Global Agricultural Micronutrient Market Overview

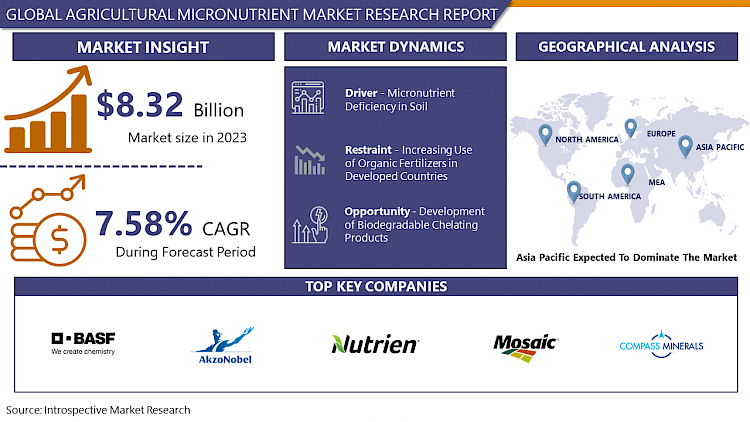

The Global Agricultural Micronutrient Market size is expected to grow from USD 8.32 billion in 2023 to USD 16.05 billion by 2032, at a CAGR of 7.58% during the forecast period (2024-2032).

Agricultural micronutrients are minerals, which are essential for plant growth. It includes elements, such as Zinc (Zn), Boron (B), Iron (Fe), Copper (Cu), Manganese (Mn), and Molybdenum (Mo). It is used by plants in small quantities so it’s called micronutrients. They play an important role in improving the yield and quality of agricultural products. These micronutrients are majorly used with soil, in foliar sprays, and in Fertigation systems. They also help in the biological processes of plants. And assist the plant in cell growth. Micronutrients are applied to the plant with conventional application equipment, by mixing micronutrients mixed with liquid and dry fertilizer inappropriate amounts. It will reduce the cost and allow the equal, uniform distribution of micronutrients. Agricultural micronutrients help to achieve balanced nutrition in crops of pulses, spices, oilseeds, and cereals. Micronutrient deficiency causes leaf discoloration, stunted growth, and loss of fruiting; these ultimately show an adverse effect on crop yields, it reduces the crop yield. Their demand has to increase in the agricultural industry for better revenue generation.

Market Dynamics And Factors For Agricultural Micronutrients Market

Drivers:

Micronutrients Deficiency in Soil

Micronutrients are required in very small amounts; they are available in plants but in low quantity and their deficiencies can lead to affect adversely crops. All over the globe soils are suffering deficiencies of micronutrients; the main factors responsible for deficiency of micronutrient in the soil is soil pH, humidity, and temperature. Higher pH levels in the soil reduce the number of micronutrients present in the soil. The product which helps in increasing the micronutrient level can lead the agricultural micronutrient market. The governmental and non-governmental organizations are spreading awareness about using the mineral-rich fertilizers in the soil to overcome micronutrient deficiency that is boosting the market for agricultural micronutrients.

Restraints:

Increasing Use of Organic Fertilizers in Developed Countries

In developed countries, the Increasing Use of Organic Fertilizers restrains the growth of the micronutrient market. The trend is to eat healthy food and consumption of food that is coming from healthy and safe sources. People are becoming aware, and putting their eyes on what kind of chemicals and fertilizers are going into the soil which is harmful and showing a long-term adverse effect on the body, and causes serious damage to health. They are avoiding this fertilizer and shifting towards organic farming and eating organic food which comes from the farm and is residuals free. Food production is more than consumption in the developed country so people are spending money only on quality food. This is increasing the demand for organic farming, and fertilizer restraining the market for micronutrients.

