Incretin Mimetics Market Synopsis:

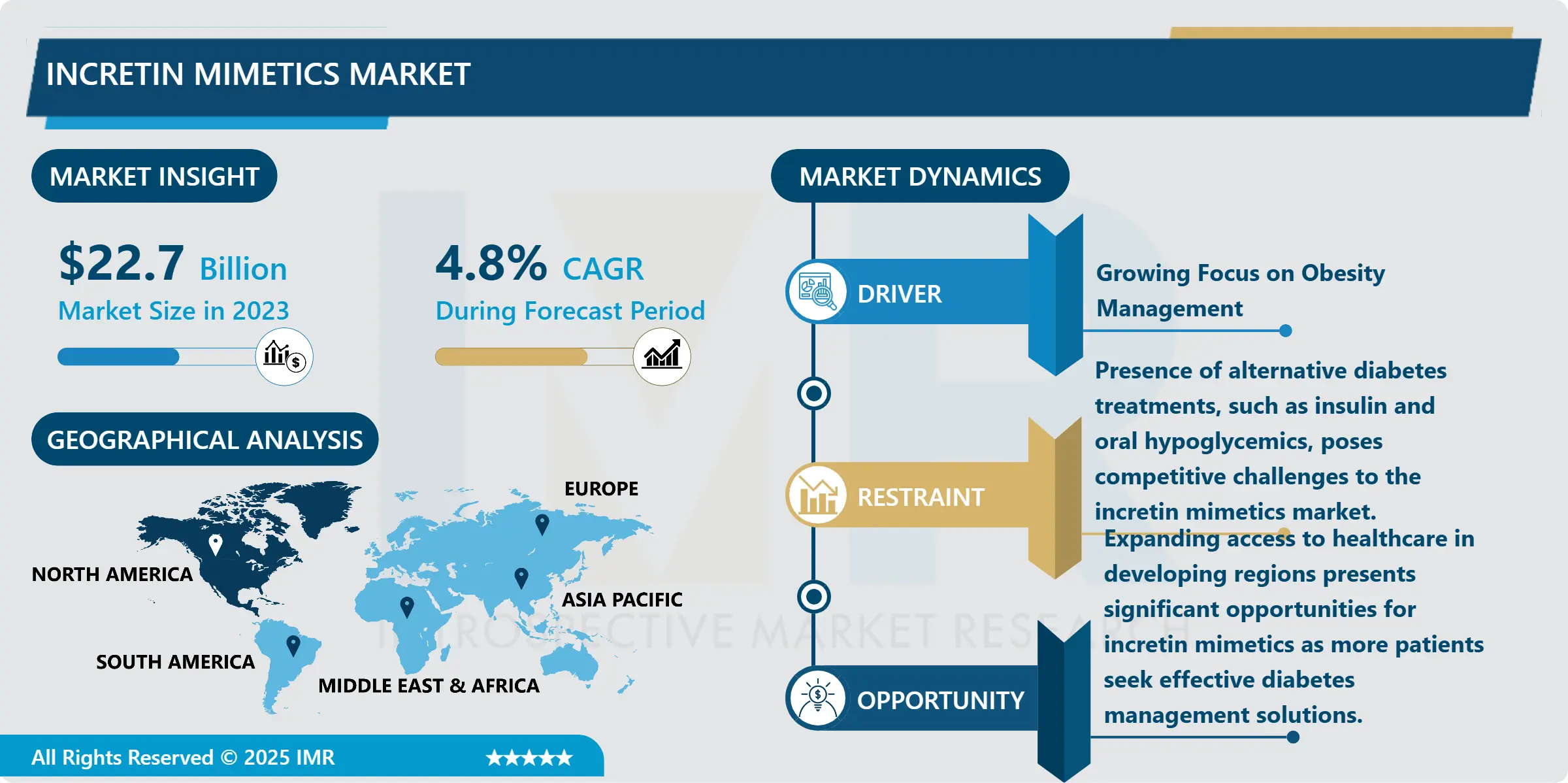

Incretin Mimetics Market Size Was Valued at USD 22.7 Billion in 2023, and is Projected to Reach USD 30.5 Billion by 2032, Growing at a CAGR of 4.8 % From 2024-2032.

