Global Airless Packaging Market Synopsis

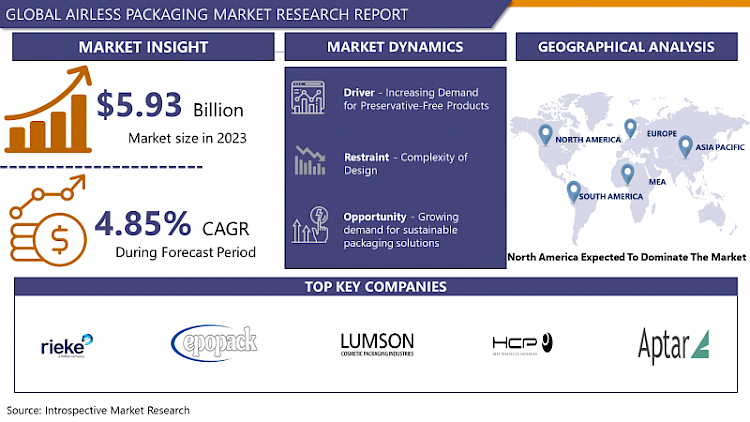

Airless Packaging Market Size Was Valued at USD 5.93 Billion in 2023 and is Projected to Reach USD 9.08 Billion by 2032, Growing at a CAGR of 4.85% From 2024-2032.

Airless packaging refers to a type of packaging that prevents the entry of air into the container, thereby preserving the product's integrity, freshness, and efficacy.The increasing adoption of airless packaging is its ability to extend the shelf life of products by minimizing exposure to oxygen and other contaminants. This is particularly crucial for sensitive products such as skincare creams, serums, and pharmaceuticals, where exposure to air can lead to oxidation and degradation of the active ingredients. Moreover, airless packaging helps reduce product waste by allowing consumers to dispense the exact amount of product they need, thereby minimizing overuse and spillage.

In addition to its functional benefits, airless packaging also offers aesthetic advantages, providing brands with opportunities for creative and eye-catching designs. The market has witnessed the introduction of various innovative airless packaging solutions, including airless pumps, bottles, jars, and tubes, catering to diverse consumer preferences and product requirements.

Geographically, North America and Europe currently dominate the airless packaging market, driven by a strong presence of cosmetics and personal care industries and a growing focus on sustainability and product safety. However, emerging markets in Asia Pacific, Latin America, and the Middle East are also witnessing increasing adoption of airless packaging, fueled by rising disposable incomes, urbanization, and changing consumer lifestyles.

Global Airless Packaging Market Trend Analysis

Increasing Demand for Preservative-Free Products

- The increasing demand for preservative-free products has become a significant driving force behind the growth of the airless packaging market. Consumers are becoming more conscious of the ingredients in the products they use, seeking safer and healthier options. This shift in consumer behavior is primarily fueled by concerns over potential health risks associated with preservatives commonly found in traditional packaging methods.

- Airless packaging offers a solution to these concerns by providing a more effective way to preserve the integrity and freshness of products without the need for added preservatives. Unlike traditional packaging, which relies on pumps or tubes that expose the product to air and contaminants, airless packaging utilizes innovative technology to create a vacuum seal that prevents air from entering the container. This airtight environment helps to extend the shelf life of products and maintain their efficacy over time.

- Furthermore, airless packaging helps to minimize waste by ensuring that consumers can use the entire contents of the product without any leftovers being trapped in inaccessible areas of the container. This not only enhances the overall consumer experience but also aligns with growing sustainability trends by reducing the amount of product that is discarded.

- The cosmetics and personal care industry have been quick to adopt airless packaging due to its ability to preserve the potency of active ingredients and prevent oxidation, which can degrade the quality of skincare formulations. Similarly, the pharmaceutical sector has also embraced airless packaging for its ability to protect sensitive medications from exposure to air and light, thereby maintaining their stability and effectiveness.

Growing demand for sustainable packaging solutions Creates an Opportunity for the Global Airless Packaging Market

- The growing demand for sustainable packaging solutions has spurred significant opportunities for the airless packaging market. Airless packaging offers several benefits that align well with sustainability goals, making it an attractive option for businesses and consumers alike.

