Global Air Purifier Market Overview

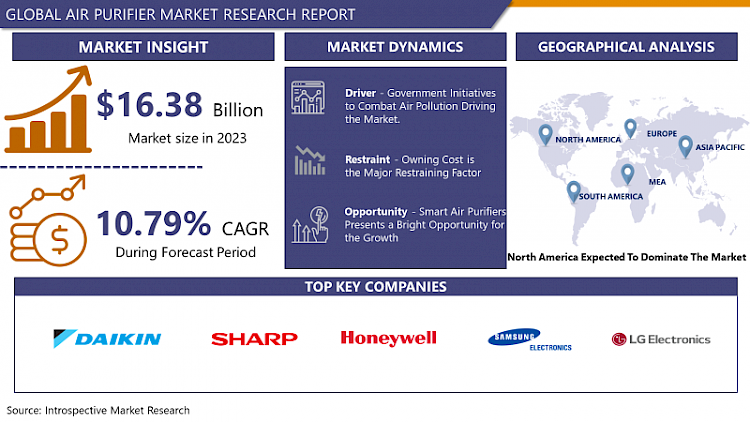

The Global Air Purifier Market size is expected to grow from USD 16.38 Billion in 2023 to USD 41.19 Billion by 2032, at a CAGR of 10.79% during the forecast period (2024-2032).

In homes and restricted areas, air purifiers assist to minimise airborne pollutants such as viruses and bacteria. Portable air purifiers, on the other hand, have been proven to be insufficient in protecting against coronavirus. As a result, air purifier manufacturers are raising awareness that air cleaners should be used in conjunction with other CDC (Centers for Disease Control and Prevention) guidelines to successfully battle exposure to the unusual virus. The high-efficiency particulate air technology is likely to dominate the market throughout the forecast period because to its vital applications in semiconductor, pharmaceutical, food & beverage production, medical, and other industrial facilities. Growing air pollution has arisen as a serious concern in the highly populated Asia-Pacific area, with negative consequences for the environment, human health, and agricultural crop output. Such issues, on the other hand, are anticipated to provide a number of possibilities for the growth of air purifier market in the future.

Market Dynamics and Factors For Air Purifiers:

Drivers

Government initiatives to combat air pollution driving the market.

Several governments are focused on limiting air pollution by enacting severe indoor air quality rules and standards, which are expected to boost the market throughout the forecast period. Moreover, air pollution control efforts carried out by governments and non-governmental organizations (NGOs) throughout the world are likely to promote market growth over the forecast period. For instance, the Government of India invested more than USD 125,000 to purchase around 300 air purifiers to be installed in the capital. To combat the spread of COVID-19, governments in several nations have implemented lockdown measures. As a result, stay-at-home and work-from-home policies have increased the demand for air purifiers. Furthermore, air purifiers are in high demand from hospitals, universities, and government organizations as people look for measures to prevent the spread of the coronavirus. Also, several factors such as changing consumer tastes, decreasing indoor air quality, rising health concerns, and increased consumer knowledge of the advantages of air purifiers, are expected to drive market expansion in the coming years.

The growth of the Air Purifier Market is attributed to the effectiveness of eliminating harmful pollutants.

Total Volatile Organic Compounds (TVOCs), particle matter (2.5-10 m), smoke, dust, hazardous chemicals, gases, and other pollutants are all reduced by using an air purifier. These purifiers are based on several filtering methods to meet the unique demands of consumers, the most popular of which is the High-efficiency Particulate Air (HEPA) technology, which has a trapping capacity of at least 99.97 percent. Air purifiers are now commonly utilized in homes, corporate and government offices, retail outlets, public areas, and other industrial infrastructures as a result of this. Also, growing consumer awareness of health issues, as well as increased usage of air purifiers in both residential and non-residential settings, are expected to drive industry expansion. Growing public knowledge of the health advantages of these filters as well as the negative impacts of breathing dirty air might help move the industry forward.