The incretin mimetics market encompasses a range of pharmaceutical products designed to mimic the action of incretin hormones, which play a crucial role in glucose metabolism and appetite regulation. Primarily used for managing type 2 diabetes mellitus (T2DM), these medications, including GLP-1 receptor agonists like Liraglutide and Exenatide, help lower blood sugar levels and promote weight loss, addressing the dual challenges of diabetes and obesity. With a growing global prevalence of diabetes, driven by factors such as sedentary lifestyles and unhealthy diets, the demand for these therapies is surging. The market is characterized by innovation in drug development, including the introduction of combination therapies and long-acting formulations, enhancing patient compliance and outcomes. Key distribution channels include hospital pharmacies, retail pharmacies, and online pharmacies, reflecting the increasing accessibility of these treatments. As research continues to explore the broader therapeutic benefits of incretin mimetics, such as cardiovascular risk reduction, the market is poised for substantial growth over the coming years.

The incretin mimetics market is experiencing robust growth, driven by the escalating prevalence of type 2 diabetes mellitus (T2DM) and obesity worldwide. These medications, particularly GLP-1 receptor agonists like Liraglutide, Semaglutide, and Exenatide, mimic the action of incretin hormones to enhance insulin secretion and reduce blood sugar levels. The dual benefit of promoting weight loss has made these therapies increasingly appealing to both patients and healthcare providers. As the global burden of diabetes rises—exacerbated by lifestyle factors such as poor diet and sedentary behavior—there is a growing demand for effective treatment options that address not only glycemic control but also associated weight management .Market dynamics are also influenced by continuous innovation in drug development and delivery methods. Pharmaceutical companies are focusing on creating longer-acting formulations, combination therapies, and user-friendly administration options, such as pre-filled pens or potential oral formulations.

This focus on patient-centric solutions is aimed at improving adherence and outcomes in diabetes management. Additionally, the market benefits from increasing awareness and education around diabetes, leading to earlier diagnoses and treatment initiation. Distribution channels such as hospital pharmacies, retail pharmacies, and online pharmacies are expanding, further enhancing accessibility to these vital medications. Moreover, the incretin mimetics market is positioned for substantial growth as ongoing research uncovers additional therapeutic benefits beyond diabetes management, such as cardiovascular risk reduction and potential applications in other metabolic disorders. As regulatory frameworks continue to support innovation and patient access, the market is expected to flourish, providing new opportunities for healthcare providers and improving the quality of life for millions of patients dealing with the complexities of T2DM and obesity.

Incretin Mimetics Market Trend Analysis:

Focus on Combination Therapies

- The trend towards combination therapies in the incretin mimetics market reflects a strategic shift in diabetes management that aims to enhance treatment efficacy and improve patient outcomes. By combining incretin mimetics, such as GLP-1 receptor agonists, with other classes of diabetes medications—like insulin or DPP-4 inhibitors—healthcare providers can address multiple aspects of diabetes simultaneously. This approach not only targets glycemic control more effectively but also helps mitigate potential side effects associated with higher doses of single agents. Additionally, combination therapies are increasingly recognized for their ability to improve patient adherence, as they can simplify treatment regimens and reduce the pill burden. With ongoing clinical research demonstrating the benefits of these multi-faceted treatment strategies, the market is seeing a rise in innovative formulations that combine these therapeutic modalities. This trend aligns with the growing emphasis on personalized medicine, where treatments are tailored to the individual needs of patients, particularly those managing complex conditions like type 2 diabetes and obesity. As a result, combination therapies are expected to play a significant role in the future landscape of diabetes care, driving both patient satisfaction and clinical effectiveness.

