Recombinant Erythropoietin Market Synopsis:

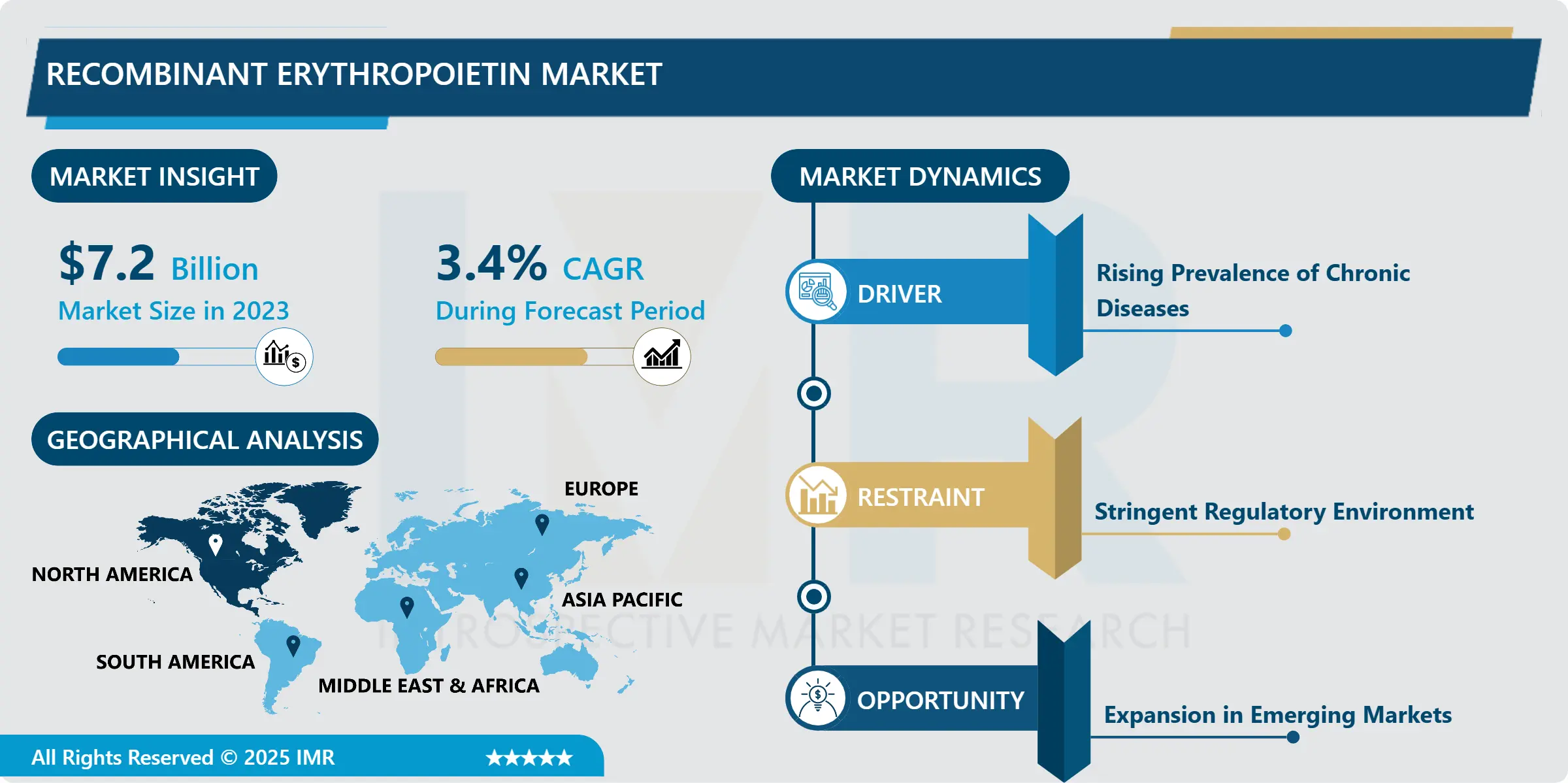

Recombinant Erythropoietin Market Size Was Valued at USD 7.2 Billion in 2023, and is Projected to Reach USD 9.73 Billion by 2032, Growing at a CAGR of 3.4% From 2024-2032.

