Global Actuators Market Overview

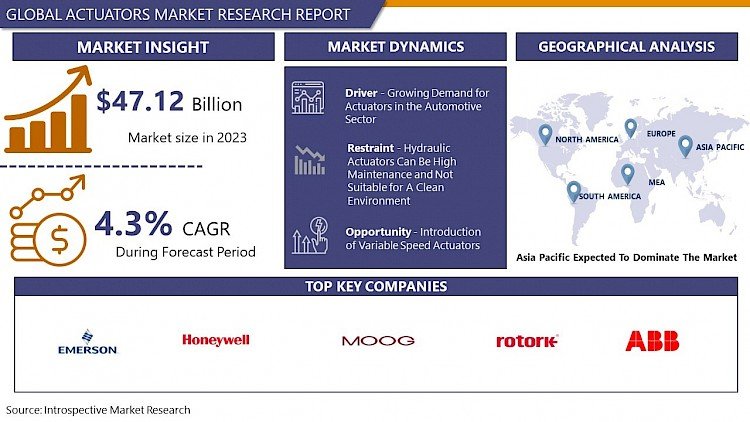

Global Actuators Market Size Was Valued at USD 47.12 Billion In 2023 And Is Projected to Reach USD 68.83 Billion By 2032, Growing at a CAGR of 4.3% From 2024 To 2032.

An actuator is a mechanism that transforms energy from various sources like electricity, hydraulics, or pneumatics into physical movement or power. This transformation enables actuators to carry out tasks, which are vital elements in a diverse range of uses.

- Actuators, especially electrical ones, provide a means of high power conversion efficiency suitable for energy-saving purposes. They have the ability to function using different types of power sources and offer accurate positioning control for precise motion.

- Actuators are capable of producing significant force and functioning at high speeds to meet the demands of robotics and heavy machinery tasks. Due to their effectiveness and minimal maintenance needs, electric actuators are both dependable and eco-friendly.

- They can be smoothly incorporated into advanced control systems for complex control and monitoring. Actuators are made to last and offer reliable functionality even in severe environments.

- Actuators are essential in many sectors, including automotive, aerospace, robotics, manufacturing, medical devices, agriculture, construction, consumer electronics, industrial plants, and renewable energy.

Market Dynamics And Factors of Actuators Market

Drivers:

The healthcare industry develops and produces innovative machines that require actuators and are used in medical devices such as wheelchairs, patient lifts, treatment chairs, dentist chairs, beds for medical purposes, and CT, MRI, and PT scanning instruments. The growth in the global healthcare actuator market is primarily attributed to factors such as healthcare facility expansion and the increasing elderly population. A common example is a use of moving coil actuators and control valves in ventilators to facilitate air supply to patients who cannot breathe on their own. due to lung disease, surgery, or other serious illness or accident. In addition, the RTPCR test, which is very effective in detecting the SARSCoV2 virus, uses linear actuators (they simply act as a conveyor belt) for its linear motion systems and to perform a large number of RTPCR tests that are required in emergencies such as COVID19. Linear drives support the loading, unloading, and moving of samples as well as the necessary liquid handling process in important test phases. Linear drives support sample labeling and the barcode process and can work faster and longer than humans. A leading company called MecVel uses actuators for various applications such as linear automation systems in incubators for newborns and electric linear actuators for X-ray machines etc.

The automotive sector contributes majorly to the growth of the actuators market globally due to one of the essential components in the automotive vehicles. Commercial vehicle and passenger car sales continue to grow, and OEMs have made the interior a key focus to improve passenger safety and comfort. so that the seats are more comfortable and smarter. Actuators are used in seats to adjust lumbar support systems, seat positioning, angles, and seat rail actuators. Various types of actuators for car seat adjustment are available on the market, including gear motors for tilt adjustment, double output shafts for caterpillar drives, and linear actuators for height and tilt adjustment. Due to the worldwide increase in sales of SUVs and premium vehicles, it is expected that the market segment for seat adjustment drives will be expanded. the passenger experiences.

Restraints:

The restraining factor of the actuator depends on the type and application. Electric actuators can be poor in dynamic response and compliance and wear issues can cause inaccuracies. Hydraulic actuators can be high maintenance and not suitable for a clean environment and also leakage can be a major restraining factor of hydraulic actuators.

