In Vitro Toxicity Testing Market Synopsis:

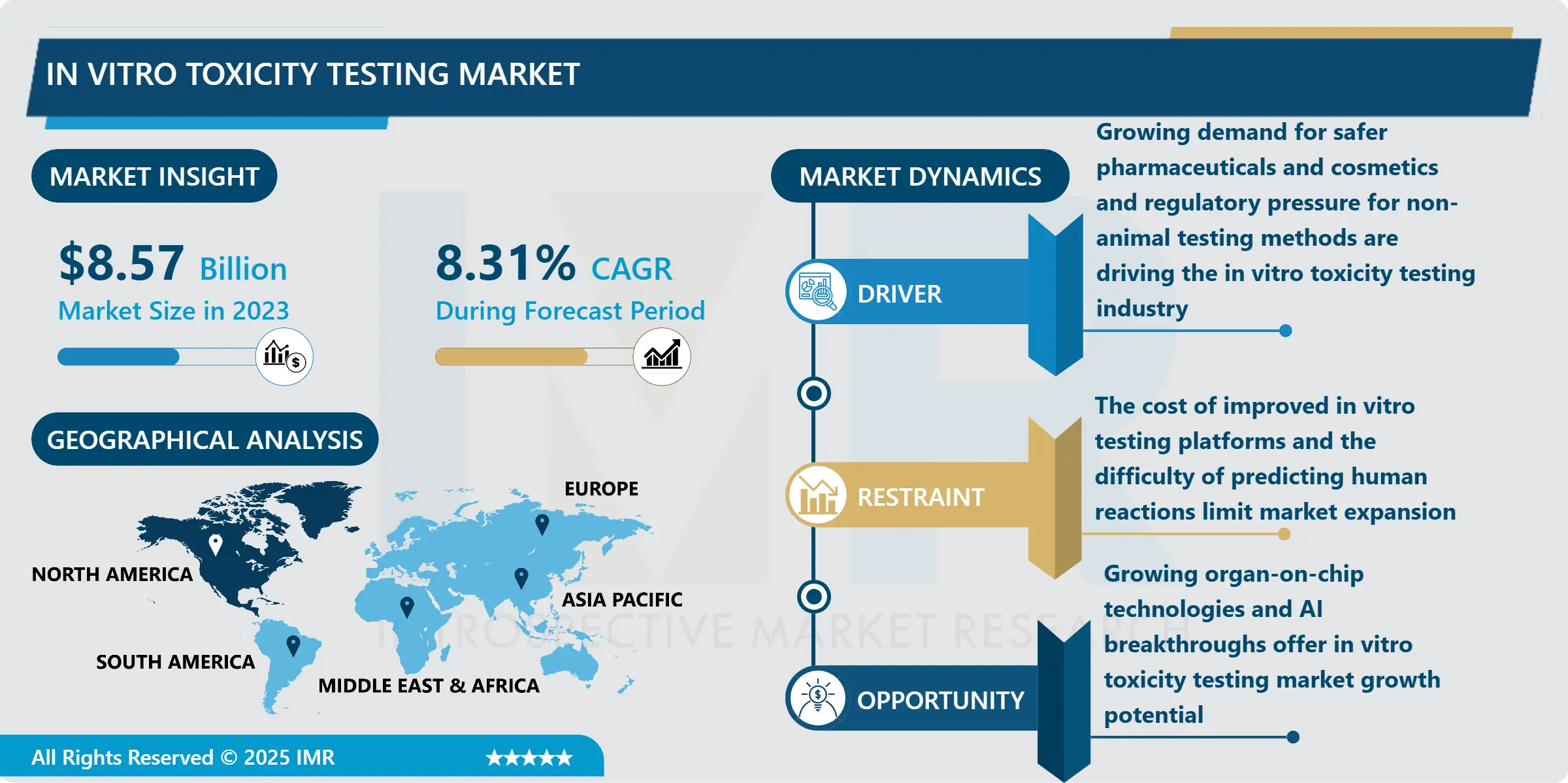

In Vitro Toxicity Testing Market Size Was Valued at USD 8.57 Billion in 2023, and is Projected to Reach USD 17.58 Billion by 2032, Growing at a CAGR of 8.31% From 2024-2032