Opportunity:

Development of Biodegradable Chelating Products

Development of Biodegradable Chelating Products helps to boost the Agricultural Micronutrients Market. There are so many harmful effects of non-biodegradable chelating agents known, that are hazardous to the soil, crop, and the health of humans. So the demand for the production of biodegradable chelates is increasing in the markets. Recently developed and adopted agents like NTA and EDDS, are widely promoted, and marketed in the markets instead of the non-biodegradable agents. The use of the biodegradable chelating product to remove metals that is harmful to plant and soil health. Farmers are also using commodity fertilizer products for specialty fertilizers, which helps to boost the market. These fertilizers provide high growth and high yield, and helps in low consumption of water. These are the main driving factors for increasing the Agricultural Micronutrients Market.

Segmentation Analysis Of Agricultural Micronutrients Market

By type, zinc is the segment that accounted for the largest share in the agriculture micronutrient market. The fast growth of this segment is due to awareness about zinc deficiency in soil across the globe and it plays an important in plant growth. Zinc contains many health benefits so it rises the demand for zinc nutritious food, which ultimately enhances the demand for zinc agriculture micronutrients. Also, the government is taking initiatives toward the increasing amount of zinc concentrate in the soil to enhance quantitative and qualitative crop yields which are supporting the micronutrient market.

By form, Chelated micronutrients are acquiring a large share in the micronutrient market. It is anticipated to grab the maximum agricultural micronutrient market share over the projected period. Chelated micronutrients are organic molecules, to form a ring-like structure these molecules combine with metal. Chelated micronutrients are seen in different ranges of soil pH. Chelated compounds have stable nature that the acceptance of chelated micronutrients is more than the non-chelated micronutrients in the agricultural micronutrient market.

By application, the soil is the segment that expected to dominate the Agricultural micronutrient market. Micronutrients are required for better yield and growth of the plants. Through soil, micronutrients are going toward the plant. So the application of agricultural micronutrients through soil is the most effective way to apply micronutrients. It is easy to apply and comparatively charges a low cost that's why in developing countries application of agricultural micronutrients is preferred through the soil, this is the most important reason behind the growth of the agricultural micronutrient market.

Regional Analysis Of Agricultural Micronutrients Market

The Asia Pacific contributed the largest share in agricultural micronutrients market, during the forecast period due to Rising awareness about the micronutrients among farmers is expected to provide more scope for market growth. The government of this region also provided plans, subsidies for fertilization and nutrition of crops, and spreading awareness about the use of this micronutrient helping in the development of this industry. Sometimes government is giving a 100% margin on fertilizers for farmers, which is the major factor helping the growth of this market in the Asia Pacific region. The requirement for high-quality agricultural products and the increasing agricultural practices are factors that boost the micronutrient fertilizer market in the Asia Pacific region.

The European region has growing demand for micronutrients; it is expected to grow with a significant growth rate in the upcoming year for agricultural micronutrient market. People and farmers from this region already know the importance of nutrients for a healthy body. They have developed countries whose main focus is on health they are ready to spend more money on food, to get a better diet. The agricultural micronutrients help to maintain the nutritional qualities of the plants, shows a good impact on the soil. These are the driving factors that are help to increase for the agricultural micronutrient market in the European region. People are also shifting on the consumption of vegetables or food that is sourced from plant origin and getting a diet that is naturally developed on-field this is also helping to increase the demand for micronutrient market.

North America is also the region that can contribute to the growth of the agricultural micronutrient market in upcoming years. In this region the area covered by the Agribusiness is large, most of the land is used for farming and there is a problem of declining arable land which will also be an important reason for the growth of the micronutrient market in this region. Increased awareness regarding crop nutrition products and adaption of the products for growing nutrition-rich crop production is the key factor for increasing demand in the agricultural micronutrient market.