Opportunities:

The actuators market hold massive growth opportunity due to the wide array of industries that uses actuators in numerous mechanical and automatic equipment and machines. The actuators are widely used in industries such as Agriculture, Construction, Electronics, and Electrical engineering, Shipping machinery, Aerospace and Defense, Oil and Gas, Food and Beverage industry, and healthcare equipment and devices. The growing use of actuators in materials handling gear, robotics, Window Automation, Cutting equipment. Such vast applications in various machinery create high demand from all over the globe which supports local as well as international players.

Variable speed actuators open up new application opportunities in sophisticated speed actuators in various applications. More cultured actuators with variable speed offer possibilities like water hammers can be a major problem in many applications. Valve seats suffer if they are forcibly pushed into their end position when the valve is closed. A speed-controlled actuator gives the control engineer the option of specifying the actuating speed at different points in the cycle. The usual way to do this is to move the valve quickly for most of its cycle and slow it down as it approaches the closed position. A fast closing speed can be specified for emergencies. The speed actuator provides high-performance characteristics and supports the growth of the Actuators Market.

Challenges:

Pneumatic actuators convert the energy generated from compressed air into mechanical movement. The installation of pneumatic actuators is very troublesome work, and the maintenance costs of these actuators are high. Pneumatic actuators are a combination of different systems including compressors, air filters, lubrication hoses, etc., dryers, and regulators. Negligence or inadequate maintenance of these systems can lead to problems such as excessive noise and air leaks. With hydraulic drives, the hydraulic fluid is pumped through a storage tank, which converts the energy into mechanical movement. Hydraulic actuators have several advantages over pneumatic actuators in terms of power generation and process control. However, the likelihood of fluid leaks, fire hazards, and actuator system degradation due to erosion caused by fluid leaks are significant threats. Therefore, leakage problems are expected, along with the high level of noise caused by the operation of pneumatic and hydraulic actuators. affect the market growth prospects over the forecast period.

Market Segmentation

Segmentation Analysis of Actuators Market

By Actuation, the Electrical actuator is the dominating segment in the Actuators Market. Electric actuator holds a large portion of the Actuators Market due to their large application in a wide array of industrial application, food and beverage, automotive industry, material handling and robotic, electronics, and electronic assembly. The automotive sector utilized the actuators in driverless transport vehicles due to extensive automation in automotive parts and machines making it utilization of electric actuator automotive segment, such integration causing the growth of Actuators Market.

By Type, the Linear actuator segment is the dominating segment in the Actuators Market. The linear actuator provides Actual accurate control and positioning which enhances the performance. Linear actuator able to stop at any point of the stroke without external sensors and low operating costs creates the most viable and opted actuators in the operation. The linear actuator is used in automotive applications which is one of the largest demanding segments in the Actuators Market. The dependency of linear on automotive sector reflects on the growth of the segment on Actuators Market.

By Application, Vehicles and Equipment held the largest share in terms of application in the Actuators Market. The actuator is a major component in vehicles that dispense power and fluid into various parts of the engine. Actuator usage in equipment including mechanical road gates, garage doors, and gates, small hoists, and cranes. In the automotive sector, these actuators are used as mechanisms for opening windows and frames of cargo or engine compartments. Electric linear actuators They are also widely used to create Electronic DIY -Mechanisms for various budgetary purposes. Thus, it supports the growth of the actuator market globally.

By Vertical, the Automotive segment is the dominating segment in the Actuators Market. Actuators are one of the vital parts of the electric control system in passenger and commercial vehicle Actuator are generally electric motor or electric valves. An electric actuator work as a movement of a load, or an action requiring a force such as clamping, using an electric motor to create the necessary force. The actuator is used in Internal combustion engines and electric vehicles which makes it global demand generating component, supporting local manufacturers as well as global export of actuators. The automotive segment is expected to grow at a fast pace during the forecasted period.

Regional Analysis of Actuators Market

The Asia-Pacific region stands as a powerhouse in the Actuators Market, commanding a dominant position driven by several factors. Booming industrialization across countries like China, India, Japan, and South Korea has fueled the demand for actuators across various sectors including manufacturing, automotive, aerospace, and healthcare. Additionally, rapid urbanization, infrastructure development projects, and increasing investments in automation technologies have further propelled market growth.

