Lentiviral Vectors Market Synopsis:

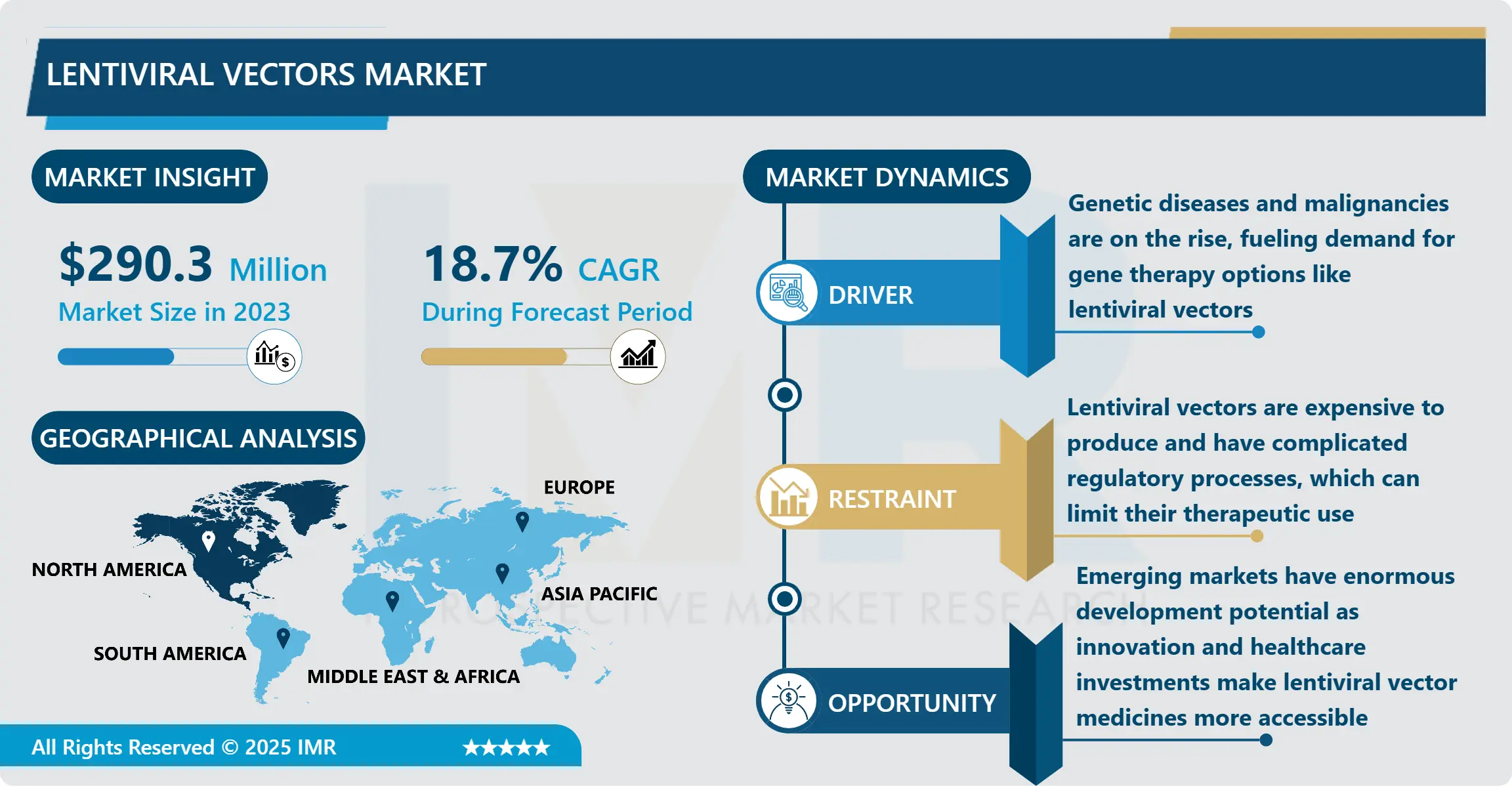

Lentiviral Vectors Market Size was valued at USD 290.3 million in 2023, and is Projected to Reach USD 1358 million by 2032, Growing at a CAGR of 18.7% From 2024-2032.

