Key Market Highlights

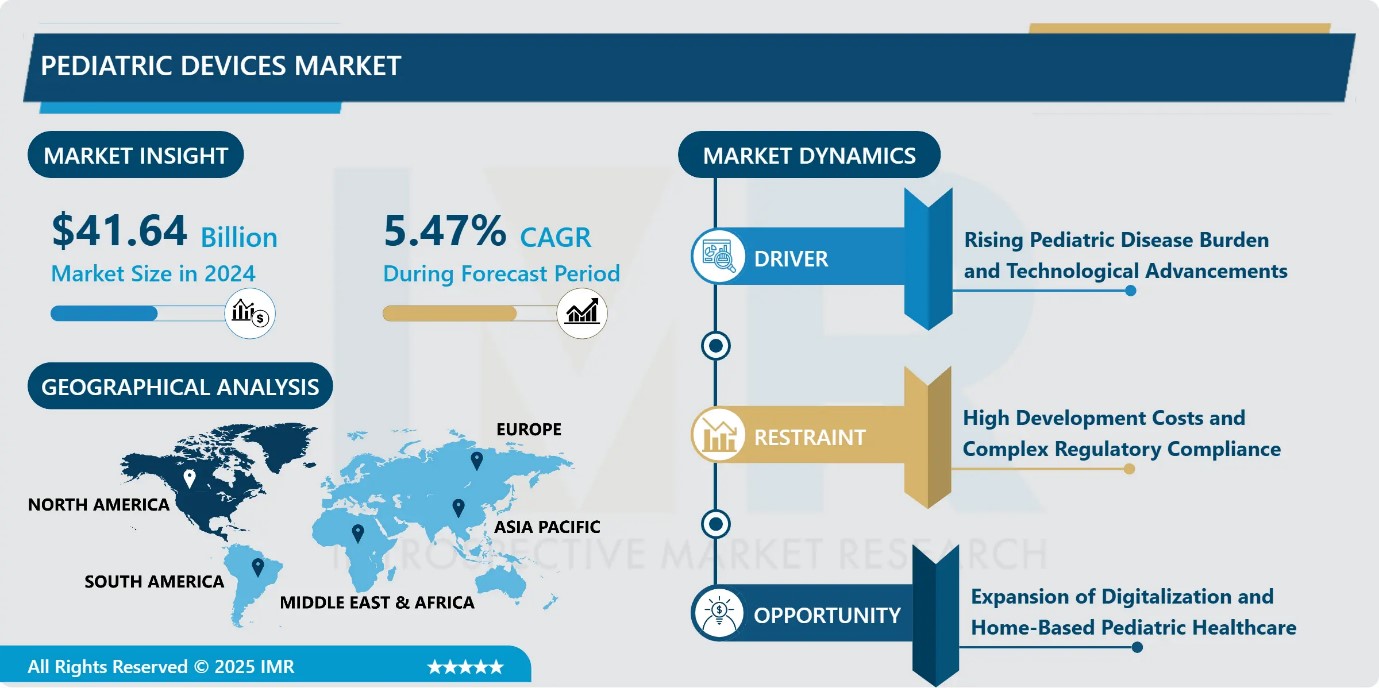

Pediatric Devices Market Size Was Valued at USD 41.64 Billion in 2024, and is Projected to Reach USD 74.80 Billion by 2035, Growing at a CAGR of 5.47% from 2025-2035.

- Market Size in 2024: USD 41.64 Billion

- Projected Market Size by 2035: USD 74.80 Billion

- CAGR (2025–2035): 5.47%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By End-User: The Hospital segment is anticipated to lead the market by accounting for 27.84% of the market share throughout the forecast period.

- By Product: The In Vitro Diagnostic (IVD) Devices segment is expected to capture 26.11% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.45% of the market share during the forecast period.

- Active Players: Abbott Laboratories (US), Atom Medical Corporation (JP), Baxter International Inc. (US), Boston Scientific Corporation (US), Cardinal Health, Inc. (US), and Other Active Players.

