Microbiome Therapeutics Market Synopsis:

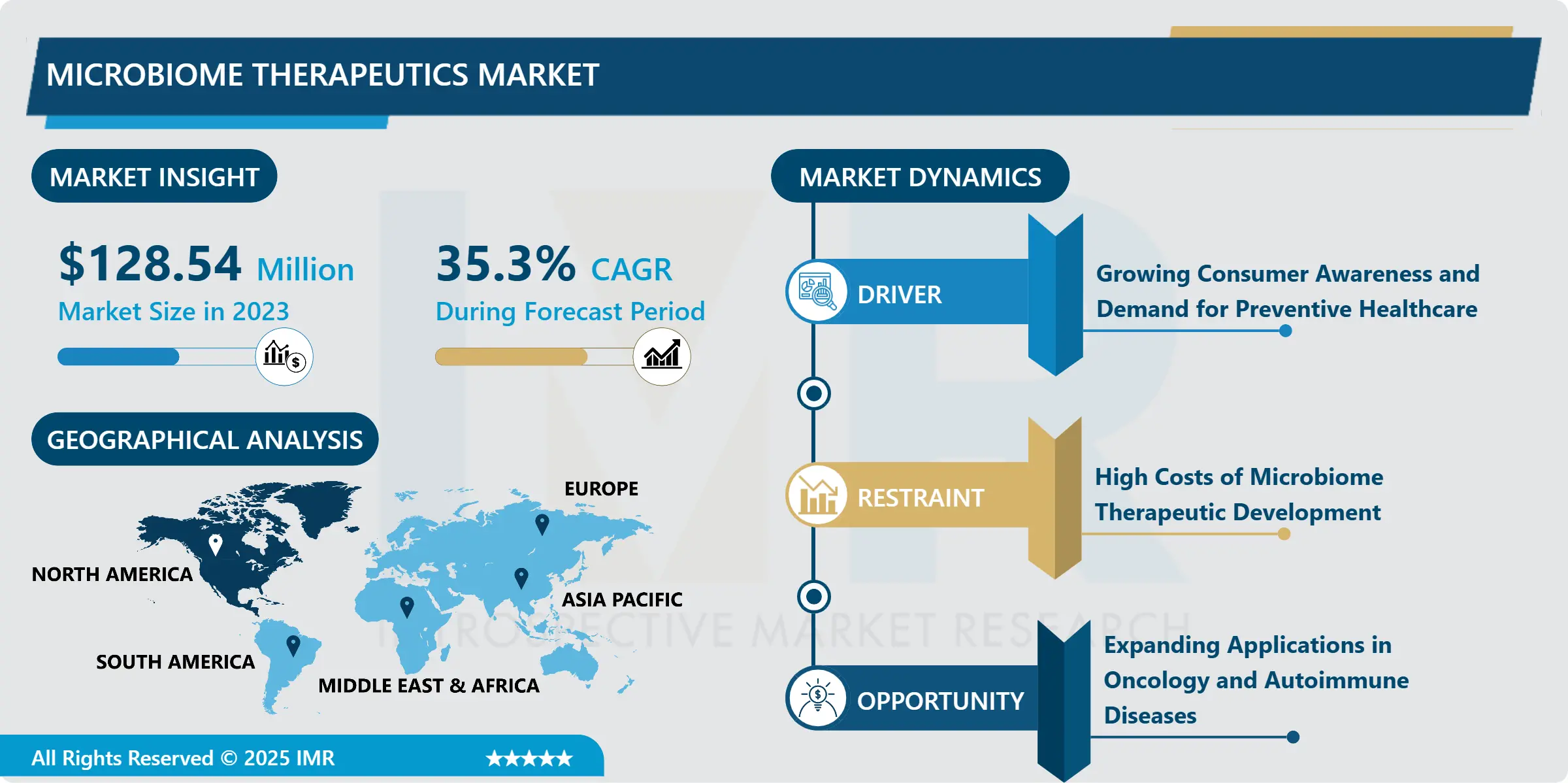

Microbiome Therapeutics Market Size Was Valued at USD 128.54 Million in 2023, and is Projected to Reach USD 1953.07 Million by 2032, Growing at a CAGR of 35.30% From 2024-2032.

The Microbiome Therapeutics Market is devoted to the discovery and monetization of treatments that interact with the human microbial ecosystem. These therapeutics seek to re-establish homeostasis in microbial ecosystem to treat multiple disease states such as gastrointestinal, metabolic, autoimmune, and infectious diseases. The market integrates some of the newest products in biotechnology, genomics and personalized medicine to enhance the quality of patient’s care.

The published data on the incidence of chronic and, in particular, lifestyle-related diseases, including diabetes, obesity, and gastrointestinal tract disorders, has contributed to the growth of interest in microbiome-based therapies. All these conditions can either be preceded or aggravated by an imbalance in the gut microbiota. In addition, high-level health literacy and the latest trends toward preventing diseases have boosted the investments in research for such revolutionary therapies.

