Anti-Aging Market Synopsis

Anti Aging Market Size Was Valued at USD 1.18 Billion in 2023 and is Projected to Reach USD 2.29 Billion by 2032, Growing at a CAGR of 7.6% From 2024-2032.

Anti-agingrefers to practices, products, and treatments aimed at reducing or reversing the effects of aging on the body and skin. This includes addressing wrinkles, fine lines, age spots, loss of elasticity, and other signs of aging. Anti-aging approaches can involve various methods, such as skin care routines, dietary changes, exercise, stress management, and medical interventions like cosmetic procedures or supplements.

- Anti-aging creams and serums often contain ingredients like retinoids, peptides, and hyaluronic acid, which can help smooth out wrinkles and fine lines, giving the skin a more youthful appearance. Ingredients such as collagen and elastin help improve skin elasticity, making it firmer and more resilient. Many anti-aging products contain moisturizing ingredients like glycerin, shea butter, and ceramides, which help hydrate the skin and prevent dryness, keeping it looking plump and youthful.

- Some anti-aging products contain ingredients like vitamin C, niacinamide, and alpha hydroxy acids (AHAs) that can help brighten the skin and even out skin tone by reducing the appearance of age spots and hyperpigmentation. Sunscreen is a crucial component of any anti-aging skincare routine, which can accelerate the aging process and lead to wrinkles, sunspots, and other signs of aging. Some anti-aging treatments, such as facial massages or devices like facial rollers, can help increase blood circulation to the skin, promoting a healthy glow and aiding in the delivery of nutrients to skin cells.

- Antioxidants such as vitamin E, vitamin C, and green tea extract help neutralize free radicals, which can damage the skin and contribute to premature aging. Using products with antioxidants can help prevent future damage and maintain a youthful complexion. There are specialized anti-aging products available for targeting specific concerns, such as eye creams for reducing puffiness and dark circles, neck creams for tightening and firming the neck area, and serums for addressing specific skin issues like dullness or loss of firmness.

- As populations in many parts of the world age, there is a growing market of older consumers who are interested in maintaining a youthful appearance and preventing the signs of aging. rising incomes in many regions, consumers have more disposable income to spend on luxury items like skincare products, including those marketed as anti-aging. Social media and advertising play a significant role in promoting the importance of youthful appearance, leading to increased interest and demand for anti-aging products among consumers of all ages.

- There is a growing emphasis on health and wellness, including skincare, among consumers. Many anti-aging products are marketed not only as cosmetic solutions but also as products that promote overall skin health and vitality. Some consumers start using anti-aging products at a younger age as a preventative measure to delay the onset of visible signs of aging, contributing to sustained demand for these products across different age groups.

Anti Aging Market Trend Analysis

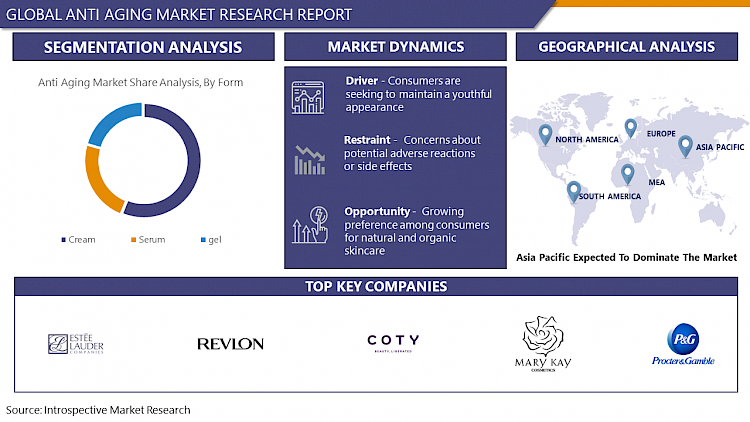

Consumers Are Seeking to Maintain a Youthful Appearance

- As populations continue to age, there is an expanding market of older consumers who are actively seeking ways to maintain a youthful appearance and address the visible signs of aging. This demographic shift in significant implications for industries related to skincare and cosmetics.

- As people age, they typically experience changes in their skin, such as wrinkles, fine lines, age spots, and loss of elasticity. These changes can lead to a desire among older consumers to find products that can help them maintain or regain a more youthful appearance. Anti-aging products, including creams, serums, masks, and treatments, are specifically formulated to target these signs of aging and promote healthier, more youthful-looking skin.

