3D Rendering and Visualization Software Market Synopsis

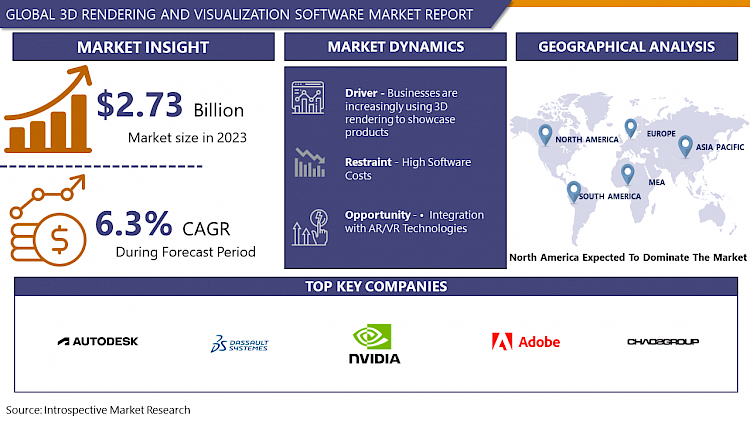

3D Rendering and Visualization Software Market Size Was Valued at USD 2.73 Billion in 2023 and is Projected to Reach USD 14.17 Billion by 2032, Growing at a CAGR of 6.3 % From 2024-2032.

3D rendering software and visualization software are applications that can be installed on a computer to create an illusion of three-dimensional objects or animations using a model of the object or person. Such technologies are used in different industries such as architecture, graphics design, film and game production, product creation, and the creative process. 3D modeling and rendering software makes use of sophisticated algorithms and techniques to replicate shading and shadows and then apply reflections for a real-looking image.

- Specialists can depict their designs in 3D computer visualization technology for customers in the domains of architecture and interior design with photorealistic results. This helps architects visualize structures and locations before constructing starts and allows them to make informed decisions thereby ensuring streamlining the decision-making and communication process.

- Unlike in the real world, rendering software in the game industry today is used to create engaging and lifelike virtual worlds. There, players can interact and explore the surroundings while they also interact with characters which too are rendered as virtual. The most important element in filmmaking is the rendering software which makes the possible appearance of special effects, CGI proceeding, and virtual scenes that are indistinguishable from actual shooting.

- Besides, there are a great number of varieties of 3D rendering and visualisation software that gives their users a wide choice of features to be used for fine-tuning and setting up the needed visual parameters to obtain the desired effects. In addition to using different level of lights and camera angles to add accuracy or contrast, they offer a variety of textures and materials which serve for the purpose of creativity and better visuals.

- Finally, other 3D rendering software programs integrate with different design tools and production pipelines, thus providing convenient import, change, and export options of 3D models in between working environments. Finally, it can be summarized that the technologies of 3D rendering and visualization are leading the way we create, communicate and have a feel of the virtual worlds in different aspects of life.

3D Rendering and Visualization Software Market Trend Analysis

Rising Demand for Immersive Content

- The increasing need for consuming individuals to have immersive experience is a key factor impelling the increase of the revenue of this industry. Increasingly, corporations understand the bottom-line appeal of interactivity and the spectrum from virtual reality (VR) to augmented reality (AR). As more consumers demand the realism of visual fidelity, the demand for providing better visual experiences grows.

- People are now growing more and more determined to see content in various forms for say architecture tours, gaming worlds, or virtual product demonstrations. 3D rendering and visualization technologies cannot be understated in achieving these expectant, since they show the illusion of reality through simulation and environment to let the users be involved in the virtual world.

- While pushing the limits of technology the challenges for creating such immersive entertainment decline. It’s these factors, right? accessibility of 3D modeling tools, strong software processors' and software algorithms that whay the popularity of 3D printing grow.

- Hence, subjects and organizations of different field of industries keenly establish the idea of immersive content to build the interaction of customers, training programs and marketing. The evolution of 3D rendering and visualization software will continue to experience the growing equipments responsible for attracting new customers and building loyal market.

Growth of the Metaverse

- The Metaverse impressively fast growing space creates a significant room for the market of the 3D rendering and visualisation software. The Metaverse is a common virtual shared space developed by the fusion of many physical realities that are supported by the improved virtual world, augmented reality, and the Internet.