Increasing healthcare access and rising awareness in developing regions

- Increasing healthcare access and rising awareness in developing regions represent significant opportunities for the incretin mimetics market. As these regions experience improvements in healthcare infrastructure, including the availability of medical facilities and trained healthcare professionals, more patients are receiving timely diagnoses and treatments for conditions like type 2 diabetes. Furthermore, heightened public awareness about diabetes and its associated health risks is driving demand for effective management solutions. Educational initiatives and community outreach programs are playing a critical role in informing patients about the benefits of incretin mimetics, leading to increased adoption of these therapies. Additionally, as governments and NGOs invest in healthcare accessibility, including subsidizing medications and enhancing patient education, the market is poised for substantial growth. This expanding landscape not only fosters a larger patient base for incretin mimetics but also encourages pharmaceutical companies to tailor their marketing and distribution strategies to meet the unique needs of these emerging markets, ultimately contributing to better health outcomes and improved quality of life for individuals affected by diabetes.

Incretin Mimetics Market Segment Analysis:

Incretin Mimetics Market is Segmented on the basis of Type, Application, End User, and Region

By Drug Type, Liraglutide segment is expected to dominate the market during the forecast period

- The Liraglutide segment is poised to dominate the incretin mimetics market during the forecast period, primarily due to its well-established efficacy and safety profile in managing Type 2 Diabetes Mellitus (T2DM). As a GLP-1 receptor agonist, Liraglutide has been extensively studied and is recognized for its ability to significantly lower blood sugar levels while also promoting weight loss. This dual benefit addresses two critical aspects of T2DM management, making it a preferred choice among healthcare providers. Furthermore, Liraglutide's approval for indications beyond diabetes, such as obesity management under the brand name Saxenda, broadens its market appeal and application, enhancing its competitive edge.

- In addition to its clinical effectiveness, Liraglutide’s strong presence in the market is bolstered by robust marketing strategies and patient support programs that encourage adherence and engagement. The drug's subcutaneous administration via pre-filled pens has also contributed to its popularity, as it offers a convenient and user-friendly option for patients. As awareness of the importance of comprehensive diabetes care grows, more healthcare professionals are likely to recommend Liraglutide as a first-line treatment, further solidifying its dominant position. With ongoing research and potential new indications on the horizon, Liraglutide is well-positioned to remain a leading player in the incretin mimetics market, catering to the evolving needs of patients and healthcare providers alike.

By Disease Indication, Type 2 Diabetes Mellitus (T2DM segment expected to held the largest share

- The Type 2 Diabetes Mellitus (T2DM) segment is expected to hold the largest share of the incretin mimetics market during the forecast period, primarily due to the increasing global prevalence of this condition. As lifestyle-related factors such as obesity, sedentary behavior, and poor dietary habits contribute to the rising rates of T2DM, there is an urgent need for effective treatment options that can help manage blood sugar levels. Incretin mimetics, particularly GLP-1 receptor agonists, have demonstrated significant efficacy in improving glycemic control, making them a vital component of diabetes management. Their ability to reduce hemoglobin A1c levels while providing additional benefits such as weight loss enhances their attractiveness as a therapeutic choice for patients struggling with T2DM.

- Moreover, the growing awareness and understanding of diabetes among healthcare providers and patients are driving increased adoption of incretin mimetics for T2DM management. Clinical guidelines increasingly recommend these therapies as first-line treatments, particularly for patients who are overweight or obese, as they effectively address both glycemic control and weight management. This dual approach is critical in reducing the risk of diabetes-related complications, which further emphasizes the importance of effective diabetes management strategies. Additionally, as research continues to uncover the long-term benefits of incretin mimetics in reducing cardiovascular risks associated with diabetes, their relevance in treating T2DM is expected to further solidify, resulting in sustained market growth.

- As healthcare systems worldwide strive to improve diabetes outcomes through comprehensive management strategies, the T2DM segment will likely remain a focal point in the incretin mimetics market. Ongoing innovations in drug formulations and delivery methods, alongside increasing patient and provider education, will support the sustained demand for these therapies. Ultimately, the emphasis on early intervention and effective management of T2DM positions this segment as a key driver of growth in the incretin mimetics market, catering to a vast and growing patient population seeking effective solutions for their diabetes management.

