Medical Robotic System Market Synopsis:

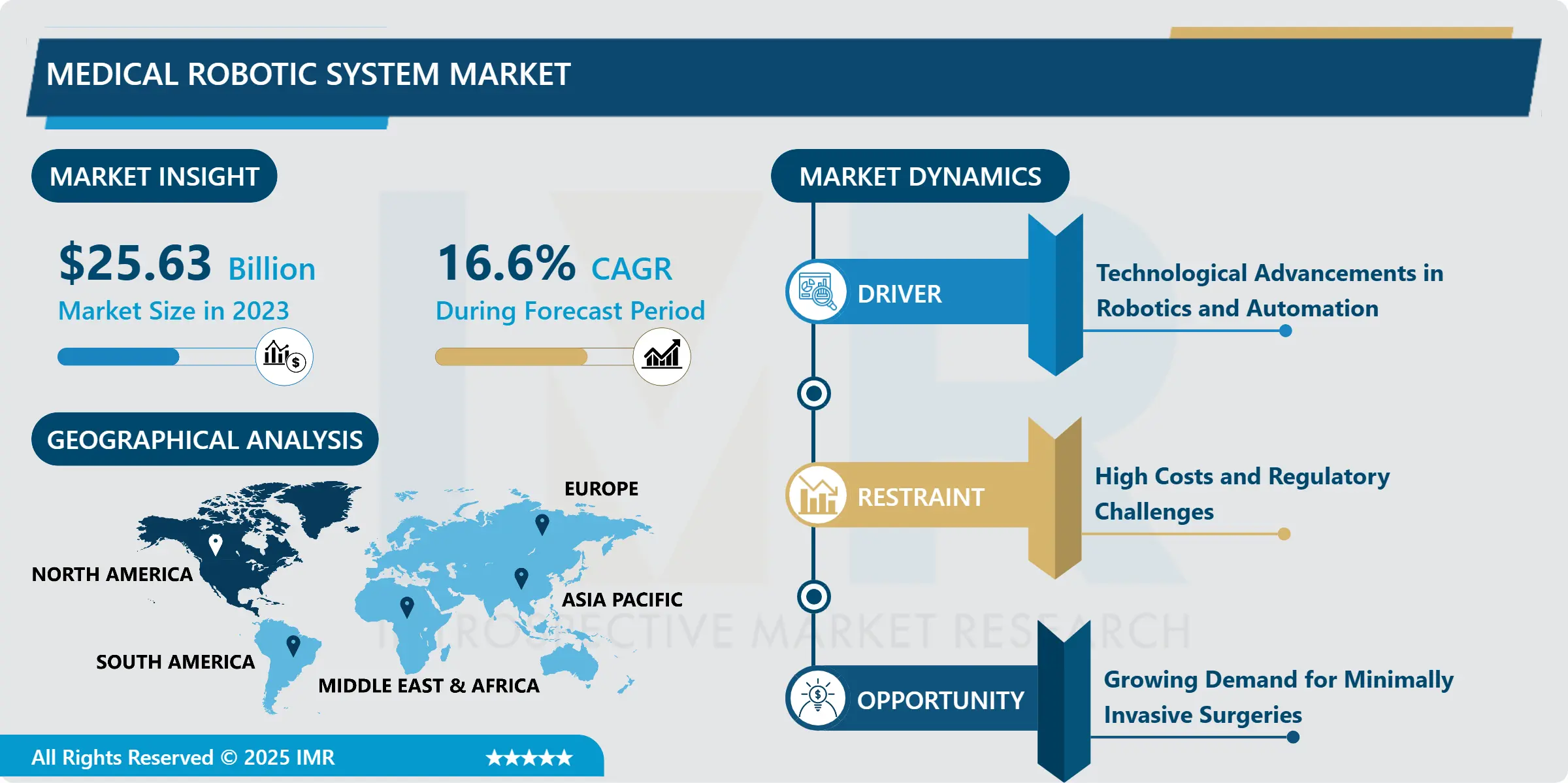

Medical Robotic System Market Size Was Valued at USD 25.63 Billion in 2023, and is Projected to Reach USD 102.02 Billion by 2032, Growing at a CAGR of 16.6% From 2024-2032.

