mTOR Inhibitors Market Synopsis:

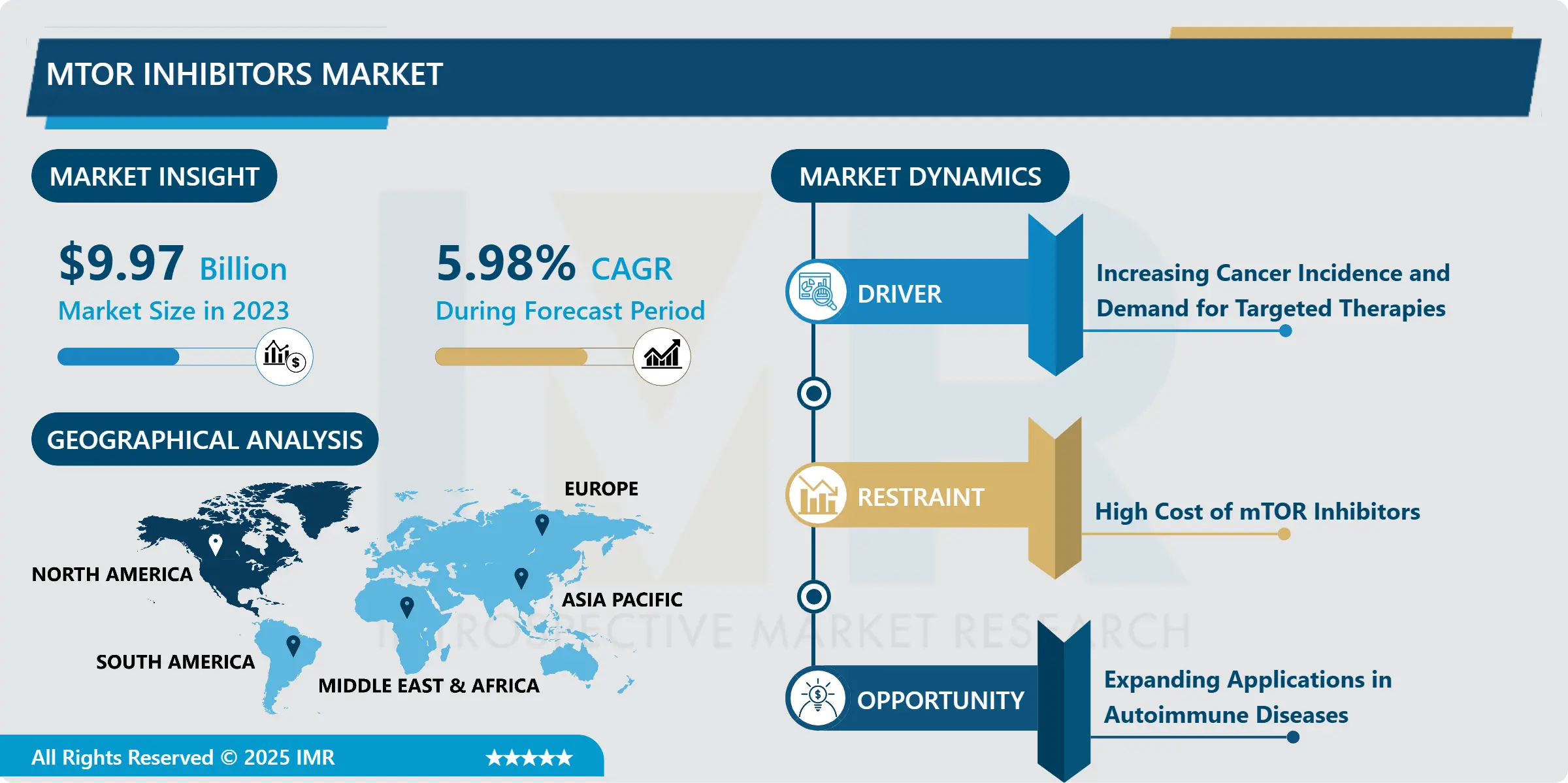

mTOR Inhibitors Market Size Was Valued at USD 9.97 Billion in 2023, and is Projected to Reach USD 16.82 Billion by 2032, Growing at a CAGR of 5.98% From 2024-2032.

mTOR inhibitors are a category of drugs that target the mTOR pathway, that is involved in control of cell and protein synthesis and metabolism. These inhibitors are applied in treatment of diseases such as; cancers, autoimmune diseases, and to prevent rejection of transplanted organs. The principal drugs belonging to this category include; rapamycin, everolimus and temsirolimus.