- Although the supposedness of the idea and companies make more investments towards creating virtual worlds, the prospects of the demand for up-market 3D rendering and visualization technologies are estimated to grow. Such devices are very important in realizing stunning virtual surroundings, attractive characters of avatars, and diverse web platforms which navigate intuitively.

- Metaverse, a virtual place, does an array of interaction possibilities in the real world; for instance, virtual meetings, e-commerce, education, and entertainment have been included. Softwares that can allow businesses for marking their presence in this virtual world will need to build up their capability of 3D rendering and visualization tools to make sure that their ideas come to life.

- Therefore, software developers are bound to innovate, develop new products and opportunities to specifications in order to meet the Metaverse requirements which will further drive the growth of the market. In another way the Metaverse is just a new level of obtaining digital comradeship and commerce and 3D rendering and visualization techniques will be one of the major supporters of such world transformation.

3D Rendering and Visualization Software Market Segment Analysis:

3D Rendering and Visualization Software Market Segmented based on Deployment, Applications and Industry.

By Deployment, 2-Bay segment is expected to dominate the market during the forecast period

- As a matter of fact, the use of cloud deployment rather dominates, in the last few years, the market of 3D Rendering and Visualization software. The cloud-based solutions being used nowadays to replace on premises deployments are causing a lot of companies especially SMEs to sign up to that particular service, and this is the reason why their adopts have generally spiked.

- On the other hand, cloud-based rendering and visualization software is scalable and flexible and it can be switched on/off if the user needs more power. The user can choose a specific project features to increase his capabilities. This scalability is particularly needed in the sector subjected to workload fluctuations or periods of high demand, since it enables faster adjustment of their rendering capacity without any additional hardware infrastructure investments.

- this opportunity is accessed through the use of cloud-based solutions which in turn promotes collaboration and cooperation. The data being stored in cloud computing, makes it possible for geographically distant teams to work collaboratively in real time on 3D projects, having access to and changing documents and materials any time while the internet connection is on.

- Thanks to this level of partnership planning would be faster and communication with other stakeholders would be improved because they have the ability to review and provide input on renderings without going through additional file sharing processes. Additionally, cloud computing and its related rendering systems allow a lot of cloud-based tools and programs to communicate, which comes down to the simplification of workflows or improving interoperability of a large number of related resources.

- The fact that the cloud deployment is currently leading the way in the field of 3D rendering and visualization software can be ascribed to its usability, flexibility, and communication capabilities. All of which highly catered to the dynamic and connected modern world.

- Meanwhile, many businesses, especially those with special security or regulatory requirements would still prefer on-premise option to render their animations. However, the ease and fast delivery of cloud based rendering solutions make it win the hearts of many other customers that in the end cloud based rendering solutions are still dominating the market space.

By End Use, Small and Medium-sized Businesses (SMBs) segment held the largest share

- Among the engaging spaces in the realm of 3D rendering and graphic software, it is the realm of product design and modeling applications that is outstanding. This dominance can be observed from the fact that 3D Rendering is not only the critical part in product development cycle of a lot of industries including automotive, manufacturing, consumer products, and industrial design, but also the most important characteristic of these industries.

- Each and every 3D model created by product designers and engineers, almost always use 3D rendering and modeling technologies in order to simulate complex models and study product functionality before commencing production. This is one of the most noticeable benefits of these tools. They eliminate the need for long trial and error design processes to iterate ideas and significantly reduce the time and cost usually associated with physical prototyping purely for testing and validation purposes.

- As a consequence, the technical aspect of the production has become more complicated, and the required customization of the manufacturing do not turn keeping the pace with the development of the 3D rendering and modeling technologies for product design and modeling. These rendering engines with advanced features like parametric modeling, real-time rendering, and virtual reality are the contributing factors to allowing designers to do creative things, move ideas into virtual testing, and showcase their designs with a high mimicry.

- In addition, with businesses opting for digital transformation and the resulting implementation of novel technologies like additive manufacturing and digital twins, an increased necessity for 3D rendering tools that are highly sophisticated and target product design and modeling applications is expected.

- Even though applications such as 3D modelling, animations, and simulations are mandatory in various fields such as entertainment, training, as well as architectural fields, this segment moves to the first place of 3D rendering & visualization software market because of the importance of 3D modelling and design.

