Radiation Protection Market Synopsis:

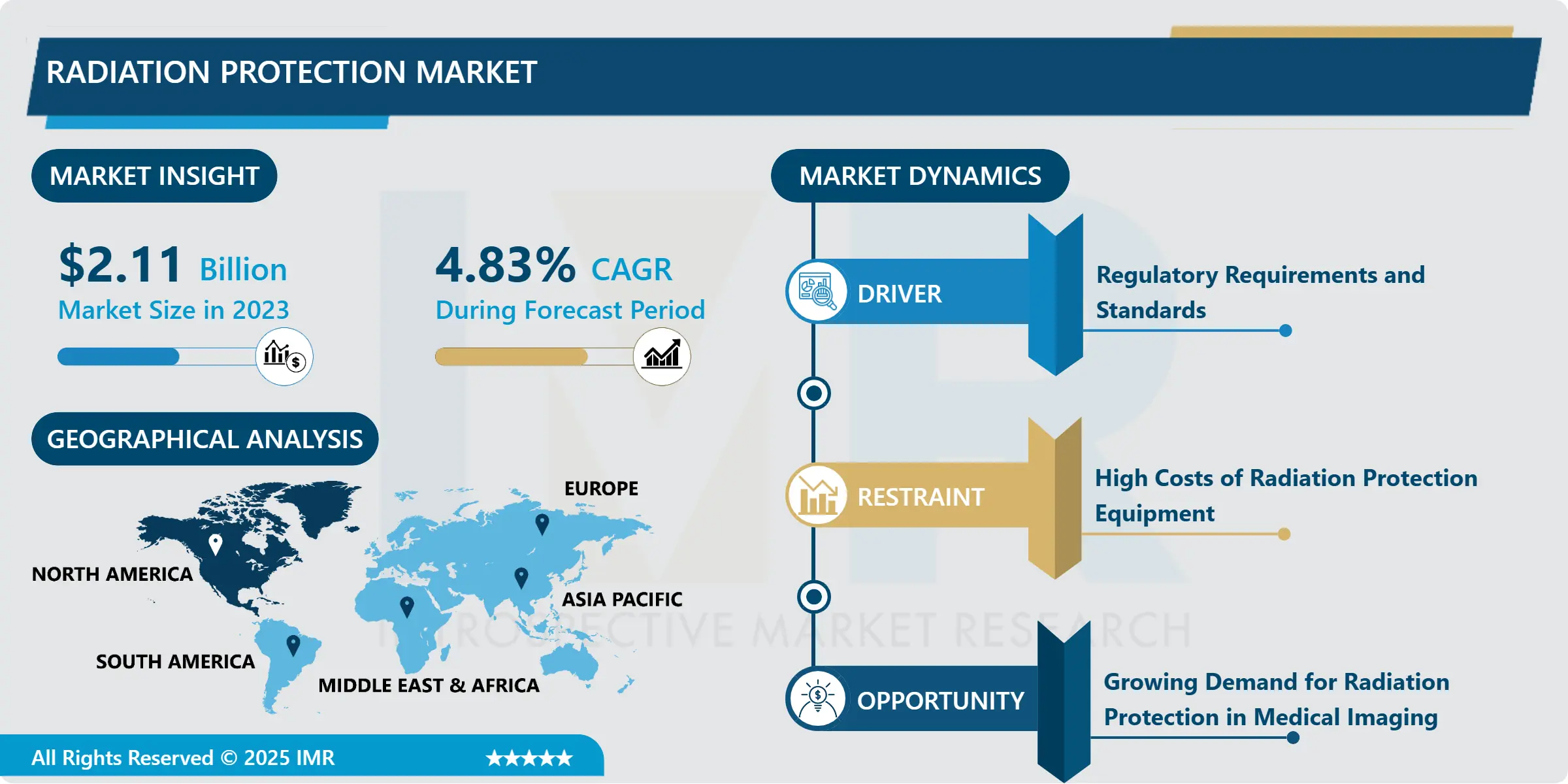

Radiation Protection Market Size Was Valued at USD 2.11 Billion in 2023, and is Projected to Reach USD 3.23 Billion by 2032, Growing at a CAGR of 4.83% From 2024-2032.

The Radiation Protection Market can be best described as a segment of industries that serves to provide technologies, products, and services for the protection of people, living organisms, and other structures and environment from the ionizing radiation hazards. This ranges from diagnostic and treatment tools to radiation detection and imaging devices, to shielding and protection systems in delivery of services, health, power generation plants, industries and military. The market is expanding owing to product development in the radiation safety industry due to increasing demand of protection from radiation in various sectors.

