Key Market Highlights

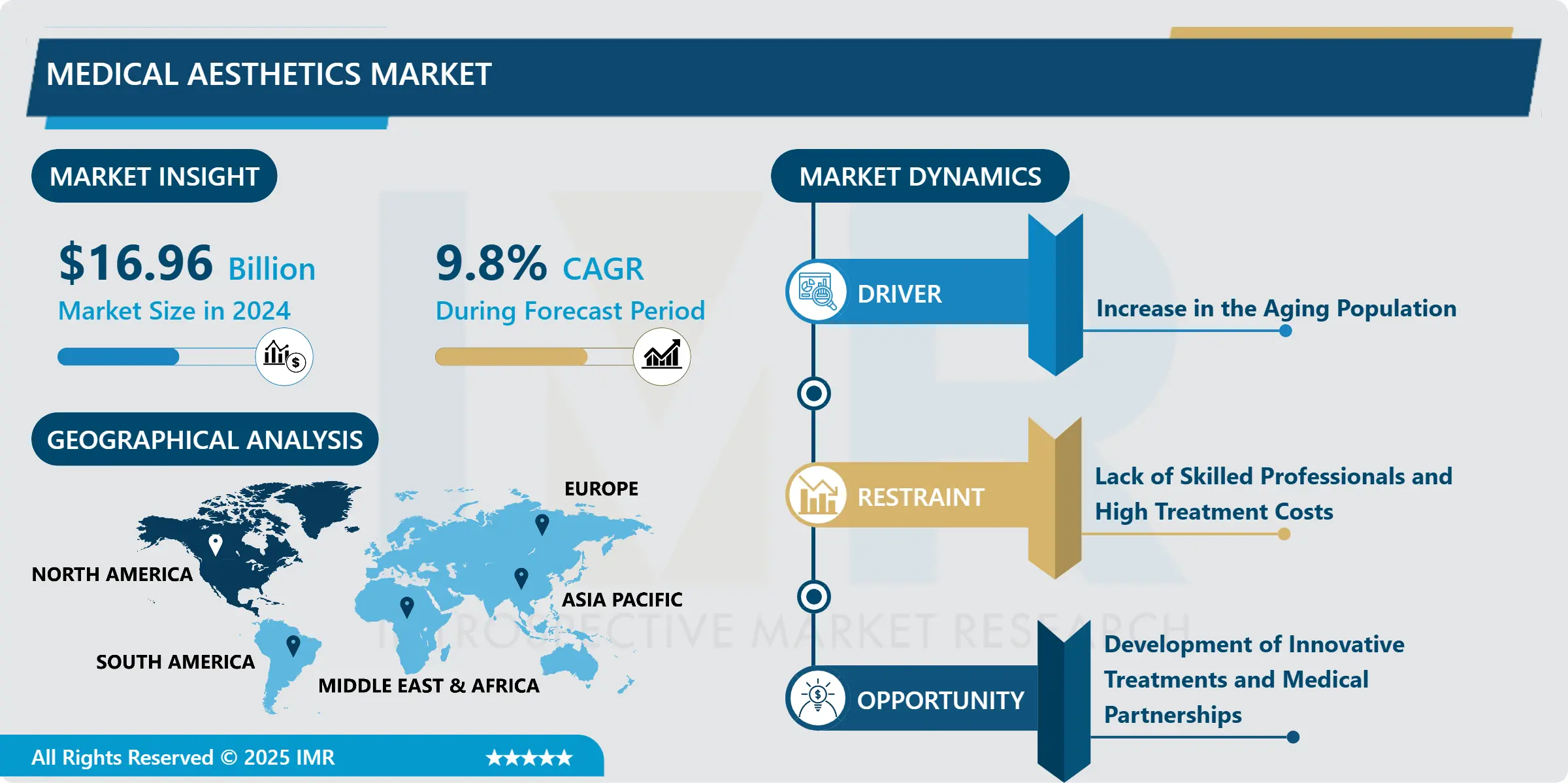

Medical Aesthetics Market Size Was Valued at USD 16.96 Billion in 2024, and is Projected to Reach USD 47.43 Billion by 2035, Growing at a CAGR of 9.8% from 2025-2035.

- Market Size in 2024: USD 16.96 Billion

- Projected Market Size by 2035: USD 47.43 Billion

- CAGR (2025–2035): 9.8%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Application: The Skin resurfacing and tightening segment is anticipated to lead the market by accounting for 27.35% of the market share throughout the forecast period.

