Asia Pacific Rehabilitation Equipment Market Overview

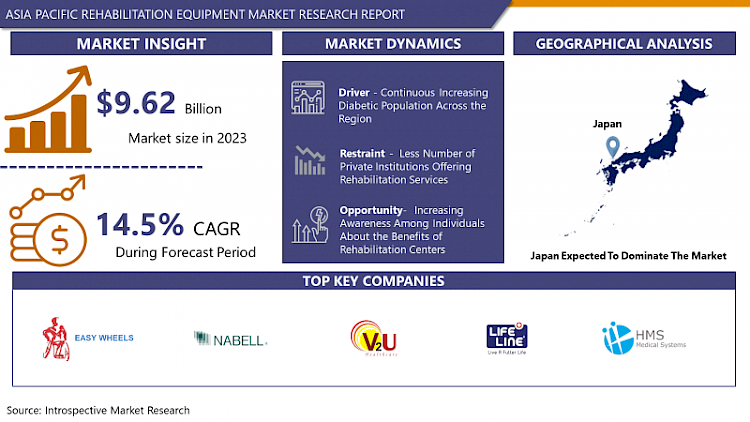

The Asia Pacific Rehabilitation Equipment market is estimated at USD 8.84 Million in 2023 and is projected to reach a revised size of USD 18.96 Million by 2032, growing at a CAGR of 8.85% over the period 2024-2032.

Rehabilitation encompasses a variety of interventions aimed at enhancing functioning and minimizing disability in individuals who have health conditions. These interventions are tailored to address the unique needs of each person, considering the interaction between their health condition and their environment. The goal is to help individuals achieve the highest possible level of independence and quality of life.

- Rehabilitation can significantly reduce the impact of a wide range of health conditions, including acute and chronic diseases, illnesses, and injuries. It works in tandem with medical and surgical interventions, aiding in recovery and achieving optimal outcomes. Additionally, rehabilitation helps prevent, reduce, or manage complications in conditions such as spinal cord injury, stroke, and fractures.

- For chronic health conditions like cardiovascular disease, cancer, and diabetes, rehabilitation plays a crucial role in minimizing or slowing down disabling effects. It equips individuals with self-management strategies, provides necessary assistive products, and addresses pain and other complications, thus promoting healthy aging.

- Investing in rehabilitation yields cost benefits for individuals and society. It can reduce hospitalization costs, shorten hospital stays, and prevent re-admissions. Furthermore, rehabilitation enables people to return to work, remain independent at home, and reduce the need for financial or caregiver support.

Market Dynamics And Factors For Asia Pacific Rehabilitation Equipment Market

Drivers:

Continuous Increasing Diabetic Population Across The Region

Diabetes is one of the most common health issues in the world. To achieve set goals, diabetes management necessitates a lifelong multifaceted treatment approach. The primary goals of diabetic rehabilitation are to achieve glycemic control, improve quality of life, prevent or delay complications, and educate patients about their condition. Diabetic foot wounds (DFWs) are threatening diabetic complications. At later stages of diabetic complications, particularly after amputation surgery, patients are frequently referred to rehabilitation facilities. Rehabilitation practices have the potential to help prevent and manage DFW's. As a result, rehabilitation should be involved in the management of DFWs at all stages of diabetic care. For instance, 25% of India's estimated 77 million diabetics are expected to develop diabetic foot ulcers during their lifetime. Nearly half of them would have an infected diabetic foot ulcer that would necessitate hospitalization, and a staggering 20% would require amputation.

According to IDF, the number of diabetic individuals in China reached 140.9 million in 2021. This number is anticipated to reach 174.4 million by the end of 2045. In addition, Pakistan and Indonesia reported 33 and 19.5 million diabetic individuals in 2021 with projections to reach 62.2 and 28.6 million by 2045 in their respective countries. This staggering number of individuals inflicts that there would be a tremendous demand for rehabilitation equipment in the coming years. The increasing number of diabetic populations coupled with supportive government policies is anticipated to strengthen the development of rehabilitation equipment market growth over the forecasted period.

Restraints:

Less Number of Private Institutions Offering Rehabilitation Services

One of the most significant barriers to understanding disability in this region is accepting community-based rehabilitation as an effective intervention. Rehabilitation services are solely provided by hospitals, and if this trend continues, only a small number of disabled people will be able to benefit from this service due to social isolation and knowledge mystification. Other major issues include the lack of a comprehensible and well-established strategy, poor planning, limited efficiency, and a lack of prioritizing of essential resources such as materials, manpower, and finance thus, hampering the development of the rehabilitation equipment market over the analysis period.