The Radiation Protection Market has therefore grown tremendously in the last couple of years because occupational and public awareness on radiation hazards has increased and more so formal regulatory measures have been put in place across the world to protect people from potentially easily hazardous radiation. This market is being fueled by the quest to shield people, hailing from different industries that include medical facilities, energy and power, industrial scrutinization, and defense, against detrimental impacts of radiation. Computer tomography (CT) scans, X-ray, radiotherapy procedures are some of the key segments with higher demands in diagnostics and treatment services hence a big chunk in this market share.

The growth is also helped also by development in radiation detection and measurement techniques, trends in razor dosimeters, measurement devices and personal protective apparels which offer data that is effective and timely. The market is easily served by government regulation on radiation protection, and taking action to force institutions to utilize high-quality protection measures. The rivalry implies that stakeholders are always improving features of products to fit newly added safety requirements which in turn drives advancement of protection materials and devices, sensing mechanisms, and control systems.

Radiation Protection Market Trend Analysis:

Advancements in Digital Radiation Detection Technologies

- One of the major emerging trends defining the Radiation Protection Market and its growth potential is the use of digital technologies in radiation detection, including radiation detection instruments. Current digital detectors provide higher accuracy, increased speed of information processing, and the ability to monitor radiation without direct contact, thereby improving radiation control. These are the modern technologies that are increasingly replacing the traditional analog equipments, especially where considerable quantities of real-time data analysis is required and where low levels of radiation are to be detected as in the health care and defense sectors and nuclear reactors.

- Digital detection technologies are equally being employed for remote and automatic radiation detection eliminating end user interaction and direct exposure to risky surroundings. This trend aligns with the emerging new world of smart ‘connected’ safety solutions, which now has a growing emphasis on including IoT elements in the products for greater accuracy and productivity. These innovations are most useful in highly specialized fields for examples nuclear energy and homeland security where dose assessment is critical for personnel protection and license approval.

Growing Demand for Radiation Protection in Medical Imaging

- The anticipated trend which can be affiliated to opportunities that exist in Radiation Protection Market relates to increase of demand on protective solutions in medical imaging. Being medical imaging procedures, X-raying, computed tomography, and radiotherapy are on the rise worldwide and so are concerns for radiation protection for patients and workers. This demand is caused by the increased insurance that some healthcare organizations have regarding extended radiation exposure, in which case they invest in better shielding and monitoring products.

- The growth of healthcare industry in developing markets is opening up new applications for radiation protection products since the newly established diagnostic imaging procuring facilities have to follow established international norms for radiation protection. As there is further development in Health care sector this market is most likely to find growing interest in technologically advanced specialized radiation protective wear and specialised systems for Medical sector that comes with high safety standard.

Radiation Protection Market Segment Analysis:

Radiation Protection Market is Segmented on the basis of Product Type, Material, Application, End User, and Region.

By Product Type, Radiation Shielding Products segment is expected to dominate the market during the forecast period

- The Radiation Protection Market is mainly categorized by product type; Radiation Shielding Products, Radiation Detection & Monitoring Products and Radiation Safety Accessories. Lead Aprons and Lead-lined Barriers are types of Radiation Shielding Products they used in circumstances that require high protection to isolate direct radiation sources from people. These products have higher demand in healthcare industry particularly in the operating theater where protection ‘shields’ are indispensable for ordinary imaging services.

- Radiation Detection & Monitoring Products are in great detail, which consist of dosimeters, and radiation detectors are used in numerous industries with the aim of constantly measuring the level of radiation being emitted. This segment is one of the fastest growing segments as a result of the introduction of advanced real-time monitoring technologies with enhanced accuracy in measurement together with compatibility with other safety products. There is ever-increasing requirement for real-time radiation data in nuclear and industrial industries to call for better detection and monitoring products.

By Application, Medical segment expected to held the largest share

- With respect to the application the market is divided into Medical, Industrial, Nuclear Power Plants, Homeland Security & Defense and Research & Development. The Medical segment occupies a significant share in the market, which is expected due to the increased use of radiation both in diagnostics and in treatments. Owing to the stringent safety standards in health care facilities, a growing number of institutions is spending fortunes in shielding products to reduce radiation hazards to patients and clinic attendees.

- The Homeland Security & Defense segment also has a role because radiation protection products to have nuclear risk identification and abeyance. These products are preferred in the security of borders and the military activities since the monitoring of radiation is importance for the safety of the nation. This segment will have heightened demand for accurate detection and nuclear shielding solutions as geopolitical tension and nuclear security grows.

