Assisted Living Software Market Synopsis

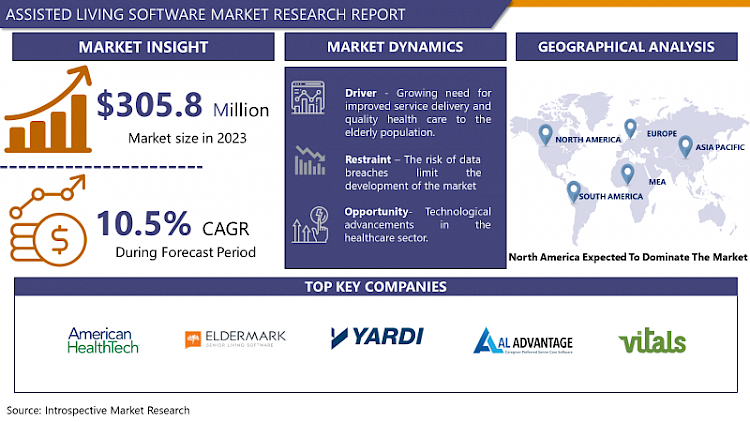

Assisted Living Software Market Size Was Valued at USD 305.8 Million in 2023, and is Projected to Reach USD 751.2 Million by 2032, Growing at a CAGR of 10.5% From 2024-2032.

The term “Assisted Living Software Market” refers to a growing trend in the overall Healthcare IT market that involves the provision of software that is specifically designed to work for assisted living facilities. Assisted living facilities provide appropriately lower levels of care for individuals who require different degrees of help with Activities of Daily Living but not the medical care provided in nursing homes. It is important to state that these are specialist software meant to enhance overall management, efficiency, and quality of services in such settings.

This need has been brought about by the increased wave of an aging population in the world thus increasing the need for assisted living services. A whole array of products and services that may encompass, for example, mobile applications and cloud-based platforms, integrated systems that could be customized on the basis of the requirements of supported assisted living facilities are what the industry encompasses. While designing and deploying these software solutions, some of the most relevant aspects to consider are data security, friendly user interface, and integration with other health care software systems.

- Some of the key vested stakeholders in the assisted living software market include healthcare providers, facility operators, and software developers. This market is expected to be defined by further developments in technology, in additional to changes in legislation in this industry of maturing and become a vital component of the overall health care technology system.

- The Assisted Living Software Market is being operated in a transitional state due to an enhancement in technology, and the factors like increasing concern for the senior population. As a result of growing rate of the elderly people across the world, dependence on advanced software in assisted living facilities has risen. Iot devices, artificial intelligence, and cloud-based platforms: These are some of the key trends that have shifted the form of senior care management by making devices integrated and making care more efficient and person-centered.

- Mainly because of its advantages over on-premises solutions, we see a shift towards cloud-based solutions in the assisted living software market. But, cloud solutions are particularly appealing for assisted living facilities of all sizes because of the benefits it offers better scalability, flexibility as well as cost management. Additionally, cloud-based technologies are helpful in achieving a higher level of care coordination and improved resident’s quality of life due to more accessible data and updates.

Assisted Living Software Market Trend Analysis

Growing elderly population is driving demand for advanced technological solutions in assisted living.

- The global market for assisted living software is driven by an increasing need for effective and integrated technologies in the assisted living industry. With the increase in the elderly population worldwide, more demand is felt for technology to support functions such as admission, care, and communication between staff, residents, and families. Apart from that, the adoption of IoT devices and wearables in assisted living places continues to drive the need for software that can capture, process, and exploit the created data for safety and health improvement. Furthermore, the COVID-19 pandemic has shifted focus on home care and remote monitoring as well as virtual communication, therefore increasing the demand for the software solutions, which support home care and telehealth services.

Integrating Assisted Living with Medical Services

- There are several opportunities in the assisted living software landscape that can foster innovation and development. Two significant areas for growth are customization and scalability, which allow the software developers to tailor the product to the specific needs of various facilities that are going to use it. In proactive resident care, the implementation of AI and more specific, prediction analysis can help in the early detection of health risks and trends.

- Additionally, the increase of concern to mobile application and user interface can improve the residents’ interaction and allow families in the assisted living homes to keep in touch with their loved ones. Such scenarios can also imply partnerships with medical centers and healthcare providers that result in solutions that connect assisted living to medical services.

