Medical Tapes Market Synopsis:

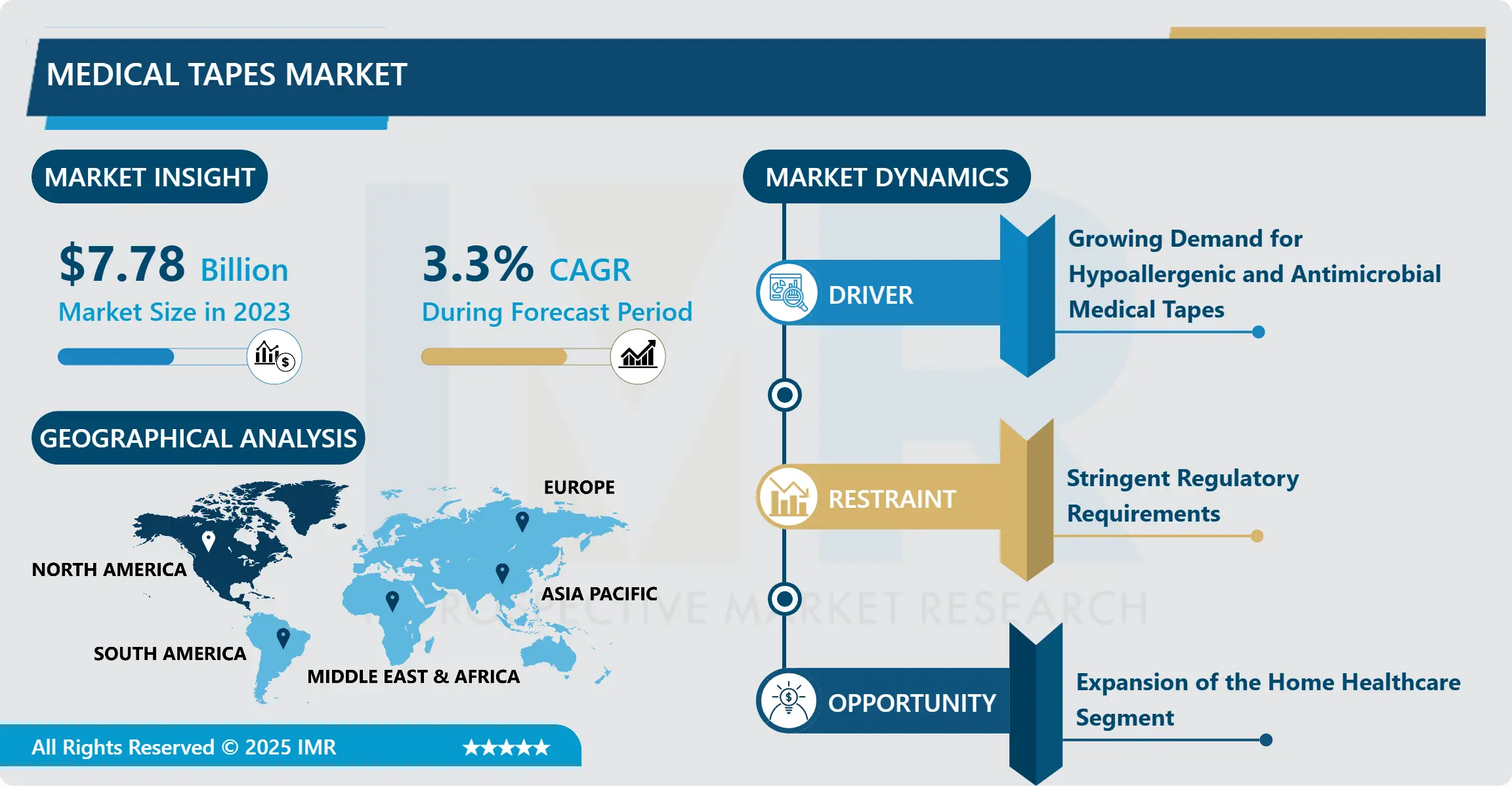

Medical Tapes Market Size Was Valued at USD 7.78 Billion in 2023, and is Projected to Reach USD 10.42 Billion by 2032, Growing at a CAGR of 3.3% From 2024-2032.

