Activated Bleaching Clay Market Synopsis

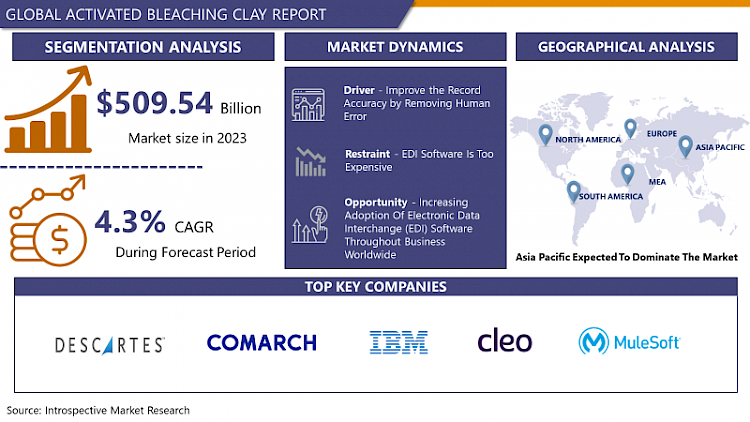

Activated Bleaching Clay Market Size Was Valued at USD 509.54 Million in 2023, and is Projected to Reach USD 744.28 Million by 2032, Growing at a CAGR of 4.3 % From 2024-2032.

Activated bleaching clay is an adsorbent material used in various industries, including oil refining, cosmetics, and wastewater treatment. It is activated through processes like acid treatment or thermal activation to enhance its adsorption properties, removing impurities and color pigments from oils, waxes, and other substances, thus improving product quality and purity.

Activated bleaching clay finds widespread application across diverse industries due to its exceptional adsorption properties and purification capabilities. In the oil refining sector, it is used extensively to remove impurities and color pigments from edible oils, vegetable oils, mineral oils, and waxes. This application ensures that the final products meet stringent quality standards, enhancing their marketability and consumer acceptance. Additionally, activated bleaching clay plays a crucial role in the cosmetics and personal care industry, where it is utilized to purify and clarify skincare products, improving their efficacy and appearance.

- Bleaching clay stems from its ability to effectively adsorb contaminants, including free fatty acids, pigments, and unwanted odors, resulting in cleaner and more refined end products. Furthermore, its cost-effectiveness and ease of use make it a preferred choice for industries seeking efficient purification solutions. The future demand growth for activated bleaching clay is expected to remain robust, driven by increasing industrialization, urbanization, and consumer demand for high-quality and pure products. As industries continue to prioritize product quality and purity, the demand for activated bleaching clay as a purification agent is anticipated to grow across various sectors.

- Advancements in manufacturing techniques and the development of eco-friendly formulations are likely to further propel the market growth of activated bleaching clay. The exploration of new applications beyond traditional sectors, such as pharmaceuticals and environmental remediation, also presents growth opportunities for the activated bleaching clay market, fostering innovation and market expansion.

Activated Bleaching Clay Market Trend Analysis

Growing Demand for Refined Vegetable Oil

- The growing demand for refined vegetable oil stands out as a major driver fueling the growth of the activated bleaching clay market. This demand surge is propelled by various factors, including changing dietary preferences, health consciousness among consumers, and the widespread use of vegetable oils in food preparation and cooking. Refined vegetable oil is favored for its neutral flavor, high smoke point, and versatility in culinary applications, making it a staple ingredient in households, restaurants, and food processing industries.

- Activated bleaching clay plays a pivotal role in the production of refined vegetable oil by removing impurities, color pigments, and undesirable odors. This purification process enhances the quality, appearance, and shelf life of vegetable oils, meeting industry standards and consumer expectations for premium-grade products. As the demand for refined vegetable oil continues to rise, especially in emerging markets with growing populations and rising disposable incomes, the market for activated bleaching clay experiences a corresponding increase in demand.

- In oil refining technologies, coupled with the emphasis on product quality and food safety, drive the adoption of activated bleaching clay as an essential purification agent in the vegetable oil industry. Market players are also exploring innovative formulations and eco-friendly solutions to meet evolving customer preferences and regulatory requirements, further contributing to the growth and sustainability of the activated bleaching clay market amidst the expanding demand for refined vegetable oil.

