Ascites Market Synopsis

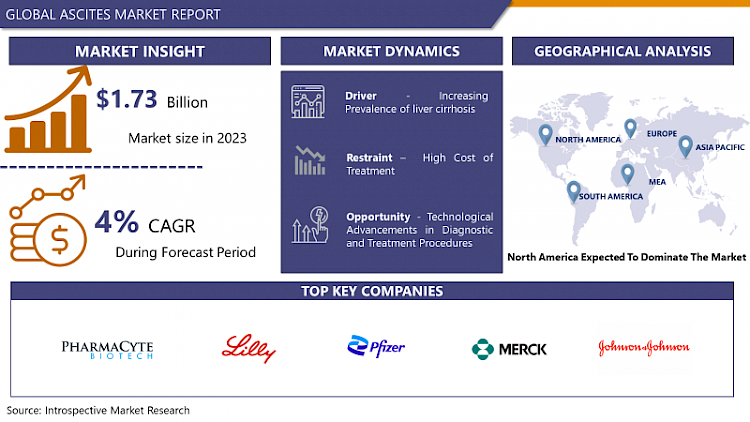

Ascites Market Size Was Valued at USD 1.73 Billion in 2023 and is Projected to Reach USD 2.46 Billion by 2032, Growing at a CAGR of 4% From 2024-2032.

The ascites market refers to the healthcare sector that addresses the diagnosis, treatment, and management of ascites, a condition characterized by the accumulation of fluid in the abdominal cavity.

- This market includes pharmaceuticals, medical devices, and diagnostic tools aimed at alleviating the symptoms and underlying causes of ascites, often associated with liver cirrhosis, heart failure, or cancer. It is a critical area of focus for healthcare providers and pharmaceutical companies, as ascites can lead to serious complications and significantly impact patients' quality of life. Ongoing research and innovation continue to drive advancements in ascites management.

- The global ascites market was witnessing growth due to the rising prevalence of conditions that can lead to ascites, including liver cirrhosis, heart failure, and certain cancers. Liver cirrhosis, often associated with excessive alcohol consumption and viral hepatitis, remains a significant contributor to ascites cases worldwide. With changing lifestyles and a global increase in obesity and alcohol consumption, the incidence of liver cirrhosis and, subsequently, ascites, was on the rise. This growing patient pool was a key driver for pharmaceutical companies and healthcare providers to invest in research, diagnosis, and treatment options for ascites.

- The ascites market was benefiting from continuous technological advancements in diagnostic and therapeutic tools. Innovations in imaging techniques, such as ultrasound and MRI, were improving the early detection and monitoring of ascites. Moreover, minimally invasive procedures for ascites management, like paracentesis and trans jugular intrahepatic portosystemic shunt (TIPS), were becoming more efficient and safer for patients. These technological developments enhanced patient outcomes and led to a surge in the adoption of these methods, fostering market growth.

- The aging global population, particularly in developed countries, was contributing to the growth of the ascites market. As people age, they become more susceptible to the conditions that cause ascites, such as cirrhosis and heart failure. Furthermore, improvements in healthcare infrastructure in emerging economies were increasing access to ascites diagnosis and treatment options.

Ascites Market Trend Analysis

Increasing Prevalence of Liver Cirrhosis

- Excessive alcohol consumption remains a primary contributor to the rising prevalence of liver cirrhosis. Chronic alcohol abuse can lead to alcoholic liver cirrhosis, which is characterized by the scarring of liver tissue. The global expansion of alcohol availability and changing drinking patterns have led to an increase in alcohol-related liver diseases. Additionally, unhealthy lifestyles marked by poor dietary choices, sedentary habits, and obesity have contributed to non-alcoholic fatty liver disease (NAFLD), which can progress to cirrhosis over time. The rise in these risk factors has driven the surge in cirrhosis cases.

- Chronic viral infections, particularly hepatitis B and hepatitis C, are significant factors in the increasing prevalence of liver cirrhosis. These viruses can cause persistent liver inflammation, leading to cirrhosis if left untreated. Despite efforts to control and vaccinate against hepatitis, many individuals worldwide remain unaware of their infection status, which allows the viruses to progress and contribute to the growing burden of cirrhosis cases.

