Radioactive Tracer Market Synopsis:

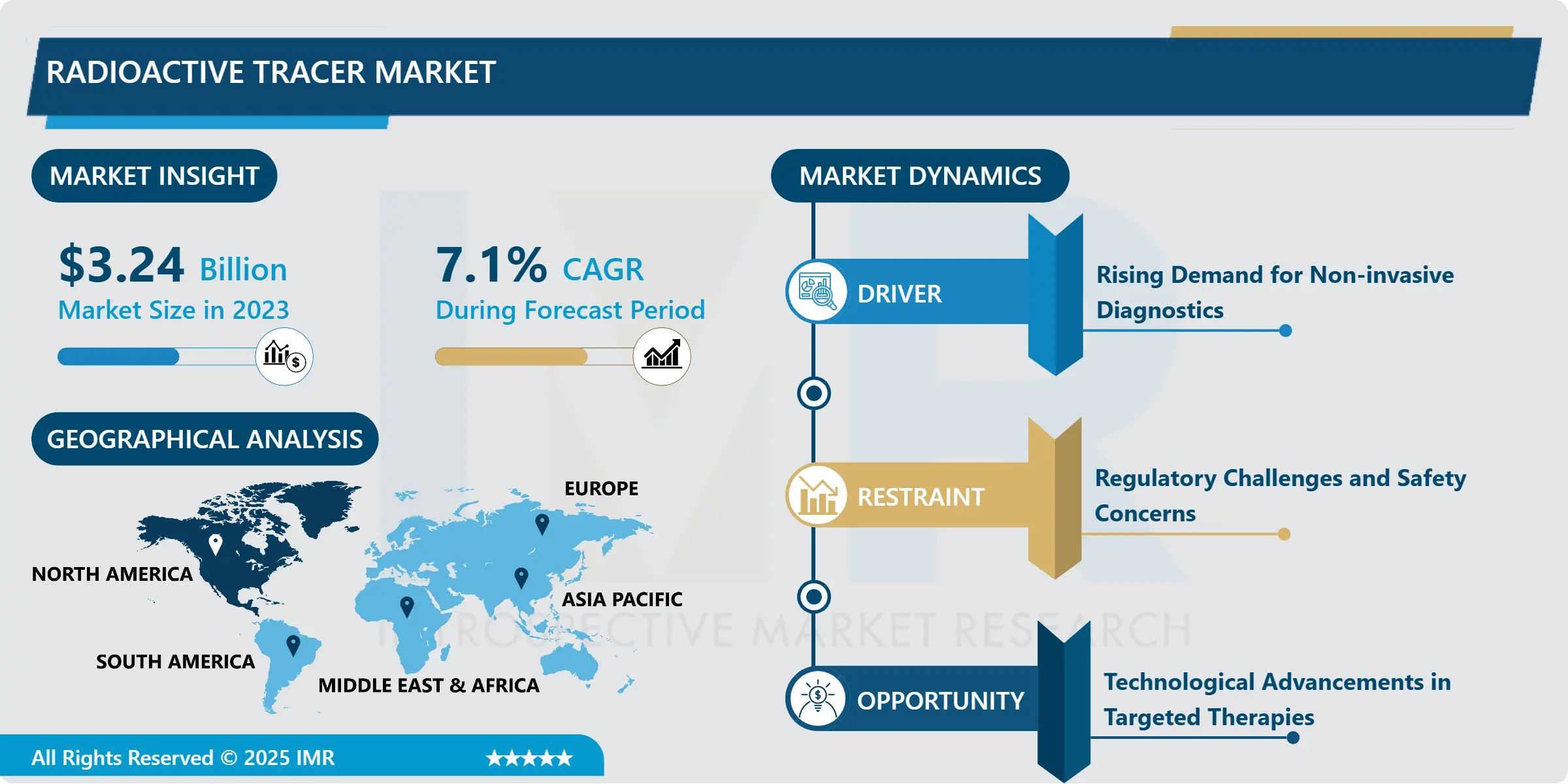

Radioactive Tracer Market Size Was Valued at USD 3.24 Billion in 2023, and is Projected to Reach USD 6.00 Billion by 2032, Growing at a CAGR of 7.10% From 2024-2032.

