Ulcerative Colitis Market Synopsis

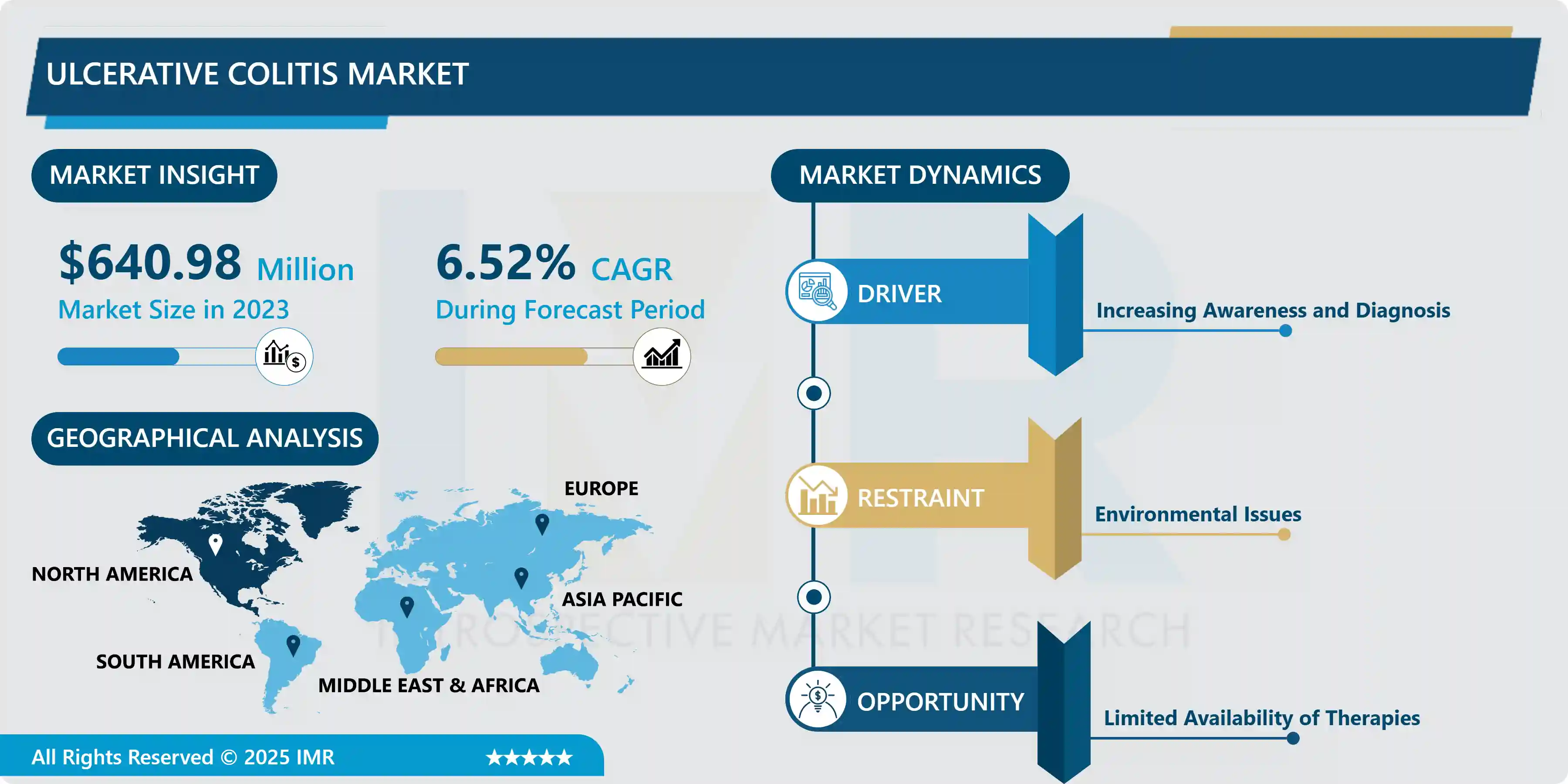

Ulcerative Colitis Market Size Was Valued at USD 640.98 Million in 2023, and is Projected to Reach USD 1131.68 Million by 2032, Growing at a CAGR of 6.52% From 2024-2032.