- The aging population is another critical driver of the rising prevalence of liver cirrhosis. As people age, their liver function tends to decline, making them more susceptible to liver diseases. Individuals who may have engaged in risky behaviors earlier in life (such as heavy alcohol consumption) may develop cirrhosis as they age. With the global demographic shift toward an older population, there is an increased number of individuals at risk for liver cirrhosis, further exacerbating its prevalence.

Technological Advancements in Diagnostic and Treatment Procedures

- Technological innovations have led to more accurate and non-invasive diagnostic methods, such as advanced imaging techniques and biomarker analysis. Early detection of ascites allows for timely intervention and management, reducing the progression of the underlying conditions and improving patient outcomes. This presents an opportunity to enhance patient care and potentially reduce the economic burden of advanced disease management.

- Modern technology allows for a more personalized approach to treatment. The ability to precisely identify the cause and severity of ascites enables healthcare providers to tailor interventions to individual patient needs. Whether it's paracentesis, drug therapies, or surgical procedures, customization based on diagnostic insights can optimize the effectiveness of treatment, minimize side effects, and improve patient quality of life.

- Advancements in diagnostic and treatment procedures attract increased interest and investment from pharmaceutical companies, medical device manufacturers, and healthcare providers. This, in turn, fosters innovation and competition within the ascites market. As new technologies and therapies emerge, there is a potential for expanded market offerings, creating opportunities for companies to gain a competitive edge and contribute to improved patient care.

According to Statista Above Graph Shows That Medical Technology Is Growing, which directly contributes to the expansion of the ascites market. Advances in medical technology lead to more effective diagnostic tools, treatment options, and patient care within the ascites field, fostering its growth by improving early detection, treatment outcomes, and overall market innovation.

Ascites Market Segment Analysis:

Ascites Market Segmented on the basis of type, Diagnosis, Treatment, End-users, and Distribution Channel.

Transudative segment is expected to dominate the market during the forecast period

- The term "Transudative" refers to a specific type of fluid accumulation in the abdominal cavity known as ascites. Transudative ascites are characterized by the presence of clear, straw-colored fluid within the abdominal cavity. This type of ascites is primarily caused by non-inflammatory conditions, often related to systemic issues such as liver cirrhosis, heart failure, or hypoalbuminemia. The underlying mechanism behind transudative ascites is an imbalance in fluid and protein distribution in the body, leading to the accumulation of this clear fluid in the peritoneal cavity.

- The prevalence and management of transudative ascites is crucial for healthcare providers and pharmaceutical companies. Treatments and therapies for transudative ascites are often directed at addressing the root causes, such as managing liver disease or heart conditions.

Hospitals and Clinics segment held the largest share of 55% in 2022

- Hospitals and clinics are the primary healthcare institutions where patients suffering from ascites seek medical attention and treatment. Ascites are often a symptom of an underlying medical condition, such as liver cirrhosis or heart failure, which requires specialized medical care and diagnosis. Hospitals and clinics are equipped with state-of-the-art diagnostic facilities, medical professionals, and specialized departments, such as gastroenterology and hepatology, which are crucial for diagnosing and managing ascites effectively.

- The prevalence of ascites is often associated with chronic diseases, particularly liver diseases, and the aging population. As the global population continues to age and the incidence of chronic diseases rises, the demand for ascites-related healthcare services is also on the rise. Hospitals and clinics are well-equipped to handle the complex needs of patients with ascites, as they can provide integrated care through a multidisciplinary approach involving specialists in various fields.

Ascites Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The region has a high prevalence of liver cirrhosis, which is one of the major underlying causes of ascites. Liver cirrhosis is often a consequence of chronic alcohol consumption and various liver diseases, and it can lead to the accumulation of fluid in the abdominal cavity, resulting in ascites. The lifestyle and dietary habits in North America have contributed to a higher incidence of liver cirrhosis, necessitating the need for diagnosis and management of ascites. This high prevalence of cirrhosis acts as a driver for the ascites market in the region, as healthcare providers and patients seek effective diagnostic and treatment solutions to manage this condition.

- North America's ascites market benefits from the presence of key market players and research institutions. The region is home to a robust healthcare and pharmaceutical industry with advanced research and development capabilities. This facilitates the development of innovative diagnostic tools, therapies, and medications for ascites management. The collaboration between research institutions and healthcare companies allows for the creation of cutting-edge technologies and treatment options, further enhancing the ascites market's growth.