There has been progress in knowledge of microbiome functions coupled by reduction of the cost of DNA sequencing. Such progress has boosted drug discovery and the emergence of precision microbiome therapeutics, promote partnerships between biotech, pharma, and research organisations.

Microbiome Therapeutics Market Trend Analysis:

Focus on Oncology Applications

-

One major ongoing development that is currently being implemented in the microbiome therapeutics market is the use of Live Biotherapeutic Products (LBPs). LBPs or live microorganisms are being explored widely today because they can directly interact with the host’s pathogen to treat diseases. They are gradually becoming legal worldwide and the regulatory environments are realigning to allow the products to feature in clinical trials and other commercial uses.

- Microbiome therapeutics still cast a wide net for potential solutions and oncology appears as one of the main fields of interest in this regard. Current discussion on gut microbiota in regulating immune events has paved way for microbiome cancer immunotherapy investigation. Specifically, the increasing focus on enhancing the efficacy of immuno-oncology treatments has fueled still higher levels of investments.

Integration with Precision Medicine

-

The countries of Asia-Pacific and Latin America remain the most promising among the emerging markets for microbiome therapeutics. Higher healthcare cost, improving consciousness of the gut health and rising incidence of lifestyle diseases in these regions is the perfect storm for market growth. Moreover, future growth potential is supported by favorable government measures to strengthen investment in the biotechnology sector, including research and the clinical trial industry.

- Microbiota manipulation combined with personalized therapy approaches is a novel concept in the field of treatment. Emerging sectors of artificial intelligence applied to medicine and bioinformatics driving the precision medicine approaches to cure various diseases bottoms up on individual microbiome. This customization as an approach is particularly compelling since it holds the potential of higher effectiveness and more averagely reported side effects that are of much interest to health care givers as well as capitalist entrepreneurs.

Microbiome Therapeutics Market Segment Analysis:

Microbiome Therapeutics Market is Segmented on the basis of Product Type, Disease Indication, Application, End User, and Region.

By Product Type, Probiotics segment is expected to dominate the market during the forecast period

-

Microbiome-based therapeutics are an emerging field of biomedical innovation, broadly categorized into five main types: Probiotics, Prebiotics, Synbiotics, Fecal Microbiota Transplantation (FMT), and Live Biotherapeutic Products (LBPs). Probiotics, which are live microorganisms that confer health benefits, and prebiotics, which are non-digestible food ingredients that stimulate the growth of beneficial bacteria, are the most well-known and widely used. These agents are recognized for their role in maintaining gut microbiota balance, improving digestion, and enhancing the immune system.

- Synbiotics, which combine both probiotics and prebiotics, are gaining traction for their synergistic effects on gut health. Meanwhile, FMT, which involves transplanting gut microbiota from healthy donors into patients, shows promise as a treatment for conditions like recurrent Clostridioides difficile infection but remains under active research for broader clinical applications. Lastly, LBPs represent a cutting-edge class of precisely engineered microbial therapeutics designed to deliver targeted health benefits with increased specificity and efficacy.

By Application, Gastrointestinal Disorders segment expected to held the largest share

-

Microbiome-based therapeutics are an emerging field of biomedical innovation, broadly categorized into five main types: Probiotics, Prebiotics, Synbiotics, Fecal Microbiota Transplantation (FMT), and Live Biotherapeutic Products (LBPs). Probiotics, which are live microorganisms that confer health benefits, and prebiotics, which are non-digestible food ingredients that stimulate the growth of beneficial bacteria, are the most well-known and widely used. These agents are recognized for their role in maintaining gut microbiota balance, improving digestion, and enhancing the immune system.

- Synbiotics, which combine both probiotics and prebiotics, are gaining traction for their synergistic effects on gut health. Meanwhile, FMT, which involves transplanting gut microbiota from healthy donors into patients, shows promise as a treatment for conditions like recurrent Clostridioides difficile infection but remains under active research for broader clinical applications. Lastly, LBPs represent a cutting-edge class of precisely engineered microbial therapeutics designed to deliver targeted health benefits with increased specificity and efficacy.

Microbiome Therapeutics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The Gastrointestinal Disorders segment is anticipated to hold the largest share in the Microbiome Therapeutics Market due to the high prevalence and growing awareness of digestive health issues such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), Crohn’s disease, and ulcerative colitis. These conditions are closely linked to imbalances in the gut microbiota, making them prime targets for microbiome-based interventions.

- The increasing number of clinical studies and FDA-approved microbiome-based therapies for gastrointestinal disorders further supports market growth in this segment. The demand for safer, more targeted, and effective treatment options is driving investment and innovation in microbiome therapeutics specifically for GI disorders. Moreover, advances in microbiome research, combined with patient preference for non-invasive treatment options, are encouraging pharmaceutical companies to focus on this segment. As a result, gastrointestinal applications continue to dominate the overall microbiome therapeutics landscape.