Pediatric Devices Market Synopsis:

Pediatric medical devices are specialized instruments designed for the diagnosis, monitoring, and treatment of patients from birth to 21 years, accounting for children’s unique anatomical and physiological needs. The global pediatric medical devices market is witnessing steady growth driven by rising incidences of congenital disorders, respiratory diseases, cancer, and preterm births. Increased demand during COVID-19, technological advancements such as AI-enabled diagnostics, expanding telemedicine, and supportive regulatory initiatives have strengthened market conditions. However, challenges including off-label device usage, limited clinical trials, small patient populations, and stringent regulations persist. Growing investments, innovation, and awareness are expected to sustain long-term market expansion.

Pediatric Devices Market Dynamics and Trend Analysis:

Pediatric Devices Market Growth Driver-Rising Pediatric Disease Burden and Technological Advancements

- The pediatric medical devices market is primarily driven by the increasing prevalence of chronic and acute diseases among children, including asthma, diabetes, congenital heart defects, and infectious conditions. The growing incidence of childhood obesity has further contributed to related health complications, intensifying the need for early diagnosis and effective treatment solutions.

- Additionally, the rising rate of preterm births worldwide has significantly increased demand for neonatal intensive care unit (NICU) equipment such as incubators, ventilators, and monitoring devices. Technological advancements are enabling the development of miniaturized, less invasive, and more precise medical devices tailored to pediatric anatomy. Moreover, rising investments in pediatric-focused research and development and increased parental awareness regarding early intervention continue to accelerate market growth.

Pediatric Devices Market Limiting Factor-High Development Costs and Complex Regulatory Compliance

- High development costs combined with stringent regulatory requirements represent a major restraint on the growth of the pediatric medical devices market. Designing devices specifically for pediatric patients requires extensive research, prolonged clinical trials, and strict adherence to safety and efficacy standards set by regulatory authorities. These processes are time-intensive and demand substantial financial investment, particularly due to the vulnerability and diverse physiological characteristics of children across different age groups, weights, and developmental stages.

- Additionally, the need for customized designs to accommodate pediatric anatomy further increases production complexity and costs. Such financial and regulatory burdens often discourage smaller manufacturers from entering the market and can delay product commercialization, thereby limiting innovation and slowing overall market expansion.

Pediatric Devices Market Expansion Opportunity-Expansion of Digitalization and Home-Based Pediatric Healthcare

- The pediatric medical devices market presents significant growth opportunities driven by the rapid expansion of digitalization and home-based healthcare solutions. Increasing integration of artificial intelligence, connected sensors, and digital health platforms into pediatric devices is enabling improved disease monitoring, personalized treatment, and remote patient management. Growing demand for home-based care, supported by favorable reimbursement policies, is accelerating the adoption of portable and user-friendly pediatric devices.

- Innovations such as AI-enabled biosensors and FDA-approved home-use therapeutic devices are facilitating the transition of care from hospitals to home settings. Additionally, rising healthcare expenditure and infrastructure development are supporting the establishment of advanced pediatric facilities and outpatient centers, further expanding the addressable market. Collectively, these factors are creating a strong opportunity for scalable, cost-effective pediatric medical device solutions.

Pediatric Devices Market Challenge and Risk-Stringent Regulations and Complexity in Pediatric Device Design

- Stringent regulatory requirements and the complexity of designing pediatric-specific devices represent a major challenge to the growth of the pediatric medical devices market. Regulatory authorities such as the U.S. FDA impose rigorous approval standards to ensure safety, efficacy, and infection control, particularly for neonatal ICU, respiratory care, and monitoring devices. These strict guidelines often prolong development timelines and increase compliance costs.

- Additionally, designing devices exclusively for pediatric patients is inherently complex due to wide variations in age, weight, physiology, and developmental stages. Devices must accommodate fragile anatomies, long-term usage, and differing clinical needs across infants, children, and adolescents. Integrating advanced technologies such as AI and telemedicine further adds to design and validation challenges, limiting faster commercialization and market expansion.

