1 5-Hexadiene (CAS 592-42-7) Market Synopsis

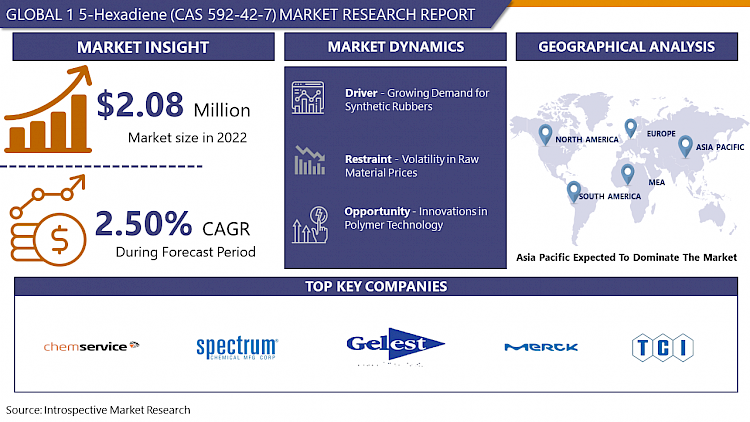

Global 1 5-Hexadiene (CAS 592-42-7) Market Size Was Valued at USD 2.08 Million in 2022, and is Projected to Reach USD 2.53 Million by 2030, Growing at a CAGR of 2.50% From 2023-2030

1,5-Hexadiene (CAS 592-42-7) is a chemical compound characterized by its six-carbon chain structure with two conjugated double bonds. It is commonly used as a monomer in polymerization reactions, particularly in the production of synthetic rubbers and elastomers. Its versatile applications also extend to the synthesis of specialty chemicals like adhesives, coatings, and additives.

- 1,5-Hexadiene (CAS 592-42-7) finds extensive application across various industries due to its unique chemical properties. It serves as a crucial monomer in the polymerization process, especially in the production of synthetic rubbers and elastomers. These materials are essential in industries such as automotive, construction, and manufacturing, where they are used for tire production, seals, gaskets, and other applications requiring flexibility and durability.

- 1,5-Hexadiene lies in its ability to contribute to the formation of polymers with desirable properties. Its structure with two conjugated double bonds allows for the creation of elastomeric materials that exhibit excellent resilience, heat resistance, and mechanical strength. Additionally, 1,5-Hexadiene enables the production of specialty chemicals like adhesives, coatings, and additives, providing versatility and functionality in various industrial applications.

- The increasing demand for synthetic rubbers and specialty chemicals in emerging economies, coupled with ongoing advancements in polymerization technologies, is projected to fuel the demand for 1,5-Hexadiene. Moreover, as industries continue to prioritize innovation, sustainability, and performance, the demand for high-quality elastomers and specialty chemicals derived from 1,5-Hexadiene is likely to experience steady growth, contributing to the overall expansion of the chemical industry.

1 5-Hexadiene (CAS 592-42-7) Market Trend Analysis:

Growing Demand for Synthetic Rubbers

- The growing demand for synthetic rubbers stands out as a major driver propelling the growth of the 1,5-Hexadiene (CAS 592-42-7) market. Synthetic rubbers are widely used in various industries such as automotive, construction, and manufacturing due to their excellent resilience, durability, and chemical resistance. 1,5-Hexadiene plays a crucial role in the production of these synthetic rubbers as it serves as a key monomer in polymerization reactions.

- 1,5-Hexadiene is its ability to contribute to the formation of elastomeric materials with desirable properties. These synthetic rubbers find applications in tire manufacturing, seals, gaskets, and other components where flexibility, strength, and heat resistance are essential. As industries continue to rely on synthetic rubbers for their versatile properties and wide-ranging applications, the demand for 1,5-Hexadiene as a critical raw material is expected to grow significantly.

- The robust growth in automotive, construction, and manufacturing sectors further fuels the demand for synthetic rubbers, thereby driving the market for 1,5-Hexadiene. Moreover, ongoing advancements in polymerization technologies and the increasing emphasis on high-performance materials contribute to the rising demand for 1,5-Hexadiene. As a result, manufacturers and suppliers of 1,5-Hexadiene are poised to benefit from the growing market opportunities presented by the expanding demand for synthetic rubbers in various industries.

