ARCore and Geospatial APIs, which design entertaining levels in the real world with AR and on the screen solely with 3D using the player's immediate surroundings as well as adjacent buildings, landscapes, and other architectural aspects.

- In June 2023, Apple introduced the Apple Vision Pro, an innovative spatial computer that effortlessly merges digital content with the real world, enabling users to remain engaged and connected with others. Vision Pro establishes an expansive platform for applications that extends beyond the limitations of a conventional screen, introducing a completely three-dimensional user interface driven by the most instinctive and natural inputs available — a user's gaze, gestures, and voice.

- In June 2023, PTC and Rockwell Automation extended their collaboration, with a particular emphasis on encouraging manufacturing companies to embrace the Internet of Things (IoT) and augmented reality (AR) software. Rockwell Automation will persist in offering PTC's ThingWorx IoT software and Vuforia AR software to both current and prospective customers in the discrete and process manufacturing sectors

|

Global Augmented Reality and Virtual Reality Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 38.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.80% |

Market Size in 2032: |

USD 94.96 Bn. |

|

Segments Covered: |

By Technology Type |

|

|

|

By End-user Type |

|

||

|

By application |

|

||

|

By Device |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY TECHNOLOGY TYPE (2017-2032)

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUGMENTED REALITY (AR)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- VIRTUAL REALITY (VR)

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY END-USER TYPE (2017-2032)

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMMERCIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONSUMER

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY APPLICATION (2017-2032)

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GAMING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIA & ENTERTAINMENT

- REAL ESTATE

- EDUCATION

- RETAIL

- HEALTHCARE

- ENGINEERING

- OTHERS

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY DEVICE (2017-2032)

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HEAD MOUNTED DISPLAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HANDHELD DEVICES

- HEAD-UP DISPLAY

- SMARTGLASSES

- OTHERS

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY COMPONENT (2017-2032)

- AUGMENTED REALITY AND VIRTUAL REALITY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- AUGMENTED REALITY AND VIRTUAL REALITY Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- GOOGLE (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MICROSOFT (US),

- SONY GROUP CORPORATION (JAPAN),

- META (US),

- SAMSUNG (SOUTH KOREA),

- HTC CORPORATION (TAIWAN),

- APPLE INC. (US),

- PTC INC. (US),

- SEIKO EPSON CORPORATION (JAPAN),

- LENOVO (CHINA),

- WIKITUDE, A QUALCOMM COMPANY (AUSTRIA),

- EON REALITY (US),

- MAXST CO., LTD. (SOUTH KOREA),

- MAGIC LEAP, INC. (US),

- BLIPPAR GROUP LIMITED(UK),

- ATHEER, INC (US),

- VUZIX (US),

- CYBERGLOVE SYSTEMS INC. (US),

- LEAP MOTIONS (ULTRALEAP) (US),

- PENUMBRA, INC. (US)

- COMPETITIVE LANDSCAPE

- GLOBAL AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Technology Type

- Historic And Forecasted Market Size By End-user Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Device

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Augmented Reality and Virtual Reality Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 38.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.80% |

Market Size in 2032: |

USD 94.96 Bn. |

|

Segments Covered: |

By Technology Type |

|

|

|

By End-user Type |

|

||

|

By application |

|

||

|

By Device |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AUGMENTED REALITY AND VIRTUAL REALITY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AUGMENTED REALITY AND VIRTUAL REALITY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AUGMENTED REALITY AND VIRTUAL REALITY MARKET COMPETITIVE RIVALRY

TABLE 005. AUGMENTED REALITY AND VIRTUAL REALITY MARKET THREAT OF NEW ENTRANTS

TABLE 006. AUGMENTED REALITY AND VIRTUAL REALITY MARKET THREAT OF SUBSTITUTES

TABLE 007. AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY COMPONENT

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY DEVICE TYPE

TABLE 011. HEAD MOUNTED DISPLAY MARKET OVERVIEW (2016-2028)

TABLE 012. HEADS UP DISPLAY MARKET OVERVIEW (2016-2028)

TABLE 013. HANDHELD DEVICES MARKET OVERVIEW (2016-2028)

TABLE 014. STATIONARY AR SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 015. SMART GLASSES MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. AUGMENTED REALITY AND VIRTUAL REALITY MARKET BY INDUSTRY

TABLE 018. GAMING MARKET OVERVIEW (2016-2028)

TABLE 019. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 020. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 021. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 022. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 023. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 024. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COMPONENT (2016-2028)