- The increasing adoption of advanced diagnostic and treatment procedures in North America is contributing significantly to the market's expansion. As the healthcare landscape evolves, patients and healthcare providers are increasingly embracing advanced diagnostic techniques and treatment modalities for ascites. These include advanced imaging technologies, minimally invasive procedures, and novel medications that improve the accuracy of diagnosis and the effectiveness of treatment. The patient population in North America is often well-informed and proactive in seeking the latest medical innovations, further boosting the ascites market by driving the demand for these advanced solutions.

Ascites Market Top Key Players:

- PharmaCyte Biotech(USA)

- Eli Lilly and Company (USA)

- Pfizer (USA)

- Merck (USA)

- BioVie – USA

- Johnson & Johnson Private Limited (USA)

- BD (Becton, Dickinson and Company) (USA)

- GI Supply (USA)

- Mylan (USA)

- GE (General Electric) (USA)

- Boston Scientific (USA)

- Gilead Sciences Inc. (USA)

- Cook Medical (USA)

- Medtronic (USA)

- Baxter International (USA)

- Fresenius Medical Care (Germany)

- Bayer (Germany)

- B. Braun (Germany)

- Diaverum (Sweden)

- Vifor Pharma (Switzerland)

- Sequana Medical (Switzerland)

- Nikkiso (Japan)

- Otsuka Pharmaceutical (Japan)

- Asahi Kasei (Japan)

- Teva Pharmaceutical Industries (Israel)

- Trion Pharma (Turkey)

Key Industry Developments in the Ascites Market:

- In January 2024, Sequana Medical NV, a pioneer in fluid overload treatment for liver disease, heart failure, and cancer, announced the US FDA's acceptance of the Premarket Approval (PMA) application for its alfapump. This fully implantable, wirelessly charged device addresses recurrent or refractory ascites due to liver cirrhosis and received breakthrough device designation in 2019. The FDA's substantive review marks a significant milestone for Sequana Medical in advancing innovative healthcare solutions.

- In March 2022, Gilead Sciences announced that it had acquired Principia Biopharma, a company developing a new ascites treatment. The resources and expertise of Gilead Sciences are anticipated to expedite the treatment's introduction to the market, giving promise to patients suffering from this challenging condition.

- In September 2021, Johnson & Johnson announced a partnership with Arbutus Biopharma to develop and commercialize an ascites drug candidate. The agreement combines the assets of both companies, and it is anticipated that the partnership will result in significant market advancements.

|

Ascites Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.73 Bn. |

|

|

CAGR (2024-2032): |

4 % |

Market Size in 2032: |

USD 2.46 Bn. |

|

|

Segments Covered: |

by Type |

|

|

|

|

by Diagnosis |

|

|

||

|

by Treatment |

|

|

||

|

by End Users |

|

|

||

|

by Distribution Channel |

|

|

||

|

by Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat of New Entrants

- Threat of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ASCITES MARKET BY TYPE (2017-2032)

- ASCITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSUDATIVE

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- EXUDATIVE

- ASCITES MARKET BY DIAGNOSIS (2017-2032)

- ASCITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ULTRASOUND

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- CT SCAN

- MRI

- BLOOD TEST

- LAPAROSCOPY

- ANGIOGRAPHY

- ASCITES MARKET BY TREATMENT (2017-2032)

- ASCITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEDICATION

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- PARACENTESIS

- SURGERY

- ASCITES MARKET BY END USERS (2017-2032)

- ASCITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS AND CLINICS

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- HOMECARE

- SPECIALTY CLINICS

- ASCITES MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- ASCITES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITAL PHARMACY

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- RETAIL PHARMACY

- ONLINE PHARMACIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- ASCITES Market Share by Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PHARMACYTE BIOTECH

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves and Recent Developments

- SWOT Analysis

- ELI LILLY AND COMPANY (USA)

- PFIZER (USA)

- MERCK (USA)

- BIOVIE – USA

- JOHNSON & JOHNSON PRIVATE LIMITED (USA)

- BD (BECTON, DICKINSON AND COMPANY) (USA)

- GI SUPPLY (USA)

- MYLAN (USA)

- GE (GENERAL ELECTRIC) (USA)

- BOSTON SCIENTIFIC – USA

- GILEAD SCIENCES INC.(USA)

- COOK MEDICAL (USA)