COVID 19 Impacts on Agricultural Micronutrients Market

The global Agricultural Micronutrients Market is in trouble because of COVID-19. The entire situation is challenging and the market has to face a very tough time. COVID impacted every business, field, and market. In this pandemic supply chain, sales, manpower, and unemployment all this factor are affecting the growth of the market. With the lockdowns, there is distortion in logistics and reduced production, and it made huge economic impacts on the market and on the world which is suffering from COVID-19. China is the world's largest producer and consumer of agriculture micronutrients. China is also suffering from COVID which affects all the global market of agricultural micronutrient market. The outbreak of COVID-19 in China had the most critical impact on the Chinese agriculture micronutrient sector, affecting the movement of micronutrient products and raw materials from inside and outside the country. All export-import business is slowing down and it reduces the market share of the product. Micronutrients are not available, and production of fertilizers is stopped so the supply of both these products is not available so the farmer is suffered from the low yield of the crop when the production is low the revenue generated from that product is also less. So this pandemic is harsh on the agricultural micronutrient market but now lockdown is not there, industries are open and everything will be back on track after some time and the industry can able to witnesses to see the growth of the micronutrient market.

Top Key Players Covered In Agricultural Micronutrients Market

- BASF SE(Germany)

- AkzoNobel (Netherlands)

- Nutrien Ltd. (Canada)

- Yara International ASA (Norway)

- The Mosaic Company (US)

- Compass minerals international (US)

- Valagro (Italy)

- Coromandel International Limited (India)

- Haifa Group (Israel)

- Helena Agri-Enterprises LLC (U.S.)

- Valagro S.p.A (Italy)

- Sigma AgriScience LLC (U.S.)

- Aries Agro Limited (India)

- Nufarm Limited (Australia)

- AgroLiquid (U.S.)

- Indian Farmer Fertilizer cooperative limited (India)

- SAPEC SA (Belgium) and Other Major Players.

Key Industry Developments in Agricultural Micronutrients Market

In September 2021, In India Coromandel International Limited launched a new product namely GroShakti Plus a fertilizer, which is a superior and complex fertilizer with new technology. Coromandel is continuously serving the farmers in all aspects to enhancing productivity of crops and increasing yield of crop, by creating Specialty nutrients, Bulk fertilizers, and nutrient based pure Organic fertilizers that’s improve the quality of soil.

In March 2021, for the development and distribution of nutrient efficiency products, The Mosaic Company made a partnership with Sound Agriculture. The product is inspired by biochemistry that activates the soil microbiome to give open space to the plant for absorption of fertilizers. Sound Agriculture has invented technology that activates the soil microbiome to give access to enter important nutrients in plants and which allow farmers to get more benefits of fertilizer.

In 2020 July, Haifa Group is investing in AgrlOT they signed an agreement with AgrIOT. They are investing around USD 2 million and getting 30% rights of the company for distribution. AgrIOT technology works on reducing costs required for farmers, frequent monitoring of development, making identification process effective.

|

Global Agricultural Micronutrient Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.58% |

Market Size in 2032: |

USD 16.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Form

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Agricultural Micronutrient Market by Type

5.1 Agricultural Micronutrient Market Overview Snapshot and Growth Engine

5.2 Agricultural Micronutrient Market Overview

5.3 Zinc

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Zinc: Grographic Segmentation

5.4 Boron

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Boron: Grographic Segmentation

5.5 Iron

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Iron: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Agricultural Micronutrient Market by Form

6.1 Agricultural Micronutrient Market Overview Snapshot and Growth Engine

6.2 Agricultural Micronutrient Market Overview

6.3 Chelated

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Chelated: Grographic Segmentation

6.4 Non-Chelated

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Non-Chelated: Grographic Segmentation

Chapter 7: Agricultural Micronutrient Market by Application

7.1 Agricultural Micronutrient Market Overview Snapshot and Growth Engine

7.2 Agricultural Micronutrient Market Overview

7.3 Soil

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Soil: Grographic Segmentation

7.4 Foliar

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Foliar: Grographic Segmentation

7.5 Fertigation

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Fertigation: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Agricultural Micronutrient Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Agricultural Micronutrient Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Agricultural Micronutrient Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 BASF SE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 AKZONOBEL