TABLE 027. NORTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY DEVICE TYPE (2016-2028)

TABLE 028. NORTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY INDUSTRY (2016-2028)

TABLE 029. N AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COMPONENT (2016-2028)

TABLE 031. EUROPE AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY DEVICE TYPE (2016-2028)

TABLE 032. EUROPE AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY INDUSTRY (2016-2028)

TABLE 033. AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COMPONENT (2016-2028)

TABLE 035. ASIA PACIFIC AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY DEVICE TYPE (2016-2028)

TABLE 036. ASIA PACIFIC AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY INDUSTRY (2016-2028)

TABLE 037. AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COMPONENT (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY DEVICE TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY INDUSTRY (2016-2028)

TABLE 041. AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COUNTRY (2016-2028)

TABLE 042. SOUTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COMPONENT (2016-2028)

TABLE 043. SOUTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY DEVICE TYPE (2016-2028)

TABLE 044. SOUTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY INDUSTRY (2016-2028)

TABLE 045. AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY COUNTRY (2016-2028)

TABLE 046. GOOGLE: SNAPSHOT

TABLE 047. GOOGLE: BUSINESS PERFORMANCE

TABLE 048. GOOGLE: PRODUCT PORTFOLIO

TABLE 049. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. PTC: SNAPSHOT

TABLE 050. PTC: BUSINESS PERFORMANCE

TABLE 051. PTC: PRODUCT PORTFOLIO

TABLE 052. PTC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. APPLE: SNAPSHOT

TABLE 053. APPLE: BUSINESS PERFORMANCE

TABLE 054. APPLE: PRODUCT PORTFOLIO

TABLE 055. APPLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SONY: SNAPSHOT

TABLE 056. SONY: BUSINESS PERFORMANCE

TABLE 057. SONY: PRODUCT PORTFOLIO

TABLE 058. SONY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SAMSUNG ELECTRONICS: SNAPSHOT

TABLE 059. SAMSUNG ELECTRONICS: BUSINESS PERFORMANCE

TABLE 060. SAMSUNG ELECTRONICS: PRODUCT PORTFOLIO

TABLE 061. SAMSUNG ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MICROSOFT: SNAPSHOT

TABLE 062. MICROSOFT: BUSINESS PERFORMANCE

TABLE 063. MICROSOFT: PRODUCT PORTFOLIO

TABLE 064. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. HTC: SNAPSHOT

TABLE 065. HTC: BUSINESS PERFORMANCE

TABLE 066. HTC: PRODUCT PORTFOLIO

TABLE 067. HTC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OCULUS: SNAPSHOT

TABLE 068. OCULUS: BUSINESS PERFORMANCE

TABLE 069. OCULUS: PRODUCT PORTFOLIO

TABLE 070. OCULUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SEIKO EPSON: SNAPSHOT

TABLE 071. SEIKO EPSON: BUSINESS PERFORMANCE

TABLE 072. SEIKO EPSON: PRODUCT PORTFOLIO

TABLE 073. SEIKO EPSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. LENOVO: SNAPSHOT

TABLE 074. LENOVO: BUSINESS PERFORMANCE

TABLE 075. LENOVO: PRODUCT PORTFOLIO

TABLE 076. LENOVO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. WIKITUDE: SNAPSHOT

TABLE 077. WIKITUDE: BUSINESS PERFORMANCE

TABLE 078. WIKITUDE: PRODUCT PORTFOLIO

TABLE 079. WIKITUDE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. MAGIC LEAP: SNAPSHOT

TABLE 080. MAGIC LEAP: BUSINESS PERFORMANCE

TABLE 081. MAGIC LEAP: PRODUCT PORTFOLIO

TABLE 082. MAGIC LEAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. BLIPPAR: SNAPSHOT

TABLE 083. BLIPPAR: BUSINESS PERFORMANCE

TABLE 084. BLIPPAR: PRODUCT PORTFOLIO

TABLE 085. BLIPPAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. UPSKILL: SNAPSHOT

TABLE 086. UPSKILL: BUSINESS PERFORMANCE

TABLE 087. UPSKILL: PRODUCT PORTFOLIO

TABLE 088. UPSKILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MAXST: SNAPSHOT

TABLE 089. MAXST: BUSINESS PERFORMANCE

TABLE 090. MAXST: PRODUCT PORTFOLIO

TABLE 091. MAXST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. EON REALITY: SNAPSHOT

