Medical Radiation Shielding Market Synopsis:

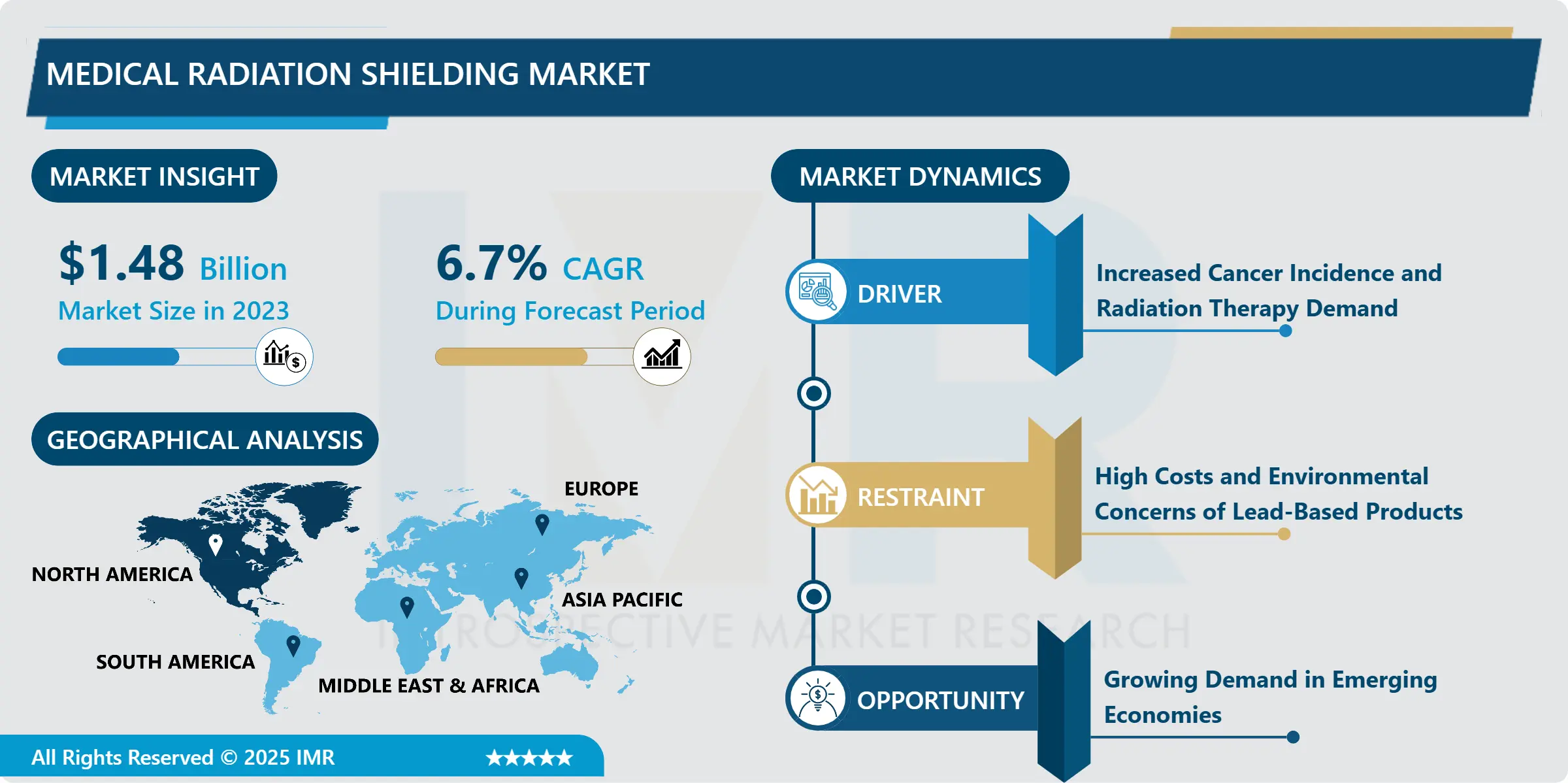

Medical Radiation Shielding Market Size Was Valued at USD 1.48 Billion in 2023, and is Projected to Reach USD 2.65 Billion by 2032, Growing at a CAGR of 6.70% From 2024-2032.