Incretin Mimetics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the incretin mimetics market over the forecast period, driven by several key factors. The region has one of the highest prevalence rates of Type 2 Diabetes Mellitus (T2DM), largely attributed to lifestyle factors such as obesity, sedentary lifestyles, and unhealthy dietary habits. This alarming increase in diabetes cases has led to heightened demand for effective treatment options, positioning incretin mimetics, particularly GLP-1 receptor agonists like Liraglutide and Semaglutide, as vital components of diabetes management strategies.

- Moreover, North America boasts advanced healthcare infrastructure, which facilitates rapid adoption of innovative therapies. The presence of well-established pharmaceutical companies, robust research and development activities, and strong regulatory support significantly contribute to the market’s growth. Healthcare providers in the region are increasingly recognizing the dual benefits of incretin mimetics in managing blood sugar levels while promoting weight loss, making these medications a preferred choice for patients. Additionally, comprehensive insurance coverage for diabetes medications enhances patient access, further fueling market expansion.

- The increasing focus on personalized medicine and patient-centric approaches in North America is also driving the growth of the incretin mimetics market. With healthcare professionals prioritizing tailored treatment plans that address individual patient needs, the adoption of these therapies is likely to continue rising. Furthermore, ongoing clinical research and the exploration of new indications for incretin mimetics, such as cardiovascular benefits, are expected to bolster market growth in the region. As awareness and education about diabetes management improve, North America will remain a critical market for incretin mimetics, contributing to the overall advancements in diabetes care.

Active Key Players in the Incretin Mimetics Market:

- AbbVie Inc. (United States)

- Amgen Inc. (United States)

- AstraZeneca (United Kingdom)

- Boehringer Ingelheim (Germany)

- Bristol-Myers Squibb (United States)

- Cipla Ltd. (India)

- Eli Lilly and Company (United States)

- GSK (GlaxoSmithKline) (United Kingdom)

- Hua Medicine (China)

- Intarcia Therapeutics, Inc. (United States)

- Merck & Co., Inc. (United States)

- Mylan N.V. (United States)

- Novo Nordisk (Denmark)

- Pfizer Inc. (United States)

- Roche (Switzerland)

- Sanofi (France)

- Takeda Pharmaceutical Company (Japan)

- Zydus Cadila (India)

- Other Active Players

|

Global Incretin Mimetics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.7 Billion |

|

Forecast Period 2024-32 CAGR: |

4.8 % |

Market Size in 2032: |

USD 30.5 Billion |

|

Segments Covered: |

By Type Drug |

|

|

|

By Disease Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Incretin Mimetics Market by Type Drug

4.1 Incretin Mimetics Market Snapshot and Growth Engine

4.2 Incretin Mimetics Market Overview

4.3 Exenatide

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Exenatide: Geographic Segmentation Analysis

4.4 Liraglutide

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Liraglutide: Geographic Segmentation Analysis

4.5 Sitagliptin

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Sitagliptin: Geographic Segmentation Analysis

4.6 Saxagliptin

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Saxagliptin: Geographic Segmentation Analysis

4.7 Alogliptin

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Alogliptin: Geographic Segmentation Analysis

4.8 and others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 and others: Geographic Segmentation Analysis

Chapter 5: Incretin Mimetics Market by Disease Indication

5.1 Incretin Mimetics Market Snapshot and Growth Engine

5.2 Incretin Mimetics Market Overview

5.3 Type 2 Diabetes Mellitus (T2DM) and weight management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Type 2 Diabetes Mellitus (T2DM) and weight management: Geographic Segmentation Analysis

Chapter 6: Incretin Mimetics Market by Distribution Channel

6.1 Incretin Mimetics Market Snapshot and Growth Engine

6.2 Incretin Mimetics Market Overview

6.3 Hospital pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital pharmacies: Geographic Segmentation Analysis

6.4 retail pharmacies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 retail pharmacies: Geographic Segmentation Analysis