Medical tapes industry therefore relates to the business section of adhesive tapes which are made purposely for application in medical fields. Such tapes are commonly employed to attach dressings, wounds, bandages and other medical products to the skin. Medical tapes are important for constant patient care in hospitals, clinics and home since they are gentle on the skin but provides effective fixation. They have types such as fabric medical tapes, paper medical tapes, the plastic medical tapes, and others; more features that the medical tapes contain encompass the hypoallergenic reputation, easy peel, and breathe easily.

The global market for medical tapes has been on the rise in the recent past, this has been occasioned by; The growing demand for healthcare products The enhanced awareness people have developed over their wounds and its treatment. Developing new products for medical application. Surgical tapes, skin support tapes, adhesive bandages and other related products are in high demand, thus are medical tapes as surgeries continue to increase, chronic diseases, and the global population is aging. Furthermore, changing lifestyles due to a preference for home care with the availability of enhanced healthcare facilities accompanied by rising usage of medical tapes for the recovery process post surgeries has been a key reason for the growth of this market. Medical tapes have proven indispensable in practices that cover the protection of wounds and attachments of medical apparatus.

It further categorises the market by the various kinds of medical tapes, particularly the fabric, paper and plastic ones. Such growth in medical adhesive technologies has also in one way driven the market, bringing to the table tapes with better stickiness, gentle on the skin and even those that are comfortable to wear for longer durations. Also, more and more healthcare workers apply tapes with hypoallergenic and antimicrobial features to provide improved results for clients with fragile skin or open wounds, which can easily get infected. The above trend depicts that there is the increasing need for the new generation tapes that with enhanced performance, especially why it comes to the needs of medical specialists and patients.

Medical Tapes Market Trend Analysis:

Growing Demand for Hypoallergenic and Antimicrobial Medical Tapes

-

Thus, the most important developments is the medicine and among them one of the most important trends in the indicated sphere is the growing demand for hypoallergenic and antimicrobial medical tapes. As more of the patient population experiences issues with skin sensitivity or allergies and especially with long-term binds such as in long-term care or after surgery, there is now an increasing demand for tapes that have minimal negative impact to the skin. These tapes are formulated to have minimal reaction with human skin, less likely to cause irritation, and thus patients are less likely to remove them. Further, there is now increased demand for medical tapes with antimicrobial properties mainly caused by the growing concern in infection control specifically in the application of the medical tapes in wound care. The increase in prevalence of this process is consistent with overall trends in medicine towards comfort, safety and avoiding adverse outcomes in chronic or high-risk patients.

Expansion of the Home Healthcare Segment

-

The shift in focus towards the procurement of home healthcare products provides a major opportunity for MM to grow in the medical tapes market. More patients today prefer to recover and obtain treatment at their homes, instead of hospitals and other facilities, and this has increased the utilization rate of such medical products such as medical tapes. These tapes are often used in facilities wound care, IV line fixatives and to guarantee that an assortment of medical devices do not shift position during home care. That is why home healthcare is a promising market segment that develops due to such factors as cost and patient preferences, as well as the availability of telemedicine technologies. Manufacturers of medical tapes are well positioned to take advantage of this upcoming trend IF they think through and develop easy-to-use, safe, medical tapes that are appropriate for home care scenarios. Moreover, vigorous product development on convenience brought about easy application and removal of tapes and other products could fulfill the needs of the health care professionals and caregivers.

Medical Tapes Market Segment Analysis:

Medical Tapes Market is Segmented on the basis of Product, Application, End User, and Region.

By Product, Medical Tapes segment is expected to dominate the market during the forecast period

-

Further, listed below about medical tapes and bandages: This list separates the medical tapes and bandages by the material they are made up, as well as by use, as these two kinds are common and crucial elements in medical methodologies for bandaging and securing wounds. Medical tapes come in a diversity of materials including acetate, viscose, cotton, silk, polyester and other material; which offer differing characteristic such as adhesion, breathability and patient comfort. Some types are paper and plastic including Polypropylene types used where flexibility or resistance to moisture is desirable. Aside from tapes, medical bandages are categorized by form and elasticity; muslin, elastic, triangular, and orthopedic bandage rolls are employed dependent on the degree of support needed; elastic plaster bandage has enhanced flexibility and provide secure fixation used for therapeutic or post-operative purposes. Further choices under “other tapes” and “other bandages” correspond with various specific uses.

