Overview:

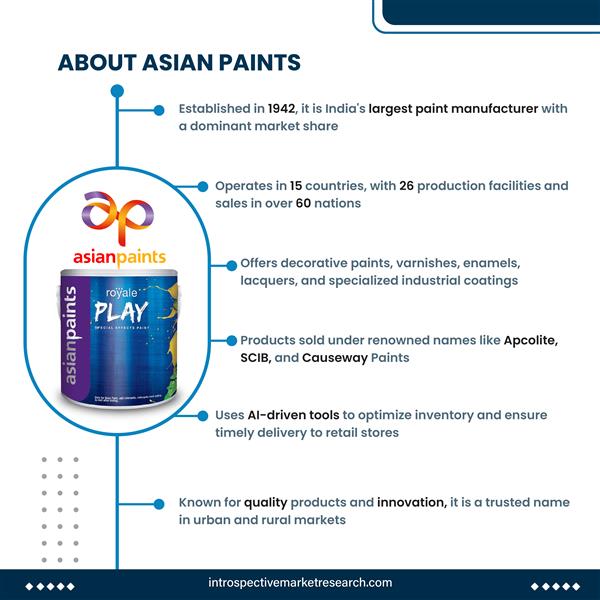

Asian Paints, established in 1942, is India's largest paint manufacturer and a well-established global brand. Despite its long-standing market dominance, the company faced a significant downturn in recent quarters, marked by weak earnings, rising competition, and increased operational costs. This case study explores the reasons behind Asian Paints' decline in Q2FY24, analyzing internal and external factors contributing to its performance challenges.

-

Weak Financial Performance:

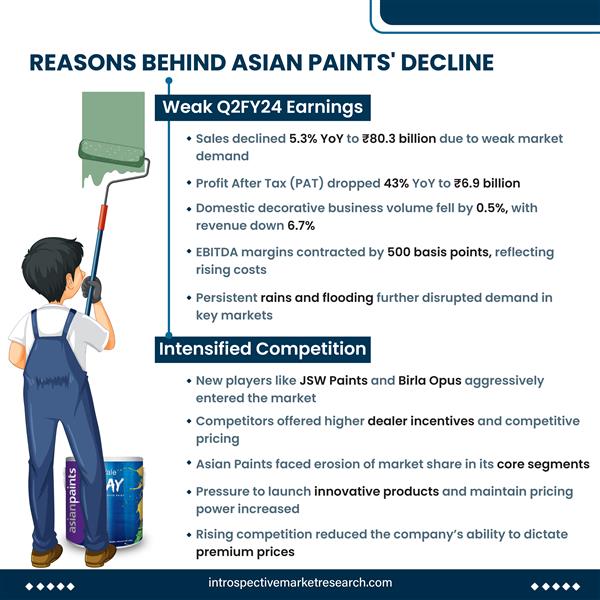

Asian Paints' sales fell by 5.3% YoY to ₹80.3 billion in Q2FY24, with profit after tax (PAT) plummeting 43% to ₹6.9 billion. The company's domestic decorative business witnessed a volume drop of 0.5%, coupled with a 6.7% revenue decline. The weakened demand, especially due to environmental factors such as persistent rains and flooding, disrupted key markets and further eroded its financial stability.

-

Intensified Competition:

Increased competition from newer entrants like JSW Paints and Birla Opus added pressure on Asian Paints. These competitors adopted aggressive pricing strategies and dealer incentives, which caused market share erosion for the incumbent. The growing competition forced Asian Paints to focus on innovation and pricing flexibility, thereby impacting its ability to maintain its premium positioning in the market.

-

Rising Material Costs:

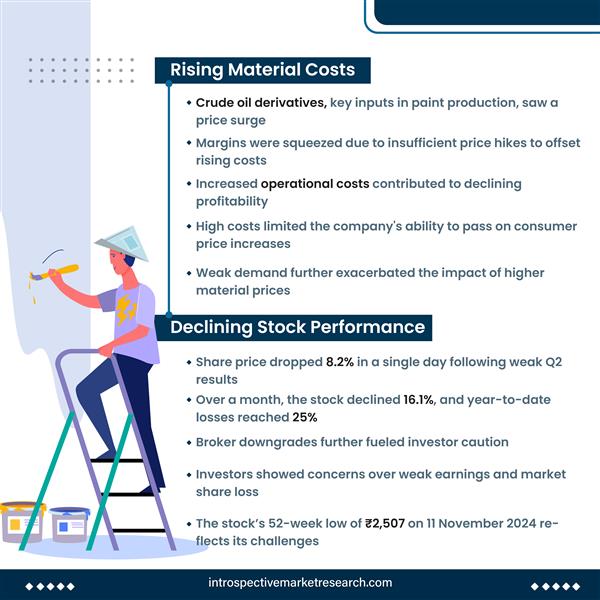

Rising prices of key raw materials, particularly crude oil derivatives used in paint production, placed significant strain on Asian Paints' margins. The company struggled to offset these costs through price hikes, exacerbating margin compression. The inability to pass on the increased costs to consumers, combined with weak demand, further impacted the company's profitability.

-

Stock Performance and Investor Sentiment:

The company's stock performance reflected its operational struggles. After reporting weak Q2 results, Asian Paints' share price dropped by 8.2% in one day, with a cumulative loss of 25% year-to-date. Broker downgrades and investor concerns about declining market share and profits further fueled the stock's downward trajectory.

Conclusion:

Asian Paints’ downturn is a multifaceted issue driven by both external and internal factors. The company’s weakened financial performance, exacerbated by poor market conditions and increased competition, highlights the challenges faced by even market leaders. The rising cost of raw materials further compressed profit margins, while environmental disruptions added to the unpredictability of demand. Despite these challenges, Asian Paints’ strong brand and market presence continue to offer potential for recovery. Moving forward, the company will need to focus on cost optimization, product innovation, and strategic pricing to regain consumer confidence and strengthen its market position. Adaptation to these changing market dynamics will be crucial in ensuring sustainable growth and profitability in the long term.