Acrylic Resins Market Synopsis

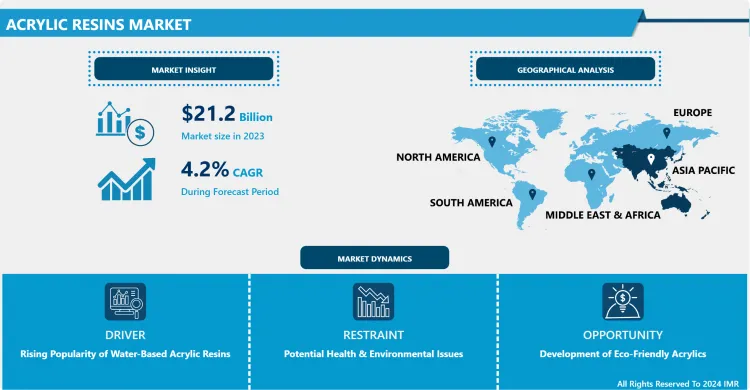

Acrylic Resins Market Size Was Valued at USD 22.09 Billion in 2024, and is Projected to Reach USD 34.73 Billion by 2035, Growing at a CAGR of 4.2% From 2025-2035.

Acrylic resins are polymers produced from acrylic acid or any of the other related chemicals. They are quite popular and find usage in numerous applications as varnish, paint, adhesive, coating among others. The above resins when cured exhibit excellent transparency as well as excellent physical durability in the form of a strong film and hence are suitable for clear coat applications where the film formed on the substrate must withstand weathering. They can be either thermoplastic or thermosetting types, that is, those which become softened when heated or those which become irreversibly “set,” or hardened after crossing over a certain temperature known as curing temperature. They give a good grip on a range of surfaces, also they maintain good color fastness and are preferred for their shinny appearance, with no tendency to turn yellow.

The acrylic resins market has shown a large growth based on its applications in automotive, construction, electronics among others. This growth is due to their well-documented characteristics such as ultra-violet light resistance, abrasion resistance and useful in coatings and adhesives, textiles and plastics among others. The market is pushed further by the growth of green consciousness, for acrylic resins can usually be made to conform to the toughest green specs while offering outstanding performance.

Since the Asia Pacific area, the most important factors have been observed to influence the markets for acrylic resins include industrialization, urbanization and development in countries like China and India. North America and Europe also have the major shares of the global market due to well-developed industrialized regions and focus on technology. Some of the regional players in the market are majorly involved in the development of new products that provide better performance characteristics and achieving market demands for environment friendly and efficient products. In sum, the acrylic resins market is expected to steadily expand as more companies demand tough, inexpensive, and eco-friendly materials for use in their operations.

Acrylic Resins Market Trend Analysis

Acrylic Resins Market Growth Drivers- Increasing preference for water-based acrylic resins over solvent-based counterparts

- There is notable growth in the use of water borne acrylic resins than solvent borne acrylic resins in the market. Such a change is under way because of growing environmental consciousness and regulatory measures insisting on limitation of volatile organic compound (VOC) emissions. Compared to the solvent borne acrylic resins, the water based acrylic resins have lesser VOC emissions during application and curing, this makes the later suitable especially in areas where air quality standards have been tightened.

- In addition, one observes that water-emulsified acrylic resins are regarded safer to handle and apply thus enhancing workplace safety standards. This trend is even more evident in segments such as architectural coatings in view of the rising trend in environmental conservation initiatives and the need to look for sustainable building materials. Manufacturers are therefore moving to research and develop other properties of water-borne acrylics so as to meet or surpass those of the solvent-borne while at the same achieving high durability, adhesion and resistance to weather among other factors.

Acrylic Resins Market Opportunities- Development of bio-based or renewable acrylic resins

- New growth opportunity in the acrylic resins market can be considered as the bio/renewable acrylic resins. Bio based acrylic resins are such an opportunity as industries today tend to focus on sustainability and start looking for substitutes to petrochemical constituents. These resins may be obtained from natural resources including plant origin raw materials or bio-polymers, thus limiting the use of petroleum based products and hence the carbon footprint.

- Bio-based acrylic resins do not compromise as far as environmental sustainability and customer preference for green products is concerned, within industries such as paints, adhesives, and coatings. Hence, market players engaged in such scientific research as the production of enhanced bio-based acrylic resins to promote the availability and demand of their products due to the increasing percentage for environmentally sensitive consumer and constant regulation of renewable sourcing or sustainability initiatives.

Acrylic Resins Market Segment Analysis:

Acrylic Resins Market Segmented on the basis of type, chemical composition and application.