Recombinant erythropoietin market comprises of the manufacturing and marketing of biosynthetic erythropoietin a factor that promotes the generation of red blood cells. This particular type of biologic drug is particularly used in the treatment of anemia which is related to chronic diseases such as chronic kidney disease and cancer chemotherapy as well as other diseases related to blood. Recombinant erythropoietin imitates the action of the naturally secreted hormone, erythropoietin derived from the kidneys, and can therefore be used for treatment in patients having low levels/endogenous EPO.

The recombinant erythropoietin (rEPO) market is an essential niche within the global biopharmaceutical industry based on the rising global incidence of chronic diseases including kidney failure, cancer, and blood disorders. Erythropoietin products have become well established in regard to the management of these diseases to alleviate anemia and address the impact these conditions have on patients’ quality of life and need for supplementary blood transfusions. Due to increasing prevalence of chronic kidney diseases worldwide as well as other diseases such as cancer the use of rEPO has therefore expanded.

There are different forms of erythropoietin on the market each with their option; epoetin alfa, epoetin beta, and darbepoetin alfa which are more effective and easier to use. Market is also influenced by the getting popularity of biosimilars market, which has provided affordable substitutes of branded erythropoietin products and increased patients’ accessibility to the treatment, especially in the growing economies. Good policies on reimbursement and approval in the developed countries have highly supported this market growth although high regulatory aspects and side effects such as thromboembolism have been acting as limping barriers.

Recombinant Erythropoietin Market Trend Analysis:

Growing Adoption of Biosimilars

-

The recombinant erythropoietin market is slowly moving towards biosimilar products based on their cheaper price and the increased level of support from the various regulatory authorities. On this basis, biosimilars as highly similar but different biologic products to approved reference drugs are cost-effective without compromising on efficacy and safety concerns.

- The relative minuses grow from this trend are most notable in emergent markets where high costs of branded erythropoietin drugs have excluded a vast number of patients from effective treatment. With increasing generic branding drug patents expiration and backed by policies to encourage use of biosimilar products. For example, governments of nations such as India and Brazil continue to promote the use of biosimilars in order to expand access to medicines. Also, through healthcare systems striving to contain costs, biosimilars are being progressively used in developed markets. This growing acceptance is expected to redefine market standards in the future year.

Expansion in Emerging Markets

-

The recombinant erythropoietin market is more developed in North America and Europe, but emerging economies such as China offer financially enticing market because the prices for imported drugs in these countries are far higher than in OECD countries. Asian-Pacific, Latin-American and African population base is experiencing increasing incidence rates of chronic kidney disease and cancer because of new fashionable life styles, increased life span and advanced diagnostic facilities.

- The growth in capacity of healthcare facilities and increased government support to enable patients’ access to necessary medicines positively drives erythropoietin products. For instance, China and India are strengthening their healthcare systems and accordingly increasing the possibility of more widespread R EPO therapy. Perhaps, most importantly, biosimilar production in these regions has decreased in cost, which is enhancing adoption. These factors make emerging markets to play a central role in the recombinant Erythropoietin market going forward.

Recombinant Erythropoietin Market Segment Analysis:

Recombinant Erythropoietin Market is Segmented on the basis of Product Type, Application, End User, and Region.

By Product Type, Epoetin Alfa segment is expected to dominate the market during the forecast period

-

Epoetin Alfa and Epoetin Beta are the most famous recombinant erythropoietin because of the potential effect of promoting erythropoiesis for the treatment of anemia as well as the broad clinical application. These first-Generation products are widely employed in many applications among them management of anemia in Chronic Kidney Disease and Chemotherapy-induced anemia.

- This second-generation erythropoiesis stimulating agent has a half-life of thirty days compared to the 24 hours that was recurrently administered to the patients, thus darbepoetin Alfa targets dosing convenience and patient compliance as an advantage over the other. The “Other” category comprising bio similar & novel formulations is also picking up most notably in the emerging economies owing to factors like cost advantage and awareness. This diversification of product offerings is aiding expansion of market access and serving a wider group of patients.