- Furthermore, as life expectancies increase and people remain active and engaged in their later years, there is a cultural emphasis on maintaining vitality and wellness. Many older consumers see skincare as an integral part of their overall health and well-being, leading them to invest in anti-aging products as part of their self-care routines.

- The advancements in skincare technology and formulations have led to the development of increasingly effective anti-aging products. Companies are continually innovating and introducing new ingredients, delivery systems, and treatment modalities that promise visible results in addressing the signs of aging.

Restraint

Concerns About Potential Adverse Reactions or Side Effects

- Concern about potential adverse reactions or side effects from the active ingredients used in these products. Despite the promises of youthful skin and rejuvenation, some consumers may hesitate to use anti-aging products due to fears of experiencing negative reactions.

- Many anti-aging products contain potent active ingredients such as retinoids, alpha hydroxy acids, and vitamin C, which can be irritating to sensitive skin types. Individuals with sensitive skin may experience redness, itching, burning, or peeling when using these products, leading them to avoid or discontinue use.

- Some people may have allergies to certain ingredients commonly found in anti-aging products. Certain active ingredients, such as retinoids and AHAs, increase the skin's sensitivity to sunlight, making it more prone to sunburn and other sun-related damage. This can be particularly concerning for individuals who spend a lot of time outdoors or live in sunny climates.

- Many anti-aging products claim to deliver significant results, but there is limited long-term data on the safety and efficacy of some active ingredients. Consumers may worry about the potential long-term consequences of using these products, such as skin thinning, increased susceptibility to environmental damage, or interference with the skin's natural processes.

Opportunity Line Here

Growing Preference Among Consumers for Natural and Organic Skincare

- Consumers are becoming increasingly conscious of the ingredients they use on their skin, as well as their potential effects on overall health. There is a growing awareness of the potential risks associated with synthetic chemicals commonly found in skincare products, such as parabens, sulfates, and phthalates. many consumers are seeking alternatives that are perceived as safer and more natural.

- Health considerations, consumers are also concerned about the environmental impact of the products they use. The production and disposal of synthetic skincare ingredients can have negative environmental consequences, including pollution and resource depletion. Natural and organic skincare products, which often utilize sustainably sourced ingredients and eco-friendly packaging, appeal to environmentally conscious consumers.

- There is a growing perception among consumers that natural and organic skincare products are gentler on the skin and may be more effective in addressing specific concerns, including signs of aging. While scientific evidence supporting the efficacy of natural ingredients in anti-aging skincare is mixed, consumer perception plays a significant role in driving demand for these products.

- Brands that prioritize natural and organic ingredients often emphasize transparency and ethical sourcing practices, fostering trust among consumers. Companies that can effectively communicate their commitment to natural and organic principles may gain a competitive advantage in the anti-aging product market.

- The natural and organic skincare market has experienced significant growth in recent years, reflecting increasing consumer demand for these products. This growth presents an opportunity for anti-aging product manufacturers to expand their offerings to cater to this segment of the market.

Challenges

Limit Accessibility to Price-Conscious Consumers

- Many anti-aging products are priced at a premium compared to other skincare products. The perceived high cost may deter price-sensitive consumers from purchasing these items, particularly in regions with lower disposable incomes or economic instability. Consumers may be hesitant to invest in expensive anti-aging products due to uncertainty about their efficacy. some premium products may offer advanced formulations and ingredients, but there is often skepticism about whether the benefits justify the high price tag. This perception can hinder adoption among consumers who are unwilling to take the risk on expensive products with uncertain outcomes.

- Premium pricing strategies may result in limited market reach, particularly in regions or demographic segments where affordability is a key consideration. This can restrict the potential customer base for anti-aging products and limit revenue growth for companies operating in the market. The anti-aging market is highly competitive, with numerous brands vying for consumer attention and market share. Brands that position themselves as premium or luxury may face increased pressure to demonstrate superior efficacy and justify their higher price points compared to competitors offering similar products at lower prices.

Anti-Aging Market Segment Analysis:

Anti Aging Market Segmented based on Product type, Target Group, and Distribution Channel.

By Product Type, the Creams segment is expected to dominate the market during the forecast period

- Cream-based formulations are easy to incorporate into daily skincare regimens, making them accessible and convenient for consumers of all ages and skin types. Unlike more intensive treatments or procedures, such as injections or laser therapy, anti-aging creams require minimal time and effort to apply and can be used at home. Anti-aging creams are widely available in retail outlets, pharmacies, specialty beauty stores, and online platforms, making them easily accessible to consumers worldwide. The broad availability ensures widespread adoption and market penetration, driving sales and market dominance.

