Preclinical Imaging Market Synopsis:

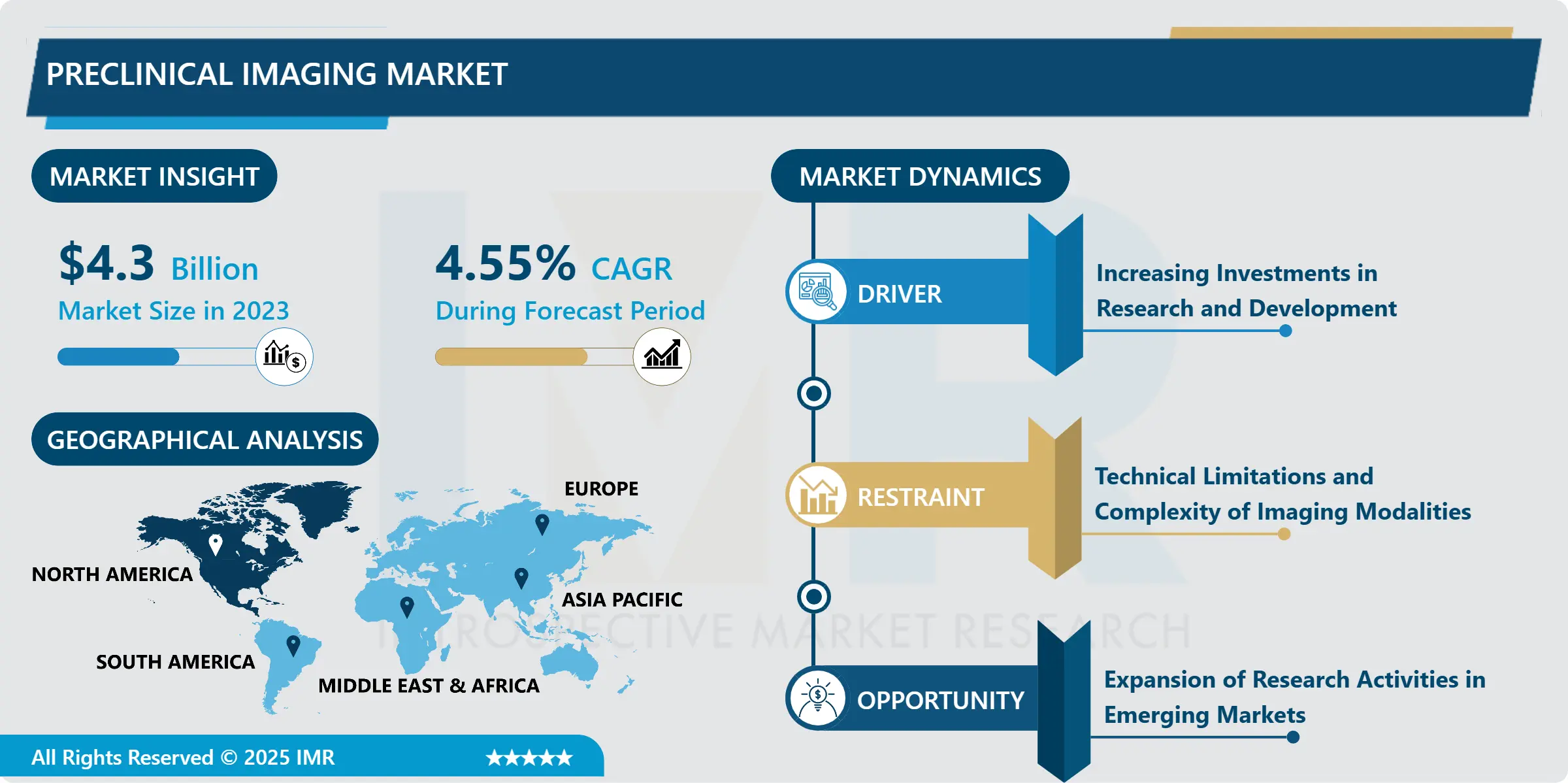

Preclinical Imaging Market Size Was Valued at USD 4.3 Billion in 2023, and is Projected to Reach USD 6.41 Billion by 2032, Growing at a CAGR of 4.55% From 2024-2032.

The Preclinical Imaging Market is defined as the subset of the broader Medical Imaging Market that is dedicated to designing, deploying, and integrating imaging technology/s and approaches for imaging biological function in research models in vivo. This market consists of magnetic resonance imaging, computed tomography, ultrasound imaging, optical imaging, used to evaluate the effectiveness of drugs, and study diseases in animal models. Imaging is a very important step in drug development so that the researcher will take his decision so that he will not proceed to the animals and blindly move to human Trial.