By Application, Anemia Treatment segment expected to held the largest share

-

The Anemia Treatment segment is the largest application area of recombinant erythropoietin due to the key use to treat anemia caused by CKD and chemotherapy. This ability to boost red blood cell production makes rEPO to be the pillar on which the management of anemia protocols across the globe is based.

- Another broad area of application is the Blood Disorders segment, comprising diseases such as myelodysplastic syndromes and aplastic anemia. Many of these disorders become dependent on erythropoietin to prevent complication arising from anemia. Off-label and Emerging indications are also one of the reason showing that the recombinant erythropoietin products are useful in many “other” ways.

Recombinant Erythropoietin Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America holds the largest share for the recombinant erythropoietin products because of the well-developed healthcare industry coupled with high incidences of chronic diseases and increasing biotechnology spending. The United States for instance benefits from the strong pipeline of erythropoietin products and biosimilar penetration.

- In addition to this, reimbursement policies that have favoured its adoption in North America is another reason that has entrenched this market further by the existence of market players. It also has the most sign ups and further active research and clinical experiments aiming at improving the quality of rEPO products. All these factors make North America to be the biggest and most significant market for recombinant erythropoietin.

Active Key Players in the Recombinant Erythropoietin Market

- Amgen Inc. (USA)

- Biocon Limited (India)

- Celltrion, Inc. (South Korea)

- Dr. Reddy’s Laboratories Ltd. (India)

- Intas Pharmaceuticals Ltd. (India)

- Johnson & Johnson (USA)

- LG Chem (South Korea)

- Merck KGaA (Germany)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Roche Holding AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Other Active Players.

|

Global Recombinant Erythropoietin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.2 Billion |

|

Forecast Period 2024-32 CAGR: |

3.4% |

Market Size in 2032: |

USD 9.73 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Recombinant Erythropoietin Market by Deployment Type

4.1 Recombinant Erythropoietin Market Snapshot and Growth Engine

4.2 Recombinant Erythropoietin Market Overview

4.3 Cloud-based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cloud-based: Geographic Segmentation Analysis

4.4 On-premises

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 On-premises: Geographic Segmentation Analysis

Chapter 5: Recombinant Erythropoietin Market by Component

5.1 Recombinant Erythropoietin Market Snapshot and Growth Engine

5.2 Recombinant Erythropoietin Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Software: Geographic Segmentation Analysis

5.4 Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Services: Geographic Segmentation Analysis

Chapter 6: Recombinant Erythropoietin Market by Organization Size

6.1 Recombinant Erythropoietin Market Snapshot and Growth Engine

6.2 Recombinant Erythropoietin Market Overview

6.3 Small and Medium-sized Enterprises (SMEs

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Small and Medium-sized Enterprises (SMEs: Geographic Segmentation Analysis

6.4 Large Enterprises

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Large Enterprises: Geographic Segmentation Analysis

Chapter 7: Recombinant Erythropoietin Market by Application

7.1 Recombinant Erythropoietin Market Snapshot and Growth Engine

7.2 Recombinant Erythropoietin Market Overview

7.3 Candidate Tracking

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Candidate Tracking: Geographic Segmentation Analysis

7.4 Interview Management

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Interview Management: Geographic Segmentation Analysis

7.5 Job Posting

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Job Posting: Geographic Segmentation Analysis

7.6 Resume Management

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Resume Management: Geographic Segmentation Analysis

7.7 Analytics

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Analytics: Geographic Segmentation Analysis

Chapter 8: Recombinant Erythropoietin Market by Industry Vertical

8.1 Recombinant Erythropoietin Market Snapshot and Growth Engine

8.2 Recombinant Erythropoietin Market Overview

8.3 IT and Telecommunication

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 IT and Telecommunication: Geographic Segmentation Analysis

8.4 BFSI (Banking

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 BFSI (Banking: Geographic Segmentation Analysis