The in vitro toxicity testing market refers to the use of laboratory-based tests to assess the toxicity of substances such as chemicals, pharmaceuticals, and environmental agents without using live animals. This market has gained substantial traction due to the increasing demand for alternative testing methods that are more ethical, cost-effective, and in compliance with regulatory guidelines. In vitro testing is increasingly adopted by the pharmaceutical, cosmetics, and chemical industries to evaluate the safety and effectiveness of their products before they are introduced to the market.

A key driver of the in vitro toxicity testing market is the growing shift toward regulatory frameworks that emphasize the reduction of animal testing. International regulations such as the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and other safety assessment guidelines require industries to adopt non-animal testing methods. In vitro tests allow more accurate and efficient predictions of the safety profile of chemicals and drugs, enhancing the reliability of product development.

Additionally, technological advancements in cell-based assays, microfluidic devices, and organ-on-a-chip models are significantly contributing to the expansion of the in vitro toxicity testing market. These innovations enable more accurate, high-throughput testing with lower costs, faster results, and greater predictability for human responses. As demand for these advanced testing methods continues to grow across various sectors, the in vitro toxicity testing market is poised for sustained expansion over the coming years.

In Vitro Toxicity Testing Market Trend Analysis:

Increasing Adoption of 3D Cell Cultures and Organ-on-a-Chip Models

- One of the significant trends driving the in vitro toxicity testing market is the growing use of 3D cell cultures and organ-on-a-chip models. These technologies mimic the in vivo environment more accurately than traditional 2D cell cultures, allowing for a better understanding of the potential toxic effects of substances on human tissues. 3D cell cultures and organ-on-a-chip platforms enable more realistic toxicological assessments, making them increasingly popular in drug development and safety testing. As these technologies continue to evolve, they offer higher predictive value and can reduce the need for animal testing, further aligning with regulatory and ethical standards.

Integration of Artificial Intelligence (AI) and Machine Learning for Toxicity Prediction

- Another emerging trend in the in vitro toxicity testing market is the integration of artificial intelligence (AI) and machine learning (ML) for predicting toxicity outcomes. AI and ML algorithms can analyze large datasets from in vitro tests, improving the speed and accuracy of toxicity assessments. These technologies help identify patterns and predict the toxicological effects of chemicals and pharmaceuticals based on molecular structures, offering more efficient risk assessments. The use of AI and ML not only accelerates the testing process but also supports the development of more robust predictive models, contributing to safer product development in industries such as pharmaceuticals, cosmetics, and chemicals.

In Vitro Toxicity Testing Market Segment Analysis:

In Vitro Toxicity Testing Market Segmented on the basis of Product and Service, Toxicology End Point and Test, Technology, Method, Industry, Distribution Channel, and Region

By Product and Service, Consumables segment is expected to dominate the market during the forecast period

- The in vitro toxicity testing market is segmented by product and service into consumables, services, assays, equipment, and software. Consumables include reagents, culture media, and laboratory supplies, which are essential for conducting toxicity tests. Services comprise the testing and consultancy services offered by contract research organizations (CROs) and other providers. Assays are standardized tests used to assess the toxic effects of substances on cell cultures, while equipment includes specialized instruments like automated cell culture systems, toxicity testing kits, and analytical tools. Software plays a crucial role in data analysis, providing computational models and databases to enhance the prediction and interpretation of toxicity results. Each of these segments contributes to the market's growth, driven by advancements in testing methodologies, increased demand for safer products, and regulatory changes promoting alternatives to animal testing.

