Ophthalmic Drugs Market Synopsis

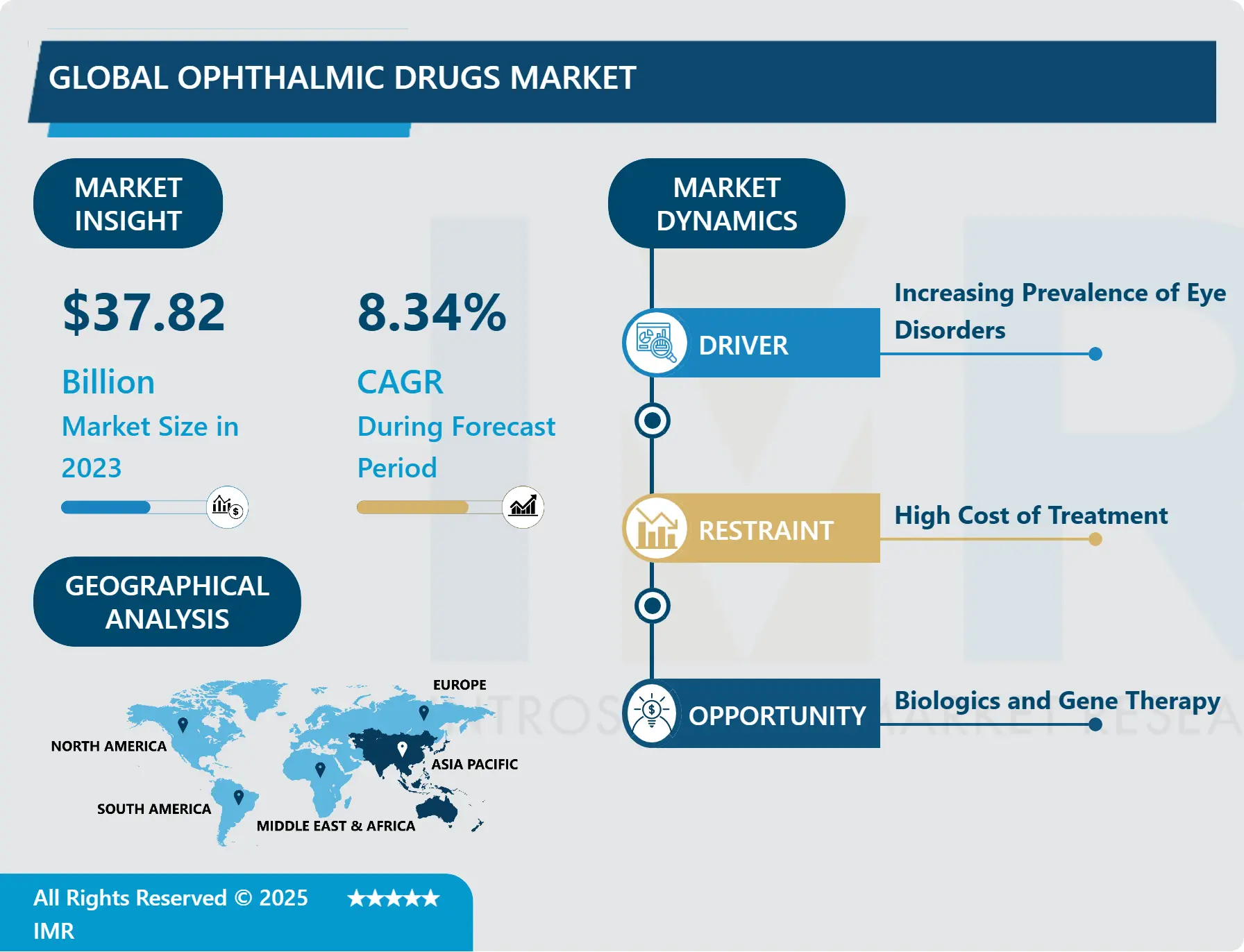

Ophthalmic Drugs Market Size Was Valued at USD 37.82 Billion in 2023, and is Projected to Reach USD 77.77 Billion by 2032, Growing at a CAGR of 8.34% From 2024-2032.