Expansion in Cosmetics and Personal Care Industry

- The expansion in the cosmetics and personal care industry presents a significant opportunity for the growth of the activated bleaching clay market. This growth is driven by several factors, including increasing consumer awareness of skincare and beauty products, rising disposable incomes, and a growing emphasis on natural and organic ingredients in cosmetic formulations. Activated bleaching clay is valued in the cosmetics industry for its ability to absorb impurities, toxins, and excess oils from the skin, making it a popular ingredient in facial masks, cleansers, and exfoliating products.

- The demand for activated bleaching clay in the cosmetics and personal care sector is propelled by its versatility and effectiveness in enhancing product quality and performance. It is used to improve product texture, stability, and appearance, contributing to the overall efficacy and appeal of skincare and beauty formulations. As consumers prioritize products that offer visible results and meet their skincare needs, the demand for activated bleaching clay as a cosmetic ingredient continues to grow.

- Moreover, the growing trend towards natural and sustainable beauty solutions creates opportunities for activated bleaching clay manufacturers to develop eco-friendly and cruelty-free formulations. Collaborations between cosmetic companies and clay suppliers drive innovation in product development, leading to the introduction of new skincare and beauty products that incorporate activated bleaching clay for its purification and detoxification benefits. As the cosmetics and personal care industry expands globally, particularly in emerging markets, the demand for activated bleaching clay is expected to witness substantial growth.

Activated Bleaching Clay Market Segment Analysis:

Activated Bleaching Clay Market Segmented on the basis of Type, Application, and End-User.

By Type, Natural Bleaching Clay segment is expected to dominate the market during the forecast period

- The natural bleaching clay segment is poised to dominate the growth of the activated bleaching clay market due to several key factors. Natural bleaching clay, derived from mineral deposits and known for its purity and effectiveness, is increasingly preferred by industries such as oil refining, cosmetics, and pharmaceuticals. It's natural composition and gentle purification properties make it a sought-after choice for applications where product quality and safety are paramount.

- Furthermore, the rising demand for natural and sustainable ingredients across various industries contributes to the dominance of the natural bleaching clay segment. Consumers and manufacturers alike are shifting towards eco-friendly and ethically sourced materials, driving the adoption of natural bleaching clay in product formulations. As regulatory bodies also encourage the use of natural ingredients in food, cosmetics, and pharmaceuticals, the natural bleaching clay segment experiences heightened demand and market growth, positioning it as a leading contributor to the overall activated bleaching clay market.

By Application, Edible Oils & Fats Refining segment held the largest share of 77.22% in 2022

- The edible oils & fats refining segment has emerged as the leader, holding the largest share in driving the growth of the activated bleaching clay market. This dominance is attributed to the indispensable role of activated bleaching clay in refining edible oils and fats. Activated bleaching clay's exceptional adsorption properties enable it to efficiently remove impurities, color pigments, and undesirable odors from oils and fats, resulting in high-quality refined products that meet industry standards and consumer preferences.

- Moreover, the increasing demand for refined edible oils and fats, driven by factors such as changing dietary habits, health consciousness, and culinary preferences, contributes significantly to the prominence of the edible oils & fats refining segment in the activated bleaching clay market. The use of activated bleaching clay ensures that refined oils and fats have improved clarity, stability, and flavor, making them suitable for a wide range of food applications. As the consumption of refined edible oils continues to rise globally, particularly in emerging markets with growing populations and urbanization, the demand for activated bleaching clay in the edible oils & fats refining segment is expected to maintain its leading position in the market.

Activated Bleaching Clay Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to dominate the growth of the activated bleaching clay market due to several key factors. With a rapidly growing population and expanding industrial sectors, countries in the Asia Pacific region, such as China, India, and Indonesia, have witnessed a significant increase in demand for activated bleaching clay across various applications. The food and beverage industry, particularly the edible oils and fats segment, is a major driver of market growth in this region, as activated bleaching clay is essential for refining oils and fats to meet quality standards and consumer preferences.

- Furthermore, the cosmetics and personal care industry in the Asia Pacific presents substantial growth opportunities for activated bleaching clay manufacturers. The region's growing middle-class population, rising disposable incomes, and changing consumer lifestyles contribute to the increased demand for skincare, haircare, and beauty products that incorporate activated bleaching clay for their purification and detoxification properties. As the Asia Pacific region continues to experience economic development, urbanization, and industrialization, the demand for activated bleaching clay is expected to surge, solidifying its dominance in the global market.