- The anti-aging creams segment benefits from continuous innovation in skincare formulations, with companies developing advanced technologies, active ingredients, and delivery systems to enhance product efficacy and performance. Many consumers prefer the sensory experience and texture of creams compared to other formulations, such as serums or oils. Creams provide hydration, nourishment, and a luxurious feel on the skin, creating a pleasant user experience that encourages consistent usage and brand loyalty. Anti-aging creams come in a wide range of formulations tailored to different skin types, concerns, and age groups.

By Target Group, Female segment held the largest share of 57.86% in 2023

- Cultural norms and beauty standards often emphasize youthfulness and physical attractiveness, leading many women to prioritize skincare and anti-aging products in their beauty routines. Women are more likely than men to invest time and money in skincare and beauty products. They tend to be more proactive about addressing signs of aging and are willing to experiment with different products and treatments to achieve the desired results.

- The skincare industry, including the anti-aging segment, has traditionally targeted women as the primary consumers. the wide range of anti-aging products specifically tailored to women's needs. Anti-aging products often cater to specific skin concerns and preferences, such as dryness, fine lines, wrinkles, and uneven skin tone. Women may be drawn to the diverse range of products available, including creams, serums, masks, and treatments, that address their individual skincare needs.

- With the growing emphasis on self-care and wellness, many women view skincare as an essential part of their self-care routines. Anti-aging products are perceived as a means of maintaining skin health and vitality, aligning with broader lifestyle trends focused on holistic well-being. Women are often exposed to advertising, endorsements, and social media content promoting anti-aging products, which can influence their purchasing decisions

Anti-Aging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Many countries in the Asia-Pacific region, including Japan, South Korea, China, and Singapore, are experiencing significant demographic shifts towards aging populations. Asian cultures often place a strong emphasis on youthfulness and maintaining a youthful appearance. There is a societal expectation, particularly for women, to prioritize skincare and invest in products that help them achieve and maintain smooth, youthful-looking skin.

- The cultural emphasis drives a high demand for anti-aging products. Countries like South Korea and Japan are renowned for their advancements in skincare technology. These countries lead the market with innovative formulations, cutting-edge ingredients, and skincare devices that target specific signs of aging. The continuous innovation in the Asia-Pacific region attracts consumers globally, further boosting its dominance in the anti-aging market.

- Economic growth in many Asian countries has led to a rise in disposable incomes. Affluent consumers are more willing to invest in high-quality skincare products, including premium anti-aging solutions. The Asia-Pacific region boasts a vibrant beauty and personal care industry, with a wide range of local and international brands competing in the market. The brands offer diverse anti-aging product lines tailored to different skin types, concerns, and preferences, catering to the diverse needs of consumers across the region.

Anti-Aging Market Top Key Players:

- Estée Lauder Companies (US)

- Revlon, Inc. (US)

- Coty Inc. (US)

- Mary Kay Inc. (US)

- Nu Skin Enterprises, Inc. (US)

- Olay (Procter & Gamble) (US)

- Neutrogena (Johnson & Johnson) (US)

- Elizabeth Arden, Inc. (US)

- Procter & Gamble (US)

- Johnson & Johnson (US)

- Clinique (Estée Lauder Companies) (US)

- Beiersdorf AG (Germany)

- The Body Shop International Limited (UK)

- Avon Products, Inc. (UK)

- L'Oréal (France)

- Clarins Group (France)

- Lancôme (L'Oréal) (France)

- Chanel (France)

- Garnier (L'Oréal) (France)

- Unilever (United Kingdom/Netherlands)

- Oriflame Cosmetics Global S.A. (Sweden)

- Kao Corporation (Japan)

- SK-II (Procter & Gamble) (Japan)

- Shiseido Company, Limited (Japan)

- Amorepacific Corporation (South Korea), and other major players

Key Industry Developments in the Anti-Aging Market:

- In October 2023, Estée Lauder Companies Inc. presented its latest clinical research findings at the 33rd IFSCC Congress, discussing the use of epigenetics in the beauty industry for anti-aging and age reversal.