Opportunities:

Increasing Awareness Among Individuals About the Benefits of Rehabilitation Centers

Despite advances in the availability of effective and safe prevention strategies around the world, cardiovascular disease (CVD) continues to be the leading cause of death and premature death. In 2019, Asia accounted for 58% of the 18.6 million CVD deaths worldwide. In 2019, CVD was the leading cause of death in Asia, accounting for 10.8 million deaths, or approximately 35% of all deaths in the region. Almost 39% of these CVD deaths were premature (defined as death before the age of 70). Initiatives are being taken by the government and other NGO bodies to circulate the importance of rehabilitation services among individuals to increase their chances of reaching out to a rehab center. For instance, The Indian government launched the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS) in 2010 to strengthen infrastructure, develop human resources, and promote good health hygiene. Similar initiatives by other economies in this region are anticipated to create lucrative opportunities for market players over the forecasted timeframe.

Regional Analysis of Asia Pacific Rehabilitation Equipment Market

Japan is anticipated to lead the development of the rehabilitation equipment market over the analysis period. In 2021, Japan had 192,327 physical therapists, 94,255 occupational therapists, and 36,255 speech-language-hearing therapists. Due to its aging population, Japan has the world's largest rehabilitation workforce, and therapist-led rehabilitation is primarily provided through the health system. The importance of long-term care quality in dealing with population aging issues has recently been recognized. As a result, there is a growing interest in developing evidence-based care on the same principles as evidence-based medicine in Japan. As a result, Japan introduced two new information systems: (i) the Monitoring and Evaluation for Rehabilitation Services for Long-Term Care (VISIT) system in 2018; and (ii) the Care, Health Status and Events (CHASE) system in 2020. The Information System for Evidence (LIFE) database was established by the central government in April 2021 to support independent living and prevent increases in the level of care required. The LIFE database combines data from VISIT and CHASE to provide real-world data on interventions and outcomes (particularly functional outcomes) in long-term care service users.

Back pain is one of the most common occurrences among Singaporeans, with an estimated 80% of adults in Singapore experiencing lower back pain at some point in their lives. Physical therapy is essential for treating and preventing back pain in Singapore. Physical therapists are trained to use a variety of techniques to treat both acute and chronic back pain, such as spinal manipulation to relieve joint pressure, reduce inflammation, and improve nerve function. Soft tissue mobilization is also used to improve flexibility and range of motion, as well as deep tissue massages to relieve pain, relax muscles, and improve circulation. In addition, with the rising number of spine-related disorders in this country, the demand for rehabilitation equipment is anticipated to increase over the analysis period.

Segmentation Analysis of Asia Pacific Rehabilitation Equipment Market

By Product, the exercise equipment segment is anticipated to lead the development of the market in the forecasted period. Physical rehabilitation equipment can range from simple and low-tech, such as an exercise ball, to heavy-duty and motorized, such as steppers. Treadmills are great for cardiovascular exercise, but physical therapists also use them to better understand a patient's range of motion, posture, and gait. Stationary bicycles are also excellent low-impact fitness tools that can help with flexibility, cardiovascular health, and pain symptoms. Many people can continue to exercise while recovering from injuries that would otherwise limit their mobility by using stationary bikes.

By Application, the physiotherapy segment is projected to have the highest share of the market. With the large population, the number of individuals opting for a career in sports is also increasing. Cricket, Football, Tennis, and Tournaments like Asian Games and Olympics are some of the trending sports topics in the Asia-Pacific. The International Federation of Sports Physical Therapy (IFSPT) states that "sports physiotherapy is a growing specialization in cultures that strive to promote an active lifestyle and athletic excellence". There is an inherent level of injury risk in the vast majority of athletic pursuits, so everyone can benefit from a session with a sports physiotherapist. Weekend warriors and professional athletes alike can find themselves put out of commission for a few weeks or months and in need of physio rehabilitation.

By End User, the hospitals & clinics segment is forecasted to have a lion's share of the market across the projected period. Hospitals & clinics are the primary healthcare settings in low-middle-income countries. These care settings offer several services under one roof and at affordable prices. In addition, they also offer support for various insurance policies thus, making the reimbursement process a lot easier and simpler. Hospitals & clinics have sufficient funds as well as space for setting up large premises dedicated to rehabilitation. They too have advanced equipment and skilled healthcare professionals that help individuals throughout the sessions thus, strengthening the expansion of the segment during the forecasted period.