The Medical Robotic System Market refers to all types of robotic solutions that have been developed with the primary intent to serve in facilities within the medical sector. These robotic systems are applied to surgery or rehabilitation, patient treatment or diagnosing, and other medical activities. This work focuses on the improvement of accuracy, speed, and safety of interventions in medicine and provide minimally invasive options for difficult operations, positive impact on patient’s scenario and relevant specialists.

The growth in the worldwide medical robotics market has been propelled in the past few years mainly by progress seen in automation and AI. As the society becomes more concerned about accuracy and fewer intrusive techniques; health care robotics has become popular with hospitals, clinics and rehabilitation facilities all over the world. Examples are surgical robots where surgeons are able to carry out delicate operations due to precision hence meaning low healing period and least trauma to the patient. Rehabilitation robots assist injured individuals moving back and forth from therapy or during stoke recovery, to learn how to walk and be independent again.

Hospitals and especially healthcare facilities in the contemporary world have, therefore, found merit in robotic systems because the systems can supplement workforce and patient management. Furthermore, the use of artificial intelligence in medical innovative devices and systems such as the medical robot, has elevated the nature of their operations in terms of responsiveness to provide feedback to the practitioners in real-time. Another factor that has supported the advancement of the market, is increased demand in medical services due to the aging population all over the world. As technologies improve the functional capabilities of robotic systems as well as their cost, the overall use of robotic systems in automation is set to increase. But they are not lacking in obstacles like high costs and tough rules that may hinder a more widespread adoption.

Medical Robotic System Market Trend Analysis:

Increasing Use of AI in Medical Robotics

- The use of Artificial Intelligence (AI) in developing robotic technology for healthcare is a happening reality. Special features of these robots include features such as machine and pattern recognition, machine learning, and real-time data analysis to support decision making where it matters now in medical procedures. For example, intelligent robotic surgery systems enable an understanding of where to make incisions and the identification of tissues structures that necessitate cutting with high levels of accuracy. It means that the patients receive individual treatment with the help of the data given in this process and outcomes are better.

- In addition, the medical application of AI in robotics assists the doctors in the diagnosis as well as forecasting tasks. AI robots can help diagnose diseases such as cancer or cardiovascular diseases from large tracts of data. They aim to minimize the number of mistakes made by surgeons, simplify numerous procedures while making them more non-invasive , allowing patients to be discharged earlier and recovery time to be much shorter. The expanded use of AI in medical robotics opens up the doors for even advanced upgrades in healthcare as it is transitioning towards a more intelligent sector reliant on data input.

Growing Demand for Minimally Invasive Surgeries

- The need for large and complex, surgical procedures which can be conducted through minimally invasive techniques is another strong prospect in the field of the medical robotic system. The above treatment procedures have found a place more and more in patients as well as in the doctors’ list due to its advantages like minimal scarification, less chance of infection, shorter hospitalization, and low cost. The equipment examples include surgical robots capable to perform high accuracy operations to facilitate minimally invasive surgery even when dealing with complication cases. For instance, robots can be useful in procedures where small incisions and delicate movements are necessary and which normal surgery may not hence offer for example.

- This has brought about the need to invest in the development of research to help in the development of new better robotic systems that are suitable for MIP. Sensor advancements, three-dimensional graphics, and haptic interaction have enhanced the effectiveness of these systems so that surgeons can accomplish complex procedures. Along this trend, the market is expected to expand, and the openings for new affordable, niche robotic technology in modern healthcare to be discovered.

Medical Robotic System Market Segment Analysis:

Medical Robotic System Market is Segmented on the basis of Product Type, Application, End User, and Region

By Product Type, Surgical Robots segment is expected to dominate the market during the forecast period

- The Medical Robotic System market can be categorized based on the product type/ application into surgical robots, rehabilitation robots, hospital robots, non-invasive radiosurgery robots and other medical robots. Surgical robots have the largest market share because of their use in minimally invasive procedures that require great accuracy. Another type of robots is the rehabilitation robots which help patients together with common uses in physical therapy and stroke rehabilitation.