The Medical Radiation Shielding Market deals with the manufacturing and supply of materials and products whose functions are to reduce the impact of ionizing radiation frequently employed in healthcare to patients and other people attending institutions as well as the environment. These shielding solutions which are composed basically of lead along with other heavy materials are vital in healthcare centers most even in locations wherein X-rays, CT scans, and radiation therapy is performed.

Medical Radiation Shielding Market has been on the rise due to the rising use of radiation based diagnostic and therapy treatments across the world. For example, with the increase in chronic diseases, in most cases, cancer, and the subsequent increase in radiation therapy, the need for a reliable radiation barrier is steadily increasing. Many of these products including lead lined doors, glass, walls, curtains and several forms of shields are used in health facilities like hospitals, diagnostic centers and cancer treatment centers. Radiation safety standards have recently been tightened and healthcare organizations have found themselves forced to upgrade their shielding infrastructure to keep radiation levels down for patients and workers. Therefore, they are concentrating on creating hi-tech products that not only provide better safety but are also slim and easy to fit and to clean.

A relative increase in the market has taken place due to the enhanced concentration on outpatient and ambulatory care facilities since these centers demand radiation shielding in light of a growing breadth of their diagnostic services. Also, developments in imaging techniques require protective coatings to deal with new ranges energy densities provided by more modern apparatus. The future of this industry is full of potential and uncertainty: while providers are in search of efficient but cheap materials due to the mass price changes of the main raw materials and growing environmental issues linked to lead-containing products.

Medical Radiation Shielding Market Trend Analysis:

Technological Advancements in Radiation Shielding Materials

- Increasing attention being paid to the effects of traditional shielding material made from lead, industries are researching for leadless shielding material. These alternatives include non lead composites and polymers, light in weight, friendly to the environment, and take away health risks posed by lead. Not only they are compliant with the relevant regulation, but also these materials are more flexible and therefore easier to manipulate, fix or remove.

- That the shift to lead-free shielding materials is seen in the market is an implication that healthcare serves are conscious of the environment and as such this move is encouraged. Numerous organisations are striving to minimise their environmental impact, and using these sophisticated materials is an excellent way to do this. Therefore, organizations that can offer high quality efficient and sustainable radiation protection solutions stand to benefit from higher demand especially from institutions seeking eco certifications or those under tough host country environmental laws.

Growing Demand in Emerging Economies

- The healthcare industry of emerging economies has been experiencing growth owing to increased investment, better access to advanced medical technology and up growing health services. There have been some development in this regards and this has increased the need for medical radiation shielding because many hospitals and diagnostic centers need to bring their facilities up to code from international standards within the radiation sector. Furthermore, the ageing population is living longer with diseases such as cancer and other treatments that are protracted by radiation-based procedures and service industries are driving a large demand for shielding products in these areas.

- Furthermore, the concern of governments of countries in the emerging economy on the quality of healthcare delivery is increasing with resultant more stringent guidelines on radiation protection in healthcare facilities. Since these areas are approaching the standards of the developed countries in terms of healthcare, they present a huge potential for radiation shielding companies. Hence firms that are able to provide superior quality and economic shielding solutions that addresses the demands of these markets are well poised to capitalize on this opportunity.

Medical Radiation Shielding Market Segment Analysis:

Medical Radiation Shielding Market Segmented on the basis of Product Type, Solution, Material, End User, and Region.

