Medical Exoskeleton Market Synopsis:

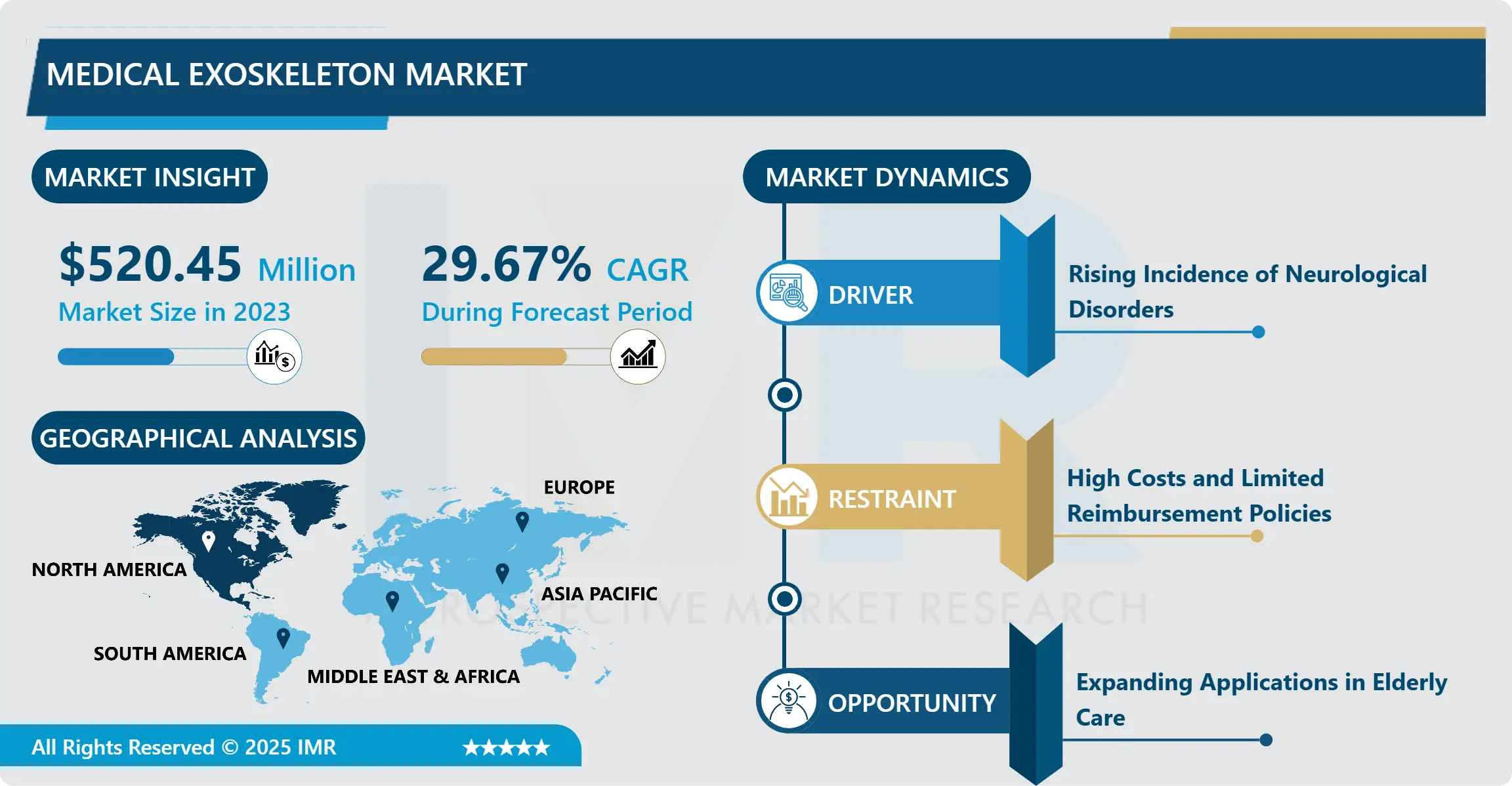

Medical Exoskeleton Market Size Was Valued at USD 520.45 Million in 2023, and is Projected to Reach USD 5,394.29 Million by 2032, Growing at a CAGR of 29.67% From 2024-2032.

