Anhydrous Borax Market Synopsis

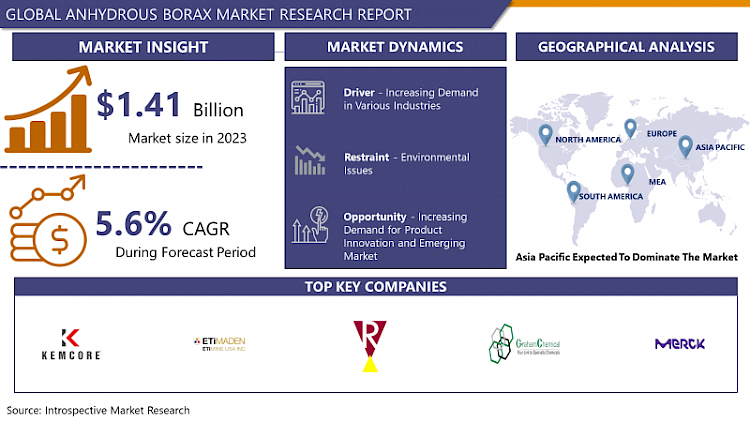

Anhydrous Borax Market Size Was Valued at USD 1.41 Billion in 2023, and is Projected to Reach USD 2.31 Billion by 2032, Growing at a CAGR of 5.6 % From 2024-2032.

Anhydrous borax, chemically known as sodium borate, is a crystalline compound composed of sodium, boron, and oxygen. It is devoid of water molecules, distinguishing it from hydrated forms like borax pentahydrate. Widely used in various industries including glass manufacturing, ceramics, agriculture, and detergents, anhydrous borax serves as a flux, a buffering agent, and a source of boron, exhibiting properties crucial for numerous industrial processes and applications.

- The anhydrous borax market is a segment of the global boron compounds industry, focusing specifically on the production, distribution, and consumption of anhydrous borax, also known as sodium borate. Anhydrous borax is a white crystalline powder primarily used in various industrial applications such as glass manufacturing, ceramics, metallurgy, and agriculture.

- The anhydrous borax market is widespread use in the glass industry, where it serves as a fluxing agent to lower the melting point of glass batches, improve their homogeneity, and enhance their thermal and chemical resistance properties. The anhydrous borax finds applications in the production of ceramics, where it acts as a flux and a constituent in glazes, enhancing the durability and appearance of ceramic products.

- The anhydrous borax plays a crucial role in metallurgical processes, particularly in the production of ferrous and non-ferrous metals. It is utilized as a flux in welding and soldering applications, aiding in the removal of oxides from metal surfaces and promoting better bonding.

- In agriculture, anhydrous borax is employed as a micronutrient fertilizer to address boron deficiencies in soil, thereby improving crop yields and quality. Its role in agriculture is vital for the healthy growth of various crops, including fruits, vegetables, and grains.

- The market for anhydrous borax is influenced by factors such as industrialization, infrastructure development, and agricultural practices globally. Emerging economies witnessing rapid industrial growth and increasing agricultural activities are expected to drive demand for anhydrous borax in the coming years. The technological advancements in boron extraction and processing methods are likely to enhance the efficiency of production, thereby positively impacting market growth.

Anhydrous Borax Market Trend Analysis

Increasing Demand in Various Industries

- The Anhydrous Borax compound, also known as sodium borate, finds extensive application across a spectrum of sectors, including agriculture, ceramics, glass, and detergent manufacturing. In agriculture, it serves as a crucial component in fertilizers, aiding in soil conditioning and nutrient uptake by plants. The ceramics and glass industries rely on anhydrous borax for its fluxing properties, facilitating the melting process and enhancing the overall quality of the final products.

- The detergent industry utilizes it as a key ingredient in laundry detergents, where it acts as a water softener and enhances cleaning efficacy. As these industries continue to expand and innovate, the demand for anhydrous borax is expected to escalate further, driving market growth and presenting lucrative opportunities for manufacturers and suppliers.