Among the many factors that have fuelled the market growth for preclinical imaging, there is a continually growing need for minimally invasiveness in drug development. Scientists are always in the process of looking for non-invasive techniques that can give immediate information on what is happening inside the body. To bypass dependence on patient self-reporting and clinical observations, the visualization of disease development and treatment outcomes in vivo has evolved as a critical need for pharma and academic organizations. Moreover, new imaging techniques and higher spatial resolution and sensitivity enhance the quality of preclinical study evaluation.

The second factor is the increasing incidence of chronic diseases, including cancer and neurological disorders, which requires huge further R&D investment. As the number of patients with such diseases rises throughout the world, the demand for new therapies is higher, so the results of possible treatments need to be assessed using preclinical imaging. Besides, the enhanced investment and grants for research activities from the governments and private organizations are enhancing the preclinical imaging market as a result, required facilities to set and apply new efficient imaging procedures are being provided.

Preclinical Imaging Market Trend Analysis:

Preclinical Imaging Market Trend Analysis:

The integration of artificial intelligence (AI) and machine learning technologies.

-

That is why one of the recent trend’s observables on the preclinical imaging market is the application of artificial intelligence and machine learning. Of these, the application is being used to improve image analysis and interpretation, and to better obtain information from images. AI as an algorithm can help business to use historical data to determine patterns, find anomalies and predict future outcomes. This trend is expected to spur further advancements of better imaging systems that will have higher accuracy as well as shorter time duration in the course of the research.

- The second major development is the use of complementary imaging modality, in which different imaging techniques are used simultaneously to capture biological events. It enables the researchers to take advantage of the different modality of detection resulting to higher sensitivity, specificity and information depth. For example, integration of MRI with optical imaging may provide both structural and functional imaging information about the disease and its treatments.

The growing demand for personalized medicine presents significant opportunities for the preclinical imaging market.

-

One of the major trends with considerable potential for preclinical imaging is the increase in the demand for personalized medicine. With health care moving toward more individual therapy modal approach, the importance of appropriate imaging modalities that can help in individual therapy plan formulation increases. This shift of focus can be greatly aided by preclinical imaging that reveals patient’s biology to researchers so that they adjust drug packaging and dosage for the best results.

- also, growth in research and development activities and industries in the emerging economy also presents a good market opportunity for the growth of the global technology market. Many of the countries in Asia Pacific and Latin America report a rising interest in investments in healthcare systems and research endeavours. With these regions hastening their capability in preclinical research, there is increasing need for sophisticated imaging systems in preclinical studies to provide localization data to the developing local pharmaceutical and biotechnology industries.

Preclinical Imaging Market Segment Analysis:

The Preclinical Imaging Market is Segmented on the basis of Technology, Modality, Application, End User, and Region

By Technology, Optical Imaging segment is expected to dominate the market during the forecast period

-

Preclinical imaging market is made of a number of technologies all of which are aimed at adding value to the research and development across the biomedical sciences. Optical imaging relies on light reflection and transmission to obtain desired pictures of sampled tissue/cells’ biological activity, providing good magnification. Magnetic Resonance Imaging (MRI) gives detailed image of soft tissues ideal for diagnosis of ailments affecting the brain and muscles. Computed Tomography (CT) provides different tissue density data which enables imaging of complicated structure in the body. Diagnostic ultrasound is the use of high-frequency sound waves to produce images of the body processes in real time usually used in developing organs and blood flow. Molecular imaging using radioactive markers helps the researchers to look into physiologic processes and metabolism processes of living bodies. On the same note, other imaging techniques may consist of a combination of these and other means to augment diagnosis and investigative research.

By Application, Oncology segment expected to held the largest share

- The applications of preclinical imaging have been implemented across the broad spectrum of medicine proving to be important in the advances in medicine and therapy. Imaging technologies help researchers studying oncology not only to observe tumor formation and progression in animal models and to evaluate the effectiveness of a certain treatment but also to study cancer biology. Neurology improves through these imaging techniques because it aids research on the brain, and helps diagnose conditions such as Alzheimer’s and Parkinson’s through observation of actual brain structure and function. The cardiovascular application uses imaging for analysing heart and blood vessels disorders to explore the disease processes and their therapeutic interventions. Preclinical imaging also includes MSD diagnosis since bone and joint diseases are evaluated in it, enabling better understanding of trauma causes and treatment outcomes. Also, in the field of infectious diseases imaging technologies help along with understanding pathogen-host interactions and the course of the infections; applications can also contain various diseases with unique models that need particular imaging approaches for adequate research and development.