- Another interesting application is regular working hospital robots that are engaged in carrying equipment and supplies as well as in patient surveillance, and which significantly help to decrease the load on staff and enhance productivity. A non-invasive surgical robot is employed for radiation therapy whereby cancer cells are destroyed without the use of a scalpel. Other types of medical robots including diagnosing or tele-diagnosing robots are being developed as technology advances and hospitals shift towards developing uses for robotic solutions.

By Application, Orthopedic Surgery segment expected to held the largest share

- Consumption of Medical Robotic System Market on the basis of application is divided into orthopedic surgery, neurosurgery, general surgery, gynecology surgery, cardiology surgery, laparoscopy surgery, and other specific procedures. Surgical robotic application in orthopedic and neurosurgical procedures is on high demand mainly due to their accuracy as they work on small structures such as bones and nerves. Such robotic systems apply in cases with high odds of complications and do help patients to recuperate faster.

- In general surgery, laparoscopy and gynecology operations, medical robots are used for minimal invasive operations since it is gaining more popularity with its benefits such as smaller incision and early recovery time of the patient. It is understood that, with advancement in robotic technology, there are several areas of use in these domains and hence better patient care as well as a higher uptake of the robotic systems.

Medical Robotic System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- At present, the market for medical robotic system is busiest in North American region due to presence of superior healthcare system in the region and large number of investments in medical robotics. To this effect the region is greatly endowed with a framework of healthcare institutions, research organizations and regulatory agencies that encourage the advancement and application of medical robotics. High healthcare spending acts as another most influential factor and the reimbursement policies also gives the boost to the development of this market in the particular regions.

- Moreover, being inhabited by not only the biggest medical robotic market but also the main companies developing medical robots and cooperating with the most important healthcare facilities the position of North America is rather solid. Canada and the United States are especially engaged in the advancement of medical robotics, with programs directed to improving the results of the health care process by technology application. Therefore, it can be predicted that North America will continue to lead the market in the future.

Active Key Players in the Medical Robotic System Market:

- Intuitive Surgical (USA)

- Stryker Corporation (USA)

- Medtronic (Ireland)

- Smith & Nephew (UK)

- Zimmer Biomet (USA)

- TransEnterix (USA)

- Accuray Incorporated (USA)

- CMR Surgical (UK)

- Titan Medical (Canada)

- Renishaw (UK)

- Johnson & Johnson (USA)

- KUKA AG (Germany)

- Other Active Players

Key Industry Developments in the Medical Robotic System Market:

- In July 2024, Intuitive Surgical reported a strong second quarter, driven by the rapid rollout of its da Vinci 5 robotic surgery system, which surpassed Wall Street expectations.

- In June 2024, Globus Medical obtained 510(k) clearance from the FDA for its ExcelsiusFlex orthopedic robot.

- In May 2024, Sony announced the development microsurgery robot to enhance surgical precision. The robot is designed to assist surgeons in performing intricate procedures with greater accuracy.

|

Medical Robotic System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.63 Billion |

|

Forecast Period 2024-32 CAGR: |

16.6% |

Market Size in 2032: |

USD 102.02 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Robotic System Market by Product Type

4.1 Medical Robotic System Market Snapshot and Growth Engine

4.2 Medical Robotic System Market Overview

4.3 Surgical Robots

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Surgical Robots: Geographic Segmentation Analysis

4.4 Rehabilitation Robots

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Rehabilitation Robots: Geographic Segmentation Analysis

4.5 Hospital Robots

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hospital Robots: Geographic Segmentation Analysis

4.6 Non-invasive Radiosurgery Robots

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Non-invasive Radiosurgery Robots: Geographic Segmentation Analysis

4.7 Other

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Other: Geographic Segmentation Analysis

Chapter 5: Medical Robotic System Market by Application

5.1 Medical Robotic System Market Snapshot and Growth Engine

5.2 Medical Robotic System Market Overview

5.3 Orthopedic Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Orthopedic Surgery: Geographic Segmentation Analysis

5.4 Neurosurgery

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Neurosurgery: Geographic Segmentation Analysis

5.5 General Surgery

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 General Surgery: Geographic Segmentation Analysis

5.6 Gynecology Surgery

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Gynecology Surgery: Geographic Segmentation Analysis

5.7 Cardiology Surgery

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Cardiology Surgery: Geographic Segmentation Analysis

5.8 Laparoscopy Surgery

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Laparoscopy Surgery: Geographic Segmentation Analysis

