Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Overview

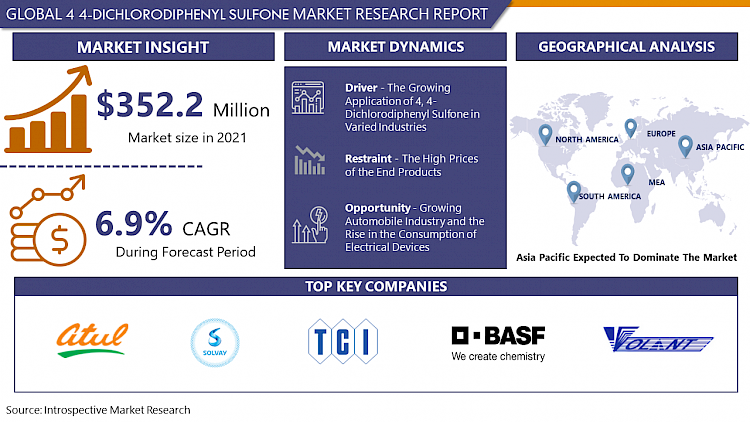

Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market was valued at USD 325.2 million in 2021 and is expected to reach USD 518.8 million by the year 2028, at a CAGR of 6.9%.

4,4-Dichlorodiphenyl Sulfone (DCDPS), is a monomer utilized for the production of polysulfones (PES) through various polymerization methods. 4,4-Dichlorodiphenyl Sulfone (DCDPS) derived polysulfones have unique characteristics such as high transparency and high-temperature performance which makes them suitable replacements for glass and metals in a wide range of automotive, aerospace, medical, and consumer products. Moreover, DCDPS, or 4,4-Dichlorodiphenyl Sulfone (DCDPS), is a solid organic compound having molecular formula (C12H8Cl2O2S) and is in crystal or powder form. In addition, it is white. The rapid urbanization and the growing usage of electrical equipment, medical devices, and automobiles have compelled manufacturers to adopt polysulfones to decrease the stress on the natural sources of metals.

4,4-dichloro diphenyl sulfone (DCDPS) is essential as a starting material required for the production of polysulfones and polyethersulfones. Polysulfones and polyethersulfones are a family of thermoplastics called engineering plastics and are utilized in applications operating at high temperatures. Moreover, polysulfones are incorporated to manufacture medical equipment (nebulizers and dialysis components), automobile parts (steering column lock switches, relay insulators, and pistons), appliances (Coffee makers, humidifiers, and microwave ovens), and electrical devices (television components and capacitor film) thus, the wide usage of polysulfones is spurring the development of the market in the forecast period.

COVID-19 Impact on 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market

The automobile sector is the prominent purchaser of polysulfone however, the COVID-19 pandemic has adversely impacted the global automobile industry, and owing to this, there is a significant decline in the demand for polysulfone. Moreover, the restriction imposed on imports and exports resulted in a shortage of 4,4-Dichlorodiphenyl Sulfone (DCDPS) which negatively impacted the production of automobiles and electronics devices. DCDPS have proven their worth in medical devices. The usage of 4,4-Dichlorodiphenyl Sulfones in medical devices enhances their durability against various disinfectants. Amid the COVID-19 pandemic, the demand for polysulfones has gradually increased owing to their higher stability at high temperatures.

Market Dynamics And Key Factors In 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market

Drivers:

High transparency, high-temperature performance, lightweight, and the capability to replace material are the unique features offered by 4,4-Dichlorodiphenyl Sulfone (DCDPS) and its derivative. Moreover, when utilized in composites for automotive, 4,4′-Dichlorodiphenyl Sulfone (DCDPS) helps create light-weighting. Light weighting is a trending concept in the automotive industry that emphasizes manufacturing vehicles that are not heavy. In addition, utilization of lightweight materials such as engineered plastics puts less strain on the engine thus, optimizing handling and better gas mileage. Furthermore, this benefit can also be applied within the Electro Mobility (or e-Mobility) industry thus, strengthening the expansion of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market during the forecast period.

