Asia Pacific Social Robots Market Overview

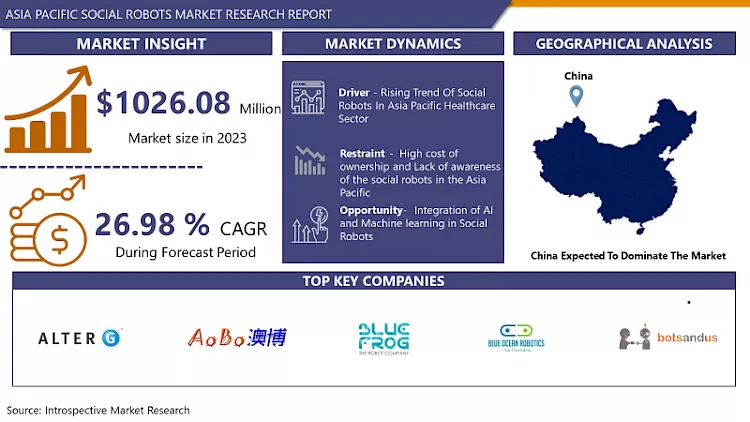

The Asia Pacific Social Robots Market size is expected to grow from USD 1026.08 million in 2023 to USD 8806.41 million by 2032, at a CAGR of 26.98% during the forecast period (2024–2032).

A social robot is an autonomous entity designed to interact and communicate with humans or other autonomous physical agents by adhering to social behaviors and rules associated with its specific role. These robots are programmed to engage in interactions that mimic human social norms, enabling them to perform tasks that require social understanding and responsiveness.

- Robots have made significant strides in language comprehension, making them invaluable tools in education, particularly for children learning a second language. These advanced machines are equipped with sophisticated natural language processing capabilities, enabling them to listen, understand, and respond to complex language queries in various languages.

- This proficiency allows robots to serve as effective tutors, offering personalized language instruction that can adapt to the learning pace and style of each student. By leveraging their ability to comprehend nuanced linguistic inputs, robots can provide feedback and guidance that is both immediate and tailored, enhancing the learning experience and outcomes for young language learners.

- In addition to their educational applications, robots excel in producing high-quality and precise work, outperforming human workers in many respects. Their inherent design and programming ensure that they operate with minimal errors, significantly reducing the likelihood of mistakes.

- Moreover, robots bring unparalleled efficiency to various industries by operating at a constant speed without the need for breaks, days off, or holiday time. This relentless work ethic enables them to produce a greater quantity of work in a shorter amount of time compared to human workers.

- Their continuous operation maximizes productivity and optimizes workflows, making them indispensable in high-demand environments where time and output are critical factors. By ensuring uninterrupted production, robots help businesses meet tight deadlines and manage large-scale operations more effectively, driving economic growth and competitive advantage in an increasingly automated world.

Market Dynamics And Factors For Asia Pacific Social Robots Market

Drivers:

Rising Trend Of Social Robots In Asia Pacific Healthcare Sector

One of the primary factors fostering a favorable view of the market is the healthcare sector's significant growth on a global scale. Hospitals and healthcare facilities frequently use social robots to aid in the treatment of illnesses like cerebral palsy. Additionally, several technological developments, including the incorporation of artificial intelligence (AI) and machine learning (ML) solutions, are boosting market expansion. These technologies help the robots navigate, recognize objects, and interact on their own. In keeping with this, the market growth is being positively impacted by the rising product demand in public services. Traffic control, telepresence, monitoring, queue management, and ensuring social distance are all handled by social robots. Researchers have started examining human-robot interactions in non-controlled or semi-controlled situations with encouraging results due to the rapid advancement of technologies integrated into social robots. For instance, Paro, a Japanese companion robot designed to resemble a baby harp seal, has been utilized in nursing homes and healthcare facilities primarily for companionship and therapy in the treatment of dementia. Paro responds to light, touch, sound, and orientation by moving and making seal noises. Thousands of them are in use in Europe, the United States, and Asia, and randomized experiments indicate that they boosted social interaction and decreased loneliness.

Restraints:

High cost of ownership and Lack of awareness of the social robots in the Asia Pacific

The cost of purchasing a social robot is one drawback of them. Generally, social robots come with high-end technologies and robust hardware which increases the cost of ownership. However, the less expensive social robots would not be as useful as the more expensive, more sophisticated ones. Also, many of the industry stakeholders are not aware of such robots and their active functions in the open environment. Therefore, the lack of connective demand in the region hampers market growth.