The radioactive tracer market is generally about the usage of radioactive isotopes to monitor and track the flow of substances in different systems. Such tracers are used in medicine in imaging and diagnostics, in environmental sciences, and in industrial applications. Radioactive tracers have the ability to match gamma rays for detection, beta particle detection or alpha particle detection. These tracers have significant application in disease diagnosis and treatment process especially in cancer, heart diseases and nervous system diseases and also in research for environmental and industrial uses.

Some of the main factors that have made radioactive tracers popular include up surging incidences of diseases such as cancer and heart diseases, which need modern diagnostic applications like PET and SPECT. The need for affordable and less invasive diagnostic techniques is fuelling growth here as radioactive materials can pinpoint the exact location of diseases and disorders in the human body, helping clinicians determine the best course of action.

The increasing awareness on pharmacogenomic and the shift toward personalized medicine and the growth and expansion of nuclear medicine is driving market growth. The new better developed radioactive isotopes and tracers that have been developed plus better imaging techniques is helping the healthcare industry to diagnose and, in some cases, follow diseases better. Further, this progress is important as it enables better efficiencies in treatments while improving results for patients, stimulating market demand.

Radioactive Tracer Market Trend Analysis:

Growing application of tracers in oncology.

- One very specifically identified trend which seems to be developing now in the radioactive tracer market is that of increasing tracer use in cancer treatment. As inhabitants of the earth experience a threat of increased cancer rates, especially in developed nations, there is an increased interest in the utilization of artificially radioactive isotopes to identify and treat cancer. These tracers help doctors monitor the tumor progression or the reaction to treatment on the procedure’s progress and patients’ outcomes in real-time. Specific tracers to reach only tumor cells also help in the success of teatment in radiation therapy, thereby improving over all results.

- Also a rapidly growing sector includes the progressive further development of tracer technology for applications of the highest level. Scientists aim at developing tracers that offer a resolution that is even higher, radiation levels that are even lower, but with the ability to differentiate easily between various tissues to help in arriving at better diagnoses. This innovation is further boosted by research partnership between pharma firms, universities and research institutions to enhance nuclear imaging and its uses, which has led to growth of new tracers in the PET and SPECT imaging.

The increasing demand for non-invasive diagnostic methods

- The global market for radioactive tracers also has the reason of a more extended requirement for more non-invasive diagnostic tools that are available in the market. As healthcare providers look forward to minimizing the length of time and expenses a patient takes before they are discharged, the move to non-invasive imaging techniques such as radioactive tracers is enhanced. The global shift to preventive health care and early disease identification means that tracers could be used not only for working population screening and more general diagnostic applications when more emerging countries are increasing their health-care spend.

- Also, the programme offers significant opportunities such as improvement of molecular imaging and expected appearance of new radiopharmaceuticals for targeted diseases. However, as the demand for precision medicine increases, the market for selectively specified and developed radioactive tracers that are tailored for unique treatment and therapy requirements is expanding. This is a chance for companies to come up with new and advanced tracers for the next generation to fill the niche that targets individualized health care needs.

Radioactive Tracer Market Segment Analysis:

The Radioactive Tracer Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Gamma Emitters segment is expected to dominate the market during the forecast period

- Gamma-emitting isotopes, beta-emitting isotopes, and alpha-emitting isotopes are the major radioactive tracer agents that are used in diagnostic and other industrial practices. Gamma emitters in the form of isotopes like technetium-99m are popular in medical imaging because they release gamma rays which can be picked by gamma cameras. These tracers are essential for visualizing organs and tissues, most especially when imaging in nuclear medicine. Beta emitters top among them being iodine-131 emit beta particles and are used for therapeutic and diagnostic applications including cancer therapy. Alpha emitters which emit alpha particles are less frequently employed but can offer much promise in targeted therapies because of the particle’s high energy and capacity to impart concentrated damage on cancer cells. Thus, each type of emitter has its own strengths for a given application, such as the tissue penetration depth, emission energy, and medical use safety profile.