4,4′-Dichlorodiphenyl Sulfone (DCDPS) is the prominent monomer for polysulfones that are utilized in composites in aerospace that helps in reducing weight and enhances thermostability. DCDPS is incorporated in structural components within the aerospace industry. Polysulfones are used over steel parts, or aluminum as the material is substantially lighter and durable. Moreover, usage of high-performance thermoplastics in aviation can significantly reduce costs and extend flight range thus, supporting the development of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market in the forecast period.

Dapsone-derived product of diphenyl sulfone is active against a broad spectrum of bacteria, majorly employed for its actions against Mycobacterium leprae, and is administered as part of the multidrug systematic plan in the treatment of all forms of leprosy. Furthermore, it has a role as an antimalarial, a leprostatic drug, an anti-infective agent, and an anti-inflammatory drug. Furthermore, Dichlorodiphenyltrichloroethane (DDT), a derivative of DCDPS is a potent insecticide for the Musca nebulo, a common Indian housefly. DCDPS are also been utilized in reactive dyes in the textile industry, and for such applications, 4,4'- Dichlorodiphenyl sulfone that is substantially free of 2,4' and 3,4' Dichlorodiphenyl sulfone is required thus, the wide applications of DCDPS are promoting the expansion of 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market over the projected period.

Restraints:

The high prices of the end products obtained by the polymerization of 4,4-Dichlorodiphenyl Sulfone (DCDPS) are the main factor restraining the growth of the market in the forecast period. The process involved in the manufacturing of polysulfones is sophisticated and requires multiple processes to obtain the pure form. Moreover, the decomposition of polysulfones is difficult and it may end up in the oceans, harming the natural flora and fauna of the environment thus, restricting the usage of 4,4-Dichlorodiphenyl Sulfone (DCDPS) during the forecast period.

Opportunities:

The growing automobile industry and the rise in the consumption of electrical devices is a profitable opportunity for the market players involved in the production of 4,4-Dichlorodiphenyl Sulfone (DCDPS) and its derivative. Moreover, the growing technological advancement to reduce the weight of aircraft and automobiles to increase their life expectancy and durability is stimulating automobile manufacturers to incorporate the usage of DCDPS. The growing population and the rise in disease outbreaks have forced governments to enhance the healthcare sector thus, the utilization of polysulfones in manufacturing medical devices has increased. Furthermore, the rise in the per capita income has resulted in the increased expenditure on consumer appliances such as coffee machines, humidifiers, microwave ovens, and televisions. Moreover, the growing fundings for research activities to develop more advanced polysulfones and polyethersulfones by governments and private organizations is offering lucrative opportunities for the market players.

Market Segmentation

Segmentation Analysis of 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market:

Depending on Grade, the 4,4-Dichlorodiphenyl Sulfone (DCDPS) market is segmented into industry and pharma. The industry segment is anticipated to have the highest share of the market during the forecast period. The rapid growth in the automotive, and aerospace industry has forced manufacturers to find alternative ways to reduce the weight of the vehicles without tampering with their strength. Moreover, the derivatives of 4,4-Dichlorodiphenyl Sulfone (DCDPS) such as polysulfones and polyethersulfones are utilized for the manufacturing of lightweight and thermoplastic components that are incorporated in vehicles and airplanes. Furthermore, polysulfones provide durability and rigidity akin to steel and aluminum which can be utilized to manufacture electrical and other household appliances, thus stimulating the growth of the industry segment in the forecast period.

Depending on the Application, the 4,4-Dichlorodiphenyl Sulfone (DCDPS) market is segmented into engineered plastics and pharmaceutical drugs. The engineered plastics segment is expected to lead the market in the projected period. The growing usage of electrical appliances, automobiles, and medical equipment has put a strain on the natural sources of steel and aluminum. The usage of polysulfones to manufacture components that can replace steel is rising. Polysulfones are resistant to high temperatures thus, making them suitable alternatives for the production of specific components of electrical, medical, and automotive devices. Moreover, lightweight engineered plastics incorporated in automobiles reduced the strain on the engine and provides better gas mileage as well improved handling thus, driving the expansion of this segment in the estimated timespan.

