Air Transport USM Market Synopsis

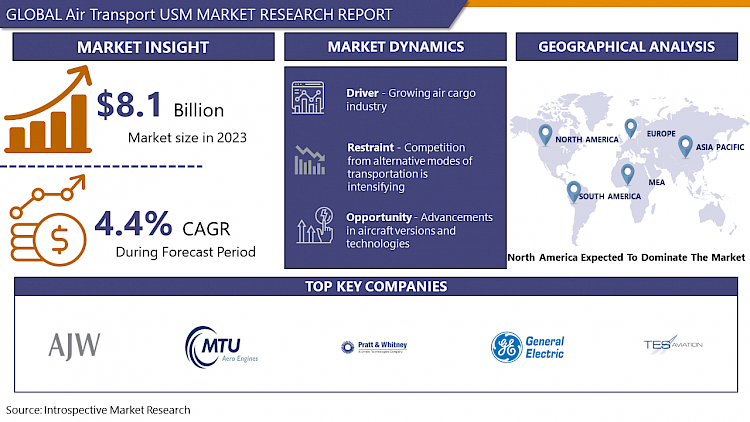

Air Transport USM Market Size Was Valued at USD 8.1 Billion in 2023, and is Projected to Reach USD 12.0 Billion by 2032, Growing at a CAGR of 4.4% From 2024-2032.

Used serviceable material (USM) in air transportation consists of reclaiming and repurposing intact aircraft parts and components from aging aircraft. End-users comprise airports, airlines, training facilities, and other service providers responsible for ensuring the safety and dependability of air transportation.

The aviation sector is perpetually striving to decrease its carbon emissions through various means, including the redesign of aircraft interiors, refuse disposal methods, and the implementation of more environmentally friendly disassembly and logistics processes. A maintenance facility upgrades, recertifies, tests, and inspects aircraft components that have been removed prior to their reintegration into the respective aircraft.

- The need to improve efficacy and safety, as well as technological advancements in aircraft, are significant factors propelling the air transport USM market. As avionics, engine technologies, and novel aircraft designs proliferate, so does the demand for aircraft components and services, including those provided by USM. Furthermore, the air transport USM market is anticipated to witness the emergence of fresh market prospects due to the advancement of novel air transport services, including urban air mobility. Over the course of the following decade, the air transport USM market is anticipated to expand substantially as a result of the rising demand for aircraft and associated products and services. This will present substantial prospects for businesses engaged in the manufacturing, upkeep, and restoration of USM components and services.

Air Transport USM Market Trend Analysis

Escalating air travel demand

- A number of factors contribute to the rising demand for air travel, including increased disposable incomes, enhanced global connectivity, improved air travel affordability, and increased tourism. Air travel is experiencing a surge in popularity as a transportation mode owing to its expediency and effectiveness. In response to the growing affordability of air travel among the general public, airlines have expanded their capacity to accommodate the escalating demand.

Increase in digital technology and internet penetration

- The global air transport USM market has been notably influenced by the expansion of internet penetration and digital technology. Online registration systems, digital payment systems, and other technologies are being increasingly utilized by travelers to plan and reserve flights, as internet-enabled devices proliferate. By reducing manual labor and refining processes, airlines have been able to save money and improve their operations. Further, the implementation of digital technologies empowers airlines to offer customized services and products by facilitating more precise consumer targeting.

Air Transport USM Market Segment Analysis:

Air Transport USM Market Segmented based on Product Type, Aircraft Type, and Provider Type.

By Product Type, Engine segment is expected to dominate the market during the forecast period

- In the future years, engines, components, and airframes are anticipated to experience an increase in demand for Air Transport USM (Used Serviceable Material), which is attributable to a number of additional factors. The primary impetus for airlines to explore more economical maintenance and repair solutions is the mounting pressure to decrease operational expenses. This is made possible by USM's provision of inexpensive components that maintain safety certification. Additionally, in an effort to promote a circular economy, sustainability trends in the aviation sector advocate for the implementation of more ecologically sound procedures, including the reuse and recycling of aircraft components. Further bolstering the USM market, the expansion of the worldwide aircraft fleet and the deterioration of a significant number of operational aircraft are expected to increase the need for replacement components, engines, and airframes.

- Engines are anticipated to be the most prevalent product type segment within the Air Transport USM market throughout the forecast period. Critical components, engines are expensive to produce and require lengthy lead times. Significant financial benefits accrue to airline operators from the acquisition of used, operational engines at a fraction of the price of new ones, especially in a competitive and cost-conscious market.