- In April 2021, Kao Corporation established Kao Beauty Brands Counseling Co., Ltd. by merging two beauty counseling companies within the group. Through professional counseling conducted by beauty consultants, Kao Beauty Brands Counseling will be reinforcing the images and values of Kao's cosmetics brands and maintaining and expanding a diverse and loyal user base.

|

Global Anti-Aging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

1.18 |

|

Forecast Period 2024-32 CAGR: |

7.6% |

Market Size in 2032: |

2.29 |

|

Segments Covered: |

By Product Type |

|

|

|

By Target Group |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ANTI AGING MARKET BY PRODUCT TYPE (2017-2032)

- ANTI AGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SERUMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CREAMS

- GELS

- OTHERS

- ANTI AGING MARKET BY TARGET GROUP (2017-2032)

- ANTI AGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MALE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FEMALE

- ANTI AGING MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- ANTI AGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HYPERMARKET/SUPERMARKET

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORE

- PHARMACIES

- E-COMMERCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Anti Aging Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ESTÉE LAUDER COMPANIES (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- REVLON, INC. (US)

- COTY INC. (US)

- MARY KAY INC. (US)

- NU SKIN ENTERPRISES, INC. (US)

- OLAY (PROCTER & GAMBLE) (US)

- NEUTROGENA (JOHNSON & JOHNSON) (US)

- ELIZABETH ARDEN, INC. (US)

- PROCTER & GAMBLE (US)

- JOHNSON & JOHNSON (US)

- CLINIQUE (ESTÉE LAUDER COMPANIES) (US)

- BEIERSDORF AG (GERMANY)

- THE BODY SHOP INTERNATIONAL LIMITED (UK)

- AVON PRODUCTS, INC. (UK)

- L'ORÉAL (FRANCE)

- CLARINS GROUP (FRANCE)

- LANCÔME (L'ORÉAL) (FRANCE)

- CHANEL (FRANCE)

- GARNIER (L'ORÉAL) (FRANCE)

- UNILEVER (UNITED KINGDOM/NETHERLANDS)

- ORIFLAME COSMETICS GLOBAL S.A. (SWEDEN)

- KAO CORPORATION (JAPAN)

- SK-II (PROCTER & GAMBLE) (JAPAN)

- SHISEIDO COMPANY, LIMITED (JAPAN)

- AMOREPACIFIC CORPORATION (SOUTH KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL ANTI AGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Target Group

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Anti-Aging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

1.18 |

|

Forecast Period 2024-32 CAGR: |

7.6% |

Market Size in 2032: |

2.29 |

|

Segments Covered: |

By Product Type |

|

|

|

By Target Group |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ANTI-AGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ANTI-AGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ANTI-AGING MARKET COMPETITIVE RIVALRY

TABLE 005. ANTI-AGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. ANTI-AGING MARKET THREAT OF SUBSTITUTES

TABLE 007. ANTI-AGING MARKET BY TYPE

TABLE 008. PRODUCT MARKET OVERVIEW (2016-2030)

TABLE 009. DEVICES MARKET OVERVIEW (2016-2030)

TABLE 010. ANTI-AGING MARKET BY TREATMENT

TABLE 011. BODY CARE TREATMENT MARKET OVERVIEW (2016-2030)

TABLE 012. FACIAL CARE TREATMENT MARKET OVERVIEW (2016-2030)

TABLE 013. ANTI-AGING MARKET BY AGE GEOGRAPHIC

TABLE 014. BABY BOOMER MARKET OVERVIEW (2016-2030)

TABLE 015. GENERATION X MARKET OVERVIEW (2016-2030)

TABLE 016. GENERATION Y MARKET OVERVIEW (2016-2030)

TABLE 017. ANTI-AGING MARKET BY APPLICATION

TABLE 018. ANTI-WRINKLE TREATMENT MARKET OVERVIEW (2016-2030)

TABLE 019. ANTI-PIGMENTATION MARKET OVERVIEW (2016-2030)

TABLE 020. SKIN RESURFACING MARKET OVERVIEW (2016-2030)

TABLE 021. ANTI-AGING MARKET BY DISTRIBUTION CHANNEL

TABLE 022. PHARMACIES MARKET OVERVIEW (2016-2030)

TABLE 023. SPECIALTY STORES MARKET OVERVIEW (2016-2030)

TABLE 024. ONLINE STORES MARKET OVERVIEW (2016-2030)

TABLE 025. NORTH AMERICA ANTI-AGING MARKET, BY TYPE (2016-2030)