Regional Analysis of 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market:

Depending on the region, the Asia-pacific region is anticipated to have the highest share of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market during the forecast period. The growing usage of DCDPS in the automotive, electrical, and electronics industries is the main factor driving the expansion of the market in this region. China is estimated to be the largest market and India is forecasted to be the fastest-growing country in this region. Moreover, the rise in the manufacturing of semiconductors and the increasing exports of consumer appliances is further stimulating the development of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market in this region. Furthermore, one of the vital usages of DCDPS made by the countries in this region is for the treatment of leprosy.

The European region is expected to show a significant growth rate attributed to the large presence of the automobile industry. Germany is the major country contributing to the expansion of the 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market in this region. Moreover, many premium car manufacturing companies are headquartered in Germany. The growing usage of DCDPS as engineered plastic to reduce the weight of the vehicles is accelerating the growth of the market in this region.

The North American region is forecasted to show a positive growth rate due to the advancement in automobile technology to manufacture lightweight vehicles. The advancement in aviation technology and the increasing usage of electronic devices are further strengthening the expansion of the market in this region.

Players Covered in 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market are:

- Aarti Industries Ltd. (India)

- Atul Ltd (India)

- Banchem Intermediates (India)

- Jiujiang Zhongxing Medicine Chemical Co. Ltd.

- Solvay S.A (Belgium)

- TCI Chemicals Private Limited (India)

- Nantong VolantChem Corp. (China)

- Huai'an Shengli Materials Co. Ltd. (China)

- Vertellus Holdings Inc. (US)

- BASF SE (Germany)

- Jiangmen Youju (China)

- Sino Polymer (China) and Others major players.

Recent Developments In 4,4-Dichlorodiphenyl Sulfone (DCDPS) Market

- In February 2021, Solvay announced the result of a joint study conducted with Metrex, a manufacturer of broad-spectrum disinfection products. The study was focused on illustrating, the chemical resistance of high-performance polymer manufactured by Solvay. The results revealed that six products of Solvay meet all the performance criteria for retention of impact strength, tensile strength, and color after continuous exposure to Metrex disinfectants.

- In September 2021, Solvay declared the completion of its installation of new thermoplastic composites (TPC) manufacturing plant at the Greenville site. With the full operational activities of this new facility, it will add more than 30 positions at the 27,000-square-foot facility. The TPC solutions manufactured in this Greenville facility will aid energy, aerospace and automotive clients achieve improved environmental responsibility by manufacturing cars and planes lighter, thus reducing pollution.

|

Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 325.2 Mn. |

|

Forecast Period 2022-28 CAGR: |

6.9% |

Market Size in 2028: |

USD 518.8 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Grade

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market by Grade

5.1 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Overview Snapshot and Growth Engine

5.2 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Overview

5.3 Industry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Industry: Grographic Segmentation

5.4 Pharma

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pharma: Grographic Segmentation

Chapter 6: 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market by Application

6.1 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Overview Snapshot and Growth Engine

6.2 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Overview

6.3 Engineered Plastics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Engineered Plastics: Grographic Segmentation

6.4 Pharmaceutical Drug

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Pharmaceutical Drug: Grographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 4 4-Dichlorodiphenyl Sulfone (DCDPS) Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 4 4-Dichlorodiphenyl Sulfone (DCDPS) Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 4 4-Dichlorodiphenyl Sulfone (DCDPS) Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 AARTI INDUSTRIES LTD.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 ATUL LTD