Assisted Living Software Market Segment Analysis:

Assisted Living Software Market is segmented based on Deployment, and Amenity Type.

By amenity type, monitoring medication segment is expected to dominate the market during the forecast period

- The Assisted Living Software Market will also continue to grow as it pertains to difficulties in cooking for residents, to providing personal care or housekeeping/laundry services to resident, but most especially monitoring medication, which according to the research, is likely to be the defining factor in the assisted living software market in the future. Presumably, the increased focus on monitoring medication reflects the compelling aspect of the need to pay special attention to compliance with all residents’ healthcare schedules and protocols to make them as safe as possible.

- With the increase in elderly patients, the challenges of managing multiple medications are becoming apparent and this has prompted assisted living facilities to adopt software solutions that can help reduce the time spent on this process, besides avoiding mistakes that could harm the residents. This trend promoting the inclusion of complex medication management features in assisted living software, not only encompasses the interests of the residents but also stimulates the market development to address the fundamental need for effective healthcare support for residents in assisted living communities.

By deployment type, on-premises segment held the largest share in 2023

- The global Assisted Living Software Market is expected to witness growth in the years to come, owing to factors such as availability of varied deployment models like on-cloud and on-premises. facility management for deploying and implementing a solution on cloud is common and growing due to the fact that it can be easily scaled, considerably cheaper and a real-time update and remote access are possible with system on cloud. On the other hand, on-premises segment, held the largest market share in 2023, is still popular among organizations which are more focused on controlling, securing and fine-tuning their data. This segment continues to dominate due to the fact that a large pool of the market requires to store data onsite and in locations that have very strict rules on data storage. Altogether, these deployment models address a wide range of demand and exigencies; with facilities requiring solutions that are well-aligned with their operational environments and security requirements.

Assisted Living Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America will continue to hold the largest share in the Assisted Living Software Market during the forthcoming years owing to various factors. It has a high population growth rate coupled with a growing population of senior citizen hence the factors that could help propel assisted living facilities whose operations would require better software solutions. In addition, North America has a highly-developed HC system and significant focus on IT solutions and regulation that define the usage of such systems.

- Moreover, adopting advanced technologies is not an issue, as about 80% of the population uses advanced technologies in daily lives, and there is a well-developed and mature technology sector that will continue to promote innovation in the development of smart assisted living software with additional features such as cloud and IoT integrations. Collectively, these factors make North America the most capable region of driving market development and launching novel application of assisted living technologies.

Active Key Players in the Assisted Living Software Market

- American Health Tech

- Eldermark

- Yardi Systems, Inc

- Al Advantage Llc

- Vitals Software

- Matrixcare, Medtelligent, Inc

- Ecp

- Realpage, Inc.

- Icaremanager

- Other Key Players

Key Industry Developments in the Assisted Living Software Market:

- In June 2021, Eldermark came up with an improved point-of-care application for the geriatric care industry. This enables the organization to manage and oversee aspects of operation data to strengthen clinical services.

|

Global Assisted Living Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 338.0 Mn. |

|

Forecast Period 2024-32 CAGR: |

10.5 % |

Market Size in 2032: |

USD 751.2 Mn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Amenity Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ASSISTED LIVING SOFTWARE MARKET BY DEPLOYMENT TYPE (2017-2032)

- ASSISTED LIVING SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON PREMISES

- ASSISTED LIVING SOFTWARE MARKET BY AMENITY TYPE (2017-2032)

- ASSISTED LIVING SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COOKING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PERSONAL CARE

- HOUSEKEEPING AND LAUNDRY

- MONITORING MEDICATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Assisted Living Software Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMERICAN HEALTH TECH

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ELDERMARK

- YARDI SYSTEMS, INC

- AL ADVANTAGE LLC

- VITALS SOFTWARE

- MATRIXCARE, MEDTELLIGENT, INC

- ECP

- REALPAGE, INC.