3D Rendering and Visualization Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- There are several reasons which push the application of 3D rendering and visualization software to the North American market which leads to its dominance. Primarily, the region hosts some of the world`s prominent technology firms and programmers who are focused on 3D image creation and visualization. North America is the home site of the giants among the industry like Autodesk, NVIDIA, Adobe, and Unity, and thus, carrying abundant experts and resources to enhance the development of 3D rendering industry there.

- 3D rendering is heavily used by various industries in which it is very crucial, such as entertainment, gaming, architecture, engineering and manufacturing and businesses in the North American region have a significant share in these sectors. Hollywood in thw US which is the epicenter of thw world film industry and highly relies of cutting-edge speciaal effects and animation technologies.

- In a similar manner, being an opinion leader, Silicon Valley is able to concentrate and direct technological innovations such that computer-generated imaging companies and other businesses in related areas compete and collaborate.

- Northern America has a robust structure that supports digital technologies, a dynamic startup system and a diverse economy/workforce, all of which enable its superiority when it comes to 3D rendering and visualization software. Accessibility to next-generation broadband networks, potent computation apparatus, skillful researchers, and R&D facilities enhance North America's authority in this sector.

- The living environment, shaped by the ever-evolving business domain and inclusion of the entrepreneurship spirit, facilitates the emergence of startups and innovators who become the drivers of new technology developments and the ones that bring most of the technological breakthroughs in the 3D rendering and visualization markets.

Active Key Players in the 3D Rendering and Visualization Software Market

- AUTODESK, INC. (UNITED STATES)

- DASSAULT SYSTÈMES SE (FRANCE)

- NVIDIA CORPORATION (UNITED STATES)

- ADOBE INC. (UNITED STATES)

- CHAOS GROUP (BULGARIA)

- TRIMBLE INC. (UNITED STATES)

- LUXION, INC. (UNITED STATES)

- NEXT LIMIT TECHNOLOGIES (SPAIN)

- OTOY INC. (UNITED STATES)

- BLENDER FOUNDATION (NETHERLANDS)

- MAXON COMPUTER GMBH (GERMANY)

- PIXAR ANIMATION STUDIOS (UNITED STATES)

- FOUNDRY (UNITED KINGDOM)

- UNITY TECHNOLOGIES (UNITED STATES)

- WETA DIGITAL (NEW ZEALAND)

- SOLID ANGLE (SPAIN)

- COREL CORPORATION (CANADA)

- KEYSHOT (UNITED STATES)

- THE FOUNDRY VISIONMONGERS LTD. (UNITED KINGDOM)

- ACT-3D B.V. (NETHERLANDS)

- SIDEFX (CANADA)

- ENSCAPE GMBH (GERMANY)

- REDSHIFT RENDERING TECHNOLOGIES INC. (UNITED STATES)

- BENTLEY SYSTEMS, INCORPORATED (UNITED STATES)

- RENDER LEGION S.R.O. (CZECH REPUBLIC)

- VRAY.INFO (BULGARIA)

- ISOTROPIX (FRANCE)

- LIGHTMAP LTD. (UNITED KINGDOM)

- E-ON SOFTWARE (FRANCE)

- OTHER KEY PLAYERS

Key Industry Developments in the 3D Rendering and Visualization Software Market:

- In December 2023, Tech Soft 3D has launched HOOPS Luminate, a new SDK for photo-realistic and real-time rendering. This toolkit offers advanced materials and extensive rendering control, enabling developers to create visually stunning 3D applications. The integration with HOOPS Visualize combines engineering-focused graphics with high-quality renderings. Product Manager Marco Salino highlights the state-of-the-art speed, quality, and realism achieved with this SDK.

- In August 2023, The Khronos Group announces the launch of ANARI 1.0, the first cross-platform 3D rendering engine API, simplifying 3D visualization application development. With implementations from AMD, Intel, and NVIDIA, and an open-source SDK from Khronos, ANARI supports high-level functionality and compatibility with glTF PBR materials. It is integrated into scientific visualization tools like VMD and VTK/ParaView, enhancing access to sophisticated 3D rendering features.

|

Global 3D Rendering and Visualization Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.73 Bn. |

|

Forecast Period 2023-34 CAGR: |

20.1% |

Market Size in 2032: |

USD 14.17 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Applications |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- 3D RENDERING AND VISUALIZATION SOFTWARE MARKET BY DEPLOYMENT (2017-2032)

- 3D RENDERING AND VISUALIZATION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- 3D RENDERING AND VISUALIZATION SOFTWARE MARKET BY APPLICATIONS (2017-2032)

