Medicinal Cannabis Market Synopsis:

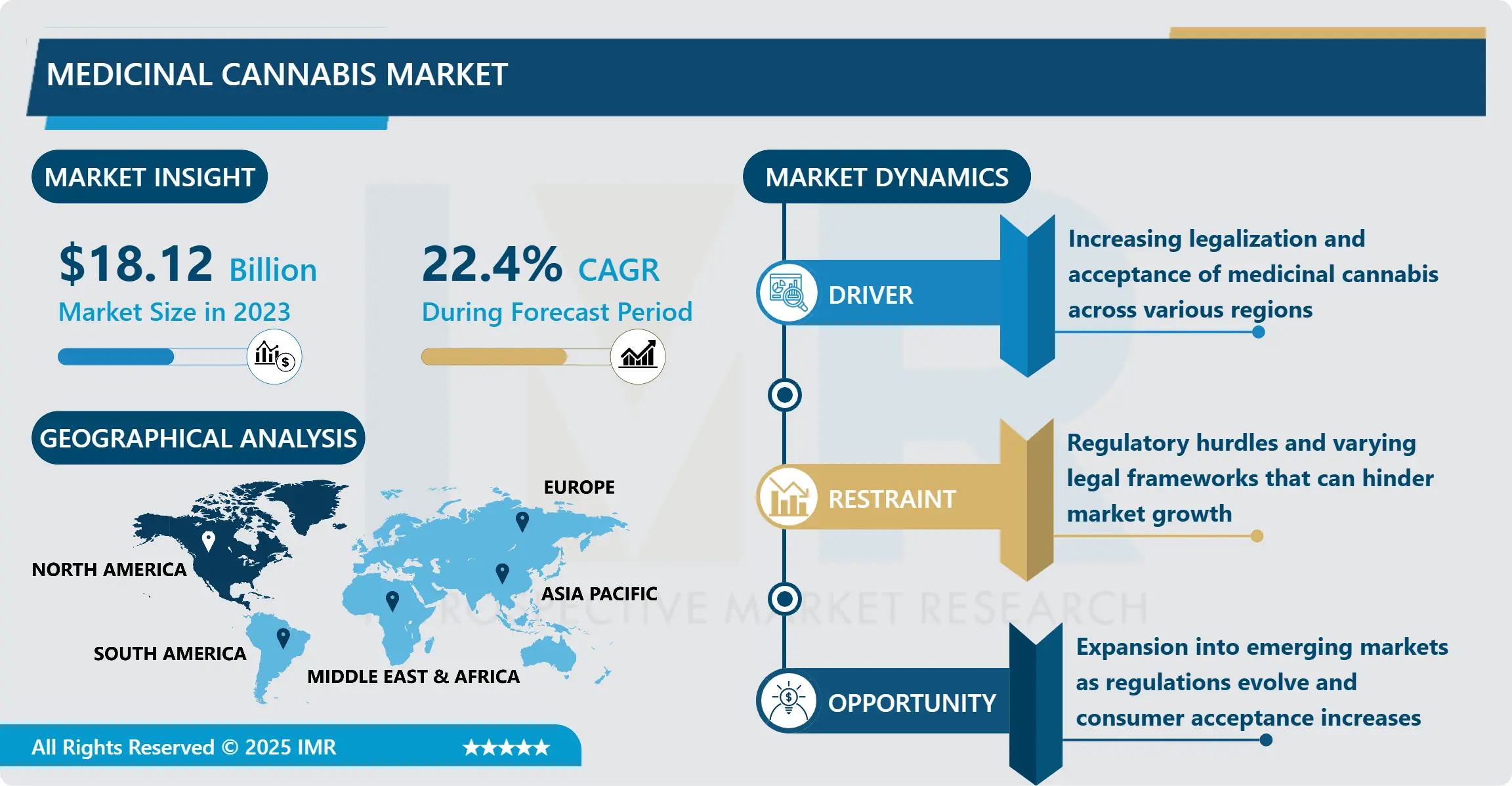

Medicinal Cannabis Market Size Was Valued at USD 18.12 Billion in 2023, and is Projected to Reach USD 111.71 Billion by 2032, Growing at a CAGR of 22.4% From 2024-2032.

The medicinal cannabis market means a segment related to the cultivation, processing, and distribution of cannabis and products based on it for medical use. This market consists of oils, tinctures, capsules and dried flowers for the purposes of treating a variety of ailments: chronic pain, epilepsy, multiple sclerosis and other serious conditions. The legal situation is different from country to country and from region to region and as such influences the market and its development. The market of medicinal cannabis is rising due to growing legalization of the product in various countries and their states; the market is also highly investable and innovative.