Restraints

Owning cost is the major restraining factor for the Air Purifier Market. The average price range of a quality air purifier is around USD 600-1000. Although with these prices, air purifier comes with smart options very few percentages of customers are interested in high-end and high-priced air purifiers. The spending capacity of the customer is highly dependent on whether a particular customer is willing to spend such an amount on to air purifier. Countries like India and China are big markets for air purifiers as both countries struggle to maintain healthy air quality due to the massive manufacturing industry. However, customers from India and China would choose cheaper alternatives rather than investing a large amount in such products. Therebefore, Pricing is the key factor need to be considered by manufacturers before the regional rollout of the product.

Opportunities

Smart Air Purifiers presents a bright opportunity for the growth of the Air Purifier Market. Many air purifiers have sensors for monitoring the density of various airborne pollutants like nitrogen dioxide (NO2, a toxic gas primarily produced by car exhausts and power plants), PM2.5 (particulate matter smaller than 2.5 microns in size, such as industrial emissions and tobacco smoke), PM10 (particulate matter up to ten microns in size, including such dust, mold, and pollen), and VOC (volatile organic compounds) (volatile organic compounds, or potentially harmful gases from things like cleaning products and paint). Wi-Fi is frequently included in smart air purifiers for phone and/or voice control, as well as to gather data on the contaminants listed above and send it to a companion app so you can monitor your home's air quality. Graphs showing your air quality over time are available in certain apps. Dyson divides it down into pollutant categories, with graphs for each. Currently, many start-ups working towards affordable smart air purifiers such as CleanAir, TEQOYA, Molekule, Calistair, and UniqAir.

Challenge

Market expansion is constrained by a lack of standardization in emerging nations and the availability of counterfeit items. Furthermore, the market expansion is projected to be hampered in the foreseeable future by technological complexity and insufficient availability of replacement parts with no assurance of quality. The majority of the local air purifiers are low-quality knock-off products that do not deliver the quality and effectiveness of the product, and the high cost of the products creates an adverse effect on the general customer who wants to move to such product. A major challenge for the market is to counter the knock-off products in the market.

Market Segmentation

By Technology, HEPA is dominating the Air Purifier Market during the forecasted period. HEPA led the market and accounted for over 40.0% share of the global revenue in 2021. HEPA (High-Efficiency Particulate Air) filters are highly efficient in trapping airborne particles, including pollen, dust, smoke, and bio-contaminants. The high quality and reliability of HEPA filters to remove airborne particles are likely to spur product penetration in the global market. Activated carbon or activated charcoal filters constitute small pieces of carbon in powdered blocks or granular form, specially treated with oxygen, to open the pores of carbon atoms. This aids in increasing the carbon surface area and making it porous, thereby augmenting its ability to absorb airborne particles. These filters are used for absorbing gases and odors from cooking, mold, chemicals, pets, and smoke. During the purifying process, the formation of ionized air and ozone is responsible for respiratory disorders such as asthma, which is likely to restrict the technology's adoption. UV irradiation, photocatalytic oxidation, ozonation, non-thermal plasma, and electrostatic precipitators are some of the other air cleaning methods. Fine particles as small as 0.1 micron and harmful gases can be converted to safer chemicals using photocatalytic oxidation technology. VOCs, bacteria, and chemically active chemicals are all destroyed with this method (CACs)

By Application, Commercial is dominating the segment in Air Purifier Market. Hospitals, workplaces, hotels, educational institutions, movie theatres, retail malls, conference centers, and other recreational facilities are all places where air purifiers are used commercially. In hotels and restaurants, air purifiers with activated carbon and HEPA are used to remove airborne particles, smoke, and odor from the air, therefore improving the air quality. Air purifiers are used to eliminate allergens, airborne pathogens, and odor from the air and maintain indoor air quality for patients and personnel in dentistry and medical labs, veterinary hospitals, boarding kennels, animal kennels, clinics, and hospitals. The capacity of air purifiers to restrict the transmission of infectious illnesses has resulted in increased demand in various healthcare institutions throughout the world during the COVID-19 pandemic.

