Liposome Drug Delivery Market Synopsis:

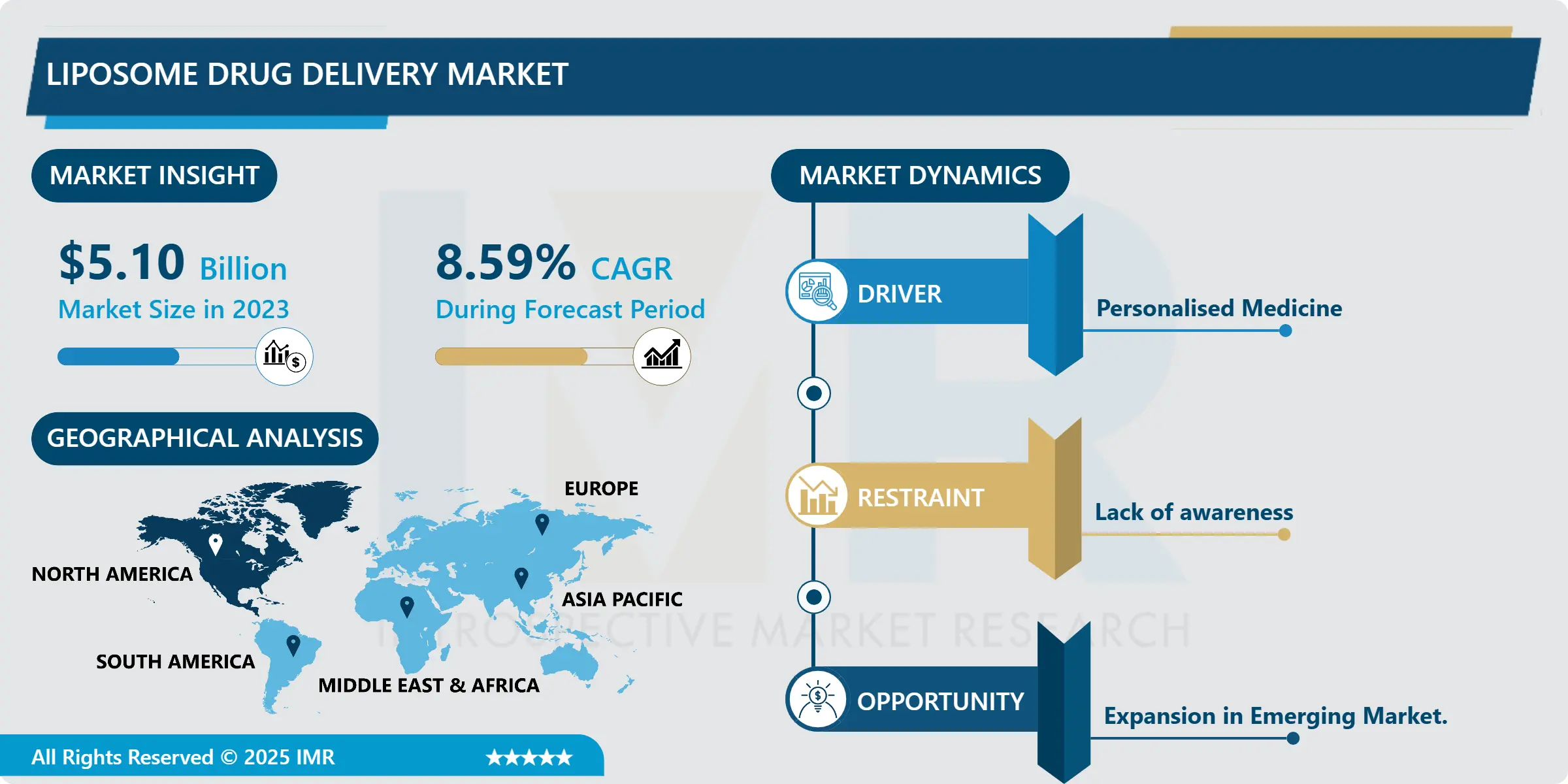

Liposome Drug Delivery Market Size Was Valued at USD 5.10 Billion in 2023, and is Projected to Reach USD 10.71 Billion by 2032, Growing at a CAGR of 8.59% From 2024-2032

Liposome drug delivery is a smart approach of packaging drugs inside liposome which is round membrane structures made up of lipid bilayer. Leveraging this technique, I increases the absorption and effectiveness of drugs by directing the medications to those specific tissues that need to be affected, cuts down on the side effects endured by patients, and grants additional protection for drugs that are sensitive to degradation. The increasing demand in the biopharmaceutical therapies and the increasing need for better drug delivery systems are the main factors for the growth of the liposome drug delivery market.