Opportunity:

Integration of AI and Machine learning in Social Robots

Social robots are becoming more popular in a range of service businesses as artificially intelligent assistants who assist customers. Additionally, they have been employed effectively in a variety of settings. According to Shariati et al., virtual reality-driven robots are more widely accepted and in demand for therapeutic and educational purposes. Due to changing societal norms, social robots have also been proposed as companions for young children and the elderly. Social robots have also benefitted families with autistic members. Additionally, the market is being helped by significant product usage in the banking, financial services, and insurance (BFSI) sector. BFSI organizations utilize social robots to do jobs including tutoring, customer service, and handling inquiries about banking. In line with this, the market is growing favorably as a result of the growing need for public services. In Asian Countries like China and Japan, Social robots manage tasks like traffic regulation, telepresence, monitoring, queue management, and maintaining social distancing. As a result of several other factors, including the rising demand for automation and digitalization across industries and the widespread usage of the product in the education sector as peer tutors or tutors, the market is anticipated to grow.

Segmentation Analysis of Asia Pacific Social Robots Market

By Technology, Context Awareness is expected to dominate the Social Robots Market. Recognizing the situation and acting or responding appropriately is one of the fundamental components of social robots. The use of context-aware technology will be advantageous in a variety of circumstances that may increase the need for social robots. These robots are being employed more frequently in educational settings since it is believed that their social characteristics and embodiment are beneficial. They might eventually be utilized as regulatory instruments. Because they can easily draw attention to themselves during group activities and interact using conventional channels of communication, social robots can be a useful platform for an awareness tool. Participants will have the ability to manage their conduct during the work session. Additionally, they seem to be fundamentally more difficult to ignore than a dashboard displayed on a tablet. Context awareness, for example, is a self-acting technology that can change the Asia Pacific Social Robots Market.

By End User Industry, Healthcare Segment is expected to dominate the Asia Pacific Social Robots Market. Healthcare settings are seeing an increase in the development, testing, and adoption of social robots. The need for mobility assistance devices is being driven by the rising population of the elderly and disabled worldwide. Also, in the therapy and hospitals segment, social robots showed promising opportunities as more and more humanoids are being deployed in healthcare facilities. For instance, The Hong Kong team behind Sophia, the well-known humanoid robot, is introducing Grace, a new prototype that is geared toward the healthcare industry and intended to connect with the elderly and those who have been left alone by the COVID-19 pandemic. This robot runs on artificial intelligence to diagnose a patient and can speak in English, Mandarin, and Cantonese.

Regional Analysis of Asia Pacific Social Robots Market

China is expected to be dominating in the Asia Pacific Social Robots Market. The growing trend of companion robots in china has pushed manufactures to develop socially active robots with high-end technology. It is also introduced in the healthcare sector as the pandemic has created a difficult time for healthcare facilities to treat people with highly infectious diseases. Robots and other IoT technologies at the hospital provided all medical services. Connected 5G thermometers were used to check patients at entry and warn personnel if anyone appeared to be feverish. Patients wore smart wristbands and rings that communicated with the AI platform of CloudMinds to monitor their vital signs, such as body temperature, heart rate, and blood oxygen levels. To detect any early indications of infection, doctors and nurses also donned the gadgets. Other autonomous droids served patients food, drinks, and medications while also providing information and amusement through dancing and other robots sprayed disinfectant and cleaned the floors. Such applications in china's healthcare facilities are boosting the market.

Japan is one of the fastest-growing regions in robots and robotic technologies. There is a wave of the development of social robots in Japan as many new robot development companies are investing and developing a new line of social robots for personal and commercial applications. For instance, Toyota's foray towards social robots is the Kirobo Mini. The automaton can hold simple conversations and is intended to be a buddy both inside and outside the car. It has a memory as well which can be expanded and customized according to to use. Moreover, Alter-ego robots are being developed by Aki Yuki, co-founder and COO of the Japanese robotics business Ory Lab Inc., to assist persons who are living with physical disabilities, mental illnesses, or age-related challenges in communicating, interacting, and participating socially or at work. Therefore, Japan is expected to grow at a significant rate.

Top Key Players Covered In Asia Pacific Social Robots Market

- AlterG Inc.

- Amy Robotics Co., Ltd.

- AoBo Information Technology Co., Ltd.

- Bionik Laboratories Corp.

- Blue Frog Robotics SAS

- Blue Ocean Robotics ApS

- BotsAndUs Ltd.

- Camanio AB

- Double Robotics Inc.

- Embodied Inc.

- Furhat Robotics AB

- Happy SAS

- Hanson Robotics Ltd.

- Aerobics Social Robotics SLL

- Intuition Robotics Ltd.

- Kinova Inc. and Other Major Players.