By Distribution Channel, Direct Tender segment expected to held the largest share

- In the In Vitro Toxicity Testing Market, the distribution channels primarily include direct tender, retail sales, and others. Direct tender involves the sale of testing services and products directly to research institutions, pharmaceutical companies, and regulatory bodies, often through contractual agreements. This channel ensures a steady and targeted supply for large-scale studies and drug development programs. Retail sales cater to smaller, individual clients such as laboratories and clinics, providing off-the-shelf toxicology test kits and devices. In addition, other distribution channels encompass online sales, partnerships with distributors, and collaborations with contract research organizations (CROs), expanding the reach of in vitro toxicity testing solutions across various sectors including cosmetics, chemicals, and biotechnology. These diverse distribution channels enable companies to tap into different segments of the market and respond to specific customer needs.

In Vitro Toxicity Testing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the in vitro toxicity testing market over the forecast period, driven by the increasing demand for advanced testing methods in the pharmaceutical, biotechnology, and chemical industries. The region's robust healthcare infrastructure, high levels of research and development activities, and regulatory support for alternative testing methods are key factors contributing to its market leadership. Additionally, the rising adoption of advanced technologies such as 3D cell cultures, organ-on-a-chip models, and AI-driven predictive tools is further boosting market growth in North America. The presence of major players and government initiatives promoting the reduction of animal testing also strengthens the region’s position in the global market.

Active Key Players in the In Vitro Toxicity Testing Market:

- Charles River Laboratories (USA),

- Covance (USA),

- Thermo Fisher Scientific (USA),

- Eurofins Scientific (Luxembourg),

- SGS SA (Switzerland),

- Merck KGaA (Germany),

- Cyprotex (UK),

- Promega Corporation (USA),

- Gentronix Limited (UK),

- BioReliance Corporation (USA)

- Other Active Players

|

Global In Vitro Toxicity Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.57 Billion |

|

Forecast Period 2024-32 CAGR: |

8.31% |

Market Size in 2032: |

USD 17.58 Billion |

|

Segments Covered: |

By Product and Service |

|

|

|

Toxicology End Point and Test |

|

||

|

Technology |

|

||

|

Method |

|

||

|

Industry |

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: In Vitro Toxicity Testing Market by Product and Service

4.1 In Vitro Toxicity Testing Market Snapshot and Growth Engine

4.2 In Vitro Toxicity Testing Market Overview

4.3 Consumables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Consumables: Geographic Segmentation Analysis

4.4 Services

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Services: Geographic Segmentation Analysis

4.5 Assays

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Assays: Geographic Segmentation Analysis

4.6 Equipments

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Equipments: Geographic Segmentation Analysis

4.7 and Software

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 and Software: Geographic Segmentation Analysis

Chapter 5: In Vitro Toxicity Testing Market by Toxicology End Point and Test

5.1 In Vitro Toxicity Testing Market Snapshot and Growth Engine

5.2 In Vitro Toxicity Testing Market Overview

5.3 ADME (Absorption

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 ADME (Absorption: Geographic Segmentation Analysis

5.4 Distribution

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Distribution: Geographic Segmentation Analysis

5.5 Metabolism

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Metabolism: Geographic Segmentation Analysis

5.6 & Excretion) Testing

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 & Excretion) Testing: Geographic Segmentation Analysis

5.7 Cytotoxicity Testing

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Cytotoxicity Testing: Geographic Segmentation Analysis

5.8 Genotoxicity Testing

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Genotoxicity Testing: Geographic Segmentation Analysis

5.9 Dermal Toxicity Testing

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Dermal Toxicity Testing: Geographic Segmentation Analysis

5.10 Ocular Toxicity Testing

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Ocular Toxicity Testing: Geographic Segmentation Analysis

5.11 Organ Toxicity Testing

5.11.1 Introduction and Market Overview

5.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.11.3 Key Market Trends, Growth Factors and Opportunities

5.11.4 Organ Toxicity Testing: Geographic Segmentation Analysis

5.12 Skin Irritation

5.12.1 Introduction and Market Overview

5.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.12.3 Key Market Trends, Growth Factors and Opportunities