Moreover, the region benefits from a robust manufacturing ecosystem, technological advancements, and a skilled labor force, which contribute to the development and adoption of advanced actuators. Government initiatives supporting industrial growth and innovation also play a significant role in driving the market forward.

Asia-Pacific region's strategic focus on renewable energy and sustainability has led to a growing demand for actuators in the renewable energy sector, particularly in wind turbines and solar panels, adding to its market dominance. With its dynamic economic landscape and continuous advancements, the Asia-Pacific region is poised to maintain its stronghold in the global Actuators Market for the foreseeable future.

Players Covered in Actuators Market are:

- Honeywell International Inc.

- Siemens AG

- Emerson Electric Co.

- Schneider Electric SE

- ABB Ltd.

- Rotork plc

- Parker Hannifin Corporation

- SMC Corporation

- Festo AG & Co. KG

- Johnson Controls International plc

- Belimo Holding AG

- Danfoss A/S

- Moog Inc.

- Curtiss-Wright Corporation

- Altra Industrial Motion Corp.

- AUMA Riester GmbH & Co. KG

- Eaton Corporation plc

- IMI plc

- Tsubakimoto Chain Co.

- Nihon Koso Co., Ltd.

Key Industry Developments of Actuators Market

- In May 2024, Flowserve has launched the new Limitorque QX Series B (QXb) quarter-turn smart electric actuator, designed to provide unmatched reliability and precision in demanding applications across various industries, such as oil and gas, water and wastewater, commercial power, chemical, and general industries.

- In November 2023, ADVICS, a well-known brake system products manufacturer, introduced a new line of electric parking brake (EPB) actuator kits in North America. These kits attach to a vehicle's caliper, making it easier to engage the parking brake. EPBs have become the standard in modern vehicles, providing convenience and efficiency compared to traditional parking brakes.

|

Global Actuators Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 47.12 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 68.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By System |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By System

3.3 By End-Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Actuators Market by Type

5.1 Actuators Market Overview Snapshot and Growth Engine

5.2 Actuators Market Overview

5.3 Linear Actuator

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Linear Actuator: Grographic Segmentation

5.4 Rotary Actuator

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Rotary Actuator: Grographic Segmentation

Chapter 6: Actuators Market by System

6.1 Actuators Market Overview Snapshot and Growth Engine

6.2 Actuators Market Overview

6.3 Electrical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electrical: Grographic Segmentation

6.4 Pneumatic

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pneumatic: Grographic Segmentation

6.5 Hydraulic

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Hydraulic: Grographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Grographic Segmentation

Chapter 7: Actuators Market by End-Users

7.1 Actuators Market Overview Snapshot and Growth Engine

7.2 Actuators Market Overview

7.3 Oil & Gas

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Oil & Gas: Grographic Segmentation

7.4 Pharmaceutical & Healthcare

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pharmaceutical & Healthcare: Grographic Segmentation

7.5 Automotive

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Automotive: Grographic Segmentation

7.6 Aerospace & Defense

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Aerospace & Defense: Grographic Segmentation

7.7 Marine

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Marine: Grographic Segmentation

7.8 Others

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Actuators Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Actuators Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Actuators Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 THE EMERSON ELECTRIC COMPANY

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 HONEYWELL INTERNATIONAL INC

8.4 MOOG INC

8.5 ROTORK PLC

8.6 PARKER HANNIFIN CORPORATION

8.7 ABB GROUP

8.8 CAMERON INTERNATIONAL CORPORATION

8.9 EATON CORPORATION PLC

8.10 OTHER MAJOR PLAYERS

Chapter 9: Global Actuators Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Linear Actuator

9.2.2 Rotary Actuator

9.3 Historic and Forecasted Market Size By System

9.3.1 Electrical

9.3.2 Pneumatic

9.3.3 Hydraulic

9.3.4 Others

9.4 Historic and Forecasted Market Size By End-Users

9.4.1 Oil & Gas

9.4.2 Pharmaceutical & Healthcare

9.4.3 Automotive

9.4.4 Aerospace & Defense

9.4.5 Marine

9.4.6 Others

Chapter 10: North America Actuators Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Linear Actuator

10.4.2 Rotary Actuator

10.5 Historic and Forecasted Market Size By System

10.5.1 Electrical

10.5.2 Pneumatic

10.5.3 Hydraulic

10.5.4 Others

10.6 Historic and Forecasted Market Size By End-Users

10.6.1 Oil & Gas

10.6.2 Pharmaceutical & Healthcare

10.6.3 Automotive

10.6.4 Aerospace & Defense

10.6.5 Marine

10.6.6 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Actuators Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Linear Actuator

