Medical Nutrition Market Synopsis:

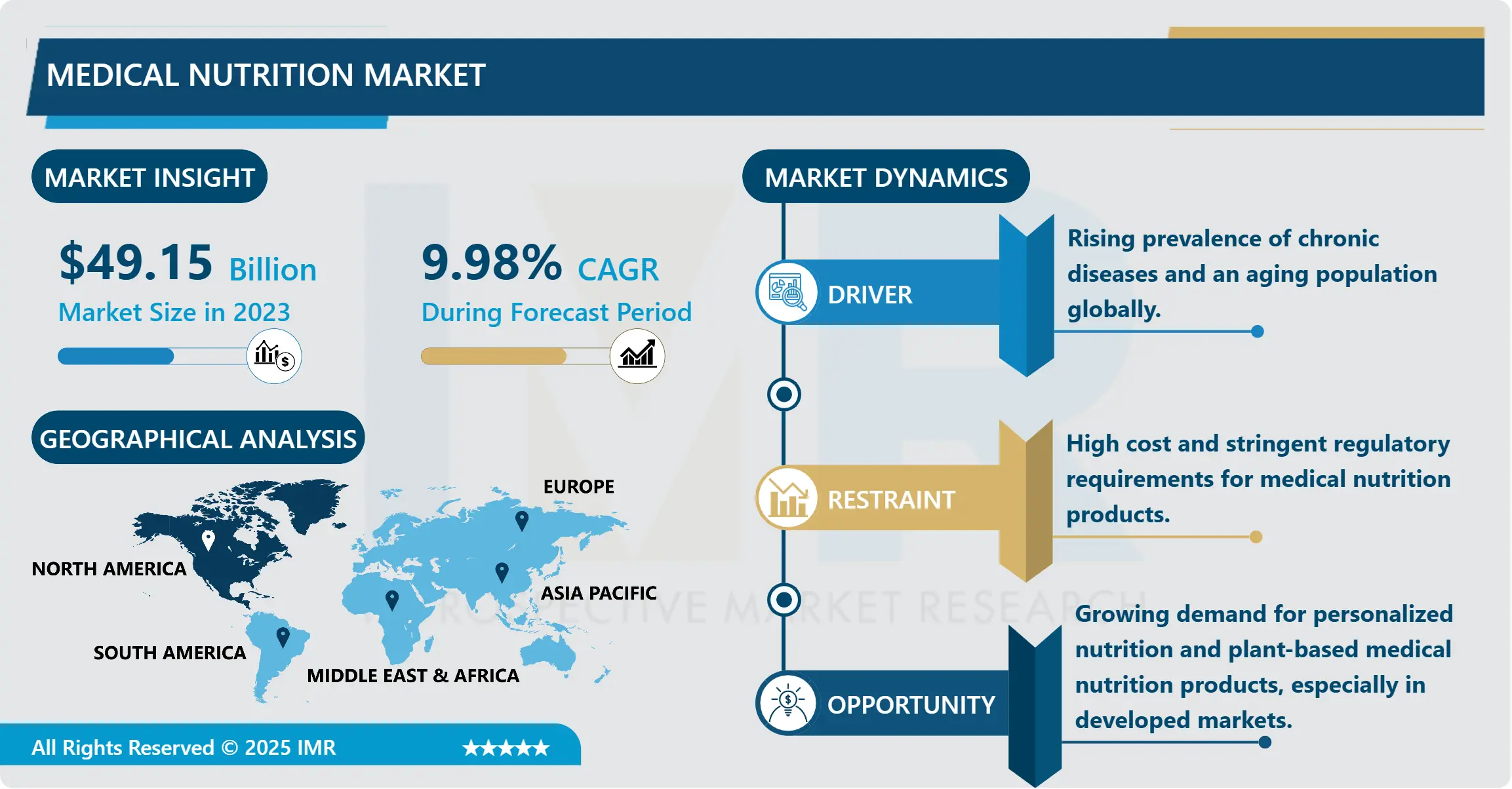

Medical Nutrition Market Size Was Valued at USD 49.15 Billion in 2023, and is Projected to Reach USD 106.84 Billion by 2032, Growing at a CAGR of 9.98% From 2024-2032.