Ophthalmic drugs market is a group of medicines used for diagnosing, treating and preventing various diseases and disorders of the human eyes. This market consists of the drugs for glaucoma treatment, eye ointments, over the counter products, eye drop products for dry eye syndrome, cataract and retinal diseases, and other surgical preparations. Consequently, the rise of ocular diseases’,the development of new drug formulation’s, and awareness of the human eye’, the ophthalmic drugs market is expanding and evolving as a result of the need for better therapeutic agents and improved patient care.

The ophthalmic drugs market is exhibiting a trend of growth mainly due to the rising incidence of eye diseases for which people are opting to buy ophthalmic drugs in large proportions. As you know, the global population is graying, or getting older; consequently, the number of people who require proper treatment is steadily increasing, which is why companies are investing in research. Better understanding of drug properties and patient requirements continues to improve ophthalmic formulations; sustained-release systems and new delivery systems are improving ophthalmic therapy effectiveness. Moreover, there is an increasing consumers’ knowledge of their eye health and the new treatments available on the market, which is also driving the market’s growth.

The market is segmented into several types of products such as anti infective, anti inflammatory, and glaucoma products among others. Recent advancement has brought biologics and gene therapies into the scene where patients expect improved outcomes. The market is highly saturated with the presence of key market players that have increased competition through newest partnerships, acquisitions, and joint ventures. Moreover, expansion and growth in the use of technologies such as telemedicine and digital healthcare also mean that patient access to ophthalmology is also creating the demand for prescription drugs.

Regionally, North America is the largest consumer in the market for ophthalmic drugs due to an enabling environment for healthcare, high expenditure, and new products currently in development. Still, the Asia-Pacific region is expected to demonstrate the highest level of growth due to increase in people’s disposable income, better healthcare facilities and increased population of patients. In conclusion, the sound prospects for development of the segment are observed due to the focus on innovations, the constantly growing average age of the population, as well as the increased attention to the field of healthcare.

Ophthalmic Drugs Market Trend Analysis

Driving Growth in the Ophthalmic Drugs Market

- Eye diseases are climbing in frequency, and are particularly common among the elderly, which is also a factor increasing demand for ophthalmic drugs. Eye diseases such as glaucoma, cataracts and macular degeneration associated with aging are expected to increase due to increase in average life expectancy hence the market for these treatments increases. Therefore, workers in the field of health care and manufacturers of drugs are concerned with creating new effective treatments for these disorders. For example, innovative diagnostic technologies and imaging technologies are making it possible to diagnose eye diseases at a previous stage hence improving the outcome of care. This increase in early diagnosis … especially the increasing awareness of eye care is providing a boost to the ophthalmic drugs including both prescriptive and over counter ones.

- However, advancement in the kind of formulations and methods of delivery of drugs to the eye are still central to boosting the effectiveness of ophthalmological therapy. Slow release products, which enable a patient to have a therapeutic concentration of the drug for a more extended period require less dosing schedule hence enhancing patient compliance and reducing side effects that are characteristic of conventional therapies. Also, advances in new therapeutic products, especially biologics and gene therapies, are helping to change the paradigm of managing multiple complicated ocular diseases. Such novel treatments not only afford the advantage of specificity in action but also can pave the way for long-term actions, hence minimize the need for repeated use. They are getting a new lease of life as new programs come up and more treatment means mean are developed to treat and even reverse some eye disorders, the ophthalmic drugs market is therefore boosted .

Innovations in Personalized Medicine and Digital Solutions in Ophthalmology

- The increasing awareness of customized medicine in ophthalmic practice is among the most progressive developments that has occurred in treatment realm. As the understanding of genomics and biomarkers is constantly improving, care professionals need to match the meticulous genotypes and pathological situations of patients. This makes the treatment to be more effective other than having standardized treatment methodologies that make adverse effects to be more frequent compared to the rest. Consequently, patients get better results, higher satisfaction and are more likely to stick to their prescribed medical regimen. Cohort pharmacogenomics targeting is another movement that pharmaceutical firms are paying more attention to it in their research act; this has seen firms directing more funds towards the development of new pharmacogenomic therapies that are individually tailored to suit specific client segments.