- MEDTRONIC – USA

- BAXTER INTERNATIONAL – USA

- FRESENIUS MEDICAL CARE - GERMANY

- TRION PHARMA - TURKEY

- B. BRAUN GERMANY

- NIKKISO - JAPAN

- ASAHI KASEI - JAPAN

- DIAVERUM - SWEDEN

- VIFOR PHARMA - SWITZERLAND

- OTSUKA PHARMACEUTICAL -JAPAN

- SEQUANA MEDICAL - SWITZERLAND

- TEVA PHARMACEUTICAL INDUSTRIES - ISRAEL

- BAYER - GERMANY

- COMPETITIVE LANDSCAPE

- GLOBAL ASCITES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Impact of COVID-19

- Key Manufacturers

- Historic and Forecasted Market Size by TYPE

- Historic and Forecasted Market Size by DIAGNOSIS

- Historic and Forecasted Market Size by TREATMENT

- Historic and Forecasted Market Size by END USERS

- Historic and Forecasted Market Size by DISTRIBUTION CHANNEL

- Historic and Forecasted Market Size by Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors and Opportunities

- Impact of COVID-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors and Opportunities

- Impact of COVID-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors and Opportunities

- Impact of COVID-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors and Opportunities

- Impact of COVID-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Impact of COVID-19

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Ascites Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.73 Bn. |

|

|

CAGR (2024-2032): |

4 % |

Market Size in 2032: |

USD 2.46 Bn. |

|

|

Segments Covered: |

by Type |

|

|

|

|

by Diagnosis |

|

|

||

|

by Treatment |

|

|

||

|

by End Users |

|

|

||

|

by Distribution Channel |

|

|

||

|

by Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ASCITES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ASCITES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ASCITES MARKET COMPETITIVE RIVALRY

TABLE 005. ASCITES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ASCITES MARKET THREAT OF SUBSTITUTES

TABLE 007. ASCITES MARKET BY TYPE

TABLE 008. TRANSUDATIVE MARKET OVERVIEW (2016-2030)

TABLE 009. EXUDATIVE MARKET OVERVIEW (2016-2030)

TABLE 010. ASCITES MARKET BY DIAGNOSIS

TABLE 011. ULTRASOUND MARKET OVERVIEW (2016-2030)

TABLE 012. CT SCAN MARKET OVERVIEW (2016-2030)

TABLE 013. MRI MARKET OVERVIEW (2016-2030)

TABLE 014. BLOOD TEST MARKET OVERVIEW (2016-2030)

TABLE 015. LAPAROSCOPY MARKET OVERVIEW (2016-2030)

TABLE 016. ANGIOGRAPHY MARKET OVERVIEW (2016-2030)

TABLE 017. ASCITES MARKET BY TREATMENT

TABLE 018. MEDICATION MARKET OVERVIEW (2016-2030)

TABLE 019. PARACENTESIS MARKET OVERVIEW (2016-2030)

TABLE 020. SURGERY MARKET OVERVIEW (2016-2030)

TABLE 021. ASCITES MARKET BY END-USERS

TABLE 022. HOSPITALS AND CLINICS MARKET OVERVIEW (2016-2030)

TABLE 023. HOMECARE MARKET OVERVIEW (2016-2030)

TABLE 024. SPECIALTY CLINICS MARKET OVERVIEW (2016-2030)

TABLE 025. ASCITES MARKET BY DISTRIBUTION CHANNEL

TABLE 026. HOSPITAL PHARMACY MARKET OVERVIEW (2016-2030)

TABLE 027. RETAIL PHARMACY MARKET OVERVIEW (2016-2030)

TABLE 028. ONLINE PHARMACIES MARKET OVERVIEW (2016-2030)

TABLE 029. NORTH AMERICA ASCITES MARKET, BY TYPE (2016-2030)

TABLE 030. NORTH AMERICA ASCITES MARKET, BY DIAGNOSIS (2016-2030)

TABLE 031. NORTH AMERICA ASCITES MARKET, BY TREATMENT (2016-2030)

TABLE 032. NORTH AMERICA ASCITES MARKET, BY END-USERS (2016-2030)

TABLE 033. NORTH AMERICA ASCITES MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 034. N ASCITES MARKET, BY COUNTRY (2016-2030)

TABLE 035. EASTERN EUROPE ASCITES MARKET, BY TYPE (2016-2030)

TABLE 036. EASTERN EUROPE ASCITES MARKET, BY DIAGNOSIS (2016-2030)

TABLE 037. EASTERN EUROPE ASCITES MARKET, BY TREATMENT (2016-2030)