- 3D RENDERING AND VISUALIZATION SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSUMER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCT DESIGN AND MODELING

- ANIMATION

- VISUALIZATION AND SIMULATION

- OTHERS (MARKETING AND SALES)

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- 3D RENDERING AND VISUALIZATION SOFTWARE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AUTODESK, INC. (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DASSAULT SYSTÈMES SE (FRANCE)

- NVIDIA CORPORATION (UNITED STATES)

- ADOBE INC. (UNITED STATES)

- CHAOS GROUP (BULGARIA)

- TRIMBLE INC. (UNITED STATES)

- LUXION, INC. (UNITED STATES)

- NEXT LIMIT TECHNOLOGIES (SPAIN)

- OTOY INC. (UNITED STATES)

- BLENDER FOUNDATION (NETHERLANDS)

- MAXON COMPUTER GMBH (GERMANY)

- PIXAR ANIMATION STUDIOS (UNITED STATES)

- FOUNDRY (UNITED KINGDOM)

- UNITY TECHNOLOGIES (UNITED STATES)

- WETA DIGITAL (NEW ZEALAND)

- SOLID ANGLE (SPAIN)

- COREL CORPORATION (CANADA)

- KEYSHOT (UNITED STATES)

- THE FOUNDRY VISIONMONGERS LTD. (UNITED KINGDOM)

- ACT-3D B.V. (NETHERLANDS)

- SIDEFX (CANADA)

- ENSCAPE GMBH (GERMANY)

- REDSHIFT RENDERING TECHNOLOGIES INC. (UNITED STATES)

- BENTLEY SYSTEMS, INCORPORATED (UNITED STATES)

- RENDER LEGION S.R.O. (CZECH REPUBLIC)

- VRAY.INFO (BULGARIA)

- ISOTROPIX (FRANCE)

- LIGHTMAP LTD. (UNITED KINGDOM)

- E-ON SOFTWARE (FRANCE)

- COMPETITIVE LANDSCAPE

- GLOBAL 3D RENDERING AND VISUALIZATION SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Applications

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global 3D Rendering and Visualization Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.73 Bn. |

|

Forecast Period 2023-34 CAGR: |

20.1% |

Market Size in 2032: |

USD 14.17 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Applications |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET BY TYPE

TABLE 008. STAND-ALONE MARKET OVERVIEW (2016-2028)

TABLE 009. PLUGIN MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET BY DEPLOYMENT MODEL

TABLE 012. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 013. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 014. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET BY APPLICATION

TABLE 015. INDUSTRIAL MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 016. ARCHITECTURE & ENGINEERING MARKET OVERVIEW (2016-2028)

TABLE 017. MEDICAL & HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 021. NORTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 022. N 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 025. EUROPE 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 026. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 029. ASIA PACIFIC 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 030. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 034. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 037. SOUTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 038. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 039. PIXAR: SNAPSHOT

TABLE 040. PIXAR: BUSINESS PERFORMANCE

TABLE 041. PIXAR: PRODUCT PORTFOLIO

TABLE 042. PIXAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. NVIDIA: SNAPSHOT

TABLE 043. NVIDIA: BUSINESS PERFORMANCE

TABLE 044. NVIDIA: PRODUCT PORTFOLIO

TABLE 045. NVIDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. AUTODESK: SNAPSHOT

TABLE 046. AUTODESK: BUSINESS PERFORMANCE

TABLE 047. AUTODESK: PRODUCT PORTFOLIO

TABLE 048. AUTODESK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SOLID ANGLE: SNAPSHOT

TABLE 049. SOLID ANGLE: BUSINESS PERFORMANCE

TABLE 050. SOLID ANGLE: PRODUCT PORTFOLIO

TABLE 051. SOLID ANGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. NEXTLIMIT: SNAPSHOT

TABLE 052. NEXTLIMIT: BUSINESS PERFORMANCE

TABLE 053. NEXTLIMIT: PRODUCT PORTFOLIO

TABLE 054. NEXTLIMIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ROBERT MCNEEL: SNAPSHOT

TABLE 055. ROBERT MCNEEL: BUSINESS PERFORMANCE

TABLE 056. ROBERT MCNEEL: PRODUCT PORTFOLIO

TABLE 057. ROBERT MCNEEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. CEBAS: SNAPSHOT