- Other major trends which are revolutionizing patient management in ophthalmology include, personalized medicine, tele-medicine and digital health solutions. These technologies help with remote care since individuals can receive consultations without physically going to the doctor, and is even more helpful for consumers residing in either underdeveloped or rural regions. Telehealth platforms improve the ways in which patients interact with healthcare by ensuring constant tracking of objective and subjective eye status and compliance with recommended treatment regimens. It is just as useful in terms of patient care but it also also helps to reduce some pressure on the healthcare facilities. Thus, since people know more about their eye health and the costs of healthcare services continue to rise, the creation of ophthalmic drugs in combination with personalized medicine and digital tools experienced significant growth and will create positive conditions for improvement in the coming years.

Ophthalmic Drugs Market Segment Analysis:

Ophthalmic Drugs Market Segmented based on By Drug Class, By Disease, By Dosage Form, By Product Type.

By Drug Class, Anti-allergy segment is expected to dominate the market during the forecast period

- Elevated allergic reactions involving the eyes requires the use of Anti-allergy medications as part of the main management. Some of the major categories of antiallergy drugs include antihistamines, anticholinergics, sympathomimetics, and cyclooxygenase inhibitors; of these, antihistamines are the most commonly used kind of drug in this category work to inhibit the ability of histamine to bind at certain receptors. This action is important in order to relief signs and symptoms including redness that exist in diseases like allergic conjunctivitis. Mast cell stabilizers, to the contrary, inhibit histamine and various other inflammatory mediators from being released from mast cells, thereby constituting an effective preventive therapy of allergic processes. These medications can be very helpful with people who are sensitive to irritants for example those that affect people with respiratory problems such as pollen, pet dater, dust mite among others. Growing evidenced clinical understanding of allergenic effects on the eyes increases the demand for anti-allergy solutions.

- The increase in demand for anti-allery drugs is evident in several ways, such as escalating pollution levels and shift in lifestyle that lead to increase in prevalence of allergic diseases. In metropolis, or areas with high level of exposure to environmental pollutants there has been a significant rise in allergies and related complications. thirdly, such factors as prolonged sitting at computer screens or staying indoors most of time and reduced physical activity which are typical to the modern man have also contributed to the worsening of eye allergies. The increasing incidences of allergies across the globe particularly among the young people has made care makers prescribe these treatments. As a result, pharmaceutical formulators are focusing on research and innovation which include launching new forms and types of formulations and delivery systems, for instance creating eye drops that give quick relief. This is expected to continue especially with rising demand for treatments that have improved symptoms of allergy that interfere with the quality of life of patients.

By Product Type, Prescription Drugs segment held the largest share in 2023

- The prescription ophthalmic medications are essential in handling severe eye ailments because they come with directed medicines suited for particular diseases including Glaucoma, AMD and severe infections. In many cases, these medications is packaged with more active ingredients and their delivery systems are more intricate for purpose of improving on their solubility and bio-availability. The treatments are recommended by doctors, which makes its approach personalized by diagnosing various diseases and health histories of a patient allowing for a more holistic approach to eye health. This delivered care is optimal in case of chronic diseases that need constant follow-up and, therefore, modification of therapy to ensure better results.

- The prescription drugs segment’s enlargement is growing due to the rising incidence of ocular diseases at a global level, especially owing to the ageing population. Some of the most prevalent eye diseases now days include diabetic retinopathy as well as cataracts, making the need for new treatments even more evident. To meet this call, more pharmaceutical firms are trying to develop innovative products through research to include combination products that address various dimensions of diseases in a single product. Also, there have been improvements made in the market form, particularly the application of sustained-release implants and injectable therapies to the corresponding treatment types. The segment, however, has a good potential for growth following the increasing awareness of eye health where more patients will seek prescription medicine for proper care of severe eye ailments revealing the importance of these drugs in vision conservation and total quality living.

Ophthalmic Drugs Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The ophthalmic drugs market in the Asia-Pacific area is currently enjoying significant growth due to increased disposable income among the population and an increasing trend towards enhancements in heath care facilities. Understanding Eye Care needs of adults in selected Kingdoms of the Middle East and North Africa The social economic development especially in new one kingdom like China and India, this leads to more economic power to rear for better health facilities including eye care. The contingency exists due to the increased public concern of their vision and the consequent higher need of prevention and curative ophthalmologic services. This trend is complemented by initiatives by the government towards improved health care delivery in an effort to popularize the early presentation for eye check-ups in case of any eye complications. Therefore, new and better ophthalmic therapeutics targeting major diseases, including corticosteroids and anti-VEGF solutions for glaucoma and DR, among others, are gaining a market within this market.