5.12.4 Skin Irritation: Geographic Segmentation Analysis

5.13 Corrosion

5.13.1 Introduction and Market Overview

5.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.13.3 Key Market Trends, Growth Factors and Opportunities

5.13.4 Corrosion: Geographic Segmentation Analysis

5.14 & Sensitization Testing

5.14.1 Introduction and Market Overview

5.14.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.14.3 Key Market Trends, Growth Factors and Opportunities

5.14.4 & Sensitization Testing: Geographic Segmentation Analysis

5.15 Phototoxicity Testing

5.15.1 Introduction and Market Overview

5.15.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.15.3 Key Market Trends, Growth Factors and Opportunities

5.15.4 Phototoxicity Testing: Geographic Segmentation Analysis

5.16 and Other Toxicity Endpoints & Tests

5.16.1 Introduction and Market Overview

5.16.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.16.3 Key Market Trends, Growth Factors and Opportunities

5.16.4 and Other Toxicity Endpoints & Tests: Geographic Segmentation Analysis

Chapter 6: In Vitro Toxicity Testing Market by Technology

6.1 In Vitro Toxicity Testing Market Snapshot and Growth Engine

6.2 In Vitro Toxicity Testing Market Overview

6.3 Cell Culture Technologies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cell Culture Technologies: Geographic Segmentation Analysis

6.4 High-Throughput Technologies

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 High-Throughput Technologies: Geographic Segmentation Analysis

6.5 Molecular Imaging

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Molecular Imaging: Geographic Segmentation Analysis

6.6 and Omics Technology

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Omics Technology: Geographic Segmentation Analysis

Chapter 7: In Vitro Toxicity Testing Market by Method

7.1 In Vitro Toxicity Testing Market Snapshot and Growth Engine

7.2 In Vitro Toxicity Testing Market Overview

7.3 Cellular Assays

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Cellular Assays: Geographic Segmentation Analysis

7.4 Biochemical Assays

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Biochemical Assays: Geographic Segmentation Analysis

7.5 Ex-Vivo Models

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Ex-Vivo Models: Geographic Segmentation Analysis

7.6 and In Silico Models

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 and In Silico Models: Geographic Segmentation Analysis

Chapter 8: In Vitro Toxicity Testing Market by Industry

8.1 In Vitro Toxicity Testing Market Snapshot and Growth Engine

8.2 In Vitro Toxicity Testing Market Overview

8.3 Pharmaceutical & Biopharmaceutical Companies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Pharmaceutical & Biopharmaceutical Companies: Geographic Segmentation Analysis

8.4 Diagnostics

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Diagnostics: Geographic Segmentation Analysis

8.5 Food

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Food: Geographic Segmentation Analysis

8.6 Chemicals

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Chemicals: Geographic Segmentation Analysis

8.7 Cosmetics & Household Products

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Cosmetics & Household Products: Geographic Segmentation Analysis

Chapter 9: In Vitro Toxicity Testing Market by Distribution Channel

9.1 In Vitro Toxicity Testing Market Snapshot and Growth Engine

9.2 In Vitro Toxicity Testing Market Overview

9.3 Direct Tender

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Direct Tender: Geographic Segmentation Analysis

9.4 Retail Sales

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Retail Sales: Geographic Segmentation Analysis

9.5 and Others

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 and Others: Geographic Segmentation Analysis

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 In Vitro Toxicity Testing Market Share by Manufacturer (2023)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 CHARLES RIVER LABORATORIES (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 COVANCE (USA)