The market for medicinal cannabis have also shown steady growth in the recent years due to legalization, an increasing number of published works on medicinal qualities of cannabis, and a changing perception regarding use of cannabis across the globe. Increasingly, cannabis is being enjoyed as something that produces pleasurable effects but it is also seen more and more as a useful medicine in many areas. That being the case, there are many pharma firms and start-ups creating room for productions and formulations of better products. Various industry reports showed that the medicinal cannabis market size reached USD 12.4 billion in 2020 and it is rapidly expected to grow in the next years due to the growing demand and modifying laws. These market trends have been projected to push this industry’s CAGR to approximately 16.5% between 2022 and 2030.

There is also increasing public awareness of the extended health benefits that come with using the cannabis in the market. People who have chronic illnesses and healthcare workers are slowly adopting medicinal cannabis as a form of treatment or management therapy for anxiety, chronic pain relief, and chemotherapy induced nausea. However, even more, a number of ongoing clinical trials along with research studies are helping in establishing the benefits of cannabis derived products, which ought to help in increasing the acceptance among the medical fraternity. However, as this research has revealed and following the promising outlook, there are obstacles that include regulatory barriers, product quality, and competition that the companies face as key challenges for the medicinal cannabis business.

Medicinal Cannabis Market Trend Analysis:

Increasing Adoption of CBD Products

-

One of the more significant patterns in the medicinal cannabis field is the increasing use of cannabidiol (CBD). CBD or Cannabidiol is a non-intoxicating compound from the cannabis plant with reported health benefits which include Inflammation reduction, Pain relief and Anxiety. Due to increased demand there are more CBD products like oil, edible, and topical applications hitting the market in the accessible category. Further, there has been an increase in the availability of CBD products on the market due to changes in regulation from different parts of the world easily seeking natural remedies for their health needs. This is because the market for nutrition with emphasis on rigorous health, body and soul remains dynamic; this means that there is equally likelihood to see more CBD products within the market with enhanced and more improved technology.

Expansion in Emerging Markets

-

Industry data suggest that there is a huge market for medicinal cannabis in the global markets to the emerging markets. Many countries in Asia-Pacific region, Latin America and Africa are considering legalization of medicinal cannabis due to pressing need for non-pharmacological management of the conditions such as chronic pain and other ailments, plus the perceived economic benefits of growing cannabis. For instance, there are the verses from the regions with the growing regulation regarding the medical marijuana market, such as Mexico and Thailand. Moreover, the global liberalizing attitude toward Cannabidiol continues to influence the current markets and therefore companies that are early entrant to these markets stand to gain by possessing a high proportion of the market share as competition in these areas are relatively low compared to developed markets. Such growth potential can make this sector as one of the most promising targets for investment and innovation.

Medicinal Cannabis Market Segment Analysis:

Medicinal Cannabis Market is Segmented on the basis of Formulation Type, Application, End User, and Region.

By Formulation Type, Flowers segment is expected to dominate the market during the forecast period

-

The flowers segment is likely to lead the market in the medicinal cannabis market in the medical industry during the predicted time span. The reasons for the increased sales of cannabis flower products can be attributed to the diverse use of cannabis flowers as well as the conventional use in medical sectors. People prefer whole flowers more, because they are convenient to use, familiar in the ways of consumption (for instance, smoking or vaporizing), and thanks to this, people can control the dosage of the preparation. This segment is also well-suited as the variety of cannabinoid profiles also varies from strain to strain providing patients with an opportunity to choose flowers that meet their therapeutic needs most adequately. With rising consumer knowledge about cannabis and its subtypes, those flowers types are expected to demand more, keeping the brand intact in the market.

- Furthermore, the advancement in the EV and contributing factors as follows: advanced cultivation techniques and consistency of quality control is improving the quality of cannabis flowers present in the market. Consumer concerns regarding quality and safety of products that is produced organically and naturally are forcing growers to opt for organic farming methods and sustainable cultivation practices. This trend will consequently, propel growth in the flowers segment as patient demands higher quality and origin of the medical marijuana. Based on current trends in the evolving regulatory environment in individual countries that will make flowers more accessible and safe, the flowers segment remains the largest segment of the medicinal cannabis market in the forecast to 2028.