The lentiviral vectors market has seen considerable growth in recent years, driven by advancements in gene therapy and the increasing need for efficient delivery systems in genetic research and clinical applications. Lentiviral vectors, derived from the lentivirus, are particularly valuable for gene therapy due to their ability to integrate into the host genome and sustain long-term gene expression. This unique capability has led to their widespread adoption for treating genetic disorders, cancers, and other complex diseases, with the global market projected to expand at a substantial compound annual growth rate (CAGR) over the next decade.

One of the key drivers behind the lentiviral vectors market is the rise in clinical trials focused on gene and cell therapies. These vectors have demonstrated effectiveness in CAR-T cell therapies for cancer and treatments for inherited disorders such as sickle cell anemia and cystic fibrosis. With increasing investment from both private and public sectors, pharmaceutical and biotech companies are intensifying their research efforts, leading to enhanced production capacities, improved vector design, and reduced manufacturing costs. The growing pipeline of gene therapy products is expected to contribute significantly to market expansion, particularly in North America and Europe, where supportive regulatory frameworks encourage innovation.

However, challenges remain, particularly regarding the complexities of large-scale manufacturing and concerns about safety and regulatory compliance. Despite these challenges, there are growing opportunities for lentiviral vectors in emerging markets, as well as in new applications like regenerative medicine and vaccine development. Innovations in vector design to improve targeting, reduce immunogenicity, and enhance safety profiles are expected to open new avenues for growth, positioning the lentiviral vectors market as a critical component in the future of gene and cell therapy advancements.

Lentiviral Vectors Market Trend Analysis:

Increasing Adoption of Gene Therapy Applications

-

The lentiviral vectors market is witnessing a significant trend driven by the rising adoption of gene therapy for various genetic disorders and cancers. As researchers and healthcare providers increasingly focus on developing innovative therapies to treat previously incurable diseases, the demand for effective and reliable delivery systems, such as lentiviral vectors, is growing. This trend is supported by advancements in biotechnology and regulatory approvals for gene therapy products, further boosting market growth.

Advancements in Vector Engineering Technologies

-

Another notable trend in the lentiviral vectors market is the continuous advancements in vector engineering technologies. Innovations in genetic modification techniques, such as CRISPR and other gene-editing tools, are enhancing the efficacy and safety profiles of lentiviral vectors. These technological improvements are facilitating the development of more targeted and efficient therapeutic strategies, leading to an increase in research activities and clinical applications of lentiviral vectors across various fields, including oncology, neurology, and hematology.

Lentiviral Vectors Market Segment Analysis:

Lentiviral Vectors Market is Segmented on the basis of Component, Type, Generation, Workflow, Delivery Method, Disease Indication, Application, End User, and Region.

By Component, Lentiviral promoter segment is expected to dominate the market during the forecast period

-

The lentiviral vectors market can be segmented by component into lentiviral promoters, lentiviral fusion tags, lentivirus packaging systems, and other related elements. Lentiviral promoters are crucial for driving the expression of therapeutic genes, playing a significant role in the effectiveness of gene delivery. Lentiviral fusion tags facilitate the identification and purification of proteins expressed from lentiviral vectors, thereby enhancing research and therapeutic outcomes. Lentivirus packaging systems are essential for producing high-titer lentiviral vectors, ensuring efficient gene transfer and expression in target cells. The other components category includes various auxiliary materials and reagents necessary for the development and application of lentiviral vectors. This segmentation underscores the diverse applications and innovations within the market, reflecting the growing demand for tailored solutions in gene therapy and molecular research.