8.4 NUTRIEN

8.5 LTD.

8.6 YARA INTERNATIONAL ASA

8.7 THE MOSAIC COMPANY

8.8 COMPASS MINERALS INTERNATIONAL

8.9 VALAGRO

8.10 COROMANDEL INTERNATIONAL LIMITED

8.11 HAIFA GROUP

8.12 HELENA AGRI-ENTERPRISES LLC

8.13 VALAGRO S.P.A

8.14 SIGMA AGRISCIENCE LLC

8.15 ARIES AGRO LIMITED

8.16 NUFARM LIMITED

8.17 AGROLIQUID

8.18 INDIAN FARMER FERTILIZER COOPERATIVE LIMITED

8.19 SAPEC SA BYD

8.20 NARI

8.21 XUJI GROUP

8.22 POTIVIO

8.23 AUTO ELECTRIC POWER PLANT

8.24 HUASHANG SANYOU

8.25 ZHEJIANG WANMA

8.26 PURUITE

8.27 TITANS

8.28 SHANGHAI XUNDAO

8.29 SINOCHARGE

8.30 RUCKUS NEW ENERGY TECH

8.31 OTHER MAJOR PLAYERS

Chapter 9: Global Agricultural Micronutrient Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Zinc

9.2.2 Boron

9.2.3 Iron

9.2.4 Others

9.3 Historic and Forecasted Market Size By Form

9.3.1 Chelated

9.3.2 Non-Chelated

9.4 Historic and Forecasted Market Size By Application

9.4.1 Soil

9.4.2 Foliar

9.4.3 Fertigation

Chapter 10: North America Agricultural Micronutrient Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Zinc

10.4.2 Boron

10.4.3 Iron

10.4.4 Others

10.5 Historic and Forecasted Market Size By Form

10.5.1 Chelated

10.5.2 Non-Chelated

10.6 Historic and Forecasted Market Size By Application

10.6.1 Soil

10.6.2 Foliar

10.6.3 Fertigation

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Agricultural Micronutrient Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Zinc

11.4.2 Boron

11.4.3 Iron

11.4.4 Others

11.5 Historic and Forecasted Market Size By Form

11.5.1 Chelated

11.5.2 Non-Chelated

11.6 Historic and Forecasted Market Size By Application

11.6.1 Soil

11.6.2 Foliar

11.6.3 Fertigation

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Agricultural Micronutrient Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Zinc

12.4.2 Boron

12.4.3 Iron

12.4.4 Others

12.5 Historic and Forecasted Market Size By Form

12.5.1 Chelated

12.5.2 Non-Chelated

12.6 Historic and Forecasted Market Size By Application

12.6.1 Soil

12.6.2 Foliar

12.6.3 Fertigation

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Agricultural Micronutrient Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Zinc

13.4.2 Boron

13.4.3 Iron

13.4.4 Others

13.5 Historic and Forecasted Market Size By Form

13.5.1 Chelated

13.5.2 Non-Chelated

13.6 Historic and Forecasted Market Size By Application

13.6.1 Soil

13.6.2 Foliar

13.6.3 Fertigation

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Agricultural Micronutrient Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Zinc

14.4.2 Boron

14.4.3 Iron

14.4.4 Others

14.5 Historic and Forecasted Market Size By Form

14.5.1 Chelated

14.5.2 Non-Chelated

14.6 Historic and Forecasted Market Size By Application

14.6.1 Soil

14.6.2 Foliar

14.6.3 Fertigation

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Agricultural Micronutrient Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

7.58% |

Market Size in 2032: |

USD 16.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. AGRICULTURAL MICRONUTRIENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. AGRICULTURAL MICRONUTRIENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. AGRICULTURAL MICRONUTRIENT MARKET COMPETITIVE RIVALRY

TABLE 005. AGRICULTURAL MICRONUTRIENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. AGRICULTURAL MICRONUTRIENT MARKET THREAT OF SUBSTITUTES

TABLE 007. AGRICULTURAL MICRONUTRIENT MARKET BY TYPE

TABLE 008. ZINC MARKET OVERVIEW (2016-2028)

