Alcoholic Drinks Market Synopsis

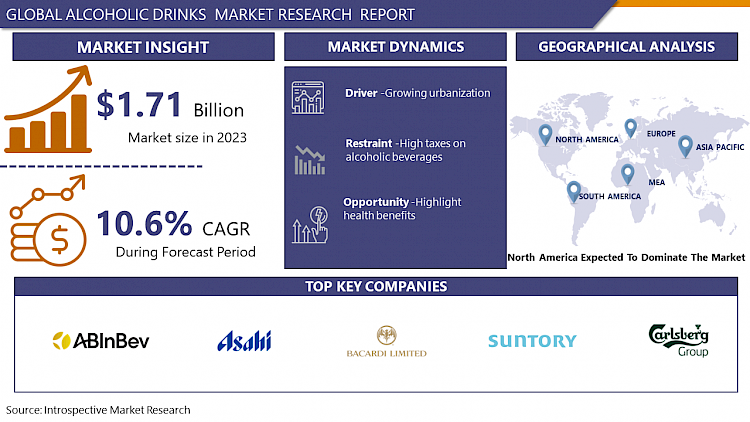

Alcoholic Drinks Market Size Was Valued at USD 1.71 Billion in 2023, and is Projected to Reach USD 4.69 Billion by 2032, Growing at a CAGR of 10.6% From 2024-2032.

Alcohol is commonly referred to as alcoholic drinks or alcoholic beverages of which ethanol is the major component. Ethanol is produced from the process involving yeast and sugar where through the two, all the alcoholic drinks cause some level of inebriation. Both these drinks have been used by man from as early as the ancient civilization and have served social, religious and cultural functions in most societies.

- Subdivisions of alcoholic beverages are beer, wine and spirits, which includes distilled beverages and fermented drinks. Beer is an aged brewed alcoholic beverage prepared from fermented grains especially barley and has remained one of the most commonly consumed beverages in the world.

- Beer, on the opposite, includes fermented crushed grapes or other fruits and have A differences in taste as well as kind due to the type of grapes, area in which they are grown and the way of manufacturing. Spirits are effective alcoholic drinks that contain a relatively higher percentage of alcohol which is produced by the fermentation of grains or fruits/vegetables. Some of the Spirits include Whisky, vodka, rum, gin among others.

- Alcohol beverages come in all sorts and kinds as do the processes used to make them and the perception that accompanies their use all over the globe. These products are taken socially in occasions such as celebrations and parties and may cause different impacts on the consumers depending on the weight, rate of metabolism, and tolerance level of the individual.

- While, most people can indulge in taking alcoholic drinks within their recommended permissible limit, intake of alcohol a above this limit has health issues such as liver ailments, increased susceptibility to accidents and alcoholism among others.

Alcoholic Drinks Market Trend Analysis

Develop Consumers are seeking out small-batch, locally-produced alcoholic drinks

- In particular, having analyzed the fluctuations in the alcoholic drinks market in recent years, it can be identified that the customers increasingly give a preference to the production of boutique and mini local breweries. This trend is associated with other significant trends in society with regard to sustainability, quality, and support of local producers. The audience is paying more attention to the origin and components of the products, since they are inclined to get a diverse, genuine, and individualized approach.

- The production of small numbers of products is easier to monitor than large numbers, thus, the quality of branded products is better than that of similar products that the mass marketers sell. The local producers tend to play up aspects such as the taste, originality in processing, and utilization of raw materials from the region that matters to consumers who are now looking for out-of-the-box experiences.

- Furthermore, the products that are associated with narratives can be attributed with a story or history, which may attract consumers with regards to the process of making the things they consume.

- The tendency of consuming small portions and regional alcoholic beverages is also related to the development of the ideas of sustainable and ethical consumption. People are paying more attention to environmental issues and prefer products that have less impact in terms of carbon emissions concerning transportation and packaging.

- Thereby when the consumers go for domestically produced products, they feel they are helping their fellow citizens and the nation in the long run. This trend not only drives customers’ choices in what appetizer to buy at a restaurant but also informs the fighting techniques of larger brands desiring to capture a part of this market by using appeals of authenticity and place.

Digital marketing & e-commerce

- The alcoholic drinks market has interesting prospects for the increase in digital marketing and the constant growth of e-commerce, which affects the ways of the brand’s interaction with consumers and vice versa. Originally this market really used physical stores and more ‘offline’ advertising sources. But thanks to modern technologies, brands can now utilize the paid targeted advertising in social networks, search engines, and other online resources, to deliver a specific message to certain target audience. This ensures that there are marketing techniques developed for specific brands to be marketed hence putting more emphasis on the branding of customer products.

- The consumption of alcoholic drinks has also benefited from e-commerce because now consumers can conveniently and easily purchase their preferred brands. Customers are able to access various products, do price comparisons, read material from other users, and order products from the comfort of their homes. This convenience factor has been of most essence to the busy consumers and those consumers who are specific in their tastes and preferences of the foods that they want to buy on the market. In addition, e-commerce provides brands with the opportunity to gather detailed information on the customers’ needs and habits, and adjust their promotional efforts and products according to these findings.

