Artificial Meat Products Market Synopsis

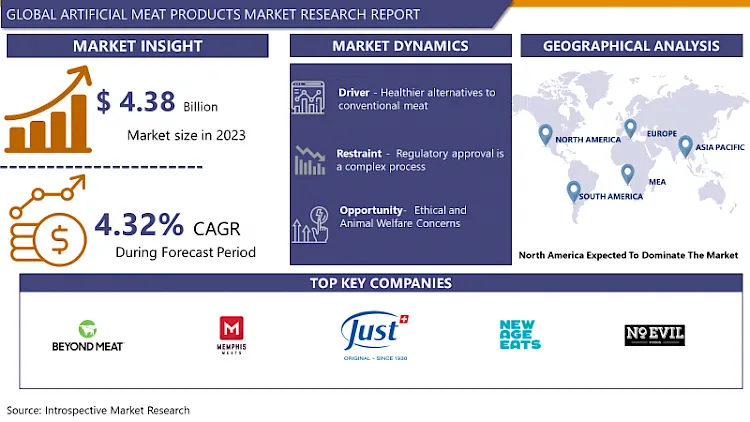

Artificial Meat Products Market Size Was Valued at USD 4.57 Billion in 2024, and is Projected to Reach USD 6.41 Billion by 2032, Growing at a CAGR of 4.32% From 2025-2032.

Artificial meat products, also known as alternative or cultured meat, are food products that replicate the taste, texture, and nutritional profile of conventional meat but are produced using alternative methods such as plant-based ingredients or laboratory cultivation of animal cells. These products aim to offer a more sustainable and ethical alternative to traditional meat production while addressing concerns related to animal welfare, environmental impact, and food security.

Artificial meat products, including plant-based alternatives and cultured meat, have various applications across various industries. They are used in consumer food products like burgers, sausages, and deli slices, as well as in food manufacturing for soups, sauces, and ready meals. They are also used in the food service sector by restaurants, fast-food chains, and catering companies to offer meatless options. Artificial meat products are marketed as healthier alternatives due to their lower saturated fat and cholesterol levels, providing protein for vegetarians, vegans, and those seeking to reduce meat consumption.

They are also promoted as more sustainable due to their lower carbon footprint, fewer natural resources, and less greenhouse gas emissions. Cultured meat offers a cruelty-free alternative to traditional meat production, addressing concerns about animal welfare. Research and development efforts are ongoing to improve taste, texture, nutritional profile, and production efficiency. Additionally, cultured meat has been proposed as a potential food source for space missions.

Artificial meat products, also known as plant-based or cultured meat, are in high demand due to their environmental sustainability, animal welfare concerns, health benefits, and food security. Traditional meat production is resource-intensive and contributes to greenhouse gas emissions, deforestation, and water pollution. Artificial meat products offer a cruelty-free alternative, as they don't require animal slaughter.

They are also perceived as healthier due to their lower saturated fat and cholesterol content. artificial meat products offer a more efficient and scalable method of meat production. Advances in food technology have led to the development of artificial meat products that closely resemble conventional meat, attracting consumers who may have been skeptical. As more people adopt vegetarian, vegan, or flexitarian diets, artificial meat products provide options that align with their dietary preferences without sacrificing taste or nutrition.

.webp)

Artificial Meat Products Market Trend Analysis

Artificial Meat Products Market Growth Driver- Healthier alternatives to conventional meat

- The growth of artificial meat products is driven by the demand for healthier alternatives to conventional meat. Health-conscious consumers are increasingly seeking meat alternatives with lower levels of saturated fat, cholesterol, and other harmful components. Artificial meat products, particularly plant-based options, often contain healthier ingredients like vegetables, grains, and legumes, rich in fiber, vitamins, and minerals. Consumption of red and processed meats has been linked to an increased risk of chronic diseases, making artificial meat products a viable alternative for those looking to reduce their intake of conventional meat while still enjoying familiar dishes.