Ulcerative colitis is a chronic inflammatory bowel disease (IBD) that primarily affects the colon (large intestine) and rectum. It is characterized by inflammation and ulcers in the inner lining of the digestive tract. The exact cause of ulcerative colitis is not fully understood, but it is believed to involve a combination of genetic, environmental, and immune system factors. Ulcerative colitis (UC) is a chronic inflammatory bowel disease primarily affecting the colon and rectum. The application of biological therapies has transformed the management of UC, providing significant relief and improving the quality of life for patients. These therapies, including monoclonal antibodies and small molecules, target specific pathways involved in inflammation, effectively reducing symptoms and achieving remission. Moreover, advancements in personalized medicine allow healthcare providers to tailor treatment plans based on individual patient profiles, enhancing therapeutic outcomes.

The advantages of modern UC therapies extend beyond symptom management. Many of these treatments not only minimize flare-ups but also promote mucosal healing, which can lead to a decrease in the need for surgical interventions. Additionally, innovations in drug delivery systems, such as oral and rectal formulations, enhance patient compliance and satisfaction. With a growing emphasis on integrated care approaches, patients can also access nutrition counselling and psychological support, which are essential for the comprehensive management of this complex disease. Ulcerative colitis treatments is expected to surge as awareness and diagnosis of the condition increase globally. The rise in the prevalence of UC, coupled with advancements in drug development and personalized treatment strategies, will drive market growth. Furthermore, ongoing research into new therapeutic targets and the exploration of combination therapies promise to expand the options available for patients, ultimately improving their health outcomes.

Ulcerative Colitis Market Trend Analysis

Increasing Awareness and Diagnosis

- The rising prevalence and incidence of ulcerative colitis (UC) significantly drive the growth of the UC market. Increasing awareness of gastrointestinal disorders and improvements in diagnostic techniques have led to more accurate and earlier diagnoses. As healthcare professionals identify a greater number of cases, the demand for effective treatment options continues to expand. This trend is particularly evident among younger populations, where lifestyle factors and genetic predispositions contribute to the rising incidence of UC.

- The ongoing advancements in therapeutic options are responding to the growing need for effective management strategies for ulcerative colitis. Innovative biologics and targeted therapies have emerged as vital components in treatment regimens, providing improved outcomes and enhancing patients' quality of life. As these treatments gain approval and recognition, they attract attention from healthcare providers and patients alike, further propelling market growth.

- Increased research funding and initiatives focused on ulcerative colitis are paving the way for discoveries. As pharmaceutical companies invest in developing novel therapies and enhancing existing treatments, the market is poised for significant expansion. Ultimately, the combination of rising UC cases, evolving treatment landscapes, and ongoing research efforts creates a robust framework for sustained growth in the ulcerative colitis market.

Advancements in Medical Research

- Advancements in medical research present significant opportunities for the growth of the ulcerative colitis (UC) market. As scientists and clinicians delve deeper into the underlying mechanisms of UC, innovative therapies and treatment options are emerging. Recent breakthroughs in biologics and small molecule therapies are enhancing the effectiveness of treatments, offering new hope for patients who struggle with this chronic condition. The introduction of precision medicine tailored to individual patient profiles is set to transform the treatment landscape, making therapies more effective and reducing adverse effects.

- Additionally, increased funding for research initiatives is fueling the development of novel therapeutic strategies. Clinical trials exploring the efficacy of new compounds and combinations are gaining traction, leading to a wider array of treatment options. This surge in research not only expands the product pipeline but also attracts investment from pharmaceutical companies eager to capitalize on the growing demand for effective UC treatments. As a result, patients are benefiting from more personalized and effective therapeutic solutions.