- Moreover, due to existing globalization in marketing and e-commerce, the alcoholic drinks industry has also gained international markets since the dictates of geographical regions cannot restrain brands’ growth. It has opened the opportunities for the small or specialized brands to co-compete with the large conglomerates with comparatively less difference in the global access. In general, the incorporation of digital plans into the alcoholic drinks market has a positive impact on consumers and brands since it has helped in improving on consumer shopping convenience as well as expanding choices while at the same helping brands effectively reach out to their consumers and establish deeper ways of interacting with them.

Alcoholic Drinks Market Segment Analysis:

Alcoholic Drinks Market is segmented based on Displacement, Propulsion and Application.

By Type, Beer is expected to dominate the market during the forecast period

- Beer is the leading segment in the global alcoholic drinks it has the highest market share in terms of volume followed by the revenue. This supremacy can be attributed to several factors such as the fact that beer has been in the market for a very long time, it is easily available and is accepted in many cultures globally.

- Most of the large-scale beer manufacturers have elaborate distribution channels, including Anheuser-Busch InBev, Heineken and Carlsberg among others, which make it possible to have their products available almost in every part of the world. The affordability of the beer compared to spirits and wines coupled with the versatility of age groups continues to enhance the supremacy of this category in the market.

- Beer beverages also have the following reasons of consumption socially accepted tradition and practices, sporting events, festivals among others where taking of beer is the order of the day. They defined craft beer as a type that has received much attention lately especially in North America and Europe due to the growing demand for non-mainstream beers and beers locally brewed.

- Such a trend has caused an increased interest in microbreweries and craft beer brands to different beers and has a positive impact on this segment. Moreover, new operations in beer tastes, types, and containers enhancing consumer attention, have made the beer a rather diverse product in the ALB segment.

- This is to mean that marketing and advertising are key aspects in sustaining beer’s supremacy. This makes the leading beer brands allocate a large of their budgets on promotions, sponsorships and other forms of digital media campaigns that try to capture the consumer’s attention. Of the promotion methods described, there is much emphasis on sponsorship in sporting activities as the techniques offer high visibility and assist in creating a positive brand connection with well-known teams and events.

- In addition, beer companies undertake exercises such as ‘responsibility campaigns’ that educate people on how to handle beer and general exercises that involve the community and also help improve the image of the beer producers. These wide-ranging tactics guarantee beer remains the world’s favorite alcoholic drink and retains its market share for consumption.

By Applications, supermarkets segment held the largest share

- Coming to the channel of distribution, supermarkets hold the largest market share when it comes to alcoholic drinks around the world. This has been more so because, supermarkets as compared to other stocks, are more convenient and they display a lot of variety besides being cheaper. Customers are capable of buying alcoholic products at supermarkets since accompanied by other household products, thus one-stop shopping market. This contributes to the large segment popularity because client can find the supermarket easily as we can see there are so many supermarkets in UK.

- Every supermarket store contains a variety of alcoholic products that include beers wines spirits and other luxury brands both regular and of the fancier quality. Underneath this variety there is a possibility to choose according to their tastes and pocket sizes, which makes supermarkets the first choice for alcoholic beverages. Also, for fresh produce, supermarkets incorporate promotions, discounts and loyalty schemes which offer the consumers value for their money and also frequent shoppers. The feature of a single location to be able to offer variety of products and accompanying prices creates a convenient shopping environment hence making supermarkets advantageous.

- Growing numbers of large retail chains and increase of supermarket’s impact area worldwide supported the primacy of this distribution channel. Supermarkets have also innovated and presented options such as online ordering and home delivery especially due to the effects of COVID-19. It has helped them to keep a better market positioning strategy where they are in a better position to capture more clients. Additionally, implementation of regulations and best practices in its supermarkets help the company to build up customer trust as the leading alcoholic drinks’ distribution channel.

Alcoholic Drinks Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The alcoholic drinks market in North America enjoys certain benefits due to the following reasons. To begin with, it exits a well-established drinking hub culture throughout the region that is part of people’s social and leisure activities. This cultural aspect is due to the constant and growing demand regardless of the type of alcohol being beer, wine, spirits or craft beverages. Furthermore, North America is a very diverse and relatively saturated market with a generous disposable income of its population. With help of such economic stability, more money can be spent on premium and specialty drinks which help in improving the number of products in the market.

- Secondly, competitive advantages resulting from the presence of recognized brands on the North American market make a huge contribution. Some of the industry players include AB InBev, Constellation Brands, and Diageo which have well established market influence together with vast distribution channels. These companies tend to monopolize shelves and address consumer preferences smartly due to their extensive resources and that of their affiliated companies. Also, there is a well-developed set of rules for production, distribution, and marketing in the region that can be considered rather stringent but stable in regards to quality and consumers’ protection.