TABLE 009. BORON MARKET OVERVIEW (2016-2028)

TABLE 010. IRON MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. AGRICULTURAL MICRONUTRIENT MARKET BY FORM

TABLE 013. CHELATED MARKET OVERVIEW (2016-2028)

TABLE 014. NON-CHELATED MARKET OVERVIEW (2016-2028)

TABLE 015. AGRICULTURAL MICRONUTRIENT MARKET BY APPLICATION

TABLE 016. SOIL MARKET OVERVIEW (2016-2028)

TABLE 017. FOLIAR MARKET OVERVIEW (2016-2028)

TABLE 018. FERTIGATION MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET, BY FORM (2016-2028)

TABLE 021. NORTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET, BY APPLICATION (2016-2028)

TABLE 022. N AGRICULTURAL MICRONUTRIENT MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE AGRICULTURAL MICRONUTRIENT MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE AGRICULTURAL MICRONUTRIENT MARKET, BY FORM (2016-2028)

TABLE 025. EUROPE AGRICULTURAL MICRONUTRIENT MARKET, BY APPLICATION (2016-2028)

TABLE 026. AGRICULTURAL MICRONUTRIENT MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC AGRICULTURAL MICRONUTRIENT MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC AGRICULTURAL MICRONUTRIENT MARKET, BY FORM (2016-2028)

TABLE 029. ASIA PACIFIC AGRICULTURAL MICRONUTRIENT MARKET, BY APPLICATION (2016-2028)

TABLE 030. AGRICULTURAL MICRONUTRIENT MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA AGRICULTURAL MICRONUTRIENT MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA AGRICULTURAL MICRONUTRIENT MARKET, BY FORM (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA AGRICULTURAL MICRONUTRIENT MARKET, BY APPLICATION (2016-2028)

TABLE 034. AGRICULTURAL MICRONUTRIENT MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET, BY FORM (2016-2028)

TABLE 037. SOUTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET, BY APPLICATION (2016-2028)

TABLE 038. AGRICULTURAL MICRONUTRIENT MARKET, BY COUNTRY (2016-2028)

TABLE 039. BASF SE: SNAPSHOT

TABLE 040. BASF SE: BUSINESS PERFORMANCE

TABLE 041. BASF SE: PRODUCT PORTFOLIO

TABLE 042. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. AKZONOBEL: SNAPSHOT

TABLE 043. AKZONOBEL: BUSINESS PERFORMANCE

TABLE 044. AKZONOBEL: PRODUCT PORTFOLIO

TABLE 045. AKZONOBEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. NUTRIEN: SNAPSHOT

TABLE 046. NUTRIEN: BUSINESS PERFORMANCE

TABLE 047. NUTRIEN: PRODUCT PORTFOLIO

TABLE 048. NUTRIEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LTD.: SNAPSHOT

TABLE 049. LTD.: BUSINESS PERFORMANCE

TABLE 050. LTD.: PRODUCT PORTFOLIO

TABLE 051. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. YARA INTERNATIONAL ASA: SNAPSHOT

TABLE 052. YARA INTERNATIONAL ASA: BUSINESS PERFORMANCE

TABLE 053. YARA INTERNATIONAL ASA: PRODUCT PORTFOLIO

TABLE 054. YARA INTERNATIONAL ASA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. THE MOSAIC COMPANY: SNAPSHOT

TABLE 055. THE MOSAIC COMPANY: BUSINESS PERFORMANCE

TABLE 056. THE MOSAIC COMPANY: PRODUCT PORTFOLIO

TABLE 057. THE MOSAIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. COMPASS MINERALS INTERNATIONAL: SNAPSHOT

TABLE 058. COMPASS MINERALS INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 059. COMPASS MINERALS INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 060. COMPASS MINERALS INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. VALAGRO: SNAPSHOT