- The rise in awareness and education surrounding ulcerative colitis is driving patient engagement and advocacy. Improved patient understanding of the condition leads to earlier diagnosis and increased treatment adherence, ultimately enhancing the market's growth potential. As awareness campaigns continue to flourish, they will play a crucial role in fostering a more informed patient population, paving the way for further advancements in the ulcerative colitis market.

Ulcerative Colitis Market Segment Analysis:

Ulcerative Colitis Market Segmented on the basis of Type, Drug Type, Molecule Type, Route of Administration, Distribution Channel, and Region

By Type, Proctosigmoiditis segment is expected to dominate the market during the forecast period

- The proctosigmoiditis segment is poised to drive significant growth in the ulcerative colitis market. This condition, which affects the rectum and sigmoid colon, is prevalent among ulcerative colitis patients. As healthcare providers enhance their diagnostic capabilities and treatment options, the demand for targeted therapies will increase. Additionally, rising awareness of gastrointestinal disorders and the need for effective management solutions are fueling market expansion. Patients are increasingly seeking tailored treatments and advancements in biologics and immunotherapies will cater to this demand.

- Furthermore, the growing prevalence of proctosigmoiditis due to factors like lifestyle changes and environmental influences is expected to contribute to market growth. As the healthcare landscape evolves, new therapeutic approaches are emerging, focusing on improving patient outcomes. Collaborations between pharmaceutical companies and research institutions are likely to accelerate the development of innovative treatments, ensuring that the proctosigmoiditis segment remains a key driver in the ulcerative colitis market's future trajectory.

By Drug Type, Immunosuppressant segment held the largest share in 2023

- The immunosuppressant segment dominated the ulcerative colitis market, driven by the increasing prevalence of the condition and the rising adoption of effective treatment options. Medications such as azathioprine and mercaptopurine played a pivotal role in managing ulcerative colitis by suppressing the immune system to reduce inflammation. These drugs are particularly beneficial for patients who do not respond well to conventional therapies. As healthcare professionals increasingly recognize the importance of personalized treatment approaches, the demand for immunosuppressants has surged, significantly impacting market growth.

- Moreover, advancements in drug formulation and delivery methods have enhanced the efficacy and safety profiles of immunosuppressants. Ongoing clinical trials and research continue to provide evidence supporting their long-term use in managing ulcerative colitis. Additionally, the growing focus on patient education and awareness around the disease has further propelled the segment's growth. As a result, immunosuppressants are anticipated to maintain their stronghold in the ulcerative colitis market in the coming years.

Ulcerative Colitis Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to lead the growth of the ulcerative colitis market, driven by a combination of increasing prevalence and heightened awareness of this chronic inflammatory condition. The region boasts advanced healthcare infrastructure and significant investment in research and development, fostering innovations in treatment options. Additionally, a growing patient population seeking effective therapies is expected to propel market expansion, alongside the availability of advanced biologics and immunomodulators that improve patient outcomes.

- Moreover, the presence of key pharmaceutical companies in North America accelerates the development of new therapies tailored to meet the needs of ulcerative colitis patients. Collaborative efforts among industry stakeholders, including healthcare providers and patient advocacy groups, enhance awareness and education regarding the condition, further driving demand for treatment. As healthcare systems prioritize chronic disease management, North America is set to remain a dominant force in the ulcerative colitis market, reflecting both economic and social investments aimed at improving the quality of life for those affected.

Ulcerative Colitis Market Top Key Players:

- Johnson & Johnson Services, Inc. (U.S.)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- GlaxoSmithKline plc. (UK)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- Astrazeneca (UK)

- Sanofi (France)

- Allergan (Ireland)

- CELGENE CORPORATION (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- InDex Pharmaceuticals Holding AB (Sweden), and Other Active Players

Key Industry Developments in the Ulcerative Colitis Market:

- In April 2023, Merck & Co., Inc. agreed to acquire Prometheus Biosciences for USD 200.00 per share in cash for a total equity value of approximately USD 10.8 billion. This agreement allows Prometheus Biosciences to maximize the potential for PRA023, a novel, late-stage candidate for ulcerative colitis, Crohn's disease, and other autoimmune conditions.