By Application, Oil & Gas segment expected to held the largest share

- Isotopes have numerous functions in various fields of endeavor, with related diagnostic and operational benefits. They are applied in the oil and gas industry in well testing, reservoir monitoring, leak detection and enhance exploration and production. In chemical and petrochemical industries tracers enable identification of the product flow within pipelines, observe reaction processes and security in case of leakage alerts. There is the medical application where tracer technique used in PET and SPECT in diagnosing diseases specifically cancers and diseases of the heart. Various fields such as environmental and agricultural use tracers to determine the level of pollution, research on the soil and water system, or … analyze the mobility of nutrients or some form of pollution. In certain industries, products and processes are checked using radioactive tracers for performance assessment, checking equipment reliability and tracing material flow, improving efficiency and safety in the various industries.

Radioactive Tracer Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is projected to remain the largest regional market of the radioactive tracer market for the foreseeable future. PET and SPECT’s high adoption also contributes to the region’s market share as are the leading healthcare suppliers and major market players. Moreover, North America enjoys relatively high research and development expenditures that lead to constant advancements and development of radioactive tracers. Affordable healthcare in general in North America strengthens nuclear medicine as an industry, giving North America the lead in the provision of this important service.

- In addition, other reasons explaining the region’s supremacy are the ageing population and an increase in chronic diseases in North America. In particular, the U.S. is ahead of all other countries in the application of radioactive tracers in medicine and oncology, cardiology, and neurology that require highly accurate diagnostic methods. The further commitment to development in medical technology and research also makes North America a leader in the uptake of new radioactive tracer technologies and helps to strengthen its market lead even more.

Active Key Players in the Radioactive Tracer Market:

- ABX advanced biochemical compounds GmbH (Germany)

- Blue Earth Diagnostics Limited (UK)

- Cardinal Health Inc. (USA)

- Curium (France)

- General Electric Co. (USA)

- IBA Radiopharma Solutions (Belgium)

- Invicro LLC. (USA)

- Newcastle University (UK)

- Novartis AG (Switzerland)

- Rotem Industries Ltd. (Israel)

- Other Active Players

|

Radioactive Tracer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.24 Billion |

|

Forecast Period 2024-32 CAGR: |

7.10 % |

Market Size in 2032: |

USD 6.00 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Radioactive Tracer Market by Type

4.1 Radioactive Tracer Market Snapshot and Growth Engine

4.2 Radioactive Tracer Market Overview

4.3 Gamma Emitters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Gamma Emitters: Geographic Segmentation Analysis

4.4 Beta Emitters

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Beta Emitters: Geographic Segmentation Analysis

4.5 Alpha Emitters

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Alpha Emitters: Geographic Segmentation Analysis

Chapter 5: Radioactive Tracer Market by Application

5.1 Radioactive Tracer Market Snapshot and Growth Engine

5.2 Radioactive Tracer Market Overview

5.3 Oil & Gas

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Oil & Gas: Geographic Segmentation Analysis

5.4 Chemical & Petrochemical

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Chemical & Petrochemical: Geographic Segmentation Analysis

5.5 Medical Diagnostics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Medical Diagnostics: Geographic Segmentation Analysis

5.6 Environmental & Agricultural

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Environmental & Agricultural: Geographic Segmentation Analysis

5.7 Industrial

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Industrial: Geographic Segmentation Analysis

Chapter 6: Radioactive Tracer Market by End User

6.1 Radioactive Tracer Market Snapshot and Growth Engine

6.2 Radioactive Tracer Market Overview

6.3 Healthcare

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Healthcare: Geographic Segmentation Analysis