- And finally, the authorities of North America proved them to be the leaders and trend-setters of the alcoholic drinks industry. This region is usually one that creates trends that are felt globally, regarding the outlook of the consumer market in the world. This leadership arises from; Population diversity that means that there are different tastes, Craft and microbrewery industry, Experimentation in flavors and styles. All these issues put together play a role in the total share of the North American total alcoholic beverages market thus enhancing it’s place in the global industry.

Active Key Players in the Alcoholic Drinks Market

- Anheuser-Busch InBev (Belgium)

- Asahi Group Holdings (Japan)

- Bacardi Limited (Bermuda)

- Beam Suntory (United States)

- Beam Suntory (United States)

- Brown-Forman Corporation (United States)

- Carlsberg Group (Denmark)

- Constellation Brands (United States)

- Diageo plc (United Kingdom)

- Edrington Group (United Kingdom)

- Gruppo Campari (Italy)

- Heineken N.V. (Netherlands)

- Kirin Holdings Company (Japan)

- Molson Coors Beverage Company (United States)

- Pernod Ricard SA (France)

- Rémy Cointreau (France)

- Suntory Holdings Limited (Japan)

- Thai Beverage Public Company Limited (Thailand)

- United Spirits Limited (India)

- William Grant & Sons (United Kingdom)

- Other Key Players

|

Global Alcoholic Drinks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.71 Bn. |

|

Forecast Period 2023-34 CAGR: |

10.6 % |

Market Size in 2032: |

USD 4.69 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ALCOHOLIC DRINKS MARKET BY TYPE (2017-2032)

- ALCOHOLIC DRINKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BEER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- SPIRITS, WINE

- CIDER

- PERRY

- RICE WINE

- HARD SELTZE

- ALCOHOLIC DRINKS MARKET BY PROPULSION (2017-2032)

- ALCOHOLIC DRINKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PUB

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BARS & RESTAURANTS

- INTERNET RETAILING

- LIQUOR STORES

- GROCERY SHOPS

- SUPERMARKETS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Alcoholic Drinks Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ANHEUSER-BUSCH INBEV (BELGIUM)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ASAHI GROUP HOLDINGS (JAPAN)

- BACARDI LIMITED (BERMUDA)

- BEAM SUNTORY (UNITED STATES)

- BEAM SUNTORY (UNITED STATES)

- BROWN-FORMAN CORPORATION (UNITED STATES)

- CARLSBERG GROUP (DENMARK)

- CONSTELLATION BRANDS (UNITED STATES)

- DIAGEO PLC (UNITED KINGDOM)

- EDRINGTON GROUP (UNITED KINGDOM)

- GRUPPO CAMPARI (ITALY)

- HEINEKEN N.V. (NETHERLANDS)

- KIRIN HOLDINGS COMPANY (JAPAN)

- MOLSON COORS BEVERAGE COMPANY (UNITED STATES)

- PERNOD RICARD SA (FRANCE)

- RÉMY COINTREAU (FRANCE)

- SUNTORY HOLDINGS LIMITED (JAPAN)

- THAI BEVERAGE PUBLIC COMPANY LIMITED (THAILAND)

- UNITED SPIRITS LIMITED (INDIA)

- WILLIAM GRANT & SONS (UNITED KINGDOM)

- COMPETITIVE LANDSCAPE

- GLOBAL ALCOHOLIC DRINKS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By Propulsion

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Alcoholic Drinks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.71 Bn. |

|

Forecast Period 2023-34 CAGR: |

10.6 % |

Market Size in 2032: |

USD 4.69 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Alcoholic Drinks Market research report is 2024-2032.

Anheuser-Busch InBev (Belgium), Asahi Group Holdings (Japan), Bacardi Limited (Bermuda), Beam Suntory (United States), Beam Suntory (United States), Brown-Forman Corporation (United States), Carlsberg Group (Denmark), Constellation Brands (United States),Diageo plc (United Kingdom), Edrington Group (United Kingdom), Gruppo Campari (Italy), Heineken N.V. (Netherlands), Kirin Holdings Company (Japan), Molson Coors Beverage Company (United States), Pernod Ricard SA (France), Rémy Cointreau (France), Suntory Holdings Limited (Japan), Thai Beverage Public Company Limited (Thailand), United Spirits Limited (India), William Grant & Sons (United Kingdom) and Other Major Players.

The Alcoholic Drinks Market is segmented into Type, Applications, and region. By Type, the market is categorized into Beer, Spirits, Wine, Cider, Perry & Rice Winem, Hard Seltzer, Others. By Applications, the market is categorized into Pub, Bars & Restaurants, Internet Retailing, Liquor Stores, Grocery Shops, Supermarkets, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Alcoholic beverages can be defined as those products that contain ethanol, a sort of alcohol that results from yeast or other microorganisms acting on sugar. These drinks consist of products like beer, wine, spirits, cider, perry, rice wine, and hard seltzers to name but a few. They are used to enhance leisure and social and cultural activities by people across the world and the use of such products is subjected to legal parameters to ensure safety and proper use.

Alcoholic Drinks Market Size Was Valued at USD 1.71 Billion in 2023, and is Projected to Reach USD 4.69 Billion by 2032, Growing at a CAGR of 10.6% From 2024-2032.