This makes the mTOR inhibitors market an important segment in the global pharmaceutical industry because of the characteristic of mTOR as a kinase that controls cell growth, division, and survival as well as cell metabolism. Abnormality of the mTOR signaling has implicated in cancers, autoimmunity, and situations necessitating organ transplant. Therefore, rapamycin and some related drugs known as mTOR inhibitors, including everolimus and temsirolimus, have been applied for treatment. Such inhibitors act through the manipulation of the mTOR signalling pathway, which regulates cancer cell proliferation and spread, restrains organ rejection after transplantation and autoimmune diseases.

Currently the market for mTOR inhibitors is rapidly expanding due to continual evilution of drugs and enhanced knowledge of mTOR pathway functions in different diseases. The use of mTOR inhibitors in treating cancer, in organ transplant, and autoimmune diseases has been shown to have therapeutic values, hence fuelling its research and development resulting to; an improved pipeline of new treatments. Moreover, the allowance of new formulations and co-therapy products also opened new doors for choice and has accelerated the market growth. Considering that the population is aging, and the occurrence of cancer and other chronic diseases increases, the consumption of mTOR inhibitors will remain high in the future.

mTOR Inhibitors Market Trend Analysis:

Increasing Combination Therapies with mTOR Inhibitors

-

Such combinations of mTOR inhibitors with other therapies are becoming increasingly popular in the market. There is growing interest in elucidating potential interactions between mTOR inhibitors and other therapies, including chemotherapy, immunotherapy and targeted therapies. These combinations are intended to improve therapeutic effects given the issues of multidirectional diseases such as cancer or autoimmune diseases that are regulated by multiple signal pathways. For example, when adding mTOR inhibitors to immune checkpoint inhibitors, there has been an improved survival rate in some types of cancers and patients’ side effects can also be controlled.

- Combination therapies are likely to slow down formation of drug resistance which is a big issue in cancer treatment. In targeting several pathways of cancer development and immune resistance, up the combinations treatments can improve the therapies already in the market with an aim of developing more individualized cancer therapy. This trend is expected to persist as other clinical trials are ongoing to evaluate other combinations of mTOR inhibitors, creating potential opportunities of this class of drugs in both oncology and immunology. Probably, the results of these combined therapies will exert positive impact to the growth of the mTOR inhibitors market.

Expanding Applications in Autoimmune Diseases

-

Hence, there is a future potential for the mTOR inhibitors market based on its use as a therapy for autoimmune diseases. At the moment, such agents as mTOR inhibitors are applied in oncology and in transplantation medicine, while their possibility of the treatment of autoimmune diseases is currently actively discussed. Rheumatoid arthritis, lupus, psoriasis and other Autoimmune diseases, is characterized by the immune system attacking the body’s own cells and this is where mTOR inhibitors have been of some value in controlling immune activity. These inhibitors operate by calming the overabundance of the immune response and may thus reduce inflammation and help sufferers of autoimmune diseases.

- With global increases in autoimmune diseases, especially in the developed world, there is a growing need for new treatment therapies and mTOR inhibitors offer the added benefit of targeting key immune dysregulation pathways in comparison to existing immunosuppressive agents. The need to treat both the immune dysfunction seen in their diseases and the inflammation they cause makes the clinical applications of mTOR inhibitors very appealing in the market. With increasing clinical trials focusing on such utilizations, the mTOR inhibitors in autoimmune disease market shall grow even further.

mTOR Inhibitors Market Segment Analysis:

mTOR Inhibitors Market is Segmented on the basis of Type, Application, Distribution Channel, End User, and Region.

By Type, Rapamycin segment is expected to dominate the market during the forecast period

-

Rapamycin is the first mTOR inhibitor and it is rather popular among scientists. It was first found to have antifungal properties but due to its powerful aphakone production and inhibition of cell proliferation and immunostimulation it was used as an immunosuppressive agent in organ transplantation. It has been also tested in cancer treatment with beneficial effects in some specific types of tumor. This activity is courtesy of the fact that rapamycin has a strong market presence based on its effectiveness and it is more or less safe than inferior drugs making it a reference institution in mTOR inhibition therapy.

- Both everolimus and temsirolimus are structural derivatives of rapamycin; however, they can be used in similar therapeutic applications owing to distinct features within particular diseases. Everolimus has been used extensively in cancer; mainly in renal cell carcinoma as well as some neuroendocrine tumours. Now, when looking at temsirolimus – this medication is also primarily used for advanced renal cell carcinoma. Despite being newer to the group of drugs than rapamycin is, these drugs have fought for their places on the market because of their incredible performance in the sphere of cancer treatment and in the sphere of organ transplantation. They are also used in combination therapies and this factor alone is expected to enhance the demand of the market in the coming years.

