Prosthetics And Orthotics Market Synopsis:

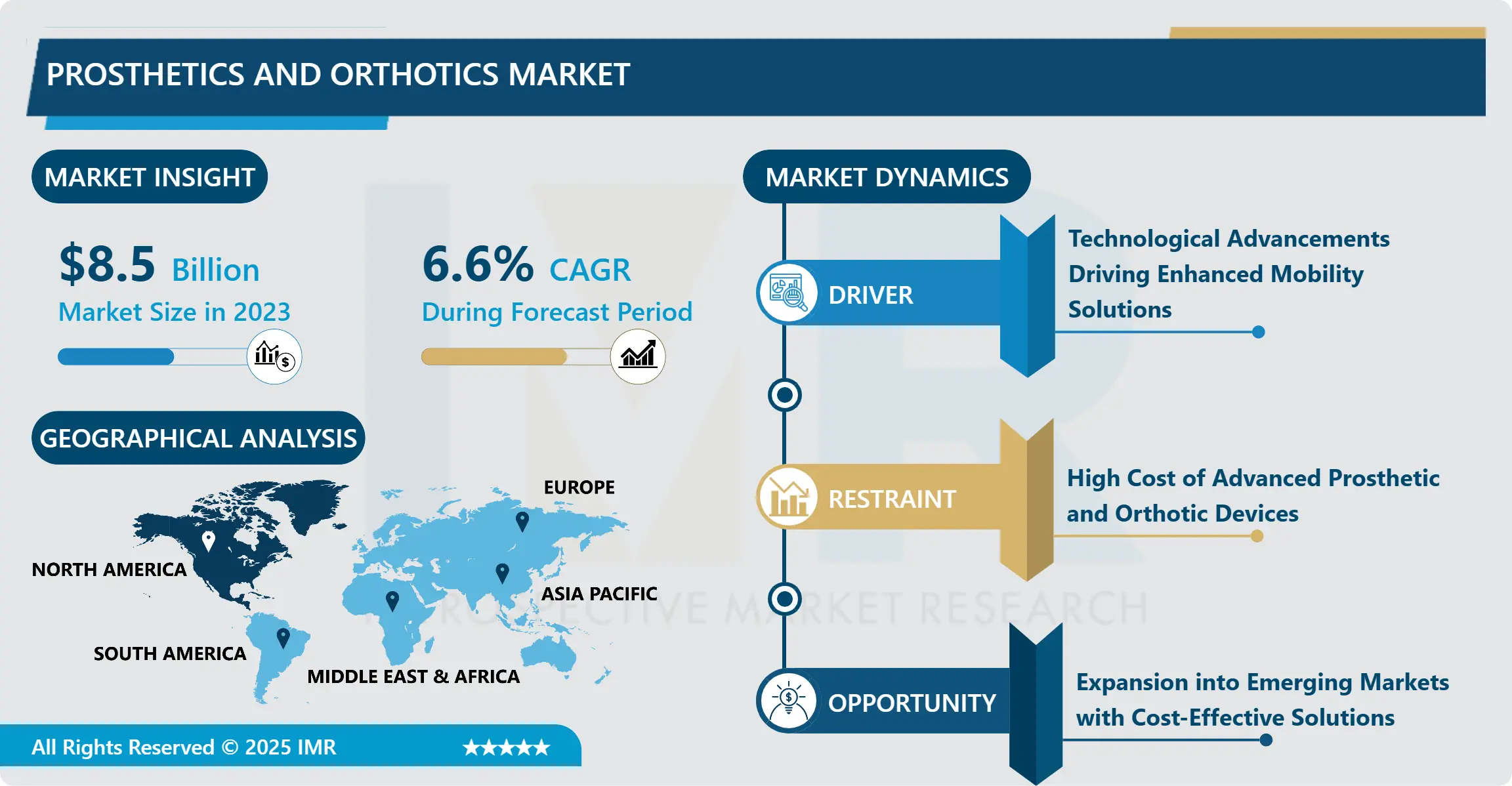

Prosthetics And Orthotics Market Size Was Valued at USD 8.5 Billion in 2023, and is Projected to Reach USD 15.2 Billion by 2032, Growing at a CAGR of 6.6% From 2024-2032.