Medical exoskeleton can be defined as an external wearable mechanism aimed to enhance or replace deficiencies of locomotion in persons who experience motility disorders because of traumas or neurological affections. These exoskeletons offer structure and help patients walk or move about for treatment of spinal cord injuries, stroke, or other disorders that affect motor mobility or function. Market includes both powered and passive exoskeletons intended for healthcare, rehabilitation, and elderly care.

The medical exoskeleton market is still a rapidly growing industry due to the growth in robotic technology, materials science, and rehabilitation medicine. They are mobility aides, secondary injury prevention, and assist in the rehabilitation of patients with severe mobility related issues. The growth of the medical exoskeleton market is spurred by the elderly population, the rising prevalence of disability, strokes, and spinal cord injury.

Advancements in technology have gone further to add capabilities to the medical exoskeleton from simple aid to rehabilitation equipment that can feed back information to the doctors. These devices are now applied in, clinical practice for gait tracking as well as muscle power training and in home applications for ambulation and other activities. The market has such a high interest from government in various countries, research institutes, and private companies so more enhanced and cheaper devices are being developed.

Although medical exoskeletons appear to be highly effective, there are limitations such as the approval process, cost implication of the exoskeleton as well as the process of assimilation of the exoskeletons into the society. They want to increase the battery life span, make devices lighter and easier to use, thus striving for better patient benefits. Another trend happening is as the market expansion proceeds, more focus is given to the need to lower the exoskeleton price and ensure that insurance companies start covering the costs of their usage.

Medical Exoskeleton Market Trend Analysis:

Technological Advancements in Powered Exoskeletons

-

Among the factors that can be seen in the medical exoskeleton Business, one of them is the shift towards the powering of medical exoskeletons. These devices are fitted with motors , sensors and AI controls to help those patients with severe mobility impairment including spinal cord injuries or strokes have some motor abilities. Climb assist exoskeletons are gradually adopted in rehabilitation centers as helping patients to regain their motor coordination and promote natural-like gait patterns.

- The application of AI an machine learning into powered exoskeleton is enhancing the personalisation of the exoskeletons to suit the patient’s need. They are able of modifying themselves with the movements of a user, its energy consumption and on the efficiency of the rehabilitation process. This trend is innovative and captured the healthcare professionals’ attention as it promises the improvement of patients’ healing processes’ duration.

Expanding Applications in Elderly Care

-

A primary trend in the medical exoskeleton market is the increasing need for such devices in elder care. With people ageing across the world, there are more and more cases when people suffer from mobility-related issues that affect the quality of life. Medical exoskeletons can overcome this problem if the elderly people get rehabs that enable them to move around with ease, thereby avoiding dependence on caregivers as well as increasing their independence.

- In addition, there is the in-home medical exoskeleton which are steadily becoming popular among the elderly who need to be helped to walk or stand, but would like to remain in their homes. This opportunity is assumed to grow significantly as more and more seniors remain within their homes, with home care technologies gaining more attention.

Medical Exoskeleton Market Segment Analysis:

Medical Exoskeleton Market Segmented on the basis of Product Type, Mobility, Application, Component, and Region

By Product Type, Powered Exoskeleton segment is expected to dominate the market during the forecast period

-

Depending on the functionality, the medical exoskeleton market can be divided into the ones with power and the ones without power. Operated exoskeletons feature motor driven and sensory driven systems which propel the wearer and therefore are most suitable to be used by quadraperlegic or paralysed people among other mechanic implant patients for instance those with spinal cord injury. Such devices are employed mainly in rehabilitation facilities, clinical establishments, and for home physiotherapy; the usage also grows because the device affords more precise and controlled movement.

- In contrast, passive exoskeletons do not contain motors and conform to the requirements of assistive devices. However, they depend solely on the physical power of the user and the biomechanical properties of the system that provides support and improves movement. Although passive exoskeletons are cheaper and easier to operate, they are not as useful for patients with high levels of dysfunction. However, they are useful for someone with slight mobility problems and they are frequently used in occupational therapy to prevent stress.