Active Key Players in the Microbiome Therapeutics Market:

- 4D Pharma (UK)

- BiomX (Israel)

- Enterome Bioscience (France)

- Ferring Pharmaceuticals (Switzerland)

- Finch Therapeutics (USA)

- MetaboGen (Sweden)

- Rebiotix (USA)

- Second Genome (USA)

- Seres Therapeutics (USA)

- Vedanta Biosciences (USA), and Other Active Players

|

Global Microbiome Therapeutics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 128.54 Million |

|

Forecast Period 2024-32 CAGR: |

35.30% |

Market Size in 2032: |

USD 1953.07 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Indication |

|

||

|

By Disease Indication |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Microbiome Therapeutics Market by Product Type

4.1 Microbiome Therapeutics Market Snapshot and Growth Engine

4.2 Microbiome Therapeutics Market Overview

4.3 Probiotics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Probiotics: Geographic Segmentation Analysis

4.4 Prebiotics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Prebiotics: Geographic Segmentation Analysis

4.5 Synbiotics

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Synbiotics: Geographic Segmentation Analysis

4.6 Fecal Microbiota Transplantation (FMT)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Fecal Microbiota Transplantation (FMT): Geographic Segmentation Analysis

4.7 Live Biotherapeutic Products (LBPs)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Live Biotherapeutic Products (LBPs): Geographic Segmentation Analysis

Chapter 5: Microbiome Therapeutics Market by Indication

5.1 Microbiome Therapeutics Market Snapshot and Growth Engine

5.2 Microbiome Therapeutics Market Overview

5.3 Inflammatory Bowel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Inflammatory Bowel : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Microbiome Therapeutics Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SERES THERAPEUTICS (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ENTEROME BIOSCIENCE (FRANCE)

6.4 REBIOTIX (USA)

6.5 VEDANTA BIOSCIENCES (USA)

6.6 4D PHARMA (UK)

6.7 SECOND GENOME (USA)

6.8 BIOMX (ISRAEL)

6.9 FERRING PHARMACEUTICALS (SWITZERLAND)

6.10 FINCH THERAPEUTICS (USA)

6.11 METABOGEN (SWEDEN)

6.12 OTHER ACTIVE PLAYERS

Chapter 7: Global Microbiome Therapeutics Market By Region

7.1 Overview

7.2. North America Microbiome Therapeutics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product Type

7.2.4.1 Probiotics

7.2.4.2 Prebiotics

7.2.4.3 Synbiotics

7.2.4.4 Fecal Microbiota Transplantation (FMT)

7.2.4.5 Live Biotherapeutic Products (LBPs)

7.2.5 Historic and Forecasted Market Size By Indication

7.2.5.1 Inflammatory Bowel

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Microbiome Therapeutics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product Type

7.3.4.1 Probiotics

7.3.4.2 Prebiotics

7.3.4.3 Synbiotics

7.3.4.4 Fecal Microbiota Transplantation (FMT)

7.3.4.5 Live Biotherapeutic Products (LBPs)

7.3.5 Historic and Forecasted Market Size By Indication

7.3.5.1 Inflammatory Bowel

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Microbiome Therapeutics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product Type

7.4.4.1 Probiotics

7.4.4.2 Prebiotics

7.4.4.3 Synbiotics

7.4.4.4 Fecal Microbiota Transplantation (FMT)

7.4.4.5 Live Biotherapeutic Products (LBPs)

7.4.5 Historic and Forecasted Market Size By Indication

7.4.5.1 Inflammatory Bowel

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Microbiome Therapeutics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product Type

7.5.4.1 Probiotics

7.5.4.2 Prebiotics

7.5.4.3 Synbiotics

7.5.4.4 Fecal Microbiota Transplantation (FMT)

7.5.4.5 Live Biotherapeutic Products (LBPs)

7.5.5 Historic and Forecasted Market Size By Indication

7.5.5.1 Inflammatory Bowel

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Microbiome Therapeutics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product Type

7.6.4.1 Probiotics

7.6.4.2 Prebiotics

7.6.4.3 Synbiotics

7.6.4.4 Fecal Microbiota Transplantation (FMT)

7.6.4.5 Live Biotherapeutic Products (LBPs)

7.6.5 Historic and Forecasted Market Size By Indication

7.6.5.1 Inflammatory Bowel

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Microbiome Therapeutics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product Type

7.7.4.1 Probiotics

7.7.4.2 Prebiotics

7.7.4.3 Synbiotics

7.7.4.4 Fecal Microbiota Transplantation (FMT)

7.7.4.5 Live Biotherapeutic Products (LBPs)

7.7.5 Historic and Forecasted Market Size By Indication

7.7.5.1 Inflammatory Bowel

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Microbiome Therapeutics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 128.54 Million |

|

Forecast Period 2024-32 CAGR: |

35.30% |

Market Size in 2032: |

USD 1953.07 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Indication |

|

||

|

By Disease Indication |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||