Theraputic nutrition is a medical specialized concept which includes products and services that are intended to offer a nutritional medical needful for those who are suffering from health dilemma. This encompasses; nutritional products for diabetics, cancer, gastrointestinal diseases, undernourished and other chronic diseases individuals. These products are fed to patients who may have issues with normal food consumption and can help a patient to regain important nutrients which help in the recovery process and general wellbeing. The medical nutritions market includes supplements, adequately nourishing diets, enteral and parenteral feeding, and meal replacement products, that provides requirements of various categories of patients.

The total package of medical nutrition is on the right path to the growth trajectory with an upsurge in demand for diets relevant to specific diseases. Chronic diseases are indeed on the rise in the world owing to factors like increasing population life, era evils like unhealthily dietary habits and lack of exercise among others, resulting in increased demand for medical nutrients products. This segment of the market is significantly controlled with various rules and regulation to guarantee safety and effectiveness. However, innovation still prevails as companies keep on put up new products for individuals with specific health challenges. Hence, due to the shift of consumer interest in the consumption of healthy nutrient dense foods with ease, lots of companies are giving emphasis to research on products that are effective and yet more delicious.

The use of personalized nutrition constitutes another major driving force that is advancing the market demand for medical nutrition. Many of the healthcare providers and nutritionists are now advising people to take individual health plans by preparing medical nutrition based on the new health profile, which is boosting the demand for specialty medical nutrition products further. Thus, the medical nutrition therapy has been convenient to patients and healthcare professionals due to advances in new technologies in the field of digital health and diagnostic equipment. Further development of this market can also be forecasted as people become more and more aware of various health benefits of targeted nutrition solutions on the global level.

Medical Nutrition Market Trend Analysis:

Rise of Plant-Based Medical Nutrition Products

- One more activity that stands as a trend for the medical nutrition is the increased production of medical nutrition products of plant origin. People and physicians are shifting their attention to plant-based products because of their benefits for health but also for animal rights, as well as the preservation of the planet. As a rule, plant-based nutrition products contain less allergens than animal-based ones, and are more easily digestible and safe for the patients, especially for those who have certain underlying food sensitivities. These products are highly valued for their vitamin, mineral and antioxidant content and therefore, respond to the current more… conscious society trends of shifting to natural ingredients that enhance their health. The medical nutrition industry is in turn adapting through the creation of vegetable-based products for different diseases or conditions including lactose intolerance or milk allergy vegetable-based meal replacements.

- Additionally, while environmental trends and sustainability are increasingly popular, the medical application of plant-based nutrients is more environmentally friendly. It shows several different strategies, where new pigments such as soy, almonds and oats are used to reflect the tendency of ethical consumption. This plant-based trend remains popular in areas such as North America and Europe because consumers there are relatively conscious of their health and the environment. The new trends show that the number of people turning to plant-based diets rises steadily, thus opening new opportunities for the development of the medical nutrition market in this segment.

Pediatric Medical Nutrition

- The indicator of pediatric segment shows significant prospect as part of the Medical Nutrition business. As more people beginning to understand the impact that nutrition has throughout the early years in the growth for the physical and mental development of children, there is a great demand for medical nutrition products for children. These are designed for advantages among children, including malnutrition, allergies, and congenital metabolic disease. To overcome this challenge, key players are developing products that young patients nutritionally need and would reluctant to reject by carrying and adding nutritional values on to them.

Medical Nutrition Market Segment Analysis:

Medical Nutrition Market is Segmented on the basis of Type, Product, Route of Administration, Application, and Region.

By Type, Paediatric Nutrition segment is expected to dominate the market during the forecast period

- The Pediatric Nutrition segment is expected to lead the medical nutrition market throughout the forecast period attributed to rising consciousness of dietary intake among children. Children and adolescents’ nutrition products are aimed at children’s nutritional problems, such as undernutrition, growth failure, or chronic diseases. Higher birth rates in emergent countries, improved healthcare expenditure and government’s special attention towards child health is fuelling the demand. Moreover, research and development in formulation technologies has expanded the range of good tasting, and more effective, paediatric formulations, which enhances usage by parents and healthcare practitioners. Since global healthcare companies focus more on preventive measures and population overall health, the baby and child nutrition sector will experience growth going forward.