By Application, Gene Therapy segment expected to held the largest share

-

The lentiviral vectors market is significantly impacted by its applications in gene therapy and vaccinology, where these vectors serve as essential tools for delivering genetic material into cells. In gene therapy, lentiviral vectors are utilized to introduce therapeutic genes that can correct genetic disorders or combat diseases such as cancer, thereby offering promising treatment options. Their ability to integrate into the host genome allows for stable and long-term expression of the desired gene, enhancing treatment efficacy. Additionally, in vaccinology, lentiviral vectors are being explored as innovative vaccine delivery systems, especially for emerging infectious diseases and cancer immunotherapies. By facilitating the expression of specific antigens, these vectors can stimulate robust immune responses, making them a valuable asset in the development of next-generation vaccines. As a result, the growing interest in gene therapies and vaccine innovations continues to drive the demand for lentiviral vectors, fostering advancements in research and clinical applications.

Lentiviral Vectors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is expected to dominate the lentiviral vectors market over the forecast period due to a combination of robust research and development activities, a well-established biotechnology sector, and significant investments in gene therapy innovations. The region benefits from leading academic institutions and research organizations that are at the forefront of gene therapy research, driving demand for advanced delivery systems like lentiviral vectors. Additionally, supportive regulatory frameworks and funding initiatives from government bodies and private entities facilitate clinical trials and the commercialization of lentiviral-based therapies. The presence of key market players in North America further strengthens the region's position, as they focus on developing cutting-edge technologies and expanding their product offerings to meet the growing needs of the healthcare industry.

Active Key Players in the Lentiviral Vectors Market:

-

Cobra Biologics Limited (U.K.)

- Sirion-Biotech GmbH (Germany)

- Merck KGaA (Germany)

- FinVector Oy (Finland)

- Oxford Biomedica (U.K.)

- OriGene Technologies, Inc. (U.S.)

- Sino Biological Inc. (China)

- Cell Biolabs, Inc. (U.S.)

- Batavia Biosciences B.V. (Netherlands)

- Lonza (Switzerland)

- GENEMEDI (China)

- Takara Bio Inc. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Waisman Biomanufacturing (U.S.)

- Cytiva (U.S.)

- Other Active Players

|

Lentiviral Vectors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 290.3 Million |

|

Forecast Period 2024-32 CAGR: |

18.7% |

Market Size in 2032: |

USD 1358 Million |

|

Segments Covered: |

By Component |

|

|

|

By Type |

|

||

|

By Generation |

|

||

|

By Workflow |

|

||

|

By Delivery Method |

|

||

|

By Disease Indication |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Lentiviral Vectors Market by Component

4.1 Lentiviral Vectors Market Snapshot and Growth Engine

4.2 Lentiviral Vectors Market Overview

4.3 Lentiviral promoter

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Lentiviral promoter: Geographic Segmentation Analysis

4.4 Lentiviral fusion tags

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Lentiviral fusion tags: Geographic Segmentation Analysis

4.5 Lentivirus packaging systems and Other

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Lentivirus packaging systems and Other: Geographic Segmentation Analysis

Chapter 5: Lentiviral Vectors Market by Type

5.1 Lentiviral Vectors Market Snapshot and Growth Engine

5.2 Lentiviral Vectors Market Overview

5.3 Product and Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Product and Services: Geographic Segmentation Analysis

Chapter 6: Lentiviral Vectors Market by Generation

6.1 Lentiviral Vectors Market Snapshot and Growth Engine

6.2 Lentiviral Vectors Market Overview

6.3 4th-generation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 4th-generation: Geographic Segmentation Analysis

6.4 3rd-generation

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 3rd-generation: Geographic Segmentation Analysis

6.5 2nd-generation and 1st-generation

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 2nd-generation and 1st-generation: Geographic Segmentation Analysis

Chapter 7: Lentiviral Vectors Market by Workflow

7.1 Lentiviral Vectors Market Snapshot and Growth Engine

7.2 Lentiviral Vectors Market Overview

7.3 Upstream Processing And Downstream Processing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Upstream Processing And Downstream Processing: Geographic Segmentation Analysis