- By Procedure: The Non-Surgical segment is expected to capture 60.70% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.20% of the market share during the forecast period.

- Active Players: AbbVie Inc. (United States), Alma Lasers (United States), Bausch Health Companies Inc. (Canada), BTL Aesthetics (Czech Republic), Candela Medical (United States), and Other Active Players.

Medical Aesthetics Market Synopsis:

Medical aesthetic devices refer to specialized medical technologies used to enhance physical appearance through non-surgical and minimally invasive procedures. These devices address concerns such as aging signs, skin rejuvenation, body contouring, hair removal, and pigmentation disorders. In recent years, the market has expanded rapidly due to growing awareness of aesthetic treatments, social media influence, celebrity endorsements, and technological advancements such as lasers, radiofrequency, and injectables. The COVID-19 pandemic further accelerated demand as consumers increasingly opted for aesthetic procedures. While women represent the majority of users, adoption among men is rising steadily. Despite strong growth prospects, high treatment costs, regulatory challenges, and potential side effects remain key market constraints globally.

Medical Aesthetics Market Dynamics and Trend Analysis:

Medical Aesthetics Market Growth Driver - Increase in the Aging Population

-

The rising global aging population is a key driver of the aesthetic services market, as older adults increasingly seek treatments to maintain a youthful appearance and improve quality of life. Age-related concerns such as wrinkles, skin laxity, volume loss, and reduced elasticity are fueling demand for non-invasive and minimally invasive procedures, including botulinum toxin, dermal fillers, skin rejuvenation, and body contouring. Higher disposable incomes among middle-aged and elderly populations further support spending on aesthetic enhancements. Additionally, technological advancements have improved the safety, effectiveness, and accessibility of procedures, encouraging wider adoption. Coupled with increasing obesity rates and prolonged economic activity among aging demographics, these factors collectively drive sustained growth in the aesthetic services market.

Medical Aesthetics Market Limiting Factor - Lack of Skilled Professionals and High Treatment Costs

-

The medical aesthetics market faces significant restraint due to a shortage of trained and certified professionals and the high cost of devices and procedures. Aesthetic treatments require specialized expertise, and the limited availability of qualified practitioners raises concerns around patient safety, service quality, and treatment outcomes. This skills gap restricts service availability and slows market expansion. Additionally, the high capital cost of advanced aesthetic devices and expensive procedures such as breast augmentation, abdominoplasty, and facelifts limit affordability for a large consumer base. The absence of reimbursement coverage and the recurring nature of non-surgical treatments further reduce cost-effectiveness. Combined with potential treatment risks, these factors collectively hinder widespread adoption and market growth.

Medical Aesthetics Market Expansion Opportunity - Development of Innovative Treatments and Medical Partnerships

-

The development of innovative, minimally invasive aesthetic treatments presents a significant growth opportunity for the medical aesthetics market. Advances such as stem cell–based therapies, regenerative dermatology, advanced laser systems, non-surgical facelifts, and energy-based body contouring technologies are transforming treatment outcomes by improving safety, effectiveness, and recovery time. These innovations appeal to consumers seeking long-lasting results with minimal downtime. Additionally, strategic partnerships between aesthetic clinics and qualified medical professionals enhance service credibility and accelerate the adoption of advanced technologies. Collaborations with hospitals and healthcare networks enable the introduction of cutting-edge procedures and expand patient access. Together, technological innovation and medical partnerships position the market for sustained expansion by meeting evolving consumer expectations and strengthening trust in aesthetic solutions.

Medical Aesthetics Market Challenge and Risk - Stringent Regulatory Requirements and Procedure-Related Risks

-

The medical aesthetics market faces notable challenges due to increasingly stringent regulatory and safety compliance requirements and the risk of procedure-related side effects. Regulatory bodies such as the FDA and European authorities are tightening quality, documentation, and post-market surveillance standards, increasing approval timelines and compliance costs, particularly for smaller players. While these measures enhance patient safety, they can delay innovation and market entry. Additionally, concerns over adverse effects including infections, vascular complications, asymmetry, and allergic reactions continue to influence consumer perceptions. Heightened media coverage of unsafe practices, counterfeit products, and unlicensed providers further amplifies public scrutiny. Together, regulatory complexity and safety-related concerns pose risks to market growth by increasing operational burdens and limiting patient confidence.