By Type, Thermoplastic Acrylic Resins segment is expected to dominate the market during the forecast period

- Looking at the forecast period, the acrylic resins segment of thermoplastic acrylic resins shall remain dominant in the market for the following reasons. Toughness and flexibility from the thermoplastic acrylic resins are also commendable and the products are easy to process; thus, they can be applied in automotive coatings and packaging, among other uses. These resins can be processed by melting and being reused many times without obvious changes in their chemical composition making them appreciable to manufacturers and easily recyclable.

- Also, the thermoplastic acrylic possesses high transmittance of light, good UV and weather resistance and good heat stability and colour retention which are desirable qualities for exterior uses. The application of thermoplastic acrylic resins is increased in car making and electronics where durability and weight are important factors, so does the application of these resins to end-use performance and improved sustainability measures.

By Application, Paints & Coatings segment expected to held the largest share

- I found out that, out of all the applications of acrylic resins, the paints and coatings application is expected to dominate the market in the forecast timeframe. This dominance is attributed to the efficient application of acrylic resins paints as well as coatings that are characterized by their good durability, weatherability, and high-quality appearance. Acrylic resins show good adhesion, form films which are resistant to water, UV rays, and abrasion; these make them fit for use in both external and internal applications.

- Also, acrylic resins are used in the synthesis of architectural paints, automotive and industrial coatings where their fast drying, high adhesion to various substrates increases application performance as well as product durability. Due to the rising focus of industries on both aesthetics, sustainability and performance, the paints and coatings segment is set to remain the most influential segment brewing the demand of acrylic resins in the global level.

Acrylic Resins Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- This work predicts that Asia Pacific will be the largest consumer of acrylic resins over the forecast period due to increased industrialization, urbanization, and infrastructure development across Asia Pacific. Major contributors include China, India, Japan, and South Korea are some contributions of the dominance from strong manufacturing industries and construction activities growth. The region has seen much economic growth and there is a growing interest that has been invested on car manufacturing, electronics, building construction, etc and for these reason the use of acrylic resins in coatings, adhesive and plastic products are deemed necessary.

- Also, Asia Pacific has benefited from government policies such as supporting industrial development and advancement in technologies thus speeding up the market growth in Asia Pacific. Since a number of world industries remain interested in the Asia Pacific sphere as a place for production and consumption, the region is likely to remain a leader in the acrylic resins market, presenting many opportunities for market participants to focus on the steadily growing trend of this segment of the global economy.

Active Key Players in the Acrylic Resins Market

- Arkema SA (France)

- BASF SE (Germany)

- DIC Corporation (Japan)

- Dow Inc (United States)

- Eastman Chemical Company (United States)

- Evonik Industries AG (Germany)

- Formosa Plastics Corporation (Taiwan)

- Huntsman Corporation (United States)

- LG Chem Ltd (South Korea)

- Mitsubishi Chemical Corporation (Japan)

- Momentive Performance Materials Inc (United States)

- Nippon Shokubai Co Ltd (Japan)

- Solvay S.A. (Belgium)

- Sumitomo Chemical Co Ltd (Japan)

- Wacker Chemie AG (Germany) and Other Active Players

Key Industry Developments:

- In October 2023, Lummus Technology, a global provider of process technologies and energy solutions, announced its acquisition of acrylic acid and acrylates technology from Air Liquide Engineering & Construction. This deal granted Lummus the rights to license and market ester-grade acrylic acid technology, along with light and heavy acrylates process technology. The acquisition significantly enhanced Lummus’ propylene production capabilities, integrating their portfolio with new solutions for acrylic acid and acrylates production.

- In April 2023, Arkema extended its suite of advanced “Inside The Cell” solutions for both current and next-generation batteries. As a proven supplier to battery cell producers with a longstanding legacy in advanced PVDF binder and separator coating solutions, Arkema advanced its offerings with a comprehensive range of complementary technologies. This new technology portfolio included advanced acrylic-based binders, dispersants, and rheology additives, marketed under the Incellion™ trademark. These innovations enabled battery manufacturers to optimize their formulations for electrode and separator solutions, tailored for both existing and next-generation cell components.

|

Global Acrylic Resins Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 22.09 Bn. |

|

Forecast Period 2024-35 CAGR: |

4.2 % |

Market Size in 2035: |

USD 34.73 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Chemical Composition |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Acrylic Resins Market by Type (2018-2035)

4.1 Acrylic Resins Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Thermoplastic Acrylic Resins

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Thermosetting Acrylic Resins

Chapter 5: Acrylic Resins Market by Chemical Composition (2018-2035)

5.1 Acrylic Resins Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pure Acrylic Resins

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Modified Acrylic Resins

Chapter 6: Acrylic Resins Market by Application (2018-2035)