Chapter 8: Lentiviral Vectors Market by Delivery Method

8.1 Lentiviral Vectors Market Snapshot and Growth Engine

8.2 Lentiviral Vectors Market Overview

8.3 In Vivo and Ex Vivo

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 In Vivo and Ex Vivo: Geographic Segmentation Analysis

Chapter 9: Lentiviral Vectors Market by Disease Indication

9.1 Lentiviral Vectors Market Snapshot and Growth Engine

9.2 Lentiviral Vectors Market Overview

9.3 Cancer

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Cancer: Geographic Segmentation Analysis

9.4 Genetic Disorders

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Genetic Disorders: Geographic Segmentation Analysis

9.5 Infectious Diseases

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Infectious Diseases: Geographic Segmentation Analysis

9.6 Veterinary Disease And Other

9.6.1 Introduction and Market Overview

9.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.6.3 Key Market Trends, Growth Factors and Opportunities

9.6.4 Veterinary Disease And Other: Geographic Segmentation Analysis

Chapter 10: Lentiviral Vectors Market by Application

10.1 Lentiviral Vectors Market Snapshot and Growth Engine

10.2 Lentiviral Vectors Market Overview

10.3 Gene Therapy And Vaccinology

10.3.1 Introduction and Market Overview

10.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

10.3.3 Key Market Trends, Growth Factors and Opportunities

10.3.4 Gene Therapy And Vaccinology: Geographic Segmentation Analysis

Chapter 11: Lentiviral Vectors Market by End User

11.1 Lentiviral Vectors Market Snapshot and Growth Engine

11.2 Lentiviral Vectors Market Overview

11.3 Biotechnology Companies

11.3.1 Introduction and Market Overview

11.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

11.3.3 Key Market Trends, Growth Factors and Opportunities

11.3.4 Biotechnology Companies: Geographic Segmentation Analysis

11.4 Pharmaceutical Companies

11.4.1 Introduction and Market Overview

11.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

11.4.3 Key Market Trends, Growth Factors and Opportunities

11.4.4 Pharmaceutical Companies: Geographic Segmentation Analysis

11.5 Contract Research Organizations

11.5.1 Introduction and Market Overview

11.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

11.5.3 Key Market Trends, Growth Factors and Opportunities

11.5.4 Contract Research Organizations: Geographic Segmentation Analysis

11.6 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

11.6.1 Introduction and Market Overview

11.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

11.6.3 Key Market Trends, Growth Factors and Opportunities

11.6.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes: Geographic Segmentation Analysis