Medical Aesthetics Market Trend - Changing Beauty Standards and Social Media Influence

-

Evolving beauty ideals and the widespread influence of social media have emerged as a key trend shaping the medical aesthetics market. Platforms such as Instagram, TikTok, and YouTube promote aspirational beauty standards through curated content shared by influencers and celebrities, increasing awareness and social acceptance of aesthetic treatments. This digital exposure has normalized procedures such as facial rejuvenation, acne treatment, and body contouring across broader age groups. Simultaneously, rising prevalence of dermatological conditions is driving demand for both in-clinic and home-based aesthetic solutions. Manufacturers are responding by introducing advanced at-home devices using LED and radiofrequency technologies, offering convenience and affordability. Together, social media-driven beauty perceptions and growing adoption of home-use aesthetic technologies are accelerating market expansion and product innovation.

Medical Aesthetics Market Segment Analysis:

Medical Aesthetics Market is segmented based The Medical Aesthetics Market is segmented into Product, Technology, Procedure, Application, End-User, and Region.

By Application, Skin resurfacing and tightening segment is expected to dominate the market with around 27.35% share during the forecast period.

-

In 2024, skin resurfacing and tightening dominated the medical aesthetics market by application, driven by rising demand for treatments addressing acne scars, wrinkles, fine lines, and skin laxity. A large patient base seeking non-invasive facial rejuvenation procedures, combined with growing awareness of advanced skin therapies, supported this segment’s leadership. Technological advancements and regulatory approvals for innovative resurfacing devices further strengthened adoption, offering benefits such as minimal downtime, natural-looking results, and quick procedures. Facial aesthetic applications continued to serve as entry-level treatments, encouraging repeat visits and long-term maintenance therapies. While body contouring showed strong growth momentum, skin resurfacing and tightening remained dominant in 2024 due to its broad applicability, high procedure volumes, and sustained consumer preference for facial rejuvenation solutions.

By Procedure, non-surgical procedures is expected to dominate with close to 60.70% market share during the forecast period.

-

In 2024, non-surgical procedures dominated the medical aesthetics market, accounting for the majority of revenue due to their minimal downtime, lower risk, and broad patient eligibility. Treatments such as botulinum toxin injections, dermal fillers, chemical peels, and non-invasive hair removal remained highly preferred, particularly among younger populations seeking preventive and maintenance-based aesthetic solutions. The dominance of non-energy-based devices was supported by high procedure volumes, ease of adoption across hospitals and dermatology clinics, and continuous product approvals addressing growing consumer demand. These procedures offer immediate results, affordability compared to surgical options, and do not require operating-room infrastructure. While surgical techniques showed signs of recovery, non-surgical approaches remained dominant in 2024 owing to their accessibility, repeat treatment cycles, and strong consumer acceptance globally.

Medical Aesthetics Market Regional Insights:

North America region is estimated to lead the market with around 31.20% share during the forecast period.

-

North America accounted for the largest share of the aesthetic medicine market in 2024, driven by strong demand for age-related aesthetic treatments and a well-developed healthcare infrastructure. A rapidly aging population has increased the uptake of non-invasive and minimally invasive procedures such as botulinum toxin injections, dermal fillers, and skin rejuvenation therapies, which offer effective results with minimal downtime. High disposable incomes, growing societal focus on appearance, and widespread awareness of aesthetic solutions further support market growth. The region also benefits from a dense concentration of board-certified and highly skilled practitioners, particularly in the U.S., where over 7,450 plastic surgeons are active. Additionally, early adoption of advanced technologies and innovative treatment offerings reinforces North America’s dominant market position.

Medical Aesthetics Market Active Players:

- AbbVie Inc. (Allergan Aesthetics) (United States)

- Alma Lasers (United States)

- Bausch Health Companies Inc. (Canada)

- BTL Aesthetics (Czech Republic)

- Candela Medical (United States)

- Cutera, Inc. (United States)

- Cynosure, LLC (United States)

- El.En. S.p.A. (Italy)

- Galderma SA (Switzerland)

- Hologic, Inc. (United States)

- Johnson & Johnson Services, Inc. (Mentor Worldwide) (United States)

- Lumenis Ltd. (Israel)

- Merz Pharma GmbH & Co. KGaA (Germany)

- Sisram Medical Ltd. (Israel)

- Zimmer Biomet Holdings Inc. (United States)

- Other Active Players

Key Industry Developments in the Medical Aesthetics Market:

-

In March 2025, Johnson & Johnson MedTech rolled out a recycling initiative in the U.K. for single-use medical devices, designed to minimize healthcare waste and support hospitals in meeting sustainability objectives. The program underscores the company’s focus on environmentally responsible healthcare practices.