By Application, Surgical Wound segment expected to held the largest share

-

With regards to application the segment of surgical wound accounted for largest market share in 2023 This list categorizes medical tape and bandage application based on kind of injury where certain products are necessary for healing as well as support. Surgical wounds and traumatic wounds require secure covering material which contributes the less chance of infections; treatment of ulcers require cover material that allows breathability in order to contribute to skin health. Sports injuries need strong support and stability during physical activities and the burns need milder protection from say blisters. The ‘other injuries’ embrace specificities bandages and tapes for distinct perse than these foregoing uses.

Medical Tapes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America remains the largest market for medical tapes in 2023 and is primarily led by the United States market. A major percentage of the market is held by the United States, thanks to its highly developed healthcare system, immense healthcare spending, and increased the use of technological solutions in the sphere of medicine. Medical tapes find a ready market in the higher incidences of chronic diseases, increasing elderly population and a graduate’s demand for surgeries and other medical procedures.

- North American region healthcare care system comprises of wound care, infection control, and post-operative care for enhanced adoption of medical tapes. It is expected that in the year 2023 market share of North America will be around 35-40% for the medical tapes segment and this is mainly contributed by the U.S. The medical tapes market in the region is also benefited from its vibrant key players, increased healthcare technologies, and healthcare reforms that are seamlessly targeted at enhancing the quality and efficacy of patient care.

Active Key Players in the Medical Tapes Market:

-

3M (USA)

- Acelity (USA)

- Adhezion Biomedical (USA)

- B. Braun Melsungen AG (Germany)

- Beiersdorf AG (Germany)

- ConvaTec Group PLC (UK)

- Essity AB (Sweden)

- Hartmann USA (USA)

- Johnson & Johnson (USA)

- KIMBERLY-CLARK CORPORATION (USA)

- Medtronic PLC (Ireland)

- MÖLNLYCKE HEALTH CARE AB (Sweden)

- Paul Hartmann AG (Germany)

- Scapa Healthcare (UK)

- Smith & Nephew (UK)

- Other Active Players

|

Medical Tapes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.78Billion |

|

Forecast Period 2024-32 CAGR: |

3.3 % |

Market Size in 2032: |

USD 10.42 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Tapes Market by Product

4.1 Medical Tapes Market Snapshot and Growth Engine

4.2 Medical Tapes Market Overview

4.3 Medical Tapes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Medical Tapes : Geographic Segmentation Analysis

4.4 (Fabric Tapes

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 (Fabric Tapes : Geographic Segmentation Analysis

4.5 Acetate

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Acetate : Geographic Segmentation Analysis

4.6 Viscose

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Viscose : Geographic Segmentation Analysis

4.7 Cotton

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Cotton : Geographic Segmentation Analysis

4.8 Silk

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Silk : Geographic Segmentation Analysis

4.9 Polyester

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Polyester : Geographic Segmentation Analysis

4.10 Other Fabric Tape

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Other Fabric Tape : Geographic Segmentation Analysis

4.11 Paper Tapes

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Paper Tapes : Geographic Segmentation Analysis

4.12 Plastic Tapes

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 Plastic Tapes : Geographic Segmentation Analysis

4.13 Propylene

4.13.1 Introduction and Market Overview

4.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.13.3 Key Market Trends, Growth Factors and Opportunities

4.13.4 Propylene : Geographic Segmentation Analysis

4.14 Other Plastic Tapes

4.14.1 Introduction and Market Overview

4.14.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.14.3 Key Market Trends, Growth Factors and Opportunities

4.14.4 Other Plastic Tapes : Geographic Segmentation Analysis

4.15 Other Tapes)

4.15.1 Introduction and Market Overview

4.15.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.15.3 Key Market Trends, Growth Factors and Opportunities

4.15.4 Other Tapes): Geographic Segmentation Analysis

Chapter 5: Medical Tapes Market by Medical Bandages ,

5.1 Medical Tapes Market Snapshot and Growth Engine

5.2 Medical Tapes Market Overview

5.3 Muslin Bandage Rolls

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Muslin Bandage Rolls : Geographic Segmentation Analysis

5.4 Elastic Bandage Rolls

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Elastic Bandage Rolls : Geographic Segmentation Analysis

5.5 Triangular Bandage Rolls

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Triangular Bandage Rolls : Geographic Segmentation Analysis

5.6 Orthopedic Bandage Rolls

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Orthopedic Bandage Rolls : Geographic Segmentation Analysis

5.7 Elastic Plaster Bandages

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Elastic Plaster Bandages : Geographic Segmentation Analysis

5.8 Other Bandages)

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Other Bandages): Geographic Segmentation Analysis