By Application, Chronic Pain segment expected to held the largest share

-

Constant pain is expecting to have the largest Market Share in the medicinal cannabis market due to the rise in the incidence of chronic pain disorders and the acceptance of medicinal marijuana as a treatment. Chronic pain is a reality that concerns millions of people around the world and generates high levels of costs as well as decrease life quality. Since opioids as any other conventional treatment option are discredited due to complications in the use owing to factors like addiction and side effects, patients are now seeking natural treatments from cannabis.

- It was found out that cannabinoids may be used to treat or manage chronic pain with a special focus on its inflammatory aspect. And the research is also increasing the divide regarding the use of cannabis for chronic pain and increasing acceptance among healthcare providers and patients. In particular, a lot of doctors are prescribing Medical Marijuana during pain management procedures. The segment of chronic pain is likely to be one of the most rapidly growing in the future, as there is a stable tendency towards the confirmation of the effectiveness of marijuana in combating chronic pain through clinical trials. Additionally, the continued legalization of marijuana for medical use in various areas is other likely driver of growth within this market as patients look for other source of pain relief.

Medicinal Cannabis Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

As for the year 2023, North America is anticipated to take over the major market for medicinal cannabis with total market share of more than 45 % of the global market. The leading reason for market dominance in North America is that there is increasing legalization of medicinal cannabis in many states across the United States and most recently in Canada. This region has made long-term efforts to build a stable institutional environment for the development of medicinal cannabis and the promotion of cannabis-based products. The legalisation of use of cannabis in the treatment of diseases and illnesses together with the increment in awareness has boosted the sale of medicinal cannabis products. Also, the continuous clinical research and the position of dominating key players located in the North America remains a primary driver of maintaining the region’s leadership in the global medicinal cannabis market in the nearest future.

Active Key Players in the Medicinal Cannabis Market:

-

Aphria Inc. (Canada)

- Aurora Cannabis (Canada)

- Bhang Inc. (USA)

- Canopy Growth Corporation (Canada)

- Charlotte's Web Holdings, Inc. (USA)

- Cresco Labs (USA)

- Cronos Group (Canada)

- Curaleaf Holdings, Inc. (USA)

- Green Thumb Industries (USA)

- Harvest Health & Recreation (USA)

- Hexo Corp. (Canada)

- MedMen Enterprises (USA)

- Organigram Holdings Inc. (Canada)

- Tilray Brands, Inc. (Canada)

- Trulieve Cannabis Corp. (USA)

- Other Active Players

Key Industry Developments in the Medicinal Cannabis Market:

-

July 2024, The company has initiated a new research initiative that is dedicated to investigating the impact of medical cannabis on neurodegenerative diseases. The objective of this project is to offer novel perspectives on the therapeutic potential of cannabinoids for conditions such as Parkinson's disease and Alzheimer's disease.

|

Medicinal Cannabis Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.12 Billion |

|

Forecast Period 2024-32 CAGR: |

22.4% |

Market Size in 2032: |

USD 111.71 Billion |

|

Segments Covered: |

By Formulation Type |

|

|

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medicinal Cannabis Market by Formulation Type

4.1 Medicinal Cannabis Market Snapshot and Growth Engine

4.2 Medicinal Cannabis Market Overview

4.3 Flowers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Flowers: Geographic Segmentation Analysis

4.4 Oils & Tinctures

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Oils & Tinctures: Geographic Segmentation Analysis

4.5 Capsules

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Capsules: Geographic Segmentation Analysis

4.6 and Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Others: Geographic Segmentation Analysis

Chapter 5: Medicinal Cannabis Market by Application

5.1 Medicinal Cannabis Market Snapshot and Growth Engine

5.2 Medicinal Cannabis Market Overview

5.3 Cancer

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cancer: Geographic Segmentation Analysis

5.4 Chronic Pain

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Chronic Pain: Geographic Segmentation Analysis

5.5 Depression & Anxiety

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Depression & Anxiety: Geographic Segmentation Analysis

5.6 Arthritis

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Arthritis: Geographic Segmentation Analysis

5.7 Diabetes

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Diabetes: Geographic Segmentation Analysis

5.8 Migraines

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Migraines: Geographic Segmentation Analysis

5.9 Epilepsy

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Epilepsy: Geographic Segmentation Analysis

5.10 Multiple Sclerosis

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Multiple Sclerosis: Geographic Segmentation Analysis

5.11 and Others

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 and Others: Geographic Segmentation Analysis