Preclinical Imaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Thus, North America remains the leading market in terms of preclinical imaging due to great development in healthcare infrastructure and large investments in R&D. The area is populated by numerous big pharma, university, and CRO players that are highly involved in nonclinical research. Another factor that supports the market is the participation of advanced imaging technology providers that remain active in developing and growing the range of their services tailored to numerous researchers’ requests. Also, high investment in biomedical research and developmental programs by the government also shapes a dominant position of the region within the worldwide preclinical imaging market.

- Furthermore, the fact that chronic diseases are very common in North America increases the demand for good imaging solutions during the preclinical processes. In light of the recent occurrence of the scientific trend towards molecular-based diagnostics and individualized therapy, various authorities are exploring the use of enhanced imaging methods to decipher downstream disease processes and outcomes of treatments. This trend along with the favorable regulatory environment make North America as prime region in preclinical imaging market, which will continue to grow and be dominated in the coming years.

Active Key Players in the Preclinical Imaging Market

- Bruker Corporation (United States)

- PerkinElmer, Inc. (United States)

- Thermo Fisher Scientific, Inc. (United States)

- Siemens Healthineers (Germany)

- GE Healthcare (United States)

- Philips Healthcare (Netherlands)

- Molecular Devices, LLC (United States)

- Mediso Medical Imaging Systems (Hungary)

- Fujifilm Holdings Corporation (Japan)

- Canon Medical Systems Corporation (Japan)

- Other Active Players

|

Preclinical Imaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.3 Billion |

|

Forecast Period 2024-32 CAGR: |

4.55 % |

Market Size in 2032: |

USD 6.41 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Modality |

|

||

|

By Application

|

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities:

|

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Industry Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Strategic Pestle Overview

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Mapping

3.6 Regulatory Framework

3.7 Princing Trend Analysis

3.8 Patent Analysis

3.9 Technology Evolution

3.10 Investment Pockets

3.11 Import-Export Analysis

Chapter 4: Preclinical Imaging Market by Technology

4.1 Preclinical Imaging Market Snapshot and Growth Engine

4.2 Preclinical Imaging Market Overview

4.3 Optical Imaging

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Optical Imaging: Geographic Segmentation Analysis

4.4 MRI (Magnetic Resonance Imaging)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 MRI (Magnetic Resonance Imaging): Geographic Segmentation Analysis

4.5 CT (Computed Tomography)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 CT (Computed Tomography): Geographic Segmentation Analysis

4.6 Ultrasound Imaging

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Ultrasound Imaging: Geographic Segmentation Analysis

4.7 Nuclear Imaging

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Nuclear Imaging: Geographic Segmentation Analysis

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Others: Geographic Segmentation Analysis

Chapter 5: Preclinical Imaging Market by Modality

5.1 Preclinical Imaging Market Snapshot and Growth Engine

5.2 Preclinical Imaging Market Overview

5.3 In Vivo Imaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 In Vivo Imaging: Geographic Segmentation Analysis

5.4 Ex Vivo Imaging

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Ex Vivo Imaging: Geographic Segmentation Analysis

Chapter 6: Preclinical Imaging Market by Application

6.1 Preclinical Imaging Market Snapshot and Growth Engine

6.2 Preclinical Imaging Market Overview

6.3 Oncology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Oncology: Geographic Segmentation Analysis

6.4 Neurology

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Neurology: Geographic Segmentation Analysis

6.5 Cardiovascular

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Cardiovascular: Geographic Segmentation Analysis

6.6 Musculoskeletal Disorders

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Musculoskeletal Disorders: Geographic Segmentation Analysis

6.7 Infectious Diseases

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Infectious Diseases: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Others: Geographic Segmentation Analysis

Chapter 7: Preclinical Imaging Market by End User

7.1 Preclinical Imaging Market Snapshot and Growth Engine

7.2 Preclinical Imaging Market Overview

7.3 Pharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Pharmaceutical Companies: Geographic Segmentation Analysis

7.4 Academic and Research Institutions

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Academic and Research Institutions: Geographic Segmentation Analysis

7.5 Contract Research Organizations (CROs)

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Contract Research Organizations (CROs): Geographic Segmentation Analysis

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Preclinical Imaging Market Share by Manufacturer (2023)

8.1.3 Concentration Ratio(CR5)

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BRUKER CORPORATION (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.3 PERKINELMER INC. (UNITED STATES)