7.4 BANCHEM INTERMEDIATES

7.5 JIUJIANG ZHONGXING MEDICINE CHEMICAL CO. LTD.

7.6 SOLVAY S.A

7.7 TCI CHEMICALS PRIVATE LIMITED

7.8 NANTONG VOLANTCHEM CORP.

7.9 HUAI'AN SHENGLI MATERIALS CO. LTD.

7.10 VERTELLUS HOLDINGS INC.

7.11 BASF SE

7.12 JIANGMEN YOUJU

7.13 SINO POLYMER

7.14 OTHER MAJOR PLAYERS

Chapter 8: Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Grade

8.2.1 Industry

8.2.2 Pharma

8.3 Historic and Forecasted Market Size By Application

8.3.1 Engineered Plastics

8.3.2 Pharmaceutical Drug

8.3.3 Others

Chapter 9: North America 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Grade

9.4.1 Industry

9.4.2 Pharma

9.5 Historic and Forecasted Market Size By Application

9.5.1 Engineered Plastics

9.5.2 Pharmaceutical Drug

9.5.3 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Grade

10.4.1 Industry

10.4.2 Pharma

10.5 Historic and Forecasted Market Size By Application

10.5.1 Engineered Plastics

10.5.2 Pharmaceutical Drug

10.5.3 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Grade

11.4.1 Industry

11.4.2 Pharma

11.5 Historic and Forecasted Market Size By Application

11.5.1 Engineered Plastics

11.5.2 Pharmaceutical Drug

11.5.3 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Grade

12.4.1 Industry

12.4.2 Pharma

12.5 Historic and Forecasted Market Size By Application

12.5.1 Engineered Plastics

12.5.2 Pharmaceutical Drug

12.5.3 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Grade

13.4.1 Industry

13.4.2 Pharma

13.5 Historic and Forecasted Market Size By Application

13.5.1 Engineered Plastics

13.5.2 Pharmaceutical Drug

13.5.3 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 325.2 Mn. |

|

Forecast Period 2022-28 CAGR: |

6.9% |

Market Size in 2028: |

USD 518.8 Mn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET COMPETITIVE RIVALRY

TABLE 005. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET THREAT OF SUBSTITUTES

TABLE 007. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET BY GRADE

TABLE 008. INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 009. PHARMA MARKET OVERVIEW (2016-2028)

TABLE 010. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET BY APPLICATION

TABLE 011. ENGINEERED PLASTICS MARKET OVERVIEW (2016-2028)

TABLE 012. PHARMACEUTICAL DRUG MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY GRADE (2016-2028)

TABLE 015. NORTH AMERICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY APPLICATION (2016-2028)

TABLE 016. N 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY GRADE (2016-2028)

TABLE 018. EUROPE 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY APPLICATION (2016-2028)

TABLE 019. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY GRADE (2016-2028)

TABLE 021. ASIA PACIFIC 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY APPLICATION (2016-2028)

TABLE 022. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY GRADE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY APPLICATION (2016-2028)

TABLE 025. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY GRADE (2016-2028)

TABLE 027. SOUTH AMERICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY APPLICATION (2016-2028)

TABLE 028. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET, BY COUNTRY (2016-2028)

TABLE 029. AARTI INDUSTRIES LTD.: SNAPSHOT

TABLE 030. AARTI INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 031. AARTI INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 032. AARTI INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. ATUL LTD: SNAPSHOT

TABLE 033. ATUL LTD: BUSINESS PERFORMANCE

TABLE 034. ATUL LTD: PRODUCT PORTFOLIO

TABLE 035. ATUL LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BANCHEM INTERMEDIATES: SNAPSHOT

TABLE 036. BANCHEM INTERMEDIATES: BUSINESS PERFORMANCE

TABLE 037. BANCHEM INTERMEDIATES: PRODUCT PORTFOLIO

TABLE 038. BANCHEM INTERMEDIATES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. JIUJIANG ZHONGXING MEDICINE CHEMICAL CO. LTD.: SNAPSHOT

TABLE 039. JIUJIANG ZHONGXING MEDICINE CHEMICAL CO. LTD.: BUSINESS PERFORMANCE

TABLE 040. JIUJIANG ZHONGXING MEDICINE CHEMICAL CO. LTD.: PRODUCT PORTFOLIO

TABLE 041. JIUJIANG ZHONGXING MEDICINE CHEMICAL CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. SOLVAY S.A: SNAPSHOT