TABLE 038. EASTERN EUROPE ASCITES MARKET, BY END-USERS (2016-2030)

TABLE 039. EASTERN EUROPE ASCITES MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 040. ASCITES MARKET, BY COUNTRY (2016-2030)

TABLE 041. WESTERN EUROPE ASCITES MARKET, BY TYPE (2016-2030)

TABLE 042. WESTERN EUROPE ASCITES MARKET, BY DIAGNOSIS (2016-2030)

TABLE 043. WESTERN EUROPE ASCITES MARKET, BY TREATMENT (2016-2030)

TABLE 044. WESTERN EUROPE ASCITES MARKET, BY END-USERS (2016-2030)

TABLE 045. WESTERN EUROPE ASCITES MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 046. ASCITES MARKET, BY COUNTRY (2016-2030)

TABLE 047. ASIA PACIFIC ASCITES MARKET, BY TYPE (2016-2030)

TABLE 048. ASIA PACIFIC ASCITES MARKET, BY DIAGNOSIS (2016-2030)

TABLE 049. ASIA PACIFIC ASCITES MARKET, BY TREATMENT (2016-2030)

TABLE 050. ASIA PACIFIC ASCITES MARKET, BY END-USERS (2016-2030)

TABLE 051. ASIA PACIFIC ASCITES MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 052. ASCITES MARKET, BY COUNTRY (2016-2030)

TABLE 053. MIDDLE EAST & AFRICA ASCITES MARKET, BY TYPE (2016-2030)

TABLE 054. MIDDLE EAST & AFRICA ASCITES MARKET, BY DIAGNOSIS (2016-2030)

TABLE 055. MIDDLE EAST & AFRICA ASCITES MARKET, BY TREATMENT (2016-2030)

TABLE 056. MIDDLE EAST & AFRICA ASCITES MARKET, BY END-USERS (2016-2030)

TABLE 057. MIDDLE EAST & AFRICA ASCITES MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 058. ASCITES MARKET, BY COUNTRY (2016-2030)

TABLE 059. SOUTH AMERICA ASCITES MARKET, BY TYPE (2016-2030)

TABLE 060. SOUTH AMERICA ASCITES MARKET, BY DIAGNOSIS (2016-2030)

TABLE 061. SOUTH AMERICA ASCITES MARKET, BY TREATMENT (2016-2030)

TABLE 062. SOUTH AMERICA ASCITES MARKET, BY END-USERS (2016-2030)

TABLE 063. SOUTH AMERICA ASCITES MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 064. ASCITES MARKET, BY COUNTRY (2016-2030)

TABLE 065. PHARMACYTE BIOTECH: SNAPSHOT

TABLE 066. PHARMACYTE BIOTECH: BUSINESS PERFORMANCE

TABLE 067. PHARMACYTE BIOTECH: PRODUCT PORTFOLIO

TABLE 068. PHARMACYTE BIOTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ELI LILLY AND COMPANY: SNAPSHOT

TABLE 069. ELI LILLY AND COMPANY: BUSINESS PERFORMANCE

TABLE 070. ELI LILLY AND COMPANY: PRODUCT PORTFOLIO

TABLE 071. ELI LILLY AND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. PFIZER: SNAPSHOT

TABLE 072. PFIZER: BUSINESS PERFORMANCE

TABLE 073. PFIZER: PRODUCT PORTFOLIO

TABLE 074. PFIZER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. MERCK: SNAPSHOT

TABLE 075. MERCK: BUSINESS PERFORMANCE

TABLE 076. MERCK: PRODUCT PORTFOLIO

TABLE 077. MERCK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BIO VIE: SNAPSHOT

TABLE 078. BIO VIE: BUSINESS PERFORMANCE

TABLE 079. BIO VIE: PRODUCT PORTFOLIO

TABLE 080. BIO VIE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. JOHNSON & JOHNSON PRIVATE LIMITED: SNAPSHOT

TABLE 081. JOHNSON & JOHNSON PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 082. JOHNSON & JOHNSON PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 083. JOHNSON & JOHNSON PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. BD: SNAPSHOT

TABLE 084. BD: BUSINESS PERFORMANCE

TABLE 085. BD: PRODUCT PORTFOLIO

TABLE 086. BD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. GI SUPPLY: SNAPSHOT

TABLE 087. GI SUPPLY: BUSINESS PERFORMANCE

TABLE 088. GI SUPPLY: PRODUCT PORTFOLIO

TABLE 089. GI SUPPLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. MYLAN: SNAPSHOT