8.4 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

8.5 SIEMENS HEALTHINEERS (GERMANY)

8.6 GE HEALTHCARE (UNITED STATES)

8.7 PHILIPS HEALTHCARE (NETHERLANDS)

8.8 MOLECULAR DEVICES LLC (UNITED STATES)

8.9 MEDISO MEDICAL IMAGING SYSTEMS (HUNGARY)

8.10 FUJIFILM HOLDINGS CORPORATION (JAPAN)

8.11 CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Preclinical Imaging Market By Region

9.1 Overview

9.2. North America Preclinical Imaging Market

9.2.1 Historic and Forecasted Market Size by Segments

9.2.2 Historic and Forecasted Market Size By Technology

9.2.2.1 Optical Imaging

9.2.2.2 MRI (Magnetic Resonance Imaging)

9.2.2.3 CT (Computed Tomography)

9.2.2.4 Ultrasound Imaging

9.2.2.5 Nuclear Imaging

9.2.2.6 Others

9.2.3 Historic and Forecasted Market Size By Modality

9.2.3.1 In Vivo Imaging

9.2.3.2 Ex Vivo Imaging

9.2.4 Historic and Forecasted Market Size By Application

9.2.4.1 Oncology

9.2.4.2 Neurology

9.2.4.3 Cardiovascular

9.2.4.4 Musculoskeletal Disorders

9.2.4.5 Infectious Diseases

9.2.4.6 Others

9.2.5 Historic and Forecasted Market Size By End User

9.2.5.1 Pharmaceutical Companies

9.2.5.2 Academic and Research Institutions

9.2.5.3 Contract Research Organizations (CROs)

9.2.5.4 Others

9.2.6 Historic and Forecast Market Size by Country

9.2.6.1 US

9.2.6.2 Canada

9.2.6.3 Mexico

9.3. Eastern Europe Preclinical Imaging Market

9.3.1 Historic and Forecasted Market Size by Segments

9.3.2 Historic and Forecasted Market Size By Technology

9.3.2.1 Optical Imaging

9.3.2.2 MRI (Magnetic Resonance Imaging)

9.3.2.3 CT (Computed Tomography)

9.3.2.4 Ultrasound Imaging

9.3.2.5 Nuclear Imaging

9.3.2.6 Others

9.3.3 Historic and Forecasted Market Size By Modality

9.3.3.1 In Vivo Imaging

9.3.3.2 Ex Vivo Imaging

9.3.4 Historic and Forecasted Market Size By Application

9.3.4.1 Oncology

9.3.4.2 Neurology

9.3.4.3 Cardiovascular

9.3.4.4 Musculoskeletal Disorders

9.3.4.5 Infectious Diseases

9.3.4.6 Others

9.3.5 Historic and Forecasted Market Size By End User

9.3.5.1 Pharmaceutical Companies

9.3.5.2 Academic and Research Institutions

9.3.5.3 Contract Research Organizations (CROs)

9.3.5.4 Others

9.3.6 Historic and Forecast Market Size by Country

9.3.6.1 Bulgaria

9.3.6.2 The Czech Republic

9.3.6.3 Hungary

9.3.6.4 Poland

9.3.6.5 Romania

9.3.6.6 Rest of Eastern Europe

9.4. Western Europe Preclinical Imaging Market

9.4.1 Historic and Forecasted Market Size by Segments

9.4.2 Historic and Forecasted Market Size By Technology

9.4.2.1 Optical Imaging

9.4.2.2 MRI (Magnetic Resonance Imaging)

9.4.2.3 CT (Computed Tomography)

9.4.2.4 Ultrasound Imaging

9.4.2.5 Nuclear Imaging

9.4.2.6 Others

9.4.3 Historic and Forecasted Market Size By Modality

9.4.3.1 In Vivo Imaging

9.4.3.2 Ex Vivo Imaging

9.4.4 Historic and Forecasted Market Size By Application

9.4.4.1 Oncology

9.4.4.2 Neurology

9.4.4.3 Cardiovascular

9.4.4.4 Musculoskeletal Disorders

9.4.4.5 Infectious Diseases

9.4.4.6 Others

9.4.5 Historic and Forecasted Market Size By End User

9.4.5.1 Pharmaceutical Companies

9.4.5.2 Academic and Research Institutions

9.4.5.3 Contract Research Organizations (CROs)

9.4.5.4 Others

9.4.6 Historic and Forecast Market Size by Country

9.4.6.1 Germany

9.4.6.2 UK

9.4.6.3 France

9.4.6.4 Netherlands

9.4.6.5 Italy

9.4.6.6 Russia

9.4.6.7 Spain

9.4.6.8 Rest of Western Europe

9.5. Asia Pacific Preclinical Imaging Market