10.4 THERMO FISHER SCIENTIFIC (USA)

10.5 EUROFINS SCIENTIFIC (LUXEMBOURG)

10.6 SGS SA (SWITZERLAND)

10.7 MERCK KGAA (GERMANY)

10.8 CYPROTEX (UK)

10.9 PROMEGA CORPORATION (USA)

10.10 GENTRONIX LIMITED (UK)

10.11 BIORELIANCE CORPORATION (USA)

10.12 OTHER ACTIVE PLAYERS

Chapter 11: Global In Vitro Toxicity Testing Market By Region

11.1 Overview

11.2. North America In Vitro Toxicity Testing Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By Product and Service

11.2.4.1 Consumables

11.2.4.2 Services

11.2.4.3 Assays

11.2.4.4 Equipments

11.2.4.5 and Software

11.2.5 Historic and Forecasted Market Size By Toxicology End Point and Test

11.2.5.1 ADME (Absorption

11.2.5.2 Distribution

11.2.5.3 Metabolism

11.2.5.4 & Excretion) Testing

11.2.5.5 Cytotoxicity Testing

11.2.5.6 Genotoxicity Testing

11.2.5.7 Dermal Toxicity Testing

11.2.5.8 Ocular Toxicity Testing

11.2.5.9 Organ Toxicity Testing

11.2.5.10 Skin Irritation

11.2.5.11 Corrosion

11.2.5.12 & Sensitization Testing

11.2.5.13 Phototoxicity Testing

11.2.5.14 and Other Toxicity Endpoints & Tests

11.2.6 Historic and Forecasted Market Size By Technology

11.2.6.1 Cell Culture Technologies

11.2.6.2 High-Throughput Technologies

11.2.6.3 Molecular Imaging

11.2.6.4 and Omics Technology

11.2.7 Historic and Forecasted Market Size By Method

11.2.7.1 Cellular Assays

11.2.7.2 Biochemical Assays

11.2.7.3 Ex-Vivo Models

11.2.7.4 and In Silico Models

11.2.8 Historic and Forecasted Market Size By Industry

11.2.8.1 Pharmaceutical & Biopharmaceutical Companies

11.2.8.2 Diagnostics

11.2.8.3 Food

11.2.8.4 Chemicals

11.2.8.5 Cosmetics & Household Products

11.2.9 Historic and Forecasted Market Size By Distribution Channel

11.2.9.1 Direct Tender

11.2.9.2 Retail Sales

11.2.9.3 and Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe In Vitro Toxicity Testing Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By Product and Service

11.3.4.1 Consumables

11.3.4.2 Services

11.3.4.3 Assays

11.3.4.4 Equipments

11.3.4.5 and Software

11.3.5 Historic and Forecasted Market Size By Toxicology End Point and Test

11.3.5.1 ADME (Absorption

11.3.5.2 Distribution

11.3.5.3 Metabolism

11.3.5.4 & Excretion) Testing

11.3.5.5 Cytotoxicity Testing

11.3.5.6 Genotoxicity Testing

11.3.5.7 Dermal Toxicity Testing

11.3.5.8 Ocular Toxicity Testing

11.3.5.9 Organ Toxicity Testing

11.3.5.10 Skin Irritation

11.3.5.11 Corrosion

11.3.5.12 & Sensitization Testing

11.3.5.13 Phototoxicity Testing

11.3.5.14 and Other Toxicity Endpoints & Tests

11.3.6 Historic and Forecasted Market Size By Technology

11.3.6.1 Cell Culture Technologies

11.3.6.2 High-Throughput Technologies

11.3.6.3 Molecular Imaging

11.3.6.4 and Omics Technology

11.3.7 Historic and Forecasted Market Size By Method

11.3.7.1 Cellular Assays

11.3.7.2 Biochemical Assays

11.3.7.3 Ex-Vivo Models

11.3.7.4 and In Silico Models

11.3.8 Historic and Forecasted Market Size By Industry

11.3.8.1 Pharmaceutical & Biopharmaceutical Companies

11.3.8.2 Diagnostics

11.3.8.3 Food

11.3.8.4 Chemicals

11.3.8.5 Cosmetics & Household Products

11.3.9 Historic and Forecasted Market Size By Distribution Channel

11.3.9.1 Direct Tender

11.3.9.2 Retail Sales

11.3.9.3 and Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe In Vitro Toxicity Testing Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By Product and Service