TABLE 090. MYLAN: BUSINESS PERFORMANCE

TABLE 091. MYLAN: PRODUCT PORTFOLIO

TABLE 092. MYLAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. GE (GENERAL ELECTRIC): SNAPSHOT

TABLE 093. GE (GENERAL ELECTRIC): BUSINESS PERFORMANCE

TABLE 094. GE (GENERAL ELECTRIC): PRODUCT PORTFOLIO

TABLE 095. GE (GENERAL ELECTRIC): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. BOSTON SCIENTIFIC: SNAPSHOT

TABLE 096. BOSTON SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 097. BOSTON SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 098. BOSTON SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. GILEAD SCIENCES INC: SNAPSHOT

TABLE 099. GILEAD SCIENCES INC: BUSINESS PERFORMANCE

TABLE 100. GILEAD SCIENCES INC: PRODUCT PORTFOLIO

TABLE 101. GILEAD SCIENCES INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. COOK MEDICAL: SNAPSHOT

TABLE 102. COOK MEDICAL: BUSINESS PERFORMANCE

TABLE 103. COOK MEDICAL: PRODUCT PORTFOLIO

TABLE 104. COOK MEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. MEDTRONIC: SNAPSHOT

TABLE 105. MEDTRONIC: BUSINESS PERFORMANCE

TABLE 106. MEDTRONIC: PRODUCT PORTFOLIO

TABLE 107. MEDTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. BAXTER INTERNATIONAL: SNAPSHOT

TABLE 108. BAXTER INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 109. BAXTER INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 110. BAXTER INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. FRESENIUS MEDICAL CARE: SNAPSHOT

TABLE 111. FRESENIUS MEDICAL CARE: BUSINESS PERFORMANCE

TABLE 112. FRESENIUS MEDICAL CARE: PRODUCT PORTFOLIO

TABLE 113. FRESENIUS MEDICAL CARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. TRION PHARMA: SNAPSHOT

TABLE 114. TRION PHARMA: BUSINESS PERFORMANCE

TABLE 115. TRION PHARMA: PRODUCT PORTFOLIO

TABLE 116. TRION PHARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. B. BRAUN: SNAPSHOT

TABLE 117. B. BRAUN: BUSINESS PERFORMANCE

TABLE 118. B. BRAUN: PRODUCT PORTFOLIO

TABLE 119. B. BRAUN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. NIKKISO: SNAPSHOT

TABLE 120. NIKKISO: BUSINESS PERFORMANCE

TABLE 121. NIKKISO: PRODUCT PORTFOLIO

TABLE 122. NIKKISO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. ASAHI KASEI: SNAPSHOT

TABLE 123. ASAHI KASEI: BUSINESS PERFORMANCE

TABLE 124. ASAHI KASEI: PRODUCT PORTFOLIO

TABLE 125. ASAHI KASEI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. DIAVERUM: SNAPSHOT

TABLE 126. DIAVERUM: BUSINESS PERFORMANCE

TABLE 127. DIAVERUM: PRODUCT PORTFOLIO

TABLE 128. DIAVERUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. VIFOR PHARMA: SNAPSHOT

TABLE 129. VIFOR PHARMA: BUSINESS PERFORMANCE

TABLE 130. VIFOR PHARMA: PRODUCT PORTFOLIO

TABLE 131. VIFOR PHARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 131. OTSUKA PHARMACEUTICAL: SNAPSHOT

TABLE 132. OTSUKA PHARMACEUTICAL: BUSINESS PERFORMANCE

TABLE 133. OTSUKA PHARMACEUTICAL: PRODUCT PORTFOLIO

TABLE 134. OTSUKA PHARMACEUTICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 134. SEQUANA MEDICAL: SNAPSHOT

TABLE 135. SEQUANA MEDICAL: BUSINESS PERFORMANCE

TABLE 136. SEQUANA MEDICAL: PRODUCT PORTFOLIO

TABLE 137. SEQUANA MEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 137. TEVA PHARMACEUTICAL INDUSTRIES: SNAPSHOT

TABLE 138. TEVA PHARMACEUTICAL INDUSTRIES: BUSINESS PERFORMANCE

TABLE 139. TEVA PHARMACEUTICAL INDUSTRIES: PRODUCT PORTFOLIO

TABLE 140. TEVA PHARMACEUTICAL INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 140. BAYER: SNAPSHOT

TABLE 141. BAYER: BUSINESS PERFORMANCE

TABLE 142. BAYER: PRODUCT PORTFOLIO

TABLE 143. BAYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 143. OTHER KEY PLAYERS: SNAPSHOT