Innovations in Polymer Technology

- Innovations in polymer technology present a significant opportunity for driving the growth of the 1,5-Hexadiene (CAS 592-42-7) market. Polymer technology advancements encompass various aspects such as synthesis methods, polymerization techniques, and material engineering, all of which contribute to the development of high-performance polymers and elastomers. 1,5-Hexadiene plays a crucial role in this context as it serves as a key monomer in the production of specialized polymers with desirable properties.

- 1,5-Hexadiene in polymer technology innovations is its ability to contribute to the creation of elastomeric materials that exhibit excellent resilience, flexibility, and mechanical strength. Innovations in polymerization processes, catalysts, and molecular design enable the customization of polymer structures to meet specific application requirements, leading to enhanced performance and functionality. This opens up opportunities for the development of advanced materials for various industries, including automotive, construction, and consumer goods.

- The continuous evolution of polymer technology drives the demand for raw materials like 1,5-Hexadiene. Manufacturers and researchers are exploring novel polymerization methods, sustainable production processes, and bio-based materials, creating new avenues for 1,5-Hexadiene applications. As industries strive for innovation, sustainability, and performance improvement, the demand for specialized polymers and elastomers derived from 1,5-Hexadiene is expected to grow, driving the overall expansion of the 1,5-Hexadiene market.

1 5-Hexadiene (CAS 592-42-7) Market Segment Analysis:

1 5-Hexadiene (CAS 592-42-7) Market Segmented on the basis of Grade, Application, and End-User.

By End-User, Automotive segment is expected to dominate the market during the forecast period

- The Automotive segment is expected to dominate the growth of the 1,5-Hexadiene (CAS 592-42-7) market. This dominance is attributed to the extensive use of synthetic rubbers and elastomers derived from 1,5-Hexadiene in the automotive industry. These materials are essential for manufacturing tires, seals, gaskets, hoses, and other components that require excellent resilience, durability, and chemical resistance.

- The increasing production and sales of vehicles globally contribute to the demand for 1,5-Hexadiene-based synthetic rubbers. With the automotive sector emphasizing performance, safety, and environmental sustainability, there is a growing preference for high-quality elastomeric materials that can withstand harsh operating conditions and improve overall vehicle performance. As a result, manufacturers of 1,5-Hexadiene are witnessing significant opportunities in supplying raw materials to the automotive industry and catering to the evolving needs of automotive manufacturers and suppliers.

By Application, Nylon Intermediates segment held the largest share of 46.75% in 2022

- The nylon intermediates segment has secured the largest share in driving the growth of the 1,5-Hexadiene (CAS 592-42-7) market. This dominance is attributed to the significant use of 1,5-Hexadiene as a key raw material in the production of nylon 6,6, a type of synthetic polymer widely used in various industries. Nylon 6,6 finds applications in automotive components, textiles, industrial materials, and consumer goods due to its strength, durability, and chemical resistance.

- Furthermore, the demand for nylon intermediates, including 1,5-Hexadiene, is driven by the growth of end-use industries such as automotive manufacturing, textiles, and engineering plastics. The versatility and performance characteristics of nylon 6,6 make it a preferred choice for applications requiring high mechanical strength and thermal stability. As a result, manufacturers and suppliers of 1,5-Hexadiene are witnessing substantial opportunities in supplying raw materials to the nylon intermediates segment and meeting the increasing demand for nylon-based products in diverse industrial sectors.

1 5-Hexadiene (CAS 592-42-7) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is anticipated to dominate as the leading region for the growth of the 1,5-Hexadiene (CAS 592-42-7) market. This dominance is driven by several factors, including rapid industrialization, a robust manufacturing sector, and increasing demand for synthetic rubbers and polymers in countries like China, India, Japan, and South Korea. The region's strategic location, favorable economic policies, and growing investments in infrastructure contribute to its strong position in the 1,5-Hexadiene market.