Chapter 6: Medical Tapes Market by Application

6.1 Medical Tapes Market Snapshot and Growth Engine

6.2 Medical Tapes Market Overview

6.3 Surgical Wound

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Surgical Wound : Geographic Segmentation Analysis

6.4 Traumatic Wound

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Traumatic Wound : Geographic Segmentation Analysis

6.5 Ulcer

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Ulcer : Geographic Segmentation Analysis

6.6 Sports Injury

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Sports Injury : Geographic Segmentation Analysis

6.7 Burn Injury

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Burn Injury : Geographic Segmentation Analysis

6.8 Others Injury

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others Injury: Geographic Segmentation Analysis

Chapter 7: Medical Tapes Market by End User

7.1 Medical Tapes Market Snapshot and Growth Engine

7.2 Medical Tapes Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals : Geographic Segmentation Analysis

7.4 Ambulatory Surgery Center

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Ambulatory Surgery Center : Geographic Segmentation Analysis

7.5 Clinics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Clinics : Geographic Segmentation Analysis

7.6 Retail

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Retail : Geographic Segmentation Analysis

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Tapes Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 3M

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 JOHNSON & JOHNSON

8.4 BEIERSDORF AG

8.5 MEDTRONIC PLC

8.6 OTHER ACTIVE PLAYERS

Chapter 9: Global Medical Tapes Market By Region

9.1 Overview

9.2. North America Medical Tapes Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product

9.2.4.1 Medical Tapes

9.2.4.2 (Fabric Tapes

9.2.4.3 Acetate

9.2.4.4 Viscose

9.2.4.5 Cotton

9.2.4.6 Silk

9.2.4.7 Polyester

9.2.4.8 Other Fabric Tape

9.2.4.9 Paper Tapes

9.2.4.10 Plastic Tapes

9.2.4.11 Propylene

9.2.4.12 Other Plastic Tapes

9.2.4.13 Other Tapes)

9.2.5 Historic and Forecasted Market Size By Medical Bandages ,

9.2.5.1 Muslin Bandage Rolls

9.2.5.2 Elastic Bandage Rolls

9.2.5.3 Triangular Bandage Rolls

9.2.5.4 Orthopedic Bandage Rolls

9.2.5.5 Elastic Plaster Bandages

9.2.5.6 Other Bandages)

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Surgical Wound

9.2.6.2 Traumatic Wound

9.2.6.3 Ulcer

9.2.6.4 Sports Injury

9.2.6.5 Burn Injury

9.2.6.6 Others Injury

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Ambulatory Surgery Center

9.2.7.3 Clinics

9.2.7.4 Retail

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Tapes Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product

9.3.4.1 Medical Tapes

9.3.4.2 (Fabric Tapes

9.3.4.3 Acetate

9.3.4.4 Viscose

9.3.4.5 Cotton

9.3.4.6 Silk

9.3.4.7 Polyester

9.3.4.8 Other Fabric Tape

9.3.4.9 Paper Tapes

9.3.4.10 Plastic Tapes

9.3.4.11 Propylene

9.3.4.12 Other Plastic Tapes

9.3.4.13 Other Tapes)

9.3.5 Historic and Forecasted Market Size By Medical Bandages ,

9.3.5.1 Muslin Bandage Rolls

9.3.5.2 Elastic Bandage Rolls

9.3.5.3 Triangular Bandage Rolls

9.3.5.4 Orthopedic Bandage Rolls

9.3.5.5 Elastic Plaster Bandages

9.3.5.6 Other Bandages)

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Surgical Wound

9.3.6.2 Traumatic Wound

9.3.6.3 Ulcer

9.3.6.4 Sports Injury

9.3.6.5 Burn Injury

9.3.6.6 Others Injury

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Ambulatory Surgery Center

9.3.7.3 Clinics

9.3.7.4 Retail

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Tapes Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product