TABLE 026. NORTH AMERICA ANTI-AGING MARKET, BY TREATMENT (2016-2030)

TABLE 027. NORTH AMERICA ANTI-AGING MARKET, BY AGE GEOGRAPHIC (2016-2030)

TABLE 028. NORTH AMERICA ANTI-AGING MARKET, BY APPLICATION (2016-2030)

TABLE 029. NORTH AMERICA ANTI-AGING MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 030. N ANTI-AGING MARKET, BY COUNTRY (2016-2030)

TABLE 031. EASTERN EUROPE ANTI-AGING MARKET, BY TYPE (2016-2030)

TABLE 032. EASTERN EUROPE ANTI-AGING MARKET, BY TREATMENT (2016-2030)

TABLE 033. EASTERN EUROPE ANTI-AGING MARKET, BY AGE GEOGRAPHIC (2016-2030)

TABLE 034. EASTERN EUROPE ANTI-AGING MARKET, BY APPLICATION (2016-2030)

TABLE 035. EASTERN EUROPE ANTI-AGING MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 036. ANTI-AGING MARKET, BY COUNTRY (2016-2030)

TABLE 037. WESTERN EUROPE ANTI-AGING MARKET, BY TYPE (2016-2030)

TABLE 038. WESTERN EUROPE ANTI-AGING MARKET, BY TREATMENT (2016-2030)

TABLE 039. WESTERN EUROPE ANTI-AGING MARKET, BY AGE GEOGRAPHIC (2016-2030)

TABLE 040. WESTERN EUROPE ANTI-AGING MARKET, BY APPLICATION (2016-2030)

TABLE 041. WESTERN EUROPE ANTI-AGING MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 042. ANTI-AGING MARKET, BY COUNTRY (2016-2030)

TABLE 043. ASIA PACIFIC ANTI-AGING MARKET, BY TYPE (2016-2030)

TABLE 044. ASIA PACIFIC ANTI-AGING MARKET, BY TREATMENT (2016-2030)

TABLE 045. ASIA PACIFIC ANTI-AGING MARKET, BY AGE GEOGRAPHIC (2016-2030)

TABLE 046. ASIA PACIFIC ANTI-AGING MARKET, BY APPLICATION (2016-2030)

TABLE 047. ASIA PACIFIC ANTI-AGING MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 048. ANTI-AGING MARKET, BY COUNTRY (2016-2030)

TABLE 049. MIDDLE EAST & AFRICA ANTI-AGING MARKET, BY TYPE (2016-2030)

TABLE 050. MIDDLE EAST & AFRICA ANTI-AGING MARKET, BY TREATMENT (2016-2030)

TABLE 051. MIDDLE EAST & AFRICA ANTI-AGING MARKET, BY AGE GEOGRAPHIC (2016-2030)

TABLE 052. MIDDLE EAST & AFRICA ANTI-AGING MARKET, BY APPLICATION (2016-2030)

TABLE 053. MIDDLE EAST & AFRICA ANTI-AGING MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 054. ANTI-AGING MARKET, BY COUNTRY (2016-2030)

TABLE 055. SOUTH AMERICA ANTI-AGING MARKET, BY TYPE (2016-2030)

TABLE 056. SOUTH AMERICA ANTI-AGING MARKET, BY TREATMENT (2016-2030)

TABLE 057. SOUTH AMERICA ANTI-AGING MARKET, BY AGE GEOGRAPHIC (2016-2030)

TABLE 058. SOUTH AMERICA ANTI-AGING MARKET, BY APPLICATION (2016-2030)

TABLE 059. SOUTH AMERICA ANTI-AGING MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 060. ANTI-AGING MARKET, BY COUNTRY (2016-2030)

TABLE 061. JOHNSON & JOHNSON (US): SNAPSHOT

TABLE 062. JOHNSON & JOHNSON (US): BUSINESS PERFORMANCE

TABLE 063. JOHNSON & JOHNSON (US): PRODUCT PORTFOLIO

TABLE 064. JOHNSON & JOHNSON (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. PROCTER & GAMBLE CO. (US): SNAPSHOT

TABLE 065. PROCTER & GAMBLE CO. (US): BUSINESS PERFORMANCE

TABLE 066. PROCTER & GAMBLE CO. (US): PRODUCT PORTFOLIO

TABLE 067. PROCTER & GAMBLE CO. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ESTÉE LAUDER COMPANIES INC. (US): SNAPSHOT