TABLE 061. VALAGRO: BUSINESS PERFORMANCE

TABLE 062. VALAGRO: PRODUCT PORTFOLIO

TABLE 063. VALAGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. COROMANDEL INTERNATIONAL LIMITED: SNAPSHOT

TABLE 064. COROMANDEL INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 065. COROMANDEL INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 066. COROMANDEL INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. HAIFA GROUP: SNAPSHOT

TABLE 067. HAIFA GROUP: BUSINESS PERFORMANCE

TABLE 068. HAIFA GROUP: PRODUCT PORTFOLIO

TABLE 069. HAIFA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. HELENA AGRI-ENTERPRISES LLC: SNAPSHOT

TABLE 070. HELENA AGRI-ENTERPRISES LLC: BUSINESS PERFORMANCE

TABLE 071. HELENA AGRI-ENTERPRISES LLC: PRODUCT PORTFOLIO

TABLE 072. HELENA AGRI-ENTERPRISES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. VALAGRO S.P.A: SNAPSHOT

TABLE 073. VALAGRO S.P.A: BUSINESS PERFORMANCE

TABLE 074. VALAGRO S.P.A: PRODUCT PORTFOLIO

TABLE 075. VALAGRO S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SIGMA AGRISCIENCE LLC: SNAPSHOT

TABLE 076. SIGMA AGRISCIENCE LLC: BUSINESS PERFORMANCE

TABLE 077. SIGMA AGRISCIENCE LLC: PRODUCT PORTFOLIO

TABLE 078. SIGMA AGRISCIENCE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ARIES AGRO LIMITED: SNAPSHOT

TABLE 079. ARIES AGRO LIMITED: BUSINESS PERFORMANCE

TABLE 080. ARIES AGRO LIMITED: PRODUCT PORTFOLIO

TABLE 081. ARIES AGRO LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. NUFARM LIMITED: SNAPSHOT

TABLE 082. NUFARM LIMITED: BUSINESS PERFORMANCE

TABLE 083. NUFARM LIMITED: PRODUCT PORTFOLIO

TABLE 084. NUFARM LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. AGROLIQUID: SNAPSHOT

TABLE 085. AGROLIQUID: BUSINESS PERFORMANCE

TABLE 086. AGROLIQUID: PRODUCT PORTFOLIO

TABLE 087. AGROLIQUID: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. INDIAN FARMER FERTILIZER COOPERATIVE LIMITED: SNAPSHOT

TABLE 088. INDIAN FARMER FERTILIZER COOPERATIVE LIMITED: BUSINESS PERFORMANCE

TABLE 089. INDIAN FARMER FERTILIZER COOPERATIVE LIMITED: PRODUCT PORTFOLIO

TABLE 090. INDIAN FARMER FERTILIZER COOPERATIVE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. SAPEC SA BYD: SNAPSHOT

TABLE 091. SAPEC SA BYD: BUSINESS PERFORMANCE

TABLE 092. SAPEC SA BYD: PRODUCT PORTFOLIO

TABLE 093. SAPEC SA BYD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. NARI: SNAPSHOT

TABLE 094. NARI: BUSINESS PERFORMANCE

TABLE 095. NARI: PRODUCT PORTFOLIO

TABLE 096. NARI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. XUJI GROUP: SNAPSHOT

TABLE 097. XUJI GROUP: BUSINESS PERFORMANCE

TABLE 098. XUJI GROUP: PRODUCT PORTFOLIO

TABLE 099. XUJI GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. POTIVIO: SNAPSHOT

TABLE 100. POTIVIO: BUSINESS PERFORMANCE

TABLE 101. POTIVIO: PRODUCT PORTFOLIO

TABLE 102. POTIVIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. AUTO ELECTRIC POWER PLANT: SNAPSHOT

TABLE 103. AUTO ELECTRIC POWER PLANT: BUSINESS PERFORMANCE

TABLE 104. AUTO ELECTRIC POWER PLANT: PRODUCT PORTFOLIO

TABLE 105. AUTO ELECTRIC POWER PLANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. HUASHANG SANYOU: SNAPSHOT

TABLE 106. HUASHANG SANYOU: BUSINESS PERFORMANCE

TABLE 107. HUASHANG SANYOU: PRODUCT PORTFOLIO

TABLE 108. HUASHANG SANYOU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. ZHEJIANG WANMA: SNAPSHOT

TABLE 109. ZHEJIANG WANMA: BUSINESS PERFORMANCE

TABLE 110. ZHEJIANG WANMA: PRODUCT PORTFOLIO

TABLE 111. ZHEJIANG WANMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. PURUITE: SNAPSHOT