- In March 2023, Takeda Pharmaceutical Company Limited received approval from the Japanese Ministry of Health, Labour, and Welfare for its Entyvio Pens (vedolizumab) maintenance therapy for moderate to severe ulcerative colitis.

|

Ulcerative Colitis Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 640.98 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.52% |

Market Size in 2032: |

USD 1131.68 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Drug Type |

|

||

|

By Molecule Type |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ulcerative Colitis Market by Type (2018-2032)

4.1 Ulcerative Colitis Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Proctosigmoiditis

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Left-Sided Colitis

4.5 Pan Colitis

4.6 Fulminant Colitis

Chapter 5: Ulcerative Colitis Market by Drug Type (2018-2032)

5.1 Ulcerative Colitis Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anti-Inflammatory Drugs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Amino salicylates

5.5 Corticosteroids

5.6 Anti-TNF biologics

5.7 Immunosuppressant

5.8 Calcineurin Inhibitors

Chapter 6: Ulcerative Colitis Market by Molecule Type (2018-2032)

6.1 Ulcerative Colitis Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Biologics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Small Molecules

Chapter 7: Ulcerative Colitis Market by Route of Administration (2018-2032)

7.1 Ulcerative Colitis Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Oral

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Injectable

Chapter 8: Ulcerative Colitis Market by Distribution Channel (2018-2032)

8.1 Ulcerative Colitis Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Retail Pharmacies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Hospital Pharmacies

8.5 Drug Store

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Ulcerative Colitis Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 JOHNSON & JOHNSON SERVICES INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BAYER AG (GERMANY)

9.4 ABBVIE INC. (U.S.)

9.5 MERCK & COINC. (U.S.)

9.6 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

9.7 GLAXOSMITHKLINE PLC. (UK)

9.8 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

9.9 PFIZER INC. (U.S.)

9.10 ABBOTT (U.S.)

9.11 ASTRAZENECA (UK)

9.12 SANOFI (FRANCE)

9.13 ALLERGAN (IRELAND)

9.14 CELGENE CORPORATION (U.S.)

9.15 BRISTOL-MYERS SQUIBB COMPANY (U.S.)

9.16 INDEX PHARMACEUTICALS HOLDING AB (SWEDEN)

9.17 AND

Chapter 10: Global Ulcerative Colitis Market By Region

10.1 Overview

10.2. North America Ulcerative Colitis Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Proctosigmoiditis

10.2.4.2 Left-Sided Colitis

10.2.4.3 Pan Colitis

10.2.4.4 Fulminant Colitis

10.2.5 Historic and Forecasted Market Size by Drug Type

10.2.5.1 Anti-Inflammatory Drugs

10.2.5.2 Amino salicylates

10.2.5.3 Corticosteroids

10.2.5.4 Anti-TNF biologics

10.2.5.5 Immunosuppressant

10.2.5.6 Calcineurin Inhibitors

10.2.6 Historic and Forecasted Market Size by Molecule Type

10.2.6.1 Biologics

10.2.6.2 Small Molecules

10.2.7 Historic and Forecasted Market Size by Route of Administration

10.2.7.1 Oral

10.2.7.2 Injectable

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Retail Pharmacies

10.2.8.2 Hospital Pharmacies

10.2.8.3 Drug Store

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Ulcerative Colitis Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Proctosigmoiditis

10.3.4.2 Left-Sided Colitis

10.3.4.3 Pan Colitis

10.3.4.4 Fulminant Colitis

10.3.5 Historic and Forecasted Market Size by Drug Type

10.3.5.1 Anti-Inflammatory Drugs

10.3.5.2 Amino salicylates

10.3.5.3 Corticosteroids

10.3.5.4 Anti-TNF biologics

10.3.5.5 Immunosuppressant

10.3.5.6 Calcineurin Inhibitors

10.3.6 Historic and Forecasted Market Size by Molecule Type

10.3.6.1 Biologics

10.3.6.2 Small Molecules

10.3.7 Historic and Forecasted Market Size by Route of Administration

10.3.7.1 Oral

10.3.7.2 Injectable

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Retail Pharmacies

10.3.8.2 Hospital Pharmacies

10.3.8.3 Drug Store

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Ulcerative Colitis Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Proctosigmoiditis