Therefore liposome drug delivery market has been demonstrated to improve tremendously in the past years with key emphases on nanotechnology and demand for targeted therapies. Liposomes are ideal for use as a vehicle for various types of therapeutic entities such as anticancer drugs and vaccines and many other anti-inflammatory agents and molecules. The features of the microspheres, including biocompatibility, encapsulation of both aqueous- and oil-soluble drug molecules, make it possible to consider them as an optimal choice in the pharmaceutical applications. The higher incidence rate of chronic diseases including cancer and cardiovascular diseases In addition increased need for personalized medicine has served to boost the use of liposomal formulations in clinical application.

Further, a favourable regulation and approval for liposomal products supplemented the growth of the market. Richardson,M (2013)As the market for generic liposomal products grows, incumbent pharmaceutical and biotechnology companies are spending significantly in R&D to develop new generations of liposomes, improve delivery systems, and gain efficacious terminus. Therefore, the Liposome drug delivery market has tremendous opportunities with an increase in the number of recently approved products and growing clinical trials that further intensify the competition. led by a strong pipeline of liposome based therapeutic agents and a rising trend of partnerships between academic institutions and industry actors the market is expected to sustain long-term growth.

Liposome Drug Delivery Market Trend Analysis:

Personalized Medicine

- Another interesting trend implemented in the liposome drug delivery market is the concept of a personalized medicine. This concept increases the effectiveness of therapeutic interference and reduces potential complications due to individualization of medical treatment according to distinctive features of the patient. Liposomes can be used to encapsulate particular drugs that respond to specific biomarkers in an individual patient making therapy more effective in diseases such as cancer, where the heterogeneity of the tumor greatly affects the result of therapy. The advances of genomics and proteomics in drug development are extending the possibility of personalized liposomal treatments as a part of the precision medicine line.

- Furthermore, technological improvements have made it possible to create pH sensitive liposomes which could be created to release their contents to an environment that is influenced by physiological parameters or signals. This not only improves the pharmacokinetics of drugs but also decreasing systemic toxicity of drugs which makes therapies safer for patients. Another factor likely fueling growth in this area is the growing trend of the customised or personal anti-cancer treatments, for which such delivery systems would be of value.

Expansion in Emerging Markets

- This has made liposome drug delivery as a market for considerable prospects for growth specially in the developing world. Potential markets like India, China and Brazil also demonstrate a growing demand for systems and technologies for delivering drugs to targeted sites of action because of the increasing patient base and healthcare spending. These markets are slowly getting exposed to latest pharmaceutical technologies like liposomal formulations that can solve the unmet medical demands of these markets.Also, the escalating incidences of diseases such as cancer and diabetes in these regions provide the market with a suitable opportunity to develop liposomal drug delivery solutions.urge in demand for advanced drug delivery systems due to their large patient populations and increasing healthcare expenditure. These markets are gradually adopting innovative pharmaceutical technologies, including liposomal formulations, which can address the unmet medical needs of their populations. Additionally, the growing prevalence of diseases like cancer and diabetes in these regions creates a favourable environment for the expansion of liposomal drug delivery solutions.

- In addition, the local pharmaceutical firms are now working in closer collaboration with their international counterparts to strengthen their inventive abilities and secure record to new technologies. This trend not only promotes innovation but also makes it possible to develop local liposomal therapy products at a reasonable price. Opportunities like these, if exploited effectively, can help players in the liposome drug delivery market provide a high market impact and help bring about positive change in health care outcomes.