9.4.4.1 Medical Tapes

9.4.4.2 (Fabric Tapes

9.4.4.3 Acetate

9.4.4.4 Viscose

9.4.4.5 Cotton

9.4.4.6 Silk

9.4.4.7 Polyester

9.4.4.8 Other Fabric Tape

9.4.4.9 Paper Tapes

9.4.4.10 Plastic Tapes

9.4.4.11 Propylene

9.4.4.12 Other Plastic Tapes

9.4.4.13 Other Tapes)

9.4.5 Historic and Forecasted Market Size By Medical Bandages ,

9.4.5.1 Muslin Bandage Rolls

9.4.5.2 Elastic Bandage Rolls

9.4.5.3 Triangular Bandage Rolls

9.4.5.4 Orthopedic Bandage Rolls

9.4.5.5 Elastic Plaster Bandages

9.4.5.6 Other Bandages)

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Surgical Wound

9.4.6.2 Traumatic Wound

9.4.6.3 Ulcer

9.4.6.4 Sports Injury

9.4.6.5 Burn Injury

9.4.6.6 Others Injury

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Ambulatory Surgery Center

9.4.7.3 Clinics

9.4.7.4 Retail

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Tapes Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product

9.5.4.1 Medical Tapes

9.5.4.2 (Fabric Tapes

9.5.4.3 Acetate

9.5.4.4 Viscose

9.5.4.5 Cotton

9.5.4.6 Silk

9.5.4.7 Polyester

9.5.4.8 Other Fabric Tape

9.5.4.9 Paper Tapes

9.5.4.10 Plastic Tapes

9.5.4.11 Propylene

9.5.4.12 Other Plastic Tapes

9.5.4.13 Other Tapes)

9.5.5 Historic and Forecasted Market Size By Medical Bandages ,

9.5.5.1 Muslin Bandage Rolls

9.5.5.2 Elastic Bandage Rolls

9.5.5.3 Triangular Bandage Rolls

9.5.5.4 Orthopedic Bandage Rolls

9.5.5.5 Elastic Plaster Bandages

9.5.5.6 Other Bandages)

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Surgical Wound

9.5.6.2 Traumatic Wound

9.5.6.3 Ulcer

9.5.6.4 Sports Injury

9.5.6.5 Burn Injury

9.5.6.6 Others Injury

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Ambulatory Surgery Center

9.5.7.3 Clinics

9.5.7.4 Retail

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Tapes Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product

9.6.4.1 Medical Tapes

9.6.4.2 (Fabric Tapes

9.6.4.3 Acetate

9.6.4.4 Viscose

9.6.4.5 Cotton

9.6.4.6 Silk

9.6.4.7 Polyester

9.6.4.8 Other Fabric Tape

9.6.4.9 Paper Tapes

9.6.4.10 Plastic Tapes

9.6.4.11 Propylene

9.6.4.12 Other Plastic Tapes

9.6.4.13 Other Tapes)

9.6.5 Historic and Forecasted Market Size By Medical Bandages ,

9.6.5.1 Muslin Bandage Rolls

9.6.5.2 Elastic Bandage Rolls

9.6.5.3 Triangular Bandage Rolls

9.6.5.4 Orthopedic Bandage Rolls

9.6.5.5 Elastic Plaster Bandages

9.6.5.6 Other Bandages)

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Surgical Wound

9.6.6.2 Traumatic Wound

9.6.6.3 Ulcer

9.6.6.4 Sports Injury

9.6.6.5 Burn Injury

9.6.6.6 Others Injury

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Ambulatory Surgery Center

9.6.7.3 Clinics

9.6.7.4 Retail

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Tapes Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product

9.7.4.1 Medical Tapes

9.7.4.2 (Fabric Tapes

9.7.4.3 Acetate

9.7.4.4 Viscose

9.7.4.5 Cotton

9.7.4.6 Silk

9.7.4.7 Polyester

9.7.4.8 Other Fabric Tape

9.7.4.9 Paper Tapes

9.7.4.10 Plastic Tapes

9.7.4.11 Propylene

9.7.4.12 Other Plastic Tapes

9.7.4.13 Other Tapes)

9.7.5 Historic and Forecasted Market Size By Medical Bandages ,

9.7.5.1 Muslin Bandage Rolls

9.7.5.2 Elastic Bandage Rolls

9.7.5.3 Triangular Bandage Rolls

9.7.5.4 Orthopedic Bandage Rolls

9.7.5.5 Elastic Plaster Bandages

9.7.5.6 Other Bandages)

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Surgical Wound

9.7.6.2 Traumatic Wound

9.7.6.3 Ulcer

9.7.6.4 Sports Injury

9.7.6.5 Burn Injury

9.7.6.6 Others Injury

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Ambulatory Surgery Center

9.7.7.3 Clinics

9.7.7.4 Retail

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Medical Tapes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.78Billion |

|

Forecast Period 2024-32 CAGR: |

3.3 % |

Market Size in 2032: |

USD 10.42 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||