Pediatric Devices Market Trend-Rapid Technological Innovation Driving the Shift Toward Miniaturized, Smart, and Minimally Invasive Pediatric Medical Devices

- Technological innovation is emerging as a key trend shaping the pediatric medical devices market. Advancements in miniaturization, smart monitoring systems, and enhanced imaging technologies are enabling the development of safer, less invasive, and child-friendly medical devices. Wearable devices for real-time monitoring, telemedicine-enabled equipment, and growth-accommodating designs are gaining widespread adoption across pediatric care settings.

- In parallel, the increasing preference for minimally invasive pediatric surgical and cardiac interventions is driving demand for precision instruments such as pediatric endoscopes, catheter-based devices, and scaled robotic tools. Recent regulatory approvals of neonatal stents and occluders with high procedural success rates further highlight this shift. Collectively, these innovations improve clinical outcomes, reduce hospital stays, and enhance patient comfort, reinforcing sustained market expansion.

Pediatric Devices Market Segment Analysis:

Pediatric Devices Market is segmented based on Product, Application, End-User and Region.

By End-User, Hospitals segment is expected to dominate the market with around 27.84% share during the forecast period.

- In 2024, the hospitals segment remained the dominant end user in the pediatric medical devices market, accounting for over half of total revenue. This dominance is primarily due to hospitals being the central providers of high-acuity and complex pediatric care, including neonatal intensive care units (NICUs), pediatric intensive care units (PICUs), and specialized surgical procedures.

- Hospitals require large-scale procurement of capital-intensive equipment such as advanced diagnostic imaging systems, ventilators, cardiac catheterization labs, and continuous monitoring devices. Favorable reimbursement frameworks, strict regulatory requirements mandating hospital-based care for critical interventions, and the rising prevalence of preterm births and chronic pediatric diseases further reinforce this position. Additionally, hospitals are at the forefront of adopting AI-enabled diagnostics and integrated monitoring technologies, sustaining their leadership in market revenue.

By Product, In Vitro Diagnostic (IVD) Devices is expected to dominate with close to 26.11% market share during the forecast period.

- IVD devices held a leading position in the pediatric medical devices market in 2024, accounting for 26.11% of total revenue, highlighting their critical role in clinical diagnostics and decision-making. These devices enable accurate detection of diseases, conditions, and infections, supporting approximately 70% of hospital and clinic-based clinical decisions. The segment’s dominance is reinforced by the rising need for continuous monitoring, precision testing, and early diagnosis in pediatric patients.

- Monitoring devices are gaining momentum, with AI-enabled, child-friendly tools facilitating real-time health tracking. Cardiology, respiratory, and anesthesia devices complement this growth, particularly due to high premature birth rates and respiratory illnesses like asthma and OSA. The segment remains dominant due to its indispensable role in pediatric diagnostics, disease management, and patient safety.

Pediatric Devices Market Regional Insights:

North America region is estimated to lead the market with around 31.45% share during the forecast period.

- In 2024, North America continued to dominate the global pediatric medical devices market, accounting for the largest revenue share due to its well-established healthcare infrastructure, high healthcare expenditure, and strong presence of leading market players. The region benefits from advanced diagnostic and therapeutic technologies, favorable reimbursement frameworks, and robust regulatory support from agencies such as the U.S. FDA. The high prevalence of pediatric chronic conditions, including asthma, cancer, congenital heart disease, and leukemia, further sustains demand, with over 40% of school-aged children affected by at least one chronic condition.

- Meanwhile, the Asia Pacific region is expected to record the fastest growth, driven by a large pediatric population, rising disease burden, improving healthcare access, and increasing investments in medical infrastructure, particularly in emerging economies.