Activated Bleaching Clay Market Top Key Players:

- Oil-Dri Corporation of America (U.S.)

- EP Minerals (U.S.)

- Mineral Technologies Inc. (U.S,)

- BASF SE (Germany)

- Merck KGaA (Germany)

- Clariant (Switzerland)

- Akzo Nobel N.V.(Netherland)

- S&B Industrial Minerals S.A. (Greece)

- Ashapura Group (India)

- HRP Industries (India)

- Korvi Activated Earth (India)

- Refoil Earth Pvt Ltd (India)

- 20 Microns Nano Minerals Ltd. (India)

- Musim Mas (Singapore)

- Dechengwang Technology Co., Ltd (China)

- The W Clay Industries Sdn. Bhd (Malaysia)

- Taiko Group (Malaysia), and Other Major Players

Key Industry Developments Activated Bleaching Clay Market

- ln May 2024, Oil-Dri Corporation of America (NYSE: ODC) completed its acquisition of Ultra Pet Company, Inc. for $46 million, solidifying its position in the cat litter industry. The strategic move aimed to expand Oil-Dri’s presence in the crystal cat litter segment. With the integration of Ultra Pet’s expertise, both companies worked towards blending cultures and optimizing operations. The acquisition was financed through a combination of cash and existing credit facilities.

- In July 2023, Minerals Technologies Inc. (NYSE: MTX) partnered with a prominent global paper company to enhance an existing precipitated calcium carbonate (PCC) plant in Brazil using MTI’s NewYield® LO PCC technology. This innovative technology converts paper mill waste into a functional filler pigment, reducing disposal costs and raw material consumption. NewYield® product improves paper properties like bulk and opacity while maintaining strength and smoothness, showcasing MTI’s leadership in sustainable paper solutions.

|

Global Activated Bleaching Clay Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 509.54 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.3 % |

Market Size in 2032 : |

USD 744.28 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ACTIVATED BLEACHING CLAY MARKET BY TYPE (2017-2030)

- ACTIVATED BLEACHING CLAY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NATURAL BLEACHING CLAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ACID-ACTIVATED BLEACHING CLAY

- BENTONITE CLAY

- ACTIVATED BLEACHING CLAY MARKET BY APPLICATION (2017-2030)

- ACTIVATED BLEACHING CLAY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EDIBLE OILS & FATS REFINING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MINERAL OIL & WAXES

- VEGETABLE OILS REFINING

- WAX REFINING

- ACTIVATED BLEACHING CLAY MARKET BY END-USER (2017-2030)

- ACTIVATED BLEACHING CLAY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETICS & PERSONAL CARE

- CHEMICALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Activated Bleaching Clay Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- OIL-DRI CORPORATION OF AMERICA (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- EP MINERALS (U.S.)

- MINERAL TECHNOLOGIES INC. (U.S,)

- BASF SE (GERMANY)

- MERCK KGAA (GERMANY)

- CLARIANT (SWITZERLAND)

- AKZO NOBEL N.V.(NETHERLAND)

- S&B INDUSTRIAL MINERALS S.A. (GREECE)

- ASHAPURA GROUP (INDIA)

- HRP INDUSTRIES (INDIA)

- KORVI ACTIVATED EARTH (INDIA)

- REFOIL EARTH PVT LTD (INDIA)

- 20 MICRONS NANO MINERALS LTD. (INDIA)

- MUSIM MAS (SINGAPORE)

- DECHENGWANG TECHNOLOGY CO., LTD (CHINA)

- THE W CLAY INDUSTRIES SDN. BHD (MALAYSIA)

- TAIKO GROUP (MALAYSIA)

- COMPETITIVE LANDSCAPE

- GLOBAL ACTIVATED BLEACHING CLAY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Activated Bleaching Clay Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 509.54 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.3 % |

Market Size in 2032 : |

USD 744.28 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ACTIVATED BLEACHING CLAY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ACTIVATED BLEACHING CLAY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ACTIVATED BLEACHING CLAY MARKET COMPETITIVE RIVALRY

TABLE 005. ACTIVATED BLEACHING CLAY MARKET THREAT OF NEW ENTRANTS

TABLE 006. ACTIVATED BLEACHING CLAY MARKET THREAT OF SUBSTITUTES

TABLE 007. ACTIVATED BLEACHING CLAY MARKET BY TYPE

TABLE 008. EDIBLE OIL & FATS MARKET OVERVIEW (2016-2028)