Top Key Players Covered In Asia Pacific Rehabilitation Equipment Market

- NIHON MEDIX

- Ito Co., Ltd

- NABELL Corporation

- Easy Wheels Pte Ltd

- V2U Healthcare Pte Ltd

- Lifeline Corporation Pte Ltd

- HMS Medical Systems

- Vissco Next

- Johari Digital

- HEMC

- GPC Medical Ltd.

- Siyi Intelligent Technology Co. Ltd.

- Ningbo Greetmed Medical Instruments Co. Ltd.

- Jiangsu Rixin Medical Equipment Co. Ltd.

- TecnoBody S.r.l. and Other Major Players.

Key Industry Developments In Asia Pacific Rehabilitation Equipment Market

In April 2022, Ito Co., Ltd signed an official supplier agreement with The Japan Lacrosse Association. Since 2018, the company has been providing combination therapy devices for conditioning support to both the men's and women's national teams.

In February 2022, Ito Co., Ltd. formed a partnership with Rihasaku Co., Ltd., a provider of exercise therapy cloud systems. The company has begun the menu for linking "ITO-InBody" and the exercise therapy cloud system "Rehasaku" with this collaboration.

|

Asia Pacific Rehabilitation Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.84 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.85% |

Market Size in 2032: |

USD 18.96 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Application

3.3 By End User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Asia Pacific Rehabilitation Equipment Market by Product

5.1 Asia Pacific Rehabilitation Equipment Market Overview Snapshot and Growth Engine

5.2 Asia Pacific Rehabilitation Equipment Market Overview

5.3 Daily Living Aids

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Daily Living Aids: Geographic Segmentation

5.4 Exercise Equipment

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Exercise Equipment: Geographic Segmentation

5.5 Body Support Devices

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Body Support Devices: Geographic Segmentation

5.6 Mobility Equipment

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Mobility Equipment: Geographic Segmentation

Chapter 6: Asia Pacific Rehabilitation Equipment Market by Application

6.1 Asia Pacific Rehabilitation Equipment Market Overview Snapshot and Growth Engine

6.2 Asia Pacific Rehabilitation Equipment Market Overview

6.3 Physiotherapy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Physiotherapy: Geographic Segmentation

6.4 Occupational Therapy

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Occupational Therapy: Geographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation

Chapter 7: Asia Pacific Rehabilitation Equipment Market by End User

7.1 Asia Pacific Rehabilitation Equipment Market Overview Snapshot and Growth Engine

7.2 Asia Pacific Rehabilitation Equipment Market Overview

7.3 Hospitals & Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals & Clinics: Geographic Segmentation

7.4 Rehab Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Rehab Centers: Geographic Segmentation

7.5 Homecare Settings

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Homecare Settings: Geographic Segmentation

7.6 Physiotherapy Centers

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Physiotherapy Centers: Geographic Segmentation

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Asia Pacific Rehabilitation Equipment Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Asia Pacific Rehabilitation Equipment Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Asia Pacific Rehabilitation Equipment Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 NIHON MEDIX

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ITO CO. LTD

8.4 NABELL CORPORATION

8.5 EASY WHEELS PTE LTD

8.6 V2U HEALTHCARE PTE LTD

8.7 LIFELINE CORPORATION PTE LTD

8.8 HMS MEDICAL SYSTEMS

8.9 VISSCO NEXT

8.10 JOHARI DIGITAL

8.11 HEMC

8.12 GPC MEDICAL LTD.

8.13 SIYI INTELLIGENT TECHNOLOGY CO. LTD.

8.14 NINGBO GREETMED MEDICAL INSTRUMENTS CO. LTD.

8.15 JIANGSU RIXIN MEDICAL EQUIPMENT CO. LTD.

8.16 TECNOBODY S.R.L.

8.17 OTHER MAJOR PLAYERS

Chapter 9:Asia Pacific Rehabilitation Equipment Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product