Liposome Drug Delivery Market Segment Analysis:

Liposome Drug Delivery Market is Segmented on the basis of Type, Application, End User, and Region

By Product Liposomal Paclitaxel segment is expected to dominate the market during the forecast period

- The product segment have liposomal paclitaxel, liposomal doxorubicin, liposomal amphotericin B and others. Market value: By 2024, the liposomal doxorubicin segment is expected to control 36.1% of the market due to the targeted delivery feature. Doxorubicin is widely used in chemotherapy treatment; however, its concentration affects the cardiac muscles massively.What makes using doxorubicin in a liposome advantageous is that it will target tumor sites while excluding healthy ones.l doxorubicin segment is estimated to hold 36.1% share of the market in 2024 owing to its targeted delivery capabilities. Doxorubicin is an effective chemotherapy drug but its use is limited by dose-dependent cardiac toxicity. Encapsulating doxorubicin inside a liposome allows it to be delivered directly to tumor sites while avoiding healthy tissues. This targeted delivery is much less toxic than systemically administered free doxorubicin.

By Technology , Stealth Liposome Technology segment expected to held the largest share

- The technologies are stealth liposome technology, non-PEGylated liposome technology and DepoFoam liposome technology. The stealth liposome technology sub-segment is expected to have 42.7% of market share in 2024 because of its higher drug encapsulation capacity. Liposome Stealth alters the membrane with hydrophilic polymers such as PEG for the purpose of minimizing uptake by the mononuclear phagocyte system. This “hides” the liposome from the immune system and results in a circulation time of up to 72 hours compared with several minutes for conventional liposomes. From the viewpoint of circulation, a longer circulation duration of stealth liposomes means that stealth liposomes have more time to selectively concentrate in tumour tissues relative to surrounding healthy tissue. It also enhances controlled release into higher concentration of the drug payload intracellularly rather than an all-at-once burst. This passive targeting through the EPR effect elevates drug concentration to the site of interest, but not the other regions of the body.

Liposome Drug Delivery Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2023, the regional analysis of the liposome drug delivery market also continued to show that the North American region remains the largest region in the Liposome drug delivery market at a global market share of approximately 45%. The leadership of this region is due partly to the developed healthcare facilities, a considerable level of investment in biopharmaceutical sector, and increased incidence of chronic ailments that can be best addressed through innovation. The United States has a central role in the overall, and especially in the commercial, process – numerous companies and research institutions are committed to the development of liposome products.

- Europe ranks second, with about 30% of the share, mainly due to the rising costs of healthcare and a properly developed legislation that encourages the use of liposomal formulations. It has also seen strong partnerships between academic institutions and commercial businesses promoting the invention of new liposomal treatments. Growing demand for targeted and efficient drugs delivery systems in the global market has defined a promising future for both North America and European markets, and at the same time, Asia-Pacific region revealed its strong potential in the future.

Active Key Players in the Liposome Drug Delivery Market:

- Alnylam Pharmaceuticals (USA)

- Amgen (USA)

- Astellas Pharma (Japan)

- Celgene (USA)

- CSPC Pharmaceutical Group (China)

- Encapsula NanoSciences (USA)

- Gilead Sciences (USA)

- Hikma Pharmaceuticals (UK)

- Horizon Therapeutics (Ireland)

- Janssen Pharmaceuticals (USA)

- Merck & Co. (USA)

- Mylan (USA)

- Sobi (Sweden)

- Takeda Pharmaceutical Company (Japan)

- Teva Pharmaceutical Industries (Israel)

- Others Active players.

|

Liposome Drug Delivery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.10 Billion |

|

Forecast Period 2024-32 CAGR: |

8.59% |

Market Size in 2032: |

USD 10.71 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Liposome Drug Delivery Market by Product

4.1 Liposome Drug Delivery Market Snapshot and Growth Engine

4.2 Liposome Drug Delivery Market Overview

4.3 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others: Geographic Segmentation Analysis

Chapter 5: Liposome Drug Delivery Market by Technology

5.1 Liposome Drug Delivery Market Snapshot and Growth Engine

5.2 Liposome Drug Delivery Market Overview

5.3 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology: Geographic Segmentation Analysis

Chapter 6: Liposome Drug Delivery Market by Indication

6.1 Liposome Drug Delivery Market Snapshot and Growth Engine

6.2 Liposome Drug Delivery Market Overview

6.3 Fungal Diseases Pain Management Cancer Therapeutics Others

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Fungal Diseases Pain Management Cancer Therapeutics Others: Geographic Segmentation Analysis

Chapter 7: Liposome Drug Delivery Market by end user

7.1 Liposome Drug Delivery Market Snapshot and Growth Engine

7.2 Liposome Drug Delivery Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals : Geographic Segmentation Analysis

7.4 Clincs

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Clincs : Geographic Segmentation Analysis