11.4.4.1 Consumables

11.4.4.2 Services

11.4.4.3 Assays

11.4.4.4 Equipments

11.4.4.5 and Software

11.4.5 Historic and Forecasted Market Size By Toxicology End Point and Test

11.4.5.1 ADME (Absorption

11.4.5.2 Distribution

11.4.5.3 Metabolism

11.4.5.4 & Excretion) Testing

11.4.5.5 Cytotoxicity Testing

11.4.5.6 Genotoxicity Testing

11.4.5.7 Dermal Toxicity Testing

11.4.5.8 Ocular Toxicity Testing

11.4.5.9 Organ Toxicity Testing

11.4.5.10 Skin Irritation

11.4.5.11 Corrosion

11.4.5.12 & Sensitization Testing

11.4.5.13 Phototoxicity Testing

11.4.5.14 and Other Toxicity Endpoints & Tests

11.4.6 Historic and Forecasted Market Size By Technology

11.4.6.1 Cell Culture Technologies

11.4.6.2 High-Throughput Technologies

11.4.6.3 Molecular Imaging

11.4.6.4 and Omics Technology

11.4.7 Historic and Forecasted Market Size By Method

11.4.7.1 Cellular Assays

11.4.7.2 Biochemical Assays

11.4.7.3 Ex-Vivo Models

11.4.7.4 and In Silico Models

11.4.8 Historic and Forecasted Market Size By Industry

11.4.8.1 Pharmaceutical & Biopharmaceutical Companies

11.4.8.2 Diagnostics

11.4.8.3 Food

11.4.8.4 Chemicals

11.4.8.5 Cosmetics & Household Products

11.4.9 Historic and Forecasted Market Size By Distribution Channel

11.4.9.1 Direct Tender

11.4.9.2 Retail Sales

11.4.9.3 and Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific In Vitro Toxicity Testing Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By Product and Service

11.5.4.1 Consumables

11.5.4.2 Services

11.5.4.3 Assays

11.5.4.4 Equipments

11.5.4.5 and Software

11.5.5 Historic and Forecasted Market Size By Toxicology End Point and Test

11.5.5.1 ADME (Absorption

11.5.5.2 Distribution

11.5.5.3 Metabolism

11.5.5.4 & Excretion) Testing

11.5.5.5 Cytotoxicity Testing

11.5.5.6 Genotoxicity Testing

11.5.5.7 Dermal Toxicity Testing

11.5.5.8 Ocular Toxicity Testing

11.5.5.9 Organ Toxicity Testing

11.5.5.10 Skin Irritation

11.5.5.11 Corrosion

11.5.5.12 & Sensitization Testing

11.5.5.13 Phototoxicity Testing

11.5.5.14 and Other Toxicity Endpoints & Tests

11.5.6 Historic and Forecasted Market Size By Technology

11.5.6.1 Cell Culture Technologies

11.5.6.2 High-Throughput Technologies

11.5.6.3 Molecular Imaging

11.5.6.4 and Omics Technology

11.5.7 Historic and Forecasted Market Size By Method

11.5.7.1 Cellular Assays

11.5.7.2 Biochemical Assays

11.5.7.3 Ex-Vivo Models

11.5.7.4 and In Silico Models

11.5.8 Historic and Forecasted Market Size By Industry

11.5.8.1 Pharmaceutical & Biopharmaceutical Companies

11.5.8.2 Diagnostics

11.5.8.3 Food

11.5.8.4 Chemicals

11.5.8.5 Cosmetics & Household Products

11.5.9 Historic and Forecasted Market Size By Distribution Channel

11.5.9.1 Direct Tender

11.5.9.2 Retail Sales

11.5.9.3 and Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa In Vitro Toxicity Testing Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By Product and Service