TABLE 144. OTHER KEY PLAYERS: BUSINESS PERFORMANCE

TABLE 145. OTHER KEY PLAYERS: PRODUCT PORTFOLIO

TABLE 146. OTHER KEY PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ASCITES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ASCITES MARKET OVERVIEW BY TYPE

FIGURE 012. TRANSUDATIVE MARKET OVERVIEW (2016-2030)

FIGURE 013. EXUDATIVE MARKET OVERVIEW (2016-2030)

FIGURE 014. ASCITES MARKET OVERVIEW BY DIAGNOSIS

FIGURE 015. ULTRASOUND MARKET OVERVIEW (2016-2030)

FIGURE 016. CT SCAN MARKET OVERVIEW (2016-2030)

FIGURE 017. MRI MARKET OVERVIEW (2016-2030)

FIGURE 018. BLOOD TEST MARKET OVERVIEW (2016-2030)

FIGURE 019. LAPAROSCOPY MARKET OVERVIEW (2016-2030)

FIGURE 020. ANGIOGRAPHY MARKET OVERVIEW (2016-2030)

FIGURE 021. ASCITES MARKET OVERVIEW BY TREATMENT

FIGURE 022. MEDICATION MARKET OVERVIEW (2016-2030)

FIGURE 023. PARACENTESIS MARKET OVERVIEW (2016-2030)

FIGURE 024. SURGERY MARKET OVERVIEW (2016-2030)

FIGURE 025. ASCITES MARKET OVERVIEW BY END-USERS

FIGURE 026. HOSPITALS AND CLINICS MARKET OVERVIEW (2016-2030)

FIGURE 027. HOMECARE MARKET OVERVIEW (2016-2030)

FIGURE 028. SPECIALTY CLINICS MARKET OVERVIEW (2016-2030)

FIGURE 029. ASCITES MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 030. HOSPITAL PHARMACY MARKET OVERVIEW (2016-2030)

FIGURE 031. RETAIL PHARMACY MARKET OVERVIEW (2016-2030)

FIGURE 032. ONLINE PHARMACIES MARKET OVERVIEW (2016-2030)

FIGURE 033. NORTH AMERICA ASCITES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. EASTERN EUROPE ASCITES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. WESTERN EUROPE ASCITES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. ASIA PACIFIC ASCITES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. MIDDLE EAST & AFRICA ASCITES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 038. SOUTH AMERICA ASCITES MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Ascites Market research report is 2024-2032.

PharmaCyte Biotech, Eli Lilly and Company, Pfizer, Merck, Bio Vie, Johnson & Johnson Private Limited, BD, GI Supply, Mylan, GE (General Electric), Boston Scientific, Gilead Sciences Inc, Cook Medical, Medtronic, Baxter International, Fresenius Medical Care, Trion Pharma, B. Braun, Nikkiso, Asahi Kasei, Diaverum, Vifor Pharma, Otsuka Pharmaceutical, Sequana Medical, Teva Pharmaceutical Industries, Bayer and Other Major Players.

The Ascites Market is segmented into Type, Diagnosis, Treatment, End-Users, Distribution Channel, and region. by Type, the market is categorized into transudative and exudative. by Diagnosis, the market is categorized into Ultrasound, CT Scan, MRI, Blood Test, Laparoscopy, and Angiography. by Treatment, the market is categorized as Medication, Paracentesis, and Surgery. by End-Users, the market is categorized into Hospitals and Clinics, Homecare, and Specialty Clinics. by Distribution Channel the market is categorized into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacies. by region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

This market includes pharmaceuticals, medical devices, and diagnostic tools aimed at alleviating the symptoms and underlying causes of ascites, often associated with liver cirrhosis, heart failure, or cancer. It is a critical area of focus for healthcare providers and pharmaceutical companies, as ascites can lead to serious complications and significantly impact patients' quality of life. Ongoing research and innovation continue to drive advancements in ascites management.

Ascites Market Size Was Valued at USD 1.73 Billion in 2023 and is Projected to Reach USD 2.46 Billion by 2032, Growing at a CAGR of 4% From 2024-2032.