The Prosthetics and Orthotics Market will also refer to the art of fabricating and utilizing artificial limb (prosthetics) and supportive structures (orthotics) for those who have physical disabilities, disability or loss of limb. These medical devices remain very important in rehabilitation, as they provide functional and aesthetic solutions to match the client’s needs. The market is highly innovative incorporating advanced materials, 3D printing and smart technology for correcting various abnormalities associated with the function and comfort of a device. It is backed by improved healthcare, longer life exp??REA, and expanded world population seeking permanent mobility.

The main growth pushing the Prosthetics and Orthotics Market forward is the rise of chronic diseases including diabetes, osteoarthritis as well as vascular diseases which due to the development of associated complications may lead to limb amputations or limited mobility particularly in the geriatric population. Higher incidence of accidental or intentional injuries, interpersonal violence as well as sports-related injuries also propel the need for efficient prosthetic and orthotic equipment. Aging consumers from North America and Europe are opting for knee pain relief products because as people grow old they often suffer from joint problems.

Two factors are primarily responsible for the increased implementation of prosthetics and orthotics; new technologies which have made the prosthetic and orthotic devices cosmetically appealing and comfortable to wear. Advancements and additions from sensors and AI have made it possible for producers to design new prosthetics that replicate movements hence enhanced function and user experience. It has also been extremely important for improving the main aspects of portable devices such as light weight, high strength, and durability through the studies of material science. These developments complement a growing consciousness and an even greater desire among users to embrace sophisticated forms of mobility that enhance market growth.

Prosthetics And Orthotics Market Trend Analysis:

Integration of wearable technology and smart systems

-

One of the leading trends in the Prosthetics and Orthotics Market concerns the incorporation of wearables and smart systems into prostheses. Intelli-prosthetics are fitted with some form of sensors and are sometimes even AI powered, the aim being to mimic the behavior of the user and offer the best performance possible. These devices are well equipped with feedback, meaning users and clinicians can observe functionality and modify it in detail. Such innovations not only increase the extent of its use but also freedom of the user since such devices permit flexibility in numerous situations and tasks.

- Also, there is a rapidly evolving technology in prosthetics and orthotics manufacturing known as 3D Printing Technology that enables highly personalized, less costly and much faster production. The technology also makes it possible to have a better fit that increases convenience and benefits to the particular consumer. In addition, 3D printing saves costs and time since clinics and manufacturers can print devices locally and where required this is especially in remote areas. These trends are putting a push for the market towards improving accessibility, flexibility, and cost effectively for all the patients around the world.

Expanding accessibility to developing regions

-

The fastest growing segment of Prosthetics and Orthotics Market today is associated with expanding its access to the developing world. As more and more people are embracing mobility and rehabilitation, regional demand for affordable prosthetics/orthotics in asia pacific, Latin America and parts of Africa is expected. Thus, if the companies pay their attention to cheaper ways of production, including 3D printing, they can also benefit from expanding geographical presence and provide millions of people in need with these important devices with the help of newly-formed collaborations with local healthcare systems.

- Another opportunity is the increasing research and development spending and neural integration and BCI for better prosthetics. Present day studies in this topic seeks to develop technologies whereby prosthetic limbs can be easily controlled by neural signals. When these technologies come to the market and become mass products the companies that have developed these technologies will have a great first-mover advantage simply because users of these technologies will desire for better solutions that will change their Belittled lives for the better.

Prosthetics And Orthotics Market Segment Analysis:

Prosthetics and Orthotics Market is Segmented on the basis of Type, Technology, Application, End User, and Region.