- Customizable nutrition profiles are another advantage of artificial meat products. Manufacturers can adjust ingredients and formulations to meet specific dietary preferences, such as low sodium, low fat, gluten-free, or allergen-free options. Functional ingredients, such as omega-3 fatty acids, antioxidants, and plant-based proteins, are often used in artificial meat products to offer additional health benefits, such as anti-inflammatory effects and improved gut health.

- Artificial meat products often align with consumers' concerns about environmental sustainability and animal welfare. By reducing reliance on conventional meat production, which is associated with land degradation, greenhouse gas emissions, and animal cruelty, artificial meat products offer a more ethical and sustainable food choice, appealing to health-conscious consumers who prioritize environmental and ethical considerations.

Artificial Meat Products Market Restraint- Regulatory approval is a complex process

- Artificial meat products face significant challenges in regulatory approval processes due to their novelty, safety concerns, and labeling requirements. Existing regulations may not fully cover all aspects of their production, safety, and labeling, necessitating the development of new guidelines or adaptations.

- Safety assessments are crucial to evaluate factors like microbial contamination, allergenicity, and health risks associated with novel ingredients or production methods. Clear and accurate labeling is essential to inform consumers about the nature and composition of artificial meat products. Ethical and environmental considerations may also be considered when evaluating artificial meat products.

- International harmonization of regulations can streamline the approval process and facilitate market access. Public perception and acceptance of artificial meat products are also considered when evaluating their safety and suitability for consumption. Addressing consumer concerns and building trust in the safety and benefits of these products is essential for regulatory approval.

Artificial Meat Products Market Opportunity- Ethical and Animal Welfare Concerns

- Artificial meat products offer a significant opportunity to address ethical and animal welfare concerns. They provide a cruelty-free alternative to traditional meat production, eliminating the need for animal slaughter and overcrowding. This reduces the demand for intensive farming practices, improving animal welfare and minimizing suffering.

- Artificial meat production also offers environmental benefits, as conventional meat production contributes to deforestation, greenhouse gas emissions, water pollution, and biodiversity loss. As consumer preferences shift towards sustainable and ethical food choices, artificial meat products align dietary preferences with values.

- The growing demand for plant-based and cultured meat products reflects a growing market opportunity in response to ethical and animal welfare concerns. Companies investing in artificial meat technologies can capitalize on this trend by offering innovative and ethical alternatives to conventional meat products.

Artificial Meat Products Market Challenge- Scale-up and Production Efficiency

- Artificial meat production faces several challenges, including reducing costs, maintaining cell culture technology, sourcing large quantities of plant proteins and ingredients, finding sustainable energy and resource usage, navigating complex regulatory frameworks, and meeting consumer acceptance and market demand.

- Scaling up production can help achieve economies of scale, but initial investment in infrastructure, technology, and research and development can be substantial. Addressing issues like nutrient supply, waste removal, and bioreactor system scalability is crucial for increased production efficiency.

- However, finding sustainable production methods that minimize environmental impact while maximizing efficiency is essential for long-term viability. Regulatory compliance is also a challenge, as companies must navigate complex regulations related to food safety, labeling, and approval processes.

Artificial Meat Products Market Segment Analysis:

Artificial Meat Products Market Segmented based on Type, Source, Distribution channel, and Region.

By Type, Chicken segment is expected to dominate the market during the forecast period

- Consumers are increasingly concerned about the health implications of traditional meat products, including cholesterol levels and the risk of diseases like cardiovascular disorders and certain cancers. Artificial chicken products offer a healthier alternative with lower saturated fat and cholesterol levels. Conventional chicken production has significant environmental impacts, including greenhouse gas emissions and deforestation.

- Artificial chicken products, especially those made from plant-based sources or cultured meat, have a lower environmental footprint, appealing to environmentally conscious consumers. Animal welfare concerns are growing, and artificial chicken products offer a cruelty-free alternative. Advancements in food technology and product development have improved the taste and texture of artificial chicken products, satisfying consumer preferences for familiar flavors and mouthfeel.

- The chicken segment of the artificial meat products market has attracted significant attention from investors and food companies. Governments and regulatory bodies are increasingly supporting artificial meat technologies, facilitating market growth and promoting innovation and commercialization.