By Application, Cancer segment expected to held the largest share

- The Cancer segment is expected to dominate the medical nutrition market in terms of application because nutrient-restricted or modified diets play a significant role in cancer patient treatment and management. Chemotherapy, radiation, and surgery in cancer patients affect nutrient intake, metabolism, and weight by inducing nutritional loss, cachexia, anorexia, taste alterations, and sip, so patients suffering from cancer require special nutrition support. Enhanced medical/nutrition products for cancer patients supply necessary nutrients; reduce inflammation; boost immune strength; and build physical endurance to optimize treatment tolerance and patient results. With increased cancer incidence around the world, healthcare workers have begun to embrace medical nutrition as part of the cancer management. Higher demand of specialized products for nutrition and dietary needs to enhance the overall quality of life and recovery rate of patients also strengthens the position of the cancer segment in this market.

Medical Nutrition Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Specifically, for the year 2023, North America has emerged as the largest market for Medical Nutrition due to high health care consumption, improvement in health infrastructure and finest awareness in among the consumers and doctors. This area has been estimated to represent about 35% of the total global market. Among them, the United States has a highly developed share due to many people over sixty years of age, frequent chronic diseases, and insurance that limits medical nutrition products. The North American market also has leading industry participants, improved research into personalized nutrition, and widespread product implementation.

Active Key Players in the Medical Nutrition Market

- Abbott Laboratories (United States)

- Ajinomoto Co., Inc. (Japan)

- B. Braun Melsungen AG (Germany)

- Baxter International Inc. (United States)

- Danone S.A. (France)

- Fresenius Kabi AG (Germany)

- GlaxoSmithKline plc (United Kingdom)

- Hero Nutritionals, Inc. (United States)

- Lonza Group AG (Switzerland)

- Mead Johnson & Company, LLC (United States)

- Medifast, Inc. (United States)

- Nestlé Health Science (Switzerland)

- Nestle S.A. (Switzerland)

- Perrigo Company plc (Ireland)

- Other Active Players

Key Industry Developments in the Medical Nutrition Market:

- June 2022, ObvioHealth, the leading virtual research organization (VRO) in the world, with extensive expertise in biotechnology, clinical, pharmaceutical, and healthcare6. It is developing innovative end-to-end remote clinical trial solutions. declared the formation of an advisory board composed of important business leaders.

- May 2022, Culina Health was founded by registered dietitians Steven Kuyan and Vanessa Rissetto. After 18 months of bootstrapping growth in the practice of 20 physicians, the company has already conducted over 18,000 sessions and has earned $4.75 million in early investment.

|

Medical Nutrition Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 49.15 Billion |

|

Forecast Period 2024-32 CAGR: |

9.98 % |

Market Size in 2032: |

USD 106.84 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Product |

|

||

|

By Route Of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Nutrition Market by Type

4.1 Medical Nutrition Market Snapshot and Growth Engine

4.2 Medical Nutrition Market Overview

4.3 Paediatric Nutrition

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Paediatric Nutrition: Geographic Segmentation Analysis

4.4 Elderly Nutrition

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Elderly Nutrition: Geographic Segmentation Analysis

4.5 Parenteral Nutrition

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Parenteral Nutrition: Geographic Segmentation Analysis

4.6 and Sports Nutrition

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Sports Nutrition: Geographic Segmentation Analysis

Chapter 5: Medical Nutrition Market by Product

5.1 Medical Nutrition Market Snapshot and Growth Engine

5.2 Medical Nutrition Market Overview

5.3 Amino Acid Solutions

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Amino Acid Solutions: Geographic Segmentation Analysis

5.4 Multivitamin Supplements

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Multivitamin Supplements: Geographic Segmentation Analysis

5.5 Antioxidants

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Antioxidants: Geographic Segmentation Analysis

5.6 Lipid Emulsions

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Lipid Emulsions: Geographic Segmentation Analysis

5.7 Trace Elements

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Trace Elements: Geographic Segmentation Analysis

5.8 and Chamber Beads

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 and Chamber Beads: Geographic Segmentation Analysis