- Moreover, the automotive, construction, and consumer goods industries in Asia Pacific are major consumers of synthetic rubbers and elastomers produced using 1,5-Hexadiene. The rising population, urbanization, and disposable income levels in the region further boost the demand for these materials, driving the growth of the 1,5-Hexadiene market. Additionally, advancements in polymer technology and the shift towards eco-friendly materials present opportunities for 1,5-Hexadiene manufacturers to cater to the evolving needs of industries and capitalize on the expanding market in Asia Pacific.

1 5-Hexadiene (CAS 592-42-7) Market Top Key Players:

- ChemService, Inc. (U.S.)

- Spectrum Chemical (U.S.)

- Gelest Inc. (U.S.)

- Sarchem Laboratories Inc. (U.S.)

- VWR International, LLC. (U.S.)

- Austin Chemical Company Inc. (U.S.)

- Santa Cruz Biotechnology, Inc (U.S.)

- Merck KGaA (Germany)

- Matrix Fine Chemicals GmbH (Germany)

- Cymit Química S.L (Spain)

- Procurenet Limited (China)

- Alfa Chemical Co., Ltd (China)

- Chemvon Biotechnology Co. Ltd (China)

- LookChem (China)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India), and Other Major Players

|

Global 1 5-Hexadiene (CAS 592-42-7) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.08 Mn. |

|

Forecast Period 2023-30 CAGR: |

2.50% |

Market Size in 2030: |

USD 2.53 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- 1 5-HEXADIENE (CAS 592-42-7) MARKET BY GRADE (2017-2030)

- 1 5-HEXADIENE (CAS 592-42-7) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDUSTRIAL GRADE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HIGH PURITY GRADE

- 1 5-HEXADIENE (CAS 592-42-7) MARKET BY APPLICATION (2017-2030)

- 1 5-HEXADIENE (CAS 592-42-7) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NYLON INTERMEDIATES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY CHEMICALS

- PHARMACEUTICALS

- AGROCHEMICALS

- FRAGRANCES

- 1 5-HEXADIENE (CAS 592-42-7) MARKET BY END-USER (2017-2030)

- 1 5-HEXADIENE (CAS 592-42-7) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TEXTILES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMOTIVE

- CONSTRUCTION

- ELECTRICAL & ELECTRONICS

- PERSONAL CARE PRODUCTS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- 1 5-Hexadiene (CAS 592-42-7) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CHEMSERVICE, INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SPECTRUM CHEMICAL (U.S.)

- GELEST INC. (U.S.)

- SARCHEM LABORATORIES INC. (U.S.)

- VWR INTERNATIONAL, LLC. (U.S.)

- AUSTIN CHEMICAL COMPANY INC. (U.S.)

- SANTA CRUZ BIOTECHNOLOGY, INC (U.S.)

- MERCK KGAA (GERMANY)

- MATRIX FINE CHEMICALS GMBH (GERMANY)

- CYMIT QUÍMICA S.L (SPAIN)

- PROCURENET LIMITED (CHINA)

- ALFA CHEMICAL CO., LTD (CHINA)

- CHEMVON BIOTECHNOLOGY CO. LTD (CHINA)

- LOOKCHEM (CHINA)

- TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD. (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL 1 5-HEXADIENE (CAS 592-42-7) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Grade

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global 1 5-Hexadiene (CAS 592-42-7) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.08 Mn. |

|

Forecast Period 2023-30 CAGR: |

2.50% |

Market Size in 2030: |

USD 2.53 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. 1 5-HEXADIENE (CAS 592-42-7) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. 1 5-HEXADIENE (CAS 592-42-7) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. 1 5-HEXADIENE (CAS 592-42-7) MARKET COMPETITIVE RIVALRY

TABLE 005. 1 5-HEXADIENE (CAS 592-42-7) MARKET THREAT OF NEW ENTRANTS

TABLE 006. 1 5-HEXADIENE (CAS 592-42-7) MARKET THREAT OF SUBSTITUTES

TABLE 007. 1 5-HEXADIENE (CAS 592-42-7) MARKET BY TYPE

TABLE 008. TYPE 1 MARKET OVERVIEW (2016-2028)

TABLE 009. TYPE 2 MARKET OVERVIEW (2016-2028)

TABLE 010. OTHER MARKET OVERVIEW (2016-2028)