- Airless packaging minimizes product wastage by ensuring efficient dispensing and preserving the integrity of the contents, which is particularly important for high-value products such as skincare and cosmetics. This reduction in waste contributes to sustainability efforts by decreasing the overall environmental footprint of the packaging.

- Additionally, airless packaging often utilizes recyclable materials, further enhancing its eco-friendliness. As consumers become increasingly conscious of the environmental impact of their purchases, products packaged in airless containers can appeal to those seeking more sustainable options.

- Moreover, the design of airless packaging allows for the elimination of preservatives, as the vacuum pump system prevents air from entering the container, reducing the need for additives that can be harmful to the environment. This aligns with the growing consumer preference for clean-label products with minimal chemical additives. Advancements in technology have led to innovations in airless packaging, such as the development of biodegradable materials and refillable systems, which further enhance its sustainability credentials.

Global Airless Packaging Market Segment Analysis:

The Global Airless Packaging Market is Segment divided into of Product Type, Material Type and Application.

By Product Type, Bottles segment is expected to dominate the market during the forecast period.

- The Bottles segment is poised to assert dominance in the Airless Packaging Market due to several key factors. Bottles offer a versatile packaging solution suitable for a wide range of products, including skincare creams, lotions, serums, and various liquid formulations. Their adaptability makes them a preferred choice for brands looking to package diverse product types within the beauty, pharmaceutical, and personal care industries.

- Additionally, bottles in the airless packaging category provide efficient dispensing mechanisms that help maintain product integrity and extend shelf life. The airless technology prevents air exposure, oxidation, and contamination, preserving the efficacy of sensitive formulations and reducing the need for preservatives. This functionality is particularly crucial for products containing active ingredients prone to degradation when exposed to air or light

- Moreover, consumer preferences for convenient and hygienic packaging solutions further drive the demand for airless bottles. The ease of use and precise dosage control offered by airless dispensers enhance the overall user experience, contributing to customer satisfaction and brand loyalty.

By Material Type, Plastic segment held the largest share of 37.4% in 2022.

- Plastic offers unparalleled versatility and flexibility in design, allowing for the creation of customized packaging solutions tailored to specific product requirements. Whether it's for cosmetics, pharmaceuticals, or personal care products, plastic airless packaging can be molded into various shapes and sizes, accommodating different formulations and dispensing mechanisms.

- Plastic airless packaging is lightweight yet durable, providing excellent protection for sensitive formulations against external factors such as air, light, and contamination. This durability ensures product integrity throughout its shelf life, enhancing consumer satisfaction and brand reputation.

- Additionally, plastic airless packaging is often more cost-effective compared to alternative materials, making it an attractive choice for manufacturers seeking to optimize production costs without compromising on quality or performance.

- Furthermore, advancements in plastic manufacturing technologies have enabled the development of eco-friendly options, such as recyclable and biodegradable plastics, addressing growing consumer concerns about sustainability and environmental impact.

Global Airless Packaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is poised to dominate the airless packaging market due to several factors. One of the primary drivers is the region's robust economy, which fuels substantial consumer spending and demand for high-quality packaging solutions across various industries. Additionally, North America boasts a mature and well-established packaging industry with a focus on innovation and sustainability, aligning well with the growing preference for airless packaging.

- Moreover, stringent regulations regarding product safety and hygiene in sectors such as cosmetics, pharmaceuticals, and personal care products further drive the adoption of airless packaging solutions. These regulations necessitate packaging that offers enhanced protection against contamination and degradation, making airless packaging an attractive option.

- Furthermore, the increasing consumer awareness regarding the environmental impact of traditional packaging materials has led to a surge in demand for eco-friendly alternatives. Airless packaging, which minimizes product waste and extends shelf life, aligns with these sustainability goals, further boosting its adoption in the region.