Players Covered in Air Purifier market are :

- Daikin Industries Ltd. (Japan)

- Sharp Corporation (Japan)

- Honeywell International Inc. (US)

- Samsung Electronics Co. Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- Dyson (UK)

- Unilever Group (UK)

- Panasonic Corporation (Japan)

- Whirlpool Corporation (US)

- AllerAir Industries Inc. (US)

- IQAir (Switzerland)

- Winix Co. Ltd. (South Korea)

- Xiaomi Corporation (China)

- Camfil AB (Sweden)

- Airpura Industries Inc. (Canada)

- Airgle Corporation (US)

- Hunter Pure Air (US)

- Kent RO Systems Ltd. (India)

- SHIL Limited (India)

- IDEAL Krug & Priester GMBH & Co. KG (Germany)

- Havells India Ltd. (India)

- Molekule (US)

- Carrier Global (US)

- Coway CO. Ltd. (South Korea) and other major players.

Regional Analysis of Air Purifier Market

The Asia Pacific is dominating the Air Purifier Market. Due to many factors, including fast urbanization and industrialization, as well as a growing population with higher disposable income, Asia Pacific led the market and accounted for over 40.0 percent of worldwide revenue in 2021. Furthermore, growing smog and air pollution situations, particularly in nations like India and China, are predicted to drive air purifier usage, complementing regional market expansion. Growing urbanization, governmental policies, and increased industrialization are only a few of the causes that have harmed South Korea's ecological balance and lowered air quality. Rising public awareness of the health risks and illnesses associated with exposure to hazardous particles at work or home is expected to boost the market growth in the nation.

North America is one of the fastest-growing regions in the Air Purifier Market. Over the projection period, the North American market is expected to grow at a CAGR of 7.2 percent. Air quality legislation such as the US EPA's establishment of national ambient air quality standards, the US Clean Air Act, and Environment Canada's comprehensive emission reduction plans are projected to provide new possibilities for air purifier producers. The increasing use of comprehensive ambient air quality monitoring systems, as well as the development and implementation of regulatory actions and the organization of air quality management programs to raise public awareness, are expected to drive up demand for air purifiers in Mexico in the coming years.

Key Developments of Air Purifier Market

- In January 2024, Coway, a leading wellness tech company, today launched the Airmega 100 air purifier, adding an affordable. The newest product is Airmega's first cylindrical model and launches at Coway's most affordable price point ever. Whether it's reducing allergens and viruses, removing smoke, or eliminating unpleasant odors, the Airmega 100 efficiently filters harmful pollutants and purifies indoor air for healthier living.

- In March 2023, Blueair launched an indoor air purifier variant known as Blue Pure Max. The new model of air purifiers featured minimal noise, robust design, and enhanced performance features to purify the air in rooms measuring 1,524 square feet in approximately 30 minutes.

|

Global Air Purifier Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 14.55 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.7 % |

Market Size in 2030: |

USD 32.8 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Technology

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Air Purifier Market by Technology

5.1 Air Purifier Market Overview Snapshot and Growth Engine

5.2 Air Purifier Market Overview

5.3 HEPA

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 HEPA: Grographic Segmentation

5.4 Activated Carbon

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Activated Carbon: Grographic Segmentation

5.5 Ionic Filters

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Ionic Filters: Grographic Segmentation

Chapter 6: Air Purifier Market by Application

6.1 Air Purifier Market Overview Snapshot and Growth Engine

6.2 Air Purifier Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial: Grographic Segmentation

6.4 Residential

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Residential: Grographic Segmentation

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Air Purifier Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Air Purifier Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Air Purifier Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 DAIKIN INDUSTRIES LTD.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 SHARP CORPORATION

7.4 HONEYWELL INTERNATIONAL INC.

7.5 SAMSUNG ELECTRONICS CO. LTD.

7.6 LG ELECTRONICS INC.

7.7 KONINKLIJKE PHILIPS N.V.

7.8 DYSON

7.9 UNILEVER GROUP

7.10 PANASONIC CORPORATION

7.11 WHIRLPOOL CORPORATION

7.12 ALLERAIR INDUSTRIES INC.

7.13 IQAIR

7.14 WINIX CO. LTD.

7.15 XIAOMI CORPORATION

7.16 CAMFIL AB

7.17 AIRPURA INDUSTRIES INC.

7.18 AIRGLE CORPORATION

7.19 HUNTER PURE AIR

7.20 KENT RO SYSTEMS LTD.

7.21 SHIL LIMITED

7.22 IDEAL KRUG & PRIESTER GMBH & CO. KG

7.23 HAVELLS INDIA LTD.

7.24 MOLEKULE

7.25 CARRIER GLOBAL

7.26 COWAY CO. LTD.

7.27 OTHER MAJOR PLAYERS

Chapter 8: Global Air Purifier Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Technology