TABLE 068. ESTÉE LAUDER COMPANIES INC. (US): BUSINESS PERFORMANCE

TABLE 069. ESTÉE LAUDER COMPANIES INC. (US): PRODUCT PORTFOLIO

TABLE 070. ESTÉE LAUDER COMPANIES INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. NU SKIN ENTERPRISES INC. (US): SNAPSHOT

TABLE 071. NU SKIN ENTERPRISES INC. (US): BUSINESS PERFORMANCE

TABLE 072. NU SKIN ENTERPRISES INC. (US): PRODUCT PORTFOLIO

TABLE 073. NU SKIN ENTERPRISES INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. AMWAY CORPORATION (US): SNAPSHOT

TABLE 074. AMWAY CORPORATION (US): BUSINESS PERFORMANCE

TABLE 075. AMWAY CORPORATION (US): PRODUCT PORTFOLIO

TABLE 076. AMWAY CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. LIGHTSTIM (US): SNAPSHOT

TABLE 077. LIGHTSTIM (US): BUSINESS PERFORMANCE

TABLE 078. LIGHTSTIM (US): PRODUCT PORTFOLIO

TABLE 079. LIGHTSTIM (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. CANDELA CORPORATION (US): SNAPSHOT

TABLE 080. CANDELA CORPORATION (US): BUSINESS PERFORMANCE

TABLE 081. CANDELA CORPORATION (US): PRODUCT PORTFOLIO

TABLE 082. CANDELA CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. HOLOGIC INC. (US): SNAPSHOT

TABLE 083. HOLOGIC INC. (US): BUSINESS PERFORMANCE

TABLE 084. HOLOGIC INC. (US): PRODUCT PORTFOLIO

TABLE 085. HOLOGIC INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. SOLTA MEDICAL INC. (US): SNAPSHOT

TABLE 086. SOLTA MEDICAL INC. (US): BUSINESS PERFORMANCE

TABLE 087. SOLTA MEDICAL INC. (US): PRODUCT PORTFOLIO

TABLE 088. SOLTA MEDICAL INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. ZO SKIN HEALTH INC. (US): SNAPSHOT

TABLE 089. ZO SKIN HEALTH INC. (US): BUSINESS PERFORMANCE

TABLE 090. ZO SKIN HEALTH INC. (US): PRODUCT PORTFOLIO

TABLE 091. ZO SKIN HEALTH INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. UNILEVER GROUP (UNITED KINGDOM): SNAPSHOT

TABLE 092. UNILEVER GROUP (UNITED KINGDOM): BUSINESS PERFORMANCE

TABLE 093. UNILEVER GROUP (UNITED KINGDOM): PRODUCT PORTFOLIO

TABLE 094. UNILEVER GROUP (UNITED KINGDOM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. PIERRE FABRE S.A. (FRANCE): SNAPSHOT

TABLE 095. PIERRE FABRE S.A. (FRANCE): BUSINESS PERFORMANCE

TABLE 096. PIERRE FABRE S.A. (FRANCE): PRODUCT PORTFOLIO

TABLE 097. PIERRE FABRE S.A. (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. L'ORÉAL S.A. (FRANCE): SNAPSHOT

TABLE 098. L'ORÉAL S.A. (FRANCE): BUSINESS PERFORMANCE

TABLE 099. L'ORÉAL S.A. (FRANCE): PRODUCT PORTFOLIO

TABLE 100. L'ORÉAL S.A. (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. GALDERMA S.A. (SWITZERLAND): SNAPSHOT

TABLE 101. GALDERMA S.A. (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 102. GALDERMA S.A. (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 103. GALDERMA S.A. (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. SHISEIDO COMPANY LIMITED (JAPAN): SNAPSHOT

TABLE 104. SHISEIDO COMPANY LIMITED (JAPAN): BUSINESS PERFORMANCE

TABLE 105. SHISEIDO COMPANY LIMITED (JAPAN): PRODUCT PORTFOLIO

TABLE 106. SHISEIDO COMPANY LIMITED (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. ALLERGAN PLC (IRELAND): SNAPSHOT

TABLE 107. ALLERGAN PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 108. ALLERGAN PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 109. ALLERGAN PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. LUMENIS LTD. (ISRAEL): SNAPSHOT