- Furthermore, a lot of investments are being made in the pharmaceutical field with regard to research and development, and a number of linkages between regional and global companies are being created. These kinds of partnerships are crucial in fast-tracking penetration of socially responsive ophthalmic drugs complementary to the routine and unique[] eye disorders in the populace. Research focus is not only offering a positive impact on the development of the therapeutic environment but also on the development of more sophisticated methods of drug delivery which include sustained release formulation and newer forms of injectables. The Asia-Pacific ophthalmic drugs market is set to grow potentially as these frameworks progress due to the potential to positively influence the general eye health in the Asia-Pacific region. Thanks to educational campaigns and efforts to increase the availability of high-tech interventions, the outlook for ophthalmic services in the Asia-Pacific region is increasing.

Active Key Players in the Ophthalmic Drugs Market

- Pfizer Inc.

- Alcon

- Novartis AG

- Bausch Health Companies Inc.

- Merck & Co., Inc

- Regeneron Pharmaceuticals Inc

- Allergan (AbbVie Inc)

- Bayer AG

- Genentech, Inc. (F. Hoffmann-La Roche Ltd)

- Nicox

- Coherus Biosciences, Inc.

- Other Key Players

|

Global Ophthalmic Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 37.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.34% |

Market Size in 2032: |

USD 77.77 Bn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Disease |

|

||

|

By Dosage Form |

|

||

|

By Product Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ophthalmic Drugs Market by Drug Class (2018-2032)

4.1 Ophthalmic Drugs Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Anti-allergy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Steroidal drugs

4.5 Anti-VEGF Agents

4.6 Anti-glaucoma

4.7 Others

Chapter 5: Ophthalmic Drugs Market by Disease (2018-2032)

5.1 Ophthalmic Drugs Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dry Eye

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Allergies

5.5 Glaucoma

5.6 Eye Infection

5.7 Infection

5.8 Retinal Disorders

5.9 Retinal Disorders

Chapter 6: Ophthalmic Drugs Market by Dosage Form (2018-2032)

6.1 Ophthalmic Drugs Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Gels

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Eye Solutions & Suspensions

6.5 Capsules and Tablets

6.6 Eye Drops

6.7 Ointments

Chapter 7: Ophthalmic Drugs Market by Product Type (2018-2032)

7.1 Ophthalmic Drugs Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Prescription Drugs

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 OTC

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Ophthalmic Drugs Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PFIZER INCALCON

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NOVARTIS AG

8.4 BAUSCH HEALTH COMPANIES INCMERCK & COINC

8.5 REGENERON PHARMACEUTICALS INC

8.6 ALLERGAN (ABBVIE INC)

8.7 BAYER AG

8.8 GENENTECH INC. (F. HOFFMANN-LA ROCHE LTD)

8.9 NICOX

8.10 COHERUS BIOSCIENCES INCOTHER KEY PLAYERS

8.11

Chapter 9: Global Ophthalmic Drugs Market By Region

9.1 Overview

9.2. North America Ophthalmic Drugs Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Drug Class

9.2.4.1 Anti-allergy

9.2.4.2 Steroidal drugs

9.2.4.3 Anti-VEGF Agents

9.2.4.4 Anti-glaucoma

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Disease

9.2.5.1 Dry Eye

9.2.5.2 Allergies

9.2.5.3 Glaucoma

9.2.5.4 Eye Infection

9.2.5.5 Infection

9.2.5.6 Retinal Disorders

9.2.5.7 Retinal Disorders

9.2.6 Historic and Forecasted Market Size by Dosage Form

9.2.6.1 Gels

9.2.6.2 Eye Solutions & Suspensions

9.2.6.3 Capsules and Tablets

9.2.6.4 Eye Drops

9.2.6.5 Ointments

9.2.7 Historic and Forecasted Market Size by Product Type

9.2.7.1 Prescription Drugs

9.2.7.2 OTC

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Ophthalmic Drugs Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Drug Class

