Methadone Hydrochloride Market Synopsis:

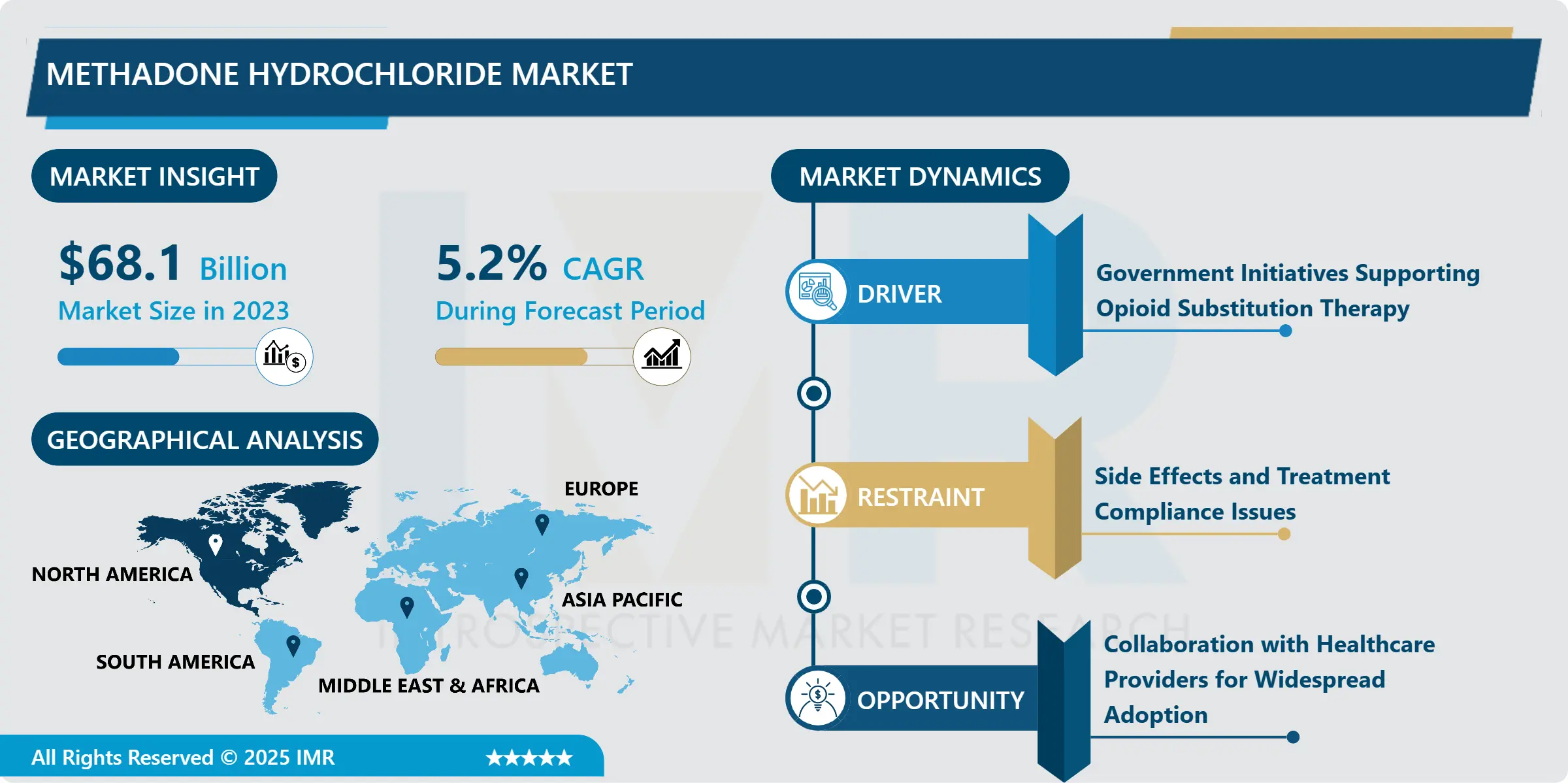

Methadone Hydrochloride Market Size Was Valued at USD 68.10 Billion in 2023, and is Projected to Reach USD 107.47 Billion by 2032, Growing at a CAGR of 5.20% From 2024-2032.