By Provider Type, OEM segment held the largest share of XX% in 2023

- In 2023, the OEM segment dominated the Air Transport USM market in terms of Provider Type. The ability of original equipment manufacturers (OEMs) to supply certified and dependable components instills confidence in airline operators regarding the performance and safety criteria essential for commercial aviation. In addition to their established brand reputations, extensive service networks, and the capability to provide maintenance, repair, and overhaul (MRO) integrated services, OEMs enjoy additional advantages that bolster their market standing. OEMs benefit from direct access to manufacturing and original design data, which enables them to refurbish and certify components more effectively. This extends the life of the aircraft and its critical components and ensures compatibility. These benefits establish the market dominance of OEMs and render them the preferred option for numerous airlines.

Air Transport USM Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The USM market for air transport in North America is propelled by robust economic expansion, the rise of low-cost carriers, and the rising volume of air passengers. The local market is characterized by intense competition and the participation of numerous well-established international airlines as well as lesser domestic carriers. The principal nations comprising the region are the United States, Canada, and Mexico. Due to massive investments in the sector, the United States and Canada are the most prominent aviation markets in the region and are anticipated to remain the dominant participants throughout the period of forecast.

- North America exhibited the highest global demand for USM services on account of its substantial geriatric fleet size and the presence of well-established MRO service providers in the area.

- Moreover, prominent aircraft engine manufacturers and a robust commercial aircraft industrial sector in the United States and Canada are anticipated to have a positive impact on the air transport USM market outlook for the region over the coming years.

Active Key Players in the Air Transport USM Market

- Pratt & Whitney

- TES Aviation Group

- General Electric

- AAR Corp.

- Lufthansa Technik (LHT)

- MTU Aero Engines AG

- AJ Walter Aviation Limited

- AFI KLM E&M

- GA Telesis, LLC

- Airliance Materials, LLC, and Other Key Players.

Key Industry Developments in the Air Transport USM Market:

- Pratt & Whitney announced in July 2023 that PW1100G Geared Turbo Fan engines would necessitate inspection and, if required, repair due to the discovery of a durability concern on discs within the high-pressure turbine.

- Launching the USM business segment in 2021, Boeing declared the expansion of its service portfolio.

|

Global Air Transport USM Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.4 % |

Market Size in 2032: |

USD 12.0 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Provider Type |

|

||

|

By Aircraft Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- AIR TRANSPORT USM MARKET BY PRODUCT TYPE (2017-2032)

- AIR TRANSPORT USM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENGINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMPONENTS

- AIRFRAME

- AIR TRANSPORT USM MARKET BY PROVIDER TYPE (2017-2032)

- AIR TRANSPORT USM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- OEM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-OEM

- AIR TRANSPORT USM MARKET BY AIRCRAFT TYPE (2017-2032)

- AIR TRANSPORT USM MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NARROWBODY JET

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WIDEBODY JET

- REGIONAL JET

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Air Transport USM Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PRATT & WHITNEY

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TES AVIATION GROUP

- GENERAL ELECTRIC

- AAR CORP.

- LUFTHANSA TECHNIK (LHT)

- MTU AERO ENGINES AG

- AJ WALTER AVIATION LIMITED

- AFI KLM E&M

- GA TELESIS, LLC

- AIRLIANCE MATERIALS, LLC

- COMPETITIVE LANDSCAPE

- GLOBAL AIR TRANSPORT USM MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Provider Type

- Historic And Forecasted Market Size By Aircraft Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Air Transport USM Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.4 % |

Market Size in 2032: |

USD 12.0 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Provider Type |

|

||

|

By Aircraft Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AIR TRANSPORT USM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AIR TRANSPORT USM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AIR TRANSPORT USM MARKET COMPETITIVE RIVALRY

TABLE 005. AIR TRANSPORT USM MARKET THREAT OF NEW ENTRANTS

TABLE 006. AIR TRANSPORT USM MARKET THREAT OF SUBSTITUTES

TABLE 007. AIR TRANSPORT USM MARKET BY TYPE

TABLE 008. ENGINE MARKET OVERVIEW (2016-2028)

TABLE 009. COMPONENTS MARKET OVERVIEW (2016-2028)

TABLE 010. AIRFRAME MARKET OVERVIEW (2016-2028)

TABLE 011. OTHER MARKET OVERVIEW (2016-2028)

TABLE 012. AIR TRANSPORT USM MARKET BY APPLICATION

TABLE 013. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 015. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA AIR TRANSPORT USM MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA AIR TRANSPORT USM MARKET, BY APPLICATION (2016-2028)

TABLE 018. N AIR TRANSPORT USM MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE AIR TRANSPORT USM MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE AIR TRANSPORT USM MARKET, BY APPLICATION (2016-2028)

TABLE 021. AIR TRANSPORT USM MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC AIR TRANSPORT USM MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC AIR TRANSPORT USM MARKET, BY APPLICATION (2016-2028)

TABLE 024. AIR TRANSPORT USM MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA AIR TRANSPORT USM MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA AIR TRANSPORT USM MARKET, BY APPLICATION (2016-2028)

TABLE 027. AIR TRANSPORT USM MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA AIR TRANSPORT USM MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA AIR TRANSPORT USM MARKET, BY APPLICATION (2016-2028)