Chapter 12: Company Profiles and Competitive Analysis

12.1 Competitive Landscape

12.1.1 Competitive Benchmarking

12.1.2 Lentiviral Vectors Market Share by Manufacturer (2023)

12.1.3 Industry BCG Matrix

12.1.4 Heat Map Analysis

12.1.5 Mergers and Acquisitions

12.2 COBRA BIOLOGICS LIMITED (U.K.)

12.2.1 Company Overview

12.2.2 Key Executives

12.2.3 Company Snapshot

12.2.4 Role of the Company in the Market

12.2.5 Sustainability and Social Responsibility

12.2.6 Operating Business Segments

12.2.7 Product Portfolio

12.2.8 Business Performance

12.2.9 Key Strategic Moves and Recent Developments

12.2.10 SWOT Analysis

12.3 SIRION-BIOTECH GMBH (GERMANY)

12.4 MERCK KGAA (GERMANY)

12.5 FINVECTOR OY (FINLAND)

12.6 OXFORD BIOMEDICA (U.K.)

12.7 ORIGENE TECHNOLOGIES INC. (U.S.)

12.8 SINO BIOLOGICAL INC. (CHINA)

12.9 CELL BIOLABS INC. (U.S.)

12.10 BATAVIA BIOSCIENCES B.V. (NETHERLANDS)

12.11 LONZA (SWITZERLAND)

12.12 GENEMEDI (CHINA)

12.13 TAKARA BIO INC. (JAPAN)

12.14 THERMO FISHER SCIENTIFIC INC. (U.S.)

12.15 WAISMAN BIOMANUFACTURING (U.S.)

12.16 CYTIVA (U.S.)

12.17 OTHER ACTIVE PLAYERS

Chapter 13: Global Lentiviral Vectors Market By Region

13.1 Overview

13.2. North America Lentiviral Vectors Market

13.2.1 Key Market Trends, Growth Factors and Opportunities

13.2.2 Top Key Companies

13.2.3 Historic and Forecasted Market Size by Segments

13.2.4 Historic and Forecasted Market Size By Component

13.2.4.1 Lentiviral promoter

13.2.4.2 Lentiviral fusion tags

13.2.4.3 Lentivirus packaging systems and Other

13.2.5 Historic and Forecasted Market Size By Type

13.2.5.1 Product and Services

13.2.6 Historic and Forecasted Market Size By Generation

13.2.6.1 4th-generation

13.2.6.2 3rd-generation

13.2.6.3 2nd-generation and 1st-generation

13.2.7 Historic and Forecasted Market Size By Workflow

13.2.7.1 Upstream Processing And Downstream Processing

13.2.8 Historic and Forecasted Market Size By Delivery Method

13.2.8.1 In Vivo and Ex Vivo

13.2.9 Historic and Forecasted Market Size By Disease Indication

13.2.9.1 Cancer

13.2.9.2 Genetic Disorders

13.2.9.3 Infectious Diseases

13.2.9.4 Veterinary Disease And Other

13.2.10 Historic and Forecasted Market Size By Application

13.2.10.1 Gene Therapy And Vaccinology

13.2.11 Historic and Forecasted Market Size By End User

13.2.11.1 Biotechnology Companies

13.2.11.2 Pharmaceutical Companies

13.2.11.3 Contract Research Organizations

13.2.11.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

13.2.12 Historic and Forecast Market Size by Country

13.2.12.1 US

13.2.12.2 Canada

13.2.12.3 Mexico

13.3. Eastern Europe Lentiviral Vectors Market

13.3.1 Key Market Trends, Growth Factors and Opportunities

13.3.2 Top Key Companies

13.3.3 Historic and Forecasted Market Size by Segments

13.3.4 Historic and Forecasted Market Size By Component

13.3.4.1 Lentiviral promoter

13.3.4.2 Lentiviral fusion tags

13.3.4.3 Lentivirus packaging systems and Other

13.3.5 Historic and Forecasted Market Size By Type

13.3.5.1 Product and Services

13.3.6 Historic and Forecasted Market Size By Generation

13.3.6.1 4th-generation

13.3.6.2 3rd-generation

13.3.6.3 2nd-generation and 1st-generation

13.3.7 Historic and Forecasted Market Size By Workflow

13.3.7.1 Upstream Processing And Downstream Processing

13.3.8 Historic and Forecasted Market Size By Delivery Method

13.3.8.1 In Vivo and Ex Vivo

13.3.9 Historic and Forecasted Market Size By Disease Indication

13.3.9.1 Cancer

13.3.9.2 Genetic Disorders

13.3.9.3 Infectious Diseases

13.3.9.4 Veterinary Disease And Other

13.3.10 Historic and Forecasted Market Size By Application

