Acinetobacter Pneumonia Therapeutics Market Synopsis

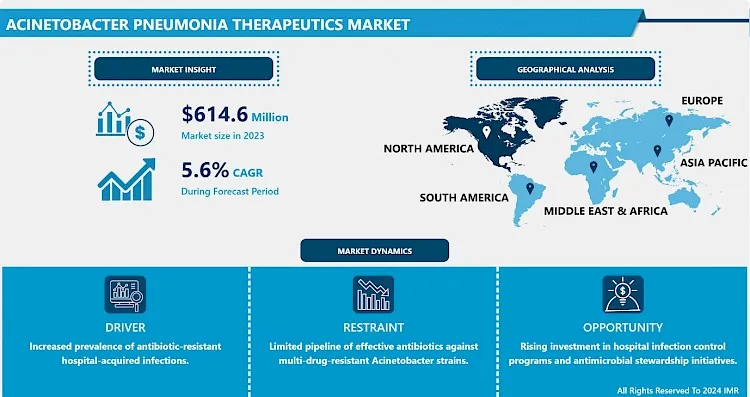

Acinetobacter Pneumonia Therapeutics Market Size Was Valued at USD 614.6 Million in 2023, and is Projected to Reach USD 1003.6 Million by 2032, Growing at a CAGR of 5.6% From 2024-2032.

The scope of this market defines the Acinetobacter pneumonia therapeutics as the complete spectrum of pharmaceutical and therapeutic solutions designed to address the disease resulting from the Acinetobacter genus of bacterial pneumonia. Popular for being resistant to several drugs Acinetobacter is a priority pathogen especially in the healthcare related infections, mainly causing severe respiratory tract infections to immunocompromised patients. Currently, available treatment includes both antibiotics and newer antimicrobials as well as other treatment strategies to treat infection and enhance patient outcomes while addressing the issue of increasing DRSP strains.

- The market for therapeutics of Acinetobacter pneumonia is led by the growth in the number of patients suffering from HAIs; this has raised the need for specific drugs for the illness. Of these organisms, Acinetobacter spp, especially A. baumannii, have emerged as important pathogens associated with hospital-acquired pneumonia and with increasing antibiotic resistance. These infections prove persistent laden on the backdrop that the bacteria develop variations that render the use of aggregate carbapenem futile. The increased demand for efficient therapeutic interventions is stimulating scientific and technological processes in both state and commercial healthcare systems. The companies are now working on the continuing discovery and development of the novel antimicrobials as well as combination therapy to overcome this pathogen as it is hardly adaptable to the hospital settings.

- The global healthcare industry is under tremendous pressure to respond to issues with antibiotic resistance of pathogens and Acinetobacter pneumonia, fits well into this category within infectious disease research. Therefore, any programs aimed at controlling MDRO infections are being infused with cash and support, both by state organizations and healthcare systems. Prospective control methods that are currently under investigation but which are potentially more suitable than standard antibiotics can be categorized as immunomodulatory and antimicrobial agents. This emphasis on new treatment modalities should continue to drive the Acinetobacter pneumonia therapeutics market ahead, especially as the medical community looks for treatment and prevention of transmission of resistant strains in the hospital.

Acinetobacter Pneumonia Therapeutics Market Trend Analysis

Growing Investment in Antibiotic Resistance Research

- One essential prominent concept in the management of the Acinetobacter pneumonia is antibiotic resistance. Since WHO and other international organizations have recognized antimicrobial resistance as a major health threat, governments and private organizations have been providing increased financial support to work on the discovery of new antibiotics and other viable treatment for infection that have become resistant. The global pharmaceutical companies, in conjunction with governments and health institutions, are investing a lot of effort and capital on emerging life-threatening resistant strains, including Acinetobacter baumannii. The use of bacteriophage therapy, immunotherapy, and nanoantibiotics is proposed as new directions of treatment that cannot be considered as antibiotics.

- This can be explained by the latter development in recent advances in both biotechnology and gene editing, making a more targeted attack on pathogens without killing helpful bacteria. While such executives seek out these higher state solutions, there are expectations that better therapies are slowly going to appear in the market in form of new therapies that will alter the shape of Acinetobacter pneumonia treatment.