TABLE 030. AIR TRANSPORT USM MARKET, BY COUNTRY (2016-2028)

TABLE 031. PRATT & WHITNEY: SNAPSHOT

TABLE 032. PRATT & WHITNEY: BUSINESS PERFORMANCE

TABLE 033. PRATT & WHITNEY: PRODUCT PORTFOLIO

TABLE 034. PRATT & WHITNEY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. TES AVIATION GROUP: SNAPSHOT

TABLE 035. TES AVIATION GROUP: BUSINESS PERFORMANCE

TABLE 036. TES AVIATION GROUP: PRODUCT PORTFOLIO

TABLE 037. TES AVIATION GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. GENERAL ELECTRIC: SNAPSHOT

TABLE 038. GENERAL ELECTRIC: BUSINESS PERFORMANCE

TABLE 039. GENERAL ELECTRIC: PRODUCT PORTFOLIO

TABLE 040. GENERAL ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. AAR CORP: SNAPSHOT

TABLE 041. AAR CORP: BUSINESS PERFORMANCE

TABLE 042. AAR CORP: PRODUCT PORTFOLIO

TABLE 043. AAR CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. LUFTHANSA TECHNIK (LHT): SNAPSHOT

TABLE 044. LUFTHANSA TECHNIK (LHT): BUSINESS PERFORMANCE

TABLE 045. LUFTHANSA TECHNIK (LHT): PRODUCT PORTFOLIO

TABLE 046. LUFTHANSA TECHNIK (LHT): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MTU AERO ENGINES: SNAPSHOT

TABLE 047. MTU AERO ENGINES: BUSINESS PERFORMANCE

TABLE 048. MTU AERO ENGINES: PRODUCT PORTFOLIO

TABLE 049. MTU AERO ENGINES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. A J WALTER AVIATION: SNAPSHOT

TABLE 050. A J WALTER AVIATION: BUSINESS PERFORMANCE

TABLE 051. A J WALTER AVIATION: PRODUCT PORTFOLIO

TABLE 052. A J WALTER AVIATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AFI KLM E&M: SNAPSHOT

TABLE 053. AFI KLM E&M: BUSINESS PERFORMANCE

TABLE 054. AFI KLM E&M: PRODUCT PORTFOLIO

TABLE 055. AFI KLM E&M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. GA TELESIS: SNAPSHOT

TABLE 056. GA TELESIS: BUSINESS PERFORMANCE

TABLE 057. GA TELESIS: PRODUCT PORTFOLIO

TABLE 058. GA TELESIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. AIRLIANCE MATERIALS: SNAPSHOT

TABLE 059. AIRLIANCE MATERIALS: BUSINESS PERFORMANCE

TABLE 060. AIRLIANCE MATERIALS: PRODUCT PORTFOLIO

TABLE 061. AIRLIANCE MATERIALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AIR TRANSPORT USM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AIR TRANSPORT USM MARKET OVERVIEW BY TYPE

FIGURE 012. ENGINE MARKET OVERVIEW (2016-2028)

FIGURE 013. COMPONENTS MARKET OVERVIEW (2016-2028)

FIGURE 014. AIRFRAME MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 016. AIR TRANSPORT USM MARKET OVERVIEW BY APPLICATION

FIGURE 017. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 019. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA AIR TRANSPORT USM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE AIR TRANSPORT USM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC AIR TRANSPORT USM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA AIR TRANSPORT USM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA AIR TRANSPORT USM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Air Transport USM Market research report is 2024-2032.

Pratt & Whitney, TES Aviation Group, General Electric, AAR Corp., Lufthansa Technik (LHT), MTU Aero Engines AG, AJ Walter Aviation Limited, AFI KLM E&M, GA Telesis, LLC, Airliance Materials, LLC, and Other Major Players.

The Air Transport USM Market is segmented into Product Type, Provider Type, Aircraft Type, and region. By Product Type, the market is categorized into Engine, Components, and Airframe. By Provider type, the market is categorized into OEM and Non-OEM. By Aircraft Type, the market is categorized into Narrowbody Jet, Widebody Jet, Turboprop, and Regional Jet. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Parts and components of decommissioned or non-operational aircraft that are salvaged, refurbished, and repurposed for use in operational aircraft constitute the practice of used serviceable material (USM) in air transport, which is an efficiency and sustainability strategy. This method assists airlines and maintenance providers in cost management while simultaneously decreasing waste and the need for replacement parts. In order to maintain the integrity and safety of the aircraft in which they are deployed, USM must adhere to stringent operational and safety objectives. The aviation industry maintains high safety standards, reduces expenses, and benefits the environment with this system.

Air Transport USM Market Size Was Valued at USD 8.1 Billion in 2023, and is Projected to Reach USD 12.0 Billion by 2032, Growing at a CAGR of 4.4% From 2024-2032.