TABLE 009. MINERAL OIL & LUBRICANTS MARKET OVERVIEW (2016-2028)

TABLE 010. ACTIVATED BLEACHING CLAY MARKET BY APPLICATION

TABLE 011. THE WET TECHNOLOGY MARKET OVERVIEW (2016-2028)

TABLE 012. THE DRY TECHNOLOGY MARKET OVERVIEW (2016-2028)

TABLE 013. THE VAPOUR-PHASE TECHNOLOGY MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA ACTIVATED BLEACHING CLAY MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA ACTIVATED BLEACHING CLAY MARKET, BY APPLICATION (2016-2028)

TABLE 017. N ACTIVATED BLEACHING CLAY MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE ACTIVATED BLEACHING CLAY MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE ACTIVATED BLEACHING CLAY MARKET, BY APPLICATION (2016-2028)

TABLE 020. ACTIVATED BLEACHING CLAY MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC ACTIVATED BLEACHING CLAY MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC ACTIVATED BLEACHING CLAY MARKET, BY APPLICATION (2016-2028)

TABLE 023. ACTIVATED BLEACHING CLAY MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ACTIVATED BLEACHING CLAY MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ACTIVATED BLEACHING CLAY MARKET, BY APPLICATION (2016-2028)

TABLE 026. ACTIVATED BLEACHING CLAY MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA ACTIVATED BLEACHING CLAY MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA ACTIVATED BLEACHING CLAY MARKET, BY APPLICATION (2016-2028)

TABLE 029. ACTIVATED BLEACHING CLAY MARKET, BY COUNTRY (2016-2028)

TABLE 030. CLARIANT: SNAPSHOT

TABLE 031. CLARIANT: BUSINESS PERFORMANCE

TABLE 032. CLARIANT: PRODUCT PORTFOLIO

TABLE 033. CLARIANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. TAIKO GROUP: SNAPSHOT

TABLE 034. TAIKO GROUP: BUSINESS PERFORMANCE

TABLE 035. TAIKO GROUP: PRODUCT PORTFOLIO

TABLE 036. TAIKO GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. BASF: SNAPSHOT

TABLE 037. BASF: BUSINESS PERFORMANCE

TABLE 038. BASF: PRODUCT PORTFOLIO

TABLE 039. BASF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. APL(AMCOL ASHAPURA GROUP): SNAPSHOT

TABLE 040. APL(AMCOL ASHAPURA GROUP): BUSINESS PERFORMANCE

TABLE 041. APL(AMCOL ASHAPURA GROUP): PRODUCT PORTFOLIO

TABLE 042. APL(AMCOL ASHAPURA GROUP): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. MUSIM MAS: SNAPSHOT

TABLE 043. MUSIM MAS: BUSINESS PERFORMANCE

TABLE 044. MUSIM MAS: PRODUCT PORTFOLIO

TABLE 045. MUSIM MAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. W CLAY INDUSTRIES: SNAPSHOT

TABLE 046. W CLAY INDUSTRIES: BUSINESS PERFORMANCE

TABLE 047. W CLAY INDUSTRIES: PRODUCT PORTFOLIO

TABLE 048. W CLAY INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. OIL-DRI: SNAPSHOT

TABLE 049. OIL-DRI: BUSINESS PERFORMANCE

TABLE 050. OIL-DRI: PRODUCT PORTFOLIO

TABLE 051. OIL-DRI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. AMCOL(BENSAN): SNAPSHOT

TABLE 052. AMCOL(BENSAN): BUSINESS PERFORMANCE

TABLE 053. AMCOL(BENSAN): PRODUCT PORTFOLIO

TABLE 054. AMCOL(BENSAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. S&B INDUSTRIAL MINERALS: SNAPSHOT

TABLE 055. S&B INDUSTRIAL MINERALS: BUSINESS PERFORMANCE

TABLE 056. S&B INDUSTRIAL MINERALS: PRODUCT PORTFOLIO

TABLE 057. S&B INDUSTRIAL MINERALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. AMC (UK) LIMITED: SNAPSHOT

TABLE 058. AMC (UK) LIMITED: BUSINESS PERFORMANCE

TABLE 059. AMC (UK) LIMITED: PRODUCT PORTFOLIO

TABLE 060. AMC (UK) LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. 20 NANO: SNAPSHOT