Global Airless Packaging Market Top Key Players:

- Lumson S.p.A. (Italy)

- AptarGroup, Inc. (USA)

- Quadpack (Spain)

- Albea Group (France)

- HCP Packaging (China)

- FusionPKG (USA)

- ABC Packaging Ltd. (UK)

- Virospack (Spain)

- Epopack Co., Ltd. (South Korea)

- Yonwoo/PKG (South Korea)

- RPC Group (UK)

- Rieke Packaging Systems (USA)

- Silgan Holdings Inc. (USA)

- Anomatic Corporation (USA)

- Libo Cosmetics Co., Ltd. (China)

- HCT Group (USA)

- Oeka (Germany)

- Viva Healthcare Packaging (Canada)

- RPC Bramlage (Germany)

- Virospack (Spain), Other Active Players

Key Industry Development of Global Airless Packaging Market:

- In March 2024, APC Packaging, a US-based sustainable packaging provider, launched the EcoReady All Plastic Airless Pump (EAPP) for skincare products. Designed with advanced airless technology, the pump is made entirely of polypropylene (PP) and omits the traditional metal spring, enhancing both functionality and eco-friendliness. Available in 15ml, 30ml, and 50ml capacities, it ensures precise dispensing while maintaining the integrity of skincare formulations.

- In May 2024, Quadpack announced that every component of their new product line is made from recyclable materials, including the outer glass bottle, inner refill, pump, and cap. These features earned it a high sustainability rating in Quadpack's Positive-Impact Packaging (PIP) system, which is based on life cycle assessments (LCAs) conducted by the company.

- In June 2023, Estal, the airless packaging specialist, joins forces with L'Oreal to pioneer a sustainable packaging solution. This collaboration aims to innovate in eco-friendly airless packaging, addressing environmental concerns in the beauty industry. By merging Estal's expertise with L'Oreal's commitment to sustainability, the partnership strives to revolutionize packaging practices, reducing waste and promoting a greener future for cosmetics.

|

Global Airless Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023 : |

USD 5.93 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.85% |

Market Size in 2032 : |

USD 9.08 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- FORM EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- AIRLESS PACKAGING MARKET BY PRODUCT TYPE (2017-2030)

- AIRLESS PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BOTTLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- JARS

- TUBES

- PUMPS

- AIRLESS PACKAGING MARKET BY MATERIAL TYPE (2017-2030)

- AIRLESS PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GLASS

- METAL

- AIRLESS PACKAGING MARKET BY APPLICATION (2017-2030)

- AIRLESS PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTHCARE

- COSMETICS

- PERSONAL CARE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- AIRLESS PACKAGING Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LUMSON S.P.A. (ITALY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- APTARGROUP, INC. (USA)

- QUADPACK (SPAIN)

- ALBEA GROUP (FRANCE)

- HCP PACKAGING (CHINA)

- FUSIONPKG (USA)

- ABC PACKAGING LTD. (UK)

- VIROSPACK (SPAIN)

- EPOPACK CO., LTD. (SOUTH KOREA)

- YONWOO/PKG (SOUTH KOREA)

- RPC GROUP (UK)

- RIEKE PACKAGING SYSTEMS (USA)

- SILGAN HOLDINGS INC. (USA)

- ANOMATIC CORPORATION (USA)

- LIBO COSMETICS CO., LTD. (CHINA)

- HCT GROUP (USA)

- OEKA (GERMANY)

- VIVA HEALTHCARE PACKAGING (CANADA)

- RPC BRAMLAGE (GERMANY)

- VIROSPACK (SPAIN), OTHER ACTIVE PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL AIRLESS PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Material Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Airless Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023 : |

USD 5.93 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.85% |

Market Size in 2032 : |

USD 9.08 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AIRLESS PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AIRLESS PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AIRLESS PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. AIRLESS PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. AIRLESS PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. AIRLESS PACKAGING MARKET BY TYPE

TABLE 008. PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 009. GLASS MARKET OVERVIEW (2016-2028)

TABLE 010. OTHER MARKET OVERVIEW (2016-2028)

TABLE 011. AIRLESS PACKAGING MARKET BY APPLICATION

TABLE 012. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 013. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 014. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHER MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA AIRLESS PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA AIRLESS PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 018. N AIRLESS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE AIRLESS PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE AIRLESS PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 021. AIRLESS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC AIRLESS PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC AIRLESS PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 024. AIRLESS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA AIRLESS PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA AIRLESS PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 027. AIRLESS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA AIRLESS PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA AIRLESS PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 030. AIRLESS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 031. APTAR GROUP: SNAPSHOT