Chapter 6: Medicinal Cannabis Market by End User

6.1 Medicinal Cannabis Market Snapshot and Growth Engine

6.2 Medicinal Cannabis Market Overview

6.3 Hospital Pharmacy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacy: Geographic Segmentation Analysis

6.4 Retail Pharmacy

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacy: Geographic Segmentation Analysis

6.5 and Online Pharmacy

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Online Pharmacy: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medicinal Cannabis Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CANOPY GROWTH CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AURORA CANNABIS

7.4 TILRAY BRANDS INC.

7.5 CURALEAF HOLDINGS INC

7.6 OTHER ACTIVE PLAYERS

Chapter 8: Global Medicinal Cannabis Market By Region

8.1 Overview

8.2. North America Medicinal Cannabis Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Formulation Type

8.2.4.1 Flowers

8.2.4.2 Oils & Tinctures

8.2.4.3 Capsules

8.2.4.4 and Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Cancer

8.2.5.2 Chronic Pain

8.2.5.3 Depression & Anxiety

8.2.5.4 Arthritis

8.2.5.5 Diabetes

8.2.5.6 Migraines

8.2.5.7 Epilepsy

8.2.5.8 Multiple Sclerosis

8.2.5.9 and Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospital Pharmacy

8.2.6.2 Retail Pharmacy

8.2.6.3 and Online Pharmacy

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medicinal Cannabis Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Formulation Type

8.3.4.1 Flowers

8.3.4.2 Oils & Tinctures

8.3.4.3 Capsules

8.3.4.4 and Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Cancer

8.3.5.2 Chronic Pain

8.3.5.3 Depression & Anxiety

8.3.5.4 Arthritis

8.3.5.5 Diabetes

8.3.5.6 Migraines

8.3.5.7 Epilepsy

8.3.5.8 Multiple Sclerosis

8.3.5.9 and Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospital Pharmacy

8.3.6.2 Retail Pharmacy

8.3.6.3 and Online Pharmacy

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medicinal Cannabis Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Formulation Type

8.4.4.1 Flowers

8.4.4.2 Oils & Tinctures

8.4.4.3 Capsules

8.4.4.4 and Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Cancer

8.4.5.2 Chronic Pain

8.4.5.3 Depression & Anxiety

8.4.5.4 Arthritis

8.4.5.5 Diabetes

8.4.5.6 Migraines

8.4.5.7 Epilepsy

8.4.5.8 Multiple Sclerosis

8.4.5.9 and Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospital Pharmacy

8.4.6.2 Retail Pharmacy

8.4.6.3 and Online Pharmacy

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medicinal Cannabis Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Formulation Type

8.5.4.1 Flowers

8.5.4.2 Oils & Tinctures

8.5.4.3 Capsules

8.5.4.4 and Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Cancer

8.5.5.2 Chronic Pain

8.5.5.3 Depression & Anxiety

8.5.5.4 Arthritis

8.5.5.5 Diabetes

8.5.5.6 Migraines

8.5.5.7 Epilepsy

8.5.5.8 Multiple Sclerosis

8.5.5.9 and Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospital Pharmacy

8.5.6.2 Retail Pharmacy

8.5.6.3 and Online Pharmacy

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medicinal Cannabis Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Formulation Type

8.6.4.1 Flowers

8.6.4.2 Oils & Tinctures

8.6.4.3 Capsules

8.6.4.4 and Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Cancer

8.6.5.2 Chronic Pain

8.6.5.3 Depression & Anxiety

8.6.5.4 Arthritis

8.6.5.5 Diabetes

8.6.5.6 Migraines

8.6.5.7 Epilepsy

8.6.5.8 Multiple Sclerosis

8.6.5.9 and Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospital Pharmacy

8.6.6.2 Retail Pharmacy

8.6.6.3 and Online Pharmacy

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medicinal Cannabis Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Formulation Type

8.7.4.1 Flowers

8.7.4.2 Oils & Tinctures

8.7.4.3 Capsules

8.7.4.4 and Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Cancer

8.7.5.2 Chronic Pain

8.7.5.3 Depression & Anxiety

8.7.5.4 Arthritis

8.7.5.5 Diabetes

8.7.5.6 Migraines

8.7.5.7 Epilepsy

8.7.5.8 Multiple Sclerosis

8.7.5.9 and Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospital Pharmacy

8.7.6.2 Retail Pharmacy

8.7.6.3 and Online Pharmacy

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Medicinal Cannabis Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.12 Billion |

|

Forecast Period 2024-32 CAGR: |

22.4% |

Market Size in 2032: |

USD 111.71 Billion |

|

Segments Covered: |

By Formulation Type |

|

|

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||