TABLE 061. 20 NANO: BUSINESS PERFORMANCE

TABLE 062. 20 NANO: PRODUCT PORTFOLIO

TABLE 063. 20 NANO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. U.G.A. GROUP: SNAPSHOT

TABLE 064. U.G.A. GROUP: BUSINESS PERFORMANCE

TABLE 065. U.G.A. GROUP: PRODUCT PORTFOLIO

TABLE 066. U.G.A. GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MCC: SNAPSHOT

TABLE 067. MCC: BUSINESS PERFORMANCE

TABLE 068. MCC: PRODUCT PORTFOLIO

TABLE 069. MCC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. PT TUNASINTI BHAKTIMAKMUR: SNAPSHOT

TABLE 070. PT TUNASINTI BHAKTIMAKMUR: BUSINESS PERFORMANCE

TABLE 071. PT TUNASINTI BHAKTIMAKMUR: PRODUCT PORTFOLIO

TABLE 072. PT TUNASINTI BHAKTIMAKMUR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. BAIYUE: SNAPSHOT

TABLE 073. BAIYUE: BUSINESS PERFORMANCE

TABLE 074. BAIYUE: PRODUCT PORTFOLIO

TABLE 075. BAIYUE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. TIANYU GROUP: SNAPSHOT

TABLE 076. TIANYU GROUP: BUSINESS PERFORMANCE

TABLE 077. TIANYU GROUP: PRODUCT PORTFOLIO

TABLE 078. TIANYU GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. GUANGXI LONGAN: SNAPSHOT

TABLE 079. GUANGXI LONGAN: BUSINESS PERFORMANCE

TABLE 080. GUANGXI LONGAN: PRODUCT PORTFOLIO

TABLE 081. GUANGXI LONGAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. HANGZHOU YONGSHENG: SNAPSHOT

TABLE 082. HANGZHOU YONGSHENG: BUSINESS PERFORMANCE

TABLE 083. HANGZHOU YONGSHENG: PRODUCT PORTFOLIO

TABLE 084. HANGZHOU YONGSHENG: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY TYPE

FIGURE 012. EDIBLE OIL & FATS MARKET OVERVIEW (2016-2028)

FIGURE 013. MINERAL OIL & LUBRICANTS MARKET OVERVIEW (2016-2028)

FIGURE 014. ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY APPLICATION

FIGURE 015. THE WET TECHNOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 016. THE DRY TECHNOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 017. THE VAPOUR-PHASE TECHNOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA ACTIVATED BLEACHING CLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Activated Bleaching Clay Market research report is 2024-2032.

Oil-Dri Corporation of America (U.S.), EP Minerals (U.S.), Mineral Technologies Inc. (U.S,), BASF SE (Germany), Merck KGaA (Germany), Clariant (Switzerland), Akzo Nobel N.V.(Netherland), S&B Industrial Minerals S.A. (Greece), Ashapura Group (India), HRP Industries (India), Korvi Activated Earth (India), Refoil Earth Pvt Ltd (India),20 Microns Nano Minerals Ltd. (India), Musim Mas (Singapore), Dechengwang Technology Co., Ltd (China), The W Clay Industries Sdn. Bhd (Malaysia), Taiko Group (Malaysia) and Other Major Players.

The Activated Bleaching Clay Market is segmented into Type, Nature, Application, and region. By Type, the market is categorized into Natural Bleaching Clay, Acid-Activated Bleaching Clay, and Bentonite Clay. By Application, the market is categorized into Edible Oils & Fats Refining, Mineral Oil & Waxes, Vegetable Oils Refining, and Wax Refining. By End-User, the market is categorized into Edible Oils & Fats Refining, Mineral Oil & Waxes, Vegetable Oils Refining, and Wax Refining. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Activated bleaching clay is an adsorbent material used in various industries, including oil refining, cosmetics, and wastewater treatment. It is activated through processes like acid treatment or thermal activation to enhance its adsorption properties, removing impurities and color pigments from oils, waxes, and other substances, thus improving product quality and purity.

Activated Bleaching Clay Market Size Was Valued at USD 509.54 Million in 2023, and is Projected to Reach USD 744.28 Million by 2032, Growing at a CAGR of 4.3 % From 2024-2032.