11.4.2 Rotary Actuator

11.5 Historic and Forecasted Market Size By System

11.5.1 Electrical

11.5.2 Pneumatic

11.5.3 Hydraulic

11.5.4 Others

11.6 Historic and Forecasted Market Size By End-Users

11.6.1 Oil & Gas

11.6.2 Pharmaceutical & Healthcare

11.6.3 Automotive

11.6.4 Aerospace & Defense

11.6.5 Marine

11.6.6 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Actuators Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Linear Actuator

12.4.2 Rotary Actuator

12.5 Historic and Forecasted Market Size By System

12.5.1 Electrical

12.5.2 Pneumatic

12.5.3 Hydraulic

12.5.4 Others

12.6 Historic and Forecasted Market Size By End-Users

12.6.1 Oil & Gas

12.6.2 Pharmaceutical & Healthcare

12.6.3 Automotive

12.6.4 Aerospace & Defense

12.6.5 Marine

12.6.6 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Actuators Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Linear Actuator

13.4.2 Rotary Actuator

13.5 Historic and Forecasted Market Size By System

13.5.1 Electrical

13.5.2 Pneumatic

13.5.3 Hydraulic

13.5.4 Others

13.6 Historic and Forecasted Market Size By End-Users

13.6.1 Oil & Gas

13.6.2 Pharmaceutical & Healthcare

13.6.3 Automotive

13.6.4 Aerospace & Defense

13.6.5 Marine

13.6.6 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Actuators Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Linear Actuator

14.4.2 Rotary Actuator

14.5 Historic and Forecasted Market Size By System

14.5.1 Electrical

14.5.2 Pneumatic

14.5.3 Hydraulic

14.5.4 Others

14.6 Historic and Forecasted Market Size By End-Users

14.6.1 Oil & Gas

14.6.2 Pharmaceutical & Healthcare

14.6.3 Automotive

14.6.4 Aerospace & Defense

14.6.5 Marine

14.6.6 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Actuators Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 47.12 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 68.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By System |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ACTUATORS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ACTUATORS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ACTUATORS MARKET COMPETITIVE RIVALRY

TABLE 005. ACTUATORS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ACTUATORS MARKET THREAT OF SUBSTITUTES

TABLE 007. ACTUATORS MARKET BY TYPE

TABLE 008. LINEAR ACTUATOR MARKET OVERVIEW (2016-2028)

TABLE 009. ROTARY ACTUATOR MARKET OVERVIEW (2016-2028)

TABLE 010. ACTUATORS MARKET BY SYSTEM

TABLE 011. ELECTRICAL MARKET OVERVIEW (2016-2028)

TABLE 012. PNEUMATIC MARKET OVERVIEW (2016-2028)

TABLE 013. HYDRAULIC MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. ACTUATORS MARKET BY END-USERS

TABLE 016. OIL & GAS MARKET OVERVIEW (2016-2028)

TABLE 017. PHARMACEUTICAL & HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 018. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 019. AEROSPACE & DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 020. MARINE MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA ACTUATORS MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA ACTUATORS MARKET, BY SYSTEM (2016-2028)

TABLE 024. NORTH AMERICA ACTUATORS MARKET, BY END-USERS (2016-2028)

TABLE 025. N ACTUATORS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE ACTUATORS MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE ACTUATORS MARKET, BY SYSTEM (2016-2028)

TABLE 028. EUROPE ACTUATORS MARKET, BY END-USERS (2016-2028)

TABLE 029. ACTUATORS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC ACTUATORS MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC ACTUATORS MARKET, BY SYSTEM (2016-2028)

TABLE 032. ASIA PACIFIC ACTUATORS MARKET, BY END-USERS (2016-2028)

TABLE 033. ACTUATORS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA ACTUATORS MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA ACTUATORS MARKET, BY SYSTEM (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA ACTUATORS MARKET, BY END-USERS (2016-2028)

TABLE 037. ACTUATORS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA ACTUATORS MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA ACTUATORS MARKET, BY SYSTEM (2016-2028)

TABLE 040. SOUTH AMERICA ACTUATORS MARKET, BY END-USERS (2016-2028)