By Source, Plant-based Meat segment held the largest share in 2024

- The rise in environmental, ethical, and health concerns has led to a growing interest in plant-based meat production. These alternatives are perceived as healthier due to lower saturated fats and cholesterol levels, which are linked to health issues like heart disease and obesity.

- Technological advancements have allowed for the development of plant-based meat products that closely mimic traditional meat, overcoming barriers to adoption. The plant-based meat market has expanded to include chicken, pork, seafood, and dairy substitutes.

- Retail and food service establishments are now offering plant-based options in restaurants, fast-food chains, and cafeterias, making them more accessible to consumers. The industry has also attracted significant investment from established food companies and venture capital firms, fueling research and marketing campaigns to promote plant-based products and educate consumers about their benefits.

Artificial Meat Products Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's growing consumer base is increasingly interested in alternative protein sources due to health, environmental sustainability, and animal welfare concerns. This demand is driving innovation and investment in the artificial meat products market. The region is home to leading companies and research institutions developing artificial meat technologies, including plant-based alternatives and cultured meat production.

- North America's robust investment ecosystem and supportive regulatory environment encourage research and development in the artificial meat sector. Consumer awareness of the environmental and ethical implications of conventional meat production is high in North America, leading to increased adoption of artificial meat alternatives. The region's well-established market infrastructure facilitates the commercialization and scaling of artificial meat products. the growing trend towards flexitarian, vegetarian, and vegan lifestyles is driving demand for meat alternatives.

Artificial Meat Products Market Top Key Players:

- Beyond Meat (US)

- Impossible Foods (US)

- Memphis Meats (US)

- JUST, Inc. (US)

- New Age Meats (US)

- No Evil Foods (US)

- Perfect Day (US)

- Eat Just, Inc. (US)

- Alpha Foods Co. (US)

- Good Catch (US)

- Tofurky (US)

- Greenleaf Foods (US)

- Gardein (Canada)

- Quorn Foods (UK)

- Plant & Bean (UK)

- Moving Mountains Foods (UK)

- VBites (UK)

- The Vegetarian Butcher (Netherlands)

- Ojah BV (Netherlands)

- Vivera (Netherlands)

- Aleph Farms (Israel)

- Mosa Meat (Netherlands)

- Future Meat Technologies (Israel)

- Gold & Green Foods (Finland)

- Other Active Players

Key Industry Developments in the Artificial Meat Products Market:

- In February 2024, Beyond Meat, Inc. a leader in plant-based meat, announced the fourth generation of its core beef platform, Beyond IV, resulting in the unveiling of the company’s new Beyond Burger and Beyond Beef exclusively at retail. The new platform raises the bar for plant-based meat products and center-of-the-plate protein generally, and further cements Beyond Meat’s commitment to creating plant-based meat products that not only taste delicious but deliver important nutritional benefits.

- In August 2024, cultivating acceptance for cultured meat in Singapore, a small island nation, and Dubai, a rapidly growing emirate in the desert with sandstorms and daytime temperatures reaching as high as 120°F that restricted agricultural production, was crucial. Both regions imported more than 90% of their food, a practice deemed unsustainable. These areas stood to benefit significantly from advancements in scientific food production, including cultured meat. Despite this potential, cultured meat faced official bans in Alabama and Florida, underscoring the challenges of integrating innovative food technologies into diverse regulatory environments.

- In January 2024, Tyson Foods announced its investment in clean meat, joining a diverse group of investors in Memphis Meats, which included industry leaders, top venture investors, and mission-driven groups such as DFJ, Atomico, Cargill, Bill Gates, and Richard Branson. Justin Whitmore, executive vice president of corporate strategy and chief sustainability officer at Tyson Foods, expressed enthusiasm about expanding their exposure to innovative meat production methods. He noted that while Tyson Foods continued to invest significantly in its traditional meat business, it also aimed to explore new growth opportunities to offer consumers more choices, given the steady increase in global protein demand.

|

Artificial Meat Products Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

4.57 Bn |

|

Forecast Period 2025-32 CAGR: |

4.32% |

Market Size in 2032: |

6.41 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Artificial Meat Products Market by Type (2018-2032)