8.2.1 HEPA

8.2.2 Activated Carbon

8.2.3 Ionic Filters

8.3 Historic and Forecasted Market Size By Application

8.3.1 Commercial

8.3.2 Residential

8.3.3 Industrial

Chapter 9: North America Air Purifier Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Technology

9.4.1 HEPA

9.4.2 Activated Carbon

9.4.3 Ionic Filters

9.5 Historic and Forecasted Market Size By Application

9.5.1 Commercial

9.5.2 Residential

9.5.3 Industrial

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Air Purifier Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Technology

10.4.1 HEPA

10.4.2 Activated Carbon

10.4.3 Ionic Filters

10.5 Historic and Forecasted Market Size By Application

10.5.1 Commercial

10.5.2 Residential

10.5.3 Industrial

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Air Purifier Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Technology

11.4.1 HEPA

11.4.2 Activated Carbon

11.4.3 Ionic Filters

11.5 Historic and Forecasted Market Size By Application

11.5.1 Commercial

11.5.2 Residential

11.5.3 Industrial

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Air Purifier Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Technology

12.4.1 HEPA

12.4.2 Activated Carbon

12.4.3 Ionic Filters

12.5 Historic and Forecasted Market Size By Application

12.5.1 Commercial

12.5.2 Residential

12.5.3 Industrial

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Air Purifier Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Technology

13.4.1 HEPA

13.4.2 Activated Carbon

13.4.3 Ionic Filters

13.5 Historic and Forecasted Market Size By Application

13.5.1 Commercial

13.5.2 Residential

13.5.3 Industrial

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Air Purifier Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 14.55 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.7 % |

Market Size in 2030: |

USD 32.8 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AIR PURIFIER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AIR PURIFIER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AIR PURIFIER MARKET COMPETITIVE RIVALRY

TABLE 005. AIR PURIFIER MARKET THREAT OF NEW ENTRANTS

TABLE 006. AIR PURIFIER MARKET THREAT OF SUBSTITUTES

TABLE 007. AIR PURIFIER MARKET BY TECHNOLOGY

TABLE 008. HEPA MARKET OVERVIEW (2016-2028)

TABLE 009. ACTIVATED CARBON MARKET OVERVIEW (2016-2028)

TABLE 010. IONIC FILTERS MARKET OVERVIEW (2016-2028)

TABLE 011. AIR PURIFIER MARKET BY APPLICATION

TABLE 012. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 013. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 014. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA AIR PURIFIER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 016. NORTH AMERICA AIR PURIFIER MARKET, BY APPLICATION (2016-2028)

TABLE 017. N AIR PURIFIER MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE AIR PURIFIER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 019. EUROPE AIR PURIFIER MARKET, BY APPLICATION (2016-2028)

TABLE 020. AIR PURIFIER MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC AIR PURIFIER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 022. ASIA PACIFIC AIR PURIFIER MARKET, BY APPLICATION (2016-2028)

TABLE 023. AIR PURIFIER MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA AIR PURIFIER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA AIR PURIFIER MARKET, BY APPLICATION (2016-2028)

TABLE 026. AIR PURIFIER MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA AIR PURIFIER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. SOUTH AMERICA AIR PURIFIER MARKET, BY APPLICATION (2016-2028)

TABLE 029. AIR PURIFIER MARKET, BY COUNTRY (2016-2028)

TABLE 030. DAIKIN INDUSTRIES LTD.: SNAPSHOT

TABLE 031. DAIKIN INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 032. DAIKIN INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 033. DAIKIN INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. SHARP CORPORATION: SNAPSHOT

TABLE 034. SHARP CORPORATION: BUSINESS PERFORMANCE

TABLE 035. SHARP CORPORATION: PRODUCT PORTFOLIO

TABLE 036. SHARP CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 037. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 038. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 039. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. SAMSUNG ELECTRONICS CO. LTD.: SNAPSHOT