7.5 Research Laboratoies other

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Research Laboratoies other: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Liposome Drug Delivery Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALNYLAM PHARMACEUTICALS (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AMGEN (USA)

8.4 ASTELLAS PHARMA (JAPAN)

8.5 CELGENE (USA)

8.6 CSPC PHARMACEUTICAL GROUP (CHINA)

8.7 ENCAPSULA NANOSCIENCES (USA)

8.8 GILEAD SCIENCES (USA)

8.9 HIKMA PHARMACEUTICALS (UK)

8.10 HORIZON THERAPEUTICS (IRELAND)

8.11 JANSSEN PHARMACEUTICALS (USA)

8.12 MERCK & CO. (USA)

8.13 MYLAN (USA)

8.14 SOBI (SWEDEN)

8.15 TAKEDA PHARMACEUTICAL COMPANY (JAPAN)

8.16 TEVA PHARMACEUTICAL INDUSTRIES (ISRAEL)

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Liposome Drug Delivery Market By Region

9.1 Overview

9.2. North America Liposome Drug Delivery Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Product

9.2.4.1 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

9.2.5 Historic and Forecasted Market Size By Technology

9.2.5.1 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

9.2.6 Historic and Forecasted Market Size By Indication

9.2.6.1 Fungal Diseases Pain Management Cancer Therapeutics Others

9.2.7 Historic and Forecasted Market Size By end user

9.2.7.1 Hospitals

9.2.7.2 Clincs

9.2.7.3 Research Laboratoies other

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Liposome Drug Delivery Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Product

9.3.4.1 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

9.3.5 Historic and Forecasted Market Size By Technology

9.3.5.1 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

9.3.6 Historic and Forecasted Market Size By Indication

9.3.6.1 Fungal Diseases Pain Management Cancer Therapeutics Others

9.3.7 Historic and Forecasted Market Size By end user

9.3.7.1 Hospitals

9.3.7.2 Clincs

9.3.7.3 Research Laboratoies other

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Liposome Drug Delivery Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Product

9.4.4.1 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

9.4.5 Historic and Forecasted Market Size By Technology

9.4.5.1 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

9.4.6 Historic and Forecasted Market Size By Indication

9.4.6.1 Fungal Diseases Pain Management Cancer Therapeutics Others

9.4.7 Historic and Forecasted Market Size By end user

9.4.7.1 Hospitals

9.4.7.2 Clincs

9.4.7.3 Research Laboratoies other

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Liposome Drug Delivery Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Product

9.5.4.1 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

9.5.5 Historic and Forecasted Market Size By Technology

9.5.5.1 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

9.5.6 Historic and Forecasted Market Size By Indication

9.5.6.1 Fungal Diseases Pain Management Cancer Therapeutics Others

9.5.7 Historic and Forecasted Market Size By end user

9.5.7.1 Hospitals

9.5.7.2 Clincs

9.5.7.3 Research Laboratoies other

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Liposome Drug Delivery Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Product

9.6.4.1 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

9.6.5 Historic and Forecasted Market Size By Technology

9.6.5.1 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

9.6.6 Historic and Forecasted Market Size By Indication

9.6.6.1 Fungal Diseases Pain Management Cancer Therapeutics Others

9.6.7 Historic and Forecasted Market Size By end user

9.6.7.1 Hospitals

9.6.7.2 Clincs

9.6.7.3 Research Laboratoies other

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Liposome Drug Delivery Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Product

9.7.4.1 Liposomal Paclitaxel Liposomal Doxorubicin Liposomal Amphotericin B others

9.7.5 Historic and Forecasted Market Size By Technology

9.7.5.1 Stealth Liposome Technology Non-PEGylated Liposome Technology Depo Foam Liposome Technology

9.7.6 Historic and Forecasted Market Size By Indication

9.7.6.1 Fungal Diseases Pain Management Cancer Therapeutics Others

9.7.7 Historic and Forecasted Market Size By end user

9.7.7.1 Hospitals

9.7.7.2 Clincs

9.7.7.3 Research Laboratoies other

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Liposome Drug Delivery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.10 Billion |

|

Forecast Period 2024-32 CAGR: |

8.59% |

Market Size in 2032: |

USD 10.71 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||