8.5 Financial Services

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Financial Services: Geographic Segmentation Analysis

8.6 and Insurance

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 and Insurance: Geographic Segmentation Analysis

8.7 Healthcare

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Healthcare : Geographic Segmentation Analysis

8.8 Education

8.8.1 Introduction and Market Overview

8.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.8.3 Key Market Trends, Growth Factors and Opportunities

8.8.4 Education: Geographic Segmentation Analysis

8.9 Manufacturing

8.9.1 Introduction and Market Overview

8.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.9.3 Key Market Trends, Growth Factors and Opportunities

8.9.4 Manufacturing: Geographic Segmentation Analysis

8.10 Retail

8.10.1 Introduction and Market Overview

8.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.10.3 Key Market Trends, Growth Factors and Opportunities

8.10.4 Retail: Geographic Segmentation Analysis

8.11 Others

8.11.1 Introduction and Market Overview

8.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.11.3 Key Market Trends, Growth Factors and Opportunities

8.11.4 Others: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Recombinant Erythropoietin Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AMGEN INC. (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 JOHNSON & JOHNSON (USA)

9.4 ROCHE HOLDING AG (SWITZERLAND)

9.5 PFIZER INC. (USA)

9.6 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

9.7 NOVARTIS AG (SWITZERLAND)

9.8 MERCK KGAA (GERMANY)

9.9 LG CHEM (SOUTH KOREA)

9.10 DR. REDDY’S LABORATORIES LTD. (INDIA)

9.11 CELLTRION INC. (SOUTH KOREA)

9.12 INTAS PHARMACEUTICALS LTD. (INDIA)

9.13 BIOCON LIMITED (INDIA)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Recombinant Erythropoietin Market By Region

10.1 Overview

10.2. North America Recombinant Erythropoietin Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Deployment Type

10.2.4.1 Cloud-based

10.2.4.2 On-premises

10.2.5 Historic and Forecasted Market Size By Component

10.2.5.1 Software

10.2.5.2 Services

10.2.6 Historic and Forecasted Market Size By Organization Size

10.2.6.1 Small and Medium-sized Enterprises (SMEs

10.2.6.2 Large Enterprises

10.2.7 Historic and Forecasted Market Size By Application

10.2.7.1 Candidate Tracking

10.2.7.2 Interview Management

10.2.7.3 Job Posting

10.2.7.4 Resume Management

10.2.7.5 Analytics

10.2.8 Historic and Forecasted Market Size By Industry Vertical

10.2.8.1 IT and Telecommunication

10.2.8.2 BFSI (Banking

10.2.8.3 Financial Services

10.2.8.4 and Insurance

10.2.8.5 Healthcare

10.2.8.6 Education

10.2.8.7 Manufacturing

10.2.8.8 Retail

10.2.8.9 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Recombinant Erythropoietin Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Deployment Type

10.3.4.1 Cloud-based

10.3.4.2 On-premises

10.3.5 Historic and Forecasted Market Size By Component

10.3.5.1 Software

10.3.5.2 Services

10.3.6 Historic and Forecasted Market Size By Organization Size

10.3.6.1 Small and Medium-sized Enterprises (SMEs

10.3.6.2 Large Enterprises

10.3.7 Historic and Forecasted Market Size By Application

10.3.7.1 Candidate Tracking

10.3.7.2 Interview Management

10.3.7.3 Job Posting

10.3.7.4 Resume Management

10.3.7.5 Analytics

10.3.8 Historic and Forecasted Market Size By Industry Vertical

10.3.8.1 IT and Telecommunication

10.3.8.2 BFSI (Banking

10.3.8.3 Financial Services

10.3.8.4 and Insurance

10.3.8.5 Healthcare

10.3.8.6 Education

10.3.8.7 Manufacturing

10.3.8.8 Retail

10.3.8.9 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Recombinant Erythropoietin Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Deployment Type