Key Industry Development In Asia Pacific Social Robots Market

- In March 2024, LG made a strategic investment to accelerate the advancement of its capabilities in service robotics, a key new business area for the company. LG executed a stock purchase agreement to acquire a stake in Bear Robotics, a prominent Silicon Valley-based startup specializing in AI-driven autonomous service robots. This investment involved USD 60 million. The move aimed to enhance LG's presence and innovation in the service robotics sector, leveraging Bear Robotics' expertise and technology.

- In January 2024, ABB announced that it had acquired the Swiss start-up Sevensense, a leading provider of AI-enabled 3D vision navigation technology for autonomous mobile robots (AMRs). Founded in 2018 as a spin-off from ETH Zurich, Sevensense's technology significantly enhances ABB's capabilities in next-generation AI-enabled robotics.

|

Asia Pacific Social Robots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1026.08 Mn. |

|

Forecast Period 2024-32 CAGR: |

26.98% |

Market Size in 2032: |

USD 8806.41 Mn. |

|

|

By Technology |

|

|

|

By End Users Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Asia Pacific Social Robots Market by Technology (2018-2032)

4.1 Asia Pacific Social Robots Market Snapshot and Growth Engine

4.2 Market Overview

4.3 ML

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 NLP

4.5 Computer Vision

4.6 Context Awareness

4.7 Others

Chapter 5: Asia Pacific Social Robots Market by End Users Industry (2018-2032)

5.1 Asia Pacific Social Robots Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Healthcare

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Education

5.5 Media and Entertainment

5.6 Retail

5.7 BFSI

5.8 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Asia Pacific Social Robots Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BMW MOTORRAD INTERNATIONAL

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Recent News & Development

6.2.8 SWOT Analysis

6.3 GOGORO

6.4 INCHONDA MOTOR CO. LTDKTM AG

6.5 MAHINDRA GROUP

6.6 NINEBOT LTDSUZUKI MOTOR CORPORATION

6.7 TERRA MOTORS CORPORATION

6.8 VMOTO LIMITED ABN

6.9 YAMAHA MOTOR COMPANY LIMITED

6.10 OTHER KEY PLAYERS

Chapter 7:Asia Pacific Social Robots Market Analysis, Insights and Forecast, 2016-2028

7.1 Market Overview

7.2 Key Market Trends, Growth Factors and Opportunities

7.3 Key Players

7.4 Historic and Forecasted Market Size by Technology

7.4.1 ML

7.4.2 NLP

7.4.3 Computer Vision

7.4.4 Context Awareness

7.4.5 Others

7.5 Historic and Forecasted Market Size by End Users Industry

7.5.1 Healthcare

7.5.2 Education

7.5.3 Media and Entertainment

7.5.4 Retail

7.5.5 BFSI

7.5.6 Others

7.6 Historic and Forecast Market Size by Country

7.6.1 China

7.6.2 India

7.6.3 Japan

7.6.4 South Korea

7.6.5 Malaysia

7.6.6 Thailand

7.6.7 Vietnam

7.6.8 The Philippines

7.6.9 Australia

7.6.10 New-Zealand

7.6.11 Rest of APAC

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Asia Pacific Social Robots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1026.08 Mn. |

|

Forecast Period 2024-32 CAGR: |

26.98% |

Market Size in 2032: |

USD 8806.41 Mn. |

|

|

By Technology |

|

|

|

By End Users Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Asia Pacific Social Robots Market research report is 2024-2032.

AlterG Inc.,Amy Robotics Co., Ltd.,AoBo Information Technology Co., Ltd.,Bionik Laboratories Corp.,Blue Frog Robotics SAS,Blue Ocean Robotics ApS,BotsAndUs Ltd.,Camanio AB,Double Robotics Inc.,Embodied Inc.,Furhat Robotics AB,Happy SAS,Hanson Robotics Ltd.,Aerobics Social Robotics SLL,Intuition Robotics Ltd.,Kinova Inc. and Other Major Players.

The Asia Pacific Social Robots Market is segmented into Technology, End User Industry and region. By Technology, the market is categorized into ML, NLP, Computer Vision, Context Awareness, Others. By End User Industry, the market is categorized into Healthcare, Education, Media and Entertainment, Retail, BFSI, Others. By region, it is analyzed across Asia-Pacific (China; India; Japan; Southeast Asia, etc.)

A social robot is an autonomous machine that interacts and communicates with people or other physical agents through the adoption of social norms and behaviors appropriate to its position. A social robot is physically embodied, just like other robots.

The Asia Pacific Social Robots Market size is expected to grow from USD 1026.08 million in 2023 to USD 8806.41 million by 2032, at a CAGR of 26.98% during the forecast period (2024–2032).