TABLE 040. SAMSUNG ELECTRONICS CO. LTD.: BUSINESS PERFORMANCE

TABLE 041. SAMSUNG ELECTRONICS CO. LTD.: PRODUCT PORTFOLIO

TABLE 042. SAMSUNG ELECTRONICS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. LG ELECTRONICS INC.: SNAPSHOT

TABLE 043. LG ELECTRONICS INC.: BUSINESS PERFORMANCE

TABLE 044. LG ELECTRONICS INC.: PRODUCT PORTFOLIO

TABLE 045. LG ELECTRONICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. KONINKLIJKE PHILIPS N.V.: SNAPSHOT

TABLE 046. KONINKLIJKE PHILIPS N.V.: BUSINESS PERFORMANCE

TABLE 047. KONINKLIJKE PHILIPS N.V.: PRODUCT PORTFOLIO

TABLE 048. KONINKLIJKE PHILIPS N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DYSON: SNAPSHOT

TABLE 049. DYSON: BUSINESS PERFORMANCE

TABLE 050. DYSON: PRODUCT PORTFOLIO

TABLE 051. DYSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. UNILEVER GROUP: SNAPSHOT

TABLE 052. UNILEVER GROUP: BUSINESS PERFORMANCE

TABLE 053. UNILEVER GROUP: PRODUCT PORTFOLIO

TABLE 054. UNILEVER GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. PANASONIC CORPORATION: SNAPSHOT

TABLE 055. PANASONIC CORPORATION: BUSINESS PERFORMANCE

TABLE 056. PANASONIC CORPORATION: PRODUCT PORTFOLIO

TABLE 057. PANASONIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. WHIRLPOOL CORPORATION: SNAPSHOT

TABLE 058. WHIRLPOOL CORPORATION: BUSINESS PERFORMANCE

TABLE 059. WHIRLPOOL CORPORATION: PRODUCT PORTFOLIO

TABLE 060. WHIRLPOOL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ALLERAIR INDUSTRIES INC.: SNAPSHOT

TABLE 061. ALLERAIR INDUSTRIES INC.: BUSINESS PERFORMANCE

TABLE 062. ALLERAIR INDUSTRIES INC.: PRODUCT PORTFOLIO

TABLE 063. ALLERAIR INDUSTRIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. IQAIR: SNAPSHOT

TABLE 064. IQAIR: BUSINESS PERFORMANCE

TABLE 065. IQAIR: PRODUCT PORTFOLIO

TABLE 066. IQAIR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. WINIX CO. LTD.: SNAPSHOT

TABLE 067. WINIX CO. LTD.: BUSINESS PERFORMANCE

TABLE 068. WINIX CO. LTD.: PRODUCT PORTFOLIO

TABLE 069. WINIX CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. XIAOMI CORPORATION: SNAPSHOT

TABLE 070. XIAOMI CORPORATION: BUSINESS PERFORMANCE

TABLE 071. XIAOMI CORPORATION: PRODUCT PORTFOLIO

TABLE 072. XIAOMI CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. CAMFIL AB: SNAPSHOT

TABLE 073. CAMFIL AB: BUSINESS PERFORMANCE

TABLE 074. CAMFIL AB: PRODUCT PORTFOLIO

TABLE 075. CAMFIL AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. AIRPURA INDUSTRIES INC.: SNAPSHOT

TABLE 076. AIRPURA INDUSTRIES INC.: BUSINESS PERFORMANCE

TABLE 077. AIRPURA INDUSTRIES INC.: PRODUCT PORTFOLIO

TABLE 078. AIRPURA INDUSTRIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. AIRGLE CORPORATION: SNAPSHOT

TABLE 079. AIRGLE CORPORATION: BUSINESS PERFORMANCE

TABLE 080. AIRGLE CORPORATION: PRODUCT PORTFOLIO

TABLE 081. AIRGLE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. HUNTER PURE AIR: SNAPSHOT