- Furthermore, the growing emphasis on sustainable practices and eco-friendly solutions is also contributing to the rising demand for anhydrous borax. As industries seek to reduce their environmental footprint, they are increasingly adopting boron-based compounds due to their biodegradable nature and minimal ecological impact. This trend is particularly notable in sectors such as agriculture and detergents, where there is a growing preference for environmentally friendly alternatives.

- The technological advancements and product innovations are further fuelling market expansion, with manufacturers continually developing new formulations and applications to cater to evolving consumer needs and regulatory requirements.

Increasing Demand for Product Innovation and Emerging Market

- The industries increasingly prioritize sustainability and efficiency, the need for innovative solutions has become paramount. Anhydrous Borax, with its versatile applications across various sectors including agriculture, ceramics, and glass manufacturing, presents an attractive opportunity for further innovation. Companies are investing in research and development to create advanced formulations and applications of Anhydrous Borax, catering to evolving consumer demands and regulatory requirements.

- The emergence of new markets, particularly in developing regions, is significantly contributing to the growth of the Anhydrous Borax market. Rapid industrialization, urbanization, and increasing disposable incomes in these regions are driving the demand for products utilizing Anhydrous Borax.

- The expanding scope of applications in sectors such as detergents, cosmetics, and pharmaceuticals further bolstering market growth. As businesses capitalize on these opportunities, strategic expansion into emerging markets and robust product innovation will continue to be fundamental in shaping the Anhydrous Borax market.

Anhydrous Borax Market Segment Analysis:

Anhydrous Borax Market Segmented on the basis of Application, End-User, and Distribution Channel.

By Application, Glass Manufacturing segment is expected to dominate the market during the forecast period

- The glass manufacturing segment is extensively used in glass production due to its unique chemical properties. As a fluxing agent, it helps reduce the melting point of glass, facilitating the fusion of raw materials at lower temperatures. This characteristic enhances energy efficiency in glass manufacturing and improves the quality and consistency of the glass produced.

- The anhydrous borax serves as a crucial component in the formulation of specialty glass such as borosilicate glass and is known for its exceptional thermal and chemical resistance. These glasses are extensively used in laboratory equipment, kitchenware, and industrial applications where durability and resistance to thermal shock are dominant. The precise control over the glass composition afforded by anhydrous borax ensures that manufacturers can tailor their products to meet specific performance requirements across various end-user industries.

- As industries strive for sustainability and eco-friendliness, anhydrous borax offers an environmentally benign solution, contributing to the overall sustainability goals of the glass manufacturing industry to continue expanding the evolving market needs and driving innovation in the sector.

By End-User, Glass & Ceramics segment held the largest share of xx% in 2022

- Borax serves as a fluxing agent, lowering the melting point of glass and ceramics, and facilitating the fusion of raw materials during manufacturing processes. This characteristic makes it indispensable in the production of various glass products, including fiberglass, borosilicate glass, and laboratory glassware, as well as ceramics such as tiles, pottery, and porcelain.

- In The glass and ceramics sector, anhydrous borax acts as a crucial ingredient in glazes and enamels, enhancing their durability, adhesion, and resistance to chemical and thermal shocks. Its ability to modify the properties of these coatings contributes significantly to the quality and performance of finished glass and ceramic products, making it an essential component in their formulation. The demand for high-quality glass and ceramic materials across the construction, automotive, and electronics industries further fuels the growth of the Anhydrous Borax Market.

Anhydrous Borax Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- North America dominates the global market for anhydrous borax due to its rich deposits and advanced extraction techniques, supplying a crucial ingredient in various industries and gaining a substantial share of the market.

- North America's supremacy in the anhydrous borax market stems from its abundant natural resources, particularly in regions like California and Nevada, where vast reserves lie beneath the earth's surface. Leveraging modern mining methods and efficient processing facilities, North American producers excel in extracting high-quality anhydrous borax with optimal purity levels, meeting stringent industry standards.