13.3.10.1 Gene Therapy And Vaccinology

13.3.11 Historic and Forecasted Market Size By End User

13.3.11.1 Biotechnology Companies

13.3.11.2 Pharmaceutical Companies

13.3.11.3 Contract Research Organizations

13.3.11.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

13.3.12 Historic and Forecast Market Size by Country

13.3.12.1 Russia

13.3.12.2 Bulgaria

13.3.12.3 The Czech Republic

13.3.12.4 Hungary

13.3.12.5 Poland

13.3.12.6 Romania

13.3.12.7 Rest of Eastern Europe

13.4. Western Europe Lentiviral Vectors Market

13.4.1 Key Market Trends, Growth Factors and Opportunities

13.4.2 Top Key Companies

13.4.3 Historic and Forecasted Market Size by Segments

13.4.4 Historic and Forecasted Market Size By Component

13.4.4.1 Lentiviral promoter

13.4.4.2 Lentiviral fusion tags

13.4.4.3 Lentivirus packaging systems and Other

13.4.5 Historic and Forecasted Market Size By Type

13.4.5.1 Product and Services

13.4.6 Historic and Forecasted Market Size By Generation

13.4.6.1 4th-generation

13.4.6.2 3rd-generation

13.4.6.3 2nd-generation and 1st-generation

13.4.7 Historic and Forecasted Market Size By Workflow

13.4.7.1 Upstream Processing And Downstream Processing

13.4.8 Historic and Forecasted Market Size By Delivery Method

13.4.8.1 In Vivo and Ex Vivo

13.4.9 Historic and Forecasted Market Size By Disease Indication

13.4.9.1 Cancer

13.4.9.2 Genetic Disorders

13.4.9.3 Infectious Diseases

13.4.9.4 Veterinary Disease And Other

13.4.10 Historic and Forecasted Market Size By Application

13.4.10.1 Gene Therapy And Vaccinology

13.4.11 Historic and Forecasted Market Size By End User

13.4.11.1 Biotechnology Companies

13.4.11.2 Pharmaceutical Companies

13.4.11.3 Contract Research Organizations

13.4.11.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

13.4.12 Historic and Forecast Market Size by Country

13.4.12.1 Germany

13.4.12.2 UK

13.4.12.3 France

13.4.12.4 The Netherlands

13.4.12.5 Italy

13.4.12.6 Spain

13.4.12.7 Rest of Western Europe

13.5. Asia Pacific Lentiviral Vectors Market

13.5.1 Key Market Trends, Growth Factors and Opportunities

13.5.2 Top Key Companies

13.5.3 Historic and Forecasted Market Size by Segments

13.5.4 Historic and Forecasted Market Size By Component

13.5.4.1 Lentiviral promoter

13.5.4.2 Lentiviral fusion tags

13.5.4.3 Lentivirus packaging systems and Other

13.5.5 Historic and Forecasted Market Size By Type

13.5.5.1 Product and Services

13.5.6 Historic and Forecasted Market Size By Generation

13.5.6.1 4th-generation

13.5.6.2 3rd-generation

13.5.6.3 2nd-generation and 1st-generation

13.5.7 Historic and Forecasted Market Size By Workflow

13.5.7.1 Upstream Processing And Downstream Processing

13.5.8 Historic and Forecasted Market Size By Delivery Method

13.5.8.1 In Vivo and Ex Vivo

13.5.9 Historic and Forecasted Market Size By Disease Indication

13.5.9.1 Cancer

13.5.9.2 Genetic Disorders

13.5.9.3 Infectious Diseases

13.5.9.4 Veterinary Disease And Other

13.5.10 Historic and Forecasted Market Size By Application

13.5.10.1 Gene Therapy And Vaccinology

13.5.11 Historic and Forecasted Market Size By End User

13.5.11.1 Biotechnology Companies

13.5.11.2 Pharmaceutical Companies

13.5.11.3 Contract Research Organizations

13.5.11.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

13.5.12 Historic and Forecast Market Size by Country

13.5.12.1 China

13.5.12.2 India

13.5.12.3 Japan

13.5.12.4 South Korea

13.5.12.5 Malaysia

13.5.12.6 Thailand

13.5.12.7 Vietnam

13.5.12.8 The Philippines

13.5.12.9 Australia

13.5.12.10 New Zealand

13.5.12.11 Rest of APAC