TABLE 042. SOLVAY S.A: BUSINESS PERFORMANCE

TABLE 043. SOLVAY S.A: PRODUCT PORTFOLIO

TABLE 044. SOLVAY S.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. TCI CHEMICALS PRIVATE LIMITED: SNAPSHOT

TABLE 045. TCI CHEMICALS PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 046. TCI CHEMICALS PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 047. TCI CHEMICALS PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. NANTONG VOLANTCHEM CORP.: SNAPSHOT

TABLE 048. NANTONG VOLANTCHEM CORP.: BUSINESS PERFORMANCE

TABLE 049. NANTONG VOLANTCHEM CORP.: PRODUCT PORTFOLIO

TABLE 050. NANTONG VOLANTCHEM CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. HUAI'AN SHENGLI MATERIALS CO. LTD.: SNAPSHOT

TABLE 051. HUAI'AN SHENGLI MATERIALS CO. LTD.: BUSINESS PERFORMANCE

TABLE 052. HUAI'AN SHENGLI MATERIALS CO. LTD.: PRODUCT PORTFOLIO

TABLE 053. HUAI'AN SHENGLI MATERIALS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. VERTELLUS HOLDINGS INC.: SNAPSHOT

TABLE 054. VERTELLUS HOLDINGS INC.: BUSINESS PERFORMANCE

TABLE 055. VERTELLUS HOLDINGS INC.: PRODUCT PORTFOLIO

TABLE 056. VERTELLUS HOLDINGS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. BASF SE: SNAPSHOT

TABLE 057. BASF SE: BUSINESS PERFORMANCE

TABLE 058. BASF SE: PRODUCT PORTFOLIO

TABLE 059. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. JIANGMEN YOUJU: SNAPSHOT

TABLE 060. JIANGMEN YOUJU: BUSINESS PERFORMANCE

TABLE 061. JIANGMEN YOUJU: PRODUCT PORTFOLIO

TABLE 062. JIANGMEN YOUJU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. SINO POLYMER: SNAPSHOT

TABLE 063. SINO POLYMER: BUSINESS PERFORMANCE

TABLE 064. SINO POLYMER: PRODUCT PORTFOLIO

TABLE 065. SINO POLYMER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 066. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 067. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 068. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY GRADE

FIGURE 012. INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 013. PHARMA MARKET OVERVIEW (2016-2028)

FIGURE 014. 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY APPLICATION

FIGURE 015. ENGINEERED PLASTICS MARKET OVERVIEW (2016-2028)

FIGURE 016. PHARMACEUTICAL DRUG MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA 4 4-DICHLORODIPHENYL SULFONE (DCDPS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market research report is 2022-2028.

Aarti Industries Ltd. (India), Atul Ltd (India), Banchem Intermediates (India), Jiujiang Zhongxing Medicine Chemical Co. Ltd., Solvay S.A (Belgium), TCI Chemicals Private Limited (India), Nantong VolantChem Corp. (China), Huai'an Shengli Materials Co. Ltd. (China), Vertellus Holdings Inc. (US), BASF SE (Germany), Jiangmen Youju (China), Sino Polymer (China), and other major players.

The 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market is segmented into grade, application, and region. By Grade, the market is categorized into Industry and Pharma. By Application, the market is categorized into Engineered Plastics, Pharmaceutical Drug, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4,4-Dichlorodiphenyl Sulfone (DCDPS) derived polysulfones have unique characteristics such as high transparency and high-temperature performance which makes them suitable replacements for glass and metals in a wide range of automotive, aerospace, medical, and consumer products.

Global 4 4-Dichlorodiphenyl Sulfone (DCDPS) Market was valued at USD 325.2 Million in 2021 and is projected to reach USD 518.8 Million by 2028, growing at a CAGR of 6.9% from 2022 to 2028.