Pediatric Devices Market Active Players:

- Abbott Laboratories (United States)

- Atom Medical Corporation (Japan)

- Baxter International Inc. (United States)

- Boston Scientific Corporation (United States)

- Cardinal Health, Inc. (United States)

- Drägerwerk AG & Co. KGaA (Germany)

- Edwards Lifesciences (United States)

- GE Healthcare (United States)

- Hamilton Medical AG (Switzerland)

- Medtronic PLC (Ireland)

- Natus Medical Incorporated (United States)

- Ningbo David Medical Device Co. Ltd. (China)

- Philips Healthcare (Netherlands)

- Siemens Healthineers (Germany)

- Stryker Corporation (United States)

- TSE Medical (Czech Republic)

- Other Active Players

Key Industry Developments in the Pediatric Devices Market:

- In April 2025, Edwards Lifesciences received CE mark approval for its SAPIEN M3 transcatheter mitral valve replacement system, marking a major advancement in minimally invasive structural heart therapies.The approval supports expanded use of catheter-based mitral valve interventions, including potential applications in complex and high-risk pediatric cardiac patients in Europe.

- In July 2024, Medtronic introduced an advanced pediatric heart valve aimed at improving treatment outcomes for children with congenital heart defects. The device features enhanced durability and a minimally invasive implantation approach, helping reduce recovery time and procedural complications.

Technical Landscape and Engineering Considerations in Pediatric Medical Devices

- The pediatric medical devices market is technically defined by the need to engineer medical equipment that accommodates the distinct anatomical, physiological, and developmental characteristics of patients from birth through adolescence. Unlike adult devices, pediatric devices require precise scaling, biocompatible materials, and adaptable designs that can accommodate growth, higher activity levels, and long-term usage. Key technical areas include miniaturized cardiology implants, neonatal ventilators with precise pressure control, low-radiation diagnostic imaging systems, and in vitro diagnostic platforms optimized for small sample volumes. Increasing integration of artificial intelligence, embedded sensors, and wireless connectivity enables real-time monitoring, predictive analytics, and remote patient management.

- Safety engineering is paramount, requiring rigorous risk mitigation for infection control, device migration, and material toxicity. Regulatory-compliant design validation, usability testing with caregivers, and interoperability with hospital information systems further define the technical complexity of pediatric medical device development.

|

Pediatric Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 41.64 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.47% |

Market Size in 2035: |

USD 74.80 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Pediatric Devices Market by Product (2018-2035)

4.1 Pediatric Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 In Vitro Diagnostic (IVD) Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cardiology Devices

4.5 Diagnostic Imaging Devices

4.6 Anesthesia & Respiratory Care Devices

4.7 Neonatal ICU Devices

4.8 Monitoring Devices

4.9 Telemedicine

Chapter 5: Pediatric Devices Market by Application (2018-2035)

5.1 Pediatric Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diagnosis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Monitoring

5.5 Treatment

5.6 Life Support

Chapter 6: Pediatric Devices Market by End User (2018-2035)

6.1 Pediatric Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pediatric Clinics

6.5 Diagnostic Laboratories

6.6 Ambulatory Surgical Centers

6.7 Research & Academic Institutes

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pediatric Devices Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ATOM MEDICAL CORPORATION (JAPAN)

7.4 BAXTER INTERNATIONAL INC. (USA)

7.5 BOSTON SCIENTIFIC CORPORATION (USA)

7.6 CARDINAL HEALTH

7.7 INC. (USA)

7.8 DRÄGERWERK AG & CO. KGAA (GERMANY)

7.9 GE HEALTHCARE (USA)

7.10 HAMILTON MEDICAL AG (SWITZERLAND)

7.11 MEDTRONIC PLC (IRELAND)

7.12 NATUS MEDICAL INCORPORATED (USA)

7.13 NINGBO DAVID MEDICAL DEVICE CO. LTD. (CHINA)

7.14 PHILIPS HEALTHCARE (NETHERLANDS)

7.15 SIEMENS HEALTHINEERS (GERMANY)

7.16 STRYKER CORPORATION (USA)

7.17 TSE MEDICAL (CZECH REPUBLIC) AND OTHER ACTIVE PLAYERS

Chapter 8: Global Pediatric Devices Market By Region

8.1 Overview

8.2. North America Pediatric Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Pediatric Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Pediatric Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Pediatric Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Pediatric Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Pediatric Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Pediatric Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 41.64 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.47% |

Market Size in 2035: |

USD 74.80 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application

|

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||