Methadone Hydrochloride is an opioid analgesic purified as a specific antagonist of opioids utilized in the treatment of opioid dependence and relief of serious pain. It is employed mainly in the management of patients requiring substituted therapy to avoid withdrawal symptoms and as an antidote to dependence on heroin or all opioids. Methadone is also used for the treatment of chronic pain in this patient population when conventional analgesics are not tolerated or ineffective.

The growth in opioid dependency around the world is one of the main reasons that drive the Methadone Hydrochloride market. With opioid addiction rate increasing all over the world especially in North America and certain parts of Europe, opioid substitution treatments such as methadone are being required. The expanding knowledge about opioid dependence treatment programs as well as the availability of the methadone treatment service is also driving the market.

These include upsurge in aging population and rising rates of cancer, arthritis, and neuropathic pain that are some of the common indications for Methadone Hydrochloride. The growing market for methadone is attributed to the essentials in searching for an option in pain control for patients who fail to respond to other drugs.

Methadone Hydrochloride Market Trend Analysis:

Growing adoption of methadone in outpatient and home care settings

-

One of the most important trends of the Methadone Hydrochloride market is the increased use of methadone for outpatient and home care. More and more individuals are getting treatment using methadone in other outpatient facilities, which is more convenient and efficient due to the new lean toward more patient-oriented healthcare systems. This should further be the case based on the fact that treatment regimens will increasingly be customized to clients.

- Drug delivery technology is improving on the way that methadone is administered into the body. New preparations and techniques including, prolonged-release oral tablets and injectable solutions are being developed since they offer more measure of control and ameliorate the chance of misuse. These advances are making methadone more sustainable for the treatment of both the opioid dependent and for those suffering from moderate pain.

The growing opioid crisis

-

The rising opioid epidemic across the global is a significant opportunity for Methadone Hydrochloride market parties. Methadone treatment programs and clinics are subsequently seen rising due to governments and health care facility giving more importance to treatment for this dependency. This presents a good business challenge to the pharmaceutical industries to provide more methadone in the market and especially in areas of highly abuse of opioids such as North America.

- One of the reasons is the establishment of new markets in developing countries might be an opportunity. Due to awareness of opioid addiction and chronic pain in the global world particularly Asia Pacific and Latin America there is need to develop methadone treatment. Entering these regions could offer great revenue opportunities for companies already enjoy a hub in the developed countries.

Methadone Hydrochloride Market Segment Analysis:

Methadone Hydrochloride Market is Segmented on the basis of Formulation, Application, End User, and Region.

By Formulation, Oral Solution segment is expected to dominate the market during the forecast period

-

The Oral Solution segment, by formulation, is anticipated to dominate the Methadone Hydrochloride Market throughout the forecast period. This dominance can be attributed to several key factors, including ease of administration, rapid onset of action, and suitability for patients who have difficulty swallowing tablets or capsules. Oral solutions are especially preferred in the treatment of opioid dependence, where precise dosage titration and flexibility are critical.

- Healthcare providers often favor liquid formulations in controlled substance treatments due to improved patient compliance and monitoring. The increasing prevalence of opioid addiction, coupled with the growing awareness of medication-assisted therapies, further supports the demand for oral solutions. As a result, this segment is projected to hold the largest market share during the forecast period.

By Application, Oral Solution segment expected to held the largest share

-

By application, the Oral Solution segment is expected to hold the largest share of the Methadone Hydrochloride Market during the forecast period. This is primarily due to its widespread use in opioid substitution therapy and chronic pain management. Oral solutions provide a practical and effective method for delivering methadone, offering precise dosing flexibility that is essential for personalized treatment regimens.

- Formulation is particularly favored in clinical settings and addiction treatment centers, where controlled administration is crucial. Moreover, the ease of ingestion makes it suitable for a broad range of patients, including those with swallowing difficulties. Growing awareness of methadone’s effectiveness in reducing opioid withdrawal symptoms and preventing relapse is likely to drive sustained demand for oral solution applications.

Methadone Hydrochloride Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America has the largest share in the Methadone Hydrochloride market, since it is one of the most popular opioid substitution treatments and chronic pain therapies. Current conveniences in the United States and Canada make narcotics like methadone available and commonplace in rehabilitation centers. It is believed that this region will continue being dominant especially in regards to opioid dependence and increasing need for adequate pain control measures.