9.4.1 Daily Living Aids

9.4.2 Exercise Equipment

9.4.3 Body Support Devices

9.4.4 Mobility Equipment

9.5 Historic and Forecasted Market Size By Application

9.5.1 Physiotherapy

9.5.2 Occupational Therapy

9.5.3 Others

9.6 Historic and Forecasted Market Size By End User

9.6.1 Hospitals & Clinics

9.6.2 Rehab Centers

9.6.3 Homecare Settings

9.6.4 Physiotherapy Centers

9.6.5 Others

9.7 Historic and Forecast Market Size by Country

9.7.1 China

9.7.2 India

9.7.3 Japan

9.7.4 Singapore

9.7.5 Australia

9.7.6 New Zealand

9.7.7 Rest of APAC

Chapter 10 Investment Analysis

Chapter 11 Analyst Viewpoint and Conclusion

|

Asia Pacific Rehabilitation Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.84 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.85% |

Market Size in 2032: |

USD 18.96 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET COMPETITIVE RIVALRY

TABLE 005. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET BY PRODUCT

TABLE 008. DAILY LIVING AIDS MARKET OVERVIEW (2016-2028)

TABLE 009. EXERCISE EQUIPMENT MARKET OVERVIEW (2016-2028)

TABLE 010. BODY SUPPORT DEVICES MARKET OVERVIEW (2016-2028)

TABLE 011. MOBILITY EQUIPMENT MARKET OVERVIEW (2016-2028)

TABLE 012. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET BY APPLICATION

TABLE 013. PHYSIOTHERAPY MARKET OVERVIEW (2016-2028)

TABLE 014. OCCUPATIONAL THERAPY MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET BY END USER

TABLE 017. HOSPITALS & CLINICS MARKET OVERVIEW (2016-2028)

TABLE 018. REHAB CENTERS MARKET OVERVIEW (2016-2028)

TABLE 019. HOMECARE SETTINGS MARKET OVERVIEW (2016-2028)

TABLE 020. PHYSIOTHERAPY CENTERS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 023. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 024. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET, BY END USER (2016-2028)

TABLE 025. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 026. NIHON MEDIX: SNAPSHOT

TABLE 027. NIHON MEDIX: BUSINESS PERFORMANCE

TABLE 028. NIHON MEDIX: PRODUCT PORTFOLIO

TABLE 029. NIHON MEDIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 029. ITO CO. LTD: SNAPSHOT

TABLE 030. ITO CO. LTD: BUSINESS PERFORMANCE

TABLE 031. ITO CO. LTD: PRODUCT PORTFOLIO

TABLE 032. ITO CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. NABELL CORPORATION: SNAPSHOT

TABLE 033. NABELL CORPORATION: BUSINESS PERFORMANCE

TABLE 034. NABELL CORPORATION: PRODUCT PORTFOLIO

TABLE 035. NABELL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. EASY WHEELS PTE LTD: SNAPSHOT

TABLE 036. EASY WHEELS PTE LTD: BUSINESS PERFORMANCE

TABLE 037. EASY WHEELS PTE LTD: PRODUCT PORTFOLIO

TABLE 038. EASY WHEELS PTE LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. V2U HEALTHCARE PTE LTD: SNAPSHOT

TABLE 039. V2U HEALTHCARE PTE LTD: BUSINESS PERFORMANCE

TABLE 040. V2U HEALTHCARE PTE LTD: PRODUCT PORTFOLIO

TABLE 041. V2U HEALTHCARE PTE LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. LIFELINE CORPORATION PTE LTD: SNAPSHOT

TABLE 042. LIFELINE CORPORATION PTE LTD: BUSINESS PERFORMANCE

TABLE 043. LIFELINE CORPORATION PTE LTD: PRODUCT PORTFOLIO

TABLE 044. LIFELINE CORPORATION PTE LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HMS MEDICAL SYSTEMS: SNAPSHOT

TABLE 045. HMS MEDICAL SYSTEMS: BUSINESS PERFORMANCE

TABLE 046. HMS MEDICAL SYSTEMS: PRODUCT PORTFOLIO

TABLE 047. HMS MEDICAL SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. VISSCO NEXT: SNAPSHOT

TABLE 048. VISSCO NEXT: BUSINESS PERFORMANCE

TABLE 049. VISSCO NEXT: PRODUCT PORTFOLIO

TABLE 050. VISSCO NEXT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. JOHARI DIGITAL: SNAPSHOT

TABLE 051. JOHARI DIGITAL: BUSINESS PERFORMANCE

TABLE 052. JOHARI DIGITAL: PRODUCT PORTFOLIO

TABLE 053. JOHARI DIGITAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HEMC: SNAPSHOT

TABLE 054. HEMC: BUSINESS PERFORMANCE

TABLE 055. HEMC: PRODUCT PORTFOLIO

TABLE 056. HEMC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. GPC MEDICAL LTD.: SNAPSHOT