Chapter 6: Medical Nutrition Market by Route of Administration

6.1 Medical Nutrition Market Snapshot and Growth Engine

6.2 Medical Nutrition Market Overview

6.3 Oral

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oral: Geographic Segmentation Analysis

6.4 Parenteral

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Parenteral: Geographic Segmentation Analysis

6.5 and Intravenous

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Intravenous: Geographic Segmentation Analysis

Chapter 7: Medical Nutrition Market by Application

7.1 Medical Nutrition Market Snapshot and Growth Engine

7.2 Medical Nutrition Market Overview

7.3 Pulmonary Diseases

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Pulmonary Diseases: Geographic Segmentation Analysis

7.4 Cancer

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Cancer: Geographic Segmentation Analysis

7.5 Gastrointestinal Diseases

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Gastrointestinal Diseases: Geographic Segmentation Analysis

7.6 Obesity

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Obesity: Geographic Segmentation Analysis

7.7 Diabetes

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Diabetes: Geographic Segmentation Analysis

7.8 Paediatric Malnutrition

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Paediatric Malnutrition: Geographic Segmentation Analysis

7.9 Renal Failure

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Renal Failure: Geographic Segmentation Analysis

7.10 and Neurological Diseases

7.10.1 Introduction and Market Overview

7.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.10.3 Key Market Trends, Growth Factors and Opportunities

7.10.4 and Neurological Diseases: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Nutrition Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ABBOTT LABORATORIES (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NESTLÉ HEALTH SCIENCE (SWITZERLAND)

8.4 DANONE S.A. (FRANCE)

8.5 FRESENIUS KABI AG (GERMANY)

8.6 MEAD JOHNSON & COMPANY (UNITED STATES)

8.7 OTHER ACTIVE PLAYERS

Chapter 9: Global Medical Nutrition Market By Region

9.1 Overview

9.2. North America Medical Nutrition Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Paediatric Nutrition

9.2.4.2 Elderly Nutrition

9.2.4.3 Parenteral Nutrition

9.2.4.4 and Sports Nutrition

9.2.5 Historic and Forecasted Market Size By Product

9.2.5.1 Amino Acid Solutions

9.2.5.2 Multivitamin Supplements

9.2.5.3 Antioxidants

9.2.5.4 Lipid Emulsions

9.2.5.5 Trace Elements

9.2.5.6 and Chamber Beads

9.2.6 Historic and Forecasted Market Size By Route of Administration

9.2.6.1 Oral

9.2.6.2 Parenteral

9.2.6.3 and Intravenous

9.2.7 Historic and Forecasted Market Size By Application

9.2.7.1 Pulmonary Diseases

9.2.7.2 Cancer

9.2.7.3 Gastrointestinal Diseases

9.2.7.4 Obesity

9.2.7.5 Diabetes

9.2.7.6 Paediatric Malnutrition

9.2.7.7 Renal Failure

9.2.7.8 and Neurological Diseases

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Nutrition Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Paediatric Nutrition

9.3.4.2 Elderly Nutrition

9.3.4.3 Parenteral Nutrition

9.3.4.4 and Sports Nutrition

9.3.5 Historic and Forecasted Market Size By Product

9.3.5.1 Amino Acid Solutions

9.3.5.2 Multivitamin Supplements

9.3.5.3 Antioxidants

9.3.5.4 Lipid Emulsions

9.3.5.5 Trace Elements

9.3.5.6 and Chamber Beads

9.3.6 Historic and Forecasted Market Size By Route of Administration

9.3.6.1 Oral

9.3.6.2 Parenteral

9.3.6.3 and Intravenous

9.3.7 Historic and Forecasted Market Size By Application

9.3.7.1 Pulmonary Diseases

9.3.7.2 Cancer

9.3.7.3 Gastrointestinal Diseases

9.3.7.4 Obesity

9.3.7.5 Diabetes

9.3.7.6 Paediatric Malnutrition

9.3.7.7 Renal Failure

9.3.7.8 and Neurological Diseases

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Nutrition Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Paediatric Nutrition