6.1 Acrylic Resins Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Paints & Coatings

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Adhesives & Sealants

6.5 Construction Materials

6.6 Textiles & Fabrics

6.7 Paper & Paperboard Coatings

6.8 Plastics & Composites

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Acrylic Resins Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARKEMA SA (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 DIC CORPORATION (JAPAN)

7.5 DOW INC (UNITED STATES)

7.6 EASTMAN CHEMICAL COMPANY (UNITED STATES)

7.7 EVONIK INDUSTRIES AG (GERMANY)

7.8 FORMOSA PLASTICS CORPORATION (TAIWAN)

7.9 HUNTSMAN CORPORATION (UNITED STATES)

7.10 LG CHEM LTD (SOUTH KOREA)

7.11 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

7.12 MOMENTIVE PERFORMANCE MATERIALS INC (UNITED STATES)

7.13 NIPPON SHOKUBAI CO LTD (JAPAN)

7.14 SOLVAY S.A. (BELGIUM)

7.15 SUMITOMO CHEMICAL CO LTD (JAPAN)

7.16 WACKER CHEMIE AG (GERMANY)

Chapter 8: Global Acrylic Resins Market By Region

8.1 Overview

8.2. North America Acrylic Resins Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Thermoplastic Acrylic Resins

8.2.4.2 Thermosetting Acrylic Resins

8.2.5 Historic and Forecasted Market Size by Chemical Composition

8.2.5.1 Pure Acrylic Resins

8.2.5.2 Modified Acrylic Resins

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Paints & Coatings

8.2.6.2 Adhesives & Sealants

8.2.6.3 Construction Materials

8.2.6.4 Textiles & Fabrics

8.2.6.5 Paper & Paperboard Coatings

8.2.6.6 Plastics & Composites

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Acrylic Resins Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Thermoplastic Acrylic Resins

8.3.4.2 Thermosetting Acrylic Resins

8.3.5 Historic and Forecasted Market Size by Chemical Composition

8.3.5.1 Pure Acrylic Resins

8.3.5.2 Modified Acrylic Resins

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Paints & Coatings

8.3.6.2 Adhesives & Sealants

8.3.6.3 Construction Materials

8.3.6.4 Textiles & Fabrics

8.3.6.5 Paper & Paperboard Coatings

8.3.6.6 Plastics & Composites

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Acrylic Resins Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Thermoplastic Acrylic Resins

8.4.4.2 Thermosetting Acrylic Resins

8.4.5 Historic and Forecasted Market Size by Chemical Composition

8.4.5.1 Pure Acrylic Resins

8.4.5.2 Modified Acrylic Resins

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Paints & Coatings

8.4.6.2 Adhesives & Sealants

8.4.6.3 Construction Materials

8.4.6.4 Textiles & Fabrics

8.4.6.5 Paper & Paperboard Coatings

8.4.6.6 Plastics & Composites

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Acrylic Resins Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Thermoplastic Acrylic Resins

8.5.4.2 Thermosetting Acrylic Resins

8.5.5 Historic and Forecasted Market Size by Chemical Composition

8.5.5.1 Pure Acrylic Resins

8.5.5.2 Modified Acrylic Resins

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Paints & Coatings

8.5.6.2 Adhesives & Sealants

8.5.6.3 Construction Materials

8.5.6.4 Textiles & Fabrics

8.5.6.5 Paper & Paperboard Coatings

8.5.6.6 Plastics & Composites

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Acrylic Resins Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Thermoplastic Acrylic Resins

8.6.4.2 Thermosetting Acrylic Resins

8.6.5 Historic and Forecasted Market Size by Chemical Composition

8.6.5.1 Pure Acrylic Resins

8.6.5.2 Modified Acrylic Resins

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Paints & Coatings

8.6.6.2 Adhesives & Sealants

8.6.6.3 Construction Materials

8.6.6.4 Textiles & Fabrics

8.6.6.5 Paper & Paperboard Coatings

8.6.6.6 Plastics & Composites

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Acrylic Resins Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Thermoplastic Acrylic Resins

8.7.4.2 Thermosetting Acrylic Resins

8.7.5 Historic and Forecasted Market Size by Chemical Composition

8.7.5.1 Pure Acrylic Resins

8.7.5.2 Modified Acrylic Resins

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Paints & Coatings

8.7.6.2 Adhesives & Sealants

8.7.6.3 Construction Materials

8.7.6.4 Textiles & Fabrics

8.7.6.5 Paper & Paperboard Coatings

8.7.6.6 Plastics & Composites

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Acrylic Resins Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 22.09 Bn. |

|

Forecast Period 2024-35 CAGR: |

4.2 % |

Market Size in 2035: |

USD 34.73 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Chemical Composition |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||