By Product Type, Shields segment is expected to dominate the market during the forecast period

- The product type of Medical Radiation Shielding Market are shield, X-ray room, lead sheet, lead brick, lead curtain, lead glass, lead line door & window, and lead line dry wall. Of these, lead sheets, and lead-lined doors have some merits dominance in the healthcare facilities because they are easy to install and efficient in minimizing exposure to radiation. Lead-lined doors and windows are especially popular as protective barriers in rooms and diagnostic areas of radiological facilities.

- Another important product is lead glass for use in diagnostic centers and, to some extent, hospitals, as they also need clear vision during treatment involving radiation exposure to the patient’s body. Lead bricks and sheets are often interphase in smaller radiation rooms designed and built based on the custom shielding requirement of the radiation shielding levels. The types of products in this range also point to the fact that the market is dominated by the need to offer usable and highly efficient shielding solutions for medical practitioners.

By End User, Hospitals segment expected to held the largest share

- The target customers who use medical radiation shielding products are hospitals, diagnostic centers, ambulatory surgical centers, cancer treatment centers, and others. Hospitals continue to be the largest end users because they carry out many diagnostic and therapeutic procedures involving the use of radiation. Therefore, hospitals spend a lot of money in protecting products to conform to the safety measures needed for workers and clients.

- Another important category is also diagnostic centres since they take more and more high radiation procedures including CT, MRI, and X-ray. Ambulatory surgical centers and cancer treatment centers are also added sources because both are increasing their diagnostic and treatment services. These many types of end users demonstrate that radiation shielding is used across numerous forms of care delivery, and each setting has characteristics that help dictate the levels of product demand.

Medical Radiation Shielding Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the Medical Radiation Shielding Market due to the advanced healthcare facility, elevated prevalence of cancer, and incorporating standards for the protection against radiation. Need for highly developed diagnostic and therapeutic tools in health care facilities and need to use radiation shielding products also increases due to the presence of major health care organizations in the region. Also, staying in health care North American providers give importance to patient or staff safety and hence they do not compromise on shielding solutions.

- State and federal agencies like the U.S. Environmental Protection Agency EPA and the Nuclear Regulatory Commission NRC set legal limits on the amount of radiation exposure in healthcare facilities creating pressure on the healthcare facilities to maintain high standards. The market for Medical Radiation Shielding is already quite developed in North America due to increased healthcare spending, a well-developed healthcare system, demand for quality and safety, and market dominance in global Medical Radiation Shielding Market.

Active Key Players in the Medical Radiation Shielding Market:

- ETS-Lindgren (USA)

- Nelco Worldwide (USA)

- Radiation Protection Products, Inc. (USA)

- Ray-Bar Engineering Corporation (USA)

- Marshield (Canada)

- Amray Radiation Protection (Ireland)

- Gaven Industries, Inc. (USA)

- A&L Shielding (USA)

- Veritas Medical Solutions (USA)

- Global Partners in Shielding, Inc. (USA)

- MAVIG GmbH (Germany)

- Wardray Premise Ltd. (UK)

- Other Active Players

Key Industry Developments in the Medical Radiation Shielding Market:

- In April 2024, BIOTRONIK announced a multinational distribution partnership with Texray, the pioneering developer of a groundbreaking radiation protection textile. In this partnership, BIOTRONIK will distribute Texray's head and neck protectors starting in selected European and Middle Eastern countries. Both partners aim to raise awareness about the critical importance of radiation protection for healthcare professionals, who serve in environments where radiation exposure is an inherent occupational risk.

|

Medical Radiation Shielding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.48 Billion |

|

Forecast Period 2024-32 CAGR: |

6.70% |

Market Size in 2032: |

USD 2.65 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Solution |

|

||

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Radiation Shielding Market by Product Type

4.1 Medical Radiation Shielding Market Snapshot and Growth Engine

4.2 Medical Radiation Shielding Market Overview

4.3 Shields

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Shields: Geographic Segmentation Analysis

4.4 X-Ray Rooms

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 X-Ray Rooms: Geographic Segmentation Analysis