13.6. Middle East & Africa Lentiviral Vectors Market

13.6.1 Key Market Trends, Growth Factors and Opportunities

13.6.2 Top Key Companies

13.6.3 Historic and Forecasted Market Size by Segments

13.6.4 Historic and Forecasted Market Size By Component

13.6.4.1 Lentiviral promoter

13.6.4.2 Lentiviral fusion tags

13.6.4.3 Lentivirus packaging systems and Other

13.6.5 Historic and Forecasted Market Size By Type

13.6.5.1 Product and Services

13.6.6 Historic and Forecasted Market Size By Generation

13.6.6.1 4th-generation

13.6.6.2 3rd-generation

13.6.6.3 2nd-generation and 1st-generation

13.6.7 Historic and Forecasted Market Size By Workflow

13.6.7.1 Upstream Processing And Downstream Processing

13.6.8 Historic and Forecasted Market Size By Delivery Method

13.6.8.1 In Vivo and Ex Vivo

13.6.9 Historic and Forecasted Market Size By Disease Indication

13.6.9.1 Cancer

13.6.9.2 Genetic Disorders

13.6.9.3 Infectious Diseases

13.6.9.4 Veterinary Disease And Other

13.6.10 Historic and Forecasted Market Size By Application

13.6.10.1 Gene Therapy And Vaccinology

13.6.11 Historic and Forecasted Market Size By End User

13.6.11.1 Biotechnology Companies

13.6.11.2 Pharmaceutical Companies

13.6.11.3 Contract Research Organizations

13.6.11.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

13.6.12 Historic and Forecast Market Size by Country

13.6.12.1 Turkiye

13.6.12.2 Bahrain

13.6.12.3 Kuwait

13.6.12.4 Saudi Arabia

13.6.12.5 Qatar

13.6.12.6 UAE

13.6.12.7 Israel

13.6.12.8 South Africa

13.7. South America Lentiviral Vectors Market

13.7.1 Key Market Trends, Growth Factors and Opportunities

13.7.2 Top Key Companies

13.7.3 Historic and Forecasted Market Size by Segments

13.7.4 Historic and Forecasted Market Size By Component

13.7.4.1 Lentiviral promoter

13.7.4.2 Lentiviral fusion tags

13.7.4.3 Lentivirus packaging systems and Other

13.7.5 Historic and Forecasted Market Size By Type

13.7.5.1 Product and Services

13.7.6 Historic and Forecasted Market Size By Generation

13.7.6.1 4th-generation

13.7.6.2 3rd-generation

13.7.6.3 2nd-generation and 1st-generation

13.7.7 Historic and Forecasted Market Size By Workflow

13.7.7.1 Upstream Processing And Downstream Processing

13.7.8 Historic and Forecasted Market Size By Delivery Method

13.7.8.1 In Vivo and Ex Vivo

13.7.9 Historic and Forecasted Market Size By Disease Indication

13.7.9.1 Cancer

13.7.9.2 Genetic Disorders

13.7.9.3 Infectious Diseases

13.7.9.4 Veterinary Disease And Other

13.7.10 Historic and Forecasted Market Size By Application

13.7.10.1 Gene Therapy And Vaccinology

13.7.11 Historic and Forecasted Market Size By End User

13.7.11.1 Biotechnology Companies

13.7.11.2 Pharmaceutical Companies

13.7.11.3 Contract Research Organizations

13.7.11.4 Contract Development and Manufacturing Organization (CDMO) and Academic/Research Institutes

13.7.12 Historic and Forecast Market Size by Country

13.7.12.1 Brazil

13.7.12.2 Argentina

13.7.12.3 Rest of SA

Chapter 14 Analyst Viewpoint and Conclusion

14.1 Recommendations and Concluding Analysis

14.2 Potential Market Strategies

Chapter 15 Research Methodology

15.1 Research Process

15.2 Primary Research

15.3 Secondary Research

|

Lentiviral Vectors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 290.3 Million |

|

Forecast Period 2024-32 CAGR: |

18.7% |

Market Size in 2032: |

USD 1358 Million |

|

Segments Covered: |

By Component |

|

|

|

By Type |

|

||

|

By Generation |

|

||

|

By Workflow |

|

||

|

By Delivery Method |

|

||

|

By Disease Indication |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||