TABLE 057. GPC MEDICAL LTD.: BUSINESS PERFORMANCE

TABLE 058. GPC MEDICAL LTD.: PRODUCT PORTFOLIO

TABLE 059. GPC MEDICAL LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SIYI INTELLIGENT TECHNOLOGY CO. LTD.: SNAPSHOT

TABLE 060. SIYI INTELLIGENT TECHNOLOGY CO. LTD.: BUSINESS PERFORMANCE

TABLE 061. SIYI INTELLIGENT TECHNOLOGY CO. LTD.: PRODUCT PORTFOLIO

TABLE 062. SIYI INTELLIGENT TECHNOLOGY CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. NINGBO GREETMED MEDICAL INSTRUMENTS CO. LTD.: SNAPSHOT

TABLE 063. NINGBO GREETMED MEDICAL INSTRUMENTS CO. LTD.: BUSINESS PERFORMANCE

TABLE 064. NINGBO GREETMED MEDICAL INSTRUMENTS CO. LTD.: PRODUCT PORTFOLIO

TABLE 065. NINGBO GREETMED MEDICAL INSTRUMENTS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. JIANGSU RIXIN MEDICAL EQUIPMENT CO. LTD.: SNAPSHOT

TABLE 066. JIANGSU RIXIN MEDICAL EQUIPMENT CO. LTD.: BUSINESS PERFORMANCE

TABLE 067. JIANGSU RIXIN MEDICAL EQUIPMENT CO. LTD.: PRODUCT PORTFOLIO

TABLE 068. JIANGSU RIXIN MEDICAL EQUIPMENT CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. TECNOBODY S.R.L.: SNAPSHOT

TABLE 069. TECNOBODY S.R.L.: BUSINESS PERFORMANCE

TABLE 070. TECNOBODY S.R.L.: PRODUCT PORTFOLIO

TABLE 071. TECNOBODY S.R.L.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET OVERVIEW BY PRODUCT

FIGURE 012. DAILY LIVING AIDS MARKET OVERVIEW (2016-2028)

FIGURE 013. EXERCISE EQUIPMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. BODY SUPPORT DEVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. MOBILITY EQUIPMENT MARKET OVERVIEW (2016-2028)

FIGURE 016. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET OVERVIEW BY APPLICATION

FIGURE 017. PHYSIOTHERAPY MARKET OVERVIEW (2016-2028)

FIGURE 018. OCCUPATIONAL THERAPY MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET OVERVIEW BY END USER

FIGURE 021. HOSPITALS & CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 022. REHAB CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 023. HOMECARE SETTINGS MARKET OVERVIEW (2016-2028)

FIGURE 024. PHYSIOTHERAPY CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. ASIA PACIFIC REHABILITATION EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Asia Pacific Rehabilitation Equipment Market research report is 2024-2032.

NIHON MEDIX, Ito Co. Ltd, NABELL Corporation, Easy Wheels Pte Ltd, V2U Healthcare Pte Ltd, Lifeline Corporation Pte Ltd, HMS Medical Systems, Vissco Next, Johari Digital, HEMC, GPC Medical Ltd., Siyi Intelligent Technology Co. Ltd., Ningbo Greetmed Medical Instruments Co. Ltd., Jiangsu Rixin Medical Equipment Co. Ltd., TecnoBody S.r.l., and Other Major Players.

The Rehabilitation Equipment Market is segmented into Product, Application, End User and Region. By Product the market is categorized into Daily Living Aids, Exercise Equipment, Body Support Devices, and Mobility Equipment. By Application, the market is categorized into Physiotherapy, Occupational Therapy, and Others. By End User, the market is categorized into Hospitals & Clinics, Rehab Centers, Homecare Settings, Physiotherapy Centers, and Others. By region, it is analyzed across Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, Rest of APAC).

The Asia-Pacific region is experiencing an unprecedented rise in the aging group and is at the forefront of the global phenomenon of population aging. According to UNFPA, one in every four people in Asia and the Pacific will be over 60 by 2050. Between 2010 and 2050, the region's population of older people (aged over 60) will triple, reaching nearly 1.3 billion people.

The Asia Pacific Rehabilitation Equipment market is estimated at USD 8.84 Million in 2023 and is projected to reach a revised size of USD 18.96 Million by 2032, growing at a CAGR of 8.85% over the period 2024-2032.