- ICAREMANAGER

- COMPETITIVE LANDSCAPE

- GLOBAL ASSISTED LIVING SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Amenity Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Assisted Living Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 338.0 Mn. |

|

Forecast Period 2024-32 CAGR: |

10.5 % |

Market Size in 2032: |

USD 751.2 Mn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Amenity Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ASSISTED LIVING SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ASSISTED LIVING SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ASSISTED LIVING SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. ASSISTED LIVING SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ASSISTED LIVING SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. ASSISTED LIVING SOFTWARE MARKET BY DEPLOYMENT TYPE

TABLE 008. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 009. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 010. ASSISTED LIVING SOFTWARE MARKET BY ENTERPRISE SIZE

TABLE 011. SMES MARKET OVERVIEW (2016-2028)

TABLE 012. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 013. ASSISTED LIVING SOFTWARE MARKET BY APPLICATION

TABLE 014. ASSISTED LIVING FACILITIES (ALFS) MARKET OVERVIEW (2016-2028)

TABLE 015. RESIDENTIAL CARE HOMES (RCFES) MARKET OVERVIEW (2016-2028)

TABLE 016. CBRFS MARKET OVERVIEW (2016-2028)

TABLE 017. ADOLESCENT FRIENDLY HEALTH SERVICES (AFHS) MARKET OVERVIEW (2016-2028)

TABLE 018. MEMORY CARE COMMUNITIES MARKET OVERVIEW (2016-2028)

TABLE 019. CONTINUING CARE RETIREMENT COMMUNITIES (CCRCS) MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA ASSISTED LIVING SOFTWARE MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 021. NORTH AMERICA ASSISTED LIVING SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 022. NORTH AMERICA ASSISTED LIVING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 023. N ASSISTED LIVING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE ASSISTED LIVING SOFTWARE MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 025. EUROPE ASSISTED LIVING SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 026. EUROPE ASSISTED LIVING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 027. ASSISTED LIVING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC ASSISTED LIVING SOFTWARE MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 029. ASIA PACIFIC ASSISTED LIVING SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 030. ASIA PACIFIC ASSISTED LIVING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 031. ASSISTED LIVING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ASSISTED LIVING SOFTWARE MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA ASSISTED LIVING SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA ASSISTED LIVING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 035. ASSISTED LIVING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA ASSISTED LIVING SOFTWARE MARKET, BY DEPLOYMENT TYPE (2016-2028)

TABLE 037. SOUTH AMERICA ASSISTED LIVING SOFTWARE MARKET, BY ENTERPRISE SIZE (2016-2028)

TABLE 038. SOUTH AMERICA ASSISTED LIVING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 039. ASSISTED LIVING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 040. AMERICAN HEALTHTECH: SNAPSHOT

TABLE 041. AMERICAN HEALTHTECH: BUSINESS PERFORMANCE

TABLE 042. AMERICAN HEALTHTECH: PRODUCT PORTFOLIO

TABLE 043. AMERICAN HEALTHTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. YARDI SYSTEMS: SNAPSHOT

TABLE 044. YARDI SYSTEMS: BUSINESS PERFORMANCE

TABLE 045. YARDI SYSTEMS: PRODUCT PORTFOLIO

TABLE 046. YARDI SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. REALPAGE: SNAPSHOT

TABLE 047. REALPAGE: BUSINESS PERFORMANCE

TABLE 048. REALPAGE: PRODUCT PORTFOLIO

TABLE 049. REALPAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. POINTCLICKCARE: SNAPSHOT

TABLE 050. POINTCLICKCARE: BUSINESS PERFORMANCE

TABLE 051. POINTCLICKCARE: PRODUCT PORTFOLIO

TABLE 052. POINTCLICKCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MATRIXCARE: SNAPSHOT

TABLE 053. MATRIXCARE: BUSINESS PERFORMANCE

TABLE 054. MATRIXCARE: PRODUCT PORTFOLIO

TABLE 055. MATRIXCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. AL ADVANTAGE: SNAPSHOT

TABLE 056. AL ADVANTAGE: BUSINESS PERFORMANCE

TABLE 057. AL ADVANTAGE: PRODUCT PORTFOLIO

TABLE 058. AL ADVANTAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ASSISTED LIVING SOFT: SNAPSHOT

TABLE 059. ASSISTED LIVING SOFT: BUSINESS PERFORMANCE

TABLE 060. ASSISTED LIVING SOFT: PRODUCT PORTFOLIO

TABLE 061. ASSISTED LIVING SOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. CAREMERGE: SNAPSHOT

TABLE 062. CAREMERGE: BUSINESS PERFORMANCE

TABLE 063. CAREMERGE: PRODUCT PORTFOLIO

TABLE 064. CAREMERGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CAREVIUM: SNAPSHOT