TABLE 112. PURUITE: BUSINESS PERFORMANCE

TABLE 113. PURUITE: PRODUCT PORTFOLIO

TABLE 114. PURUITE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. TITANS: SNAPSHOT

TABLE 115. TITANS: BUSINESS PERFORMANCE

TABLE 116. TITANS: PRODUCT PORTFOLIO

TABLE 117. TITANS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. SHANGHAI XUNDAO: SNAPSHOT

TABLE 118. SHANGHAI XUNDAO: BUSINESS PERFORMANCE

TABLE 119. SHANGHAI XUNDAO: PRODUCT PORTFOLIO

TABLE 120. SHANGHAI XUNDAO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 120. SINOCHARGE: SNAPSHOT

TABLE 121. SINOCHARGE: BUSINESS PERFORMANCE

TABLE 122. SINOCHARGE: PRODUCT PORTFOLIO

TABLE 123. SINOCHARGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 123. RUCKUS NEW ENERGY TECH: SNAPSHOT

TABLE 124. RUCKUS NEW ENERGY TECH: BUSINESS PERFORMANCE

TABLE 125. RUCKUS NEW ENERGY TECH: PRODUCT PORTFOLIO

TABLE 126. RUCKUS NEW ENERGY TECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 126. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 127. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 128. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 129. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY TYPE

FIGURE 012. ZINC MARKET OVERVIEW (2016-2028)

FIGURE 013. BORON MARKET OVERVIEW (2016-2028)

FIGURE 014. IRON MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY FORM

FIGURE 017. CHELATED MARKET OVERVIEW (2016-2028)

FIGURE 018. NON-CHELATED MARKET OVERVIEW (2016-2028)

FIGURE 019. AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY APPLICATION

FIGURE 020. SOIL MARKET OVERVIEW (2016-2028)

FIGURE 021. FOLIAR MARKET OVERVIEW (2016-2028)

FIGURE 022. FERTIGATION MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA AGRICULTURAL MICRONUTRIENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Agricultural Micronutrient Market research report is 2024-2032.

BASF SE (Germany), AkzoNobel (Netherlands), Nutrien, Ltd. (Canada), Yara International ASA (Norway), The Mosaic Company (US), Compass minerals international (US), and Valagro (Italy), Coromandel International Limited (India), Haifa Group (Israel), Helena Agri-Enterprises LLC (U.S.), Valagro S.p.A (Italy), Sigma AgriScience, LLC (U.S.), Aries Agro Limited (India), Nufarm Limited (Australia), and AgroLiquid (U.S.), Indian Farmer Fertilizer cooperative limited (India), SAPEC SA (Belgium), and Other Major Players.

Agricultural Micronutrient Market is segmented into Type, Form, Application and region. By Type, the market is categorized into Zinc, Boron, Iron, others. By Form, the market is categorized into Chelated, Non-Chelated. By Application, the market is categorized into Soil, Foliar, and Fertigation. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Agricultural micronutrients are minerals, which are essential for plant growth. It includes elements, such as Zinc (Zn), Boron (B), Iron (Fe), Copper (Cu), Manganese (Mn), and Molybdenum (Mo). It is used by plants in small quantities so it’s called micronutrients.

The Global Agricultural Micronutrient Market size is expected to grow from USD 8.32 billion in 2023 to USD 16.05 billion by 2032, at a CAGR of 7.58% during the forecast period (2024-2032).