TABLE 082. HUNTER PURE AIR: BUSINESS PERFORMANCE

TABLE 083. HUNTER PURE AIR: PRODUCT PORTFOLIO

TABLE 084. HUNTER PURE AIR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. KENT RO SYSTEMS LTD.: SNAPSHOT

TABLE 085. KENT RO SYSTEMS LTD.: BUSINESS PERFORMANCE

TABLE 086. KENT RO SYSTEMS LTD.: PRODUCT PORTFOLIO

TABLE 087. KENT RO SYSTEMS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. SHIL LIMITED: SNAPSHOT

TABLE 088. SHIL LIMITED: BUSINESS PERFORMANCE

TABLE 089. SHIL LIMITED: PRODUCT PORTFOLIO

TABLE 090. SHIL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. IDEAL KRUG & PRIESTER GMBH & CO. KG: SNAPSHOT

TABLE 091. IDEAL KRUG & PRIESTER GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 092. IDEAL KRUG & PRIESTER GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 093. IDEAL KRUG & PRIESTER GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. HAVELLS INDIA LTD.: SNAPSHOT

TABLE 094. HAVELLS INDIA LTD.: BUSINESS PERFORMANCE

TABLE 095. HAVELLS INDIA LTD.: PRODUCT PORTFOLIO

TABLE 096. HAVELLS INDIA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. MOLEKULE: SNAPSHOT

TABLE 097. MOLEKULE: BUSINESS PERFORMANCE

TABLE 098. MOLEKULE: PRODUCT PORTFOLIO

TABLE 099. MOLEKULE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. CARRIER GLOBAL: SNAPSHOT

TABLE 100. CARRIER GLOBAL: BUSINESS PERFORMANCE

TABLE 101. CARRIER GLOBAL: PRODUCT PORTFOLIO

TABLE 102. CARRIER GLOBAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. COWAY CO. LTD.: SNAPSHOT

TABLE 103. COWAY CO. LTD.: BUSINESS PERFORMANCE

TABLE 104. COWAY CO. LTD.: PRODUCT PORTFOLIO

TABLE 105. COWAY CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 106. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 107. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 108. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AIR PURIFIER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AIR PURIFIER MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. HEPA MARKET OVERVIEW (2016-2028)

FIGURE 013. ACTIVATED CARBON MARKET OVERVIEW (2016-2028)

FIGURE 014. IONIC FILTERS MARKET OVERVIEW (2016-2028)

FIGURE 015. AIR PURIFIER MARKET OVERVIEW BY APPLICATION

FIGURE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 018. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA AIR PURIFIER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE AIR PURIFIER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC AIR PURIFIER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA AIR PURIFIER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA AIR PURIFIER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Air Purifier Market research report is 2024-2032.

Daikin Industries Ltd. (Japan), Sharp Corporation (Japan), Honeywell International Inc. (US), Samsung Electronics Co. Ltd. (South Korea), LG Electronics Inc. (South Korea), Koninklijke Philips N.V. (Netherlands), Dyson (UK), Unilever Group (UK), Panasonic Corporation (Japan), Whirlpool Corporation (US), AllerAir Industries Inc. (US), IQAir (Switzerland), Winix Co. Ltd. (South Korea), Xiaomi Corporation (China), Camfil AB (Sweden), Airpura Industries Inc. (Canada), Airgle Corporation (US), Hunter Pure Air (US), Kent RO Systems Ltd. (India), SHIL Limited (India), IDEAL Krug & Priester GMBH & Co. KG (Germany), Havells India Ltd. (India), Molekule (US), Carrier Global (US), Coway CO. Ltd. (South Korea), and other major players.

The Air Purifier Market is segmented into Technology, Application, and region. By Technology, the market is categorized into HEPA, Activated Carbon, Ionic Filters. By Application, the market is categorized into Commercial, Residential, Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

In homes and restricted areas, air purifiers assist to minimise airborne pollutants such as viruses and bacteria. Portable air purifiers, on the other hand, have been proven to be insufficient in protecting against coronavirus.

The Global Air Purifier Market size is expected to grow from USD 16.38 Billion in 2023 to USD 41.19 Billion by 2032, at a CAGR of 10.79% during the forecast period (2024-2032).