By Product Type, Prosthetics segment is expected to dominate the market during the forecast period

-

The Prosthetics and Orthotics Market is divided into two main product types: prosthetics and orthotics. Orthosia are professional structures that are artificial appendages used to augment a missing body organ for example a limb and they are made according to the need of the client both functional and aesthetic. These products consist of least complicated mechanical appendages to the most complex smart prostheses fitted with sensors and artificial intelligence to mimic actual movements and improve the life of the users. While orthotics are defined as being external supportive appliances that are used to bring about correction or prevention of biomechanical abnormalities or problems. Canes are normally used to enhance instability of limbs or joints, during a healing process and to alleviate pain that is as a result arthritis or injury. In combination, both prosthetics and orthotics fulfill an important function within rehabilitation, allowing a patient to remain as autonomous as possible and increasing his or her ability to move around.

By Application, Prosthetics segment expected to held the largest share

-

For the purpose of market segmentation, application in the global prosthetics and orthotics market is divided into motor function, support, and other uses. Prosthetics applications are dedicated to providing patients with a chance for a normal life after losing their limbs because of the trauma, disease, or birth defects. They fulfil various tasks – from improving simple navigation to providing assistance with elaborate actions for athletes and other people with active lifestyles. Orthotics applications, on the other hand, deal with a wide range of concerns relating to muscles, bones and joints based on the provision of stability aligning and improving pain of clients with joint, bone and muscular ailments. Orthotics are used in rehabilitation, to assist with injury healing and other conditions including arthritis; provide therapy and enhance the body alignment and movement for patients with physical disorder/ disease. Combined (month/ year), prosthetics and orthotics applications enable users to achieve functionality hence improving their lives.

Prosthetics And Orthotics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America occupies the largest share in the Prosthetics and Orthotics Market owing to increased healthcare standards, expenditure on healthcare and the increased demand for provinces in the advanced technologies. Particularly, the United States offers a well-developed system of R&D; numerous organizations of various types, and companies exert the major efforts to develop prosthetic and orthotic technologies. Furthermore, the reimbursement policies for prosthetic and orthotic treatments are influential and more favorable within all extensive government and private insurance schemes in this region.

- In addition, through advancing donor age and persistent diabetic and obesity rates within the area, have further raised the demand for orthotic and prosthetic care. Thus, such factors as public awareness campaigns, support from associations of war veterans, and efforts from the side of healthcare institutions also constitute the market’s strengths. North America is forecasted to maintain its supremacy due to technological developments and excellent industry participants over the market.

Active Key Players in the Prosthetics And Orthotics Market:

- Blatchford (United Kingdom)

- Fillauer (United States)

- Hanger, Inc. (United States)

- Össur (Iceland)

- Ottobock (Germany)

- Proteor (France)

- Spinal Technology Inc. (United States)

- Steeper Group (United Kingdom)

- Teh Lin Prosthetic & Orthopaedic Inc. (Taiwan)

- WillowWood (United States)

- Other Active Players

|

Prosthetics And Orthotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.50 Billion |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 15.20 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Prosthetics And Orthotics Market by Product Type

4.1 Prosthetics And Orthotics Market Snapshot and Growth Engine

4.2 Prosthetics And Orthotics Market Overview

4.3 Prosthetics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Prosthetics: Geographic Segmentation Analysis

4.4 Orthotics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Orthotics: Geographic Segmentation Analysis

Chapter 5: Prosthetics And Orthotics Market by Technology

5.1 Prosthetics And Orthotics Market Snapshot and Growth Engine

5.2 Prosthetics And Orthotics Market Overview

5.3 Conventional Prosthetics and Orthotics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Conventional Prosthetics and Orthotics: Geographic Segmentation Analysis

5.4 Smart Prosthetics and Orthotics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Smart Prosthetics and Orthotics: Geographic Segmentation Analysis

Chapter 6: Prosthetics And Orthotics Market by Application

6.1 Prosthetics And Orthotics Market Snapshot and Growth Engine

6.2 Prosthetics And Orthotics Market Overview

6.3 Prosthetics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Prosthetics: Geographic Segmentation Analysis

6.4 Orthotics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Orthotics: Geographic Segmentation Analysis

Chapter 7: Prosthetics And Orthotics Market by End User

7.1 Prosthetics And Orthotics Market Snapshot and Growth Engine

7.2 Prosthetics And Orthotics Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Prosthetic and Orthotic Clinics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Prosthetic and Orthotic Clinics: Geographic Segmentation Analysis