TABLE 092. EON REALITY: BUSINESS PERFORMANCE

TABLE 093. EON REALITY: PRODUCT PORTFOLIO

TABLE 094. EON REALITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. VUZIX: SNAPSHOT

TABLE 095. VUZIX: BUSINESS PERFORMANCE

TABLE 096. VUZIX: PRODUCT PORTFOLIO

TABLE 097. VUZIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. CYBERGLOVE SYSTEMS: SNAPSHOT

TABLE 098. CYBERGLOVE SYSTEMS: BUSINESS PERFORMANCE

TABLE 099. CYBERGLOVE SYSTEMS: PRODUCT PORTFOLIO

TABLE 100. CYBERGLOVE SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. LEAP MOTION: SNAPSHOT

TABLE 101. LEAP MOTION: BUSINESS PERFORMANCE

TABLE 102. LEAP MOTION: PRODUCT PORTFOLIO

TABLE 103. LEAP MOTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. SIXENSE ENTERPRISES: SNAPSHOT

TABLE 104. SIXENSE ENTERPRISES: BUSINESS PERFORMANCE

TABLE 105. SIXENSE ENTERPRISES: PRODUCT PORTFOLIO

TABLE 106. SIXENSE ENTERPRISES: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY COMPONENT

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY DEVICE TYPE

FIGURE 015. HEAD MOUNTED DISPLAY MARKET OVERVIEW (2016-2028)

FIGURE 016. HEADS UP DISPLAY MARKET OVERVIEW (2016-2028)

FIGURE 017. HANDHELD DEVICES MARKET OVERVIEW (2016-2028)

FIGURE 018. STATIONARY AR SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 019. SMART GLASSES MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY INDUSTRY

FIGURE 022. GAMING MARKET OVERVIEW (2016-2028)

FIGURE 023. MEDIA & ENTERTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 024. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 025. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 026. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 027. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 028. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA AUGMENTED REALITY AND VIRTUAL REALITY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Augmented Reality and Virtual Reality Market research report is 2024-2032.

Google (US), Microsoft (US), Sony Group Corporation (Japan), META (US), SAMSUNG (South Korea), HTC Corporation (Taiwan), Apple Inc. (US), PTC Inc. (US), Seiko Epson Corporation (Japan), Lenovo (China), Wikitude, a Qualcomm company (Austria), EON Reality (US), MAXST Co., Ltd. (South Korea), Magic Leap, Inc. (US), Blippar Group Limited(UK), Atheer, Inc (US), Vuzix (US), CyberGlove Systems Inc. (US), Leap Motions (Ultraleap) (US), Penumbra, Inc. (US)XX, and Other Major Players.

The Augmented Reality and Virtual Reality Market is segmented into By Technology Type, By End-user Type, By application, By Device, By Component and region. By Technology Type, the market is categorized into Augmented Reality (AR) and Virtual Reality (VR). By End-user Type, the market is categorized into Commercial and Consumer. By application, the market is categorized into Gaming, Media & Entertainment, Real Estate, Education, Retail, Healthcare, Engineering and Others. By Device, the market is categorized into Head Mounted Display, Handheld Devices, Head-up display, Smartglasses and Others.By Component, the market is categorized into Hardware, Display, Processor, Sensors, User interface ICs, Power Management ICs, Others , Software and Services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The augmented reality (AR) and virtual reality (VR) market comprises the rapidly growing field that involves the development of technologies allowing for the realistic interaction with objects in digitally-generated environments. Augmented reality is the technology under which digital information is superimposed over real-world environment, thus bringing some sense of reality in it by embedding it with virtual reality, generally, using smart phones or AR glasses. While augmented reality overlays digital images and data on top of the real world, embracing features of a physical environment, virtual reality generates completely computer generated environments that are commonly accessed via a headset and allow the user to indirectly interface with artificial environments. The AR/VR hardware market includes headsets, sensors, and input devices like controllers, gloves, and others, while the software market covers games, entertainment, learning applications in healthcare, business training as well as across numerous other industries. Leveraging technology and as usage of AR and VR applications becomes more widespread across sectors, the market for both technologies also continues to grow, providing new and exciting experiences and applications for consumers globally.

Augmented Reality and Virtual Reality Market Size Was Valued at USD 34.80 Billion in 2023, and is Projected to Reach USD 94.96 Billion by 2032, Growing at a CAGR of 11.80% From 2024-2032.