Expanding Demand for Hospital Infection Control Programs

- That Acinetobacter infection is becoming more widespread and many of these infections are acquired during hospital stays make this market inviting to develop.. Hospitals and healthcare facilities across the global are enhancing measures on infection control and prevention and introducing new therapeutic antibiotics targeting drug resistant bacteria. This has made the Acinetobacter species a focus of therapeutic development as the clinicians battle to reducing the incidence of these infections in clinical facilities. The formation and improvements in broader antimicrobial stewardships are also another favorable environment for therapeutic progress in managing Acinetobacter pneumonia.

Acinetobacter Pneumonia Therapeutics Market Segment Analysis:

Acinetobacter Pneumonia Therapeutics Market is segmented on the basis of type, application.

By Drug, Xacduro segment is expected to dominate the market during the forecast period

- Of the two main regions in the Acinetobacter pneumonia therapeutics market, the Xacduro segment is expected to maintain a dominating position throughout the forecast period due to its versatility in the treatment of MDR infections. Xacduro is a new agent to treat pneumonia with sulbactam and durlobactam to fight against Acinetobacter baumannii, which is a well-known, multi-drug-resistant pathogen responsible for hospital-acquired pneumonia. Its action is two shaped and restricts bacterial growth and puts a stop to enzyme production by the bacteria hence making it a viable option. This global sketch answers the paramount requirement for selective medications in healthcare sectors where Acinetobacter related diseases reign and are hard to manage. This community believes that post-approval, authorization, and uptake of Xacduro will grow due to its applications to severe drug-resistant infection markets that specialized therapeutic providers are adopting.

By Application, Oral segment expected to held the largest share

- Based on application, the oral segment is expected to form the biggest part of the Acinetobacter pneumonia therapeutics market mainly because most patients prefer oral dosage. The use of oral therapeutics is highly useful in the outpatient and the long-term management of the diseased patient since it is far less invasive than most intravenous treatments. This mode of administration has the advantage of increased coverage, since patients may take the treatments in their homes and, therefore, shorter hospitalization and overall health care expenditures. Self-medication has also kept increasing for the other formulations and has also put pressure on manufacturers to enhance the oral formulations and their absorptions and bioavailability. Therefore, due to the very applicability and convenience of the oral segment and its preferable carrying out, it is expected to remain the market leader in the forecast period.

Acinetobacter Pneumonia Therapeutics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- By 2023, the Acinetobacter pneumonia therapeutics market in North America shall outweigh others due to high prevalence of infection, well-developed healthcare system and strong market research for antibiotic-resistant pathogens. The United States has been more aggressive in fighting antibiotic-resistant infections than many other countries since it has a robust government to support and fund the growth of healthcare solutions. Some information show that North America can occupy over 40% of market share in the Acinetobacter pneumonia therapeutics market around the globe. This stronghold is associated with advanced healthcare system, high hospitalization rate, the specialised grossly developed pharmaceutical market for antibiotics and related drugs, and the high amount of hospital acquired infections.

Active Key Players in the Acinetobacter Pneumonia Therapeutics Market

- Abbott Laboratories (USA)

- AstraZeneca (UK)

- Basilea Pharmaceutica Ltd. (Switzerland)

- Cipla Limited (India)

- Entasis Therapeutics (USA)

- GlaxoSmithKline plc (UK)

- Johnson & Johnson (USA)

- Melinta Therapeutics (USA)

- Merck & Co., Inc. (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Roche Holding AG (Switzerland)

- Sanofi (France)

- Shionogi & Co., Ltd. (Japan)

- Venatorx Pharmaceuticals, Inc. (USA), Other key Players.

|

Global Acinetobacter Pneumonia Therapeutics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 614.6 Million |

|

Forecast Period 2024-32 CAGR: |

5.6 % |

Market Size in 2032: |

USD 1003.6 Million |

|

Segments Covered: |

By Drug Class |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Acinetobacter Pneumonia Therapeutics Market by Drug Class (2018-2032)

4.1 Acinetobacter Pneumonia Therapeutics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Xacduro

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polymyxins

4.5 Cephalosporins

4.6 Carbapenems

Chapter 5: Acinetobacter Pneumonia Therapeutics Market by Application (2018-2032)