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Geographic Segmentation Analysis

Chapter 6: Medical Robotic System Market by End User

6.1 Medical Robotic System Market Snapshot and Growth Engine

6.2 Medical Robotic System Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

6.5 Rehabilitation Centers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Rehabilitation Centers: Geographic Segmentation Analysis

6.6 Specialty Centers

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Specialty Centers: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Medical Robotic System Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INTUITIVE SURGICAL (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 STRYKER CORPORATION (USA)

7.4 MEDTRONIC (IRELAND)

7.5 SMITH & NEPHEW (UK)

7.6 ZIMMER BIOMET (USA)

7.7 TRANSENTERIX (USA)

7.8 ACCURAY INCORPORATED (USA)

7.9 OTHER ACTIVE PLAYERS

Chapter 8: Global Medical Robotic System Market By Region

8.1 Overview

8.2. North America Medical Robotic System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Surgical Robots

8.2.4.2 Rehabilitation Robots

8.2.4.3 Hospital Robots

8.2.4.4 Non-invasive Radiosurgery Robots

8.2.4.5 Other

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Orthopedic Surgery

8.2.5.2 Neurosurgery

8.2.5.3 General Surgery

8.2.5.4 Gynecology Surgery

8.2.5.5 Cardiology Surgery

8.2.5.6 Laparoscopy Surgery

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Rehabilitation Centers

8.2.6.4 Specialty Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Medical Robotic System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Surgical Robots

8.3.4.2 Rehabilitation Robots

8.3.4.3 Hospital Robots

8.3.4.4 Non-invasive Radiosurgery Robots

8.3.4.5 Other

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Orthopedic Surgery

8.3.5.2 Neurosurgery

8.3.5.3 General Surgery

8.3.5.4 Gynecology Surgery

8.3.5.5 Cardiology Surgery

8.3.5.6 Laparoscopy Surgery

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Rehabilitation Centers

8.3.6.4 Specialty Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Medical Robotic System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Surgical Robots

8.4.4.2 Rehabilitation Robots

8.4.4.3 Hospital Robots

8.4.4.4 Non-invasive Radiosurgery Robots

8.4.4.5 Other

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Orthopedic Surgery

8.4.5.2 Neurosurgery

8.4.5.3 General Surgery

8.4.5.4 Gynecology Surgery

8.4.5.5 Cardiology Surgery

8.4.5.6 Laparoscopy Surgery

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Rehabilitation Centers

8.4.6.4 Specialty Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Medical Robotic System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Surgical Robots

8.5.4.2 Rehabilitation Robots

8.5.4.3 Hospital Robots

8.5.4.4 Non-invasive Radiosurgery Robots

8.5.4.5 Other

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Orthopedic Surgery

8.5.5.2 Neurosurgery

8.5.5.3 General Surgery

8.5.5.4 Gynecology Surgery

8.5.5.5 Cardiology Surgery

8.5.5.6 Laparoscopy Surgery

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Rehabilitation Centers

8.5.6.4 Specialty Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Medical Robotic System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Surgical Robots

8.6.4.2 Rehabilitation Robots

8.6.4.3 Hospital Robots

8.6.4.4 Non-invasive Radiosurgery Robots

8.6.4.5 Other

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Orthopedic Surgery

8.6.5.2 Neurosurgery

8.6.5.3 General Surgery

8.6.5.4 Gynecology Surgery

8.6.5.5 Cardiology Surgery

8.6.5.6 Laparoscopy Surgery

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Rehabilitation Centers

8.6.6.4 Specialty Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Medical Robotic System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Surgical Robots

8.7.4.2 Rehabilitation Robots

8.7.4.3 Hospital Robots

8.7.4.4 Non-invasive Radiosurgery Robots

8.7.4.5 Other

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Orthopedic Surgery

8.7.5.2 Neurosurgery

8.7.5.3 General Surgery

8.7.5.4 Gynecology Surgery

8.7.5.5 Cardiology Surgery

8.7.5.6 Laparoscopy Surgery

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Rehabilitation Centers

8.7.6.4 Specialty Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Medical Robotic System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.63 Billion |

|

Forecast Period 2024-32 CAGR: |

16.6% |

Market Size in 2032: |

USD 102.02 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||