9.5.1 Historic and Forecasted Market Size by Segments

9.5.2 Historic and Forecasted Market Size By Technology

9.5.2.1 Optical Imaging

9.5.2.2 MRI (Magnetic Resonance Imaging)

9.5.2.3 CT (Computed Tomography)

9.5.2.4 Ultrasound Imaging

9.5.2.5 Nuclear Imaging

9.5.2.6 Others

9.5.3 Historic and Forecasted Market Size By Modality

9.5.3.1 In Vivo Imaging

9.5.3.2 Ex Vivo Imaging

9.5.4 Historic and Forecasted Market Size By Application

9.5.4.1 Oncology

9.5.4.2 Neurology

9.5.4.3 Cardiovascular

9.5.4.4 Musculoskeletal Disorders

9.5.4.5 Infectious Diseases

9.5.4.6 Others

9.5.5 Historic and Forecasted Market Size By End User

9.5.5.1 Pharmaceutical Companies

9.5.5.2 Academic and Research Institutions

9.5.5.3 Contract Research Organizations (CROs)

9.5.5.4 Others

9.5.6 Historic and Forecast Market Size by Country

9.5.6.1 China

9.5.6.2 India

9.5.6.3 Japan

9.5.6.4 South Korea

9.5.6.5 Malaysia

9.5.6.6 Thailand

9.5.6.7 Vietnam

9.5.6.8 The Philippines

9.5.6.9 Australia

9.5.6.10 New Zealand

9.5.6.11 Rest of APAC

9.6. Middle East & Africa Preclinical Imaging Market

9.6.1 Historic and Forecasted Market Size by Segments

9.6.2 Historic and Forecasted Market Size By Technology

9.6.2.1 Optical Imaging

9.6.2.2 MRI (Magnetic Resonance Imaging)

9.6.2.3 CT (Computed Tomography)

9.6.2.4 Ultrasound Imaging

9.6.2.5 Nuclear Imaging

9.6.2.6 Others

9.6.3 Historic and Forecasted Market Size By Modality

9.6.3.1 In Vivo Imaging

9.6.3.2 Ex Vivo Imaging

9.6.4 Historic and Forecasted Market Size By Application

9.6.4.1 Oncology

9.6.4.2 Neurology

9.6.4.3 Cardiovascular

9.6.4.4 Musculoskeletal Disorders

9.6.4.5 Infectious Diseases

9.6.4.6 Others

9.6.5 Historic and Forecasted Market Size By End User

9.6.5.1 Pharmaceutical Companies

9.6.5.2 Academic and Research Institutions

9.6.5.3 Contract Research Organizations (CROs)

9.6.5.4 Others

9.6.6 Historic and Forecast Market Size by Country

9.6.6.1 Turkey

9.6.6.2 Bahrain

9.6.6.3 Kuwait

9.6.6.4 Saudi Arabia

9.6.6.5 Qatar

9.6.6.6 UAE

9.6.6.7 Israel

9.6.6.8 South Africa

9.7. South America Preclinical Imaging Market

9.7.1 Historic and Forecasted Market Size by Segments

9.7.2 Historic and Forecasted Market Size By Technology

9.7.2.1 Optical Imaging

9.7.2.2 MRI (Magnetic Resonance Imaging)

9.7.2.3 CT (Computed Tomography)

9.7.2.4 Ultrasound Imaging

9.7.2.5 Nuclear Imaging

9.7.2.6 Others

9.7.3 Historic and Forecasted Market Size By Modality

9.7.3.1 In Vivo Imaging

9.7.3.2 Ex Vivo Imaging

9.7.4 Historic and Forecasted Market Size By Application

9.7.4.1 Oncology

9.7.4.2 Neurology

9.7.4.3 Cardiovascular

9.7.4.4 Musculoskeletal Disorders

9.7.4.5 Infectious Diseases

9.7.4.6 Others

9.7.5 Historic and Forecasted Market Size By End User

9.7.5.1 Pharmaceutical Companies

9.7.5.2 Academic and Research Institutions

9.7.5.3 Contract Research Organizations (CROs)

9.7.5.4 Others

9.7.6 Historic and Forecast Market Size by Country

9.7.6.1 Brazil

9.7.6.2 Argentina

9.7.6.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Preclinical Imaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.3 Billion |

|

Forecast Period 2024-32 CAGR: |

4.55 % |

Market Size in 2032: |

USD 6.41 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Modality |

|

||

|

By Application

|

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities:

|

|

||

|

Companies Covered in the report: |

|

||