Radiation Protection Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the largest share of Radiation Protection Market, because of the sound health care system in the United States, a well-established nuclear power sector, strict legal regulation of radiation protection. The market has leading industry players, continuous technological developments, and large governmental investments for radiation shielding in healthcare and defense applications that help North America to become stronger.

- The region has witnessed considerable investments in the Research & Development of technologies used for detections of radiations and monitoring in the region with especial emphasize to the United States. The commitment towards new product development and hence acquiring safety compliance certifications along with the extensive range of established healthcare and industrial facilities in North America retain the market at a vantage point in the Radiation Protection Market.

Active Key Players in the Radiation Protection Market:

- 3M (United States)

- Honeywell International Inc. (United States)

- Mirion Technologies Inc. (United States)

- LANDAUER, Inc. (United States)

- Amray Group (Ireland)

- Infab Corporation (United States)

- Radiation Protection Products, Inc. (United States)

- Protech Medical (United States)

- Bar-Ray Products (United States)

- ELLA Legros (France)

- Berlac Group (Switzerland)

- Lite Tech, Inc. (United States), and Other Active Players

Key Industry Developments in the Radiation Protection Market:

- In May 2024, Hefei Institutes of Physical Science developed a new composite material with micron plate Sm2O3 to enhance shielding against neutron and gamma radiation.

- In December 2023, the IAEA announced the development of a new safety guide to address radiation protection and safety in existing exposure situations, aiming to provide comprehensive guidance for diverse radiation scenarios.

- In November 2023, Sweden's Texray secured an investment of € 3.9 million to enhance radiation protection for medical practitioners with advanced textile solutions.

- In September 2023, the Dutch government approved funding for the Pallas research reactor at Petten to replace the aging HFR and boost medical isotope production.

|

Radiation Protection Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.11 Billion |

|

Forecast Period 2024-32 CAGR: |

4.83% |

Market Size in 2032: |

USD 3.23 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Radiation Protection Market by Product Type

4.1 Radiation Protection Market Snapshot and Growth Engine

4.2 Radiation Protection Market Overview

4.3 Radiation Shielding Products

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Radiation Shielding Products: Geographic Segmentation Analysis

4.4 Radiation Detection & Monitoring Products

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Radiation Detection & Monitoring Products: Geographic Segmentation Analysis

4.5 Radiation Safety Accessories

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Radiation Safety Accessories: Geographic Segmentation Analysis

Chapter 5: Radiation Protection Market by Material

5.1 Radiation Protection Market Snapshot and Growth Engine

5.2 Radiation Protection Market Overview

5.3 Lead-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Lead-based: Geographic Segmentation Analysis

5.4 Lead-free

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Lead-free: Geographic Segmentation Analysis

5.5 Lead-composite

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Lead-composite: Geographic Segmentation Analysis

Chapter 6: Radiation Protection Market by Application

6.1 Radiation Protection Market Snapshot and Growth Engine

6.2 Radiation Protection Market Overview

6.3 Medical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Medical: Geographic Segmentation Analysis

6.4 Industrial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Industrial: Geographic Segmentation Analysis

6.5 Nuclear Power Plants

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Nuclear Power Plants: Geographic Segmentation Analysis

6.6 Homeland Security & Defense

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Homeland Security & Defense: Geographic Segmentation Analysis

6.7 Research & Development

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Research & Development: Geographic Segmentation Analysis

Chapter 7: Radiation Protection Market by End User

7.1 Radiation Protection Market Snapshot and Growth Engine

7.2 Radiation Protection Market Overview

7.3 Hospitals & Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

7.4 Diagnostic Imaging Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Imaging Centers: Geographic Segmentation Analysis

7.5 Research Laboratories

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Research Laboratories: Geographic Segmentation Analysis

7.6 Industrial Processing Plants

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Industrial Processing Plants: Geographic Segmentation Analysis

7.7 Military & Defense Organizations

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Military & Defense Organizations: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Radiation Protection Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 3M (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

8.4 MIRION TECHNOLOGIES INC. (UNITED STATES)

8.5 LANDAUER INC. (UNITED STATES)

8.6 AMRAY GROUP (IRELAND)

8.7 INFAB CORPORATION (UNITED STATES)

8.8 RADIATION PROTECTION PRODUCTS INC. (UNITED STATES)

8.9 PROTECH MEDICAL (UNITED STATES)

8.10 BAR-RAY PRODUCTS (UNITED STATES)

8.11 ELLA LEGROS (FRANCE)

8.12 BERLAC GROUP (SWITZERLAND)

8.13 LITE TECH INC. (UNITED STATES)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Radiation Protection Market By Region