- The market for methadone in North America is further favorable by government policies and funds for treating opioid dependency. These initiatives have made the adoption of methadone prime in addiction centers hence maintaining market share of methadone in this region.

Active Key Players in the Methadone Hydrochloride Market:

-

Alvogen (USA)

- Aurobindo Pharma (India)

- Camber Pharmaceuticals (USA)

- Dr. Reddy’s Laboratories (India)

- Endo International (Ireland)

- Lupin Pharmaceuticals (India)

- Mylan (USA)

- Sandoz (Switzerland)

- Sun Pharmaceutical Industries (India)

- Teva Pharmaceutical Industries (Israel), and Other Active Players

|

Global Methadone Hydrochloride Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 68.10 Billion |

|

Forecast Period 2024-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 107.47 Billion |

|

Segments Covered: |

By Formulation |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Methadone Hydrochloride Market by Formulation

4.1 Methadone Hydrochloride Market Snapshot and Growth Engine

4.2 Methadone Hydrochloride Market Overview

4.3 Oral Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Oral Solution: Geographic Segmentation Analysis

4.4 Oral Tablet

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Oral Tablet: Geographic Segmentation Analysis

4.5 Injectable Solution

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Injectable Solution: Geographic Segmentation Analysis

Chapter 5: Methadone Hydrochloride Market by Application

5.1 Methadone Hydrochloride Market Snapshot and Growth Engine

5.2 Methadone Hydrochloride Market Overview

5.3 Pain Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Pain Management: Geographic Segmentation Analysis

5.4 Opioid Dependence Treatment

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Opioid Dependence Treatment: Geographic Segmentation Analysis

Chapter 6: Methadone Hydrochloride Market by End User

6.1 Methadone Hydrochloride Market Snapshot and Growth Engine

6.2 Methadone Hydrochloride Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinics: Geographic Segmentation Analysis

6.5 Home Care Settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Home Care Settings: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Methadone Hydrochloride Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MYLAN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CAMBER PHARMACEUTICALS (USA)

7.4 TEVA PHARMACEUTICAL INDUSTRIES (ISRAEL)

7.5 ENDO INTERNATIONAL (IRELAND)

7.6 SUN PHARMACEUTICAL INDUSTRIES (INDIA)

7.7 LUPIN PHARMACEUTICALS (INDIA)

7.8 ALVOGEN (USA)

7.9 AUROBINDO PHARMA (INDIA)

7.10 DR. REDDY’S LABORATORIES (INDIA)

7.11 SANDOZ (SWITZERLAND)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Methadone Hydrochloride Market By Region

8.1 Overview

8.2. North America Methadone Hydrochloride Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Formulation

8.2.4.1 Oral Solution

8.2.4.2 Oral Tablet

8.2.4.3 Injectable Solution

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Pain Management

8.2.5.2 Opioid Dependence Treatment

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Home Care Settings

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Methadone Hydrochloride Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Formulation

8.3.4.1 Oral Solution

8.3.4.2 Oral Tablet

8.3.4.3 Injectable Solution

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Pain Management

8.3.5.2 Opioid Dependence Treatment

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Home Care Settings

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Methadone Hydrochloride Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Formulation

8.4.4.1 Oral Solution

8.4.4.2 Oral Tablet

8.4.4.3 Injectable Solution

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Pain Management

8.4.5.2 Opioid Dependence Treatment

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Home Care Settings

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Methadone Hydrochloride Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Formulation

8.5.4.1 Oral Solution

8.5.4.2 Oral Tablet

8.5.4.3 Injectable Solution

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Pain Management

8.5.5.2 Opioid Dependence Treatment

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Home Care Settings

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Methadone Hydrochloride Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Formulation

8.6.4.1 Oral Solution

8.6.4.2 Oral Tablet

8.6.4.3 Injectable Solution

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Pain Management

8.6.5.2 Opioid Dependence Treatment

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Home Care Settings

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Methadone Hydrochloride Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Formulation

8.7.4.1 Oral Solution

8.7.4.2 Oral Tablet

8.7.4.3 Injectable Solution

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Pain Management

8.7.5.2 Opioid Dependence Treatment

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Home Care Settings

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Methadone Hydrochloride Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 68.10 Billion |

|

Forecast Period 2024-32 CAGR: |

5.20% |

Market Size in 2032: |

USD 107.47 Billion |

|

Segments Covered: |

By Formulation |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||