- The North America boasts a robust infrastructure for transportation and distribution, facilitating seamless movement of anhydrous borax across domestic and international markets. The region's commitment to research and innovation fuels continuous advancements in anhydrous borax technology, driving product development and improving efficiency in manufacturing processes. Collaborations between industry players and academic institutions foster a culture of innovation, leading to the introduction of novel applications and enhanced performance characteristics for anhydrous borax-based products.

- North America's proactive regulatory environment ensures compliance with environmental and safety regulations, instilling confidence among consumers and promoting sustainable practices throughout the supply chain. As the region continues to evolve and adapt to changing market dynamics, its position as a global leader in the anhydrous borax Market.

Anhydrous Borax Market Top Key Players:

- Etimine USA (USA)

- Sigma-Aldrich (USA)

- Graham Chemical (USA)

- Rose Mill Co. (USA)

- Kemcore (Hong Kong)

- Borax (USA)

- Searles Valley Minerals (USA)

- Liaobin (China), and Other Major Players.

Key Industry Developments in the Anhydrous Borax Market:

- In May 2024, Merck announced its €300 million investment in a new Bioprocessing Production Center in Daejeon, South Korea. This largest investment by Merck’s Life Science sector in Asia-Pacific will create around 300 jobs by 2028. Matthias Heinzel emphasized the move will enhance collaboration and expedite innovative therapies in the dynamic regional market.

- In April 2023, Mill Rock Capital established Mill Rock Advanced Materials LLC, a growth platform concentrating on investments within the advanced materials and industrial additives solutions sectors. Mill Rock Advanced Materials had completed the acquisition of Asbury Carbons, Inc. from the Riddle family and the Asbury Carbons, Inc. Employee Stock Ownership Plan. Stephen A. Riddle, a substantial investment, will continue serving on the board of directors. Financial details of the transaction were not revealed.

|

Global Anhydrous Borax Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 1.41.8 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.6 % |

Market Size in 2032 : |

USD 2.31 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ANHYDROUS BORAX MARKET BY APPLICATION (2017-2030)

- ANHYDROUS BORAX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GLASS MANUFACTURING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CERAMIC INDUSTRY

- AGRICULTURE

- DETERGENTS AND CLEANING PRODUCTS

- METALLURGY

- ANHYDROUS BORAX MARKET BY END-USER (2017-2030)

- ANHYDROUS BORAX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CHEMICAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AGRICULTURE

- GLASS & CERAMICS

- ANHYDROUS BORAX MARKET BY DISTRIBUTION CHANNEL (2017-2030)

- ANHYDROUS BORAX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIRECT SALES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DISTRIBUTORS/WHOLESALERS

- ONLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Anhydrous Borax Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ETIMINE USA (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SIGMA-ALDRICH (USA)

- GRAHAM CHEMICAL (USA)

- ROSE MILL CO. (USA)

- KEMCORE (HONG KONG)

- BORAX (USA)

- SEARLES VALLEY MINERALS (USA)

- LIAOBIN (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL ANHYDROUS BORAX MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Anhydrous Borax Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 1.41.8 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.6 % |

Market Size in 2032 : |

USD 2.31 Mn. |

|

Segments Covered: |

By Application |

|

|

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ANHYDROUS BORAX MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ANHYDROUS BORAX MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ANHYDROUS BORAX MARKET COMPETITIVE RIVALRY

TABLE 005. ANHYDROUS BORAX MARKET THREAT OF NEW ENTRANTS

TABLE 006. ANHYDROUS BORAX MARKET THREAT OF SUBSTITUTES

TABLE 007. ANHYDROUS BORAX MARKET BY TYPE

TABLE 008. EXCELLENCE GRADE MARKET OVERVIEW (2016-2028)

TABLE 009. FIRST GRADE MARKET OVERVIEW (2016-2028)

TABLE 010. QUALIFIED GRADE MARKET OVERVIEW (2016-2028)

TABLE 011. ANHYDROUS BORAX MARKET BY APPLICATION

TABLE 012. METALLURGY MARKET OVERVIEW (2016-2028)