TABLE 041. ACTUATORS MARKET, BY COUNTRY (2016-2028)

TABLE 042. THE EMERSON ELECTRIC COMPANY: SNAPSHOT

TABLE 043. THE EMERSON ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 044. THE EMERSON ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 045. THE EMERSON ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HONEYWELL INTERNATIONAL INC: SNAPSHOT

TABLE 046. HONEYWELL INTERNATIONAL INC: BUSINESS PERFORMANCE

TABLE 047. HONEYWELL INTERNATIONAL INC: PRODUCT PORTFOLIO

TABLE 048. HONEYWELL INTERNATIONAL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. MOOG INC: SNAPSHOT

TABLE 049. MOOG INC: BUSINESS PERFORMANCE

TABLE 050. MOOG INC: PRODUCT PORTFOLIO

TABLE 051. MOOG INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ROTORK PLC: SNAPSHOT

TABLE 052. ROTORK PLC: BUSINESS PERFORMANCE

TABLE 053. ROTORK PLC: PRODUCT PORTFOLIO

TABLE 054. ROTORK PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. PARKER HANNIFIN CORPORATION: SNAPSHOT

TABLE 055. PARKER HANNIFIN CORPORATION: BUSINESS PERFORMANCE

TABLE 056. PARKER HANNIFIN CORPORATION: PRODUCT PORTFOLIO

TABLE 057. PARKER HANNIFIN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ABB GROUP: SNAPSHOT

TABLE 058. ABB GROUP: BUSINESS PERFORMANCE

TABLE 059. ABB GROUP: PRODUCT PORTFOLIO

TABLE 060. ABB GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CAMERON INTERNATIONAL CORPORATION: SNAPSHOT

TABLE 061. CAMERON INTERNATIONAL CORPORATION: BUSINESS PERFORMANCE

TABLE 062. CAMERON INTERNATIONAL CORPORATION: PRODUCT PORTFOLIO

TABLE 063. CAMERON INTERNATIONAL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. EATON CORPORATION PLC: SNAPSHOT

TABLE 064. EATON CORPORATION PLC: BUSINESS PERFORMANCE

TABLE 065. EATON CORPORATION PLC: PRODUCT PORTFOLIO

TABLE 066. EATON CORPORATION PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 067. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 068. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 069. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ACTUATORS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ACTUATORS MARKET OVERVIEW BY TYPE

FIGURE 012. LINEAR ACTUATOR MARKET OVERVIEW (2016-2028)

FIGURE 013. ROTARY ACTUATOR MARKET OVERVIEW (2016-2028)

FIGURE 014. ACTUATORS MARKET OVERVIEW BY SYSTEM

FIGURE 015. ELECTRICAL MARKET OVERVIEW (2016-2028)

FIGURE 016. PNEUMATIC MARKET OVERVIEW (2016-2028)

FIGURE 017. HYDRAULIC MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. ACTUATORS MARKET OVERVIEW BY END-USERS

FIGURE 020. OIL & GAS MARKET OVERVIEW (2016-2028)

FIGURE 021. PHARMACEUTICAL & HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 022. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 023. AEROSPACE & DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 024. MARINE MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA ACTUATORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE ACTUATORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC ACTUATORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA ACTUATORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA ACTUATORS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Actuators Market research report is 2024-2032.

The Emerson Electric Company, Honeywell International Inc, Moog Inc, Rotork Plc, Parker Hannifin Corporation, ABB Group, Cameron International Corporation, Eaton Corporation Plc. and other major players.

The Actuators Market has been segmented into Type, System, End-Users, and region. By Type, the market is categorized into Linear Actuator, Rotary Actuator. By System, the market is categorized into Electrical, Pneumatic, Hydraulic, and Others. By End-Users, the market is categorized into Oil & Gas, Pharmaceutical & Healthcare, Automotive, Aerospace & Defense, Marine, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Actuators are devices that convert energy into motion and are primarily used to move or control mechanisms and systems. Actuators are powered by an external power source, typically electrical power, hydraulic fluid pressure, or pneumatic pressure, which is then converted into motion.

Global Actuators Market Size Was Valued at USD 47.12 Billion In 2023 And Is Projected to Reach USD 68.83 Billion By 2032, Growing at a CAGR of 4.3% From 2024 To 2032.