TABLE 011. 1 5-HEXADIENE (CAS 592-42-7) MARKET BY APPLICATION

TABLE 012. ORGANIC SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 013. LAB USE MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY APPLICATION (2016-2028)

TABLE 017. N 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY APPLICATION (2016-2028)

TABLE 020. 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY APPLICATION (2016-2028)

TABLE 023. 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY APPLICATION (2016-2028)

TABLE 026. 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY APPLICATION (2016-2028)

TABLE 029. 1 5-HEXADIENE (CAS 592-42-7) MARKET, BY COUNTRY (2016-2028)

TABLE 030. SHANGHAI JINHONG CHEMICAL: SNAPSHOT

TABLE 031. SHANGHAI JINHONG CHEMICAL: BUSINESS PERFORMANCE

TABLE 032. SHANGHAI JINHONG CHEMICAL: PRODUCT PORTFOLIO

TABLE 033. SHANGHAI JINHONG CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. HUBEI JINGHONG CHEMICAL: SNAPSHOT

TABLE 034. HUBEI JINGHONG CHEMICAL: BUSINESS PERFORMANCE

TABLE 035. HUBEI JINGHONG CHEMICAL: PRODUCT PORTFOLIO

TABLE 036. HUBEI JINGHONG CHEMICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. YI BANG: SNAPSHOT

TABLE 037. YI BANG: BUSINESS PERFORMANCE

TABLE 038. YI BANG: PRODUCT PORTFOLIO

TABLE 039. YI BANG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. SHENZHEN NEXCONN PHARMATECHS: SNAPSHOT

TABLE 040. SHENZHEN NEXCONN PHARMATECHS: BUSINESS PERFORMANCE

TABLE 041. SHENZHEN NEXCONN PHARMATECHS: PRODUCT PORTFOLIO

TABLE 042. SHENZHEN NEXCONN PHARMATECHS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. HANGZHOU 3H CHEM: SNAPSHOT

TABLE 043. HANGZHOU 3H CHEM: BUSINESS PERFORMANCE

TABLE 044. HANGZHOU 3H CHEM: PRODUCT PORTFOLIO

TABLE 045. HANGZHOU 3H CHEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY TYPE

FIGURE 012. TYPE 1 MARKET OVERVIEW (2016-2028)

FIGURE 013. TYPE 2 MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 015. 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY APPLICATION

FIGURE 016. ORGANIC SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 017. LAB USE MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA 1 5-HEXADIENE (CAS 592-42-7) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the 1 5-Hexadiene (CAS 592-42-7) Market research report is 2023-2030.

ChemService, Inc. (U.S.), Spectrum Chemical (U.S.), Gelest Inc. (U.S.), Sarchem Laboratories Inc. (U.S.), VWR International, LLC. (U.S.), Austin Chemical Company Inc. (U.S.), Santa Cruz Biotechnology, Inc (U.S.), Merck KGaA (Germany), Matrix Fine Chemicals GmbH (Germany), Cymit Química S.L (Spain), Procurenet Limited (China), Alfa Chemical Co., Ltd (China), Chemvon Biotechnology Co. Ltd (China), LookChem (China), Tokyo Chemical Industry (India) Pvt. Ltd. (India), and Other Major Players.

The 1 5-Hexadiene (CAS 592-42-7) Market is segmented into Grade, Application, End-user, and Region. By Grade, the market is categorized into Industrial Grade and High Purity Grade. By Application, the market is categorized into Nylon Intermediates Specialty Chemicals, Pharmaceuticals, Agrochemicals, and Fragrances. By End-user, the market is categorized into Textiles, Automotive, Construction, Electrical & Electronics, and Personal Care Products. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

1,5-Hexadiene (CAS 592-42-7) is a chemical compound characterized by its six-carbon chain structure with two conjugated double bonds. It is commonly used as a monomer in polymerization reactions, particularly in the production of synthetic rubbers and elastomers. Its versatile applications also extend to the synthesis of specialty chemicals like adhesives, coatings, and additives.

Global 1 5-Hexadiene (CAS 592-42-7) Market Size Was Valued at USD 2.08 Million in 2022 and is Projected to Reach USD 2.53 Million by 2030, Growing at a CAGR of 2.50% From 2023-2030