TABLE 110. LUMENIS LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 111. LUMENIS LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 112. LUMENIS LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. HOME SKINOVATIONS LTD. (ISRAEL): SNAPSHOT

TABLE 113. HOME SKINOVATIONS LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 114. HOME SKINOVATIONS LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 115. HOME SKINOVATIONS LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. BEIERSDORF AG (GERMANY): SNAPSHOT

TABLE 116. BEIERSDORF AG (GERMANY): BUSINESS PERFORMANCE

TABLE 117. BEIERSDORF AG (GERMANY): PRODUCT PORTFOLIO

TABLE 118. BEIERSDORF AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 119. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 120. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 121. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ANTI-AGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ANTI-AGING MARKET OVERVIEW BY TYPE

FIGURE 012. PRODUCT MARKET OVERVIEW (2016-2030)

FIGURE 013. DEVICES MARKET OVERVIEW (2016-2030)

FIGURE 014. ANTI-AGING MARKET OVERVIEW BY TREATMENT

FIGURE 015. BODY CARE TREATMENT MARKET OVERVIEW (2016-2030)

FIGURE 016. FACIAL CARE TREATMENT MARKET OVERVIEW (2016-2030)

FIGURE 017. ANTI-AGING MARKET OVERVIEW BY AGE GEOGRAPHIC

FIGURE 018. BABY BOOMER MARKET OVERVIEW (2016-2030)

FIGURE 019. GENERATION X MARKET OVERVIEW (2016-2030)

FIGURE 020. GENERATION Y MARKET OVERVIEW (2016-2030)

FIGURE 021. ANTI-AGING MARKET OVERVIEW BY APPLICATION

FIGURE 022. ANTI-WRINKLE TREATMENT MARKET OVERVIEW (2016-2030)

FIGURE 023. ANTI-PIGMENTATION MARKET OVERVIEW (2016-2030)

FIGURE 024. SKIN RESURFACING MARKET OVERVIEW (2016-2030)

FIGURE 025. ANTI-AGING MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 026. PHARMACIES MARKET OVERVIEW (2016-2030)

FIGURE 027. SPECIALTY STORES MARKET OVERVIEW (2016-2030)

FIGURE 028. ONLINE STORES MARKET OVERVIEW (2016-2030)

FIGURE 029. NORTH AMERICA ANTI-AGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. EASTERN EUROPE ANTI-AGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. WESTERN EUROPE ANTI-AGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. ASIA PACIFIC ANTI-AGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 033. MIDDLE EAST & AFRICA ANTI-AGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. SOUTH AMERICA ANTI-AGING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Anti Aging Market research report is 2024-2032.

Estée Lauder Companies (US), Revlon, Inc. (US), Coty Inc. (US), Mary Kay Inc. (US), Nu Skin Enterprises, Inc. (US), Olay (Procter & Gamble) (US), Neutrogena (Johnson & Johnson) (US), Elizabeth Arden, Inc. (US), Procter & Gamble (US), Johnson & Johnson (US), Clinique (Estée Lauder Companies) (US), Beiersdorf AG (Germany), The Body Shop International Limited (UK), Avon Products, Inc. (UK), L'Oréal (France), Clarins Group (France), Lancôme (L'Oréal) (France), Chanel (France), Garnier (L'Oréal) (France), Unilever (United Kingdom/Netherlands), Oriflame Cosmetics Global S.A. (Sweden), Kao Corporation (Japan), SK-II (Procter & Gamble) (Japan), Shiseido Company, Limited (Japan), Amorepacific Corporation (South Korea), and Other Major Players.

The Anti Aging Market is segmented into Product Type, Target Group, Distribution Channel, and region. By Product Type, the market is categorized into Serums, Creams, Gels, and Others. By Target Group, the market is categorized into Male and female. By Distribution Channel, the market is categorized into Hypermarkets/supermarkets, Specialty Stores, Pharmacies, and E-Commerce. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The anti-aging market encompasses the sale of products and services aimed at reducing or reversing the visible signs of aging, such as wrinkles, fine lines, and age spots. This market includes skincare products, supplements, treatments, devices, and procedures designed to promote youthful-looking skin and overall wellness. It caters to consumers of various ages seeking to maintain or enhance their appearance, health, and vitality as they age.

Anti-Aging Market Size Was Valued at USD 1.18 Billion in 2023 and is Projected to Reach USD 2.29 Billion by 2032, Growing at a CAGR of 7.6% From 2024-2032