Market Overview:

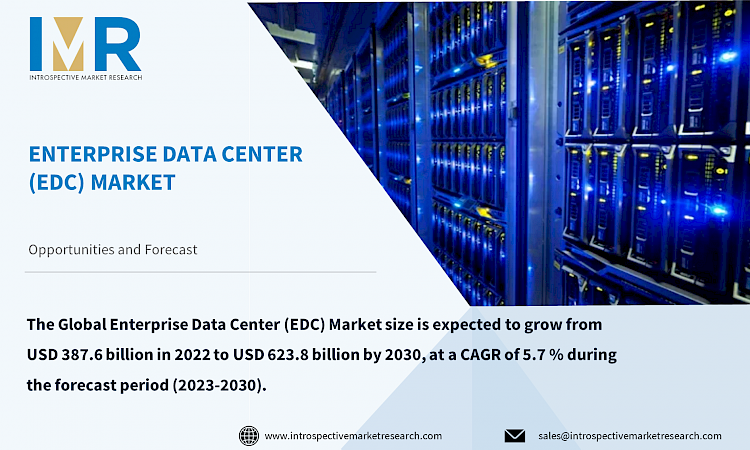

Enterprise Data Center (EDC) Market Size Was Valued at USD 409.7 Billion in 2023, and is Projected to Reach USD 674.7 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

The virtualization and setup of EDC resources is automated operations management. This includes software-defined networking, software-defined storage, and CPU virtualization. Software container capabilities will soon be added to this mix as well. According to the SDDC, resources can be standardized and made accessible through standardized APIs. Self-service provisioning, adaptable configurations, and rapid scaling are consequently made possible. The next-generation EDC's services and level of service must be competitive with those offered by cloud service providers. If a buyer has a choice, the wealthier, more cost-effective option will typically prevail. A data center component design known as a "hyperconverged infrastructure," or HCI, groups resources into scalable "appliances" (or software platforms).

Top Key Players in Enterprise Data Center (EDC) Market:

Equinix, Digital Realty, China Telecom, NTT Communications, Telehouse/KDDI, Coresite, Verizon, Cyxtera Technologies, China Unicom, Amazon Web Services,365 Data Centers, Other Major Key Players

Market Dynamics and Factors for Enterprise Data Center (EDC) Market:

Drivers:

Rising Demand For Enterprise Data Centers

As businesses undergo digital transformation, their reliance on data-intensive applications and services increases. EDCs provide the necessary infrastructure to support these transformations, including data storage, processing, and analysis. The demand for EDCs grows as organizations seek to modernize their operations and leverage technologies like cloud computing, IoT, and big data.

Enterprises are increasingly adopting cloud services, whether through public, private, or hybrid cloud models. EDCs play a crucial role in supporting these cloud deployments by offering secure, scalable, and high-performance infrastructure. The growth of cloud services contributes to the expansion of the EDC market. With the proliferation of cyber threats and regulations around data privacy, enterprises are investing in secure data storage and management. EDCs provide controlled environments with advanced security measures, making them a preferred choice for organizations seeking to safeguard sensitive data and comply with industry regulations.

Opportunities:

IT And Telecom Sector Presents Growth Opportunity

The IT and Telecom sectors generate and process massive amounts of data, including communication logs, network traffic, user interactions, and application data. EDCs provide the necessary infrastructure to store, manage, and process this data efficiently, ensuring smooth operations and optimal service delivery.

Telecommunication companies require data centers to support their network infrastructure, including mobile networks, internet service provisioning, and data routing. EDCs play a vital role in housing the core components of these networks, such as switches, routers, and communication servers.

Segmentation Analysis of the Enterprise Data Center (EDC) Market:

By Type, the Owned segment had the largest market share. Owned data centers are strictly owned and operated by the organizations themselves, whereas rented data centers are leased from third-party providers.

By Application, Retail Industry is likely to dominate in this area. The rise of e-commerce has led to a surge in online transactions, order processing, and customer interactions. EDCs provide the necessary computing power and storage capacity to support e-commerce platforms, manage inventory, process orders, and deliver a seamless shopping experience to customers.

Regional Analysis of the Enterprise Data Center (EDC) Market:

North America has a well-established IT and Telecom infrastructure, with a high level of technology adoption and digital transformation across various industries. This maturity drives the demand for EDCs to support the growing data storage, processing, and networking needs of businesses.

The region is home to many leading technology companies, financial institutions, and enterprises that require advanced data center solutions. The strong economic base and culture of innovation in North America lead to continuous investments in EDCs to stay competitive and support business growth.

Key Industry Development:

In February 2020, EdgeConneX, a top global data centre operator with 50 facilities in 30 markets around the world, and Adani Enterprises, the flagship firm of the Adani Group, one of India's largest multi-infrastructure companies, announced the creation of a 50:50 joint venture.