By Application, Cancer Treatment segment expected to held the largest share

-

Oncotherapy is one of the biggest and rapidly developing fields of mTOR inhibitors’ usage. It is a type of targeted therapy which is mainly used in treating solid tumours such as renal cell carcinoma, breast cancer and neuroendocrine tumours; the drugs arrest tumour growth and improve immune response of the body. The ability of mTOR inhibitors in targeting cancer cell growth, along with the persistent rise in cancer incidence supported by advances in molecular targeted therapies should continue to drive the market size. Molecular targeted therapies using mTOR inhibitors in combination with other treatments are also under trial in clinical studies that may also increase their application in cancer treatment.

- Anti-proliferative drugs such as mTOR inhibitors are used in organ transplantation since they down regulate the immune system and thus reduces the chances of rejecting the grafts. This application still holds be one of the most important in the use of mTOR inhibitors particularly in renal, liver and heart transplantation. It is possible to prove that the application of mTOR inhibitors leads to more favorable long-term effect in transplant recipients, lowering rejection risk without involvement of such steroid and other immunosuppression agents. Considering that the number of organ transplants increases each year, the need for mTOR inhibitors in these cases will also increase.

mTOR Inhibitors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is the largest consumer of mTOR inhibitors globally followed by Europe due to supportive advancement in healthcare sector, increased prevalence of cancer patients and a very marketable organ transplantation market in the region. The mTOR inhibitors have particularly gained much acceptance in the United States because of the rising cancer prevalence, the escalating organ transplant surgeries, and the rising necessity for specific therapies. Moreover, the region receives big funding for healthcare advancement and medicine production, and thus the MTOR inhibitors are easily accessible for multiple uses.

- North America is again strongly positioned, as agencies such as the FDA recognize several mTOR inhibitors for clinical practice. Another thing is the concentration of major pharmaceutical companies and research institutions in the region hence development of newer mTOR inhibitors is continuous. This has placed North America at the forefront of market and innovation in mTOR inhibitors.

Active Key Players in the mTOR Inhibitors Market:

- Novartis (Switzerland)

- Pfizer (USA)

- AstraZeneca (UK)

- Bristol-Myers Squibb (USA)

- Bayer (Germany)

- Eli Lilly (USA)

- Merck & Co. (USA)

- AbbVie (USA)

- Sun Pharmaceutical (India)

- Mylan (USA)

- Biocon (India)

- Helsinn Healthcare (Switzerland)

- Other Active Players

|

Global mTOR Inhibitors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.97 Billion |

|

Forecast Period 2024-32 CAGR: |

5.98% |

Market Size in 2032: |

USD 16.82 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: mTOR Inhibitors Market by Type

4.1 mTOR Inhibitors Market Snapshot and Growth Engine

4.2 mTOR Inhibitors Market Overview

4.3 Rapamycin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Rapamycin: Geographic Segmentation Analysis

4.4 Everolimus

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Everolimus: Geographic Segmentation Analysis

4.5 Temsirolimus

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Temsirolimus: Geographic Segmentation Analysis

4.6 Other

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Other : Geographic Segmentation Analysis

Chapter 5: mTOR Inhibitors Market by Application

5.1 mTOR Inhibitors Market Snapshot and Growth Engine

5.2 mTOR Inhibitors Market Overview

5.3 Cancer Treatment

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cancer Treatment: Geographic Segmentation Analysis

5.4 Organ Transplantation

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Organ Transplantation: Geographic Segmentation Analysis

5.5 Autoimmune Diseases

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Autoimmune Diseases: Geographic Segmentation Analysis

5.6 Other

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Other: Geographic Segmentation Analysis

Chapter 6: mTOR Inhibitors Market by End-User

6.1 mTOR Inhibitors Market Snapshot and Growth Engine

6.2 mTOR Inhibitors Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Institutes: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: mTOR Inhibitors Market by Distribution Channel

7.1 mTOR Inhibitors Market Snapshot and Growth Engine

7.2 mTOR Inhibitors Market Overview

7.3 Online Pharmacies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Online Pharmacies: Geographic Segmentation Analysis

7.4 Retail Pharmacies

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Retail Pharmacies: Geographic Segmentation Analysis

7.5 Hospital Pharmacies

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Hospital Pharmacies: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 mTOR Inhibitors Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NOVARTIS (SWITZERLAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 PFIZER (USA)

8.4 ASTRAZENECA (UK)

8.5 BRISTOL-MYERS SQUIBB (USA)

8.6 BAYER (GERMANY)

8.7 ELI LILLY (USA)

8.8 MERCK & CO. (USA)

8.9 ABBVIE (USA)

8.10 SUN PHARMACEUTICAL (INDIA)

8.11 MYLAN (USA)

8.12 BIOCON (INDIA)

8.13 HELSINN HEALTHCARE (SWITZERLAND)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global mTOR Inhibitors Market By Region