By Application, Spinal Cord Injury segment expected to held the largest share

-

Merely in the application, some of the common uses of Medical Exoskeleton include treatment of patients who have been paralyzed by their spinal cords or stroke, which are the leading causes of long term immobility. These devices are useful to spinal cord injury patients as long as it allows them to stand and walk as a way to strengthen their muscles, promote blood flow, and boost wellness. There is a particular application of exoskeletons in rehabilitation centres where such systems are included into multifaceted therapy regimens.

- Another important market with big demand in exoskeleton for patients who have stroke disorders. These devices assist in physical motor rehabilitations to give the patients a chance of independent movement through having balance and mobility. In addition to spinal cord injury patients and stroke survivors, exoskeletons are also applied to other musculoskeletal and neurological disorders which affect mobility such as multiple sclerosis and muscular dystrophy.

Medical Exoskeleton Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America continues to hold the largest share in the medical exoskeleton market due to better healthcare structure, higher investment in research, and development and presence of key medical exoskeleton market players. The American market is particularly promising for exoskeleton manufacturing, including for rehabilitation and care of seniors, backed by legislation and positive reimbursement laws.

- Furthermore, the regions dedication to technological advancement has resulted in high tech exoskeletons, fitted with features like Artificial Intelligence as well as better designed controls. These advantages when coupled with a continually growing elderly population and a higher prevalence of neurological disorders make North America the largest market for medical exoskeletons.

Active Key Players in the Medical Exoskeleton Market:

-

Ekso Bionics (USA)

- ReWalk Robotics (Israel)

- CYBERDYNE Inc. (Japan)

- Bionik Laboratories Corp (Canada)

- Ottobock SE & Co. KGaA (Germany)

- Hocoma AG (Switzerland)

- Parker Hannifin Corporation (USA)

- Lockheed Martin Corporation (USA)

- ExoAtlet (Russia)

- Wandercraft (France)

- Wearable Robotics srl (Italy)

- Rex Bionics Ltd (UK)

- Other Active Players

Key Industry Developments in the Medical Exoskeleton Market:

-

In February 2024, the Italian Institute of Technology (IIT) and the Prosthetic Center of National Institute for Insurance against Accidents at Work (INAIL) unveiled a robotic exoskeleton, known as TWAIN, to allow individuals with reduced or even absent motor abilities in the lower limbs, to maintain an upright position, walk with the assistance of crutches or walkers, and to stand up and sit down.

- In January 2024, engineers from the University of Colorado Boulder, US, and the Korea Advanced Institute of Science and Technology (KAIST) introduced SNAP, a stretchable microneedle adhesive patch about the size of a band-aid, designed to adhere to the skin and capture electromyography (EMG) signals from human muscles, potentially enhancing the efficiency of operating robotic exoskeletons.

- In January 2024, several medical exoskeleton companies participated in the Consumer Electronics Show (CES), one of the largest tech conferences in the world, and exhibited products ranging from AI-powered assistants to wearable robots.

- Starting in January 2024, ReWalk Personal Exoskeleton platform by ReWalk Robotics is being classified within the Medicare brace benefit category.

- In November 2023, ReWalk Robotics announced the successful demonstration of proof-of-concept with its next-generation prototype exoskeleton, which incorporates sensing technologies and AI to enable autonomous decision-making.

|

Medical Exoskeleton Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 520.45 Million |

|

Forecast Period 2024-32 CAGR: |

29.67% |

Market Size in 2032: |

USD 5,394.29 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Mobility |

|

||

|

By Application |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Exoskeleton Market by Product Type

4.1 Medical Exoskeleton Market Snapshot and Growth Engine

4.2 Medical Exoskeleton Market Overview

4.3 Powered Exoskeleton

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Powered Exoskeleton: Geographic Segmentation Analysis

4.4 Passive Exoskeleton

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Passive Exoskeleton: Geographic Segmentation Analysis

Chapter 5: Medical Exoskeleton Market by Mobility

5.1 Medical Exoskeleton Market Snapshot and Growth Engine

5.2 Medical Exoskeleton Market Overview

5.3 Stationary

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Stationary: Geographic Segmentation Analysis

5.4 Mobile

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Mobile: Geographic Segmentation Analysis

Chapter 6: Medical Exoskeleton Market by Application

6.1 Medical Exoskeleton Market Snapshot and Growth Engine

6.2 Medical Exoskeleton Market Overview

6.3 Spinal Cord Injury

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Spinal Cord Injury: Geographic Segmentation Analysis