4.1 Artificial Meat Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Beef

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chicken

4.5 Pork

4.6 Seafood

4.7 Others

Chapter 5: Artificial Meat Products Market by Source (2018-2032)

5.1 Artificial Meat Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Artificial Meat

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plant-based Meat

Chapter 6: Artificial Meat Products Market by Distribution Channel (2018-2032)

6.1 Artificial Meat Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 Online Retail

6.6 Foodservice Channels

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Artificial Meat Products Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BLUE YONDER GROUP (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 E2OPEN LLC (US)

7.4 INFOR (US)

7.5 KINAXIS (CANADA)

7.6 ACCENTURE PLC (IRELAND)

7.7 SAP SE (GERMANY)

7.8 PEARLCHAIN (CHINA)

7.9 ORTEC (NETHERLANDS)

7.10 VIEWLOCITY TECHNOLOGIES PTY LTD (US)

7.11 SAP SE (GERMANY)

7.12 ORTEC (NETHERLANDS)

7.13 4FLOW AG (GERMANY)

7.14 TESISQUARE S.P.A. (ITALY)

7.15 PEARLCHAIN (CHINA)

7.16 ONE NETWORK ENTERPRISES (INDIA)

7.17 KINAXIS (CANADA)

7.18 DESCARTES SYSTEMS GROUP INC. (CANADA)

7.19 QUINTIQ (DASSAULT SYSTÈMES) (USA)

7.20 MP OBJECTS (MPO) (USA)

7.21 ANTUIT.AI (USA)

7.22 ONE NETWORK ENTERPRISES (INDIA)

Chapter 8: Global Artificial Meat Products Market By Region

8.1 Overview

8.2. North America Artificial Meat Products Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Beef

8.2.4.2 Chicken

8.2.4.3 Pork

8.2.4.4 Seafood

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 Artificial Meat

8.2.5.2 Plant-based Meat

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Supermarkets/Hypermarkets

8.2.6.2 Specialty Stores

8.2.6.3 Online Retail

8.2.6.4 Foodservice Channels

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Artificial Meat Products Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Beef

8.3.4.2 Chicken

8.3.4.3 Pork

8.3.4.4 Seafood

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 Artificial Meat

8.3.5.2 Plant-based Meat

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Supermarkets/Hypermarkets

8.3.6.2 Specialty Stores

8.3.6.3 Online Retail

8.3.6.4 Foodservice Channels

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Artificial Meat Products Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Beef

8.4.4.2 Chicken

8.4.4.3 Pork

8.4.4.4 Seafood

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 Artificial Meat

8.4.5.2 Plant-based Meat

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Supermarkets/Hypermarkets

8.4.6.2 Specialty Stores

8.4.6.3 Online Retail

8.4.6.4 Foodservice Channels

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Artificial Meat Products Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Beef

8.5.4.2 Chicken

8.5.4.3 Pork

8.5.4.4 Seafood

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 Artificial Meat

8.5.5.2 Plant-based Meat

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Supermarkets/Hypermarkets

8.5.6.2 Specialty Stores

8.5.6.3 Online Retail

8.5.6.4 Foodservice Channels

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Artificial Meat Products Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Beef

8.6.4.2 Chicken

8.6.4.3 Pork

8.6.4.4 Seafood

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 Artificial Meat

8.6.5.2 Plant-based Meat

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Supermarkets/Hypermarkets

8.6.6.2 Specialty Stores

8.6.6.3 Online Retail

8.6.6.4 Foodservice Channels

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Artificial Meat Products Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Beef

8.7.4.2 Chicken

8.7.4.3 Pork

8.7.4.4 Seafood

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 Artificial Meat

8.7.5.2 Plant-based Meat

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Supermarkets/Hypermarkets

8.7.6.2 Specialty Stores

8.7.6.3 Online Retail

8.7.6.4 Foodservice Channels

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Artificial Meat Products Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

4.57 Bn |

|

Forecast Period 2025-32 CAGR: |

4.32% |

Market Size in 2032: |

6.41 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||