- In February 2025, Candela Medical received European Commission approval for the expanded use of its GentleMax Pro system to treat benign vascular and pigmented lesions. This regulatory clearance broadens the device’s clinical scope and strengthens Candela’s growth prospects in the European market.

Technological Framework and Advanced Treatment Modalities in the Medical Aesthetics Market

-

The medical aesthetics market is driven by advanced technologies that enable safe, precise, and minimally invasive cosmetic procedures. Technically, the market comprises energy-based and non-energy-based devices, including laser systems, radiofrequency (RF), ultrasound, cryolipolysis, and intense pulsed light (IPL), as well as injectables such as botulinum toxin and dermal fillers. These technologies target skin layers, adipose tissue, or neuromuscular junctions to achieve skin tightening, fat reduction, wrinkle smoothing, and facial volume restoration.

- Innovations such as AI-assisted treatment planning, real-time skin imaging, temperature-controlled energy delivery, and combination platforms have improved treatment accuracy and outcomes. Additionally, advancements in regenerative aesthetics, including biostimulators and platelet-rich plasma (PRP), enhance collagen production and tissue repair. Together, these technical developments enable customizable treatments, reduced recovery time, and consistent clinical results across diverse patient populations.

|

Medical Aesthetics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 16.96 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.8% |

Market Size in 2035: |

USD 47.43 Bn. |

|

Segments Covered: |

|

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Medical Aesthetics Market by Product Type (2018-2035)

4.1 Medical Aesthetics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aesthetic Laser Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Energy-Based Devices

4.5 Body Contouring Devices

4.6 Facial Aesthetic Devices

4.7 Aesthetic Implants

4.8 Skin Aesthetic Devices

4.9 Injectables

4.10 Dermal Fillers

4.11 Others

Chapter 5: Medical Aesthetics Market by Technology (2018-2035)

5.1 Medical Aesthetics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Laser-Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Radiofrequency

5.5 Ultrasound

5.6 Cryolipolysis

5.7 Electrical Stimulation

5.8 Others

Chapter 6: Medical Aesthetics Market by Procedure Type (2018-2035)

6.1 Medical Aesthetics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Non-Surgical/Minimally Invasive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Surgical

Chapter 7: Medical Aesthetics Market by Application (2018-2032)

7.1 Medical Aesthetics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Skin Resurfacing and Tightening

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Anti-Aging and Wrinkles

7.5 Body Shaping and Cellulite Reduction

7.6 Hair Removal

7.7 Breast Enhancement

7.8 Vascular and Pigment Lesions

7.9 Reconstructive Procedures

7.10 Psoriasis and Vitiligo

7.11 Others

Chapter 8: Medical Aesthetics Market by End User (2018-2035)

8.1 Medical Aesthetics Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Dermatology Clinics

8.5 Cosmetic Surgery Centers

8.6 Medical Spas and Beauty Centers

8.7 Home Use

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Medical Aesthetics Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ABBVIE INC. (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 ALMA LASERS (UNITED STATES)

9.4 BAUSCH HEALTH COMPANIES INC. (CANADA)

9.5 BTL AESTHETICS (CZECH REPUBLIC)

9.6 CANDELA MEDICAL (UNITED STATES)

9.7 CUTERA

9.8 INC. (UNITED STATES)

9.9 CYNOSURE

9.10 LLC (UNITED STATES)

9.11 EL.EN. S.P.A. (ITALY)

9.12 GALDERMA SA (SWITZERLAND)

9.13 HOLOGIC

9.14 INC. (UNITED STATES)

9.15 JOHNSON & JOHNSON SERVICES

9.16 INC. – MENTOR WORLDWIDE (UNITED STATES)

9.17 LUMENIS LTD. (ISRAEL)

9.18 MERZ PHARMA GMBH & CO. KGAA (GERMANY)

9.19 SISRAM MEDICAL LTD. (ISRAEL)

9.20 ZIMMER BIOMET HOLDINGS INC. (UNITED STATES) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Medical Aesthetics Market By Region

10.1 Overview

10.2. North America Medical Aesthetics Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Medical Aesthetics Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Medical Aesthetics Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Medical Aesthetics Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Medical Aesthetics Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Medical Aesthetics Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Medical Aesthetics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 16.96 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.8% |

Market Size in 2035: |

USD 47.43 Bn. |

|

Segments Covered: |

|

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||