7.5 Rehabilitation Centers

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Rehabilitation Centers: Geographic Segmentation Analysis

7.6 Home Care Settings

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Home Care Settings: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Prosthetics And Orthotics Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BLATCHFORD (UNITED KINGDOM)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 FILLAUER (UNITED STATES)

8.4 HANGER INC. (UNITED STATES)

8.5 ÖSSUR (ICELAND)

8.6 OTTOBOCK (GERMANY)

8.7 PROTEOR (FRANCE)

8.8 SPINAL TECHNOLOGY INC. (UNITED STATES)

8.9 STEEPER GROUP (UNITED KINGDOM)

8.10 TEH LIN PROSTHETIC & ORTHOPAEDIC INC. (TAIWAN)

8.11 WILLOWWOOD (UNITED STATES)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Prosthetics And Orthotics Market By Region

9.1 Overview

9.2. North America Prosthetics And Orthotics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Prosthetics

9.2.4.2 Orthotics

9.2.5 Historic and Forecasted Market Size By Technology

9.2.5.1 Conventional Prosthetics and Orthotics

9.2.5.2 Smart Prosthetics and Orthotics

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Prosthetics

9.2.6.2 Orthotics

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Prosthetic and Orthotic Clinics

9.2.7.3 Rehabilitation Centers

9.2.7.4 Home Care Settings

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Prosthetics And Orthotics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Prosthetics

9.3.4.2 Orthotics

9.3.5 Historic and Forecasted Market Size By Technology

9.3.5.1 Conventional Prosthetics and Orthotics

9.3.5.2 Smart Prosthetics and Orthotics

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Prosthetics

9.3.6.2 Orthotics

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Prosthetic and Orthotic Clinics

9.3.7.3 Rehabilitation Centers

9.3.7.4 Home Care Settings

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Prosthetics And Orthotics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Prosthetics

9.4.4.2 Orthotics

9.4.5 Historic and Forecasted Market Size By Technology

9.4.5.1 Conventional Prosthetics and Orthotics

9.4.5.2 Smart Prosthetics and Orthotics

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Prosthetics

9.4.6.2 Orthotics

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Prosthetic and Orthotic Clinics

9.4.7.3 Rehabilitation Centers

9.4.7.4 Home Care Settings

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Prosthetics And Orthotics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Prosthetics

9.5.4.2 Orthotics

9.5.5 Historic and Forecasted Market Size By Technology

9.5.5.1 Conventional Prosthetics and Orthotics

9.5.5.2 Smart Prosthetics and Orthotics

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Prosthetics

9.5.6.2 Orthotics

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Prosthetic and Orthotic Clinics

9.5.7.3 Rehabilitation Centers

9.5.7.4 Home Care Settings

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Prosthetics And Orthotics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Prosthetics

9.6.4.2 Orthotics

9.6.5 Historic and Forecasted Market Size By Technology

9.6.5.1 Conventional Prosthetics and Orthotics

9.6.5.2 Smart Prosthetics and Orthotics

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Prosthetics

9.6.6.2 Orthotics

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Prosthetic and Orthotic Clinics

9.6.7.3 Rehabilitation Centers

9.6.7.4 Home Care Settings

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Prosthetics And Orthotics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Prosthetics

9.7.4.2 Orthotics

9.7.5 Historic and Forecasted Market Size By Technology

9.7.5.1 Conventional Prosthetics and Orthotics

9.7.5.2 Smart Prosthetics and Orthotics

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Prosthetics

9.7.6.2 Orthotics

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Prosthetic and Orthotic Clinics

9.7.7.3 Rehabilitation Centers

9.7.7.4 Home Care Settings

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Prosthetics And Orthotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.50 Billion |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 15.20 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||