6.4 Stroke

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Stroke: Geographic Segmentation Analysis

6.5 Other

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Other: Geographic Segmentation Analysis

Chapter 7: Medical Exoskeleton Market by Component

7.1 Medical Exoskeleton Market Snapshot and Growth Engine

7.2 Medical Exoskeleton Market Overview

7.3 Hardware

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hardware: Geographic Segmentation Analysis

7.4 Software

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Software: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Exoskeleton Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 EKSO BIONICS (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 REWALK ROBOTICS (ISRAEL)

8.4 CYBERDYNE INC. (JAPAN)

8.5 BIONIK LABORATORIES CORP (CANADA)

8.6 OTTOBOCK SE & CO. KGAA (GERMANY)

8.7 HOCOMA AG (SWITZERLAND)

8.8 PARKER HANNIFIN CORPORATION (USA)

8.9 LOCKHEED MARTIN CORPORATION (USA)

8.10 EXOATLET (RUSSIA)

8.11

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Medical Exoskeleton Market By Region

9.1 Overview

9.2. North America Medical Exoskeleton Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product Type

9.2.4.1 Powered Exoskeleton

9.2.4.2 Passive Exoskeleton

9.2.5 Historic and Forecasted Market Size By Mobility

9.2.5.1 Stationary

9.2.5.2 Mobile

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Spinal Cord Injury

9.2.6.2 Stroke

9.2.6.3 Other

9.2.7 Historic and Forecasted Market Size By Component

9.2.7.1 Hardware

9.2.7.2 Software

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Exoskeleton Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product Type

9.3.4.1 Powered Exoskeleton

9.3.4.2 Passive Exoskeleton

9.3.5 Historic and Forecasted Market Size By Mobility

9.3.5.1 Stationary

9.3.5.2 Mobile

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Spinal Cord Injury

9.3.6.2 Stroke

9.3.6.3 Other

9.3.7 Historic and Forecasted Market Size By Component

9.3.7.1 Hardware

9.3.7.2 Software

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Exoskeleton Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product Type

9.4.4.1 Powered Exoskeleton

9.4.4.2 Passive Exoskeleton

9.4.5 Historic and Forecasted Market Size By Mobility

9.4.5.1 Stationary

9.4.5.2 Mobile

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Spinal Cord Injury

9.4.6.2 Stroke

9.4.6.3 Other

9.4.7 Historic and Forecasted Market Size By Component

9.4.7.1 Hardware

9.4.7.2 Software

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Exoskeleton Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product Type

9.5.4.1 Powered Exoskeleton

9.5.4.2 Passive Exoskeleton

9.5.5 Historic and Forecasted Market Size By Mobility

9.5.5.1 Stationary

9.5.5.2 Mobile

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Spinal Cord Injury

9.5.6.2 Stroke

9.5.6.3 Other

9.5.7 Historic and Forecasted Market Size By Component

9.5.7.1 Hardware

9.5.7.2 Software

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Exoskeleton Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product Type

9.6.4.1 Powered Exoskeleton

9.6.4.2 Passive Exoskeleton

9.6.5 Historic and Forecasted Market Size By Mobility

9.6.5.1 Stationary

9.6.5.2 Mobile

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Spinal Cord Injury

9.6.6.2 Stroke

9.6.6.3 Other

9.6.7 Historic and Forecasted Market Size By Component

9.6.7.1 Hardware

9.6.7.2 Software

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Exoskeleton Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product Type

9.7.4.1 Powered Exoskeleton

9.7.4.2 Passive Exoskeleton

9.7.5 Historic and Forecasted Market Size By Mobility

9.7.5.1 Stationary

9.7.5.2 Mobile

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Spinal Cord Injury

9.7.6.2 Stroke

9.7.6.3 Other

9.7.7 Historic and Forecasted Market Size By Component

9.7.7.1 Hardware

9.7.7.2 Software

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Medical Exoskeleton Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 520.45 Million |

|

Forecast Period 2024-32 CAGR: |

29.67% |

Market Size in 2032: |

USD 5,394.29 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Mobility |

|

||

|

By Application |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||