9.1 Overview

9.2. North America mTOR Inhibitors Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Rapamycin

9.2.4.2 Everolimus

9.2.4.3 Temsirolimus

9.2.4.4 Other

9.2.5 Historic and Forecasted Market Size By Application

9.2.5.1 Cancer Treatment

9.2.5.2 Organ Transplantation

9.2.5.3 Autoimmune Diseases

9.2.5.4 Other

9.2.6 Historic and Forecasted Market Size By End-User

9.2.6.1 Hospitals

9.2.6.2 Clinics

9.2.6.3 Research Institutes

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size By Distribution Channel

9.2.7.1 Online Pharmacies

9.2.7.2 Retail Pharmacies

9.2.7.3 Hospital Pharmacies

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe mTOR Inhibitors Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Rapamycin

9.3.4.2 Everolimus

9.3.4.3 Temsirolimus

9.3.4.4 Other

9.3.5 Historic and Forecasted Market Size By Application

9.3.5.1 Cancer Treatment

9.3.5.2 Organ Transplantation

9.3.5.3 Autoimmune Diseases

9.3.5.4 Other

9.3.6 Historic and Forecasted Market Size By End-User

9.3.6.1 Hospitals

9.3.6.2 Clinics

9.3.6.3 Research Institutes

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size By Distribution Channel

9.3.7.1 Online Pharmacies

9.3.7.2 Retail Pharmacies

9.3.7.3 Hospital Pharmacies

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe mTOR Inhibitors Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Rapamycin

9.4.4.2 Everolimus

9.4.4.3 Temsirolimus

9.4.4.4 Other

9.4.5 Historic and Forecasted Market Size By Application

9.4.5.1 Cancer Treatment

9.4.5.2 Organ Transplantation

9.4.5.3 Autoimmune Diseases

9.4.5.4 Other

9.4.6 Historic and Forecasted Market Size By End-User

9.4.6.1 Hospitals

9.4.6.2 Clinics

9.4.6.3 Research Institutes

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size By Distribution Channel

9.4.7.1 Online Pharmacies

9.4.7.2 Retail Pharmacies

9.4.7.3 Hospital Pharmacies

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific mTOR Inhibitors Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Rapamycin

9.5.4.2 Everolimus

9.5.4.3 Temsirolimus

9.5.4.4 Other

9.5.5 Historic and Forecasted Market Size By Application

9.5.5.1 Cancer Treatment

9.5.5.2 Organ Transplantation

9.5.5.3 Autoimmune Diseases

9.5.5.4 Other

9.5.6 Historic and Forecasted Market Size By End-User

9.5.6.1 Hospitals

9.5.6.2 Clinics

9.5.6.3 Research Institutes

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size By Distribution Channel

9.5.7.1 Online Pharmacies

9.5.7.2 Retail Pharmacies

9.5.7.3 Hospital Pharmacies

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa mTOR Inhibitors Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Rapamycin

9.6.4.2 Everolimus

9.6.4.3 Temsirolimus

9.6.4.4 Other

9.6.5 Historic and Forecasted Market Size By Application

9.6.5.1 Cancer Treatment

9.6.5.2 Organ Transplantation

9.6.5.3 Autoimmune Diseases

9.6.5.4 Other

9.6.6 Historic and Forecasted Market Size By End-User

9.6.6.1 Hospitals

9.6.6.2 Clinics

9.6.6.3 Research Institutes

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size By Distribution Channel

9.6.7.1 Online Pharmacies

9.6.7.2 Retail Pharmacies

9.6.7.3 Hospital Pharmacies

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America mTOR Inhibitors Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Rapamycin

9.7.4.2 Everolimus

9.7.4.3 Temsirolimus

9.7.4.4 Other

9.7.5 Historic and Forecasted Market Size By Application

9.7.5.1 Cancer Treatment

9.7.5.2 Organ Transplantation

9.7.5.3 Autoimmune Diseases

9.7.5.4 Other

9.7.6 Historic and Forecasted Market Size By End-User

9.7.6.1 Hospitals

9.7.6.2 Clinics

9.7.6.3 Research Institutes

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size By Distribution Channel

9.7.7.1 Online Pharmacies

9.7.7.2 Retail Pharmacies

9.7.7.3 Hospital Pharmacies

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global mTOR Inhibitors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.97 Billion |

|

Forecast Period 2024-32 CAGR: |

5.98% |

Market Size in 2032: |

USD 16.82 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||