6.5 and online pharmacies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and online pharmacies: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Incretin Mimetics Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBVIE INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMGEN INC. (UNITED STATES)

7.4 ASTRAZENECA (UNITED KINGDOM)

7.5 BOEHRINGER INGELHEIM (GERMANY)

7.6 BRISTOL-MYERS SQUIBB (UNITED STATES)

7.7 CIPLA LTD. (INDIA)

7.8 AND ELI LILLY AND COMPANY (UNITED STATES)

7.9 OTHER ACTIVE PLAYERS

Chapter 8: Global Incretin Mimetics Market By Region

8.1 Overview

8.2. North America Incretin Mimetics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type Drug

8.2.4.1 Exenatide

8.2.4.2 Liraglutide

8.2.4.3 Sitagliptin

8.2.4.4 Saxagliptin

8.2.4.5 Alogliptin

8.2.4.6 and others

8.2.5 Historic and Forecasted Market Size By Disease Indication

8.2.5.1 Type 2 Diabetes Mellitus (T2DM) and weight management

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Hospital pharmacies

8.2.6.2 retail pharmacies

8.2.6.3 and online pharmacies

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Incretin Mimetics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type Drug

8.3.4.1 Exenatide

8.3.4.2 Liraglutide

8.3.4.3 Sitagliptin

8.3.4.4 Saxagliptin

8.3.4.5 Alogliptin

8.3.4.6 and others

8.3.5 Historic and Forecasted Market Size By Disease Indication

8.3.5.1 Type 2 Diabetes Mellitus (T2DM) and weight management

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Hospital pharmacies

8.3.6.2 retail pharmacies

8.3.6.3 and online pharmacies

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Incretin Mimetics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type Drug

8.4.4.1 Exenatide

8.4.4.2 Liraglutide

8.4.4.3 Sitagliptin

8.4.4.4 Saxagliptin

8.4.4.5 Alogliptin

8.4.4.6 and others

8.4.5 Historic and Forecasted Market Size By Disease Indication

8.4.5.1 Type 2 Diabetes Mellitus (T2DM) and weight management

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Hospital pharmacies

8.4.6.2 retail pharmacies

8.4.6.3 and online pharmacies

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Incretin Mimetics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type Drug

8.5.4.1 Exenatide

8.5.4.2 Liraglutide

8.5.4.3 Sitagliptin

8.5.4.4 Saxagliptin

8.5.4.5 Alogliptin

8.5.4.6 and others

8.5.5 Historic and Forecasted Market Size By Disease Indication

8.5.5.1 Type 2 Diabetes Mellitus (T2DM) and weight management

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Hospital pharmacies

8.5.6.2 retail pharmacies

8.5.6.3 and online pharmacies

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Incretin Mimetics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type Drug

8.6.4.1 Exenatide

8.6.4.2 Liraglutide

8.6.4.3 Sitagliptin

8.6.4.4 Saxagliptin

8.6.4.5 Alogliptin

8.6.4.6 and others

8.6.5 Historic and Forecasted Market Size By Disease Indication

8.6.5.1 Type 2 Diabetes Mellitus (T2DM) and weight management

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Hospital pharmacies

8.6.6.2 retail pharmacies

8.6.6.3 and online pharmacies

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Incretin Mimetics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type Drug

8.7.4.1 Exenatide

8.7.4.2 Liraglutide

8.7.4.3 Sitagliptin

8.7.4.4 Saxagliptin

8.7.4.5 Alogliptin

8.7.4.6 and others

8.7.5 Historic and Forecasted Market Size By Disease Indication

8.7.5.1 Type 2 Diabetes Mellitus (T2DM) and weight management

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Hospital pharmacies

8.7.6.2 retail pharmacies

8.7.6.3 and online pharmacies

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Incretin Mimetics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22.7 Billion |

|

Forecast Period 2024-32 CAGR: |

4.8 % |

Market Size in 2032: |

USD 30.5 Billion |

|

Segments Covered: |

By Type Drug |

|

|

|

By Disease Indication |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||