5.1 Acinetobacter Pneumonia Therapeutics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Parenteral

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Acinetobacter Pneumonia Therapeutics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT LABORATORIES (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ASTRAZENECA (UK)

6.4 BASILEA PHARMACEUTICA LTD. (SWITZERLAND)

6.5 CIPLA LIMITED (INDIA)

6.6 ENTASIS THERAPEUTICS (USA)

6.7 GLAXOSMITHKLINE PLC (UK)

6.8 JOHNSON & JOHNSON (USA)

6.9 MELINTA THERAPEUTICS (USA)

6.10 MERCK & COINC. (USA)

6.11 NOVARTIS AG (SWITZERLAND)

6.12 PFIZER INC. (USA)

6.13 ROCHE HOLDING AG (SWITZERLAND)

6.14 SANOFI (FRANCE)

6.15 SHIONOGI & COLTD. (JAPAN)

6.16 VENATORX PHARMACEUTICALS INC. (USA)

6.17 OTHER KEY PLAYERS

Chapter 7: Global Acinetobacter Pneumonia Therapeutics Market By Region

7.1 Overview

7.2. North America Acinetobacter Pneumonia Therapeutics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Drug Class

7.2.4.1 Xacduro

7.2.4.2 Polymyxins

7.2.4.3 Cephalosporins

7.2.4.4 Carbapenems

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Oral

7.2.5.2 Parenteral

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Acinetobacter Pneumonia Therapeutics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Drug Class

7.3.4.1 Xacduro

7.3.4.2 Polymyxins

7.3.4.3 Cephalosporins

7.3.4.4 Carbapenems

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Oral

7.3.5.2 Parenteral

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Acinetobacter Pneumonia Therapeutics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Drug Class

7.4.4.1 Xacduro

7.4.4.2 Polymyxins

7.4.4.3 Cephalosporins

7.4.4.4 Carbapenems

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Oral

7.4.5.2 Parenteral

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Acinetobacter Pneumonia Therapeutics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Drug Class

7.5.4.1 Xacduro

7.5.4.2 Polymyxins

7.5.4.3 Cephalosporins

7.5.4.4 Carbapenems

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Oral

7.5.5.2 Parenteral

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Acinetobacter Pneumonia Therapeutics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Drug Class

7.6.4.1 Xacduro

7.6.4.2 Polymyxins

7.6.4.3 Cephalosporins

7.6.4.4 Carbapenems

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Oral

7.6.5.2 Parenteral

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Acinetobacter Pneumonia Therapeutics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Drug Class

7.7.4.1 Xacduro

7.7.4.2 Polymyxins

7.7.4.3 Cephalosporins

7.7.4.4 Carbapenems

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Oral

7.7.5.2 Parenteral

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Acinetobacter Pneumonia Therapeutics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 614.6 Million |

|

Forecast Period 2024-32 CAGR: |

5.6 % |

Market Size in 2032: |

USD 1003.6 Million |

|

Segments Covered: |

By Drug Class |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Acinetobacter Pneumonia Therapeutics Market research report is 2024-2032.

Pfizer Inc. (USA), GlaxoSmithKline plc (UK), Merck & Co., Inc. (USA), Cipla Limited (India), AstraZeneca (UK) and Other Major Players.

The Acinetobacter Pneumonia Therapeutics Market is segmented into Type, Application, and region. By Type, the market is categorized into Xacduro, Polymyxins, Cephalosporins, Carbapenems. By Application, the market is categorized into Oral, Parenteral. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The scope of this market defines the Acinetobacter pneumonia therapeutics as the complete spectrum of pharmaceutical and therapeutic solutions designed to address the disease resulting from the Acinetobacter genus of bacterial pneumonia. Popular for being resistant to several drugs Acinetobacter is a priority pathogen especially in the healthcare related infections, mainly causing severe respiratory tract infections to immunocompromised patients. Currently, available treatment includes both antibiotics and newer antimicrobials as well as other treatment strategies to treat infection and enhance patient outcomes while addressing the issue of increasing DRSP strains.

Acinetobacter Pneumonia Therapeutics Market Size Was Valued at USD 614.6 Million in 2023, and is Projected to Reach USD 1003.6 Million by 2032, Growing at a CAGR of 5.6% From 2024-2032.