TABLE 058. CEBAS: BUSINESS PERFORMANCE

TABLE 059. CEBAS: PRODUCT PORTFOLIO

TABLE 060. CEBAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. OTOY: SNAPSHOT

TABLE 061. OTOY: BUSINESS PERFORMANCE

TABLE 062. OTOY: PRODUCT PORTFOLIO

TABLE 063. OTOY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ADVENT: SNAPSHOT

TABLE 064. ADVENT: BUSINESS PERFORMANCE

TABLE 065. ADVENT: PRODUCT PORTFOLIO

TABLE 066. ADVENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. CHAOS GROUP: SNAPSHOT

TABLE 067. CHAOS GROUP: BUSINESS PERFORMANCE

TABLE 068. CHAOS GROUP: PRODUCT PORTFOLIO

TABLE 069. CHAOS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BUNKSPEED(3DS): SNAPSHOT

TABLE 070. BUNKSPEED(3DS): BUSINESS PERFORMANCE

TABLE 071. BUNKSPEED(3DS): PRODUCT PORTFOLIO

TABLE 072. BUNKSPEED(3DS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LUXION(KEYSHOT): SNAPSHOT

TABLE 073. LUXION(KEYSHOT): BUSINESS PERFORMANCE

TABLE 074. LUXION(KEYSHOT): PRODUCT PORTFOLIO

TABLE 075. LUXION(KEYSHOT): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. LUMION: SNAPSHOT

TABLE 076. LUMION: BUSINESS PERFORMANCE

TABLE 077. LUMION: PRODUCT PORTFOLIO

TABLE 078. LUMION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SOLIDIRIS: SNAPSHOT

TABLE 079. SOLIDIRIS: BUSINESS PERFORMANCE

TABLE 080. SOLIDIRIS: PRODUCT PORTFOLIO

TABLE 081. SOLIDIRIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. STAND-ALONE MARKET OVERVIEW (2016-2028)

FIGURE 013. PLUGIN MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY DEPLOYMENT MODEL

FIGURE 016. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 017. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 018. 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 019. INDUSTRIAL MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 020. ARCHITECTURE & ENGINEERING MARKET OVERVIEW (2016-2028)

FIGURE 021. MEDICAL & HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA 3D RENDERING AND VIRTUALIZATION SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the 3D Rendering and Visualization Software Market research report is 2024-2032.

Autodesk, Inc. (United States), Dassault Systèmes SE (France), NVIDIA Corporation (United States), Adobe Inc. (United States), Chaos Group (Bulgaria), Trimble Inc. (United States, Luxion, Inc. (United States), Next Limit Technologies (Spain), OTOY Inc. (United States), Blender Foundation (Netherlands), MAXON Computer GmbH (Germany), Pixar Animation Studios (United States), Foundry (United Kingdom), Unity Technologies (United States), Weta Digital (New Zealand), Solid Angle (Spain), Corel Corporation (Canada), KeyShot (United States), The Foundry Visionmongers Ltd. (United Kingdom), Act-3D B.V. (Netherlands), SideFX (Canada), Enscape GmbH (Germany), Redshift Rendering Technologies Inc. (United States), Bentley Systems, Incorporated (United States), Render Legion s.r.o. (Czech Republic), VRay.info (Bulgaria), Isotropix (France), Lightmap Ltd. (United Kingdom), E-on Software (France) and Other Major Players.

The 3D Rendering and Visualization Software Market is segmented into Deployemnt, Applications, Industry, and region. By Deployment, the market is categorized into On-premises, Cloud. By Applications, the market is categorized into Product Design and Modeling, Animation, Visualization and Simulation, Others (Marketing and Sales). By Industry, the market is categorized into Architecture, Engineering, and Construction, Gaming & Entertainment, Healthcare, Manufacturing & Automotive, Others (Education) By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

3D rendering and visualization software is a digital toolset used to create lifelike images, animations, and interactive experiences from three-dimensional models. It employs advanced algorithms to simulate lighting, textures, shadows, and reflections, producing realistic visual representations of virtual objects and environments. Widely utilized across industries such as architecture, gaming, film production, and product design, this software enables professionals to visualize concepts, communicate ideas effectively, and bring imaginary worlds to life with stunning realism.

3D Rendering and Visualization Software Market Size Was Valued at USD 2.73 Billion in 2023 and is Projected to Reach USD 14.17 Billion by 2032, Growing at a CAGR of 6.3 % From 2024-2032.