TABLE 013. GLASS MARKET OVERVIEW (2016-2028)

TABLE 014. ENAMEL MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA ANHYDROUS BORAX MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA ANHYDROUS BORAX MARKET, BY APPLICATION (2016-2028)

TABLE 018. N ANHYDROUS BORAX MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE ANHYDROUS BORAX MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE ANHYDROUS BORAX MARKET, BY APPLICATION (2016-2028)

TABLE 021. ANHYDROUS BORAX MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC ANHYDROUS BORAX MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC ANHYDROUS BORAX MARKET, BY APPLICATION (2016-2028)

TABLE 024. ANHYDROUS BORAX MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ANHYDROUS BORAX MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA ANHYDROUS BORAX MARKET, BY APPLICATION (2016-2028)

TABLE 027. ANHYDROUS BORAX MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA ANHYDROUS BORAX MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA ANHYDROUS BORAX MARKET, BY APPLICATION (2016-2028)

TABLE 030. ANHYDROUS BORAX MARKET, BY COUNTRY (2016-2028)

TABLE 031. BORAX: SNAPSHOT

TABLE 032. BORAX: BUSINESS PERFORMANCE

TABLE 033. BORAX: PRODUCT PORTFOLIO

TABLE 034. BORAX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. SEARLES VALLEY MINERALS: SNAPSHOT

TABLE 035. SEARLES VALLEY MINERALS: BUSINESS PERFORMANCE

TABLE 036. SEARLES VALLEY MINERALS: PRODUCT PORTFOLIO

TABLE 037. SEARLES VALLEY MINERALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. LIAOBIN: SNAPSHOT

TABLE 038. LIAOBIN: BUSINESS PERFORMANCE

TABLE 039. LIAOBIN: PRODUCT PORTFOLIO

TABLE 040. LIAOBIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ANHYDROUS BORAX MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ANHYDROUS BORAX MARKET OVERVIEW BY TYPE

FIGURE 012. EXCELLENCE GRADE MARKET OVERVIEW (2016-2028)

FIGURE 013. FIRST GRADE MARKET OVERVIEW (2016-2028)

FIGURE 014. QUALIFIED GRADE MARKET OVERVIEW (2016-2028)

FIGURE 015. ANHYDROUS BORAX MARKET OVERVIEW BY APPLICATION

FIGURE 016. METALLURGY MARKET OVERVIEW (2016-2028)

FIGURE 017. GLASS MARKET OVERVIEW (2016-2028)

FIGURE 018. ENAMEL MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA ANHYDROUS BORAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE ANHYDROUS BORAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC ANHYDROUS BORAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA ANHYDROUS BORAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA ANHYDROUS BORAX MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Anhydrous Borax Market research report is 2024-2032.

Etimine USA (USA), Sigma-Aldrich (USA), Graham Chemical (USA), Rose Mill Co. (USA), Kemcore (Hong Kong), Borax (USA), Searles Valley Minerals (USA), Liaobin (China), and Other Major Players.

The Anhydrous Borax Market is segmented into Application, End-User, Distribution Channel, and region. By Application, the market is categorized into Glass Manufacturing, Ceramic Industry, Agriculture, Detergents and Cleaning Products, and Metallurgy. By End-User, the market is categorized into Chemical, Agriculture, and Glass & Ceramics. By Distribution Channel, the market is categorized into Direct Sales, Distributors/Wholesalers, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Anhydrous borax, chemically known as sodium borate, is a crystalline compound composed of sodium, boron, and oxygen. It is devoid of water molecules, distinguishing it from hydrated forms like borax pentahydrate. Widely used in various industries including glass manufacturing, ceramics, agriculture, and detergents, anhydrous borax serves as a flux, a buffering agent, and a source of boron, exhibiting properties crucial for numerous industrial processes and applications.

Anhydrous Borax Market Size Was Valued at USD 1.41 Billion in 2023, and is Projected to Reach USD 2.31 Billion by 2032, Growing at a CAGR of 5.6 % From 2024-2032.