9.4.4.2 Elderly Nutrition

9.4.4.3 Parenteral Nutrition

9.4.4.4 and Sports Nutrition

9.4.5 Historic and Forecasted Market Size By Product

9.4.5.1 Amino Acid Solutions

9.4.5.2 Multivitamin Supplements

9.4.5.3 Antioxidants

9.4.5.4 Lipid Emulsions

9.4.5.5 Trace Elements

9.4.5.6 and Chamber Beads

9.4.6 Historic and Forecasted Market Size By Route of Administration

9.4.6.1 Oral

9.4.6.2 Parenteral

9.4.6.3 and Intravenous

9.4.7 Historic and Forecasted Market Size By Application

9.4.7.1 Pulmonary Diseases

9.4.7.2 Cancer

9.4.7.3 Gastrointestinal Diseases

9.4.7.4 Obesity

9.4.7.5 Diabetes

9.4.7.6 Paediatric Malnutrition

9.4.7.7 Renal Failure

9.4.7.8 and Neurological Diseases

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Nutrition Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Paediatric Nutrition

9.5.4.2 Elderly Nutrition

9.5.4.3 Parenteral Nutrition

9.5.4.4 and Sports Nutrition

9.5.5 Historic and Forecasted Market Size By Product

9.5.5.1 Amino Acid Solutions

9.5.5.2 Multivitamin Supplements

9.5.5.3 Antioxidants

9.5.5.4 Lipid Emulsions

9.5.5.5 Trace Elements

9.5.5.6 and Chamber Beads

9.5.6 Historic and Forecasted Market Size By Route of Administration

9.5.6.1 Oral

9.5.6.2 Parenteral

9.5.6.3 and Intravenous

9.5.7 Historic and Forecasted Market Size By Application

9.5.7.1 Pulmonary Diseases

9.5.7.2 Cancer

9.5.7.3 Gastrointestinal Diseases

9.5.7.4 Obesity

9.5.7.5 Diabetes

9.5.7.6 Paediatric Malnutrition

9.5.7.7 Renal Failure

9.5.7.8 and Neurological Diseases

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Nutrition Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Paediatric Nutrition

9.6.4.2 Elderly Nutrition

9.6.4.3 Parenteral Nutrition

9.6.4.4 and Sports Nutrition

9.6.5 Historic and Forecasted Market Size By Product

9.6.5.1 Amino Acid Solutions

9.6.5.2 Multivitamin Supplements

9.6.5.3 Antioxidants

9.6.5.4 Lipid Emulsions

9.6.5.5 Trace Elements

9.6.5.6 and Chamber Beads

9.6.6 Historic and Forecasted Market Size By Route of Administration

9.6.6.1 Oral

9.6.6.2 Parenteral

9.6.6.3 and Intravenous

9.6.7 Historic and Forecasted Market Size By Application

9.6.7.1 Pulmonary Diseases

9.6.7.2 Cancer

9.6.7.3 Gastrointestinal Diseases

9.6.7.4 Obesity

9.6.7.5 Diabetes

9.6.7.6 Paediatric Malnutrition

9.6.7.7 Renal Failure

9.6.7.8 and Neurological Diseases

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Nutrition Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Paediatric Nutrition

9.7.4.2 Elderly Nutrition

9.7.4.3 Parenteral Nutrition

9.7.4.4 and Sports Nutrition

9.7.5 Historic and Forecasted Market Size By Product

9.7.5.1 Amino Acid Solutions

9.7.5.2 Multivitamin Supplements

9.7.5.3 Antioxidants

9.7.5.4 Lipid Emulsions

9.7.5.5 Trace Elements

9.7.5.6 and Chamber Beads

9.7.6 Historic and Forecasted Market Size By Route of Administration

9.7.6.1 Oral

9.7.6.2 Parenteral

9.7.6.3 and Intravenous

9.7.7 Historic and Forecasted Market Size By Application

9.7.7.1 Pulmonary Diseases

9.7.7.2 Cancer

9.7.7.3 Gastrointestinal Diseases

9.7.7.4 Obesity

9.7.7.5 Diabetes

9.7.7.6 Paediatric Malnutrition

9.7.7.7 Renal Failure

9.7.7.8 and Neurological Diseases

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Medical Nutrition Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 49.15 Billion |

|

Forecast Period 2024-32 CAGR: |

9.98 % |

Market Size in 2032: |

USD 106.84 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Product |

|

||

|

By Route Of Administration |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||