6.4 Energy & Power

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Energy & Power: Geographic Segmentation Analysis

6.5 Agriculture

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Agriculture: Geographic Segmentation Analysis

6.6 Manufacturing

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Manufacturing: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Radioactive Tracer Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABX ADVANCED BIOCHEMICAL COMPOUNDS GMBH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BLUE EARTH DIAGNOSTICS LIMITED (UK)

7.4 CARDINAL HEALTH INC. (USA)

7.5 CURIUM (FRANCE)

7.6 GENERAL ELECTRIC CO. (USA)

7.7 IBA RADIOPHARMA SOLUTIONS (BELGIUM)

7.8 INVICRO LLC. (USA)

7.9 NEWCASTLE UNIVERSITY (UK)

7.10 NOVARTIS AG (SWITZERLAND)

7.11 ROTEM INDUSTRIES LTD. (ISRAEL)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Radioactive Tracer Market By Region

8.1 Overview

8.2. North America Radioactive Tracer Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Gamma Emitters

8.2.4.2 Beta Emitters

8.2.4.3 Alpha Emitters

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Oil & Gas

8.2.5.2 Chemical & Petrochemical

8.2.5.3 Medical Diagnostics

8.2.5.4 Environmental & Agricultural

8.2.5.5 Industrial

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Healthcare

8.2.6.2 Energy & Power

8.2.6.3 Agriculture

8.2.6.4 Manufacturing

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Radioactive Tracer Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Gamma Emitters

8.3.4.2 Beta Emitters

8.3.4.3 Alpha Emitters

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Oil & Gas

8.3.5.2 Chemical & Petrochemical

8.3.5.3 Medical Diagnostics

8.3.5.4 Environmental & Agricultural

8.3.5.5 Industrial

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Healthcare

8.3.6.2 Energy & Power

8.3.6.3 Agriculture

8.3.6.4 Manufacturing

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Radioactive Tracer Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Gamma Emitters

8.4.4.2 Beta Emitters

8.4.4.3 Alpha Emitters

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Oil & Gas

8.4.5.2 Chemical & Petrochemical

8.4.5.3 Medical Diagnostics

8.4.5.4 Environmental & Agricultural

8.4.5.5 Industrial

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Healthcare

8.4.6.2 Energy & Power

8.4.6.3 Agriculture

8.4.6.4 Manufacturing

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Radioactive Tracer Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Gamma Emitters

8.5.4.2 Beta Emitters

8.5.4.3 Alpha Emitters

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Oil & Gas

8.5.5.2 Chemical & Petrochemical

8.5.5.3 Medical Diagnostics

8.5.5.4 Environmental & Agricultural

8.5.5.5 Industrial

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Healthcare

8.5.6.2 Energy & Power

8.5.6.3 Agriculture

8.5.6.4 Manufacturing

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Radioactive Tracer Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Gamma Emitters

8.6.4.2 Beta Emitters

8.6.4.3 Alpha Emitters

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Oil & Gas

8.6.5.2 Chemical & Petrochemical

8.6.5.3 Medical Diagnostics

8.6.5.4 Environmental & Agricultural

8.6.5.5 Industrial

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Healthcare

8.6.6.2 Energy & Power

8.6.6.3 Agriculture

8.6.6.4 Manufacturing

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Radioactive Tracer Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Gamma Emitters

8.7.4.2 Beta Emitters

8.7.4.3 Alpha Emitters

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Oil & Gas

8.7.5.2 Chemical & Petrochemical

8.7.5.3 Medical Diagnostics

8.7.5.4 Environmental & Agricultural

8.7.5.5 Industrial

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Healthcare

8.7.6.2 Energy & Power

8.7.6.3 Agriculture

8.7.6.4 Manufacturing

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Radioactive Tracer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.24 Billion |

|

Forecast Period 2024-32 CAGR: |

7.10 % |

Market Size in 2032: |

USD 6.00 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||