10.4.4.1 Cloud-based

10.4.4.2 On-premises

10.4.5 Historic and Forecasted Market Size By Component

10.4.5.1 Software

10.4.5.2 Services

10.4.6 Historic and Forecasted Market Size By Organization Size

10.4.6.1 Small and Medium-sized Enterprises (SMEs

10.4.6.2 Large Enterprises

10.4.7 Historic and Forecasted Market Size By Application

10.4.7.1 Candidate Tracking

10.4.7.2 Interview Management

10.4.7.3 Job Posting

10.4.7.4 Resume Management

10.4.7.5 Analytics

10.4.8 Historic and Forecasted Market Size By Industry Vertical

10.4.8.1 IT and Telecommunication

10.4.8.2 BFSI (Banking

10.4.8.3 Financial Services

10.4.8.4 and Insurance

10.4.8.5 Healthcare

10.4.8.6 Education

10.4.8.7 Manufacturing

10.4.8.8 Retail

10.4.8.9 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Recombinant Erythropoietin Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Deployment Type

10.5.4.1 Cloud-based

10.5.4.2 On-premises

10.5.5 Historic and Forecasted Market Size By Component

10.5.5.1 Software

10.5.5.2 Services

10.5.6 Historic and Forecasted Market Size By Organization Size

10.5.6.1 Small and Medium-sized Enterprises (SMEs

10.5.6.2 Large Enterprises

10.5.7 Historic and Forecasted Market Size By Application

10.5.7.1 Candidate Tracking

10.5.7.2 Interview Management

10.5.7.3 Job Posting

10.5.7.4 Resume Management

10.5.7.5 Analytics

10.5.8 Historic and Forecasted Market Size By Industry Vertical

10.5.8.1 IT and Telecommunication

10.5.8.2 BFSI (Banking

10.5.8.3 Financial Services

10.5.8.4 and Insurance

10.5.8.5 Healthcare

10.5.8.6 Education

10.5.8.7 Manufacturing

10.5.8.8 Retail

10.5.8.9 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Recombinant Erythropoietin Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Deployment Type

10.6.4.1 Cloud-based

10.6.4.2 On-premises

10.6.5 Historic and Forecasted Market Size By Component

10.6.5.1 Software

10.6.5.2 Services

10.6.6 Historic and Forecasted Market Size By Organization Size

10.6.6.1 Small and Medium-sized Enterprises (SMEs

10.6.6.2 Large Enterprises

10.6.7 Historic and Forecasted Market Size By Application

10.6.7.1 Candidate Tracking

10.6.7.2 Interview Management

10.6.7.3 Job Posting

10.6.7.4 Resume Management

10.6.7.5 Analytics

10.6.8 Historic and Forecasted Market Size By Industry Vertical

10.6.8.1 IT and Telecommunication

10.6.8.2 BFSI (Banking

10.6.8.3 Financial Services

10.6.8.4 and Insurance

10.6.8.5 Healthcare

10.6.8.6 Education

10.6.8.7 Manufacturing

10.6.8.8 Retail

10.6.8.9 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Recombinant Erythropoietin Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Deployment Type

10.7.4.1 Cloud-based

10.7.4.2 On-premises

10.7.5 Historic and Forecasted Market Size By Component

10.7.5.1 Software

10.7.5.2 Services

10.7.6 Historic and Forecasted Market Size By Organization Size

10.7.6.1 Small and Medium-sized Enterprises (SMEs

10.7.6.2 Large Enterprises

10.7.7 Historic and Forecasted Market Size By Application

10.7.7.1 Candidate Tracking

10.7.7.2 Interview Management

10.7.7.3 Job Posting

10.7.7.4 Resume Management

10.7.7.5 Analytics

10.7.8 Historic and Forecasted Market Size By Industry Vertical

10.7.8.1 IT and Telecommunication

10.7.8.2 BFSI (Banking

10.7.8.3 Financial Services

10.7.8.4 and Insurance

10.7.8.5 Healthcare

10.7.8.6 Education

10.7.8.7 Manufacturing

10.7.8.8 Retail

10.7.8.9 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Recombinant Erythropoietin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.2 Billion |

|

Forecast Period 2024-32 CAGR: |

3.4% |

Market Size in 2032: |

USD 9.73 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||