4.5 Lead Sheets

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Lead Sheets: Geographic Segmentation Analysis

4.6 Lead Bricks

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Lead Bricks: Geographic Segmentation Analysis

4.7 Lead Curtains

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Lead Curtains: Geographic Segmentation Analysis

4.8 Lead Glass

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Lead Glass: Geographic Segmentation Analysis

4.9 Lead-Lined Doors & Windows

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Lead-Lined Doors & Windows: Geographic Segmentation Analysis

4.10 Lead-Lined Drywalls

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Lead-Lined Drywalls: Geographic Segmentation Analysis

Chapter 5: Medical Radiation Shielding Market by Solution

5.1 Medical Radiation Shielding Market Snapshot and Growth Engine

5.2 Medical Radiation Shielding Market Overview

5.3 Radiation Therapy Shielding

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Radiation Therapy Shielding: Geographic Segmentation Analysis

5.4 Diagnostic Shielding

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Diagnostic Shielding: Geographic Segmentation Analysis

Chapter 6: Medical Radiation Shielding Market by Material

6.1 Medical Radiation Shielding Market Snapshot and Growth Engine

6.2 Medical Radiation Shielding Market Overview

6.3 Lead-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Lead-Based: Geographic Segmentation Analysis

6.4 Tungsten-Based

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Tungsten-Based: Geographic Segmentation Analysis

6.5 Other

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other: Geographic Segmentation Analysis

Chapter 7: Medical Radiation Shielding Market by End User

7.1 Medical Radiation Shielding Market Snapshot and Growth Engine

7.2 Medical Radiation Shielding Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Geographic Segmentation Analysis

7.4 Diagnostic Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Centers: Geographic Segmentation Analysis

7.5 Ambulatory Surgical Centers

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Ambulatory Surgical Centers: Geographic Segmentation Analysis

7.6 Cancer Treatment Centers

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Cancer Treatment Centers: Geographic Segmentation Analysis

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Radiation Shielding Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ETS-LINDGREN (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NELCO WORLDWIDE (USA)

8.4 RADIATION PROTECTION PRODUCTS INC. (USA)

8.5 RAY-BAR ENGINEERING CORPORATION (USA)

8.6 MARSHIELD (CANADA)

8.7 AMRAY RADIATION PROTECTION (IRELAND)

8.8 GAVEN INDUSTRIES INC. (USA)

8.9 A&L SHIELDING (USA)

8.10 OTHER ACTIVE PLAYERS

Chapter 9: Global Medical Radiation Shielding Market By Region

9.1 Overview

9.2. North America Medical Radiation Shielding Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Shields

9.2.4.2 X-Ray Rooms

9.2.4.3 Lead Sheets

9.2.4.4 Lead Bricks

9.2.4.5 Lead Curtains

9.2.4.6 Lead Glass

9.2.4.7 Lead-Lined Doors & Windows

9.2.4.8 Lead-Lined Drywalls

9.2.5 Historic and Forecasted Market Size By Solution

9.2.5.1 Radiation Therapy Shielding

9.2.5.2 Diagnostic Shielding

9.2.6 Historic and Forecasted Market Size By Material

9.2.6.1 Lead-Based

9.2.6.2 Tungsten-Based

9.2.6.3 Other

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Hospitals

9.2.7.2 Diagnostic Centers

9.2.7.3 Ambulatory Surgical Centers

9.2.7.4 Cancer Treatment Centers

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Radiation Shielding Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Shields

9.3.4.2 X-Ray Rooms

9.3.4.3 Lead Sheets

9.3.4.4 Lead Bricks

9.3.4.5 Lead Curtains

9.3.4.6 Lead Glass

9.3.4.7 Lead-Lined Doors & Windows

9.3.4.8 Lead-Lined Drywalls

9.3.5 Historic and Forecasted Market Size By Solution

9.3.5.1 Radiation Therapy Shielding

9.3.5.2 Diagnostic Shielding

9.3.6 Historic and Forecasted Market Size By Material

9.3.6.1 Lead-Based

9.3.6.2 Tungsten-Based

9.3.6.3 Other

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Hospitals

9.3.7.2 Diagnostic Centers

9.3.7.3 Ambulatory Surgical Centers

9.3.7.4 Cancer Treatment Centers

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Radiation Shielding Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Shields