10.4.4.2 Left-Sided Colitis

10.4.4.3 Pan Colitis

10.4.4.4 Fulminant Colitis

10.4.5 Historic and Forecasted Market Size by Drug Type

10.4.5.1 Anti-Inflammatory Drugs

10.4.5.2 Amino salicylates

10.4.5.3 Corticosteroids

10.4.5.4 Anti-TNF biologics

10.4.5.5 Immunosuppressant

10.4.5.6 Calcineurin Inhibitors

10.4.6 Historic and Forecasted Market Size by Molecule Type

10.4.6.1 Biologics

10.4.6.2 Small Molecules

10.4.7 Historic and Forecasted Market Size by Route of Administration

10.4.7.1 Oral

10.4.7.2 Injectable

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Retail Pharmacies

10.4.8.2 Hospital Pharmacies

10.4.8.3 Drug Store

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Ulcerative Colitis Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Proctosigmoiditis

10.5.4.2 Left-Sided Colitis

10.5.4.3 Pan Colitis

10.5.4.4 Fulminant Colitis

10.5.5 Historic and Forecasted Market Size by Drug Type

10.5.5.1 Anti-Inflammatory Drugs

10.5.5.2 Amino salicylates

10.5.5.3 Corticosteroids

10.5.5.4 Anti-TNF biologics

10.5.5.5 Immunosuppressant

10.5.5.6 Calcineurin Inhibitors

10.5.6 Historic and Forecasted Market Size by Molecule Type

10.5.6.1 Biologics

10.5.6.2 Small Molecules

10.5.7 Historic and Forecasted Market Size by Route of Administration

10.5.7.1 Oral

10.5.7.2 Injectable

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Retail Pharmacies

10.5.8.2 Hospital Pharmacies

10.5.8.3 Drug Store

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Ulcerative Colitis Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Proctosigmoiditis

10.6.4.2 Left-Sided Colitis

10.6.4.3 Pan Colitis

10.6.4.4 Fulminant Colitis

10.6.5 Historic and Forecasted Market Size by Drug Type

10.6.5.1 Anti-Inflammatory Drugs

10.6.5.2 Amino salicylates

10.6.5.3 Corticosteroids

10.6.5.4 Anti-TNF biologics

10.6.5.5 Immunosuppressant

10.6.5.6 Calcineurin Inhibitors

10.6.6 Historic and Forecasted Market Size by Molecule Type

10.6.6.1 Biologics

10.6.6.2 Small Molecules

10.6.7 Historic and Forecasted Market Size by Route of Administration

10.6.7.1 Oral

10.6.7.2 Injectable

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Retail Pharmacies

10.6.8.2 Hospital Pharmacies

10.6.8.3 Drug Store

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Ulcerative Colitis Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Proctosigmoiditis

10.7.4.2 Left-Sided Colitis

10.7.4.3 Pan Colitis

10.7.4.4 Fulminant Colitis

10.7.5 Historic and Forecasted Market Size by Drug Type

10.7.5.1 Anti-Inflammatory Drugs

10.7.5.2 Amino salicylates

10.7.5.3 Corticosteroids

10.7.5.4 Anti-TNF biologics

10.7.5.5 Immunosuppressant

10.7.5.6 Calcineurin Inhibitors

10.7.6 Historic and Forecasted Market Size by Molecule Type

10.7.6.1 Biologics

10.7.6.2 Small Molecules

10.7.7 Historic and Forecasted Market Size by Route of Administration

10.7.7.1 Oral

10.7.7.2 Injectable

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Retail Pharmacies

10.7.8.2 Hospital Pharmacies

10.7.8.3 Drug Store

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Ulcerative Colitis Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 640.98 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.52% |

Market Size in 2032: |

USD 1131.68 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Drug Type |

|

||

|

By Molecule Type |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||