9.1 Overview

9.2. North America Radiation Protection Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Radiation Shielding Products

9.2.4.2 Radiation Detection & Monitoring Products

9.2.4.3 Radiation Safety Accessories

9.2.5 Historic and Forecasted Market Size By Material

9.2.5.1 Lead-based

9.2.5.2 Lead-free

9.2.5.3 Lead-composite

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Medical

9.2.6.2 Industrial

9.2.6.3 Nuclear Power Plants

9.2.6.4 Homeland Security & Defense

9.2.6.5 Research & Development

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals & Clinics

9.2.7.2 Diagnostic Imaging Centers

9.2.7.3 Research Laboratories

9.2.7.4 Industrial Processing Plants

9.2.7.5 Military & Defense Organizations

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Radiation Protection Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Radiation Shielding Products

9.3.4.2 Radiation Detection & Monitoring Products

9.3.4.3 Radiation Safety Accessories

9.3.5 Historic and Forecasted Market Size By Material

9.3.5.1 Lead-based

9.3.5.2 Lead-free

9.3.5.3 Lead-composite

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Medical

9.3.6.2 Industrial

9.3.6.3 Nuclear Power Plants

9.3.6.4 Homeland Security & Defense

9.3.6.5 Research & Development

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals & Clinics

9.3.7.2 Diagnostic Imaging Centers

9.3.7.3 Research Laboratories

9.3.7.4 Industrial Processing Plants

9.3.7.5 Military & Defense Organizations

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Radiation Protection Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Radiation Shielding Products

9.4.4.2 Radiation Detection & Monitoring Products

9.4.4.3 Radiation Safety Accessories

9.4.5 Historic and Forecasted Market Size By Material

9.4.5.1 Lead-based

9.4.5.2 Lead-free

9.4.5.3 Lead-composite

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Medical

9.4.6.2 Industrial

9.4.6.3 Nuclear Power Plants

9.4.6.4 Homeland Security & Defense

9.4.6.5 Research & Development

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals & Clinics

9.4.7.2 Diagnostic Imaging Centers

9.4.7.3 Research Laboratories

9.4.7.4 Industrial Processing Plants

9.4.7.5 Military & Defense Organizations

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Radiation Protection Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Radiation Shielding Products

9.5.4.2 Radiation Detection & Monitoring Products

9.5.4.3 Radiation Safety Accessories

9.5.5 Historic and Forecasted Market Size By Material

9.5.5.1 Lead-based

9.5.5.2 Lead-free

9.5.5.3 Lead-composite

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Medical

9.5.6.2 Industrial

9.5.6.3 Nuclear Power Plants

9.5.6.4 Homeland Security & Defense

9.5.6.5 Research & Development

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals & Clinics

9.5.7.2 Diagnostic Imaging Centers

9.5.7.3 Research Laboratories

9.5.7.4 Industrial Processing Plants

9.5.7.5 Military & Defense Organizations

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Radiation Protection Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Radiation Shielding Products

9.6.4.2 Radiation Detection & Monitoring Products

9.6.4.3 Radiation Safety Accessories

9.6.5 Historic and Forecasted Market Size By Material

9.6.5.1 Lead-based

9.6.5.2 Lead-free

9.6.5.3 Lead-composite

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Medical

9.6.6.2 Industrial

9.6.6.3 Nuclear Power Plants

9.6.6.4 Homeland Security & Defense

9.6.6.5 Research & Development

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals & Clinics

9.6.7.2 Diagnostic Imaging Centers

9.6.7.3 Research Laboratories

9.6.7.4 Industrial Processing Plants

9.6.7.5 Military & Defense Organizations

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Radiation Protection Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Radiation Shielding Products

9.7.4.2 Radiation Detection & Monitoring Products

9.7.4.3 Radiation Safety Accessories

9.7.5 Historic and Forecasted Market Size By Material

9.7.5.1 Lead-based

9.7.5.2 Lead-free

9.7.5.3 Lead-composite

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Medical

9.7.6.2 Industrial

9.7.6.3 Nuclear Power Plants

9.7.6.4 Homeland Security & Defense

9.7.6.5 Research & Development

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals & Clinics

9.7.7.2 Diagnostic Imaging Centers

9.7.7.3 Research Laboratories

9.7.7.4 Industrial Processing Plants

9.7.7.5 Military & Defense Organizations

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Radiation Protection Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.11 Billion |

|

Forecast Period 2024-32 CAGR: |

4.83% |

Market Size in 2032: |

USD 3.23 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||