TABLE 065. CAREVIUM: BUSINESS PERFORMANCE

TABLE 066. CAREVIUM: PRODUCT PORTFOLIO

TABLE 067. CAREVIUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CAREVOYANT: SNAPSHOT

TABLE 068. CAREVOYANT: BUSINESS PERFORMANCE

TABLE 069. CAREVOYANT: PRODUCT PORTFOLIO

TABLE 070. CAREVOYANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. DUDE SOLUTIONS: SNAPSHOT

TABLE 071. DUDE SOLUTIONS: BUSINESS PERFORMANCE

TABLE 072. DUDE SOLUTIONS: PRODUCT PORTFOLIO

TABLE 073. DUDE SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ECP: SNAPSHOT

TABLE 074. ECP: BUSINESS PERFORMANCE

TABLE 075. ECP: PRODUCT PORTFOLIO

TABLE 076. ECP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. ELDERMARK: SNAPSHOT

TABLE 077. ELDERMARK: BUSINESS PERFORMANCE

TABLE 078. ELDERMARK: PRODUCT PORTFOLIO

TABLE 079. ELDERMARK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. ICAREMANAGER: SNAPSHOT

TABLE 080. ICAREMANAGER: BUSINESS PERFORMANCE

TABLE 081. ICAREMANAGER: PRODUCT PORTFOLIO

TABLE 082. ICAREMANAGER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. MEDTELLIGENT: SNAPSHOT

TABLE 083. MEDTELLIGENT: BUSINESS PERFORMANCE

TABLE 084. MEDTELLIGENT: PRODUCT PORTFOLIO

TABLE 085. MEDTELLIGENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. VITALS SOFTWARE: SNAPSHOT

TABLE 086. VITALS SOFTWARE: BUSINESS PERFORMANCE

TABLE 087. VITALS SOFTWARE: PRODUCT PORTFOLIO

TABLE 088. VITALS SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 089. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 090. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 091. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY DEPLOYMENT TYPE

FIGURE 012. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 013. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY ENTERPRISE SIZE

FIGURE 015. SMES MARKET OVERVIEW (2016-2028)

FIGURE 016. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 017. ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 018. ASSISTED LIVING FACILITIES (ALFS) MARKET OVERVIEW (2016-2028)

FIGURE 019. RESIDENTIAL CARE HOMES (RCFES) MARKET OVERVIEW (2016-2028)

FIGURE 020. CBRFS MARKET OVERVIEW (2016-2028)

FIGURE 021. ADOLESCENT FRIENDLY HEALTH SERVICES (AFHS) MARKET OVERVIEW (2016-2028)

FIGURE 022. MEMORY CARE COMMUNITIES MARKET OVERVIEW (2016-2028)

FIGURE 023. CONTINUING CARE RETIREMENT COMMUNITIES (CCRCS) MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA ASSISTED LIVING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Assisted Living Software Market research report is 2024-2032.

American Health Tech, Eldermark, Yardi Systems, Inc, AL Advantage LLC, VITALS SOFTWARE, MatrixCare, Medtelligent, Inc, ECP, RealPage, Inc., iCareManager and Other Major Players.

The Assisted Living Software Market is segmented into deployment, amenity type, and region. By deployment, the market is categorized into On Cloud, and On Premises. By amenity type, the market is categorized into Cooking, Personal Care, Housekeeping and Laundry, Monitoring Medication, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Assisted living software is an application for managing the day-to-day functioning of assisted living residences. It provides a number of features, such as the ability to manage care delivery for residents, supervise medications, review staff and other employee schedules, and exchange information between affiliated staff, residents, and their families. This kind of software helps to improve the quality of the assistance that is delivered in assisted living facilities through managing some of the administrative processes and meeting the set health standards.

Assisted Living Software Market Size Was Valued at USD 305.8 Million in 2023, and is Projected to Reach USD 751.2 Million by 2032, Growing at a CAGR of 10.5% From 2024-2032.