11.6.4.1 Consumables

11.6.4.2 Services

11.6.4.3 Assays

11.6.4.4 Equipments

11.6.4.5 and Software

11.6.5 Historic and Forecasted Market Size By Toxicology End Point and Test

11.6.5.1 ADME (Absorption

11.6.5.2 Distribution

11.6.5.3 Metabolism

11.6.5.4 & Excretion) Testing

11.6.5.5 Cytotoxicity Testing

11.6.5.6 Genotoxicity Testing

11.6.5.7 Dermal Toxicity Testing

11.6.5.8 Ocular Toxicity Testing

11.6.5.9 Organ Toxicity Testing

11.6.5.10 Skin Irritation

11.6.5.11 Corrosion

11.6.5.12 & Sensitization Testing

11.6.5.13 Phototoxicity Testing

11.6.5.14 and Other Toxicity Endpoints & Tests

11.6.6 Historic and Forecasted Market Size By Technology

11.6.6.1 Cell Culture Technologies

11.6.6.2 High-Throughput Technologies

11.6.6.3 Molecular Imaging

11.6.6.4 and Omics Technology

11.6.7 Historic and Forecasted Market Size By Method

11.6.7.1 Cellular Assays

11.6.7.2 Biochemical Assays

11.6.7.3 Ex-Vivo Models

11.6.7.4 and In Silico Models

11.6.8 Historic and Forecasted Market Size By Industry

11.6.8.1 Pharmaceutical & Biopharmaceutical Companies

11.6.8.2 Diagnostics

11.6.8.3 Food

11.6.8.4 Chemicals

11.6.8.5 Cosmetics & Household Products

11.6.9 Historic and Forecasted Market Size By Distribution Channel

11.6.9.1 Direct Tender

11.6.9.2 Retail Sales

11.6.9.3 and Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America In Vitro Toxicity Testing Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By Product and Service

11.7.4.1 Consumables

11.7.4.2 Services

11.7.4.3 Assays

11.7.4.4 Equipments

11.7.4.5 and Software

11.7.5 Historic and Forecasted Market Size By Toxicology End Point and Test

11.7.5.1 ADME (Absorption

11.7.5.2 Distribution

11.7.5.3 Metabolism

11.7.5.4 & Excretion) Testing

11.7.5.5 Cytotoxicity Testing

11.7.5.6 Genotoxicity Testing

11.7.5.7 Dermal Toxicity Testing

11.7.5.8 Ocular Toxicity Testing

11.7.5.9 Organ Toxicity Testing

11.7.5.10 Skin Irritation

11.7.5.11 Corrosion

11.7.5.12 & Sensitization Testing

11.7.5.13 Phototoxicity Testing

11.7.5.14 and Other Toxicity Endpoints & Tests

11.7.6 Historic and Forecasted Market Size By Technology

11.7.6.1 Cell Culture Technologies

11.7.6.2 High-Throughput Technologies

11.7.6.3 Molecular Imaging

11.7.6.4 and Omics Technology

11.7.7 Historic and Forecasted Market Size By Method

11.7.7.1 Cellular Assays

11.7.7.2 Biochemical Assays

11.7.7.3 Ex-Vivo Models

11.7.7.4 and In Silico Models

11.7.8 Historic and Forecasted Market Size By Industry

11.7.8.1 Pharmaceutical & Biopharmaceutical Companies

11.7.8.2 Diagnostics

11.7.8.3 Food

11.7.8.4 Chemicals

11.7.8.5 Cosmetics & Household Products

11.7.9 Historic and Forecasted Market Size By Distribution Channel

11.7.9.1 Direct Tender

11.7.9.2 Retail Sales

11.7.9.3 and Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global In Vitro Toxicity Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.57 Billion |

|

Forecast Period 2024-32 CAGR: |

8.31% |

Market Size in 2032: |

USD 17.58 Billion |

|

Segments Covered: |

By Product and Service |

|

|

|

Toxicology End Point and Test |

|

||

|

Technology |

|

||

|

Method |

|

||

|

Industry |

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||