TABLE 032. APTAR GROUP: BUSINESS PERFORMANCE

TABLE 033. APTAR GROUP: PRODUCT PORTFOLIO

TABLE 034. APTAR GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. ALBEA BEAUTY HOLDINGS: SNAPSHOT

TABLE 035. ALBEA BEAUTY HOLDINGS: BUSINESS PERFORMANCE

TABLE 036. ALBEA BEAUTY HOLDINGS: PRODUCT PORTFOLIO

TABLE 037. ALBEA BEAUTY HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. LUMSON SPA: SNAPSHOT

TABLE 038. LUMSON SPA: BUSINESS PERFORMANCE

TABLE 039. LUMSON SPA: PRODUCT PORTFOLIO

TABLE 040. LUMSON SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. HCP PACKAGING: SNAPSHOT

TABLE 041. HCP PACKAGING: BUSINESS PERFORMANCE

TABLE 042. HCP PACKAGING: PRODUCT PORTFOLIO

TABLE 043. HCP PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. QUADPACK INDUSTRIES: SNAPSHOT

TABLE 044. QUADPACK INDUSTRIES: BUSINESS PERFORMANCE

TABLE 045. QUADPACK INDUSTRIES: PRODUCT PORTFOLIO

TABLE 046. QUADPACK INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. LIBO COSMETICS COMPANY: SNAPSHOT

TABLE 047. LIBO COSMETICS COMPANY: BUSINESS PERFORMANCE

TABLE 048. LIBO COSMETICS COMPANY: PRODUCT PORTFOLIO

TABLE 049. LIBO COSMETICS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. FUSION PACKAGING: SNAPSHOT

TABLE 050. FUSION PACKAGING: BUSINESS PERFORMANCE

TABLE 051. FUSION PACKAGING: PRODUCT PORTFOLIO

TABLE 052. FUSION PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. WESTROCK: SNAPSHOT

TABLE 053. WESTROCK: BUSINESS PERFORMANCE

TABLE 054. WESTROCK: PRODUCT PORTFOLIO

TABLE 055. WESTROCK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ABC PACKAGING LTD: SNAPSHOT

TABLE 056. ABC PACKAGING LTD: BUSINESS PERFORMANCE

TABLE 057. ABC PACKAGING LTD: PRODUCT PORTFOLIO

TABLE 058. ABC PACKAGING LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AIRLESS PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AIRLESS PACKAGING MARKET OVERVIEW BY TYPE

FIGURE 012. PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 013. GLASS MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 015. AIRLESS PACKAGING MARKET OVERVIEW BY APPLICATION

FIGURE 016. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 017. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 018. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA AIRLESS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE AIRLESS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC AIRLESS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA AIRLESS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA AIRLESS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Airless Packaging Market research report is 2024-2032.

Lumson S.p.A. (Italy), AptarGroup, Inc. (USA), Quadpack (Spain), Albea Group (France), HCP Packaging (China), FusionPKG (USA), ABC Packaging Ltd. (UK), Virospack (Spain), Epopack Co., Ltd. (South Korea), Yonwoo/PKG (South Korea), RPC Group (UK), Rieke Packaging Systems (USA), Silgan Holdings Inc. (USA), Anomatic Corporation (USA), Libo Cosmetics Co., Ltd. (China), HCT Group (USA), Oeka (Germany), Viva Healthcare Packaging (Canada), RPC Bramlage (Germany), Virospack (Spain), Other Active Players.

The Global Airless Packaging Market is segmented into Product Type, Material Type and Application and region. By Product Type, the market is categorized into Bottles, Jars, Tubes, Pumps. By Material Type, the market is categorized into Plastic, Glass, Metal. By Application, the market is categorized Food & Beverages, Healthcare, Cosmetics, Personal Care. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Airless packaging refers to a type of packaging that prevents the entry of air into the container, thereby preserving the product's integrity, freshness, and efficacy.

Airless Packaging Market Size Was Valued at USD 5.93 Billion in 2023 and is Projected to Reach USD 9.08 Billion by 2032, Growing at a CAGR of 4.85% From 2024-2032.