9.4.4.2 X-Ray Rooms

9.4.4.3 Lead Sheets

9.4.4.4 Lead Bricks

9.4.4.5 Lead Curtains

9.4.4.6 Lead Glass

9.4.4.7 Lead-Lined Doors & Windows

9.4.4.8 Lead-Lined Drywalls

9.4.5 Historic and Forecasted Market Size By Solution

9.4.5.1 Radiation Therapy Shielding

9.4.5.2 Diagnostic Shielding

9.4.6 Historic and Forecasted Market Size By Material

9.4.6.1 Lead-Based

9.4.6.2 Tungsten-Based

9.4.6.3 Other

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Hospitals

9.4.7.2 Diagnostic Centers

9.4.7.3 Ambulatory Surgical Centers

9.4.7.4 Cancer Treatment Centers

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Radiation Shielding Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Shields

9.5.4.2 X-Ray Rooms

9.5.4.3 Lead Sheets

9.5.4.4 Lead Bricks

9.5.4.5 Lead Curtains

9.5.4.6 Lead Glass

9.5.4.7 Lead-Lined Doors & Windows

9.5.4.8 Lead-Lined Drywalls

9.5.5 Historic and Forecasted Market Size By Solution

9.5.5.1 Radiation Therapy Shielding

9.5.5.2 Diagnostic Shielding

9.5.6 Historic and Forecasted Market Size By Material

9.5.6.1 Lead-Based

9.5.6.2 Tungsten-Based

9.5.6.3 Other

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Hospitals

9.5.7.2 Diagnostic Centers

9.5.7.3 Ambulatory Surgical Centers

9.5.7.4 Cancer Treatment Centers

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Radiation Shielding Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Shields

9.6.4.2 X-Ray Rooms

9.6.4.3 Lead Sheets

9.6.4.4 Lead Bricks

9.6.4.5 Lead Curtains

9.6.4.6 Lead Glass

9.6.4.7 Lead-Lined Doors & Windows

9.6.4.8 Lead-Lined Drywalls

9.6.5 Historic and Forecasted Market Size By Solution

9.6.5.1 Radiation Therapy Shielding

9.6.5.2 Diagnostic Shielding

9.6.6 Historic and Forecasted Market Size By Material

9.6.6.1 Lead-Based

9.6.6.2 Tungsten-Based

9.6.6.3 Other

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Hospitals

9.6.7.2 Diagnostic Centers

9.6.7.3 Ambulatory Surgical Centers

9.6.7.4 Cancer Treatment Centers

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Radiation Shielding Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Shields

9.7.4.2 X-Ray Rooms

9.7.4.3 Lead Sheets

9.7.4.4 Lead Bricks

9.7.4.5 Lead Curtains

9.7.4.6 Lead Glass

9.7.4.7 Lead-Lined Doors & Windows

9.7.4.8 Lead-Lined Drywalls

9.7.5 Historic and Forecasted Market Size By Solution

9.7.5.1 Radiation Therapy Shielding

9.7.5.2 Diagnostic Shielding

9.7.6 Historic and Forecasted Market Size By Material

9.7.6.1 Lead-Based

9.7.6.2 Tungsten-Based

9.7.6.3 Other

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Hospitals

9.7.7.2 Diagnostic Centers

9.7.7.3 Ambulatory Surgical Centers

9.7.7.4 Cancer Treatment Centers

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Medical Radiation Shielding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.48 Billion |

|

Forecast Period 2024-32 CAGR: |

6.70% |

Market Size in 2032: |

USD 2.65 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Solution |

|

||

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||