9.3.4.1 Anti-allergy

9.3.4.2 Steroidal drugs

9.3.4.3 Anti-VEGF Agents

9.3.4.4 Anti-glaucoma

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Disease

9.3.5.1 Dry Eye

9.3.5.2 Allergies

9.3.5.3 Glaucoma

9.3.5.4 Eye Infection

9.3.5.5 Infection

9.3.5.6 Retinal Disorders

9.3.5.7 Retinal Disorders

9.3.6 Historic and Forecasted Market Size by Dosage Form

9.3.6.1 Gels

9.3.6.2 Eye Solutions & Suspensions

9.3.6.3 Capsules and Tablets

9.3.6.4 Eye Drops

9.3.6.5 Ointments

9.3.7 Historic and Forecasted Market Size by Product Type

9.3.7.1 Prescription Drugs

9.3.7.2 OTC

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Ophthalmic Drugs Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Drug Class

9.4.4.1 Anti-allergy

9.4.4.2 Steroidal drugs

9.4.4.3 Anti-VEGF Agents

9.4.4.4 Anti-glaucoma

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Disease

9.4.5.1 Dry Eye

9.4.5.2 Allergies

9.4.5.3 Glaucoma

9.4.5.4 Eye Infection

9.4.5.5 Infection

9.4.5.6 Retinal Disorders

9.4.5.7 Retinal Disorders

9.4.6 Historic and Forecasted Market Size by Dosage Form

9.4.6.1 Gels

9.4.6.2 Eye Solutions & Suspensions

9.4.6.3 Capsules and Tablets

9.4.6.4 Eye Drops

9.4.6.5 Ointments

9.4.7 Historic and Forecasted Market Size by Product Type

9.4.7.1 Prescription Drugs

9.4.7.2 OTC

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Ophthalmic Drugs Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Drug Class

9.5.4.1 Anti-allergy

9.5.4.2 Steroidal drugs

9.5.4.3 Anti-VEGF Agents

9.5.4.4 Anti-glaucoma

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Disease

9.5.5.1 Dry Eye

9.5.5.2 Allergies

9.5.5.3 Glaucoma

9.5.5.4 Eye Infection

9.5.5.5 Infection

9.5.5.6 Retinal Disorders

9.5.5.7 Retinal Disorders

9.5.6 Historic and Forecasted Market Size by Dosage Form

9.5.6.1 Gels

9.5.6.2 Eye Solutions & Suspensions

9.5.6.3 Capsules and Tablets

9.5.6.4 Eye Drops

9.5.6.5 Ointments

9.5.7 Historic and Forecasted Market Size by Product Type

9.5.7.1 Prescription Drugs

9.5.7.2 OTC

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Ophthalmic Drugs Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Drug Class

9.6.4.1 Anti-allergy

9.6.4.2 Steroidal drugs

9.6.4.3 Anti-VEGF Agents

9.6.4.4 Anti-glaucoma

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Disease

9.6.5.1 Dry Eye

9.6.5.2 Allergies

9.6.5.3 Glaucoma

9.6.5.4 Eye Infection

9.6.5.5 Infection

9.6.5.6 Retinal Disorders

9.6.5.7 Retinal Disorders

9.6.6 Historic and Forecasted Market Size by Dosage Form

9.6.6.1 Gels

9.6.6.2 Eye Solutions & Suspensions

9.6.6.3 Capsules and Tablets

9.6.6.4 Eye Drops

9.6.6.5 Ointments

9.6.7 Historic and Forecasted Market Size by Product Type

9.6.7.1 Prescription Drugs

9.6.7.2 OTC

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Ophthalmic Drugs Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Drug Class

9.7.4.1 Anti-allergy

9.7.4.2 Steroidal drugs

9.7.4.3 Anti-VEGF Agents

9.7.4.4 Anti-glaucoma

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Disease

9.7.5.1 Dry Eye

9.7.5.2 Allergies

9.7.5.3 Glaucoma

9.7.5.4 Eye Infection

9.7.5.5 Infection

9.7.5.6 Retinal Disorders

9.7.5.7 Retinal Disorders

9.7.6 Historic and Forecasted Market Size by Dosage Form

9.7.6.1 Gels

9.7.6.2 Eye Solutions & Suspensions

9.7.6.3 Capsules and Tablets

9.7.6.4 Eye Drops

9.7.6.5 Ointments

9.7.7 Historic and Forecasted Market Size by Product Type

9.7.7.1 Prescription Drugs

9.7.7.2 OTC

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Ophthalmic Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 37.82 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.34% |

Market Size in 2032: |

USD 77.77 Bn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Disease |

|

||

|

By Dosage Form |

|

||

|

By Product Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||